Deck 11: Operational Budgets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/87

العب

ملء الشاشة (f)

Deck 11: Operational Budgets

1

An operating budget is the component of a master budget that contains management's plans for revenues, production, and operating costs.

True

2

A master budget is a comprehensive plan for an upcoming financial period.

True

3

The cash budget is included in an organisation's operating budget.

False

4

The ending inventories budget is typically expressed in terms of costs, while the production budget is typically expressed in units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

5

If actual activities do not follow plans, a variance is likely to result.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

6

Production and inventory budgets form the basis for developing the revenue budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

7

In a production budget, beginning inventory plus budgeted production equals sales plus targeted ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

8

A formalised financial plan for organisational operations is called a long-term strategy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

9

Managers need information from about current beginning inventories and required ending inventories to prepare the production budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

10

The shortest period for which a cash budget can be prepared is six months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

11

Budgeting provides a means for defining managers' decision rights (responsibility and financial decision making authority).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

12

Master budgets are often summarised in a company's short-term operating plans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

13

When an organisation's actual revenues are greater than its budgeted revenues, the difference is referred to as a favorable variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

14

Differences between budgeted amounts and actual amounts are called budget variances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

15

Cash paid or received from the purchase or sale of property or equipment is shown in the capital budget and does not appear in the cash budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

16

The master budget includes two components: an operating budget and a time budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

17

Favorable variances are positive amounts; unfavorable variances are negative amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

18

To prepare a budgeted income statement, managers draw data from the revenue budget, the cost of goods sold budget, and the cash budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

19

Managers often use short-term loans or prearranged lines of credit to balance the cash budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

20

A financial budget is the master budget component that leads to all budgeted financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

21

Kelita Ltd, projects sales for its first three months of operation as follows: Inventory on 1st October is $40,000. Subsequent beginning inventories should be 40% of that month's cost of goods sold. Goods are priced at 140% of their cost. 50% of purchases are paid for in the month of purchase; the balance is paid in the following month. It is expected that 50% of credit sales will be collected in the month following sale, 30% in the second month following the sale, and the balance the third month. A 5% discount is given if payment is received in the month following sale.

What is the projected cost of purchases for October?

A) $80,000

B) $93,333

C) $120,000

D) $180,000

What is the projected cost of purchases for October?

A) $80,000

B) $93,333

C) $120,000

D) $180,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

22

A flexible budget reflects a range of operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

23

Sales of $250,000 are forecast for the third quarter. Gross profit is 60% of sales, and beginning inventory is $165,000. If ending inventory is budgeted as $183,000, what are the budgeted purchases?

A) $118,000

B) $132,000

C) $168,000

D) $82,000

A) $118,000

B) $132,000

C) $168,000

D) $82,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

24

The principles of activity-based costing can be applied to the budgeting process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

25

When managers intentionally set budgeted costs too low and budgeted revenues too high, they are creating budgetary slack.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

26

Budget variances cannot be calculated from a static budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

27

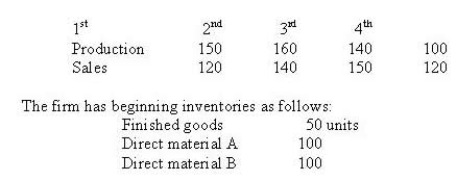

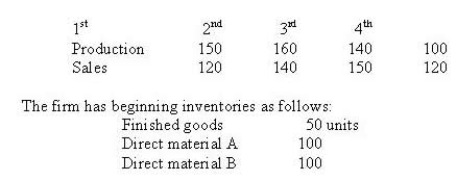

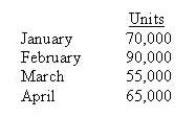

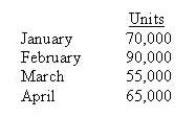

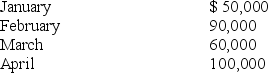

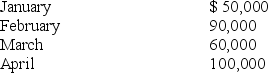

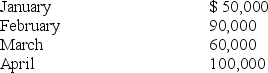

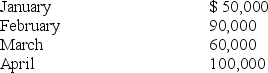

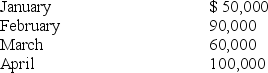

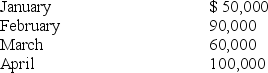

Ray Company's projected sales budget for the next four months is as follows: Beginning inventory for the year is 27,000 units. Ending inventory for each month should be 30% of the next month's sales.

How many units need to be available for sale in February?

A) 90,000

B) 106,500

C) 73,500

D) 117,000

How many units need to be available for sale in February?

A) 90,000

B) 106,500

C) 73,500

D) 117,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

28

Participative budgeting involves customers and managers at all levels in the organisation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

29

Planning Systems, has forecast the following unit sales and production for the next year, by quarter: A finished unit requires one unit of material A and two units of material B. There should be enough material on hand at the end of each quarter to meet 20% of the next quarter's production needs. There are no work-in-process inventories.

What is the ending inventory for material B in quarter 1?

A) 28

B) 32

C) 56

D) 64

What is the ending inventory for material B in quarter 1?

A) 28

B) 32

C) 56

D) 64

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

30

Planning Systems has forecast the following unit sales and production for the next year, by quarter:  A finished unit requires one unit of material A and two units of material B. There should be enough material on hand at the end of each quarter to meet 20% of the next quarter's production needs. There are no work-in-process inventories. What is ending finished goods inventory for quarter 2?

A finished unit requires one unit of material A and two units of material B. There should be enough material on hand at the end of each quarter to meet 20% of the next quarter's production needs. There are no work-in-process inventories. What is ending finished goods inventory for quarter 2?

A) 50

B) 70

C) 80

D) 100

A finished unit requires one unit of material A and two units of material B. There should be enough material on hand at the end of each quarter to meet 20% of the next quarter's production needs. There are no work-in-process inventories. What is ending finished goods inventory for quarter 2?

A finished unit requires one unit of material A and two units of material B. There should be enough material on hand at the end of each quarter to meet 20% of the next quarter's production needs. There are no work-in-process inventories. What is ending finished goods inventory for quarter 2?A) 50

B) 70

C) 80

D) 100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

31

One disadvantage of participative budgeting is employees' tendency to set targets too high to impress management with their motivation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

32

Kelita Ltd, projects sales for its first three months of operation as follows:  Inventory on 1st October is $40,000. Subsequent beginning inventories should be 40% of that month's cost of goods sold. Goods are priced at 140% of their cost. 50% of purchases are paid for in the month of purchase; the balance is paid in the following month. It is expected that 50% of credit sales will be collected in the month following sale, 30% in the second month following the sale, and the balance the third month. A 5% discount is given if payment is received in the month following sale. What is the projected cost of goods sold for October?

Inventory on 1st October is $40,000. Subsequent beginning inventories should be 40% of that month's cost of goods sold. Goods are priced at 140% of their cost. 50% of purchases are paid for in the month of purchase; the balance is paid in the following month. It is expected that 50% of credit sales will be collected in the month following sale, 30% in the second month following the sale, and the balance the third month. A 5% discount is given if payment is received in the month following sale. What is the projected cost of goods sold for October?

A) $140,000

B) $220,000

C) $257,000

D) $100,000

Inventory on 1st October is $40,000. Subsequent beginning inventories should be 40% of that month's cost of goods sold. Goods are priced at 140% of their cost. 50% of purchases are paid for in the month of purchase; the balance is paid in the following month. It is expected that 50% of credit sales will be collected in the month following sale, 30% in the second month following the sale, and the balance the third month. A 5% discount is given if payment is received in the month following sale. What is the projected cost of goods sold for October?

Inventory on 1st October is $40,000. Subsequent beginning inventories should be 40% of that month's cost of goods sold. Goods are priced at 140% of their cost. 50% of purchases are paid for in the month of purchase; the balance is paid in the following month. It is expected that 50% of credit sales will be collected in the month following sale, 30% in the second month following the sale, and the balance the third month. A 5% discount is given if payment is received in the month following sale. What is the projected cost of goods sold for October?A) $140,000

B) $220,000

C) $257,000

D) $100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

33

When evaluating actual results at the end of an accounting period, the static budget provides an appropriate benchmark for actual operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

34

Planning Systems, has forecast the following unit sales and production for the next year, by quarter: A finished unit requires one unit of material A and two units of material B. There should be enough material on hand at the end of each quarter to meet 20% of the next quarter's production needs. There are no work-in-process inventories.

How much material A must be purchased in quarter 2?

A) 138

B) 142

C) 156

D) 162

How much material A must be purchased in quarter 2?

A) 138

B) 142

C) 156

D) 162

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

35

Matz Ltd expects to sell 24,000 units of finished goods over the next 6-month period. The company has 10,000 units on hand and its managers want to have 14,000 units on hand at the end of the period. To produce one unit of finished product, two units of direct materials are needed. Matz has 100,000 units of direct material on hand and has budgeted for an ending inventory of 110,000 units. What is the number of finished units to be produced?

A) 38,000

B) 28,000

C) 20,000

D) 24,000

A) 38,000

B) 28,000

C) 20,000

D) 24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

36

Planning Systems, has forecast the following unit sales and production for the next year, by quarter: A finished unit requires one unit of material A and two units of material B. There should be enough material on hand at the end of each quarter to meet 20% of the next quarter's production needs. There are no work-in-process inventories.

How much material B must be purchased in quarter 1?

A) 264

B) 196

C) 204

D) 256

How much material B must be purchased in quarter 1?

A) 264

B) 196

C) 204

D) 256

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

37

Matz Ltd expects to sell 24,000 units of finished goods over the next 6-month period. The company has 10,000 units on hand and its managers want to have 14,000 units on hand at the end of the period. To produce one unit of finished product, two units of direct materials are needed. Matz has 100,000 units of direct material on hand and has budgeted for an ending inventory of 110,000 units. What is the amount of direct material to be purchased (in units)?

A) 38,000

B) 46,000

C) 66,000

D) 18,000

A) 38,000

B) 46,000

C) 66,000

D) 18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

38

Cost-volume-profit analysis is a simplified version of a flexible budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

39

Planning Systems, has forecast the following unit sales and production for the next year, by quarter: A finished unit requires one unit of material A and two units of material B. There should be enough material on hand at the end of each quarter to meet 20% of the next quarter's production needs. There are no work-in-process inventories.

What is the ending inventory for material A for quarter 2?

A) 24

B) 28

C) 30

D) 100

What is the ending inventory for material A for quarter 2?

A) 24

B) 28

C) 30

D) 100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

40

Ray Company's projected sales budget for the next four months is as follows:  Beginning inventory for the year is 27,000 units. Ending inventory for each month should be 30% of the next month's sales. How many units should the company produce in January?

Beginning inventory for the year is 27,000 units. Ending inventory for each month should be 30% of the next month's sales. How many units should the company produce in January?

A) 106,000

B) 90,000

C) 70,000

D) 78,000

Beginning inventory for the year is 27,000 units. Ending inventory for each month should be 30% of the next month's sales. How many units should the company produce in January?

Beginning inventory for the year is 27,000 units. Ending inventory for each month should be 30% of the next month's sales. How many units should the company produce in January?A) 106,000

B) 90,000

C) 70,000

D) 78,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

41

An advantage of a flexible budget is that it

A) Allows comparisons of the actual costs with those that should have been incurred

B) Considers only variable costs

C) Allows management freedom in meeting goals

D) Allows comparison of actual costs to master budget costs

A) Allows comparisons of the actual costs with those that should have been incurred

B) Considers only variable costs

C) Allows management freedom in meeting goals

D) Allows comparison of actual costs to master budget costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

42

One objective of budgeting is motivating managers to

A) Eliminate all variances.

B) Use resources efficiently.

C) Lessen the need for communication.

D) Establish prices for external sales of goods and services.

A) Eliminate all variances.

B) Use resources efficiently.

C) Lessen the need for communication.

D) Establish prices for external sales of goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

43

To overcome possible problems with budgets that are developed only by top level managers, an alternative is to use

A) Mandatory budgets

B) Authoritative budgets

C) Flexible budgets

D) Participative budgets

A) Mandatory budgets

B) Authoritative budgets

C) Flexible budgets

D) Participative budgets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is not required to develop a budgeted income statement?

A) Sales forecast

B) Cash budget

C) Production budget

D) Marketing budget

A) Sales forecast

B) Cash budget

C) Production budget

D) Marketing budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

45

The Phillips Company's budgeted annual indirect labor cost is: $7,200 + $0.75 per direct labor hour. Operating budgets for the current month are based on 30,000 hours of budgeted direct labor hours. Budgeted indirect labor cost is

A) $22,500

B) $29,700

C) $22,000

D) $23,100

A) $22,500

B) $29,700

C) $22,000

D) $23,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

46

Steve Company uses the following flexible budget formula for monthly repair cost: total cost = $700 + $0.40 per machine hour. The annual operating budget calls for 35,000 hours of planned machine time. Budgeted repair cost is

A) $14,000

B) $14,700

C) $22,400

D) $22,000

A) $14,000

B) $14,700

C) $22,400

D) $22,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following must managers develop prior to preparing a budgeted income statement?

A) Cash budget

B) Budgeted balance sheet

C) Support department budgets

D) Support department cost allocations

A) Cash budget

B) Budgeted balance sheet

C) Support department budgets

D) Support department cost allocations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

48

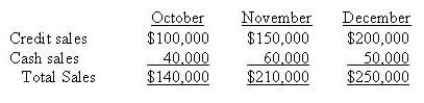

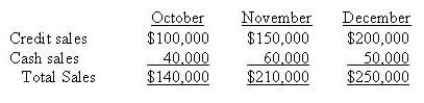

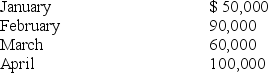

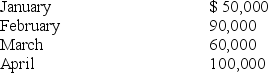

Gold Company has the following balances at 31st December 2010: Cash $6,000; accounts receivable $34,000 ($10,000 from November and $24,000 from December); merchandise inventory $40,000; and accounts payable $20,000 (for merchandise purchases only). Budgeted sales follow:  Other data:

Other data:

· Sales are 40% cash, 50% collected during the following month, and 10% collected during the second month after sale. A 3% cash discount is given on cash sales

· Cost of goods sold is 40% of sales

· Ending inventory must be 140% of the next month's cost of sales

· Purchases are paid 70% in month of purchase and 30% in the following month

· The selling and administrative cost function is: $6,000 + $0.2 × sales. This includes $1,000 for depreciation

· All costs are paid in the month incurred

· Minimum cash balance requirement is $6,000

What will be the ending cash balance for January?

A) $(280)

B) $13,720

C) $19,720

D) $6,000

Other data:

Other data:· Sales are 40% cash, 50% collected during the following month, and 10% collected during the second month after sale. A 3% cash discount is given on cash sales

· Cost of goods sold is 40% of sales

· Ending inventory must be 140% of the next month's cost of sales

· Purchases are paid 70% in month of purchase and 30% in the following month

· The selling and administrative cost function is: $6,000 + $0.2 × sales. This includes $1,000 for depreciation

· All costs are paid in the month incurred

· Minimum cash balance requirement is $6,000

What will be the ending cash balance for January?

A) $(280)

B) $13,720

C) $19,720

D) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

49

Kelita Ltd, projects sales for its first three months of operation as follows: Inventory on 1st October is $40,000. Subsequent beginning inventories should be 40% of that month's cost of goods sold. Goods are priced at 140% of their cost. 50% of purchases are paid for in the month of purchase; the balance is paid in the following month. It is expected that 50% of credit sales will be collected in the month following sale, 30% in the second month following the sale, and the balance the third month. A 5% discount is given if payment is received in the month following sale.

What are the anticipated cash receipts for November?

A) $107,500

B) $105,000

C) $110,000

D) $160,000

What are the anticipated cash receipts for November?

A) $107,500

B) $105,000

C) $110,000

D) $160,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

50

Gold Company has the following balances at 31st December 31 2010: Cash $6,000; accounts receivable $34,000 ($10,000 from November and $24,000 from December); merchandise inventory $40,000; and accounts payable $20,000 (for merchandise purchases only). Budgeted sales follow:  Other data:

Other data:

· Sales are 40% cash, 50% collected during the following month, and 10% collected during the second month after sale. A 3% cash discount is given on cash sales

· Cost of goods sold is 40% of sales

· Ending inventory must be 140% of the next month's cost of sales

· Purchases are paid 70% in month of purchase and 30% in the following month

· The selling and administrative cost function is: $6,000 + $0.2 × sales. This includes $1,000 for depreciation

· All costs are paid in the month incurred

· Minimum cash balance requirement is $6,000

What is the budgeted cost of purchases for February?

A) $19,200

B) $30,400

C) $15,000

D) $52,800

Other data:

Other data:· Sales are 40% cash, 50% collected during the following month, and 10% collected during the second month after sale. A 3% cash discount is given on cash sales

· Cost of goods sold is 40% of sales

· Ending inventory must be 140% of the next month's cost of sales

· Purchases are paid 70% in month of purchase and 30% in the following month

· The selling and administrative cost function is: $6,000 + $0.2 × sales. This includes $1,000 for depreciation

· All costs are paid in the month incurred

· Minimum cash balance requirement is $6,000

What is the budgeted cost of purchases for February?

A) $19,200

B) $30,400

C) $15,000

D) $52,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

51

Kelita Ltd, projects sales for its first three months of operation as follows: Inventory on 1st October is $40,000. Subsequent beginning inventories should be 40% of that month's cost of goods sold. Goods are priced at 140% of their cost. 50% of purchases are paid for in the month of purchase; the balance is paid in the following month. It is expected that 50% of credit sales will be collected in the month following sale, 30% in the second month following the sale, and the balance the third month. A 5% discount is given if payment is received in the month following sale.

What are the anticipated cash disbursements for October?

A) $120,000

B) $180,000

C) $140,000

D) $60,000

What are the anticipated cash disbursements for October?

A) $120,000

B) $180,000

C) $140,000

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

52

A formalised financial plan for organisational operations in the coming year is best described as a

A) Long-term strategy

B) Short-term operating plan

C) Budget

D) Decision right

A) Long-term strategy

B) Short-term operating plan

C) Budget

D) Decision right

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

53

Kelita Ltd, projects sales for its first three months of operation as follows: Inventory on 1st October is $40,000. Subsequent beginning inventories should be 40% of that month's cost of goods sold. Goods are priced at 140% of their cost. 50% of purchases are paid for in the month of purchase; the balance is paid in the following month. It is expected that 50% of credit sales will be collected in the month following sale, 30% in the second month following the sale, and the balance the third month. A 5% discount is given if payment is received in the month following sale.

What are the anticipated cash receipts for October?

A) $-0-

B) $40,000

C) $47,500

D) $66,500

What are the anticipated cash receipts for October?

A) $-0-

B) $40,000

C) $47,500

D) $66,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

54

The actual preparation of a budget usually begins with the

A) Production budget

B) Cash budget

C) Sales budget

D) Direct materials budget

A) Production budget

B) Cash budget

C) Sales budget

D) Direct materials budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

55

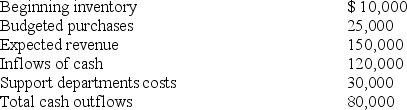

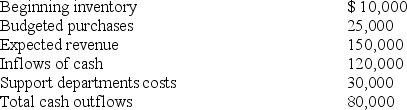

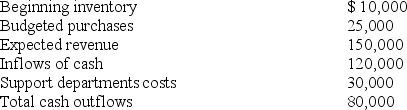

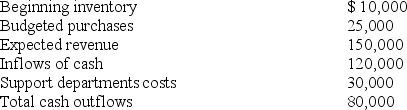

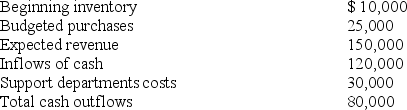

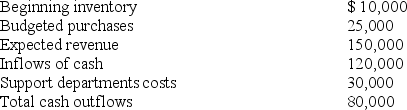

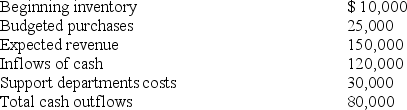

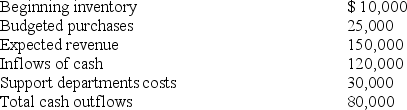

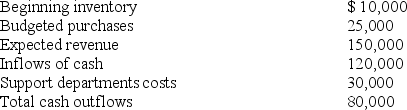

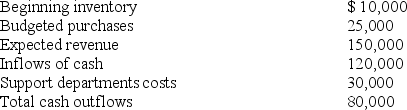

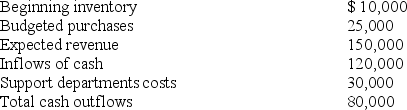

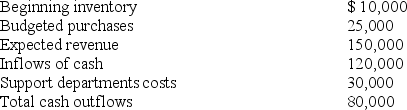

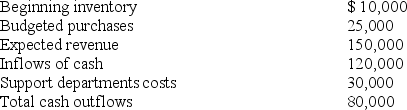

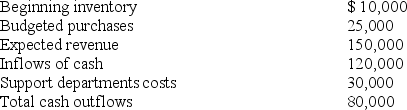

TFS Ltd, a retail company selling hotel furniture, has just completed its master budget for the next fiscal year. Ending inventory is budgeted at 20% of cost of goods available for sale. Selected data from that process appear in the table below:  Which of the following amounts is irrelevant in the preparation of TFS' budgeted income statement?

Which of the following amounts is irrelevant in the preparation of TFS' budgeted income statement?

A) Beginning inventory of $10,000

B) Expected revenue of $150,000

C) Expected inflows of cash of $120,000

D) Budgeted support department costs of $30,000

Which of the following amounts is irrelevant in the preparation of TFS' budgeted income statement?

Which of the following amounts is irrelevant in the preparation of TFS' budgeted income statement?A) Beginning inventory of $10,000

B) Expected revenue of $150,000

C) Expected inflows of cash of $120,000

D) Budgeted support department costs of $30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

56

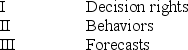

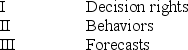

Budgets provide a mechanism for defining which of the following for individual managers?

A) I only

B) I and II only

C) I and III only

D) I, II, and III

A) I only

B) I and II only

C) I and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

57

Gold Company has the following balances at 31st December 2010: Cash $6,000; accounts receivable $34,000 ($10,000 from November and $24,000 from December); merchandise inventory $40,000; and accounts payable $20,000 (for merchandise purchases only). Budgeted sales follow:  Other data:

Other data:

· Sales are 40% cash, 50% collected during the following month, and 10% collected during the second month after sale. A 3% cash discount is given on cash sales

· Cost of goods sold is 40% of sales

· Ending inventory must be 140% of the next month's cost of sales

· Purchases are paid 70% in month of purchase and 30% in the following month

· The selling and administrative cost function is: $6,000 + $0.2 × sales. This includes $1,000 for depreciation

· All costs are paid in the month incurred

· Minimum cash balance requirement is $6,000

The cash disbursements for purchases in March are

A) $46,400

B) $32,480

C) $38,240

D) $48,720

Other data:

Other data:· Sales are 40% cash, 50% collected during the following month, and 10% collected during the second month after sale. A 3% cash discount is given on cash sales

· Cost of goods sold is 40% of sales

· Ending inventory must be 140% of the next month's cost of sales

· Purchases are paid 70% in month of purchase and 30% in the following month

· The selling and administrative cost function is: $6,000 + $0.2 × sales. This includes $1,000 for depreciation

· All costs are paid in the month incurred

· Minimum cash balance requirement is $6,000

The cash disbursements for purchases in March are

A) $46,400

B) $32,480

C) $38,240

D) $48,720

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

58

Gold Company has the following balances at 31st December 2010: Cash $6,000; accounts receivable $34,000 ($10,000 from November and $24,000 from December); merchandise inventory $40,000; and accounts payable $20,000 (for merchandise purchases only). Budgeted sales follow:  Other data:

Other data:

· Sales are 40% cash, 50% collected during the following month, and 10% collected during the second month after sale. A 3% cash discount is given on cash sales

· Cost of goods sold is 40% of sales

· Ending inventory must be 140% of the next month's cost of sales

· Purchases are paid 70% in month of purchase and 30% in the following month

· The selling and administrative cost function is: $6,000 + $0.2 × sales. This includes $1,000 for depreciation

· All costs are paid in the month incurred

· Minimum cash balance requirement is $6,000

Cash receipts for April will be

A) $38,800

B) $77,800

C) $100,000

D) $68,800

Other data:

Other data:· Sales are 40% cash, 50% collected during the following month, and 10% collected during the second month after sale. A 3% cash discount is given on cash sales

· Cost of goods sold is 40% of sales

· Ending inventory must be 140% of the next month's cost of sales

· Purchases are paid 70% in month of purchase and 30% in the following month

· The selling and administrative cost function is: $6,000 + $0.2 × sales. This includes $1,000 for depreciation

· All costs are paid in the month incurred

· Minimum cash balance requirement is $6,000

Cash receipts for April will be

A) $38,800

B) $77,800

C) $100,000

D) $68,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

59

TFS Ltd, a retail company selling hotel furniture, has just completed its master budget for the next fiscal year. Ending inventory is budgeted at 20% of cost of goods available for sale. Selected data from that process appear in the table below:  TFS' budgeted gross profit for the next fiscal year will be

TFS' budgeted gross profit for the next fiscal year will be

A) $136,000

B) $106,000

C) $125,000

D) $122,000

TFS' budgeted gross profit for the next fiscal year will be

TFS' budgeted gross profit for the next fiscal year will beA) $136,000

B) $106,000

C) $125,000

D) $122,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

60

TFS Ltd, a retail company selling hotel furniture, has just completed its master budget for the next fiscal year. Ending inventory is budgeted at 20% of cost of goods available for sale. Selected data from that process appear in the table below:  TFS' budgeted cost of goods sold for the next fiscal year will be

TFS' budgeted cost of goods sold for the next fiscal year will be

A) $25,000

B) $35,000

C) $21,000

D) $28,000

TFS' budgeted cost of goods sold for the next fiscal year will be

TFS' budgeted cost of goods sold for the next fiscal year will beA) $25,000

B) $35,000

C) $21,000

D) $28,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

61

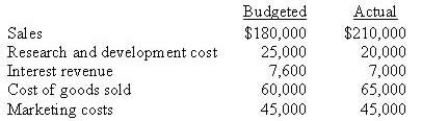

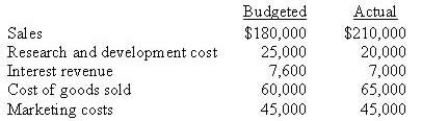

At the end of 2009, SWP prepared its master budget for 2010. Selected amounts from that budget, along with actual results for 2010, are presented below: Which items in the table have favorable variances?

A) Sales and marketing expense

B) Cost of goods sold and sales

C) Sales and research and development expense

D) Sales and interest revenue

A) Sales and marketing expense

B) Cost of goods sold and sales

C) Sales and research and development expense

D) Sales and interest revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

62

BNN Ltd expects to operate at a profit in its next fiscal year. Which statement about its budgeted income statement is true?

A) Operating expenses are expected to be greater than gross profit

B) Operating income is expected to be greater than net profit

C) Net profit is expected to be greater than operating income

D) Actual gross profit less operating expenses will equal expected net profit

A) Operating expenses are expected to be greater than gross profit

B) Operating income is expected to be greater than net profit

C) Net profit is expected to be greater than operating income

D) Actual gross profit less operating expenses will equal expected net profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

63

Uncontrollable external factors can create challenges in measuring the results for which managers should be held responsible. Which of the following is the best example of an uncontrollable external factor for a manager who oversees all of the operations for a business?

A) Production volumes were above normal levels so that overtime was paid to direct labor employees

B) Poor quality direct materials were purchased so more materials than usual were required in the manufacturing process

C) Raw materials prices changed because of a change in environmental laws.

D) Utilities costs were higher than normal even though weather and usage were typical for that time of year

A) Production volumes were above normal levels so that overtime was paid to direct labor employees

B) Poor quality direct materials were purchased so more materials than usual were required in the manufacturing process

C) Raw materials prices changed because of a change in environmental laws.

D) Utilities costs were higher than normal even though weather and usage were typical for that time of year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

64

On a budgeted income statement, the gross margin is determined by

A) Revenue + cost of goods sold

B) Cost of goods sold + operating costs

C) Revenue - operating costs

D) Revenue - cost of goods sold

A) Revenue + cost of goods sold

B) Cost of goods sold + operating costs

C) Revenue - operating costs

D) Revenue - cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

65

At the end of 2009, SWP prepared its master budget for 2010. Selected amounts from that budget, along with actual results for 2010, are presented below: The variance for cost of goods sold could be explained by

A) Actual sales being greater than the budget

B) Actual sales being less than the budget

C) Price discounts for purchasing in bulk

D) Decreases in raw material prices

A) Actual sales being greater than the budget

B) Actual sales being less than the budget

C) Price discounts for purchasing in bulk

D) Decreases in raw material prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

66

TFS Ltd, a retail company selling hotel furniture, has just completed its master budget for the next fiscal year. Ending inventory is budgeted at 20% of cost of goods available for sale. Selected data from that process appear in the table below:  TFS' budgeted profit before taxes for the next financial year will be

TFS' budgeted profit before taxes for the next financial year will be

A) $106,000

B) $40,000

C) $66,000

D) $92,000

TFS' budgeted profit before taxes for the next financial year will be

TFS' budgeted profit before taxes for the next financial year will beA) $106,000

B) $40,000

C) $66,000

D) $92,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

67

TFS Ltd, a retail company selling hotel furniture, has just completed its master budget for the next fiscal year. Ending inventory is budgeted at 20% of cost of goods available for sale. Selected data from that process appear in the table below:  TFS' actual profit for the next fiscal year will be

TFS' actual profit for the next fiscal year will be

A) Greater than the budgeted profit

B) Less than the budgeted profit

C) Equal to the budgeted profit

D) Undeterminable from the information given

TFS' actual profit for the next fiscal year will be

TFS' actual profit for the next fiscal year will beA) Greater than the budgeted profit

B) Less than the budgeted profit

C) Equal to the budgeted profit

D) Undeterminable from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

68

A budget that reflects a range of operations is called a

A) Standard budget

B) Activity-based budget

C) Flexible budget

D) Benchmark budget

A) Standard budget

B) Activity-based budget

C) Flexible budget

D) Benchmark budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

69

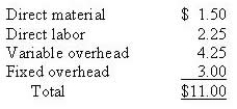

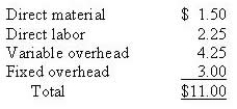

ATR's budgeted product costs for the third quarter of 2010 were based on an expected volume of 1,500 units. The budgeted unit costs appear below: If ATR had a budgeted volume of 2,000 units, the total budgeted product cost for the third quarter of 2010 would have been

A) $22,000

B) $16,000

C) $20,500

D) None of the above

A) $22,000

B) $16,000

C) $20,500

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is a simple version of a flexible budget?

A) A budgeted income statement

B) An activity-based costing analysis

C) A variance analysis

D) A cost-volume-profit analysis

A) A budgeted income statement

B) An activity-based costing analysis

C) A variance analysis

D) A cost-volume-profit analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

71

TFS Ltd, a retail company selling hotel furniture, has just completed its master budget for the next fiscal year. Ending inventory is budgeted at 20% of cost of goods available for sale. Selected data from that process appear in the table below:  Which of the following amounts will be subtracted from gross profit on TFS' budgeted income statement?

Which of the following amounts will be subtracted from gross profit on TFS' budgeted income statement?

A) $30,000

B) $80,000

C) $14,000

D) $110,000

Which of the following amounts will be subtracted from gross profit on TFS' budgeted income statement?

Which of the following amounts will be subtracted from gross profit on TFS' budgeted income statement?A) $30,000

B) $80,000

C) $14,000

D) $110,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

72

In 2010, OSW budgeted its sales volume at 10,000 units. Actual volume was 9,800 units. If OSW uses the static budget to calculate variances and assuming that inventory levels are insignificant, which of the following statements is true?

A) Profits will be less than expected

B) Budgeted variable costs will be overstated compared to actual variable costs

C) Profits will be more than expected due to favorable cost variances

D) Sales managers will not receive a bonus

A) Profits will be less than expected

B) Budgeted variable costs will be overstated compared to actual variable costs

C) Profits will be more than expected due to favorable cost variances

D) Sales managers will not receive a bonus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

73

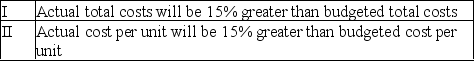

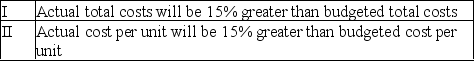

ATR's budgeted product costs for the third quarter of 2010 were based on an expected volume of 1,500 units. The budgeted unit costs appear below: If ATR's actual volume for the third quarter of 2010 was 15% above its expected volume

A) I

B) II

C) I and II

D) None of the above (neither I nor II)

A) I

B) II

C) I and II

D) None of the above (neither I nor II)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

74

At the end of 2009, SWP prepared its master budget for 2010. Selected amounts from that budget, along with actual results for 2010, are presented below: The research and development cost variance could be explained by

A) Starting too many projects

B) Cost increases due to new information technologies

C) Efficient cost management

D) Higher salaries

A) Starting too many projects

B) Cost increases due to new information technologies

C) Efficient cost management

D) Higher salaries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

75

At the end of 2009, SWP prepared its master budget for 2010. Selected amounts from that budget, along with actual results for 2010, are presented below: Which items in the table have unfavorable variances?

A) Marketing expense and cost of goods sold

B) Cost of goods sold and sales

C) Interest revenue and research and development expense

D) Interest revenue and cost of goods sold

A) Marketing expense and cost of goods sold

B) Cost of goods sold and sales

C) Interest revenue and research and development expense

D) Interest revenue and cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

76

At the end of 2009, SWP prepared its master budget for 2010. Selected amounts from that budget, along with actual results for 2010, are presented below:  SWP's total budget variance for the data provided is

SWP's total budget variance for the data provided is

A) $29,400 favorable

B) $29,400 unfavorable

C) $40,600 favorable

D) $40,600 unfavorable

SWP's total budget variance for the data provided is

SWP's total budget variance for the data provided isA) $29,400 favorable

B) $29,400 unfavorable

C) $40,600 favorable

D) $40,600 unfavorable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

77

TFS Ltd, a retail company selling hotel furniture, has just completed its master budget for the next fiscal year. Ending inventory is budgeted at 20% of cost of goods available for sale. Selected data from that process appear in the table below:  TFS' budgeted cost of goods available for sale for the next fiscal year will be

TFS' budgeted cost of goods available for sale for the next fiscal year will be

A) $10,000

B) $25,000

C) $15,000

D) $35,000

TFS' budgeted cost of goods available for sale for the next fiscal year will be

TFS' budgeted cost of goods available for sale for the next fiscal year will beA) $10,000

B) $25,000

C) $15,000

D) $35,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

78

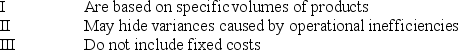

Static budgets

A) I and III only

B) II and III only

C) I and II only

D) I, II, and III

A) I and III only

B) II and III only

C) I and II only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is based on forecasts of specific volumes of products or services?

A) Variance analysis

B) Flexible budgets

C) Static budgets

D) Financial statements

A) Variance analysis

B) Flexible budgets

C) Static budgets

D) Financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck

80

ATR's budgeted product costs for the third quarter of 2010 were based on an expected volume of 1,500 units. The budgeted unit costs appear below:  ATR's total budgeted product cost for the third quarter of 2010 was

ATR's total budgeted product cost for the third quarter of 2010 was

A) $16,500

B) $12,000

C) $4,500

D) None of the above

ATR's total budgeted product cost for the third quarter of 2010 was

ATR's total budgeted product cost for the third quarter of 2010 wasA) $16,500

B) $12,000

C) $4,500

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 87 في هذه المجموعة.

فتح الحزمة

k this deck