Deck 23: Flexible Budgets and Standard Cost Systems

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

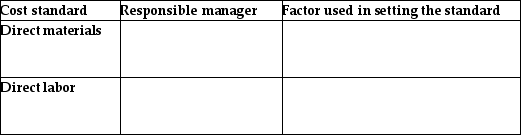

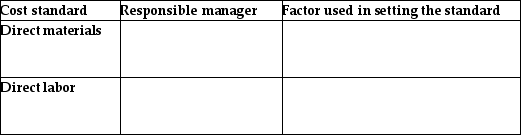

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/223

العب

ملء الشاشة (f)

Deck 23: Flexible Budgets and Standard Cost Systems

1

The sales volume variance is the difference between the ________.

A) actual results and the expected results in the flexible budget for the actual units sold

B) expected results in the flexible budget for the actual units sold and the static budget

C) static budget and actual amounts due to differences in sales price

D) flexible budget and static budget due to differences in fixed costs

A) actual results and the expected results in the flexible budget for the actual units sold

B) expected results in the flexible budget for the actual units sold and the static budget

C) static budget and actual amounts due to differences in sales price

D) flexible budget and static budget due to differences in fixed costs

B

2

A flexible budget summarizes revenues and costs for various levels of sales volume within a relevant range.

True

3

The flexible budget variance is the difference between the ________.

A) actual results and the expected results in the flexible budget for the actual units sold

B) expected results in the flexible budget for the units expected to be sold and the static budget

C) flexible budget and actual amounts due to differences in volumes

D) flexible budget and static budget due to differences in fixed costs

A) actual results and the expected results in the flexible budget for the actual units sold

B) expected results in the flexible budget for the units expected to be sold and the static budget

C) flexible budget and actual amounts due to differences in volumes

D) flexible budget and static budget due to differences in fixed costs

A

4

The sales volume variance is a result of the difference between the actual sales price and the budgeted sales price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

5

A static budget presents financial data at multiple levels of sales volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following amounts of a flexible budget remains constant, within the specified relevant range, when the sales volume changes?

A) total contribution margin

B) total fixed costs

C) total variable costs

D) total sales revenue

A) total contribution margin

B) total fixed costs

C) total variable costs

D) total sales revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

7

The static budget, at the beginning of the month, for Divine Décor Company, follows:

Static budget:

Sales volume: 1500 units; Sales price: $70.00 per unit

Variable costs: $32.00 per unit; Fixed costs: $38,000 per month

Operating income: $19,000

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 990 units; Sales price: $75.00 per unit

Variable costs: $35.00 per unit; Fixed costs: $33,000 per month

Operating income: $6600

Calculate the flexible budget variance for sales revenue.

A) $6980 U

B) $6980 F

C) $4950 U

D) $4950 F

Static budget:

Sales volume: 1500 units; Sales price: $70.00 per unit

Variable costs: $32.00 per unit; Fixed costs: $38,000 per month

Operating income: $19,000

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 990 units; Sales price: $75.00 per unit

Variable costs: $35.00 per unit; Fixed costs: $33,000 per month

Operating income: $6600

Calculate the flexible budget variance for sales revenue.

A) $6980 U

B) $6980 F

C) $4950 U

D) $4950 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

8

Reflector Glass Company prepared the following static budget for the year:

If a flexible budget is prepared at a volume of 9700 units, calculate the amount of operating income. The production level is within the relevant range.

A) $30,000

B) $14,550

C) $50,350

D) $3000

If a flexible budget is prepared at a volume of 9700 units, calculate the amount of operating income. The production level is within the relevant range.

A) $30,000

B) $14,550

C) $50,350

D) $3000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

9

The flexible budget variance is the difference between the actual results and the expected results in the flexible budget for the actual units sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

10

A favorable variance reflects a decrease in operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

11

Alphonse Company manufactures staplers. The budgeted sales price is $14.00 per stapler, the variable costs are $3.00 per stapler, and budgeted fixed costs are $12,000. What is the budgeted operating income for 4200 staplers?

A) $46,200

B) $34,200

C) $58,800

D) $12,600

A) $46,200

B) $34,200

C) $58,800

D) $12,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

12

A static budget is prepared for only one level of sales volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

13

Ibis Paper Company prepared the following static budget for November:

If a flexible budget is prepared at a volume of 14,500 units, calculate the operating income. The production level is within the relevant range.

A) $188,500

B) $156,000

C) $142,500

D) $175,000

If a flexible budget is prepared at a volume of 14,500 units, calculate the operating income. The production level is within the relevant range.

A) $188,500

B) $156,000

C) $142,500

D) $175,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

14

A variance is the difference between an actual amount and the budgeted amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

15

The sales volume variance is the difference between the expected results in the flexible budget for the actual units sold and the static budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

16

The static budget, at the beginning of the month, for Vintage Wine Company follows:

Static budget:

Sales volume: 2000 units; Sales price: $50.00 per unit

Variable costs: $13.00 per unit; Fixed costs: $25,500 per month

Operating income: $48,500

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 1900 units; Sales price: $58.50 per unit

Variable costs: $16.00 per unit; Fixed costs: $34,300 per month

Operating income: $46,450

Calculate the flexible budget variance for variable costs.

A) $30,400 U

B) $1650 U

C) $5700 U

D) $24,700 F

Static budget:

Sales volume: 2000 units; Sales price: $50.00 per unit

Variable costs: $13.00 per unit; Fixed costs: $25,500 per month

Operating income: $48,500

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 1900 units; Sales price: $58.50 per unit

Variable costs: $16.00 per unit; Fixed costs: $34,300 per month

Operating income: $46,450

Calculate the flexible budget variance for variable costs.

A) $30,400 U

B) $1650 U

C) $5700 U

D) $24,700 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

17

Infinity Clock Company prepared the following static budget for the year: If a flexible budget is prepared at a volume of 8900 units, calculate the amount of operating income. The production level is within the relevant range.

A) $28,150

B) $28,500

C) $13,350

D) $3000

A) $28,150

B) $28,500

C) $13,350

D) $3000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

18

Define variance. What is the difference between a favorable and an unfavorable variance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following amounts of a flexible budget changes, within the specified relevant range, with changes in sales volume?

A) sales price per unit

B) total fixed costs

C) variable cost per unit

D) total contribution margin

A) sales price per unit

B) total fixed costs

C) variable cost per unit

D) total contribution margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

20

The flexible budget variance is the difference between expected results in the flexible budget for the actual units sold and the static budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

21

A company is analyzing its month-end results by comparing it to both static and flexible budgets. During the month, the actual sales price was higher than the expected sales price as per the static budget. This difference results in a(n) ________.

A) favorable flexible budget variance for sales revenues

B) favorable sales volume variance for sales revenues

C) unfavorable flexible budget variance for sales revenues

D) unfavorable sales volume variance for sales revenues

A) favorable flexible budget variance for sales revenues

B) favorable sales volume variance for sales revenues

C) unfavorable flexible budget variance for sales revenues

D) unfavorable sales volume variance for sales revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

22

An unfavorable flexible budget variance in operating income might be due to a(n) ________.

A) increase in sales price per unit

B) decrease in sales volume

C) increase in variable cost per unit

D) decrease in fixed costs

A) increase in sales price per unit

B) decrease in sales volume

C) increase in variable cost per unit

D) decrease in fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

23

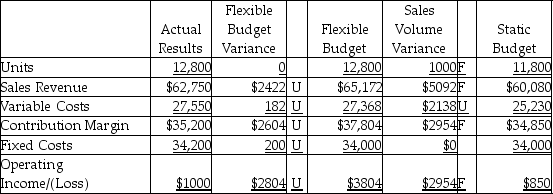

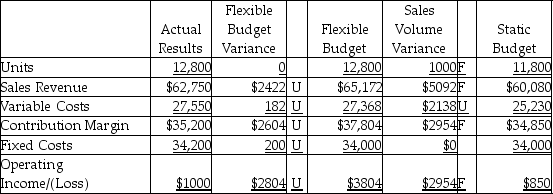

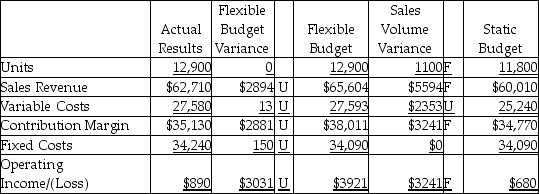

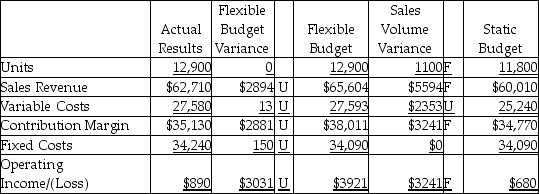

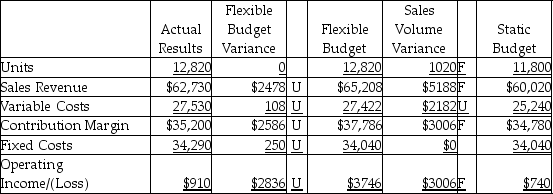

The Dear Dairy Cheese Company completed the flexible budget analysis for the second quarter, which is given below.  Which of the following statements would be a correct factor to explain the flexible budget variance for fixed costs?

Which of the following statements would be a correct factor to explain the flexible budget variance for fixed costs?

A) decrease in sales price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Which of the following statements would be a correct factor to explain the flexible budget variance for fixed costs?

Which of the following statements would be a correct factor to explain the flexible budget variance for fixed costs?A) decrease in sales price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

24

The static budget, at the beginning of the month, for Wadsworth Company follows:

Static budget:

Sales volume: 2000 units; Sales price: $50.00 per unit

Variable costs: $14.00 per unit; Fixed costs: $25,100 per month

Operating income: $46,900

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 1900 units; Sales price: $58.00 per unit

Variable costs: $16.5 per unit; Fixed costs: $34,000 per month

Operating income: $44,850

Calculate the flexible budget variance for operating income.

A) $3600 U

B) $3600 F

C) $1550 F

D) $15,200 F

Static budget:

Sales volume: 2000 units; Sales price: $50.00 per unit

Variable costs: $14.00 per unit; Fixed costs: $25,100 per month

Operating income: $46,900

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 1900 units; Sales price: $58.00 per unit

Variable costs: $16.5 per unit; Fixed costs: $34,000 per month

Operating income: $44,850

Calculate the flexible budget variance for operating income.

A) $3600 U

B) $3600 F

C) $1550 F

D) $15,200 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

25

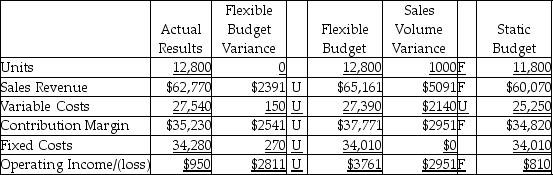

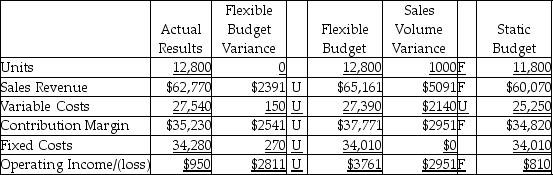

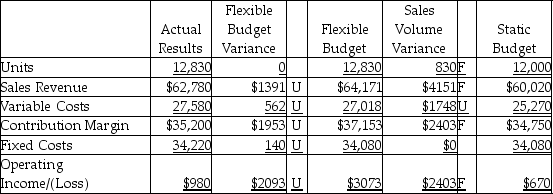

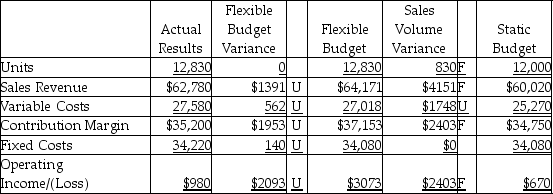

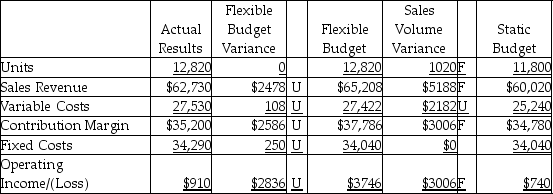

The Body Balance Fitness Company completed the flexible budget analysis for the second quarter, which is given below.  Which of the following statements would be a correct factor to explain the flexible budget variance for variable costs?

Which of the following statements would be a correct factor to explain the flexible budget variance for variable costs?

A) decrease in sales price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Which of the following statements would be a correct factor to explain the flexible budget variance for variable costs?

Which of the following statements would be a correct factor to explain the flexible budget variance for variable costs?A) decrease in sales price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

26

A favorable sales volume variance in sales revenue suggests a(n) ________.

A) increase in actual sales price per unit as compared to budgeted sales price

B) increase in number of actual units sold when compared to the expected number of units sold

C) increase in actual variable cost per unit as compared to expected variable cost per unit

D) decrease in actual fixed costs

A) increase in actual sales price per unit as compared to budgeted sales price

B) increase in number of actual units sold when compared to the expected number of units sold

C) increase in actual variable cost per unit as compared to expected variable cost per unit

D) decrease in actual fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

27

The static budget, at the beginning of the month, for Beacon Banner Company follows:

Static budget:

Sales volume: 1100 units; Sales price: $70.00 per unit

Variable costs: $33.00 per unit; Fixed costs: $37,800 per month

Operating income: $2900

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 995 units; Sales price: $75.00 per unit

Variable costs: $35.00 per unit; Fixed costs: $35,000 per month

Operating income: $4800

Calculate the sales volume variance for revenue.

A) $2800 U

B) $7350 U

C) $3885 U

D) $4975 F

Static budget:

Sales volume: 1100 units; Sales price: $70.00 per unit

Variable costs: $33.00 per unit; Fixed costs: $37,800 per month

Operating income: $2900

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 995 units; Sales price: $75.00 per unit

Variable costs: $35.00 per unit; Fixed costs: $35,000 per month

Operating income: $4800

Calculate the sales volume variance for revenue.

A) $2800 U

B) $7350 U

C) $3885 U

D) $4975 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

28

The Comfort Foam Products Company completed the flexible budget analysis for the second quarter, which is given below.  Which of the following would be a correct factor to explain the sales volume variance for variable costs?

Which of the following would be a correct factor to explain the sales volume variance for variable costs?

A) decrease in sales price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Which of the following would be a correct factor to explain the sales volume variance for variable costs?

Which of the following would be a correct factor to explain the sales volume variance for variable costs?A) decrease in sales price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

29

The static budget, at the beginning of the month, for New England Furniture Company follows: Static budget:

Sales volume: 1000 units; Sales price: $71.00 per unit

Variable costs: $33.00 per unit; Fixed costs: $36,200 per month

Operating income: $1800

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 960 units; Sales price: $74.00 per unit

Variable costs: $35.00 per unit; Fixed costs: $35,000 per month

Operating income: $2440

Calculate the sales volume variance for fixed costs.

A) $1920 U

B) $1200 F

C) $1520 U

D) $0

Sales volume: 1000 units; Sales price: $71.00 per unit

Variable costs: $33.00 per unit; Fixed costs: $36,200 per month

Operating income: $1800

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 960 units; Sales price: $74.00 per unit

Variable costs: $35.00 per unit; Fixed costs: $35,000 per month

Operating income: $2440

Calculate the sales volume variance for fixed costs.

A) $1920 U

B) $1200 F

C) $1520 U

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

30

A favorable flexible budget variance in sales revenue suggests a(n) ________.

A) increase in sales price per unit

B) increase in volume

C) decrease in variable cost per unit

D) decrease in fixed costs

A) increase in sales price per unit

B) increase in volume

C) decrease in variable cost per unit

D) decrease in fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

31

A company is analyzing its month-end results by comparing it to both static and flexible budgets.

-During the month, the actual fixed costs were lower than the expected fixed costs as per the static budget. This difference results in a(n) ________.

A) unfavorable flexible budget variance for fixed costs

B) favorable sales volume variance for fixed costs

C) favorable flexible budget variance for fixed costs

D) unfavorable sales volume variance for fixed costs

-During the month, the actual fixed costs were lower than the expected fixed costs as per the static budget. This difference results in a(n) ________.

A) unfavorable flexible budget variance for fixed costs

B) favorable sales volume variance for fixed costs

C) favorable flexible budget variance for fixed costs

D) unfavorable sales volume variance for fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

32

A company is analyzing its month-end results by comparing it to both static and flexible budgets.

-During the month, the actual sales volume was lower than the expected sales volume as per the static budget. This difference results in an unfavorable ________.

A) flexible budget variance for variable costs

B) sales volume variance for variable costs

C) flexible budget variance for sales revenue

D) sales volume variance for sales revenue

-During the month, the actual sales volume was lower than the expected sales volume as per the static budget. This difference results in an unfavorable ________.

A) flexible budget variance for variable costs

B) sales volume variance for variable costs

C) flexible budget variance for sales revenue

D) sales volume variance for sales revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

33

The Crockery Pottery Company completed the flexible budget analysis for the second quarter, which is given below.  Which of the following would be a correct factor to explain the sales volume variance for sales revenue?

Which of the following would be a correct factor to explain the sales volume variance for sales revenue?

A) increase in sales price per unit

B) increase in sales volume

C) increase in variable cost per unit

D) increase in fixed costs

Which of the following would be a correct factor to explain the sales volume variance for sales revenue?

Which of the following would be a correct factor to explain the sales volume variance for sales revenue?A) increase in sales price per unit

B) increase in sales volume

C) increase in variable cost per unit

D) increase in fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

34

The static budget, at the beginning of the month, for Jabari Company follows:

Static budget:

Sales volume: 2100 units; Sales price: $52.00 per unit

Variable costs: $12.00 per unit; Fixed costs: $26,500 per month

Operating income: $57,500

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 1900 units; Sales price: $58.00 per unit

Variable costs: $17.00 per unit; Fixed cost: $37,000 per month

Operating income: $40,900

Calculate the sales volume variance for operating income.

A) $8600 U

B) $200 F

C) $8000 U

D) $8000 F

Static budget:

Sales volume: 2100 units; Sales price: $52.00 per unit

Variable costs: $12.00 per unit; Fixed costs: $26,500 per month

Operating income: $57,500

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 1900 units; Sales price: $58.00 per unit

Variable costs: $17.00 per unit; Fixed cost: $37,000 per month

Operating income: $40,900

Calculate the sales volume variance for operating income.

A) $8600 U

B) $200 F

C) $8000 U

D) $8000 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

35

The Chesapeake Oyster Company completed the flexible budget analysis for the second quarter, which is given below.  Which of the following statements would be a correct factor to explain the flexible budget variance for sales revenue?

Which of the following statements would be a correct factor to explain the flexible budget variance for sales revenue?

A) decrease in sales price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Which of the following statements would be a correct factor to explain the flexible budget variance for sales revenue?

Which of the following statements would be a correct factor to explain the flexible budget variance for sales revenue?A) decrease in sales price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

36

The Alaska Fish Company completed the flexible budget analysis for the second quarter, which is given below.  Which of the following statements would be a correct factor to explain the sales volume variance for operating income?

Which of the following statements would be a correct factor to explain the sales volume variance for operating income?

A) decrease in sales price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Which of the following statements would be a correct factor to explain the sales volume variance for operating income?

Which of the following statements would be a correct factor to explain the sales volume variance for operating income?A) decrease in sales price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

37

An unfavorable flexible budget variance in variable costs suggests a(n) ________.

A) increase in sales price per unit

B) decrease in sales volume

C) increase in variable cost per unit

D) decrease in fixed costs

A) increase in sales price per unit

B) decrease in sales volume

C) increase in variable cost per unit

D) decrease in fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

38

A company is analyzing its month-end results by comparing it to both static and flexible budgets.

-During the month, the actual variable costs per unit were lower than the expected variable costs per unit as per the static budget. This difference results in a(n) ________.

A) favorable flexible budget variance for variable costs

B) favorable sales volume variance for variable costs

C) unfavorable flexible budget variance for variable costs

D) unfavorable sales volume variance for variable costs

-During the month, the actual variable costs per unit were lower than the expected variable costs per unit as per the static budget. This difference results in a(n) ________.

A) favorable flexible budget variance for variable costs

B) favorable sales volume variance for variable costs

C) unfavorable flexible budget variance for variable costs

D) unfavorable sales volume variance for variable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

39

The static budget, at the beginning of the month, for La Verne Company follows:

Static budget:

Sales volume: 2100 units: Sales price: $57.00 per unit

Variable cost: $13.00 per unit: Fixed costs: $25,000 per month

Operating income: $67,400

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 1900 units: Sales price: $58.00 per unit

Variable cost: $17.00 per unit: Fixed costs $35,000 per month

Operating income: $42,900

Calculate the sales volume variance for variable costs.

A) $8800 U

B) $2600 F

C) $200 U

D) $8800 F

Static budget:

Sales volume: 2100 units: Sales price: $57.00 per unit

Variable cost: $13.00 per unit: Fixed costs: $25,000 per month

Operating income: $67,400

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 1900 units: Sales price: $58.00 per unit

Variable cost: $17.00 per unit: Fixed costs $35,000 per month

Operating income: $42,900

Calculate the sales volume variance for variable costs.

A) $8800 U

B) $2600 F

C) $200 U

D) $8800 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

40

The static budget, at the beginning of the month, for Amira Company follows:

Static budget:

Sales volume: 1000 units; Sales price: $70.00 per unit

Variable costs: $32.00 per unit; Fixed costs: $36,800 per month

Operating income: $1200

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 980 units; Sales price: $74.00 per unit

Variable costs: $35.00 per unit; Fixed costs: $34,600 per month

Operating income: $3620

Calculate the flexible budget variance for fixed costs.

A) $2200 U

B) $2200 F

C) $0

D) $3180 F

Static budget:

Sales volume: 1000 units; Sales price: $70.00 per unit

Variable costs: $32.00 per unit; Fixed costs: $36,800 per month

Operating income: $1200

Actual results, at the end of the month, follows:

Actual results:

Sales volume: 980 units; Sales price: $74.00 per unit

Variable costs: $35.00 per unit; Fixed costs: $34,600 per month

Operating income: $3620

Calculate the flexible budget variance for fixed costs.

A) $2200 U

B) $2200 F

C) $0

D) $3180 F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

41

An unfavorable sales volume variance in operating income suggests a(n) ________.

A) increase in number of actual units sold when compared to the expected number of units sold

B) decrease in number of actual units sold when compared to the expected number of units sold

C) increase in variable cost per unit

D) decrease in fixed costs

A) increase in number of actual units sold when compared to the expected number of units sold

B) decrease in number of actual units sold when compared to the expected number of units sold

C) increase in variable cost per unit

D) decrease in fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

42

Top Half produces and sells two types of t-shirts-Fancy and Plain. The company provides the following data:

Compute the flexible budget variance for Fancy t-shirts for sales revenue.

Compute the flexible budget variance for Fancy t-shirts for sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

43

Top managers of Marshall Industries predicted annual sales of 23,600 units of its product at a unit price of $5.00. Actual sales for the year were 22,800 units at $5.50 each. Variable costs were budgeted at $2.45 per unit, and actual variable costs were $2.40 per unit. Actual fixed costs of $45,000 exceeded budgeted fixed costs by $2,000. Prepare Marshall's flexible budget performance report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following best describes a standard?

A) a sales price, cost, or quantity that is expected under normal conditions

B) costs incurred to produce a product

C) cost variance

D) actual sales price, cost, or quantity

A) a sales price, cost, or quantity that is expected under normal conditions

B) costs incurred to produce a product

C) cost variance

D) actual sales price, cost, or quantity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

45

Marathon Sports Equipment Company projected sales of 82,000 units at a unit sales price of $14 for the year. Actual sales for the year were 75,000 units at $13.00 per unit. Variable costs were budgeted at $3 per unit, and the actual amount was $4 per unit. Budgeted fixed costs totaled $376,000, while actual fixed costs amounted to $425,000. What is the sales volume variance for total revenue?

A) $173,000 favorable

B) $173,000 unfavorable

C) $98,000 unfavorable

D) $98,000 favorable

A) $173,000 favorable

B) $173,000 unfavorable

C) $98,000 unfavorable

D) $98,000 favorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is NOT a benefit of a static budget performance report?

A) It is useful in evaluating a manager's effectiveness when actual sales approximate budgeted amounts.

B) It is useful in evaluating a manager's control over fixed costs.

C) It is useful in evaluating a manager's control over variable costs.

D) It is useful in evaluating a manager's control over fixed selling and administrative expenses.

A) It is useful in evaluating a manager's effectiveness when actual sales approximate budgeted amounts.

B) It is useful in evaluating a manager's control over fixed costs.

C) It is useful in evaluating a manager's control over variable costs.

D) It is useful in evaluating a manager's control over fixed selling and administrative expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

47

Bear Creek Golf Center reported actual operating income for the current year as $65,000. The flexible budget operating income for actual volume is $59,000, while the static budget operating income is $60,000. What is the flexible budget variance for operating income?

A) $6000 favorable

B) $6000 unfavorable

C) $1000 unfavorable

D) $1000 favorable

A) $6000 favorable

B) $6000 unfavorable

C) $1000 unfavorable

D) $1000 favorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

48

Setting standard costs is a function of the company's production department and does not require input from other departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

49

A report that summarizes actual results, budgeted amounts and the difference between them is called the ________.

A) static budget performance report

B) mobile budget report

C) budgetary control report

D) strategic budget report

A) static budget performance report

B) mobile budget report

C) budgetary control report

D) strategic budget report

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

50

A standard cost system is an accounting system that uses standards for product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

51

Companies conduct time-and-motion studies and use benchmarks from other companies when developing standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

52

A standard is a sales price, cost, or quantity that is expected under normal conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

53

Global Engineering's actual operating income for the current year is $58,000. The flexible budget operating income for actual sales volume is $39,000, while the static budget operating income is $53,000. What is the sales volume variance for operating income?

A) $14,000 favorable

B) $5000 unfavorable

C) $14,000 unfavorable

D) $5000 favorable

A) $14,000 favorable

B) $5000 unfavorable

C) $14,000 unfavorable

D) $5000 favorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

54

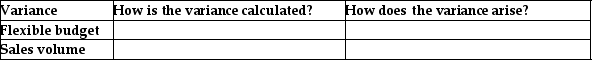

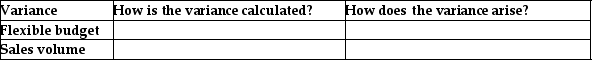

Complete the following table:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

55

In a standard costing system, each input of direct materials, direct labor, and manufacturing overhead has a cost standard and an efficiency standard.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

56

Midnight Sun Outfitters projected sales of 76,000 units for the year at a unit sales price of $12.00. Actual sales for the year were 72,000 units at $15.00 per unit. Variable costs were budgeted at $4.50 per unit, and the actual variable cost was $4.75 per unit. Budgeted fixed costs totaled $378,000, while actual fixed costs amounted to $410,000. What is the sales volume variance for operating income?

A) $136,000 unfavorable

B) $30,000 unfavorable

C) $30,000 favorable

D) $166,000 unfavorable

A) $136,000 unfavorable

B) $30,000 unfavorable

C) $30,000 favorable

D) $166,000 unfavorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

57

A favorable sales volume variance in variable costs suggests a(n) ________.

A) increase in number of actual units sold when compared to the expected number of units sold

B) decrease in number of actual units sold when compared to the expected number of units sold

C) increase in variable cost per unit

D) decrease in fixed costs

A) increase in number of actual units sold when compared to the expected number of units sold

B) decrease in number of actual units sold when compared to the expected number of units sold

C) increase in variable cost per unit

D) decrease in fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

58

Benefit Pillow Company projected sales of 75,000 units for the year at a unit sales price of $14.00. Actual sales for the year were 70,000 units at $19.00 per unit. Variable costs were budgeted at $4.00 per unit, and the actual variable cost was $4.90 per unit. Budgeted fixed costs totaled $377,000 while actual fixed costs amounted to $410,000. What is the flexible budget variance for operating income?

A) $323,000 unfavorable

B) $254,000 favorable

C) $254,000 unfavorable

D) $287,000 favorable

A) $323,000 unfavorable

B) $254,000 favorable

C) $254,000 unfavorable

D) $287,000 favorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

59

Hercules Sports Equipment Company projected sales of 80,000 units at a unit sales price of $12 for the year. Actual sales for the year were 77,000 units at $15 per unit. Variable costs were budgeted at $2 per unit, and the actual amount was $5 per unit. Budgeted fixed costs totaled $388,000, while actual fixed costs amounted to $436,000. What is the flexible budget variance for variable costs?

A) $240,000 unfavorable

B) $231,000 unfavorable

C) $231,000 favorable

D) $240,000 favorable

A) $240,000 unfavorable

B) $231,000 unfavorable

C) $231,000 favorable

D) $240,000 favorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

60

Standard costs are developed by the cooperative effort of purchasing, production, human resources, and accounting personnel.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

61

Cedar Designs Company, a custom cabinet manufacturing company, is setting standard costs for one of its products. The main material is cedar wood, sold by the square foot. The current cost of cedar wood is $6.00 per square foot from the supplier. Delivery costs are $0.25 per square foot. Carpenters' wages are $30.00 per hour. Payroll costs are $3.60 per hour, and benefits are $6.00 per hour. How much is the direct labor standard cost per hour?

A) $30.00

B) $9.60

C) $33.60

D) $39.60

A) $30.00

B) $9.60

C) $33.60

D) $39.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

62

A standard cost system helps management set performance standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is the correct formula for measuring a cost variance?

A) Cost Variance = (Actual Cost + Standard Cost) / Actual Quantity

B) Cost Variance = (Actual Cost - Standard Cost) × Actual Quantity

C) Cost Variance = (Actual Cost + Standard Cost) + Actual Quantity

D) Cost Variance = (Actual Cost - Standard Cost) - Actual Quantity

A) Cost Variance = (Actual Cost + Standard Cost) / Actual Quantity

B) Cost Variance = (Actual Cost - Standard Cost) × Actual Quantity

C) Cost Variance = (Actual Cost + Standard Cost) + Actual Quantity

D) Cost Variance = (Actual Cost - Standard Cost) - Actual Quantity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

64

A company is setting its direct materials and direct labor standards for its leading product. Direct materials cost from the supplier are $8 per square foot, net of purchase discount. Freight-in amounts to $0.10 per square foot. Basic wages of the assembly line personnel are $18 per hour. Payroll taxes are approximately 25% of wages. Benefits amount to $4 per hour. How much is the direct materials cost standard per square foot?

A) $8.10

B) $8.00

C) $22.00

D) $30.00

A) $8.10

B) $8.00

C) $22.00

D) $30.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

65

A cost variance measures the difference in quantities of actual inputs used and the standard quantity of inputs allowed for the actual number of units produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following is an example of a direct labor cost standard?

A) $40 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 0.5 direct labor hours per unit

A) $40 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 0.5 direct labor hours per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

67

The static budget is used to compute flexible budget variances as well as cost and efficiency variances for direct materials and direct labor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

68

List three ways in which using a standard cost system helps managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following is a reason companies use standard costs?

A) to enhance customer loyalty

B) to ensure the accuracy of the financial records

C) to share best practices with other companies

D) to identify performance standards

A) to enhance customer loyalty

B) to ensure the accuracy of the financial records

C) to share best practices with other companies

D) to identify performance standards

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

70

An efficiency variance measures how well the business uses its materials or human resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

71

An efficiency variance measures how well a company keeps unit costs of material and labor inputs within standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

72

For each of the following cost standards, indicate which manager is responsible for the standard, and list one factor that should be used in setting the standard.

-

-

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following is an example of a direct materials cost standard?

A) $40 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 6 direct labor hours per unit

A) $40 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 6 direct labor hours per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

74

For each of the following cost standards, indicate which manager is responsible for the standard, and list one factor that should be used in setting the standard.

-

-

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

75

Developing efficiency standards based on best practices is called benchmarking.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

76

A company is setting its direct materials and direct labor standards for its leading product. Direct material costs from the supplier are $9 per square foot, net of purchase discount. Freight-in amounts to $0.20 per square foot. Basic wages of the assembly line personnel are $14 per hour. Payroll taxes are approximately 22% of wages. How much is the direct labor cost standard per hour? (Round your answer to the nearest cent.)

A) $3.08

B) $14.00

C) $17.08

D) $26.08

A) $3.08

B) $14.00

C) $17.08

D) $26.08

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following is an example of a direct labor efficiency standard?

A) $20 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 6 direct labor hours per unit

A) $20 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 6 direct labor hours per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

78

Oak Valley Company, a custom cabinet manufacturing company, is setting standard costs for one of its products. The main material is cedar wood, sold by the square foot. The current cost of cedar wood is $8.00 per square foot from the supplier. Delivery costs are $0.25 per square foot. Carpenters' wages are $25.00 per hour. Payroll costs are $3.60 per hour, and benefits are $6.00 per hour. How much is the direct materials standard cost per square foot?

A) $14.25

B) $11.85

C) $8.25

D) $8.00

A) $14.25

B) $11.85

C) $8.25

D) $8.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is an example of a direct materials efficiency standard?

A) $40 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 6 direct labor hours per unit

A) $40 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 6 direct labor hours per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is a reason companies use standard costs?

A) to enhance customer loyalty

B) to set sales prices of products and services

C) to share best practices with other companies

D) to ensure the accuracy of the financial records

A) to enhance customer loyalty

B) to set sales prices of products and services

C) to share best practices with other companies

D) to ensure the accuracy of the financial records

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 223 في هذه المجموعة.

فتح الحزمة

k this deck