Deck 18: Corporations: Organizations and Stock

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

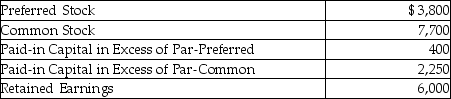

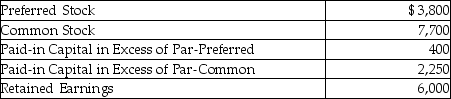

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

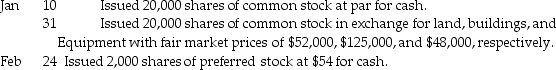

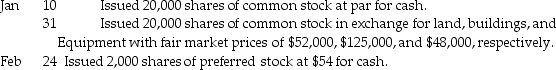

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/124

العب

ملء الشاشة (f)

Deck 18: Corporations: Organizations and Stock

1

The ownership of the corporation consists of:

A)the governing body.

B)the officers of the corporation.

C)the stockholders

D)the board of directors.

A)the governing body.

B)the officers of the corporation.

C)the stockholders

D)the board of directors.

C

2

Characteristics of a corporation include:

A)stockholders having unlimited liability.

B)direct management by the stockholders.

C)stockholders having limited liability.

D)choosing a board of directors.

A)stockholders having unlimited liability.

B)direct management by the stockholders.

C)stockholders having limited liability.

D)choosing a board of directors.

C

3

Preemptive rights allow a stockholder to:

A)share in profits first.

B)maintain a proportionate ownership interest in the corporation.

C)vote their shares at the annual meeting

D)dispose or sell their stock without notice.

A)share in profits first.

B)maintain a proportionate ownership interest in the corporation.

C)vote their shares at the annual meeting

D)dispose or sell their stock without notice.

B

4

Authorized capital stock is:

A)shares listed in the charter.

B)shares issued to the corporation's officers.

C)shares sold and in stockholder possession.

D)shares that pay dividends.

A)shares listed in the charter.

B)shares issued to the corporation's officers.

C)shares sold and in stockholder possession.

D)shares that pay dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following would normally not appear in the Stockholders' Equity section of the balance sheet?

A)Cash

B)Paid-in Capital

C)Common Stock

D)Preferred Stock

A)Cash

B)Paid-in Capital

C)Common Stock

D)Preferred Stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is a characteristic of a corporation?

A)The stockholders have limited liability.

B)When stockholders sell their shares, the corporation is dissolved.

C)A corporation cannot own property in its name.

D)Cash dividends to the stockholders are non-taxable.

A)The stockholders have limited liability.

B)When stockholders sell their shares, the corporation is dissolved.

C)A corporation cannot own property in its name.

D)Cash dividends to the stockholders are non-taxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

7

Preferred stock is considered to be non-cumulative when:

A)preferred stockholders get their yearly dividend and a percent of what is left over, sharing with common stockholders.

B)preferred stockholders have a right to the current year's dividend, but do not receive holdovers from past years when dividends were not paid.

C)preferred stockholders have a right to a certain dividend every year.

D)None of these answers are correct.

A)preferred stockholders get their yearly dividend and a percent of what is left over, sharing with common stockholders.

B)preferred stockholders have a right to the current year's dividend, but do not receive holdovers from past years when dividends were not paid.

C)preferred stockholders have a right to a certain dividend every year.

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

8

Officers of the corporation are:

A)appointed by the stockholders.

B)stockholders of the corporation.

C)appointed by the board of directors.

D)None of these answers are correct.

A)appointed by the stockholders.

B)stockholders of the corporation.

C)appointed by the board of directors.

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

9

If preferred stock is cumulative, the preferred stockholders:

A)have a right to certain dividends every year.

B)may receive a bonus.

C)will always receive a yearly dividend.

D)All of these answers are correct.

A)have a right to certain dividends every year.

B)may receive a bonus.

C)will always receive a yearly dividend.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is not a characteristic of a corporation?

A)Ease of formation

B)No mutual agency

C)Unlimited life

D)Limited liability

A)Ease of formation

B)No mutual agency

C)Unlimited life

D)Limited liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

11

Articles of incorporation contain all of the following except:

A)the names of the directors.

B)the location of the business.

C)the life expectancy (usually forever)of the business.

D)the nature of the business.

A)the names of the directors.

B)the location of the business.

C)the life expectancy (usually forever)of the business.

D)the nature of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

12

The major parts of the Stockholders' Equity section of the balance sheet are:

A)Paid-in Capital and Retained Earnings.

B)Stock and Retained Earnings.

C)Stock, Paid-in Capital, and Retained Earnings.

D)Authorized Stock and Preferred Stock.

A)Paid-in Capital and Retained Earnings.

B)Stock and Retained Earnings.

C)Stock, Paid-in Capital, and Retained Earnings.

D)Authorized Stock and Preferred Stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

13

Common stockholders have all the following rights except:

A)the right to prior claims of profit over preferred stockholders.

B)the right to vote.

C)the right to sell their stock.

D)the right to share in assets upon liquidation after creditors and preferred stockholders.

A)the right to prior claims of profit over preferred stockholders.

B)the right to vote.

C)the right to sell their stock.

D)the right to share in assets upon liquidation after creditors and preferred stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

14

A major disadvantage of a corporation is the:

A)difficulty in transferring ownership.

B)limited life.

C)difficulty in raising capital.

D)double taxation of income to the corporation and of dividends paid to shareholders.

A)difficulty in transferring ownership.

B)limited life.

C)difficulty in raising capital.

D)double taxation of income to the corporation and of dividends paid to shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

15

The articles of incorporation are:

A)submitted by the incorporators to the IRS for approval.

B)submitted by the incorporators to the Office of the Secretary of State for approval.

C)submitted by the incorporators to Securities and Exchange Commission for approval.

D)submitted by the incorporators to the Governor of the State for approval.

A)submitted by the incorporators to the IRS for approval.

B)submitted by the incorporators to the Office of the Secretary of State for approval.

C)submitted by the incorporators to Securities and Exchange Commission for approval.

D)submitted by the incorporators to the Governor of the State for approval.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

16

Stockholders' investment appears in:

A)Paid-in Capital.

B)Owner's Equity.

C)Retained Earnings.

D)Cash.

A)Paid-in Capital.

B)Owner's Equity.

C)Retained Earnings.

D)Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

17

One type of preferred stock that provides for the payment of preferred dividends that are in arrears is called:

A)non-participating.

B)cumulative.

C)non-cumulative.

D)participating.

A)non-participating.

B)cumulative.

C)non-cumulative.

D)participating.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

18

Preferred stockholders have what right over common stockholders?

A)Voting rights

B)Prior claim to dividends

C)More risk than common stockholders

D)Preemptive rights

A)Voting rights

B)Prior claim to dividends

C)More risk than common stockholders

D)Preemptive rights

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

19

Issued stock is:

A)authorized shares of stock that can be sold.

B)stock only sold to another company.

C)shares sold and in stockholders' possession.

D)stock sold to stockholders.

A)authorized shares of stock that can be sold.

B)stock only sold to another company.

C)shares sold and in stockholders' possession.

D)stock sold to stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

20

If only one type of stock is issued, it is:

A)no-par preferred stock.

B)preferred stock.

C)legal capital.

D)common stock.

A)no-par preferred stock.

B)preferred stock.

C)legal capital.

D)common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

21

A form issued by the corporation that shows the name of the stockholder and the number of shares owned is called a(n):

A)article of incorporation.

B)charter.

C)proxy.

D)stock certificate.

A)article of incorporation.

B)charter.

C)proxy.

D)stock certificate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

22

The Articles of Incorporation are submitted to the Secretary of State.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

23

A stock certificate is released for authorized stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

24

Each share of capital stock of a corporation gives its owner the right to:

A)share in the assets if the corporation liquidates.

B)set company policy.

C)hire and fire employees.

D)manage the daily operations of the business.

A)share in the assets if the corporation liquidates.

B)set company policy.

C)hire and fire employees.

D)manage the daily operations of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

25

The financial loss that each stockholder in a corporation can incur is limited to the amount invested by the stockholder.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

26

Voting rights are a characteristic of which type stock?

A)Common but not preferred

B)Preferred but not common

C)Both common and preferred

D)Neither common or preferred

A)Common but not preferred

B)Preferred but not common

C)Both common and preferred

D)Neither common or preferred

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

27

An amount determined by the corporation directors and assigned to no-par value stock is:

A)par value.

B)stated value.

C)book value.

D)market value.

A)par value.

B)stated value.

C)book value.

D)market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

28

Cox Corporation has issued 1,000 shares of stock. Janis owns 200 shares. If the corporation issues an additional 500 shares, how many shares does Janis have the preemptive right to purchase?

A)100 shares

B)200 shares

C)500 shares

D)None

A)100 shares

B)200 shares

C)500 shares

D)None

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

29

Double taxation is said to be a disadvantage of a corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

30

An advantage of a corporation would be:

A)limited liability for the shareholders.

B)unlimited life.

C)double taxation (income of corporation and dividends to shareholders).

D)both A and B are correct.

A)limited liability for the shareholders.

B)unlimited life.

C)double taxation (income of corporation and dividends to shareholders).

D)both A and B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

31

Retained Earnings is the account in which a corporation's net income and net losses are placed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

32

Stockholders pay federal income tax on their stock dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

33

Dividends in arrears occur when the company does not pay dividends to:

A)cumulative preferred stockholders.

B)non-cumulative preferred stockholders.

C)participating preferred stockholders.

D)non-participating common stockholders.

A)cumulative preferred stockholders.

B)non-cumulative preferred stockholders.

C)participating preferred stockholders.

D)non-participating common stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

34

Corporations are subject to more government regulations than sole proprietorships and partnerships.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

35

A change in ownership terminates the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

36

The stockholders of a corporation have mutual agency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

37

A share of stock may be sold at any given time according to the stock's:

A)stated value.

B)book value.

C)market value.

D)par value.

A)stated value.

B)book value.

C)market value.

D)par value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

38

Par value is equal to:

A)market value of the stock.

B)the amount stated in the charter or legal capital.

C)retained earnings.

D)the initial price at which the stock is sold.

A)market value of the stock.

B)the amount stated in the charter or legal capital.

C)retained earnings.

D)the initial price at which the stock is sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

39

Corporations can issue:

A)par value shares.

B)no-par value shares.

C)stated value shares.

D)All of these answers are correct.

A)par value shares.

B)no-par value shares.

C)stated value shares.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

40

When a corporation has only one class of stock, it will be common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

41

Organization costs are:

A)part of the company's start-up and are listed as expenses.

B)listed as an intangible asset on the balance sheet.

C)a current asset on the balance sheet.

D)another expense on the income statement.

A)part of the company's start-up and are listed as expenses.

B)listed as an intangible asset on the balance sheet.

C)a current asset on the balance sheet.

D)another expense on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

42

Cumulative preferred stock means that the preferred stockholders have a right to a certain dividend every year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

43

The entry to record selling 300 shares of no-par common stock with a stated value of $60 for $70 would be to:

A)debit Cash $21,000; credit Common Stock $21,000.

B)debit Cash $18,000; credit Common Stock $18,000.

C)debit Cash $21,000; credit Common Stock $18,000; debit Paid-in Capital in Excess of Par Value-Common $3,000.

D)debit Cash $21,000; credit Common Stock $18,000; credit Paid-in Capital in Excess of Stated Value-Common $3,000.

A)debit Cash $21,000; credit Common Stock $21,000.

B)debit Cash $18,000; credit Common Stock $18,000.

C)debit Cash $21,000; credit Common Stock $18,000; debit Paid-in Capital in Excess of Par Value-Common $3,000.

D)debit Cash $21,000; credit Common Stock $18,000; credit Paid-in Capital in Excess of Stated Value-Common $3,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

44

Five hundred shares of $25 par common stock was exchanged for a piece of equipment with a fair market value of $13,500. The journal entry to record the transaction would include a credit to:

A)Equipment for $12,500.

B)Debit to Common Stock for $12,500.

C)Credit to Paid-In Capital in Excess of Par-Common for $1,000.

D)Credit to Common Stock for $13,500.

A)Equipment for $12,500.

B)Debit to Common Stock for $12,500.

C)Credit to Paid-In Capital in Excess of Par-Common for $1,000.

D)Credit to Common Stock for $13,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

45

Shares of outstanding stock always equal the number of shares of authorized stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

46

A company would rarely sell its stock for below par value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

47

When stock is exchanged for non-cash assets:

A)debit the asset for prior book value; credit Common Stock for cash received.

B)debit assets for market value; credit Common Stock for par value and, if needed, Paid-in Capital in Excess of Par.

C)debit assets for market value; credit Common Stock for market value.

D)debit assets for par value; credit Common Stock for par value.

A)debit the asset for prior book value; credit Common Stock for cash received.

B)debit assets for market value; credit Common Stock for par value and, if needed, Paid-in Capital in Excess of Par.

C)debit assets for market value; credit Common Stock for market value.

D)debit assets for par value; credit Common Stock for par value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

48

A corporation is not required to pay dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

49

The entry to record selling 150 shares of no-par common stock with a stated value of $30 for $40 would be to:

A)debit Common Stock for $6,000; credit Cash for $6,000.

B)debit Cash for $6,000; credit Common Stock for $6,000.

C)debit Cash for $6,000; credit Common Stock for $4,500; credit Paid-In Capital in Excess of Stated Value-Common for $1,500.

D)debit Cash for $6,000; credit Common Stock for $4,500; credit Paid-In Capital in Excess of Par Value-Common for $1,500.

A)debit Common Stock for $6,000; credit Cash for $6,000.

B)debit Cash for $6,000; credit Common Stock for $6,000.

C)debit Cash for $6,000; credit Common Stock for $4,500; credit Paid-In Capital in Excess of Stated Value-Common for $1,500.

D)debit Cash for $6,000; credit Common Stock for $4,500; credit Paid-In Capital in Excess of Par Value-Common for $1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

50

A common shareholder's right to purchase an equivalent percentage of new stock is his preemptive right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

51

No entry was recorded for the exchange of stock for land. This error would cause:

A)the period end stockholders' equity to be understated.

B)the period end stockholders' equity to be overstated.

C)the period's net income to be understated.

D)Both A and C are correct.

A)the period end stockholders' equity to be understated.

B)the period end stockholders' equity to be overstated.

C)the period's net income to be understated.

D)Both A and C are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

52

List and discuss the following:

a. Rights of common stockholders

b. Rights of preferred stockholders

a. Rights of common stockholders

b. Rights of preferred stockholders

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

53

Revenue earned by the business was recorded as additional paid-in capital. This error would cause:

A)the period's net income to be understated.

B)the period's net income to be overstated.

C)the period end assets to be overstated.

D)None of these are correct.

A)the period's net income to be understated.

B)the period's net income to be overstated.

C)the period end assets to be overstated.

D)None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

54

The two main sources of stockholders' equity are investments by stockholders and net income retained in the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

55

RH Corporation Stockholders' Equity section includes the following information:  Total paid-in capital is:

Total paid-in capital is:

A)$48,000.

B)$55,000.

C)$27,000.

D)$21,000.

Total paid-in capital is:

Total paid-in capital is:A)$48,000.

B)$55,000.

C)$27,000.

D)$21,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

56

Common stock was sold in excess of par; the excess was credited to Sales. This error would cause:

A)the period's net income to be understated.

B)the period's net income to be overstated.

C)the period end assets to be overstated.

D)None of these are correct.

A)the period's net income to be understated.

B)the period's net income to be overstated.

C)the period end assets to be overstated.

D)None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

57

A corporation shares its profits with stockholders in the form of dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

58

The Zonga Corporation Stockholders' Equity section includes the following:  Total paid-in capital is:

Total paid-in capital is:

A)$83,730.

B)$76,380.

C)$70,000.

D)$77,350.

Total paid-in capital is:

Total paid-in capital is:A)$83,730.

B)$76,380.

C)$70,000.

D)$77,350.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

59

The entry to record MidIowa.net selling 800 shares of $6.00 par value common stock at $8.00 would be to:

A)debit Cash $6,400; credit Common Stock $4,800; credit Paid-in Capital in Excess of Par Value-Common $1,600.

B)debit Cash $4,800; credit Common Stock $4,800.

C)debit Cash $6,400; debit Paid-in Capital in Excess of Par Value-Common $1,600; credit Common Stock $8,000.

D)None of these answers are correct.

A)debit Cash $6,400; credit Common Stock $4,800; credit Paid-in Capital in Excess of Par Value-Common $1,600.

B)debit Cash $4,800; credit Common Stock $4,800.

C)debit Cash $6,400; debit Paid-in Capital in Excess of Par Value-Common $1,600; credit Common Stock $8,000.

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

60

List and discuss the (a)advantages and (b)disadvantages of the corporation form of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

61

The Logan Company issued 140 shares of its $12 par value stock for $14 per share. The entry to record the receipt of cash and issuance of the stock would include a:

A)debit to Cash of $1,680; credit to Common Stock for $1,680.

B)debit to Cash for $1,960.

C)credit to Common Stock for $1,960.

D)debit to Discount on Common Stock for $280

A)debit to Cash of $1,680; credit to Common Stock for $1,680.

B)debit to Cash for $1,960.

C)credit to Common Stock for $1,960.

D)debit to Discount on Common Stock for $280

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

62

The Collins Corporation Stockholders' Equity section includes the following:  What was the total amount preferred stock was sold for?

What was the total amount preferred stock was sold for?

A)$12,000

B)$14,700

C)$16,100

D)$20,200

What was the total amount preferred stock was sold for?

What was the total amount preferred stock was sold for?A)$12,000

B)$14,700

C)$16,100

D)$20,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

63

Madison Corporation is authorized to issue 3,000 shares of common stock. Record the journal entry for each of the following independent situations. Assume Madison issues 750 shares at $15 on August 31.

a)Common stock has a $10 per share par value.

b)Common stock has no par value and no stated amount.

c)Common stock is no-par stock with a stated value of $8 per share.

a)Common stock has a $10 per share par value.

b)Common stock has no par value and no stated amount.

c)Common stock is no-par stock with a stated value of $8 per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

64

When a company sells stock at an amount greater then par value, the excess amount is referred to as:

A)a discount.

B)a premium.

C)a bonus.

D)Companies cannot sell stock for more than par value.

A)a discount.

B)a premium.

C)a bonus.

D)Companies cannot sell stock for more than par value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

65

Journalize the following independent transactions:

a)Casey Company sells 250 shares of $20 par-value common stock at $20.

b)Jacob Corporation sells 100 shares of $15 par-value common stock at $20.

c)Moss Inc. sells 40 shares of no-par common stock with a $15 stated value for $30 per share.

a)Casey Company sells 250 shares of $20 par-value common stock at $20.

b)Jacob Corporation sells 100 shares of $15 par-value common stock at $20.

c)Moss Inc. sells 40 shares of no-par common stock with a $15 stated value for $30 per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

66

If stock shares are sold at more than their par value, the excess money is called:

A)earnings.

B)paid-in capital in excess of par.

C)gain on issue of stock.

D)discount on issue of stock.

A)earnings.

B)paid-in capital in excess of par.

C)gain on issue of stock.

D)discount on issue of stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

67

Carmen Corporation issued 200 shares of its $10 par value stock to an attorney. The shares are in full settlement for $8,000 of legal services to help set up the company. Prepare the journal entry for the stock issuance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

68

ABC sells 400 shares of its $23 par common stock for $27. The entry would entail a credit(s)of:

A)Cash of $9,200.

B)Paid-in Capital in Excess of Par-Common for $800; Common Stock for $10,800.

C)Paid-in Capital in Excess of Par-Common for $1,600; Common Stock for $9,200.

D)Common Stock for $10,800.

A)Cash of $9,200.

B)Paid-in Capital in Excess of Par-Common for $800; Common Stock for $10,800.

C)Paid-in Capital in Excess of Par-Common for $1,600; Common Stock for $9,200.

D)Common Stock for $10,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

69

A company issues no-par value with no stated value stock. Therefore, the company does not have a minimum legal capital amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

70

The sale of common stock above par was recorded by crediting Common Stock for the total amount. This error would cause:

A)the period end stockholders' equity to be overstated.

B)the period end stockholders' equity to be understated.

C)the period's net income to be understated.

D)None of these are correct.

A)the period end stockholders' equity to be overstated.

B)the period end stockholders' equity to be understated.

C)the period's net income to be understated.

D)None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

71

The par value of stock represents the legal capital of the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

72

The Harvester Corporation issued 40 shares of $20 par value stock to its accountant. The shares are in full payment for her $900 fee for assistance in setting up the new company. The entry to record the issuance of the stock would include a:

A)credit to Common Stock for $900.

B)debit to Common Stock for $900.

C)credit to Common Stock for $800.

D)debit to Common Stock for $800.

A)credit to Common Stock for $900.

B)debit to Common Stock for $900.

C)credit to Common Stock for $800.

D)debit to Common Stock for $800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

73

R. Red formed a corporation with an authorization of 20,000 shares of $50 par, 6% non-cumulative preferred stock and 100,000 shares of $10 par common stock. The following selected transactions were completed during the first year of operations. Journalize the transactions omitting explanations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

74

The sale of common stock was recorded as a sale of preferred stock. This error would cause:

A)the period end stockholders' equity to be overstated.

B)the period end stockholders' equity to be understated.

C)the period's net income to be understated.

D)None of these are correct.

A)the period end stockholders' equity to be overstated.

B)the period end stockholders' equity to be understated.

C)the period's net income to be understated.

D)None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

75

Birch Company issued 200 shares of common stock with a par value of $12 per share in exchange for equipment with a fair market value of $3,000. Record the journal entry for the stock issuance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

76

Sunrise Online issued 500 shares of its $10 common stock in exchange for equipment with a fair market value of $7,500. The entry to record the transaction would include a:

A)debit to Equipment for $5,000.

B)debit to Common Stock for $5,000.

C)credit to Paid-in Capital in Excess of Par Value for $2,500.

D)credit to Common Stock Subscribed for $5,000.

A)debit to Equipment for $5,000.

B)debit to Common Stock for $5,000.

C)credit to Paid-in Capital in Excess of Par Value for $2,500.

D)credit to Common Stock Subscribed for $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

77

In exchange for $1,500 legal services to help set up the new company, Hickory Grove Corporation issued 100 shares of $10 par value stock to its attorney. The entry to record the issuance of the stock would include a:

A)credit to Common Stock for $1,000.

B)debit to Common Stock for $1,000.

C)credit to Common Stock for $1,500.

D)debit to Paid-in Capital in Excess of Par Value for $500.

A)credit to Common Stock for $1,000.

B)debit to Common Stock for $1,000.

C)credit to Common Stock for $1,500.

D)debit to Paid-in Capital in Excess of Par Value for $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

78

The TM Stockholders' Equity section includes the following:  What was the total amount common stock was sold for?

What was the total amount common stock was sold for?

A)$7,700

B)$13,700

C)$11,500

D)$9,950

What was the total amount common stock was sold for?

What was the total amount common stock was sold for?A)$7,700

B)$13,700

C)$11,500

D)$9,950

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

79

Washington Corporation issued 4,000 shares of its $20 par value common stock for $23 per share. The entry to record the issuance would include a:

A)debit to Cash for $80,000.

B)credit to Common Stock for $12,000.

C)credit to Common Stock for $80,000.

D)debit to Paid-in Capital in Excess of Par Value for $12,000.

A)debit to Cash for $80,000.

B)credit to Common Stock for $12,000.

C)credit to Common Stock for $80,000.

D)debit to Paid-in Capital in Excess of Par Value for $12,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

80

Dolly's Best issued 200 shares of its $10 common stock in exchange for used packaging equipment with a fair market value of $2,400. The entry to record the acquisition of the equipment would include a:

A)debit to Equipment for $2,000.

B)debit to Paid-in Capital in Excess of Par for $400.

C)credit to Common Stock for $2,400.

D)debit to Equipment for $2,400.

A)debit to Equipment for $2,000.

B)debit to Paid-in Capital in Excess of Par for $400.

C)credit to Common Stock for $2,400.

D)debit to Equipment for $2,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck