Deck 8: Paying, Recording, and Reporting Payroll and Payroll Taxes: the Conclusion of the Payroll Process

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

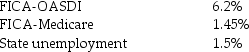

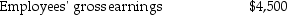

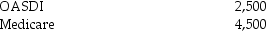

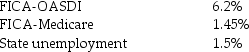

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

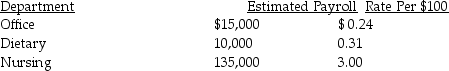

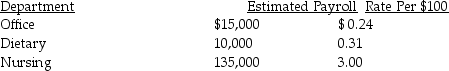

سؤال

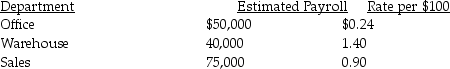

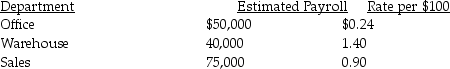

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/120

العب

ملء الشاشة (f)

Deck 8: Paying, Recording, and Reporting Payroll and Payroll Taxes: the Conclusion of the Payroll Process

1

What type of an account is Wages and Salaries Payable?

A)Asset

B)Liability

C)Revenue

D)Expense

A)Asset

B)Liability

C)Revenue

D)Expense

B

2

Wages and Salaries Expense is:

A)equal to net pay.

B)equal to gross pay.

C)equal to the employer's taxes.

D)None of the above are correct.

A)equal to net pay.

B)equal to gross pay.

C)equal to the employer's taxes.

D)None of the above are correct.

B

3

The entry to record the payroll tax expense would include:

A)a credit to Federal Income Taxes Payable.

B)a credit to Cash.

C)a credit to FICA (OASDI and Medicare)Taxes Payable.

D)a credit to Wages Payable.

A)a credit to Federal Income Taxes Payable.

B)a credit to Cash.

C)a credit to FICA (OASDI and Medicare)Taxes Payable.

D)a credit to Wages Payable.

C

4

Which of the following statements is true?

A)Payroll Tax Expense increases on the debit side of the account.

B)FICA-Social Security Tax Payable is a liability.

C)Payroll Tax Expense has a debit normal balance.

D)All of these answers are correct.

A)Payroll Tax Expense increases on the debit side of the account.

B)FICA-Social Security Tax Payable is a liability.

C)Payroll Tax Expense has a debit normal balance.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

5

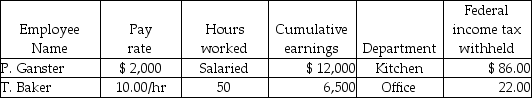

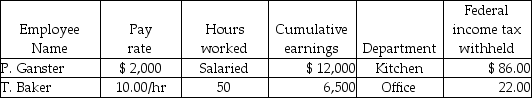

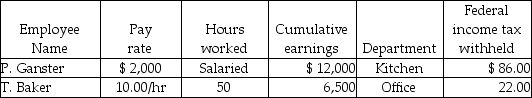

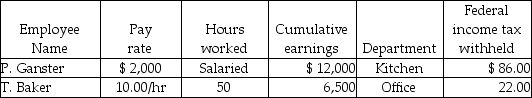

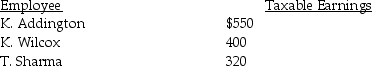

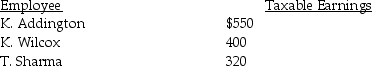

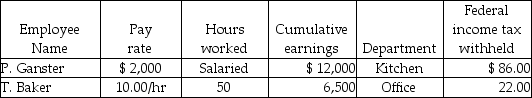

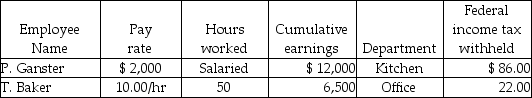

Grammy's Bakery had the following information for the pay period ending June 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Kitchen Salaries Expense?

A)Debit $12,000

B)Credit $12,000

C)Debit $2,000

D)Credit $2,000

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Kitchen Salaries Expense?

A)Debit $12,000

B)Credit $12,000

C)Debit $2,000

D)Credit $2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

6

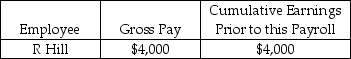

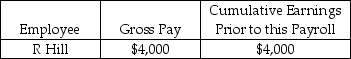

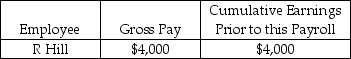

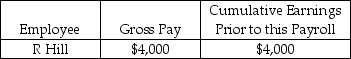

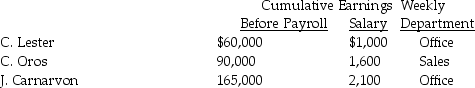

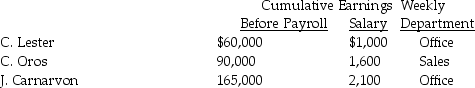

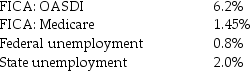

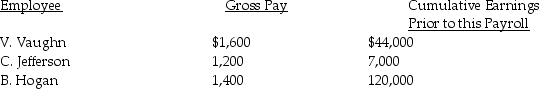

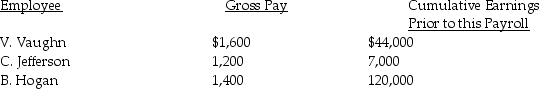

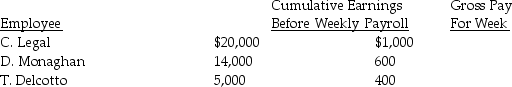

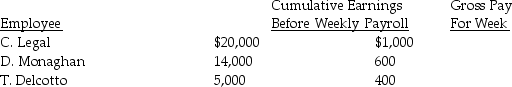

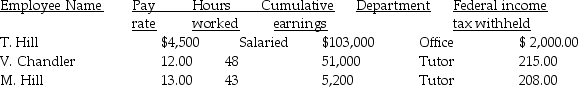

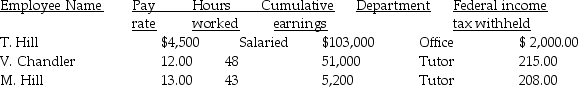

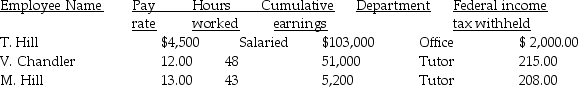

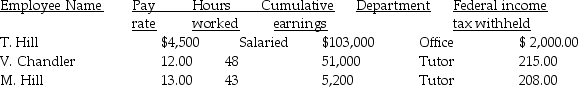

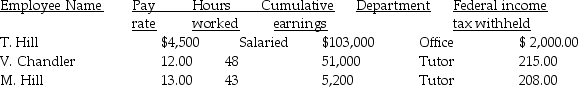

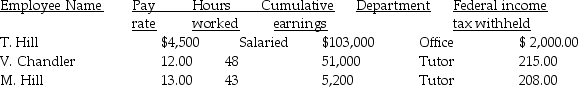

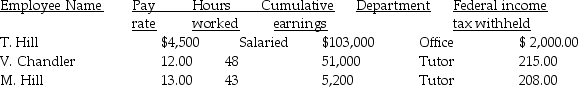

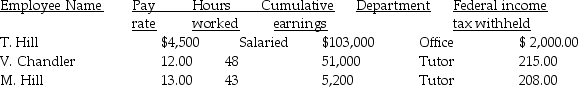

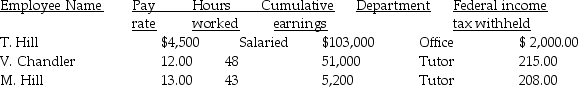

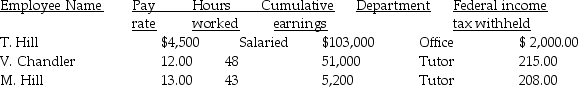

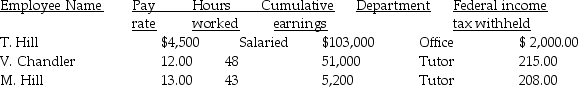

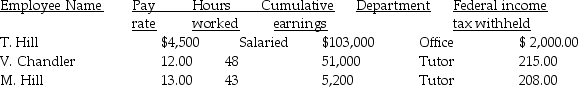

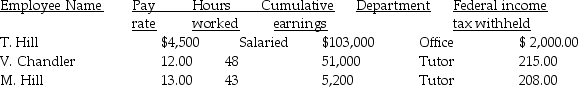

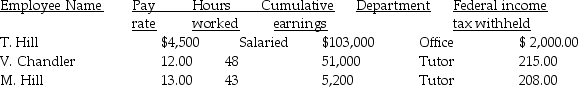

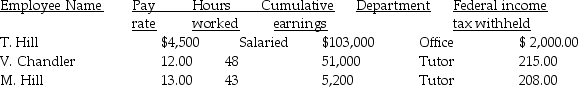

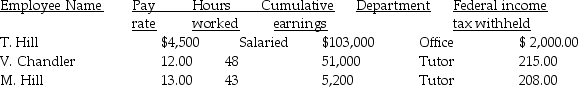

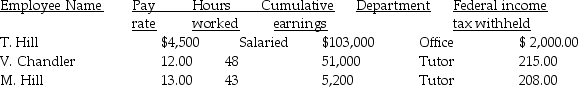

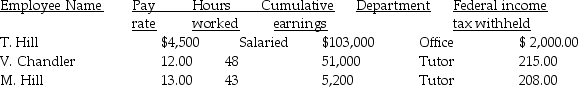

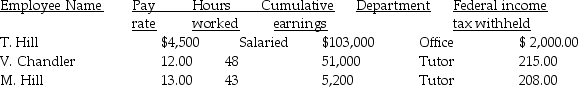

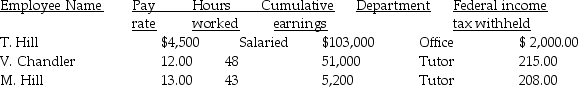

Great Lakes Tutoring had the following payroll information on February 28:  Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State Unemployment tax rate is 2% on the first $7,000

Federal Unemployment tax rate is 0.8% on the first $7,000

Using the information above, the journal entry to record the payroll tax expense for Great Lakes Tutoring would include:

A)a debit to Payroll Tax Expense in the amount of $390.

B)a credit to FUTA Payable for $24.

C)a credit to SUTA Payable for $60.

D)All of the above are correct.

Assume:

Assume:FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State Unemployment tax rate is 2% on the first $7,000

Federal Unemployment tax rate is 0.8% on the first $7,000

Using the information above, the journal entry to record the payroll tax expense for Great Lakes Tutoring would include:

A)a debit to Payroll Tax Expense in the amount of $390.

B)a credit to FUTA Payable for $24.

C)a credit to SUTA Payable for $60.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

7

Wages and Salaries Payable would be used to record:

A)gross earnings of the employees.

B)net earnings of the employees not paid.

C)cumulative earnings of the employees

D)the paid portion of the earnings.

A)gross earnings of the employees.

B)net earnings of the employees not paid.

C)cumulative earnings of the employees

D)the paid portion of the earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

8

Prepaid Worker's Compensation Insurance is what type of account?

A)Asset

B)Expense

C)Liability

D)Revenue

A)Asset

B)Expense

C)Liability

D)Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

9

The debit amount to Payroll Tax Expense represents:

A)the employer's portion of the payroll taxes.

B)the employees' portion of the payroll taxes.

C)the employer's and employees' portion of the payroll taxes.

D)None of the above are correct.

A)the employer's portion of the payroll taxes.

B)the employees' portion of the payroll taxes.

C)the employer's and employees' portion of the payroll taxes.

D)None of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

10

Great Lakes Tutoring had the following payroll information on February 28:  Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State Unemployment tax rate is 2% on the first $7,000

Federal Unemployment tax rate is 0.8% on the first $7,000

Using the information above, the journal entry to record the employee's tax expense would include:

A)a debit to Payroll Tax Expense in the amount of $4,000.

B)a debit to Wages and Salaries Expense in the amount of $4,000.

C)a credit to Cash in the amount of $4,000.

D)a credit to FUTA Payable for $24.

Assume:

Assume:FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State Unemployment tax rate is 2% on the first $7,000

Federal Unemployment tax rate is 0.8% on the first $7,000

Using the information above, the journal entry to record the employee's tax expense would include:

A)a debit to Payroll Tax Expense in the amount of $4,000.

B)a debit to Wages and Salaries Expense in the amount of $4,000.

C)a credit to Cash in the amount of $4,000.

D)a credit to FUTA Payable for $24.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following statements is false?

A)Payroll Tax Expense is an expense account.

B)FICA-Social Security Tax Payable increases on the credit side of the account.

C)Payroll Tax Expense increases on the debit side of the account.

D)SUTA Tax Payable increases on the debit side of the account.

A)Payroll Tax Expense is an expense account.

B)FICA-Social Security Tax Payable increases on the credit side of the account.

C)Payroll Tax Expense increases on the debit side of the account.

D)SUTA Tax Payable increases on the debit side of the account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

12

What type of account is Payroll Tax Expense?

A)Asset

B)Liability

C)Revenue

D)Expense

A)Asset

B)Liability

C)Revenue

D)Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

13

As the Prepaid Workers Compensation is recognized, the amount will transfer to:

A)Workers Compensation Insurance Payable.

B)Workers Compensation Insurance Expense.

C)Cash.

D)Payroll Tax Expense.

A)Workers Compensation Insurance Payable.

B)Workers Compensation Insurance Expense.

C)Cash.

D)Payroll Tax Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

14

The Wages and Salaries Expense account would be used to record:

A)net earnings for the office workers.

B)a credit to the amount owed to the office workers.

C)gross earnings for the office workers.

D)a debit for the amount of net pay owed to the office workers.

A)net earnings for the office workers.

B)a credit to the amount owed to the office workers.

C)gross earnings for the office workers.

D)a debit for the amount of net pay owed to the office workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

15

The account for Payroll Tax Expense includes all of the following except:

A)federal unemployment taxes.

B)FICA taxes (OASDI and Medicare)paid by the employer for the latest payroll period.

C)state unemployment taxes.

D)federal income tax.

A)federal unemployment taxes.

B)FICA taxes (OASDI and Medicare)paid by the employer for the latest payroll period.

C)state unemployment taxes.

D)federal income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

16

The information needed to make the journal entries to record the wages and salaries expense comes from:

A)form W-2.

B)the look-back period.

C)the payroll register.

D)form 941.

A)form W-2.

B)the look-back period.

C)the payroll register.

D)form 941.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

17

What is debited if State Unemployment Tax Payable (SUTA)is credited?

A)Payroll Tax Expense

B)Cash

C)Salaries Payable

D)Salaries Expense

A)Payroll Tax Expense

B)Cash

C)Salaries Payable

D)Salaries Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

18

Payroll Cash is a(n):

A)revenue.

B)liability.

C)asset.

D)expense.

A)revenue.

B)liability.

C)asset.

D)expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

19

The employer's total FICA, SUTA, and FUTA tax is recorded as:

A)a debit to Payroll Tax Expense.

B)a credit to Payroll Tax Expense.

C)a credit to Payroll Tax Payable.

D)a debit to Payroll Tax Payable.

A)a debit to Payroll Tax Expense.

B)a credit to Payroll Tax Expense.

C)a credit to Payroll Tax Payable.

D)a debit to Payroll Tax Payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

20

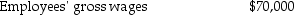

Grammy's Bakery had the following information for the pay period ending June 30:  Assume:

Assume:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Office Salaries Expense?

A)Debit $550

B)Credit $550

C)Debit $500

D)Credit $500

Assume:

Assume:FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Office Salaries Expense?

A)Debit $550

B)Credit $550

C)Debit $500

D)Credit $500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

21

The balance in the Wages and Salaries Expense account is equal to net pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

22

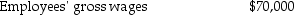

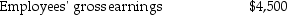

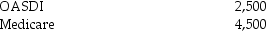

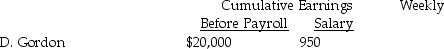

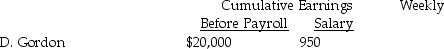

Prepare a general journal payroll entry for Advanced Computer Programming using the following information:

Assume the following:

Assume the following:

a)FICA: OASDI, 6.2% on a limit of $106,800; Medicare, 1.45%

b)Federal income tax is 15% of gross pay

c)Each employee pays $20 per week for medical insurance

Assume the following:

Assume the following:a)FICA: OASDI, 6.2% on a limit of $106,800; Medicare, 1.45%

b)Federal income tax is 15% of gross pay

c)Each employee pays $20 per week for medical insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

23

The payroll tax expense is recorded at the same time the payroll is recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

24

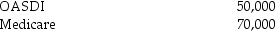

Payroll information for Kinzer's Interior Decorating for the first week in October is as follows:

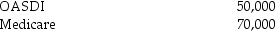

Taxable earnings for FICA-

Taxable earnings for FICA-

Taxable earnings subject to Federal and State Unemployment taxes: $5,000

Taxable earnings subject to Federal and State Unemployment taxes: $5,000

Assume the following tax rates:

Required: Prepare the payroll tax expense entry.

Required: Prepare the payroll tax expense entry.

Taxable earnings for FICA-

Taxable earnings for FICA- Taxable earnings subject to Federal and State Unemployment taxes: $5,000

Taxable earnings subject to Federal and State Unemployment taxes: $5,000Assume the following tax rates:

Required: Prepare the payroll tax expense entry.

Required: Prepare the payroll tax expense entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

25

The employer records deductions from the employee's paycheck:

A)as debits to expense accounts.

B)as credits to liability accounts until paid.

C)as debits to asset accounts until paid.

D)as credits to capital accounts.

A)as debits to expense accounts.

B)as credits to liability accounts until paid.

C)as debits to asset accounts until paid.

D)as credits to capital accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

26

Why would a company use a separate payroll cash account?

A)Provides for better internal control

B)Ease of account reconciliation

C)Determine whether or not the employee has cashed their check

D)All of the above are correct.

A)Provides for better internal control

B)Ease of account reconciliation

C)Determine whether or not the employee has cashed their check

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

27

Using the information provided below, prepare a journal entry to record the payroll tax expense for Mr. B's Carpentry.

Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State unemployment tax rate is 2% on the first $7,000

Federal unemployment tax rate is 0.8% on the first $7,000.

Assume:

Assume:FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State unemployment tax rate is 2% on the first $7,000

Federal unemployment tax rate is 0.8% on the first $7,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

28

FIT Payable has a credit normal balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

29

There is no limit on the amount of taxes paid for SUTA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

30

An employer must always use a calendar year for payroll purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

31

Mike's Door Service's payroll data for the second week of June included the following:

Taxable earnings for FICA:

Taxable earnings for FICA:

Taxable earnings for state unemployment taxes $2,000

Taxable earnings for state unemployment taxes $2,000

Assume the following tax rates:

Required: Prepare the payroll tax expense entry.

Required: Prepare the payroll tax expense entry.

Taxable earnings for FICA:

Taxable earnings for FICA: Taxable earnings for state unemployment taxes $2,000

Taxable earnings for state unemployment taxes $2,000Assume the following tax rates:

Required: Prepare the payroll tax expense entry.

Required: Prepare the payroll tax expense entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

32

What liability account is reduced when the employees are paid?

A)Payroll Taxes Payable

B)Federal Income Taxes Payable

C)Wages and Salaries Payable

D)Wages and Salaries Expense

A)Payroll Taxes Payable

B)Federal Income Taxes Payable

C)Wages and Salaries Payable

D)Wages and Salaries Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

33

FICA taxes are levied only on employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

34

The entry to record the payment of taxes withheld from employees and FICA taxes would be to:

A)credit Cash; debit FICA-Social Security Payable, FICA-Medicare Payable, and Federal Income Tax Payable.

B)debit Cash; credit FICA-Social Security Payable, FICA-Medicare Payable, and Federal Income Tax Payable.

C)credit Cash; credit FICA-Social Security Payable, FICA-Medicare Payable, and Federal Income Tax Payable.

D)None of these answers are correct.

A)credit Cash; debit FICA-Social Security Payable, FICA-Medicare Payable, and Federal Income Tax Payable.

B)debit Cash; credit FICA-Social Security Payable, FICA-Medicare Payable, and Federal Income Tax Payable.

C)credit Cash; credit FICA-Social Security Payable, FICA-Medicare Payable, and Federal Income Tax Payable.

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

35

Record in the general journal the payroll tax entry for the week ended August 31. Use the following information gathered to make the entry.

a)FICA tax rate is: OASDI 6.2% on a limit of $106,800, and Medicare is 1.45%

a)FICA tax rate is: OASDI 6.2% on a limit of $106,800, and Medicare is 1.45%

b)Federal Unemployment is 0.8% on a limit of $7,000

c)State Unemployment is 2% on a limit of $7,000

a)FICA tax rate is: OASDI 6.2% on a limit of $106,800, and Medicare is 1.45%

a)FICA tax rate is: OASDI 6.2% on a limit of $106,800, and Medicare is 1.45%b)Federal Unemployment is 0.8% on a limit of $7,000

c)State Unemployment is 2% on a limit of $7,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

36

When a business starts, what must it obtain that identifies itself to the government?

A)State Employment Number

B)Federal Unemployment Number

C)Employer Identification Number

D)A look-back period

A)State Employment Number

B)Federal Unemployment Number

C)Employer Identification Number

D)A look-back period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

37

Sweetman's Recording Studio payroll records show the following information:

Assume the following:

Assume the following:

a)FICA: OASDI, 6.2% on a limit of $106,800; Medicare, 1.45%

b)Each employee contributes $40 per week for union dues

c)State income tax is 5% of gross pay

d)Federal income tax is 20% of gross pay

Prepare a general journal payroll entry.

Assume the following:

Assume the following:a)FICA: OASDI, 6.2% on a limit of $106,800; Medicare, 1.45%

b)Each employee contributes $40 per week for union dues

c)State income tax is 5% of gross pay

d)Federal income tax is 20% of gross pay

Prepare a general journal payroll entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

38

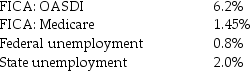

Using the information below, determine the amount of the payroll tax expense for B. Harper Company's first payroll of the year. In your answer list the amounts for FICA (OASDI and Medicare), SUTA, and FUTA.

Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State Unemployment tax rate is 5.0% on the first $7,000

Federal Unemployment tax rate is 0.8% on the first $7,000

Assume:

Assume:FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State Unemployment tax rate is 5.0% on the first $7,000

Federal Unemployment tax rate is 0.8% on the first $7,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

39

Form 941 taxes include OASDI, Medicare, and federal unemployment tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

40

If Wages and Salaries Payable is debited, what account would most likely be credited?

A)Cash

B)Wages and Salaries Expense

C)Payroll Expense

D)SUTA Payable

A)Cash

B)Wages and Salaries Expense

C)Payroll Expense

D)SUTA Payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

41

Prepare the general journal entry to record the payroll.

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

42

Businesses will make their payroll tax deposits based on payroll taxes collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

43

The correct journal entry to record the payment of FUTA is to:

A)debit Cash; credit FUTA Payable.

B)debit FUTA Expense; credit Cash.

C)debit FUTA Payable; credit Cash.

D)debit Cash; credit FUTA Expense.

A)debit Cash; credit FUTA Payable.

B)debit FUTA Expense; credit Cash.

C)debit FUTA Payable; credit Cash.

D)debit Cash; credit FUTA Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

44

The tax paid by the employer for both the employee and employer:

A)must be deposited in an authorized depository.

B)must be deposited directly in the company's checking account.

C)can be paid when the company is determined to have excess cash.

D)None of these answers are correct.

A)must be deposited in an authorized depository.

B)must be deposited directly in the company's checking account.

C)can be paid when the company is determined to have excess cash.

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

45

The correct journal entry to record the payment of SUTA is:

A)debit SUTA Expense; credit Cash.

B)debit Cash; credit SUTA Expense.

C)debit Cash; credit SUTA Payable.

D)debit SUTA Payable; credit Cash.

A)debit SUTA Expense; credit Cash.

B)debit Cash; credit SUTA Expense.

C)debit Cash; credit SUTA Payable.

D)debit SUTA Payable; credit Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

46

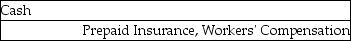

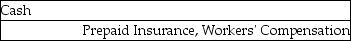

The journal entry to record the estimated advance premium payment for workers' compensation is:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

47

Compute the total state income tax. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

48

Compute the employers payroll tax. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

49

The look-back period is used to determine whether:

A)a business should make its Form 941 tax deposits on a monthly or semiweekly basis.

B)an employer will use Form 940.

C)an employer has sent the W-2s to their employees on timely basis.

D)an employer must pay unemployment taxes.

A)a business should make its Form 941 tax deposits on a monthly or semiweekly basis.

B)an employer will use Form 940.

C)an employer has sent the W-2s to their employees on timely basis.

D)an employer must pay unemployment taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

50

A monthly depositor:

A)is an employer who only has to deposit Form 941 taxes on the 15th day of the month (or next banking day).

B)is determined by the amount of Form 941 taxes that they paid in the prior year.

C)will remain a monthly depositor, once classified, for one year at which time they will be reevaluated.

D)All of the above answers are correct.

A)is an employer who only has to deposit Form 941 taxes on the 15th day of the month (or next banking day).

B)is determined by the amount of Form 941 taxes that they paid in the prior year.

C)will remain a monthly depositor, once classified, for one year at which time they will be reevaluated.

D)All of the above answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

51

Compute the net pay. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

52

Compute the total federal income tax. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

53

Prepare the general journal entry to record the employer's payroll tax expense.

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

54

Different deposit rules apply to employers based on the amount collected and owed by that employer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

55

Compute the total deductions. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

56

Workers' Compensation Insurance is:

A)paid by the employer to protect the employee against job-related injury or death.

B)paid by the employee to protect himself/herself against job-related accidents or death.

C)paid by the employer to protect the employee against non job-related injury or death.

D)paid by the employee to protect himself/herself against non job-related accidents and death.

A)paid by the employer to protect the employee against job-related injury or death.

B)paid by the employee to protect himself/herself against job-related accidents or death.

C)paid by the employer to protect the employee against non job-related injury or death.

D)paid by the employee to protect himself/herself against non job-related accidents and death.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

57

FUTA taxes are paid:

A)by the end of January of the following year if the amount owed is less than $500.

B)by the end of the month following the end of the calendar quarter if the amount owed is more than $500.

C)at the same time as the Form 941 taxes.

D)Both A and B are correct.

A)by the end of January of the following year if the amount owed is less than $500.

B)by the end of the month following the end of the calendar quarter if the amount owed is more than $500.

C)at the same time as the Form 941 taxes.

D)Both A and B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

58

Why are all of the employer payroll taxes listed in separate payable accounts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

59

Why are the employee deductions recorded as payables on the employer's books?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

60

A calendar quarter is made up of:

A)4 months.

B)13 weeks.

C)12 weeks.

D)however many weeks are needed to complete the month.

A)4 months.

B)13 weeks.

C)12 weeks.

D)however many weeks are needed to complete the month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

61

Kristi's Mentoring had the following information for the pay period ending September 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total gross earnings for the office. _________

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total gross earnings for the office. _________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

62

Kristi's Mentoring had the following information for the pay period ending September 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total federal income tax. ________

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total federal income tax. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

63

Estimate the annual advance premium for workers' compensation insurance, and record it in general journal form using the following data:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

64

From the following data, calculate the estimate annual advance premium for workers' compensation insurance and record it in general journal form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

65

The following amounts are an expense to the company except:

A)FICA-OASDI Payable.

B)FUTA Payable.

C)SUTA Payable.

D)All of the above are correct.

A)FICA-OASDI Payable.

B)FUTA Payable.

C)SUTA Payable.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

66

A company must pay Form 941 taxes electronically if:

A)they do business in multiple states.

B)they pay more than $200,000 in a given year.

C)they pay less than $200,000 in a given year.

D)The company would never have to pay electronically.

A)they do business in multiple states.

B)they pay more than $200,000 in a given year.

C)they pay less than $200,000 in a given year.

D)The company would never have to pay electronically.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

67

Kristi's Mentoring had the following information for the pay period ending September 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total retirement. ________

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total retirement. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

68

Kristi's Mentoring had the following information for the pay period ending September 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total regular earnings. ________

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total regular earnings. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

69

The employer pays the same amount as the employee for Federal Unemployment taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

70

Kristi's Mentoring had the following information for the pay period ending September 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total overtime earnings. ________

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total overtime earnings. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

71

S. Ferrari, an employee of Plum Hollow Country Club, earned $1,100 during the first week of January. His withholding included: federal income tax, 15%; state income tax, 5%; FICA-OASDI, 6.2%; FICA-Medicare, 1.45%; and union dues $25. Determine the tax for OASDI, Medicare, Federal Income Tax, and State Income Tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

72

Kristi's Mentoring had the following information for the pay period ending September 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total employers payroll tax. ________

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total employers payroll tax. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

73

Both employer and employee contribute to FICA-OASDI and SUTA tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

74

Premiums for worker's compensation insurance may be adjusted based on actual payroll amounts at the end of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

75

Kristi's Mentoring had the following information for the pay period ending September 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the employees' FICA-Medicare. ________

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the employees' FICA-Medicare. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

76

A banking day is any day that the bank is open to the public for business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

77

Kristi's Mentoring had the following information for the pay period ending September 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the employees' FICA-OASDI. ________

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the employees' FICA-OASDI. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

78

Kristi's Mentoring had the following information for the pay period ending September 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total gross earnings for the tutors. ________

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total gross earnings for the tutors. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

79

Kristi's Mentoring had the following information for the pay period ending September 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total state income tax. ________

FICA-OASDI applied to the first $106,800 at a rate of 6.2%

FICA-OASDI applied to the first $106,800 at a rate of 6.2%FICA-Medicare applied at a rate of 1.45%

FUTA applied to the first $7,000 at a rate of 0.8%

SUTA applied to the first $7,000 at a rate of 5.6%

State income tax is 3.8%

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

Compute the total state income tax. ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

80

Grammy's Bakery had the following information for the pay period ending June 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to FUTA Payable?

A)Debit $4.00

B)Credit $4.00

C)Debit $20.40

D)Credit $20.40

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to FUTA Payable?

A)Debit $4.00

B)Credit $4.00

C)Debit $20.40

D)Credit $20.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck