Deck 10: Purchases and Cash Payments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

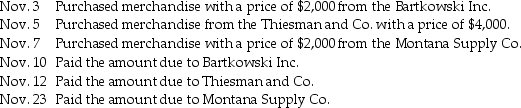

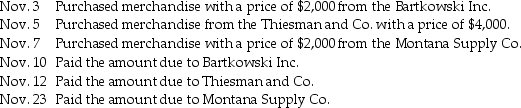

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/122

العب

ملء الشاشة (f)

Deck 10: Purchases and Cash Payments

1

When merchandise is bought for resale, which of the following accounts would be increased?

A)Store Equipment

B)Purchases

C)A/R

D)Capital

A)Store Equipment

B)Purchases

C)A/R

D)Capital

B

2

When the term F.O.B. shipping point is used, title passes:

A)when goods reach the halfway point.

B)when goods reach the destination.

C)when goods are shipped.

D)when the buyer unpacks the goods.

A)when goods reach the halfway point.

B)when goods reach the destination.

C)when goods are shipped.

D)when the buyer unpacks the goods.

C

3

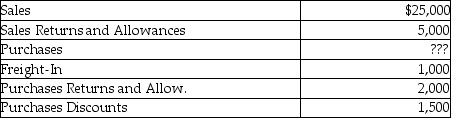

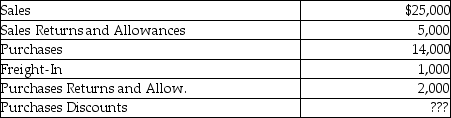

Jackie's Online Service on April 30 has the following account balances:  If net purchases for the period are $14,000, what is the amount of gross purchases?

If net purchases for the period are $14,000, what is the amount of gross purchases?

A)$18,500

B)$15,500

C)$17,500

D)$16,500

If net purchases for the period are $14,000, what is the amount of gross purchases?

If net purchases for the period are $14,000, what is the amount of gross purchases?A)$18,500

B)$15,500

C)$17,500

D)$16,500

C

4

Net purchases are:

A)Purchases + Purchases Returns and Allowances.

B)Purchases - Purchases Discount - Purchases Returns and Allowances.

C)Purchases - Freight - Purchases Returns and Allowances.

D)Purchases + Freight-in.

A)Purchases + Purchases Returns and Allowances.

B)Purchases - Purchases Discount - Purchases Returns and Allowances.

C)Purchases - Freight - Purchases Returns and Allowances.

D)Purchases + Freight-in.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

5

If a display rack was purchased for the store, which of the following accounts would be increased?

A)Store Equipment

B)Purchases

C)Cash

D)Capital

A)Store Equipment

B)Purchases

C)Cash

D)Capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

6

Purchases Discount:

A)is a contra-cost account.

B)has a normal debit balance.

C)decreases Net Income.

D)All of the above are correct.

A)is a contra-cost account.

B)has a normal debit balance.

C)decreases Net Income.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

7

A cost account is treated the same as:

A)an asset.

B)Capital.

C)a revenue.

D)an expense.

A)an asset.

B)Capital.

C)a revenue.

D)an expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

8

Clothes' R Us bought some new clothes for its fashion line and is required to pay the freight costs. The freight terms are:

A)F.O.B. destination.

B)F.O.B. shipping point.

C)3/10, n/30.

D)None of these are correct.

A)F.O.B. destination.

B)F.O.B. shipping point.

C)3/10, n/30.

D)None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

9

F.O.B. shipping point means:

A)the buyer pays for the freight.

B)the seller pays for the freight.

C)the title passes at time of shipment.

D)Both A and C are correct.

A)the buyer pays for the freight.

B)the seller pays for the freight.

C)the title passes at time of shipment.

D)Both A and C are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

10

A form used with a business by the requesting department asking the purchasing department to buy specific goods is called a:

A)purchase order.

B)purchase requisition.

C)purchase invoice.

D)debit memorandum.

A)purchase order.

B)purchase requisition.

C)purchase invoice.

D)debit memorandum.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

11

The term F.O.B. means:

A)free on board.

B)freight or bill.

C)freight order billing.

D)found on base.

A)free on board.

B)freight or bill.

C)freight order billing.

D)found on base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

12

When merchandise is bought for resale, which of the following accounts would be decreased?

A)Store Equipment

B)Purchases

C)Cash

D)Capital

A)Store Equipment

B)Purchases

C)Cash

D)Capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

13

A characteristic of Purchases Returns and Allowances is:

A)it has a normal credit balance.

B)it increases when merchandise is returned.

C)it decreases cost.

D)All of the above are correct.

A)it has a normal credit balance.

B)it increases when merchandise is returned.

C)it decreases cost.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

14

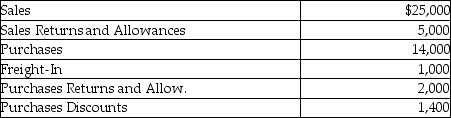

Jackie's Online Service on April 30 has the following account balances:  Net purchases for the period are:

Net purchases for the period are:

A)$10,600.

B)$9,600.

C)$12,600.

D)$14,000.

Net purchases for the period are:

Net purchases for the period are:A)$10,600.

B)$9,600.

C)$12,600.

D)$14,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

15

On November 30, Janoch's Dog Kennel purchased $600 of merchandise on account from the Ganster Company. The goods were shipped F.O.B. shipping point. The freight charge of $40 was paid by Ganster Company and added to the invoice. The amount to record in the Purchases account is:

A)$600.

B)$640.

C)$560.

D)$550.

A)$600.

B)$640.

C)$560.

D)$550.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

16

The entry to record a purchase of $5,000 on account, terms of 2/10, n/30, would include a:

A)debit to Purchases Discount for $100.

B)credit to Accounts Payable for $5,000.

C)debit to Accounts Payable for $5,000.

D)credit to Cash for $5,000.

A)debit to Purchases Discount for $100.

B)credit to Accounts Payable for $5,000.

C)debit to Accounts Payable for $5,000.

D)credit to Cash for $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

17

Purchases is a(n):

A)cost.

B)asset.

C)liability.

D)revenue.

A)cost.

B)asset.

C)liability.

D)revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

18

Purchase Discounts are taken on:

A)shipping expense.

B)Purchases Returns and Allowances.

C)Purchases.

D)All of the above are correct.

A)shipping expense.

B)Purchases Returns and Allowances.

C)Purchases.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

19

Before paying an invoice, the accounting department must check:

A)the purchase order.

B)the invoice.

C)the receiving report.

D)All of the above are correct.

A)the purchase order.

B)the invoice.

C)the receiving report.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

20

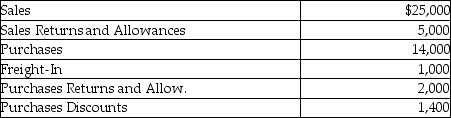

Jackie's Online Service on April 30 has the following account balances:  If net purchases for the period are $11,000, what is the amount in the Purchases Discounts account?

If net purchases for the period are $11,000, what is the amount in the Purchases Discounts account?

A)$3,000

B)$4,000

C)2,000

D)$1,000

If net purchases for the period are $11,000, what is the amount in the Purchases Discounts account?

If net purchases for the period are $11,000, what is the amount in the Purchases Discounts account?A)$3,000

B)$4,000

C)2,000

D)$1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

21

The freight paid on goods purchased F.O.B. Shipping Point was not recorded. This error will cause:

A)net income to be overstated.

B)net income to be understated.

C)net income to not be affected.

D)total liabilities to be overstated.

A)net income to be overstated.

B)net income to be understated.

C)net income to not be affected.

D)total liabilities to be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

22

A form used in business to place an order for the buying of goods from a seller is:

A)purchase requisition.

B)purchase order.

C)purchase discount.

D)purchases returns.

A)purchase requisition.

B)purchase order.

C)purchase discount.

D)purchases returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

23

Purchases discounts:

A)decrease net income.

B)increase net income.

C)have no effect on net income.

D)Not enough information provided.

A)decrease net income.

B)increase net income.

C)have no effect on net income.

D)Not enough information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

24

The return of merchandise was recorded as a debit to Accounts Receivable and a credit to Purchases Returns and Allowances. This error will cause:

A)net income to be overstated.

B)net income to be understated.

C)total liabilities to be understated.

D)total assets to be overstated.

A)net income to be overstated.

B)net income to be understated.

C)total liabilities to be understated.

D)total assets to be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following transactions will cause a liability to be credited and a cost account to be debited when the periodic inventory system is in use?

A)Recorded the adjustment for depreciation

B)Recorded the adjustment for the consumption of supplies

C)Purchased merchandise inventory on account

D)Purchased office supplies on account

A)Recorded the adjustment for depreciation

B)Recorded the adjustment for the consumption of supplies

C)Purchased merchandise inventory on account

D)Purchased office supplies on account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following transactions will cause one asset to be debited and another to be credited when the periodic inventory system is in use?

A)Purchased merchandise on account

B)Purchased merchandise for cash.

C)Purchased office supplies for cash

D)Purchased office supplies on account

A)Purchased merchandise on account

B)Purchased merchandise for cash.

C)Purchased office supplies for cash

D)Purchased office supplies on account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

27

Heidi's Accessories bought 50 necklaces for $10 each on account. The invoice included a 6% sales tax and payment terms of 2/10, n/30. In addition, 5 necklaces were returned prior to payment. The entry to record the purchase would include:

A)a debit to Accounts Payable for $530.

B)a debit to Accounts Payable for $500.

C)a debit to Purchases for $530.

D)a debit to Purchases for $500.

A)a debit to Accounts Payable for $530.

B)a debit to Accounts Payable for $500.

C)a debit to Purchases for $530.

D)a debit to Purchases for $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

28

A characteristic of Purchases is:

A)it has a debit normal balance.

B)it reduces net income.

C)that it is used to record the purchase of merchandise to be resold.

D)All of the above are correct.

A)it has a debit normal balance.

B)it reduces net income.

C)that it is used to record the purchase of merchandise to be resold.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

29

The term used when the purchaser is responsible for the cost of freight is:

A)F.O.B. shipping point.

B)F.O.B. destination.

C)Freight-In.

D)Purchases.

A)F.O.B. shipping point.

B)F.O.B. destination.

C)Freight-In.

D)Purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

30

Office Supplies (not used for resale)bought on account were returned for credit and recorded with a debit to Accounts Payable and a credit to Purchase Returns and Allowances. This error will cause:

A)net income to be overstated.

B)net income to be understated.

C)net income to not be affected.

D)total assets to be understated.

A)net income to be overstated.

B)net income to be understated.

C)net income to not be affected.

D)total assets to be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

31

Hardware Restoration had net purchases of $50,000. If Purchases Returns and Allowances are $10,000 and Purchases Discounts are $1,500, what are gross purchases?

A)$38,500

B)$50,000

C)$61,500

D)$40,000

A)$38,500

B)$50,000

C)$61,500

D)$40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

32

A purchase discount correctly taken was debited to Purchases at the time the entry was recorded. This error will cause:

A)net income to be overstated.

B)net income to be understated.

C)net income to not be affected.

D)total assets to be overstated.

A)net income to be overstated.

B)net income to be understated.

C)net income to not be affected.

D)total assets to be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

33

The Purchases Discount account normally has a debit balance and is a contra-cost account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

34

The term used when the seller is responsible for the cost of freight is:

A)F.O.B. shipping point.

B)F.O.B. destination.

C)Freight-In.

D)Purchases.

A)F.O.B. shipping point.

B)F.O.B. destination.

C)Freight-In.

D)Purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

35

Purchases:

A)decrease net income.

B)increase net income.

C)have no effect on net income.

D)Not enough information provided.

A)decrease net income.

B)increase net income.

C)have no effect on net income.

D)Not enough information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

36

A purchase discount was recorded as a credit to the Purchases account and a debit to Accounts Payable. This error will cause:

A)net income to be overstated.

B)net income to be understated.

C)net income to not be affected.

D)total assets to be overstated.

A)net income to be overstated.

B)net income to be understated.

C)net income to not be affected.

D)total assets to be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

37

R&R Lumber reports Purchases of $60,000. If Purchases Returns and Allowances are $6,000 and Purchases Discounts are $1,500, what are the net Purchases?

A)$54,000

B)$52,500

C)$67,500

D)$58,500

A)$54,000

B)$52,500

C)$67,500

D)$58,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

38

Purchases Returns and Allowances:

A)decrease net income.

B)increase net income.

C)have no effect on net income.

D)Not enough information provided.

A)decrease net income.

B)increase net income.

C)have no effect on net income.

D)Not enough information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

39

The account Freight-In accumulates the shipping costs to the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

40

Purchased office supplies on account. This will be recorded with:

A)a debit to Accounts Payable and a credit to Supplies.

B)a debit to Supplies and a credit to Supplies Expense.

C)a debit to Supplies and a credit to Accounts Payable.

D)a credit to Supplies and a debit to Purchases.

A)a debit to Accounts Payable and a credit to Supplies.

B)a debit to Supplies and a credit to Supplies Expense.

C)a debit to Supplies and a credit to Accounts Payable.

D)a credit to Supplies and a debit to Purchases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

41

A receiving report is used to notify the company of the quantity and condition of the goods received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following accounts is a contra-cost account?

A)Accumulated Depreciation

B)Purchases Returns and Allowances

C)Sales Returns and Allowances

D)Sales Discount

A)Accumulated Depreciation

B)Purchases Returns and Allowances

C)Sales Returns and Allowances

D)Sales Discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

43

When the terms are F.O.B. shipping point, the buyer is responsible for the cost of shipping from the seller's shipping point to the purchaser's location but the title does not pass until it is delivered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

44

Purchase discounts are given to the buyer from the supplier for early payment on account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

45

A debit memorandum decreases which account on the seller's books?

A)Accounts Payable

B)Purchases Returns and Allowances

C)Sales Returns and Allowances

D)Accounts Receivable

A)Accounts Payable

B)Purchases Returns and Allowances

C)Sales Returns and Allowances

D)Accounts Receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

46

Explain the difference between F.O.B. shipping point and F.O.B. destination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

47

On February 12, Clare purchased $400 of merchandise on account from Larsen's Accessories, terms 2/10, n/30. The goods were shipped F.O.B. destination. The freight charge was $40. The amount to be recorded in the Accounts Payable Subsidiary ledger is:

A)$392.

B)$408.

C)$400.

D)$440.

A)$392.

B)$408.

C)$400.

D)$440.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

48

Purchases Discounts are not taken on freight costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

49

An entry to record the payment to a vendor was correctly recorded and posted to the general ledger but was not posted to the subsidiary ledger. This error will cause:

A)net income to be overstated.

B)net income to be understated.

C)the accounts payable control account to not agree with the subsidiary ledger.

D)the accounts receivable control account to not agree with the subsidiary ledger.

A)net income to be overstated.

B)net income to be understated.

C)the accounts payable control account to not agree with the subsidiary ledger.

D)the accounts receivable control account to not agree with the subsidiary ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

50

An invoice approval form is used by accounting to check the invoice before approving it for payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

51

The Purchases Returns and Allowances account normally has a credit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

52

A debit memorandum increases which account on the seller's books?

A)Accounts Payable

B)Purchases Returns and Allowances

C)Sales Returns and Allowances

D)Accounts Receivable

A)Accounts Payable

B)Purchases Returns and Allowances

C)Sales Returns and Allowances

D)Accounts Receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

53

Payment for merchandise should not be made until approval is given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

54

The normal balance for Purchases Returns and Allowances is:

A)a debit.

B)a credit.

C)It does not have a normal balance.

D)zero.

A)a debit.

B)a credit.

C)It does not have a normal balance.

D)zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

55

Tyler returned $500 of merchandise within the discount period. The entry to record the return is to:

A)debit Purchases for $500; credit Accounts Payable for $500.

B)debit Purchases for $500; credit Purchases Returns and Allowances for $500.

C)debit Accounts Payable/Suppliers Name for $500; credit Purchases Returns and Allowances for $500.

D)debit to Accounts Payable for $500, credit Purchases Discount for $500.

A)debit Purchases for $500; credit Accounts Payable for $500.

B)debit Purchases for $500; credit Purchases Returns and Allowances for $500.

C)debit Accounts Payable/Suppliers Name for $500; credit Purchases Returns and Allowances for $500.

D)debit to Accounts Payable for $500, credit Purchases Discount for $500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

56

A debit memorandum increases which account on the buyer's books?

A)Accounts Payable

B)Purchases Returns and Allowances

C)Sales Returns and Allowances

D)Accounts Receivable

A)Accounts Payable

B)Purchases Returns and Allowances

C)Sales Returns and Allowances

D)Accounts Receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

57

The seller's sales invoice is the buyer's purchase invoice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

58

A debit memorandum decreases which account on the buyer's books?

A)Accounts Payable

B)Purchases Returns and Allowances

C)Sales Returns and Allowances

D)Accounts Receivable

A)Accounts Payable

B)Purchases Returns and Allowances

C)Sales Returns and Allowances

D)Accounts Receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

59

The entry to record returned merchandise to Vans Company is:

A)debit Purchases Returns and Allowances; credit Accounts Payable in the general ledger.

B)debit Accounts Payable; credit Purchases.

C)debit Accounts Payable/Vans Company in the accounts payable subsidiary ledger and debit Accounts Payable in the general ledger; credit Purchases Returns and Allowances.

D)debit Purchases; credit Accounts Payable.

A)debit Purchases Returns and Allowances; credit Accounts Payable in the general ledger.

B)debit Accounts Payable; credit Purchases.

C)debit Accounts Payable/Vans Company in the accounts payable subsidiary ledger and debit Accounts Payable in the general ledger; credit Purchases Returns and Allowances.

D)debit Purchases; credit Accounts Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

60

On September 6, Mark purchased merchandise for his electric store. The invoice was for $35,000 plus freight of $750, terms 2/15, n/30. The freight was included on the invoice. On September 10, Mark returned merchandise for $5,000 credit. On September 19, Mark paid the amount owed. Fill in the blanks below.

a)The credit to Accounts Payable on September 6 is ________.

b)The debit to Freight-In on September 6 is ________.

c)The debit to Accounts Payable on September 10 is ________.

d)The credit to Purchases Discount on September 19 is ________.

e)The credit to Cash on September 19 is ________.

a)The credit to Accounts Payable on September 6 is ________.

b)The debit to Freight-In on September 6 is ________.

c)The debit to Accounts Payable on September 10 is ________.

d)The credit to Purchases Discount on September 19 is ________.

e)The credit to Cash on September 19 is ________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

61

Determine the amount of credit to be earned on a full return of merchandise purchased with an invoice price of $5,000 and credit terms of 2/10, n/30 when full payment was made within the discount period.

$ ________

$ ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

62

Jackson purchased $500 of goods and received credit terms of 2/10, n/30. How much did he pay if payment was made during the discount period?

A)$450

B)$510

C)$500

D)$490

A)$450

B)$510

C)$500

D)$490

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

63

Individual amounts are recorded during the month to the accounts payable ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

64

Medeco bought goods for $250 on credit. Medeco returned $50 worth of goods. Terms of the sale were 2/10, n/30. If Medeco pays the amount owed within the discount period, what is the amount they should pay?

A)$250

B)$204

C)$196

D)$200

A)$250

B)$204

C)$196

D)$200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

65

If a debit memorandum is issued, the buyer will reduce their accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

66

Returned merchandise paid for within the discount period for a Cash refund. This will be recorded with:

A)a credit to a liability.

B)a credit to an asset.

C)a debit to a liability.

D)a debit to an asset.

A)a credit to a liability.

B)a credit to an asset.

C)a debit to a liability.

D)a debit to an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

67

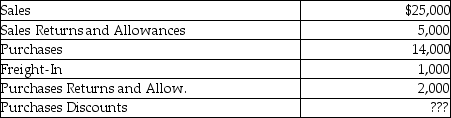

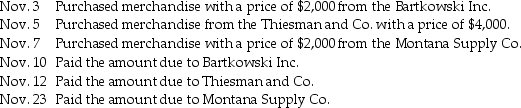

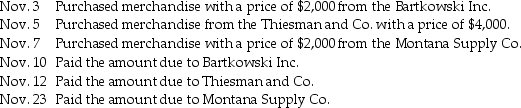

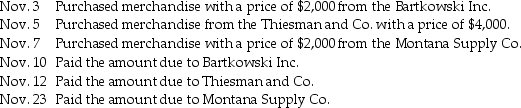

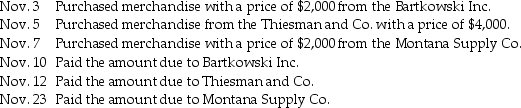

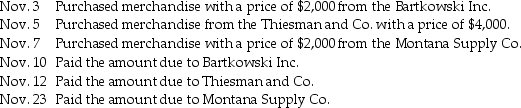

Journalize the following transactions. All purchases are on account and subject to terms of 2/10, n/30. The periodic inventory method is used.

Journalize the Nov. 3 transaction.

Journalize the Nov. 3 transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

68

Journalize the following transactions. All purchases are on account and subject to terms of 2/10, n/30. The periodic inventory method is used.

Journalize the Nov. 5 transaction.

Journalize the Nov. 5 transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

69

Journalize the following transactions. All purchases are on account and subject to terms of 2/10, n/30. The periodic inventory method is used.

Journalize the Nov. 7 transaction.

Journalize the Nov. 7 transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

70

The entry to record a payment on a $600 account within the 2% discount period would include a:

A)debit to Accounts Payable for $588.

B)debit to Accounts Payable for $600.

C)credit to Purchases for $588.

D)debit to Cash for $600.

A)debit to Accounts Payable for $588.

B)debit to Accounts Payable for $600.

C)credit to Purchases for $588.

D)debit to Cash for $600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

71

Journalize the following transactions. All purchases are on account and subject to terms of 2/10, n/30. The periodic inventory method is used.

Journalize the Nov. 10 transaction.

Journalize the Nov. 10 transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

72

Heidi's Accessories bought 50 necklaces for $10 each on account. The invoice included a 6% sales tax and payment terms of 2/10, n/30. In addition, 5 necklaces were returned prior to payment. The entry to record the return would include:

A)a debit to Accounts Payable for $50.00.

B)a debit to Accounts Payable for $53.00.

C)a debit to Purchases Returns and Allowances for $50.00.

D)a debit to Purchases Returns and Allowances for $53.00.

A)a debit to Accounts Payable for $50.00.

B)a debit to Accounts Payable for $53.00.

C)a debit to Purchases Returns and Allowances for $50.00.

D)a debit to Purchases Returns and Allowances for $53.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

73

Determine the amount to be paid within the discount period for purchase with an invoice price of $5,000 and credit terms of 2/10, n/30 when $500 has already been returned for credit.

$ ________

$ ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

74

Determine the total cost of a purchase paid for within the discount period with an invoice price of $7,000 and credit terms of 2/10, n/30 when $1,500 has already been returned for credit. The goods were purchased with freight terms of F.O.B shipping point and freight of $50.

$ ________

$ ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

75

Returned merchandise under the periodic inventory method. This will be recorded with:

A)a debit to Accounts Payable and a credit to Purchases Returns and Allowances.

B)a debit to Merchandise Inventory and a credit to Purchases.

C)a credit to Accounts Payable and a debit to Merchandise Inventory.

D)a debit to Accounts Payable and a credit to Merchandise Inventory.

A)a debit to Accounts Payable and a credit to Purchases Returns and Allowances.

B)a debit to Merchandise Inventory and a credit to Purchases.

C)a credit to Accounts Payable and a debit to Merchandise Inventory.

D)a debit to Accounts Payable and a credit to Merchandise Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

76

Determine the amount to be paid within the discount period for purchase with an invoice price of $10,000, subject to credit terms of 2/10, n/30.

$ ________

$ ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

77

The buyer issues a debit memorandum to indicate that a previous purchase amount is being reduced because goods were returned or an allowance was requested.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

78

Determine the amount to be paid to the vendor within the discount period for purchase with an invoice price of $3,000 and credit terms of 2/10, n/30 when $700 has already been returned for credit. The goods were purchased with freight terms of F.O.B shipping point and freight of $50 was included on the invoice.

$ ________

$ ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

79

On June 15, Paradise Park purchased merchandise for the race track.. The invoice was for $4,500, terms 2/10, n/30. On June 20, Paradise Park returned $200 of merchandise for credit. On June 25, it paid the amount owed. Fill in the blanks below.

a)The debit to Purchases on June 15 is ________.

b)The credit to Accounts Payable on June 15 is ________.

c)The credit to Purchases Returns and Allowances on June 20 is ________.

d)The credit to Cash on June 25 is ________.

e)The credit to Purchases Discount on June 25 is ________.

a)The debit to Purchases on June 15 is ________.

b)The credit to Accounts Payable on June 15 is ________.

c)The credit to Purchases Returns and Allowances on June 20 is ________.

d)The credit to Cash on June 25 is ________.

e)The credit to Purchases Discount on June 25 is ________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

80

Heidi's Accessories bought 50 necklaces for $10 each on account. The invoice included a 6% sales tax and payment terms of 2/10, n/30. In addition, 5 necklaces were returned prior to payment. The entry to record the payment (within the discount period)would include:

A)a credit to Cash for $477.

B)a credit to Cash for $468.

C)a credit to Accounts Receivable for $477.

D)a credit to Accounts Receivable for $468.

A)a credit to Cash for $477.

B)a credit to Cash for $468.

C)a credit to Accounts Receivable for $477.

D)a credit to Accounts Receivable for $468.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck