Deck 7: Calculating Pay and Payroll Taxes: The Beginning of the Payroll Process

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

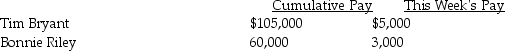

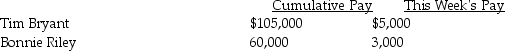

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

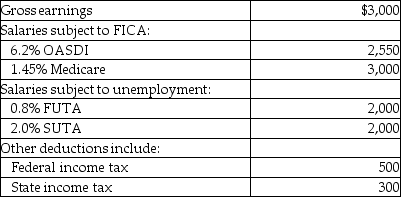

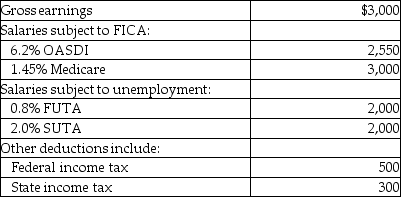

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/127

العب

ملء الشاشة (f)

Deck 7: Calculating Pay and Payroll Taxes: The Beginning of the Payroll Process

1

Gross Earnings are the same as:

A)regular earnings only.

B)regular earnings + overtime earnings.

C)net earnings.

D)net earnings + overtime earnings.

A)regular earnings only.

B)regular earnings + overtime earnings.

C)net earnings.

D)net earnings + overtime earnings.

B

2

A company can deem an employee as salaried:

A)if they do not want to pay overtime wages.

B)if the employee meets the salaried laws under the Fair Labor Standards Act.

C)to make the payroll process easier.

D)if they have been employed at the company for 1 year or longer.

A)if they do not want to pay overtime wages.

B)if the employee meets the salaried laws under the Fair Labor Standards Act.

C)to make the payroll process easier.

D)if they have been employed at the company for 1 year or longer.

B

3

Under the Fair Labor Standards Act, for any hours that an employee works over 40 during a work week:

A)the employee must be paid double.

B)the employee is paid time and a half.

C)the employee must receive the minimum wage.

D)All of these answers are correct.

A)the employee must be paid double.

B)the employee is paid time and a half.

C)the employee must receive the minimum wage.

D)All of these answers are correct.

B

4

Brian Temple's cumulative earnings are $73,000, and his gross pay for the week is $5,300. If the FICA rates are: OASDI 6.2% on a limit of $106,800 and Medicare is 1.45%, what are his FICA-OASDI and FICA-Medicare taxes for the week?

A)$0; $76.85

B)$328.60; $0

C)$328.60; $76.85

D)$3,286; $768.50

A)$0; $76.85

B)$328.60; $0

C)$328.60; $76.85

D)$3,286; $768.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

5

Net pay equals:

A)gross pay less all deductions.

B)regular earnings + overtime earnings.

C)Gross earnings.

D)net earnings + overtime earnings greater than the amount withheld from the employee.

A)gross pay less all deductions.

B)regular earnings + overtime earnings.

C)Gross earnings.

D)net earnings + overtime earnings greater than the amount withheld from the employee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

6

Tracey Thrasher earned $800 for the week. If her cumulative earnings are $30,000 prior to this pay period, how much FICA-OASDI must her employer withhold from her earnings? FICA tax rates are OASDI 6.2% on a limit of $106,800.

A)$496.00

B)$0

C)$49.60

D)None of the above are correct.

A)$496.00

B)$0

C)$49.60

D)None of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

7

The number of allowances claimed by an employee determines how much will be withheld from their paycheck for:

A)FICA-OASDI.

B)FICA-Medicare.

C)federal income tax.

D)All of these answers are correct.

A)FICA-OASDI.

B)FICA-Medicare.

C)federal income tax.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

8

Compute employee FICA taxes for the year on earnings of $108,000 at 6.2% on a limit of $106,800 for OASDI and 1.45% for Medicare.

A)$8,187.60

B)$8,262.00

C)$8,170.20

D)$6,621.60

A)$8,187.60

B)$8,262.00

C)$8,170.20

D)$6,621.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

9

Payroll taxes include all of the following except:

A)federal income tax.

B)state income tax.

C)FICA-OASDI.

D)All of the above are payroll taxes.

A)federal income tax.

B)state income tax.

C)FICA-OASDI.

D)All of the above are payroll taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

10

Brian Temple's cumulative earnings are $102,000, and his gross pay for the week is $5,300. If the FICA rates are: OASDI 6.2% on a limit of $106,800 and Medicare is 1.45%, what are his FICA-OASDI and FICA-Medicare taxes for the week?

A)$297.60; $76.85

B)$0; $0

C)$31.00; $7.25

D)$31.00; $76.85

A)$297.60; $76.85

B)$0; $0

C)$31.00; $7.25

D)$31.00; $76.85

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

11

The law that governs overtime earnings is called:

A)Federal Insurance Contribution Act.

B)Federal Wage and Hour Law.

C)Fair Labor Standards Act.

D)Both B and C are correct.

A)Federal Insurance Contribution Act.

B)Federal Wage and Hour Law.

C)Fair Labor Standards Act.

D)Both B and C are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following taxes has a maximum amount an employee must pay in a year?

A)Federal income tax

B)FICA-Medicare tax

C)FICA-OASDI tax

D)State Income tax

A)Federal income tax

B)FICA-Medicare tax

C)FICA-OASDI tax

D)State Income tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

13

Brian Temple's cumulative earnings are $107,000, and his gross pay for the week is $5,300. If the FICA rates are: OASDI 6.2% on a limit of $106,800 and Medicare is 1.45%, what are his FICA-OASDI and FICA-Medicare taxes for the week?

A)$0; $76.85

B)$0; $0

C)$328.60; $76.85

D)$328.60; $0

A)$0; $76.85

B)$0; $0

C)$328.60; $76.85

D)$328.60; $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

14

The Federal Insurance Contributions Act is better known as:

A)FIT.

B)overtime laws.

C)FUTA.

D)FICA.

A)FIT.

B)overtime laws.

C)FUTA.

D)FICA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

15

To compute federal income tax to be withheld:

A)use the net earnings and number of allowances.

B)use gross earnings, number of allowances, and marital status.

C)use net earnings and Form W-4.

D)None of these answers are correct.

A)use the net earnings and number of allowances.

B)use gross earnings, number of allowances, and marital status.

C)use net earnings and Form W-4.

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

16

If Sheila worked 38 hours, how many hours of overtime will Sheila earn?

A)0

B)1

C)9

D)5

A)0

B)1

C)9

D)5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

17

There are two parts to FICA:

A)old age benefits and workers' compensation.

B)retirement and income tax withholdings.

C)OASDI and Medicare.

D)All of these answers are correct.

A)old age benefits and workers' compensation.

B)retirement and income tax withholdings.

C)OASDI and Medicare.

D)All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

18

FICA taxes provide funding to the government to pay:

A)monthly retirement benefits for persons over age 62.

B)medical benefits for persons over age 65.

C)benefits for person who have become disabled.

D)All of the above are correct.

A)monthly retirement benefits for persons over age 62.

B)medical benefits for persons over age 65.

C)benefits for person who have become disabled.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

19

The Fair Labor Standards Act must be followed if:

A)the company has more than 100 employees.

B)the employees have received regular earnings.

C)the company does business in more than one state.

D)if all employees are categorized as salary.

A)the company has more than 100 employees.

B)the employees have received regular earnings.

C)the company does business in more than one state.

D)if all employees are categorized as salary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

20

A pay period is defined as:

A)weekly.

B)bi-weekly.

C)monthly.

D)All of the above are correct.

A)weekly.

B)bi-weekly.

C)monthly.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

21

On January 15, Robert Love earned $4,000 and has the following deductions: FICA-OASDI 6.2%, FICA-Medicare 1.45%; federal income tax of $200; and state income tax $40. What is his net pay?

A)$3,400

B)$3,454

C)$4,454

D) $$4,000

A)$3,400

B)$3,454

C)$4,454

D) $$4,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

22

The amount of FICA-OASDI and FICA-Medicare withheld from the employee's check is determined by the employee's:

A)take-home pay.

B)net pay.

C)earnings for the period and cumulative earnings.

D)W-4.

A)take-home pay.

B)net pay.

C)earnings for the period and cumulative earnings.

D)W-4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

23

The amount of federal income tax withheld from an employee during the year is determined by the employee's:

A)W-4 form.

B)W-2 form.

C)1040 form.

D)None of these answers are correct.

A)W-4 form.

B)W-2 form.

C)1040 form.

D)None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

24

Todd earns an hourly rate of $20 and had taxes withheld totaling $200. What would his net earnings be if he worked 44 hours (assuming double time over 40 hours)?

A)$760

B)$780

C)$720

D)$860

A)$760

B)$780

C)$720

D)$860

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

25

Bob Hill's hourly rate is $25.00, and he worked 38 hours during the week. What is his gross pay for the week?

A)$950

B)$780

C)$1,000

D)$975

A)$950

B)$780

C)$1,000

D)$975

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

26

Derek works 43 hours at a rate of pay of $15 per hour. He receives double pay over 40 hours. What is his gross pay?

A)$800

B)$720

C)$780

D)$690

A)$800

B)$720

C)$780

D)$690

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

27

Carrie Stein's hourly wage is $40.00, and she worked 42 hours during the week. Assuming an overtime rate of time and a half over 40 hours, Carrie's gross pay is:

A)$1,780.

B)$1,720.

C)$2,580.

D)$1,600.

A)$1,780.

B)$1,720.

C)$2,580.

D)$1,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

28

Another name for the Fair Labor Standards Act is:

A)Federal Insurance Contribution Act.

B)Federal Wage and Hour Law.

C)Federal Income Tax Act.

D)Federal Hourly Law.

A)Federal Insurance Contribution Act.

B)Federal Wage and Hour Law.

C)Federal Income Tax Act.

D)Federal Hourly Law.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

29

Employers pay the following payroll taxes, except:

A)FICA-OASDI.

B)Federal income tax.

C)Workers' Compensation.

D)FICA-Medicare.

A)FICA-OASDI.

B)Federal income tax.

C)Workers' Compensation.

D)FICA-Medicare.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

30

Valerie Chandler works 42 hours as a coffee barista and earns $12 per hour. Compute her weekly pay assuming an overtime rate of 1.5.

A)$552

B)$516

C)$480

D)$624

A)$552

B)$516

C)$480

D)$624

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

31

Kim received $1,850 for working 40 hours. What was Kim's rate of pay per hour?

A)$46.25

B)$44.00

C)$45.00

D)$40.00

A)$46.25

B)$44.00

C)$45.00

D)$40.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the below allowances would have the least amount of taxes withheld for federal income tax purposes?

A)S-1

B)S-0

C)S-3

D)S-2

A)S-1

B)S-0

C)S-3

D)S-2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

33

When calculating the employee's payroll the clerk forgot about the wage base limits. What impact could this error cause on the employee's check?

A)FICA-OASDI could be overstated.

B)FUTA could be overstated.

C)SUTA could be overstated.

D)All of these could be correct.

A)FICA-OASDI could be overstated.

B)FUTA could be overstated.

C)SUTA could be overstated.

D)All of these could be correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

34

Net pay is the same as:

A)gross pay.

B)take-home pay.

C)before taxes pay.

D)pay before deductions.

A)gross pay.

B)take-home pay.

C)before taxes pay.

D)pay before deductions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following would not typically be an employee payroll withholding?

A)Unemployment taxes

B)Medical Insurance

C)State income tax

D)Social Security

A)Unemployment taxes

B)Medical Insurance

C)State income tax

D)Social Security

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

36

A calendar year is:

A)any 12-month period.

B)a 12-month period beginning January 1 and ending on December 31.

C)always the same as the company's fiscal year.

D)None of the above answers are correct.

A)any 12-month period.

B)a 12-month period beginning January 1 and ending on December 31.

C)always the same as the company's fiscal year.

D)None of the above answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

37

Kathy Addington earns $72,000 per year. What is her net pay for the month ended January 31, if FICA tax rates are: 6.2% for OASDI and 1.45% for Medicare; federal income tax is 20%; and union dues are $85 per month?

A)$4,100

B)$4,256

C)$4,326

D)$4,293

A)$4,100

B)$4,256

C)$4,326

D)$4,293

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

38

A W-4 form:

A)determines the amount of FICA-OASDI to be withheld.

B)determines the amount of FICA-Medicare to be withheld.

C)provides the number of allowances an employee has claimed.

D)shows total wages earned for the year.

A)determines the amount of FICA-OASDI to be withheld.

B)determines the amount of FICA-Medicare to be withheld.

C)provides the number of allowances an employee has claimed.

D)shows total wages earned for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

39

Compute net earnings on March 3, when gross (taxable)pay equals $750. FICA-OASDI tax rates are 6.2%, FICA-Medicare rate is 1.45%, federal income tax $71.00, and state income tax $5.00.

A)$615.00

B)$610.00

C)$616.62

D)$672.12

A)$615.00

B)$610.00

C)$616.62

D)$672.12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

40

A summary record of each person's earnings, deductions, and net pay is called a(n):

A)payroll register.

B)W-4.

C)employee individual earnings record.

D)general journal.

A)payroll register.

B)W-4.

C)employee individual earnings record.

D)general journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

41

An employer can reduce the federal unemployment tax rate by paying the state unemployment tax on time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

42

All employees must contribute to Federal and State income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

43

Calculate the total wages earned for each employee (assume an overtime rate of time and a half over 40 hours):

a)Dave earns $22 per hour and worked 45 hours in one week.

b)Jeff earns $18 per hour and worked 42 hours in one week.

a)Dave earns $22 per hour and worked 45 hours in one week.

b)Jeff earns $18 per hour and worked 42 hours in one week.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

44

To have less money withheld from your paycheck, an employee can claim more allowances than they actually have.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

45

All states charge a state income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

46

Regular earnings are equal to total earnings less deductions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

47

FICA-Medicare provides for medical benefits after age 65.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

48

The two parts of FICA are OASDI and Medicare.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the below allowances would have the most amount of taxes withheld for federal income tax purposes?

A)S-1

B)S-0

C)S-3

D)S-2

A)S-1

B)S-0

C)S-3

D)S-2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

50

A maximum limit is set for all FICA taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

51

All states use the same percent for the state tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

52

Companies can choose different pay periods for hourly workers versus salary workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

53

Compute the net pay for each employee listed below. Assume the following rates: FICA-OASDI 6.2% on a limit of $106,800; Medicare is 1.45%; federal income tax is 20%; state income tax is 5%; and union dues are $10.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

54

A work week is 150 hours in length.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

55

An allowance or exemption represents a certain amount of a person's income that will be considered nontaxable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

56

Gross pay is equal to take-home pay.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

57

When an employee's earnings are greater than FICA base limit during the calendar year, no more FICA-OASDI tax is deducted from earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

58

Gross pay is the amount that the employee takes home.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

59

Net pay is equal to gross pay less deductions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

60

The amount withheld for FICA is based on the W-4 form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

61

Why would a business decide to use an external company to prepare their payroll checks and related reports?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

62

The College Credit Card Services has a significant increase in business each spring due to a large increase in new applicants from graduating college students. Subsequently, each spring 40 temporary workers are hired for a 12-week period, working 40 hours per week at $10 per hour and then they are laid off. College's permanent employment total is 350 workers. Because of these yearly layoffs, College's state unemployment merit tax rate is 9%. If the number of layoffs could be reduced, the merit tax rate could be reduced to 4.1%.

As the payroll specialist for College, you have been asked to evaluate the following and determine the pros/cons of each decision:

1. Should College stop hiring temporary employees and ask its full-time workers to work overtime to handle the extra load?

2. Should College get its temporary employees from a temporary employment agency and therefore not be subject to the extra taxes?

As the payroll specialist for College, you have been asked to evaluate the following and determine the pros/cons of each decision:

1. Should College stop hiring temporary employees and ask its full-time workers to work overtime to handle the extra load?

2. Should College get its temporary employees from a temporary employment agency and therefore not be subject to the extra taxes?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

63

An employee has gross earnings of $1,000 with withholdings of 6.2% FICA-OASDI, 1.45 % FICA-Medicare, $50 for federal income tax and $10 for state income tax. How much is the gross pay?

A)$1000.00

B)$781.15

C)$771.15

D)$791.15

A)$1000.00

B)$781.15

C)$771.15

D)$791.15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

64

What is the purpose of the Fair Labor Standards Act?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

65

Explain what is meant by the cumulative gross earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

66

If the employee has $300 withheld from their check for FICA-OASDI, what is the amount that the employer would need to pay?

A)$300

B)$100

C)$0

D)$400

A)$300

B)$100

C)$0

D)$400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

67

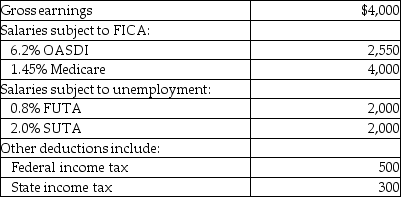

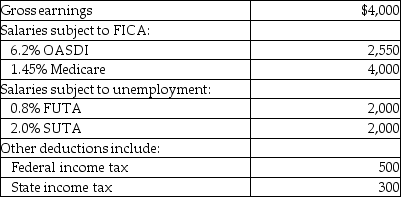

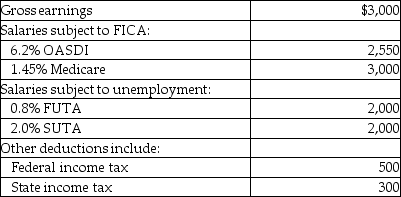

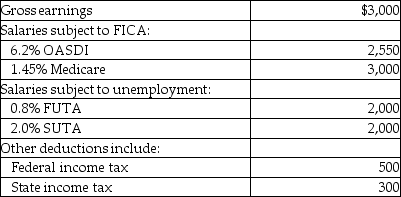

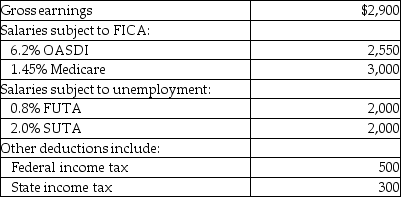

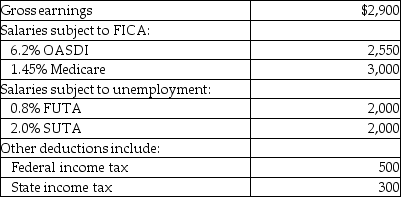

Ocean's Auction House's payroll for April includes the following data:  What is the net pay?

What is the net pay?

A)$1,998.40

B)$1,942.40

C)$3,000.00

D)$2,798.40

What is the net pay?

What is the net pay?A)$1,998.40

B)$1,942.40

C)$3,000.00

D)$2,798.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

68

List the purposes of Federal Insurance Contributions Act.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

69

If the employee has $500 withheld from their check for federal income tax, what is the amount that the employer would need to pay for their portion of the federal income tax?

A)$500

B)$100

C)$0

D)$400

A)$500

B)$100

C)$0

D)$400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

70

Unemployment taxes are:

A)based on wages paid to employees.

B)based employer's payment history.

C)the same for all employers.

D)Both A and B are correct.

A)based on wages paid to employees.

B)based employer's payment history.

C)the same for all employers.

D)Both A and B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

71

An employee earns $32 per hour. She worked 55 hours the third week of January.

Calculate the gross pay.

The business is involved in interstate commerce.

Federal Income Tax rate = 20%

State Income Tax rate = 5%

FICA rate OASDI = 6.2% and Medicare = 1.45%

FUTA rate = .8%

SUTA rate = 5.6%

$ ________

Calculate the gross pay.

The business is involved in interstate commerce.

Federal Income Tax rate = 20%

State Income Tax rate = 5%

FICA rate OASDI = 6.2% and Medicare = 1.45%

FUTA rate = .8%

SUTA rate = 5.6%

$ ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

72

Ocean's Auction House's payroll for April includes the following data:  What is the employer's portion of the tax?

What is the employer's portion of the tax?

A)$1,072.10

B)$56.00

C)$272.10

D)$800.00

What is the employer's portion of the tax?

What is the employer's portion of the tax?A)$1,072.10

B)$56.00

C)$272.10

D)$800.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

73

Ocean's Auction House's payroll for April includes the following data:  What is the employee's portion of the tax?

What is the employee's portion of the tax?

A)$1,057.60

B)$1,001.60

C)$257.60

D)$800.00

What is the employee's portion of the tax?

What is the employee's portion of the tax?A)$1,057.60

B)$1,001.60

C)$257.60

D)$800.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

74

An employee has gross earnings of $1,000 with withholdings of 6.2% FICA-OASDI, 1.45% FICA-Medicare, $50 for federal income tax and $10 for state income tax. How much is the net pay?

A)$900.00

B)$781.15

C)$863.50

D)$791.15

A)$900.00

B)$781.15

C)$863.50

D)$791.15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

75

An employee earns $16 per hour. He worked 45 hours the last week of January (assuming time and a half for overtime).

Calculate the total amount of employee deductions.

The business is involved in interstate commerce.

Federal Income Tax rate = 20%

State Income Tax rate = 5%

FICA rate OASDI = 6.2% and Medicare = 1.45%

FUTA rate = .8%

SUTA rate = 5.6%

$ ________

Calculate the total amount of employee deductions.

The business is involved in interstate commerce.

Federal Income Tax rate = 20%

State Income Tax rate = 5%

FICA rate OASDI = 6.2% and Medicare = 1.45%

FUTA rate = .8%

SUTA rate = 5.6%

$ ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

76

Workers' compensation:

A)insures employees against losses they may incur due to injury or death while on the job.

B)is based on the total estimated payroll.

C)is paid for by the employer.

D)All of the above are correct.

A)insures employees against losses they may incur due to injury or death while on the job.

B)is based on the total estimated payroll.

C)is paid for by the employer.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

77

Ocean's Auction House's payroll for April includes the following data:  What is the gross pay?

What is the gross pay?

A)$1,998.40

B)$1,942.40

C)$2,900.00

D)$2,798.40

What is the gross pay?

What is the gross pay?A)$1,998.40

B)$1,942.40

C)$2,900.00

D)$2,798.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

78

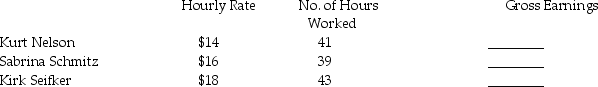

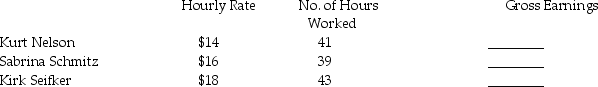

From the following information, complete the chart for gross earnings for the week. Assume an overtime rate of time and a half over 40 hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

79

An employee earns $32 per hour.

She worked 50 hours the third week of January (assume time and a half for overtime)

Calculate the net pay.

The business is involved in interstate commerce.

Federal Income Tax rate = 20%

State Income Tax rate = 5%

FICA rate OASDI = 6.2% and Medicare = 1.45%

FUTA rate = .8%

SUTA rate = 5.6%

$ ________

She worked 50 hours the third week of January (assume time and a half for overtime)

Calculate the net pay.

The business is involved in interstate commerce.

Federal Income Tax rate = 20%

State Income Tax rate = 5%

FICA rate OASDI = 6.2% and Medicare = 1.45%

FUTA rate = .8%

SUTA rate = 5.6%

$ ________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

80

The payroll taxes the employer is responsible for are:

A)FICA-OASDI.

B)FICA-Medicare.

C)worker's compensation.

D)All of the above are correct.

A)FICA-OASDI.

B)FICA-Medicare.

C)worker's compensation.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck