Deck 6: Banking Procedure and Control of Cash

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/125

العب

ملء الشاشة (f)

Deck 6: Banking Procedure and Control of Cash

1

When the bank pays a check written by the company, it would:

A)credit the customer's bank account.

B)debit the customer's bank account.

C)debit the cash account on the company's books

D)no increase or decrease is made to the company's bank account.

A)credit the customer's bank account.

B)debit the customer's bank account.

C)debit the cash account on the company's books

D)no increase or decrease is made to the company's bank account.

B

2

A restrictive endorsement on a check:

A)can be further endorsed by someone else.

B)is the safest endorsement for businesses.

C)permits the bank to use its best judgment.

D)None of these answers are correct.

A)can be further endorsed by someone else.

B)is the safest endorsement for businesses.

C)permits the bank to use its best judgment.

D)None of these answers are correct.

B

3

Advantages of on-line banking include:

A)convenience.

B)transaction speed.

C)effectiveness.

D)All of the above are correct.

A)convenience.

B)transaction speed.

C)effectiveness.

D)All of the above are correct.

D

4

A deposit received by the bank will include:

A)a debit to the company's bank account.

B)a credit to the company's bank account.

C)no increase or decrease is made to the company's bank account.

D)a credit to the cash account on the company's books.

A)a debit to the company's bank account.

B)a credit to the company's bank account.

C)no increase or decrease is made to the company's bank account.

D)a credit to the cash account on the company's books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

5

The drawee is the:

A)person who writes the check.

B)bank that drawer has an account with.

C)the person to whom the check is payable.

D)the person who reconciles the account.

A)person who writes the check.

B)bank that drawer has an account with.

C)the person to whom the check is payable.

D)the person who reconciles the account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

6

A blank endorsement on a check:

A)can be further endorsed by someone else.

B)cannot be further endorsed by someone else.

C)is the safest type of endorsement.

D)permits only the original endorser to get the money.

A)can be further endorsed by someone else.

B)cannot be further endorsed by someone else.

C)is the safest type of endorsement.

D)permits only the original endorser to get the money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

7

The first two numbers of the ABA code listed on the check represent:

A)the Federal Reserve District.

B)the check number.

C)the routing number.

D)the account number.

A)the Federal Reserve District.

B)the check number.

C)the routing number.

D)the account number.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

8

A signature card shows the signature of only the person who authorizes others in the company to sign checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

9

The check is written and signed by the:

A)drawer.

B)drawee.

C)payee.

D)payer.

A)drawer.

B)drawee.

C)payee.

D)payer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

10

A full endorsement on a check:

A)is the same as a blank endorsement.

B)can be endorsed only by the person or company named in the original endorsement.

C)is the safest endorsement for businesses.

D)does none of the above.

A)is the same as a blank endorsement.

B)can be endorsed only by the person or company named in the original endorsement.

C)is the safest endorsement for businesses.

D)does none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

11

When a bank credits your account, it is decreasing the balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

12

The person or company to whom a check is payable is called the:

A)payer.

B)drawer.

C)drawee.

D)payee.

A)payer.

B)drawer.

C)drawee.

D)payee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

13

Using correct cash handling procedures, deposits should be made by the end of the week.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

14

A signature card is kept in the bank files so that possible forgeries could be spotted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

15

An example of an internal control is:

A)the use of bank account.

B)all checks are prenumbered.

C)all checks written must have reference source documents.

D)All of these answers are correct.

A)the use of bank account.

B)all checks are prenumbered.

C)all checks written must have reference source documents.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

16

Internal control over a company's assets should include the following policy:

A)Responsibilities and duties of employees will be divided.

B)All cash receipts will be deposited into the bank the same day they arrive.

C)All cash payments will be made by check (except petty cash).

D)All of these answers are correct.

A)Responsibilities and duties of employees will be divided.

B)All cash receipts will be deposited into the bank the same day they arrive.

C)All cash payments will be made by check (except petty cash).

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

17

One internal control safeguard is to assign all the duties of receiving, depositing, and recording cash to one employee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

18

If the written amount on the check does not match the amount expressed in figures, the bank may:

A)pay the amount written in words.

B)return the check unpaid.

C)contact the drawer to see what was meant.

D)All of the above are correct choices.

A)pay the amount written in words.

B)return the check unpaid.

C)contact the drawer to see what was meant.

D)All of the above are correct choices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

19

Company policy for internal control should include all of the following except:

A)Employees will be rotated.

B)Monthly bank statements should be sent to and reconciled by the same employees who authorize payments and write checks.

C)The owner (or responsible employee)signs all checks after receiving authorization to pay from the departments concerned.

D)At time of payment, all supporting invoices or documents will be stamped "paid."

A)Employees will be rotated.

B)Monthly bank statements should be sent to and reconciled by the same employees who authorize payments and write checks.

C)The owner (or responsible employee)signs all checks after receiving authorization to pay from the departments concerned.

D)At time of payment, all supporting invoices or documents will be stamped "paid."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

20

Endorsing a check:

A)guarantees payment.

B)transfers the right to deposit or transfer cash.

C)cancels the transaction.

D)All of these answers are correct.

A)guarantees payment.

B)transfers the right to deposit or transfer cash.

C)cancels the transaction.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

21

A nonsufficient funds check was returned to your company. How does the bank treat this on your bank statement?

A)It is added to the bank balance.

B)It is shown as a debit memo.

C)It is shown as a credit memo.

D)None of these answers are correct.

A)It is added to the bank balance.

B)It is shown as a debit memo.

C)It is shown as a credit memo.

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

22

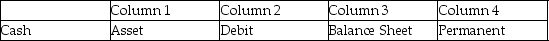

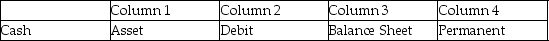

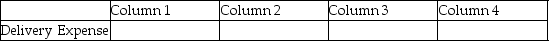

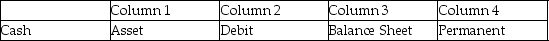

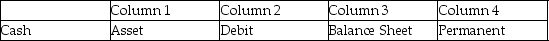

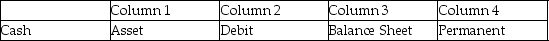

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the nature of the account (permanent/temporary).

Example:

Example:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

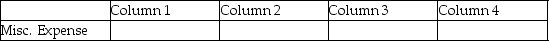

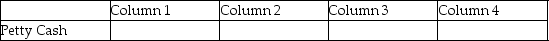

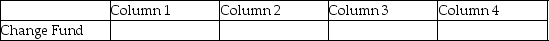

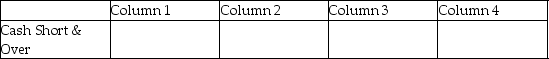

23

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the nature of the account (permanent/temporary).

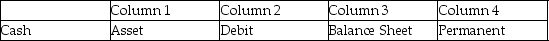

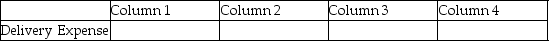

Example:

Example:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

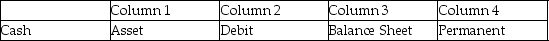

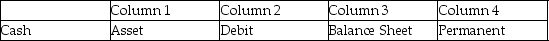

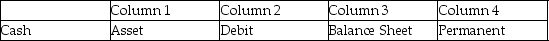

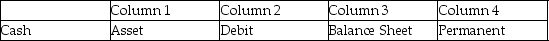

24

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the nature of the account (permanent/temporary).

Example:

Example:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

25

The drawee of a check is normally the bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

26

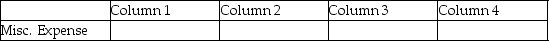

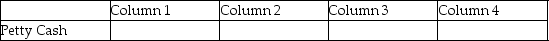

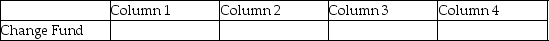

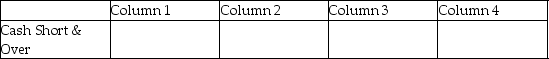

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the nature of the account (permanent/temporary).

Example:

Example:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

27

The bank statement shows:

A)the beginning bank balance of the cash at the start of the month.

B)the checks the bank has paid and any deposits received.

C)any other charges or additions to the bank balance.

D)All of these answers are correct.

A)the beginning bank balance of the cash at the start of the month.

B)the checks the bank has paid and any deposits received.

C)any other charges or additions to the bank balance.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

28

List and describe some of the electronic conveniences that we are now provided when doing our banking.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

29

What is the purpose of internal control?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

30

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the nature of the account (permanent/temporary).

Example:

Example:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

31

Scotch Services received a credit memorandum from the bank. During the bank reconciliation they should:

A)increase their cash account on the company's books.

B)decrease their cash account on the company's books.

C)increase the ending cash balance on the bank statement.

D)decrease the ending cash balance on the bank statement.

A)increase their cash account on the company's books.

B)decrease their cash account on the company's books.

C)increase the ending cash balance on the bank statement.

D)decrease the ending cash balance on the bank statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

32

On a bank reconciliation, deposits added to the bank side are called:

A)deposits in transit.

B)late deposits.

C)deposits on hold.

D)outstanding deposits.

A)deposits in transit.

B)late deposits.

C)deposits on hold.

D)outstanding deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

33

Phishing occurs when a bank customer receives an email requesting personal information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

34

List at least five company policies that would be included in an internal control system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

35

The drawee of the check is the person receiving the money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

36

Outstanding checks:

A)have been subtracted on the bank records but not the checkbook records.

B)have not been presented to the bank for payment and have not been subtracted from the checkbook.

C)have not been presented to the bank for payment but have been subtracted in the checkbook.

D)have been returned to the business for nonpayment.

A)have been subtracted on the bank records but not the checkbook records.

B)have not been presented to the bank for payment and have not been subtracted from the checkbook.

C)have not been presented to the bank for payment but have been subtracted in the checkbook.

D)have been returned to the business for nonpayment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

37

Checks that have been processed by the bank and are no longer negotiable are:

A)outstanding checks.

B)canceled checks.

C)checks in process.

D)blank checks.

A)outstanding checks.

B)canceled checks.

C)checks in process.

D)blank checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

38

The drawer writes the check.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

39

The bank statement included bank charges. On the bank reconciliation, the item is:

A)an addition to the balance per company books.

B)an addition to the balance per bank statement.

C)a deduction from the balance per bank statement.

D)a deduction from the balance per company books.

A)an addition to the balance per company books.

B)an addition to the balance per bank statement.

C)a deduction from the balance per bank statement.

D)a deduction from the balance per company books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

40

A deposit ticket usually separates checks deposited from coin and currency deposited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

41

How would outstanding checks be handled when reconciling the ending cash balance per the bank statement to the correct adjusted cash balance?

A)They would be added to the balance of the bank statement.

B)They would be subtracted from the balance of the bank statement.

C)They would be added to the balance per books.

D)They would be ignored.

A)They would be added to the balance of the bank statement.

B)They would be subtracted from the balance of the bank statement.

C)They would be added to the balance per books.

D)They would be ignored.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

42

Bank service charges would be shown on a bank reconciliation as:

A)added to the balance per bank statement.

B)deducted from the balance per bank statement.

C)added to the balance per books.

D)deducted from the balance per books.

A)added to the balance per bank statement.

B)deducted from the balance per bank statement.

C)added to the balance per books.

D)deducted from the balance per books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

43

The May bank statement for Accounting Services shows a balance of $6,300, but the balance per books shows a cash balance of $7,980. Other information includes: 1. A check for $200 to pay the electric bill was recorded on the books as $20.

2. Included on the bank statement was a note collected by the bank for $400 plus interest of $30.

3. Checks outstanding totaled $260.

4. Bank service charges were $50.

5. Deposits in transit were $2,140.

Which item(s)will require a journal entry to update the balance in the Cash account?

A)Checks outstanding and deposits in transit

B)Bank service charges, note collected by the bank, and deposits in transit

C)Bank service charges, note collected by the bank, and error made by Accounting Services

D)None of these answers are correct.

2. Included on the bank statement was a note collected by the bank for $400 plus interest of $30.

3. Checks outstanding totaled $260.

4. Bank service charges were $50.

5. Deposits in transit were $2,140.

Which item(s)will require a journal entry to update the balance in the Cash account?

A)Checks outstanding and deposits in transit

B)Bank service charges, note collected by the bank, and deposits in transit

C)Bank service charges, note collected by the bank, and error made by Accounting Services

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

44

From the bank reconciliation no entry was recorded for a debit memo for a new check fee expense. This would cause:

A)liabilities to be understated.

B)liabilities to be overstated.

C)expenses to be understated.

D)expenses to be overstated.

A)liabilities to be understated.

B)liabilities to be overstated.

C)expenses to be understated.

D)expenses to be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following bank reconciliation items would be reflected in a journal entry?

A)Error made by the bank

B)Outstanding Checks

C)Bank service charges

D)Deposit in transit

A)Error made by the bank

B)Outstanding Checks

C)Bank service charges

D)Deposit in transit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

46

An example of electronic funds transfer is:

A)a transfer of funds without the use of paper checks.

B)a transfer of funds by writing a check.

C)the same as a deposit in transit.

D)All of these are correct.

A)a transfer of funds without the use of paper checks.

B)a transfer of funds by writing a check.

C)the same as a deposit in transit.

D)All of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

47

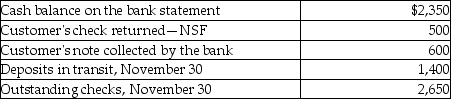

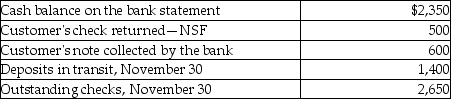

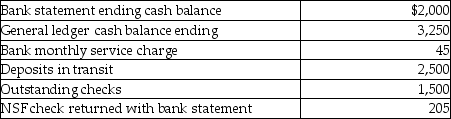

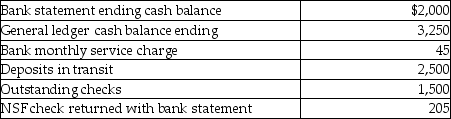

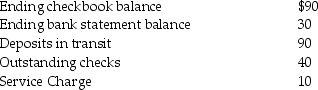

Determine the adjusted cash balance per bank for Santa's Packaging on November 30, from the following information:

A)$1,250

B)$1,100

C)$1,550

D)$1,350

A)$1,250

B)$1,100

C)$1,550

D)$1,350

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

48

From the bank reconciliation no entry was recorded for deposits in transit. This would cause:

A)assets to be overstated.

B)assets to be understated.

C)no impact since deposits in transit are already included in the balance per books.

D)no impact since deposits are not recorded on the books.

A)assets to be overstated.

B)assets to be understated.

C)no impact since deposits in transit are already included in the balance per books.

D)no impact since deposits are not recorded on the books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

49

The May bank statement for Accounting Services shows a balance of $6,300, but the balance per books shows a cash balance of $7,980. Other information includes: 1. A check for $200 to pay the electric bill was recorded on the books as $20.

2. Included on the bank statement was a note collected by the bank for $400 plus interest of $30.

3. Checks outstanding totaled $260.

4. Bank service charges were $50.

5. Deposits in transit were $2,140.

Which item(s)should be subtracted from the balance per books?

A)Bank service charge

B)Checks outstanding and bank service charge

C)Bank service charge and the note collected by the bank

D)None of the above are correct.

2. Included on the bank statement was a note collected by the bank for $400 plus interest of $30.

3. Checks outstanding totaled $260.

4. Bank service charges were $50.

5. Deposits in transit were $2,140.

Which item(s)should be subtracted from the balance per books?

A)Bank service charge

B)Checks outstanding and bank service charge

C)Bank service charge and the note collected by the bank

D)None of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

50

A payment for $25 is incorrectly recorded on the checkbook stub as $52. The $27 error should be shown on the bank reconciliation as:

A)added to the balance per bank statement.

B)deducted from the balance per bank statement.

C)added to the balance per books.

D)deducted from the balance per books.

A)added to the balance per bank statement.

B)deducted from the balance per bank statement.

C)added to the balance per books.

D)deducted from the balance per books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

51

The May bank statement for Accounting Services shows a balance of $6,300, but the balance per books shows a cash balance of $7,980. Other information includes: 1. A check for $200 to pay the electric bill was recorded on the books as $20.

2. Included on the bank statement was a note collected by the bank for $400 plus interest of $30

3. Checks outstanding totaled $260.

4. Bank service charges were $50.

5. Deposits in transit were $2,140.

The adjusted cash balance at the end of August should be:

A)$9,810.

B)$7,620.

C)$7,980.

D)$8,180.

2. Included on the bank statement was a note collected by the bank for $400 plus interest of $30

3. Checks outstanding totaled $260.

4. Bank service charges were $50.

5. Deposits in transit were $2,140.

The adjusted cash balance at the end of August should be:

A)$9,810.

B)$7,620.

C)$7,980.

D)$8,180.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

52

The journal entry to reverse the entry of a customer's nonsufficient funds check would include a:

A)debit to Cash.

B)credit to Cash.

C)debit to Accounts Payable.

D)credit to Accounts Receivable.

A)debit to Cash.

B)credit to Cash.

C)debit to Accounts Payable.

D)credit to Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

53

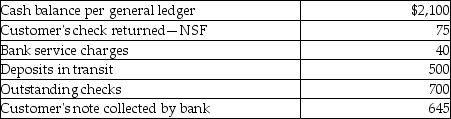

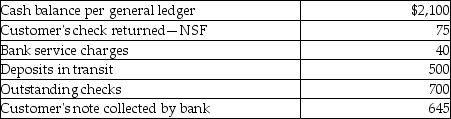

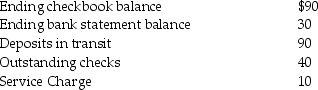

Information to calculate the adjusted cash balance for Sam's Gift Wrapping is as follows:

A)$2,330

B)$2,430

C)$2,630

D)$2,230

A)$2,330

B)$2,430

C)$2,630

D)$2,230

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

54

If the owner of Que Legal Services forgot to deduct a withdrawal from the balance per books, what entry would be necessary?

A)Debit Cash; credit Withdrawals

B)Debit Withdrawals; credit Cash

C)Debit Revenue; credit Cash

D)Debit cash; credit Revenue

A)Debit Cash; credit Withdrawals

B)Debit Withdrawals; credit Cash

C)Debit Revenue; credit Cash

D)Debit cash; credit Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

55

The bank would issue a credit memorandum to Maria's Life Management when the bank:

A)received the deposits in transit.

B)collects a note receivable from a customer.

C)discovered a check that was deposited was returned for nonsufficient funds.

D)None of these answers are correct.

A)received the deposits in transit.

B)collects a note receivable from a customer.

C)discovered a check that was deposited was returned for nonsufficient funds.

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

56

The May bank statement for Accounting Services shows a balance of $6300, but the balance per books shows a cash balance of $7,980. Other information includes: 1. A check for $200 to pay the electric bill was recorded on the books as $20.

2. Included on the bank statement was a note collected by the bank for $400 plus interest of $30.

3. Checks outstanding totaled $260.

4. Bank service charges were $50.

5. Deposits in transit were $2,140.

Which item should be added to the company's book balance during the bank reconciliation?

A)Deposit in transit

B)Check outstanding

C)Bank service charge

D)Note collected by the bank

2. Included on the bank statement was a note collected by the bank for $400 plus interest of $30.

3. Checks outstanding totaled $260.

4. Bank service charges were $50.

5. Deposits in transit were $2,140.

Which item should be added to the company's book balance during the bank reconciliation?

A)Deposit in transit

B)Check outstanding

C)Bank service charge

D)Note collected by the bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

57

Bank interest earned on a checking account would be shown on a bank reconciliation as:

A)added to the balance per bank statement.

B)deducted from the balance per bank statement.

C)added to the balance per books.

D)deducted from the balance per books.

A)added to the balance per bank statement.

B)deducted from the balance per bank statement.

C)added to the balance per books.

D)deducted from the balance per books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

58

The journal entry to adjust the records from Nothin' But Organization bank reconciliation would include:

A)the total of outstanding checks.

B)deposits in transit.

C)notification from the bank of a customer's NSF check.

D)correction of any errors or omissions on the bank statement.

A)the total of outstanding checks.

B)deposits in transit.

C)notification from the bank of a customer's NSF check.

D)correction of any errors or omissions on the bank statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

59

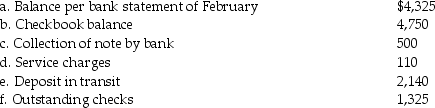

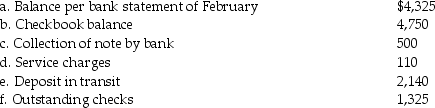

Calculate, from the following information accumulated by Sandra Johnson, the adjusted cash balance at the end of April.

A)$3,000

B)$4,250

C)$4,000

D)$5,500

A)$3,000

B)$4,250

C)$4,000

D)$5,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

60

A payment for $31 is incorrectly recorded on the checkbook stub as $13. The $18 error should be shown on the bank reconciliation as:

A)added to the balance per bank statement.

B)deducted from the balance per bank statement.

C)added to the balance per books.

D)deducted from the balance per books.

A)added to the balance per bank statement.

B)deducted from the balance per bank statement.

C)added to the balance per books.

D)deducted from the balance per books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

61

Transferring money without paper checks is called electronic funds transfer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

62

A bank service charge would be included on the bank reconciliation as a(n):

A)addition to the balance per books.

B)subtraction from the balance per books.

C)addition to the balance per bank.

D)subtraction from the balance per bank.

A)addition to the balance per books.

B)subtraction from the balance per books.

C)addition to the balance per bank.

D)subtraction from the balance per bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

63

When adjustments are made to the bank balance when completing a bank reconciliation, a journal entry is needed to bring the bank balance up to date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

64

Canceled checks are negotiable at the bank for the face value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

65

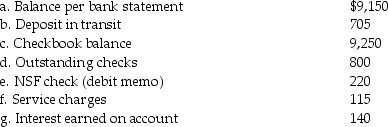

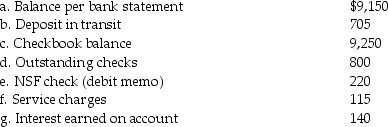

Prepare a bank reconciliation from the following information:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

66

Construct the bank reconciliation for Mitter Company as of July 31, from the following information:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

67

Indicate what effect each situation will have on the bank reconciliation process. Place the number of your choice beside the items listed.

1. Add to bank balance

2. Deduct from bank balance

3. Add to checkbook balance

4. Deduct from checkbook balance

________ a. deposit in transit

________ b. bank service charge

________ c. NSF check

________ d. Check written for $95 recorded on the company's ledger as $59

________ e. Outstanding checks

________ f. Check written for $80 recorded as $800

________ g. Check printing charges

________ h. Interest earned on checking account

1. Add to bank balance

2. Deduct from bank balance

3. Add to checkbook balance

4. Deduct from checkbook balance

________ a. deposit in transit

________ b. bank service charge

________ c. NSF check

________ d. Check written for $95 recorded on the company's ledger as $59

________ e. Outstanding checks

________ f. Check written for $80 recorded as $800

________ g. Check printing charges

________ h. Interest earned on checking account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

68

On a bank reconciliation, outstanding checks are deducted from the balance per books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

69

Deposits in transit result because of a timing difference between the bank records and checkbook records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

70

Indicate which adjustments would require a journal entry during the completion of the bank reconciliation. Place an "X" on the respective line(s). ________ a. Deposit in transit

________ b. Bank service charge

________ c. NSF check

________ d. Check written for $58 recorded on the company's ledger as $85

________ e. Outstanding checks

________ f. Check written for $42 recorded as $4

________ g. Check printing charge

________ h. Note collected by bank.

________ b. Bank service charge

________ c. NSF check

________ d. Check written for $58 recorded on the company's ledger as $85

________ e. Outstanding checks

________ f. Check written for $42 recorded as $4

________ g. Check printing charge

________ h. Note collected by bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

71

Deposits that have been added to the bank balance but not the checkbook balance are called deposits in transit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

72

Determine the reconciled bank balance given the following:

The balance per bank statement is $ 110

The balance per general ledger is $107

There is a credit memo for a note collected, $408

There is a credit memo for interest earned, $25

There is a debit memo for a customer's NSF check $350

Deposits in transit, $850

Outstanding checks amount to $845

This month's service charge amounts to $50

There is a debit memo for check printing fees, $25

$ ________

The balance per bank statement is $ 110

The balance per general ledger is $107

There is a credit memo for a note collected, $408

There is a credit memo for interest earned, $25

There is a debit memo for a customer's NSF check $350

Deposits in transit, $850

Outstanding checks amount to $845

This month's service charge amounts to $50

There is a debit memo for check printing fees, $25

$ ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

73

List the various steps and procedures included in the bank reconciliation process.

What are the advantages in preparing a monthly bank reconciliation?

What are the advantages in preparing a monthly bank reconciliation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

74

If a check marked NSF is returned from the bank, an adjusting entry crediting cash is needed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

75

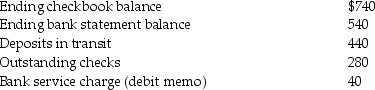

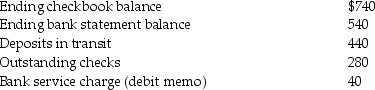

Construct the bank reconciliation for Kendra's Tutoring, as of October 31, from the following information:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

76

Any adjustment to the depositor's records because of an item on the bank statement requires a journal entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

77

The bank added another company's deposit to our account. This would be included on the bank reconciliation as a(n):

A)addition to the balance per books.

B)subtraction from the balance per books.

C)addition to the balance per bank.

D)subtraction from the balance per bank.

A)addition to the balance per books.

B)subtraction from the balance per books.

C)addition to the balance per bank.

D)subtraction from the balance per bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

78

An error, on the company's books, in recording a $82 deposit as $28 would be included on the bank reconciliation as a(n):

A)addition to the balance per bank.

B)subtraction from the balance per bank.

C)addition to the balance per books.

D)subtraction from the balance per books.

A)addition to the balance per bank.

B)subtraction from the balance per bank.

C)addition to the balance per books.

D)subtraction from the balance per books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

79

The bank charged another company's check against our account, this would be included on the bank reconciliation as a(n):

A)addition to the balance per books.

B)subtraction from the balance per books.

C)addition to the balance per bank.

D)subtraction from the balance per bank.

A)addition to the balance per books.

B)subtraction from the balance per books.

C)addition to the balance per bank.

D)subtraction from the balance per bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

80

From the following information, prepare the bank reconciliation for Paul's Photography Studio for June.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck