Deck 24: Departmental Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/120

العب

ملء الشاشة (f)

Deck 24: Departmental Accounting

1

A maintenance department would be an example of a:

A)cost center.

B)direct expense.

C)profit center.

D)None of these answers are correct.

A)cost center.

B)direct expense.

C)profit center.

D)None of these answers are correct.

A

2

The financial statement(s)that can be broken down by departments would be:

A)income statement.

B)balance sheet.

C)statement of owner's equity.

D)All of these answers are correct.

A)income statement.

B)balance sheet.

C)statement of owner's equity.

D)All of these answers are correct.

A

3

Sales minus cost of goods sold yields:

A)operating expenses.

B)gross profit.

C)income before taxes.

D)net income.

A)operating expenses.

B)gross profit.

C)income before taxes.

D)net income.

B

4

When a company tracks gross profit by department, the sales journal will:

A)not differ from a company that does not track gross profit by department.

B)have a separate column for accounts receivable for each department.

C)have a separate column for sales for each department.

D)have a column for purchases for each department.

A)not differ from a company that does not track gross profit by department.

B)have a separate column for accounts receivable for each department.

C)have a separate column for sales for each department.

D)have a column for purchases for each department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

5

A unit or department that incurs costs and generates revenues is a(n):

A)expense center.

B)direct center.

C)cost center.

D)profit center.

A)expense center.

B)direct center.

C)cost center.

D)profit center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

6

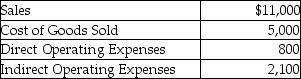

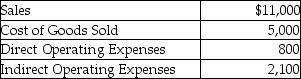

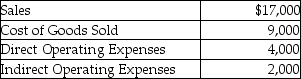

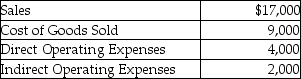

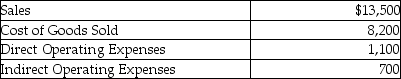

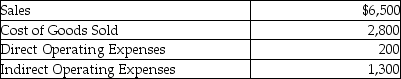

The photography department in a department store experienced the following revenue and expenses during October:  The photography departmental gross profit on sales is:

The photography departmental gross profit on sales is:

A)$3,100.

B)$5,200.

C)$6,000.

D)$8,100.

The photography departmental gross profit on sales is:

The photography departmental gross profit on sales is:A)$3,100.

B)$5,200.

C)$6,000.

D)$8,100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

7

Normally, the report prepared for a department is a(n):

A)cash flow statement.

B)statement of equity.

C)income statement.

D)balance sheet.

A)cash flow statement.

B)statement of equity.

C)income statement.

D)balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

8

Gross profit by department appears on the:

A)balance sheet.

B)statement of retained earnings.

C)statement of cash flows.

D)income statement.

A)balance sheet.

B)statement of retained earnings.

C)statement of cash flows.

D)income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

9

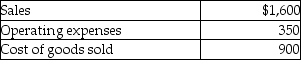

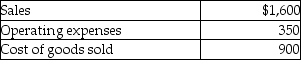

Calculate a department's gross profit on sales given the following:

A)$350.

B)$700.

C)$1,050.

D)$1,250.

A)$350.

B)$700.

C)$1,050.

D)$1,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

10

The administrative department of a mall is a(n):

A)cost center.

B)profit center.

C)investment center.

D)revenue center.

A)cost center.

B)profit center.

C)investment center.

D)revenue center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

11

A company has four departments (A, B, C and

A)A

B)B

C)C

D)and the net sales are $35,000; $40,000; $60,000 and $25,000 respectively. The cost of goods sold per department are $25,000; $15,000; $40,000 and $15,000 respectively. What department has the lowest gross profit?

D)both A and D

A)A

B)B

C)C

D)and the net sales are $35,000; $40,000; $60,000 and $25,000 respectively. The cost of goods sold per department are $25,000; $15,000; $40,000 and $15,000 respectively. What department has the lowest gross profit?

D)both A and D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

12

An example of a cost center is:

A)a Holiday Inn.

B)the restaurant in a motel.

C)the administrative department in a motel.

D)the catering department in a motel.

A)a Holiday Inn.

B)the restaurant in a motel.

C)the administrative department in a motel.

D)the catering department in a motel.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

13

A profit center is a unit in which the manager:

A)has the responsibility for controlling costs, but not for directly generating revenue.

B)is not responsible for controlling costs, but is responsible for generating revenue.

C)is responsible for controlling costs and generating revenue.

D)None of these answers are correct.

A)has the responsibility for controlling costs, but not for directly generating revenue.

B)is not responsible for controlling costs, but is responsible for generating revenue.

C)is responsible for controlling costs and generating revenue.

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

14

In a department store, the men's clothing section would be a(n):

A)profit center.

B)direct expense.

C)cost center.

D)indirect expense.

A)profit center.

B)direct expense.

C)cost center.

D)indirect expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

15

The women's shoe department shows gross sales of $245,000 with the cost of the shoes $147,000. The men's shoe department shows gross sales of $184,000 with the cost of the shoes $110,000. What is the gross profit for each department respectively?

A)$392,000 and $294,000

B)$245,000 and $184,000

C)$98,000 and $74,000

D)$429,000 and $257,000

A)$392,000 and $294,000

B)$245,000 and $184,000

C)$98,000 and $74,000

D)$429,000 and $257,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

16

In a cost center, the manager:

A)has the responsibility for controlling costs, but not directly generating revenue.

B)is not responsible for controlling costs, but is responsible for generating revenue.

C)is responsible for controlling costs and generating revenue.

D)None of these answers are correct.

A)has the responsibility for controlling costs, but not directly generating revenue.

B)is not responsible for controlling costs, but is responsible for generating revenue.

C)is responsible for controlling costs and generating revenue.

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

17

A company has four departments (A, B, C and

A)A

B)B

C)C

D)D

D)and the net sales are $35,000; $40,000; $60,000 and $25,000 respectively. The cost of goods sold per department are $25,000; $15,000; $40,000 and $15,000 respectively. What department has the highest gross profit?

A)A

B)B

C)C

D)D

D)and the net sales are $35,000; $40,000; $60,000 and $25,000 respectively. The cost of goods sold per department are $25,000; $15,000; $40,000 and $15,000 respectively. What department has the highest gross profit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

18

Departmental reports are useful for all of the following purposes except:

A)determining performance.

B)determining future revenue.

C)controlling.

D)planning.

A)determining performance.

B)determining future revenue.

C)controlling.

D)planning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

19

The espresso department experienced the following revenue and expenses during October:  The espresso departmental gross profit on sales is:

The espresso departmental gross profit on sales is:

A)$2,000.

B)$4,000.

C)$8,000.

D)$11,000.

The espresso departmental gross profit on sales is:

The espresso departmental gross profit on sales is:A)$2,000.

B)$4,000.

C)$8,000.

D)$11,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

20

The sales department of a construction firm is a(n):

A)profit center.

B)cost center.

C)investment center.

D)allocation center.

A)profit center.

B)cost center.

C)investment center.

D)allocation center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

21

A profit center and a cost center both generate revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

22

Most companies that prepare departmental income statements also prepare departmental balance sheets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

23

A human resource department would be a profit center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

24

Departmental income statements are prepared to indicate how well each department is performing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

25

In departmental accounting, it is necessary to break down revenue, but not expenses by departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

26

To calculate gross profit, subtract cost of goods sold and operating expenses from net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

27

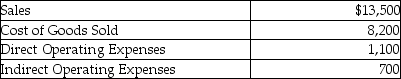

The photography department in a department store experienced the following revenue and expenses during October:  The photography departmental gross profit on sales is:

The photography departmental gross profit on sales is:

A)$15,300.

B)$20,200.

C)$13,000.

D)$14,300.

The photography departmental gross profit on sales is:

The photography departmental gross profit on sales is:A)$15,300.

B)$20,200.

C)$13,000.

D)$14,300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

28

To calculate gross profit, subtract cost of goods sold from net sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

29

To calculate departmental gross profit, separate accounts should be set up for Sales, Purchases, etc., for each department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

30

All of the following are used to compute gross profit except:

A)sales.

B)purchase returns and allowances.

C)rent expense.

D)purchases.

A)sales.

B)purchase returns and allowances.

C)rent expense.

D)purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

31

The toy department of a department store would be a cost center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

32

The PPC department of Ajax shows gross sales of $730,600 for computer supplies and $934,900 for office supplies. The cost of the computer supplies was $534,000 and the cost of the office supplies was $491,400. What is the gross profit for each category of the department respectively?

A)$730,600 and $934,900

B)$534,000 and $491,400

C)$239,200 and $400,900

D)$196,600 and $443,500

A)$730,600 and $934,900

B)$534,000 and $491,400

C)$239,200 and $400,900

D)$196,600 and $443,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

33

A department with sales of $80,000 and cost of goods sold of $55,000 has a gross profit of $25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

34

A department income statement showing gross profit by department is a useful tool in analyzing performance of individual departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

35

The data processing department of a tax firm would be a profit center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

36

What is the total gross profit of the company if there are three departments (A, B, and

A)$390,000

B)$650,000

C)$400,000

C)and the net sales are $200,000, $164,000, and $286,000, respectively, and cost of goods sold is $86,000, $92,000, and $82,000, respectively?

D)$260,000

A)$390,000

B)$650,000

C)$400,000

C)and the net sales are $200,000, $164,000, and $286,000, respectively, and cost of goods sold is $86,000, $92,000, and $82,000, respectively?

D)$260,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

37

All of the following are used to compute gross profit except:

A)sales.

B)sales returns and allowances.

C)accounts receivable.

D)purchases.

A)sales.

B)sales returns and allowances.

C)accounts receivable.

D)purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

38

A department with sales of $120,000; cost of goods sold of $75,000; and operating expenses of $20,000 has a gross profit of $25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

39

A company has three departments (A, B, and

A)A

B)B

C)C

C)and the net sales are $350,000; $410,000; and $285,000 respectively. The cost of goods sold per department are $295,000; $360,000; and $225,000 respectively. What department has the highest gross profit?

D)Both departments A and B

A)A

B)B

C)C

C)and the net sales are $350,000; $410,000; and $285,000 respectively. The cost of goods sold per department are $295,000; $360,000; and $225,000 respectively. What department has the highest gross profit?

D)Both departments A and B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

40

A profit center and a cost center both generate costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

41

To determine how each profit center is performing, management would analyze the:

A)income tax rate.

B)indirect expenses.

C)gross profit for each profit center.

D)other expenses.

A)income tax rate.

B)indirect expenses.

C)gross profit for each profit center.

D)other expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

42

If the cosmetic department in the store measures 10,000 square feet and the total building cost is $30,000 for a 40,000 square foot building, the cost that would be allocated to the cosmetic department would be:

A)$30,000.

B)$10,000.

C)$22,500.

D)$7,500.

A)$30,000.

B)$10,000.

C)$22,500.

D)$7,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

43

Indirect expenses are allocated to departments based on:

A)decisions of the stockholders.

B)directives from the board of directors.

C)some reasonable basis, such as square footage.

D)generally accepted accounting principles.

A)decisions of the stockholders.

B)directives from the board of directors.

C)some reasonable basis, such as square footage.

D)generally accepted accounting principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

44

If delivery expense is not traceable to a department, it would be considered a(n):

A)direct expense.

B)indirect expense.

C)profit center issue.

D)cost center issue.

A)direct expense.

B)indirect expense.

C)profit center issue.

D)cost center issue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

45

The difference between a department's gross profit and its operating expenses is known as the:

A)departmental operating margin.

B)departmental operating cost.

C)departmental operating income.

D)departmental gross profit.

A)departmental operating margin.

B)departmental operating cost.

C)departmental operating income.

D)departmental gross profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

46

Indirect expenses are those expenses that:

A)may be incurred outside the control of a department manager.

B)cannot be identified with a specific department.

C)are incurred for the general benefit of a company.

D)All of these answers are correct.

A)may be incurred outside the control of a department manager.

B)cannot be identified with a specific department.

C)are incurred for the general benefit of a company.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following would not be considered a direct expense?

A)Building expenses

B)Advertising expense

C)Administrative expense

D)All of the above

A)Building expenses

B)Advertising expense

C)Administrative expense

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

48

If the music department in a department store is 8,000 square feet and the total square feet is 40,000, how much of the total building cost of $40,000 will be allocated to music?

A)$8,000

B)$1,000

C)$32,000

D)$10,000

A)$8,000

B)$1,000

C)$32,000

D)$10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following would be a direct expense of a sales department?

A)Sales salaries

B)Office salaries

C)Advertising expense

D)Sales salaries and Advertising expense

A)Sales salaries

B)Office salaries

C)Advertising expense

D)Sales salaries and Advertising expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

50

A cost center is evaluated on the volume of revenues generated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following statements is incorrect?

A)Building expense is an indirect expense.

B)Indirect expenses cannot be assigned to different departments based on an allocation such as square feet.

C)If an expense is traceable to a particular department, it is a direct expense.

D)Advertising expense can be both a direct and an indirect expense.

A)Building expense is an indirect expense.

B)Indirect expenses cannot be assigned to different departments based on an allocation such as square feet.

C)If an expense is traceable to a particular department, it is a direct expense.

D)Advertising expense can be both a direct and an indirect expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

52

Advertising totaled $10,000; $3,000 was indirect. What would be the best choice to use to allocate the indirect cost?

A)Allocate the indirect expense based on square feet.

B)Allocate the indirect expense based on gross sales.

C)Charge indirect expense to administrative expense.

D)Allocate the indirect expense based on goods shipped.

A)Allocate the indirect expense based on square feet.

B)Allocate the indirect expense based on gross sales.

C)Charge indirect expense to administrative expense.

D)Allocate the indirect expense based on goods shipped.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

53

When a company tracks gross profit by department, the sales journal has separate columns for Sales for each department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

54

Administrative expenses are:

A)indirect expenses.

B)direct expenses.

C)not broken down by department.

D)All of these answers are correct.

A)indirect expenses.

B)direct expenses.

C)not broken down by department.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

55

The accountant must always consider operating expenses, such as rent and advertising, when determining gross profit for a department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

56

Explain the difference between a "cost center" and a "profit center."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

57

A department with sales of $120,000; cost of goods sold of $75,000; and operating expenses of $20,000 has a gross profit of $45,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

58

Direct expenses are those expenses that:

A)can be identified with a specific department.

B)cannot be identified with a specific department.

C)can be identified with more than one department.

D)None of these answers are correct.

A)can be identified with a specific department.

B)cannot be identified with a specific department.

C)can be identified with more than one department.

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following would be a direct expense?

A)Depreciation expense

B)Sales salaries

C)Building expense

D)Administrative expense

A)Depreciation expense

B)Sales salaries

C)Building expense

D)Administrative expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

60

When a company tracks gross profit by department, the sales journal has separate columns for Accounts Receivable for each department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

61

Carla's building expenses, which are indirect, are based on each department's square footage. Department A occupies 35,000 square feet. Department B occupies 55,000 square feet, and Department C occupies 10,000 square feet. If the building expenses total $250,000, how much is allocated to Department B?

A)$83,333

B)$137,500

C)$87,500

D)$25,000

A)$83,333

B)$137,500

C)$87,500

D)$25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

62

Julia Company allocates its indirect advertising expenses based on each department's gross sales. If the men's apparel department has gross sales of $225,000 out of a total of $2,025,000 in gross sales, what fraction would Julia use to allocate its indirect advertising expenses?

A)1/9

B)1/10

C)1/11

D)1/8

A)1/9

B)1/10

C)1/11

D)1/8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

63

If gross sales for the tools department are $500,000 and gross sales for the appliances department are $300,000, what is the fraction used to apportion the indirect advertising for the appliances department if it is based on gross sales?

A)1/2

B)1/3

C)3/8

D)2/3

A)1/2

B)1/3

C)3/8

D)2/3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

64

If the gross sales for the computer department are $3,700 and the book department gross sales are $6,300, what is the allocation for advertising expense of $750 to these departments, based on gross sales?

A)Computer department $425; book department $325

B)Computer department $375; book department $375

C)Computer department $277.50; book department $472.50

D)Computer department $462.50; book department $287.50

A)Computer department $425; book department $325

B)Computer department $375; book department $375

C)Computer department $277.50; book department $472.50

D)Computer department $462.50; book department $287.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

65

Compute net income for the housewares department, when gross profit is $550,000, direct expenses $235,000, indirect expenses are $110,000 and sales are $875,000.

A)($20,000)

B)$530,000

C)$205,000

D)$325,000

A)($20,000)

B)$530,000

C)$205,000

D)$325,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

66

Advertising expense totaled $20,000. If indirect advertising costs are allocated based on gross sales per department, what amount would be allocated to the glassware department if $5,000 of advertising is indirect? Gross Sales: jewelry, $80,000; glassware, $30,000; watches, $40,000.

A)$1,000

B)$1,333

C)$2,500

D)$2,667

A)$1,000

B)$1,333

C)$2,500

D)$2,667

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

67

Joyful Praises Corporation has total advertising expenses of $84,000: $32,000 for radio advertising and $52,000 for print advertising. The print advertising is allocated to Departments A and B based on net sales generated in each department. Department A has net sales of $558,000 and Department B has net sales of $186,000. How much of the print advertising should be allocated to Department A?

A)$13,000

B)$39,000

C)$63,000

D)$21,000

A)$13,000

B)$39,000

C)$63,000

D)$21,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which allocation base is best used to allocate building depreciation?

A)Square feet of space used

B)Number of employees

C)Hours used

D)Building depreciation can be separately traced to each department

A)Square feet of space used

B)Number of employees

C)Hours used

D)Building depreciation can be separately traced to each department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

69

If there is a total of 50,000 square feet of floor space, and the hardware department utilizes 12,500 square feet, what percent of the total square footage is in hardware?

A)20%

B)25%

C)40%

D)80%

A)20%

B)25%

C)40%

D)80%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is not a direct departmental expense in a sales department?

A)Sales salaries

B)Delivery expense for related items

C)Advertising for the sales department

D)All are direct departmental expenses.

A)Sales salaries

B)Delivery expense for related items

C)Advertising for the sales department

D)All are direct departmental expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

71

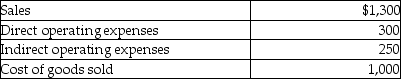

The candy department experienced the following revenue and expenses during October:  The candy departmental net income is:

The candy departmental net income is:

A)$6,400.

B)$3,500.

C)$4,200.

D)$5,300.

The candy departmental net income is:

The candy departmental net income is:A)$6,400.

B)$3,500.

C)$4,200.

D)$5,300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

72

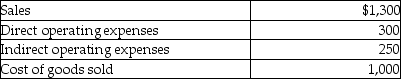

Calculate the costume jewelry department net income given the following:

A)$1,300

B)$1,000

C)$300

D)($250)

A)$1,300

B)$1,000

C)$300

D)($250)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following indirect expenses would most likely be allocated on the basis of gross sales?

A)Rent expense

B)Utilities expense

C)Miscellaneous expense

D)None of the above

A)Rent expense

B)Utilities expense

C)Miscellaneous expense

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

74

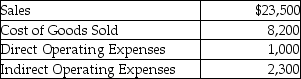

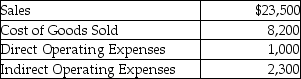

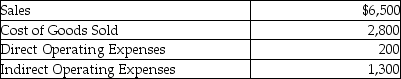

The photography department in a department store experienced the following revenue and expenses during October:  The photography departmental net income is:

The photography departmental net income is:

A)$6,500.

B)$3,700.

C)$3,500.

D)$2,200.

The photography departmental net income is:

The photography departmental net income is:A)$6,500.

B)$3,700.

C)$3,500.

D)$2,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following expenses is the most difficult to allocate to departments?

A)Cost of goods sold

B)Use of general supplies by everyone

C)Salaries and wages

D)Merchandise purchases

A)Cost of goods sold

B)Use of general supplies by everyone

C)Salaries and wages

D)Merchandise purchases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

76

If the property, plant, and equipment can be traced to a specific department, depreciation expense is a(n):

A)direct expense.

B)indirect expense.

C)cash expense.

D)sales expense.

A)direct expense.

B)indirect expense.

C)cash expense.

D)sales expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which allocation base is best used to allocate advertising expense by selling department?

A)Square feet of spaced used

B)Gross sales of each department as a percent of total gross sales

C)An even split among all selling departments

D)Some other method not listed.

A)Square feet of spaced used

B)Gross sales of each department as a percent of total gross sales

C)An even split among all selling departments

D)Some other method not listed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

78

Windermere Corporation has 25,000 square feet in department A; 20,000 square feet in department B; and 55,000 square feet in department C. Janitorial services as based on square footages in each department. How will the $35,000 of janitorial services be allocated?

A)$19,250 to C; $7,000 to B; and $8,750 to A.

B)$19,250 to A; $7,000 to B; and $8,750 to C.

C)Split evenly ($11,666.67)to each department.

D)Cannot be determined by given information.

A)$19,250 to C; $7,000 to B; and $8,750 to A.

B)$19,250 to A; $7,000 to B; and $8,750 to C.

C)Split evenly ($11,666.67)to each department.

D)Cannot be determined by given information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

79

Advertising expense totaled $40,000. If indirect advertising costs are allocated based on gross sales per department, what amount would be allocated to the Jewelry department if $10,000 of advertising is indirect? Gross Sales: Jewelry, $60,000; Glassware, $50,000; Watches, $40,000.

A)$16,000

B)$4,000

C)$20,000

D)$3,333

A)$16,000

B)$4,000

C)$20,000

D)$3,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

80

Departmental accounting requires:

A)measuring departmental gross profit.

B)allocating direct costs to departments.

C)allocating indirect costs to departments.

D)None of these answers is correct.

A)measuring departmental gross profit.

B)allocating direct costs to departments.

C)allocating indirect costs to departments.

D)None of these answers is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck