Deck 8: Activity Analysis: Costing and Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/96

العب

ملء الشاشة (f)

Deck 8: Activity Analysis: Costing and Management

1

In an ABC system costs are first assigned to cost pools, then always to units of product.

False

2

Product advertising for a new product is an example of a customer-sustaining cost in an ABC system.

False

3

Accountants, on their own, normally can determine cost drivers for all cost pools without consulting other employees in the organisation.

False

4

Organisations interested in using activity-based management must first implement an activity-based costing system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

5

When applying ABC concepts to the determination of product costs, the first step is to identify activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

6

Activity-based costing, compared to traditional costing, decreases the accuracy of cost measurement by using arbitrary cost allocation bases for overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

7

Each cost pool in an ABC system has at least one cost driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

8

In an activity-based costing system, both organisation-sustaining and facility-sustaining activities are assumed to be unaffected by the number of customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

9

Activity-based management and activity-based costing are two ways of describing the same thing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

10

In an ABC system, a "cost object" could be a unit of product, a product line, or a customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

11

Generally speaking, activity-based costing traces direct costs more accurately than traditional costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

12

Unlike activity-based costing, traditional costing systems never use multiple cost pools for overhead allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

13

The terms "cost driver" and "allocation base" are interchangeable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

14

Administrative salaries are an example of an organisation-sustaining cost in an ABC system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

15

An activity is a type of task or function performed in an organisation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

16

Both activity-based costing and traditional costing allocate overhead costs to cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

17

All organisations that use activity-based costing also use activity-based management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

18

Ideally, activity costs in an ABC system are allocated to cost objects using a driver that explains changes in those costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

19

Each cost pool in an ABC system has its own cost allocation rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

20

Information about potential cost drivers may be requested from employees directly involved in activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

21

The costs of designing and implementing an ABC system include employee time and training.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

22

Le Pavilion is an historic hotel just outside of Melbourne. It is owned by Refined Hotels, which operates additional properties in Sydney, Brisbane and Perth. Le Pavilion has 9 floors, with approximately 20 rooms per floor. Facilities also include a workout room, restaurant, and pool. The hotel is organised in 5 departments: front desk, engineering, housekeeping, food & beverage, and customer relations. As part of its operation, Le Pavilion regularly incurs the following costs: General manager's salary

Housekeeping supplies

Utility costs

Depreciation on workout room equipment

Advertising

Food and beverage costs

Depreciation on restaurant equipment

If Le Pavilion is the cost object, which of the following best describes the general manager's salary?

A) Batch-level cost

B) Customer-sustaining cost

C) Facility-sustaining cost

D) Organisation-sustaining cost

Housekeeping supplies

Utility costs

Depreciation on workout room equipment

Advertising

Food and beverage costs

Depreciation on restaurant equipment

If Le Pavilion is the cost object, which of the following best describes the general manager's salary?

A) Batch-level cost

B) Customer-sustaining cost

C) Facility-sustaining cost

D) Organisation-sustaining cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

23

ABC systems are similar to traditional costing systems in the way they

A) Allocate direct costs to cost objects

B) Define cost allocation bases

C) Trace direct costs to cost objects

D) Trace indirect costs to activities

A) Allocate direct costs to cost objects

B) Define cost allocation bases

C) Trace direct costs to cost objects

D) Trace indirect costs to activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

24

Cost accounting systems were originally developed to

A) Assign costs to products for financial reporting purposes

B) Assign costs to products for tax reporting purposes

C) Give managers better information for making decisions

D) Allocate direct costs to cost objects

A) Assign costs to products for financial reporting purposes

B) Assign costs to products for tax reporting purposes

C) Give managers better information for making decisions

D) Allocate direct costs to cost objects

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

25

ABC systems differ from traditional systems in that ABC systems

A) Trace direct costs to cost objects

B) Use multiple cost pools and cost drivers to allocate direct costs

C) Use multiple cost pools and cost drivers to allocate overhead costs

D) Assign costs only to units of product

A) Trace direct costs to cost objects

B) Use multiple cost pools and cost drivers to allocate direct costs

C) Use multiple cost pools and cost drivers to allocate overhead costs

D) Assign costs only to units of product

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

26

Activity-based management can be used to manage both quality and constrained resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

27

ABC systems differ from traditional costing systems because ABC systems use

A) Multiple activity cost pools and cost drivers to allocate overhead costs

B) More automation and information technology to allocate overhead costs

C) Less automation and information technology to allocate overhead costs

D) a and b

A) Multiple activity cost pools and cost drivers to allocate overhead costs

B) More automation and information technology to allocate overhead costs

C) Less automation and information technology to allocate overhead costs

D) a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

28

Le Pavilion is a historic hotel just outside of Melbourne. It is owned by Refined Hotels, which operates additional properties in Sydney, Brisbane and Perth. Le Pavilion has 9 floors, with approximately 20 rooms per floor. Facilities also include a workout room, restaurant, and pool. The hotel is organised in 5 departments: front desk, engineering, housekeeping, food & beverage, and customer relations. As part of its operation, Le Pavilion regularly incurs the following costs: General manager's salary

Housekeeping supplies

Utility costs

Depreciation on workout room equipment

Advertising

Food and beverage costs

Depreciation on restaurant equipment

From the perspective of Refined Hotels, advertising specifically for Le Pavilion is best described as a(n)

A) Unit-level cost

B) Customer-sustaining cost

C) Product-sustaining cost

D) Batch-level cost

Housekeeping supplies

Utility costs

Depreciation on workout room equipment

Advertising

Food and beverage costs

Depreciation on restaurant equipment

From the perspective of Refined Hotels, advertising specifically for Le Pavilion is best described as a(n)

A) Unit-level cost

B) Customer-sustaining cost

C) Product-sustaining cost

D) Batch-level cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

29

ABC systems measure resource flows in an organisation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

30

The availability of activity costs is inversely related to the cost of implementing an ABC system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

31

How are direct and overhead costs assigned to cost objects under traditional accounting systems?

A) A

B) B

C) C

D) D

A) A

B) B

C) C

D) D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

32

ABC systems allow managers to focus on measurement at the activity level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

33

Le Pavilion is a historic hotel just outside of Melbourne. It is owned by Refined Hotels, which operates additional properties in Sydney, Brisbane and Perth. Le Pavilion has 9 floors, with approximately 20 rooms per floor. Facilities also include a workout room, restaurant, and pool. The hotel is organised in 5 departments: front desk, engineering, housekeeping, food & beverage, and customer relations. As part of its operation, Le Pavilion regularly incurs the following costs: General manager's salary

Housekeeping supplies

Utility costs

Depreciation on workout room equipment

Advertising

Food and beverage costs

Depreciation on restaurant equipment

Which cost listed above is most likely to be a customer-sustaining cost?

A) Depreciation on workout room equipment

B) Utility costs

C) Housekeeping supplies

D) General manager's salary

Housekeeping supplies

Utility costs

Depreciation on workout room equipment

Advertising

Food and beverage costs

Depreciation on restaurant equipment

Which cost listed above is most likely to be a customer-sustaining cost?

A) Depreciation on workout room equipment

B) Utility costs

C) Housekeeping supplies

D) General manager's salary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

34

Managers can use activity-based management to control environmental costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which statement about costing systems is true?

A) Both traditional and activity-based costing systems use a two-stage allocation process

B) Traditional costing systems use a two-stage allocation process, but ABC systems require three stages

C) ABC systems typically use a two-stage allocation process, whereas traditional systems use a single stage

D) Both traditional and activity-based costing systems use a three-stage allocation process

A) Both traditional and activity-based costing systems use a two-stage allocation process

B) Traditional costing systems use a two-stage allocation process, but ABC systems require three stages

C) ABC systems typically use a two-stage allocation process, whereas traditional systems use a single stage

D) Both traditional and activity-based costing systems use a three-stage allocation process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

36

Compared to a traditional costing system, an activity-based costing system usually involves

A) Fewer cost pools

B) More cost pools

C) bigger cost pools

D) b and c

A) Fewer cost pools

B) More cost pools

C) bigger cost pools

D) b and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

37

Le Pavilion is a historic hotel just outside of Melbourne. It is owned by Refined Hotels, which operates additional properties in Sydney, Brisbane and Perth. Le Pavilion has 9 floors, with approximately 20 rooms per floor. Facilities also include a workout room, restaurant, and pool. The hotel is organised in 5 departments: front desk, engineering, housekeeping, food & beverage, and customer relations. As part of its operation, Le Pavilion regularly incurs the following costs: General manager's salary

Housekeeping supplies

Utility costs

Depreciation on workout room equipment

Advertising

Food and beverage costs

Depreciation on restaurant equipment

Le Pavilion could define its cost objects as

I Customers only

II Departments only

III Number of employees

A) I only

B) I and II only

C) II only

D) I, II, and III

Housekeeping supplies

Utility costs

Depreciation on workout room equipment

Advertising

Food and beverage costs

Depreciation on restaurant equipment

Le Pavilion could define its cost objects as

I Customers only

II Departments only

III Number of employees

A) I only

B) I and II only

C) II only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

38

Le Pavilion is a historic hotel just outside of Melbourne. It is owned by Refined Hotels, which operates additional properties in Sydney, Brisbane and Perth. Le Pavilion has 9 floors, with approximately 20 rooms per floor. Facilities also include a workout room, restaurant, and pool. The hotel is organised in 5 departments: front desk, engineering, housekeeping, food & beverage, and customer relations. As part of its operation, Le Pavilion regularly incurs the following costs: General manager's salary

Housekeeping supplies

Utility costs

Depreciation on workout room equipment

Advertising

Food and beverage costs

Depreciation on restaurant equipment

Advertising for the Refined Hotels chain is best described as a(n)

A) Facility-sustaining cost

B) Organisation-sustaining cost

C) Product-sustaining cost

D) Batch-level cost

Housekeeping supplies

Utility costs

Depreciation on workout room equipment

Advertising

Food and beverage costs

Depreciation on restaurant equipment

Advertising for the Refined Hotels chain is best described as a(n)

A) Facility-sustaining cost

B) Organisation-sustaining cost

C) Product-sustaining cost

D) Batch-level cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

39

APL Ltd allocates overhead to cost objects using a two-stage process. From this information, we can infer that APL

A) Uses a traditional costing system

B) Uses an activity-based costing system

C) May be using either a traditional or an activity-based costing system

D) Is reporting its product costs accurately

A) Uses a traditional costing system

B) Uses an activity-based costing system

C) May be using either a traditional or an activity-based costing system

D) Is reporting its product costs accurately

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

40

One of the uncertainties associated with ABC and ABM systems is employee response to design and implementation of the system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

41

The salary of the manager of a plant producing a number of products, within a multinational organisation is

A) an organisational-sustaining cost

B) a facility-sustaining cost

C) a customer-sustaining cost

D) a product-sustaining cost

A) an organisational-sustaining cost

B) a facility-sustaining cost

C) a customer-sustaining cost

D) a product-sustaining cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

42

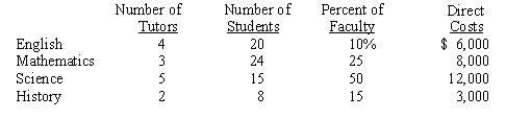

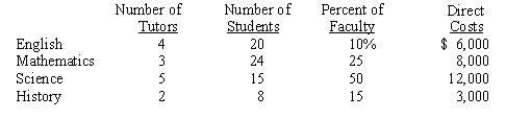

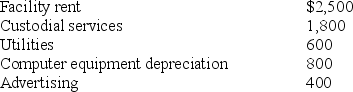

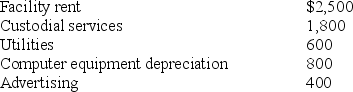

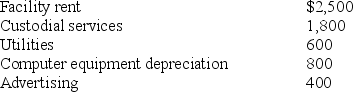

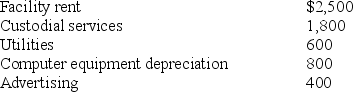

Tutors-R-Us provides academic enrichment and review activities for high school students in 4 subject areas: English, mathematics, science, and history. In November 2010, the firm's information system produced the following data: Regardless of subject area, clients pay $50 per hour for tutoring services. Costs associated with the Tutors-R-Us operations for November 2010 included:

Which of the following is the most logical allocation base for facility rent if the relevant cost object is a subject area (product line)?

Which of the following is the most logical allocation base for facility rent if the relevant cost object is a subject area (product line)?

A) Number of tutors

B) Direct costs

C) Percentage of square metres occupied

D) Direct labor hours

Which of the following is the most logical allocation base for facility rent if the relevant cost object is a subject area (product line)?

Which of the following is the most logical allocation base for facility rent if the relevant cost object is a subject area (product line)?A) Number of tutors

B) Direct costs

C) Percentage of square metres occupied

D) Direct labor hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

43

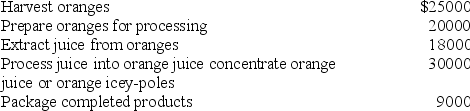

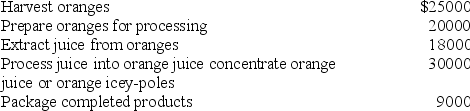

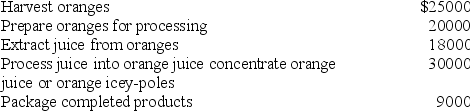

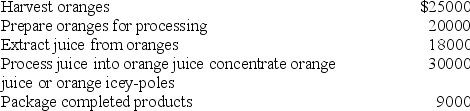

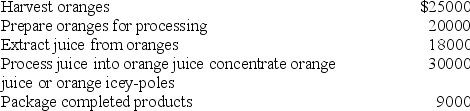

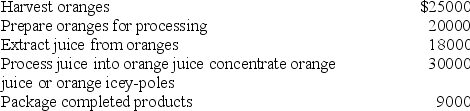

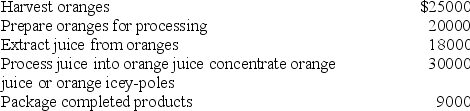

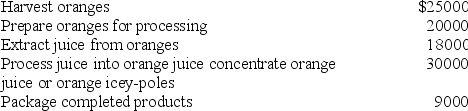

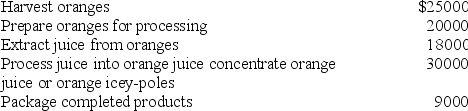

The FSOJ Company undertakes the following activities in its production operation and incurred the following costs during the first half of 2010:  Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.

Which of the following activities is likely to be classified as product-level?

A) Packaging

B) Harvesting

C) Extracting

D) Prepare oranges for processing

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.

Which of the following activities is likely to be classified as product-level?

A) Packaging

B) Harvesting

C) Extracting

D) Prepare oranges for processing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the steps listed below normally occurs first when assigning costs in an ABC system?

A) Assign costs to activity-based pools

B) Allocate activity costs to each cost object

C) Identify activities

D) Identify the relevant cost object

A) Assign costs to activity-based pools

B) Allocate activity costs to each cost object

C) Identify activities

D) Identify the relevant cost object

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following is not part of the process used to assign costs in an ABC system?

A) Identify activities

B) Differentiate value-adding and non-value-adding activities

C) Identify the relevant cost object

D) Assign costs to activity-based pools

A) Identify activities

B) Differentiate value-adding and non-value-adding activities

C) Identify the relevant cost object

D) Assign costs to activity-based pools

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

46

In an ABC system, a cost driver must be chosen for each

A) Activity

B) Cost pool

C) Cost object

D) Unit-level activity

A) Activity

B) Cost pool

C) Cost object

D) Unit-level activity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

47

The FSOJ Company undertakes the following activities in its production operation and incurred the following costs during the first half of 2010:  Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.

Preparing oranges for processing involves peeling and removing seeds. The best cost driver for the cost of preparing oranges for processing would be

A) Square metres occupied by the preparation equipment

B) Percent of oranges harvested for each product line

C) Direct labor hours

D) Total direct costs

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.

Preparing oranges for processing involves peeling and removing seeds. The best cost driver for the cost of preparing oranges for processing would be

A) Square metres occupied by the preparation equipment

B) Percent of oranges harvested for each product line

C) Direct labor hours

D) Total direct costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which category of the ABC hierarchy has costs that are primarily fixed and activities with little or no cause-and-effect relationship with costs?

A) Unit-level

B) Batch-level

C) Organisation-sustaining

D) Product-sustaining

A) Unit-level

B) Batch-level

C) Organisation-sustaining

D) Product-sustaining

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

49

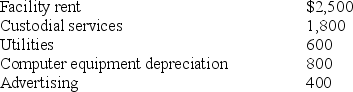

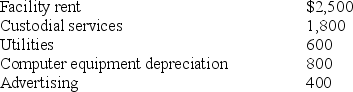

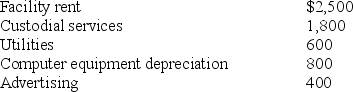

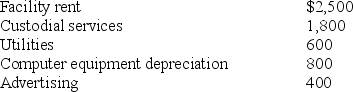

Tutors-R-Us provides academic enrichment and review activities for high school students in 4 subject areas: English, mathematics, science, and history. In November 2010, the firm's information system produced the following data: Regardless of subject area, clients pay $50 per hour for tutoring services. Costs associated with the Tutors-R-Us operations for November 2010 included:

If the number of tutors in each area is the cost driver for custodial services, the total custodial services cost allocated to history would be:

If the number of tutors in each area is the cost driver for custodial services, the total custodial services cost allocated to history would be:

A) $450

B) $270

C) $257

D) None of the above

If the number of tutors in each area is the cost driver for custodial services, the total custodial services cost allocated to history would be:

If the number of tutors in each area is the cost driver for custodial services, the total custodial services cost allocated to history would be:A) $450

B) $270

C) $257

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

50

Tutors-R-Us provides academic enrichment and review activities for high school students in 4 subject areas: English, mathematics, science, and history. In November 2010, the firm's information system produced the following data: Regardless of subject area, clients pay $50 per hour for tutoring services. Costs associated with the Tutors-R-Us operations for November 2010 included:

Which of these groups of costs are most likely to have a common cost driver?

Which of these groups of costs are most likely to have a common cost driver?

A) Advertising & computer equipment depreciation

B) Computer equipment depreciation & utilities

C) Utilities & custodial services

D) Utilities & advertising

Which of these groups of costs are most likely to have a common cost driver?

Which of these groups of costs are most likely to have a common cost driver?A) Advertising & computer equipment depreciation

B) Computer equipment depreciation & utilities

C) Utilities & custodial services

D) Utilities & advertising

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

51

The FSOJ Company undertakes the following activities in its production operation and incurred the following costs during the first half of 2010:  Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month. During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month. During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.

Which of the preceding costs would most likely have "number of setups" as its cost driver?

A) Harvest oranges

B) Package completed products

C) Process juice

D) Extract juice

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month. During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month. During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.Which of the preceding costs would most likely have "number of setups" as its cost driver?

A) Harvest oranges

B) Package completed products

C) Process juice

D) Extract juice

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

52

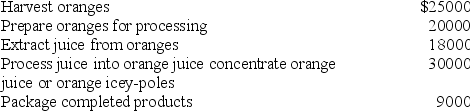

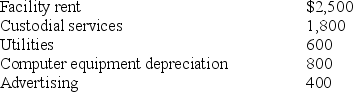

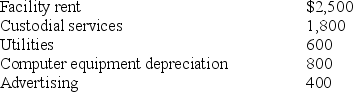

Tutors-R-Us provides academic enrichment and review activities for high school students in 4 subject areas: English, mathematics, science, and history. In November 2010, the firm's information system produced the following data  Regardless of subject area, clients pay $50 per hour for tutoring services. Costs associated with the Tutors-R-Us operations for November 2010 included: Facility rent $2,500

Regardless of subject area, clients pay $50 per hour for tutoring services. Costs associated with the Tutors-R-Us operations for November 2010 included: Facility rent $2,500

Custodial services 1,800

Utilities 600

Computer equipment depreciation 800

Advertising 400

Which of the following could be a cost object for Tutors-R-Us?

I A student

II A subject area

III A cost pool

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

Regardless of subject area, clients pay $50 per hour for tutoring services. Costs associated with the Tutors-R-Us operations for November 2010 included: Facility rent $2,500

Regardless of subject area, clients pay $50 per hour for tutoring services. Costs associated with the Tutors-R-Us operations for November 2010 included: Facility rent $2,500Custodial services 1,800

Utilities 600

Computer equipment depreciation 800

Advertising 400

Which of the following could be a cost object for Tutors-R-Us?

I A student

II A subject area

III A cost pool

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

53

Managers are most likely to identify activities in an ABC system by

A) Examining the financial statements

B) Forecasting market demand using the high-low method

C) Consulting employees

D) Tracking general ledger account balances

A) Examining the financial statements

B) Forecasting market demand using the high-low method

C) Consulting employees

D) Tracking general ledger account balances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

54

Tutors-R-Us provides academic enrichment and review activities for high school students in 4 subject areas: English, mathematics, science, and history. In November 2010, the firm's information system produced the following data: Regardless of subject area, clients pay $50 per hour for tutoring services. Costs associated with the Tutors-R-Us operations for November 2010 included:

The number of students in each area is most likely to be a cost driver for

The number of students in each area is most likely to be a cost driver for

A) Utility costs

B) Advertising costs

C) Cost for tutors

D) Price charged for tutoring

The number of students in each area is most likely to be a cost driver for

The number of students in each area is most likely to be a cost driver forA) Utility costs

B) Advertising costs

C) Cost for tutors

D) Price charged for tutoring

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

55

In an ABC system, an activity is best defined as a

A) Type of task performed in an organisation

B) Collection of activities in a particular department

C) Collection of cost drivers associated with a particular cost pool

D) Group of cost pools associated with a particular department

A) Type of task performed in an organisation

B) Collection of activities in a particular department

C) Collection of cost drivers associated with a particular cost pool

D) Group of cost pools associated with a particular department

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

56

At least one cost driver is required for each ABC cost

A) Activity

B) Pool

C) Object

D) Product line

A) Activity

B) Pool

C) Object

D) Product line

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

57

Ideally, activity costs are allocated to cost objects using a ______ that explains changes in activity ______.

A) Pool, Cost

B) Pool, Driver

C) Driver, Cost

D) Driver, Pools

A) Pool, Cost

B) Pool, Driver

C) Driver, Cost

D) Driver, Pools

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

58

Tutors-R-Us provides academic enrichment and review activities for high school students in 4 subject areas: English, mathematics, science, and history. In November 2010, the firm's information system produced the following data: Regardless of subject area, clients pay $50 per hour for tutoring services. Costs associated with the Tutors-R-Us operations for November 2010 included:

Assume Tutors-R-Us allocates facility rent, custodial services, and utilities on the basis of square metres occupied and computer equipment depreciation on the basis of number of students. Advertising is not allocated. If students received 200 hours of mathematics tutoring in November 2010, what will the total profit from mathematics tutoring be for the same period?

Assume Tutors-R-Us allocates facility rent, custodial services, and utilities on the basis of square metres occupied and computer equipment depreciation on the basis of number of students. Advertising is not allocated. If students received 200 hours of mathematics tutoring in November 2010, what will the total profit from mathematics tutoring be for the same period?

A) $10,000

B) $8,775

C) $8,488

D) $488

Assume Tutors-R-Us allocates facility rent, custodial services, and utilities on the basis of square metres occupied and computer equipment depreciation on the basis of number of students. Advertising is not allocated. If students received 200 hours of mathematics tutoring in November 2010, what will the total profit from mathematics tutoring be for the same period?

Assume Tutors-R-Us allocates facility rent, custodial services, and utilities on the basis of square metres occupied and computer equipment depreciation on the basis of number of students. Advertising is not allocated. If students received 200 hours of mathematics tutoring in November 2010, what will the total profit from mathematics tutoring be for the same period?A) $10,000

B) $8,775

C) $8,488

D) $488

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

59

The FSOJ Company undertakes the following activities in its production operation and incurred the following costs during the first half of 2010:  Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.

Assume processing costs are allocated on the basis of number of machine setups. How much processing cost will be allocated to each product line?

A) $5,000 to each product line

B) $7,500 each to orange juice concentrate and orange icey-poles, and $15,000 to orange juice

C) $10,000 to each product line

D) None of the above

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.

Assume processing costs are allocated on the basis of number of machine setups. How much processing cost will be allocated to each product line?

A) $5,000 to each product line

B) $7,500 each to orange juice concentrate and orange icey-poles, and $15,000 to orange juice

C) $10,000 to each product line

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

60

The FSOJ Company undertakes the following activities in its production operation and incurred the following costs during the first half of 2010:  Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.If juice extraction costs are allocated to product lines based on relative sales values, that is, each product line's portion of total sales, the amount allocated to icey-poles will be

A) $900

B) $5,400

C) $4,500

D) None of the above

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.

Processing the juice into 3 final products involves the use of 2 machines, each of which incurred depreciation costs of $15,000 for the first half of 2010. Each product requires a different set up on the processing machines, so FSOJ normally sets up the machines to produce concentrate for the first week of each month. The machine is then set up to produce orange juice for the next 2 weeks. Finally, workers set up the same machines to produce orange icey-poles during the last week of each month.During the first half of 2010, 20% of the oranges harvested were turned into orange juice concentrate, 50% were processed into orange juice, and 30% became orange icey-poles. The relative sales values of each product were: 75% for orange juice, 20% for orange juice concentrate, and 5% for icey-poles. The orange juice concentrate operation takes up 40% of FSOJ's total factory space. Regular orange juice and orange icey-poles occupy 35% and 25%, respectively.If juice extraction costs are allocated to product lines based on relative sales values, that is, each product line's portion of total sales, the amount allocated to icey-poles will be

A) $900

B) $5,400

C) $4,500

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

61

The process of using ABC information to evaluate the costs and benefits of production and internal support activities is called

A) Activity-based management

B) Activity-based budgeting

C) Activity-based costing

D) Activity-based consulting

A) Activity-based management

B) Activity-based budgeting

C) Activity-based costing

D) Activity-based consulting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

62

Lookin' for a Home is an animal shelter in Parramatta, New South Wales. The shelter relies on government grants and private donations for funding. It takes in homeless dogs and cats and keeps them until they are adopted by qualified individuals. One of the shelter's cost pools is animal recordkeeping, which involves maintaining a database with details about each animal in the shelter. Which of the following is the most appropriate cost driver for the animal recordkeeping cost pool?

A) Number of government grants sought

B) Number of employees who work in the shelter

C) Number of animal intake and adoption transactions

D) Square feet allocated to the recordkeeping operation

A) Number of government grants sought

B) Number of employees who work in the shelter

C) Number of animal intake and adoption transactions

D) Square feet allocated to the recordkeeping operation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

63

BVH manufactures and sells mobile phones. Which of the following activities is least likely to be considered a value-added activity for BVH?

A) Repairing phones

B) Offering phones for sale in designer colors

C) Making phones smaller

D) Creating several ring-tone options for mobile phones

A) Repairing phones

B) Offering phones for sale in designer colors

C) Making phones smaller

D) Creating several ring-tone options for mobile phones

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

64

Cost drivers are most likely to be identified using information

A) From the financial statements

B) Elicited from customers

C) Elicited from employees involved in related activities

D) From textbooks

A) From the financial statements

B) Elicited from customers

C) Elicited from employees involved in related activities

D) From textbooks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

65

Activity-based management relies on

A) Accurate ABC information

B) Objective financial reporting

C) Outside consultants

D) Participative management techniques

A) Accurate ABC information

B) Objective financial reporting

C) Outside consultants

D) Participative management techniques

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of these is not a benefit of Activity Based Costing?

A) Increased awareness of cause and effect relationships

B) Identification of non-value-added activities

C) Modifications to the accounting system

D) All of the above are benefits. i.e. none of the items is not a benefit

A) Increased awareness of cause and effect relationships

B) Identification of non-value-added activities

C) Modifications to the accounting system

D) All of the above are benefits. i.e. none of the items is not a benefit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

67

Value-added activities

A) Increase revenues

B) Increase the worth of an organisation's goods and services to customers

C) Increase the worth of an organisation's goods and services to shareholders

D) Increase costs that are unrelated to customers

A) Increase revenues

B) Increase the worth of an organisation's goods and services to customers

C) Increase the worth of an organisation's goods and services to shareholders

D) Increase costs that are unrelated to customers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

68

Costs associated with developing an ABC system most likely include

A) Reduced profits

B) Loss of market share

C) Employee time and consulting fees

D) Increased overhead costs

A) Reduced profits

B) Loss of market share

C) Employee time and consulting fees

D) Increased overhead costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

69

Phuong is a customer of PVL Ltd. She consistently orders low-margin products, but requires costly services from PVL. In employing ABM techniques to manage customer profitability, PVL's staff should

A) Make no changes in service to Phuong

B) Develop creative approaches to managing Phuong as a customer

C) Require Phuong to pay for all orders in cash

D) Classify Phuong as a value-added customer and increase the amount of services provided to her

A) Make no changes in service to Phuong

B) Develop creative approaches to managing Phuong as a customer

C) Require Phuong to pay for all orders in cash

D) Classify Phuong as a value-added customer and increase the amount of services provided to her

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

70

The managers of HRY are analysing some of their corporate costs to determine the costs of each department's use of administrative services. The accountant wants to allocate the costs of payroll processing using an activity-based costing system. The most appropriate cost driver for the payroll processing cost pool is the

A) Number of pay periods per month

B) Number of employees

C) Average hourly wage for all employees

D) Maximum number of deductions from an individual employee's pay-cheque

A) Number of pay periods per month

B) Number of employees

C) Average hourly wage for all employees

D) Maximum number of deductions from an individual employee's pay-cheque

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

71

A cost driver is

A) A measure of activity that causes costs to fluctuate

B) Only used in ABC systems

C) Seldom related to cost changes in an ABC system

D) Usually related to cost changes in a traditional costing system

A) A measure of activity that causes costs to fluctuate

B) Only used in ABC systems

C) Seldom related to cost changes in an ABC system

D) Usually related to cost changes in a traditional costing system

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

72

MNK is a large public company that employs numerous accounts receivable clerks. Their jobs involve processing invoices and keeping the accounting records updated. Which of the following is the most likely cost driver for the accounts receivable activity cost pool?

A) Number of journal entries

B) Number of product lines produced by MNK

C) Number of invoices

D) Average dollar amount for each credit sale

A) Number of journal entries

B) Number of product lines produced by MNK

C) Number of invoices

D) Average dollar amount for each credit sale

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

73

The best allocation base choice for an ABC cost pool is a(n)

A) Cost driver

B) Activity dictionary

C) Allocation rate

D) Financial measure

A) Cost driver

B) Activity dictionary

C) Allocation rate

D) Financial measure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

74

Activity-based costing information can be used to identify the relative cost of maintaining different customers. Managers can use that information, coupled with activity-based management techniques, to manage

A) Customer quality

B) Customer profitability

C) Inventory levels

D) Staffing levels in the marketing department.

A) Customer quality

B) Customer profitability

C) Inventory levels

D) Staffing levels in the marketing department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

75

How can ABC information be used to manage constrained resources?

A) ABC information cannot be used to manage constrained resources

B) ABC information can help managers identify the best way to relax constraints

C) ABC information can help managers decrease the rate at which products get through the manufacturing process

D) ABC information can help managers justify price increases due to constrained resources

A) ABC information cannot be used to manage constrained resources

B) ABC information can help managers identify the best way to relax constraints

C) ABC information can help managers decrease the rate at which products get through the manufacturing process

D) ABC information can help managers justify price increases due to constrained resources

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

76

When implementing an ABC system, the accounting information system may require modifications to

A) Include fewer ledger accounts

B) Include only costs from the most recent periods

C) Gather and report activity and cost driver information

D) Do all of the above

A) Include fewer ledger accounts

B) Include only costs from the most recent periods

C) Gather and report activity and cost driver information

D) Do all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

77

An allocation base is

A) Normally related to cost changes in a traditional costing system

B) A measure of activity that causes costs to fluctuate

C) Seldom related to cost changes in an ABC system

D) Often used incorrectly as a synonym for "cost driver"

A) Normally related to cost changes in a traditional costing system

B) A measure of activity that causes costs to fluctuate

C) Seldom related to cost changes in an ABC system

D) Often used incorrectly as a synonym for "cost driver"

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

78

FNG employs 4 purchasing agents. Rick processes purchase orders for vendors starting with the letters A through H, while Merrill does the same task for vendors from I through N. Phillip deals with vendors in the O through R range, and Kathy handles the rest of the alphabet. The most likely cost driver for the purchasing agents' salaries is the

A) Number of vendors within each alphabetical segment

B) Number of purchase orders processed each month

C) Average dollar amount of each purchase order

D) Number of product lines FNG produces

A) Number of vendors within each alphabetical segment

B) Number of purchase orders processed each month

C) Average dollar amount of each purchase order

D) Number of product lines FNG produces

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following statements is true?

A) Cost drivers are a special kind of allocation base

B) Allocation bases are a special kind of cost driver

C) Cost drivers and allocation bases are two names for the same thing

D) Allocation bases are seldom used in traditional costing systems

A) Cost drivers are a special kind of allocation base

B) Allocation bases are a special kind of cost driver

C) Cost drivers and allocation bases are two names for the same thing

D) Allocation bases are seldom used in traditional costing systems

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is not a benefit of an ABC system?

A) Helping managers focus on measurement at the activity level

B) Increasing bonuses for managers

C) Improving accuracy in cost measurement

D) Motivating employees to find ways to improve performance

A) Helping managers focus on measurement at the activity level

B) Increasing bonuses for managers

C) Improving accuracy in cost measurement

D) Motivating employees to find ways to improve performance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck