Deck 17: Responsibility Accounting, Performance Evaluation and Transfer Pricing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

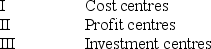

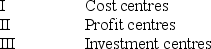

سؤال

سؤال

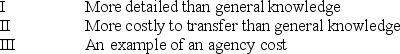

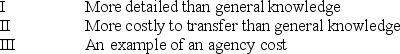

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

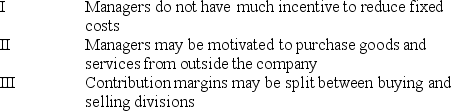

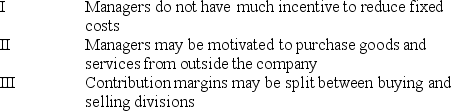

سؤال

سؤال

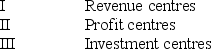

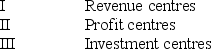

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/63

العب

ملء الشاشة (f)

Deck 17: Responsibility Accounting, Performance Evaluation and Transfer Pricing

1

Transfer pricing policies can affect a company's tax liability, particularly if it does business internationally.

True

2

Return on investment cannot be used effectively to evaluate profit centres because it motivates managers to make suboptimal decisions from the viewpoint of the organisations' owners.

True

3

An ideal transfer price would be the opportunity cost of internal transfers.

True

4

If a product has an external market and divisions are treated as profit centres, cost-based transfer prices can often lead to suboptimal decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

5

Return on investment can be decomposed into two ratios: investment turnover and return on sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

6

Responsibility accounting is the process of using financial information to justify pay increases and promotions for managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

7

In a dual-rate transfer pricing system, the selling department is credited for the market price and the buying department is charged the product's variable cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

8

In a profit centre, managers' primary goal is to maximise revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

9

Return on investment is typically calculated as net profit divided by total sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

10

Technical details about complex manufacturing processes are examples of specific knowledge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

11

Economic value added can be measured so that it reduces most of the problems that arise under residual income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

12

A transfer price is required only when goods or services are transferred between cost centres in the same organisation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

13

Division A of a firm produces a single product, which is sold only to Division B. Division A has a total investment of $1,000,000, while Division B has a total investment of $2,000,000. Division A annually sells 100,000 units of its product to Division B for $5 per unit and earns $150,000 in operating profit. Division B currently earns $250,000. If Division A raises its selling price to $6 per unit and nothing else changes,

A) Division A's ROI will increase to 20%

B) The firm's overall ROI will rise

C) The firm's overall ROI will fall

D) The firm's overall ROI will remain unchanged

A) Division A's ROI will increase to 20%

B) The firm's overall ROI will rise

C) The firm's overall ROI will fall

D) The firm's overall ROI will remain unchanged

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

14

A segment with an ROI of 30% has a profit of $84,000. The company's required rate of return on segment investments is 18%. The segment's residual income is

A) $50,400

B) $25,200

C) $26,712

D) $33,600

A) $50,400

B) $25,200

C) $26,712

D) $33,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

15

Investment centre managers are held responsible only for their costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

16

Choices about decision-making authority and about organisational structure are often related.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

17

If a supplying division has excess capacity, the best transfer price is the product's variable cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

18

Residual income measures a company's profits given a required rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

19

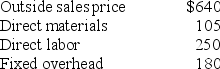

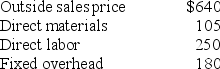

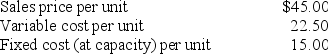

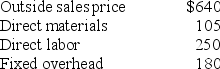

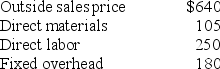

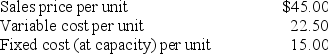

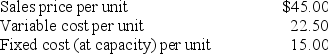

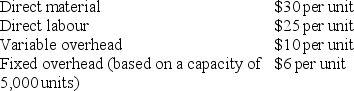

The Gold Coast Division of Vallance Ltd produces and sells a product to outside and internal customers. Per-unit data collected from its operations include:  If the Gold Coast division is operating at full capacity and selling solely to outside customers, what price should another division pay for Gold Coast's product?

If the Gold Coast division is operating at full capacity and selling solely to outside customers, what price should another division pay for Gold Coast's product?

A) $285

B) $625

C) $640

D) $480

If the Gold Coast division is operating at full capacity and selling solely to outside customers, what price should another division pay for Gold Coast's product?

If the Gold Coast division is operating at full capacity and selling solely to outside customers, what price should another division pay for Gold Coast's product?A) $285

B) $625

C) $640

D) $480

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

20

If manufacturing departments are only responsible for production decisions, they are considered cost centres.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

21

When decision making is decentralised

A) Upper management does not make decisions

B) Decision-making authority is delegated throughout the organisation

C) The important information in an organisation is very general

D) Organisations are less likely to experience agency costs concerning goal congruence

A) Upper management does not make decisions

B) Decision-making authority is delegated throughout the organisation

C) The important information in an organisation is very general

D) Organisations are less likely to experience agency costs concerning goal congruence

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

22

THN Pty Ltd reported operating profit of $30,000, revenue of $50,000, and average operating assets of $40,000 for a recent year. Which of the following is true?

A) THN has an adequate return on investment

B) THN's return on sales was 1.67

C) THN's return on investment was 75%

D) THN's return on sales was 80%

A) THN has an adequate return on investment

B) THN's return on sales was 1.67

C) THN's return on investment was 75%

D) THN's return on sales was 80%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following responsibility centres can be evaluated using residual income?

A) Cost centres

B) Profit centres

C) Revenue centres

D) Investment centres

A) Cost centres

B) Profit centres

C) Revenue centres

D) Investment centres

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which type of knowledge is most costly to transfer within an organisation?

A) Centralised

B) Decentralised

C) Financial

D) Specific

A) Centralised

B) Decentralised

C) Financial

D) Specific

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Victorian Division of WDY reported net profit of $2,500, operating profit of $4,000, average equity of $24,000, and average operating assets of $30,000 in a recent accounting period. If Victoria's required rate of return is 12%, its residual income was

A) $380

B) $(380)

C) $400

D) $1,100

A) $380

B) $(380)

C) $400

D) $1,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

26

Residual income is calculated as

A) Operating profit - (required rate of return × average operating assets)

B) Net profit - (required rate of return × average operating assets)

C) Operating profit - (required rate of return × average equity)

D) Net profit - (required rate of return × average equity)

A) Operating profit - (required rate of return × average operating assets)

B) Net profit - (required rate of return × average operating assets)

C) Operating profit - (required rate of return × average equity)

D) Net profit - (required rate of return × average equity)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

27

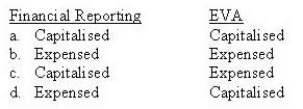

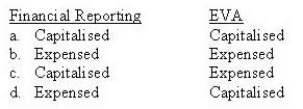

How are research and development costs treated for financial reporting and for economic value added (EVA) calculations?

A) Capitalised/Capitalised

B) Expensed/Expensed

C) Capitalised/Expensed

D) Expensed/Capitalised

A) Capitalised/Capitalised

B) Expensed/Expensed

C) Capitalised/Expensed

D) Expensed/Capitalised

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

28

Economic value added uses "adjusted after-tax operating profit" as one of its inputs. One purpose of using after-tax profit, rather than operating profit, is to B

A) Encourage managers to file tax reports

B) Encourage managers to minimise taxes

C) Improve information reported to the ASIC

D) Remove bias from the EVA calculation

A) Encourage managers to file tax reports

B) Encourage managers to minimise taxes

C) Improve information reported to the ASIC

D) Remove bias from the EVA calculation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

29

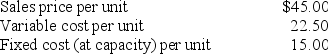

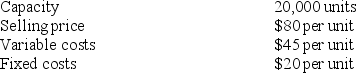

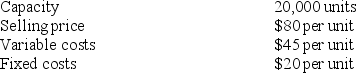

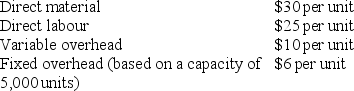

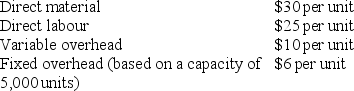

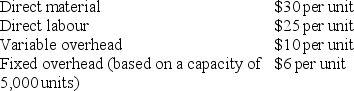

The National Division of Roboto Ltd is buying 10,000 widgets from an outside supplier at $30 per unit. Roboto's Overseas Division, which is producing and selling at full capacity (12,000 units), has the following sales and cost structure:  If the National Division buys its 10,000 widgets from the Overseas Division, the transfer price should be

If the National Division buys its 10,000 widgets from the Overseas Division, the transfer price should be

A) $45.00

B) $30.00

C) $22.50

D) $37.50

If the National Division buys its 10,000 widgets from the Overseas Division, the transfer price should be

If the National Division buys its 10,000 widgets from the Overseas Division, the transfer price should beA) $45.00

B) $30.00

C) $22.50

D) $37.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

30

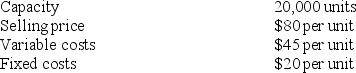

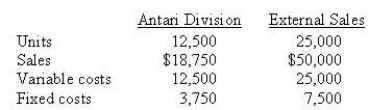

Division A of Sibley Ltd has operating data as follows:  Division B wants to purchase units from Division A. If Division A agrees to sell units to Division B, A's variable costs will be $5 less per unit.

Division B wants to purchase units from Division A. If Division A agrees to sell units to Division B, A's variable costs will be $5 less per unit.

If Division A is operating at capacity, what is the minimum price it should charge?

A) $40

B) $75

C) $20

D) $60

Division B wants to purchase units from Division A. If Division A agrees to sell units to Division B, A's variable costs will be $5 less per unit.

Division B wants to purchase units from Division A. If Division A agrees to sell units to Division B, A's variable costs will be $5 less per unit.If Division A is operating at capacity, what is the minimum price it should charge?

A) $40

B) $75

C) $20

D) $60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

31

Decision-making based on general knowledge is more likely to occur in this type of organisation

A) Centralised

B) Decentralised

C) Effective

D) Ineffective

A) Centralised

B) Decentralised

C) Effective

D) Ineffective

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

32

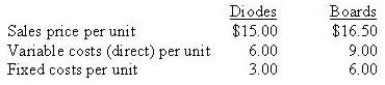

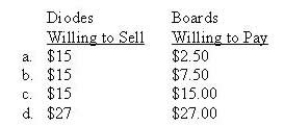

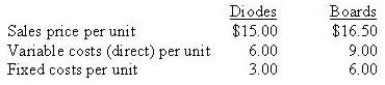

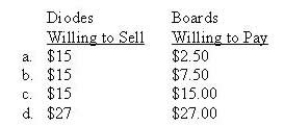

Hitek Ltd has 2 divisions, Diodes and Boards. The diode can be sold internally or externally. If sold externally, the sales price is $15 per diode. The Boards division needs 3 diodes for each electronic board it produces. The external sales prices and costs are:  If Diodes can sell all of its production externally, what is the minimum price at which it would be willing to sell internally, and what is the maximum price the Board Division would be willing to pay?

If Diodes can sell all of its production externally, what is the minimum price at which it would be willing to sell internally, and what is the maximum price the Board Division would be willing to pay?

A) $15/$2.50

B) $15/$7.50

C) $15/$15

D) $15/$27

If Diodes can sell all of its production externally, what is the minimum price at which it would be willing to sell internally, and what is the maximum price the Board Division would be willing to pay?

If Diodes can sell all of its production externally, what is the minimum price at which it would be willing to sell internally, and what is the maximum price the Board Division would be willing to pay?

A) $15/$2.50

B) $15/$7.50

C) $15/$15

D) $15/$27

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

33

KNY Pty Ltd reported operating profit of $80,000 and average operating assets of $120,000 in a recent accounting period. Which of the following transactions would definitely increase KNY's return on investment?

A) Increasing product prices

B) Switching suppliers for raw materials

C) Collecting accounts receivable

D) Decreasing research and development expense

A) Increasing product prices

B) Switching suppliers for raw materials

C) Collecting accounts receivable

D) Decreasing research and development expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

34

The Gold Coast Division of Vallance Ltd produces and sells a product to outside and internal customers. Per-unit data collected from its operations include:  If the Gold Coast Division has excess capacity available to meet an internal order, what transfer price should be set?

If the Gold Coast Division has excess capacity available to meet an internal order, what transfer price should be set?

A) $625

B) $355

C) $430

D) $285

If the Gold Coast Division has excess capacity available to meet an internal order, what transfer price should be set?

If the Gold Coast Division has excess capacity available to meet an internal order, what transfer price should be set?A) $625

B) $355

C) $430

D) $285

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

35

Division A of Sibley Ltd has operating data as follows:  B wants to purchase units from Division A. If Division A agrees to sell units to Division B, A's variable costs will be $5 less per unit.

B wants to purchase units from Division A. If Division A agrees to sell units to Division B, A's variable costs will be $5 less per unit.

If Division A has capacity available to meet B's requirements, what is the minimum price it should charge?

A) $40

B) $75

C) $20

D) $60

B wants to purchase units from Division A. If Division A agrees to sell units to Division B, A's variable costs will be $5 less per unit.

B wants to purchase units from Division A. If Division A agrees to sell units to Division B, A's variable costs will be $5 less per unit.If Division A has capacity available to meet B's requirements, what is the minimum price it should charge?

A) $40

B) $75

C) $20

D) $60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

36

The National Division of Roboto Ltd is buying 10,000 widgets from an outside supplier at $30 per unit. Roboto's Overseas Division, which is producing and selling at full capacity (12,000 units), has the following sales and cost structure:  If the Overseas Division meets the outside supplier's price and sells the 10,000 widgets to National, the effect on overall company profits will be

If the Overseas Division meets the outside supplier's price and sells the 10,000 widgets to National, the effect on overall company profits will be

A) $ 75,000 higher

B) $150,000 lower

C) $300,000 higher

D) $225.000 lower

If the Overseas Division meets the outside supplier's price and sells the 10,000 widgets to National, the effect on overall company profits will be

If the Overseas Division meets the outside supplier's price and sells the 10,000 widgets to National, the effect on overall company profits will beA) $ 75,000 higher

B) $150,000 lower

C) $300,000 higher

D) $225.000 lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

37

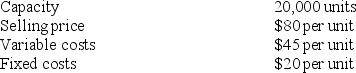

Division A produces a component for Honda Ltd's main product - motor vehicles. The division operates as a profit centre. It also sells to outsiders. The present selling price is $75 per component. The company buys 600,000 units of a similar component per year from outside sources. The external purchase price is $73 as a result of a quantity discount. Division A has adequate capacity to supply the needs of the Assembly division. The following data are for Division A:  The minimum price at which A would sell components internally is

The minimum price at which A would sell components internally is

A) $71

B) $73

C) $75

D) $65

The minimum price at which A would sell components internally is

The minimum price at which A would sell components internally isA) $71

B) $73

C) $75

D) $65

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following best describes "general knowledge" in a decision-making context?

A) Detailed information about manufacturing processes

B) Customer lists and preferences kept by individual departments in retail sales

C) Knowledge that is easily transferred between employees

D) Knowledge that can be obtained only outside the organisation

A) Detailed information about manufacturing processes

B) Customer lists and preferences kept by individual departments in retail sales

C) Knowledge that is easily transferred between employees

D) Knowledge that can be obtained only outside the organisation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

39

Division A produces a component for Honda Ltd's main product - motor vehicles. The division operates as a profit centre. It also sells to outsiders. The present selling price is $75 per component. The company buys 600,000 units of a similar component per year from outside sources. The external purchase price is $73 as a result of a quantity discount. Division A has adequate capacity to supply the needs of the Assembly division. The following data are for Division A:  The price range within which A would sell components to the Assembly Division is

The price range within which A would sell components to the Assembly Division is

A) $71 to $73

B) $65 to $73

C) $71 to $75

D) $65 to $75

The price range within which A would sell components to the Assembly Division is

The price range within which A would sell components to the Assembly Division isA) $71 to $73

B) $65 to $73

C) $71 to $75

D) $65 to $75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

40

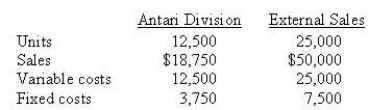

The Jupiter Division of Space Ltd produces dilithium crystals. One-third of its output is sold to the Antari Division, and the remainder is sold externally. Jupiter's estimated sales and cost data for the coming year are:  Assume that Jupiter cannot sell any additional crystals externally. If the Antari Division has an opportunity to buy from an outside supplier at $1.40 per crystal and Jupiter refuses to meet this price, the company as a whole will be

Assume that Jupiter cannot sell any additional crystals externally. If the Antari Division has an opportunity to buy from an outside supplier at $1.40 per crystal and Jupiter refuses to meet this price, the company as a whole will be

A) $1,250 better off

B) $3,750 worse off

C) $6,250 better off

D) $5,000 worse off

Assume that Jupiter cannot sell any additional crystals externally. If the Antari Division has an opportunity to buy from an outside supplier at $1.40 per crystal and Jupiter refuses to meet this price, the company as a whole will be

Assume that Jupiter cannot sell any additional crystals externally. If the Antari Division has an opportunity to buy from an outside supplier at $1.40 per crystal and Jupiter refuses to meet this price, the company as a whole will beA) $1,250 better off

B) $3,750 worse off

C) $6,250 better off

D) $5,000 worse off

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

41

Among the responsibility centres listed, which type of responsibility centre is most likely to use growth in sales as a performance measure?

A) Cost

B) Profit

C) Revenue

D) Investment

A) Cost

B) Profit

C) Revenue

D) Investment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

42

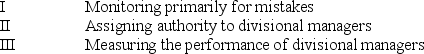

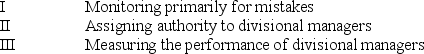

Budgets can be used to evaluate managerial performance in

A) II only

B) I and II only

C) II and III only

D) I, II, and III

A) II only

B) I and II only

C) II and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

43

A corporate accounting department would most often be considered a

A) Cost centre, because it is typically a high cost operation

B) Cost centre, because its costs can be controlled by upper management

C) Revenue centre, if accountants have input in pricing decisions

D) Cost centre, because it is a support service

A) Cost centre, because it is typically a high cost operation

B) Cost centre, because its costs can be controlled by upper management

C) Revenue centre, if accountants have input in pricing decisions

D) Cost centre, because it is a support service

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

44

Specific knowledge is

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

45

Setting transfer prices can be especially problematic when

A) Managers are evaluated based on non-financial factors

B) Compensation is tied to the financial performance of responsibility centres

C) Centralised decision making is the organisational norm

D) Compensation is tied to the financial performance of the organisation as a whole

A) Managers are evaluated based on non-financial factors

B) Compensation is tied to the financial performance of responsibility centres

C) Centralised decision making is the organisational norm

D) Compensation is tied to the financial performance of the organisation as a whole

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

46

The price used to record exchanges of goods and services inside an organisation is called a

A) Transfer price

B) Exchange price

C) Full price

D) Suboptimal price

A) Transfer price

B) Exchange price

C) Full price

D) Suboptimal price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following transfer pricing systems potentially takes the most time to establish?

A) Market-based

B) Dual-rate

C) Negotiated

D) Full-cost

A) Market-based

B) Dual-rate

C) Negotiated

D) Full-cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

48

Dual-rate transfer pricing systems are appropriate when the

A) Market price is unknown

B) Selling department has excess capacity

C) Market price is higher than the variable cost

D) Market price is higher than the full cost

A) Market price is unknown

B) Selling department has excess capacity

C) Market price is higher than the variable cost

D) Market price is higher than the full cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

49

Teresa's Taco Ltd had the following results during the most recent year: Sales $500,000; Residual income $5,000; investment turnover 2.5; and a required rate of return of 15%. The operating (pretax) profit was

A) $30,500

B) $192,500

C) $35,000

D) $16,250

A) $30,500

B) $192,500

C) $35,000

D) $16,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

50

Efficiency measures, such as number of new products developed, may be more useful than financial measures in

A) Profit centres.

B) Discretionary cost centres.

C) Revenue centres.

D) Investment centres.

A) Profit centres.

B) Discretionary cost centres.

C) Revenue centres.

D) Investment centres.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

51

The Geelong Division of the Wasson Widget Co. requires a 12% rate of return. During a recent year Shannon had a net profit of $400,000 and a residual income of $250,000. What was its ROI?

A) 32%

B) 15%

C) 12%

D) 26%

A) 32%

B) 15%

C) 12%

D) 26%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

52

A transfer pricing policy based on market price

A) Maximises total organisational profit.

B) Is best because the market price is always objective and easily obtainable.

C) May result in suboptimal decision making for the company as a whole.

D) Is the only alternative accepted by the Australian Taxation Office.

A) Maximises total organisational profit.

B) Is best because the market price is always objective and easily obtainable.

C) May result in suboptimal decision making for the company as a whole.

D) Is the only alternative accepted by the Australian Taxation Office.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is an advantage of cost-based transfer prices?

A) I only

B) II only

C) III only

D) None of the above (I, II, and III are all disadvantages)

A) I only

B) II only

C) III only

D) None of the above (I, II, and III are all disadvantages)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

54

Teresa's Taco Ltd had the following results during the most recent year: Sales $500,000; Residual income $5,000; investment turnover 2.5; and a required rate of return of 15%. The capital investment was

A) $1,250,000

B) $75,000

C) $170,000

D) $200,000

A) $1,250,000

B) $75,000

C) $170,000

D) $200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

55

Managers are held responsible for revenues in

A) I and III only

B) II and III only

C) I only

D) I, II, and III

A) I and III only

B) II and III only

C) I only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

56

Responsibility accounting includes

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

57

When a company uses activity-based transfer prices

A) The internal buyer is motivated to overstate the number of units to buy internally

B) The internal buyer is motivated to understate the number of units to buy internally

C) Capacity is usually reserved for products or services that are transferred internally

D) Batch-level costs are excluded from the computation

A) The internal buyer is motivated to overstate the number of units to buy internally

B) The internal buyer is motivated to understate the number of units to buy internally

C) Capacity is usually reserved for products or services that are transferred internally

D) Batch-level costs are excluded from the computation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

58

Problems with market-based transfer prices include

A) Lack of knowledge about underlying costs

B) Lack of objectivity

C) Their impact on corporate profitability

D) Their lack of reliance on supply-and-demand relationships

A) Lack of knowledge about underlying costs

B) Lack of objectivity

C) Their impact on corporate profitability

D) Their lack of reliance on supply-and-demand relationships

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

59

An advantage of centralised decision making is

A) More motivated employees

B) More rapid decision making in all contexts

C) Greater effectiveness in volatile environments

D) Less monitoring of decisions

A) More motivated employees

B) More rapid decision making in all contexts

C) Greater effectiveness in volatile environments

D) Less monitoring of decisions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

60

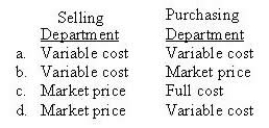

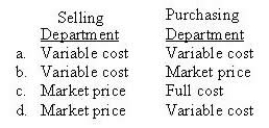

Which prices are recorded by departments under a dual-rate transfer pricing system?

A) Variable cost/Variable cost

B) Variable cost/Market price

C) Market price/Full cost

D) Market price/Variable cost

A) Variable cost/Variable cost

B) Variable cost/Market price

C) Market price/Full cost

D) Market price/Variable cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

61

Division S sold a part to both Division P and outside customers last year. The revenues from these sales were $30,000 (1,000 units) and $35,000 (1,000 units), respectively. Next year, S plans to increase the unit sales price to $42 and wants a proportionate increase in the sales price to Division P. The unit costs are $9 variable and $15 fixed. If Division P does not agree to the price increase, 50% of Division S's fixed costs will be eliminated. What is the highest price Division P would be willing to pay for external purchases?

A) $30.00

B) $36.00

C) $16.50

D) $28.50

A) $30.00

B) $36.00

C) $16.50

D) $28.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

62

Teresa's Taco Ltd had the following results during the most recent year: Sales $500,000; Residual income $5,000; investment turnover 2.5; and a required rate of return of 15%. The return on sales was

A) 7%

B) 6.1%

C) 38.5%

D) 3.25%

A) 7%

B) 6.1%

C) 38.5%

D) 3.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

63

Teresa's Taco Ltd had the following results during the most recent year: Sales $500,000; Residual income $5,000; investment turnover 2.5; and a required rate of return of 15%. The return on investment was

A) 15.4%

B) 21.67%

C) 15.25%

D) 17.5%

A) 15.4%

B) 21.67%

C) 15.25%

D) 17.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck