Deck 2: Job Order Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/195

العب

ملء الشاشة (f)

Deck 2: Job Order Costing

1

The materials requisition serves as the source document for debiting the accounts in the materials ledger.

False

2

A job order cost system would be appropriate for a crude oil refining business.

False

3

Depreciation expense on factory equipment is part of factory overhead cost.

True

4

A job order cost accounting system provides for a separate record of the cost of each particular quantity of product that passes through the factory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

5

A process cost accounting system is best used by manufacturers of like units of product that are not distinguishable from each other during a continuous production process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

6

If factory overhead applied exceeds the actual costs, overhead is said to be under applied.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

7

If factory overhead applied exceeds the actual costs, the factory overhead account will have a credit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

8

Materials are transferred from the storeroom to the factory in response to materials requisitions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

9

The process cost system is appropriate where few products are manufactured and each product is made to customers' specifications.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

10

Each account in the work in process subsidiary ledger in a job order costing system is called a job cost sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

11

If the under applied factory overhead amount is immaterial, it is transferred to Cost of Goods Sold at the end of the fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

12

Perpetual inventory controlling accounts and subsidiary ledgers are maintained for materials, work in process, and finished goods in job order costing systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

13

The document that serves as the basis for recording direct labor on a job cost sheet is the time ticket.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

14

Cost accounting systems measure, record, and report product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

15

A process cost accounting system provides product costs for each of the departments or processes within the factory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

16

A process cost accounting system provides for a separate record of the cost of each particular quantity of product that passes through the factory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

17

When the goods are sold, their costs are transferred from Work in Process to Finished Goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

18

The document that serves as the basis for recording direct labor on a job cost sheet is the clock card.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

19

Factory overhead is applied to production using a predetermined overhead rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

20

A manufacturer may employ a job order cost system for some of its products and a process cost system for others.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

21

In a factory with several processing departments, a single factory overhead rate may not provide accurate product costs and effective cost control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

22

Direct labor cost is an example of a period cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

23

Nonmanufacturing costs are generally classified into two categories: selling and administrative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

24

Information about costs developed through a job order cost system cannot be used to evaluate an organization's cost performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

25

Job order cost accounting systems may be used for planning and controlling a service business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

26

Job order cost accounting systems may be used to evaluate a company's efficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

27

On the balance sheet for a manufacturing business, the cost of direct materials, direct labor, and factory overhead, which have entered into the manufacturing process but are associated with products that have not been finished, is reported as direct materials inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

28

The debit to factory overhead for the cost of indirect materials is obtained from the summary of the materials requisitions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

29

In the job order costing system, the finished goods account is the controlling account for the factory overhead ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

30

The current year's advertising costs are normally considered period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

31

As product costs are incurred in the manufacturing process, they are accounted for as assets and reported on the balance sheet as inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

32

Activity-based costing is a method of accumulating and allocating costs by department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

33

Generally accepted accounting principles require companies to use only one factory overhead rate for product costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

34

Interim financial statements for a manufacturing business would report over applied factory overhead as a deferred item on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

35

Period costs are costs that are incurred for the production requirements of a certain period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

36

A manufacturing business reports just two types of inventory on its balance sheet: work in process inventory and finished goods inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

37

A receiving report is prepared when purchased materials are first received by the manufacturing department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

38

The inventory accounts generally maintained by a manufacturing firm are only finished goods and materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

39

Job order cost systems can be used to compare unit costs of similar jobs to determine if costs are staying within expected ranges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

40

Job cost sheets can provide information to managers on unit cost trends, the cost impact of continuous improvement in the manufacturing process, the cost impact of materials changes, and the cost impact of direct materials price or direct labor rate changes over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following systems provides for a separate record of the cost of each particular quantity of product that passes through the factory?

A)job order cost system

B)general cost system

C)replacement cost system

D)process cost system

A)job order cost system

B)general cost system

C)replacement cost system

D)process cost system

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

42

A service organization will not use the job order costing method because it has no direct materials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

43

For which of the following businesses would the job order cost system be appropriate?

A)canned soup processor

B)oil refinery

C)lumber mill

D)hospital

A)canned soup processor

B)oil refinery

C)lumber mill

D)hospital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following costs are not included in finished goods inventory?

A)direct labor

B)factory overhead

C)chief financial officer's salary

D)direct materials

A)direct labor

B)factory overhead

C)chief financial officer's salary

D)direct materials

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following products would be manufactured using a job order costing system?

A)a cell phone

B)a highlighter pen

C)a graduation invitation

D)a recliner

A)a cell phone

B)a highlighter pen

C)a graduation invitation

D)a recliner

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

46

For which of the following businesses would the process cost system be appropriate?

A)a custom cabinet maker

B)a landscaper

C)a paper mill

D)a catering firm

A)a custom cabinet maker

B)a landscaper

C)a paper mill

D)a catering firm

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following is the correct flow of manufacturing costs?

A)raw materials, work in process, finished goods, cost of goods sold

B)raw materials, finished goods, cost of goods sold, work in process

C)work in process, finished goods, raw materials, cost of goods sold

D)cost of goods sold, raw materials, work in process, finished goods

A)raw materials, work in process, finished goods, cost of goods sold

B)raw materials, finished goods, cost of goods sold, work in process

C)work in process, finished goods, raw materials, cost of goods sold

D)cost of goods sold, raw materials, work in process, finished goods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

48

Job order cost accounting systems can be used only for companies that manufacture a product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is not a reason a service firm would use a job order costing system?

A)to help control costs

B)to determine client billing

C)to determine department costs within the firm

D)to determine profit

A)to help control costs

B)to determine client billing

C)to determine department costs within the firm

D)to determine profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

50

The direct labor and overhead costs of providing services to clients are accumulated in a work in process account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following would be most likely to use process costing?

A)a custom furniture manufacturer

B)an auto body repair shop

C)a law firm

D)a lawn fertilizer manufacturer

A)a custom furniture manufacturer

B)an auto body repair shop

C)a law firm

D)a lawn fertilizer manufacturer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

52

Using the job order cost system, service organizations are able to bill customers on a weekly or monthly basis, even when the job has not been completed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

53

Job order costing and process costing are

A)pricing systems

B)cost accounting systems

C)cost flow systems

D)inventory tracking systems

A)pricing systems

B)cost accounting systems

C)cost flow systems

D)inventory tracking systems

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is not a characteristic of a job order costing system?

A)It accumulates cost for each department within the factory.

B)It provides a separate record for the cost of each quantity of product that passes through the factory.

C)It is best suited for industries that manufacture custom goods.

D)It uses only one work in process account.

A)It accumulates cost for each department within the factory.

B)It provides a separate record for the cost of each quantity of product that passes through the factory.

C)It is best suited for industries that manufacture custom goods.

D)It uses only one work in process account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following are the two main types of cost accounting systems for manufacturing operations?

A)process cost and general accounting systems

B)job order cost and process cost systems

C)job order and general accounting systems

D)process cost and replacement cost systems

A)process cost and general accounting systems

B)job order cost and process cost systems

C)job order and general accounting systems

D)process cost and replacement cost systems

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

56

The job order costing system is not used by service organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

57

In a job order cost accounting system for a service business, materials costs are normally included as part of overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following would most likely use a job order costing system?

A)a paper mill

B)a swimming pool installer

C)a company that manufactures chlorine for swimming pools

D)an oil refinery

A)a paper mill

B)a swimming pool installer

C)a company that manufactures chlorine for swimming pools

D)an oil refinery

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

59

A law firm would use a job order cost system to accumulate all of the costs associated with a particular client engagement, such as lawyer time, copying charges, filing fees, and overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

60

The job order costing system is used by service firms to determine revenues, expenses, and ultimately profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

61

In a job order cost accounting system, the entry to record the flow of direct materials into production is

A)to debit Work in Process, and credit Materials

B)to debit Materials, and credit Work in Process

C)to debit Factory Overhead, and credit Materials

D)to debit Work in Process, and credit Supplies

A)to debit Work in Process, and credit Materials

B)to debit Materials, and credit Work in Process

C)to debit Factory Overhead, and credit Materials

D)to debit Work in Process, and credit Supplies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following is a period cost?

A)depreciation on factory lunchroom furniture

B)salary of telephone receptionist in the sales office

C)salary of a security guard for the factory parking lot

D)computer chips used by a computer manufacturer

A)depreciation on factory lunchroom furniture

B)salary of telephone receptionist in the sales office

C)salary of a security guard for the factory parking lot

D)computer chips used by a computer manufacturer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is a product cost?

A)salary of a sales manager

B)advertising for a particular product

C)drill bits for a drill press used in the plant assembly area

D)salary of the company receptionist

A)salary of a sales manager

B)advertising for a particular product

C)drill bits for a drill press used in the plant assembly area

D)salary of the company receptionist

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

64

The Thomlin Company forecasts that total overhead for the current year will be $15,500,000 with 250,000 total machine hours.Year to date, the actual overhead is $16,000,000 and the actual machine hours are 330,000 hours.The predetermined overhead rate based on machine hours is

A)$48 per machine hour

B)$62 per machine hour

C)$45 per machine hour

D)$50 per machine hour

A)$48 per machine hour

B)$62 per machine hour

C)$45 per machine hour

D)$50 per machine hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

65

Each document in the cost ledger is called a

A)finished goods sheet

B)stock record

C)materials requisition

D)job cost sheet

A)finished goods sheet

B)stock record

C)materials requisition

D)job cost sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

66

The amount of time spent by an employee in the factory is usually recorded on

A)time tickets

B)job order cost sheets

C)employees' earnings records

D)statement of owners' equity

A)time tickets

B)job order cost sheets

C)employees' earnings records

D)statement of owners' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

67

The entry to record the flow of direct labor costs into production in a job order cost accounting system is

A)debit Factory Overhead, credit Work in Process

B)debit Finished Goods, credit Wages Payable

C)debit Work in Process, credit Wages Payable

D)debit Factory Overhead, credit Wages Payable

A)debit Factory Overhead, credit Work in Process

B)debit Finished Goods, credit Wages Payable

C)debit Work in Process, credit Wages Payable

D)debit Factory Overhead, credit Wages Payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following would record the labor costs to an individual job?

A)clock cards

B)in-and-out cards

C)time tickets

D)a payroll register

A)clock cards

B)in-and-out cards

C)time tickets

D)a payroll register

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

69

The amount of time spent by an employee on an individual job are recorded on

A)pay stubs

B)in-and-out cards

C)time tickets

D)employees' earnings records

A)pay stubs

B)in-and-out cards

C)time tickets

D)employees' earnings records

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

70

A summary of the materials requisitions completed during a period serves as the basis for transferring the cost of the materials from the controlling account in the general ledger to the controlling accounts for

A)Work in Process and Cost of Goods Sold

B)Work in Process and Factory Overhead

C)Finished Goods and Cost of Goods Sold

D)Work in Process and Finished Goods

A)Work in Process and Cost of Goods Sold

B)Work in Process and Factory Overhead

C)Finished Goods and Cost of Goods Sold

D)Work in Process and Finished Goods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

71

The Thomlin Company forecasts that total overhead for the current year will be $15,000,000 with 300,000 total machine hours.Year to date, the actual overhead is $16,000,000 and the actual machine hours are 330,000 hours.If the Thomlin Company uses a predetermined overhead rate based on machine hours for applying overhead, as of this point in time year to date, the overhead is

A)$1,000,000 over applied

B)$1,000,000 under applied

C)$500,000 over applied

D)$500,000 under applied

A)$1,000,000 over applied

B)$1,000,000 under applied

C)$500,000 over applied

D)$500,000 under applied

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

72

The source document for the data for debiting Work in Process for direct materials is a

A)purchase order

B)purchase requisition

C)materials requisition

D)receiving report

A)purchase order

B)purchase requisition

C)materials requisition

D)receiving report

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

73

At the end of the year, overhead applied was $42,000,000.Actual overhead was $40,300,000.Closing over/under applied overhead into Cost of Goods Sold would cause net income to

A)increase by $1,700,000

B)decrease by $1,700,000

C)increase by $3,400,000

D)decrease by $3,400,000

A)increase by $1,700,000

B)decrease by $1,700,000

C)increase by $3,400,000

D)decrease by $3,400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

74

At the end of July, the first month of the current fiscal year, the factory overhead account had a debit balance.Which of the following describes the nature of this balance and how it would be reported on the interim balance sheet?

A)Over applied, deferred credit

B)Under applied, deferred debit

C)Under applied, deferred credit

D)Over applied, deferred debit

A)Over applied, deferred credit

B)Under applied, deferred debit

C)Under applied, deferred credit

D)Over applied, deferred debit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

75

In a job order cost accounting system, when goods that have been ordered are received, the receiving department personnel count, inspect the goods, and complete a

A)purchase order

B)sales invoice

C)receiving report

D)purchase requisition

A)purchase order

B)sales invoice

C)receiving report

D)purchase requisition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

76

At the end of the fiscal year, the balance in Factory Overhead is small.The balance would be

A)transferred to Work in Process

B)transferred to Cost of Goods Sold

C)transferred to Finished Goods

D)allocated between Work in Process and Finished Goods

A)transferred to Work in Process

B)transferred to Cost of Goods Sold

C)transferred to Finished Goods

D)allocated between Work in Process and Finished Goods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

77

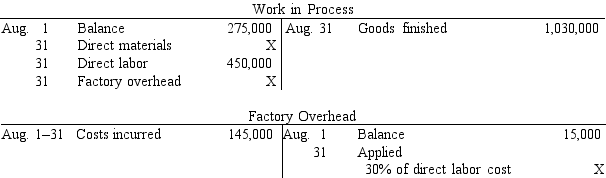

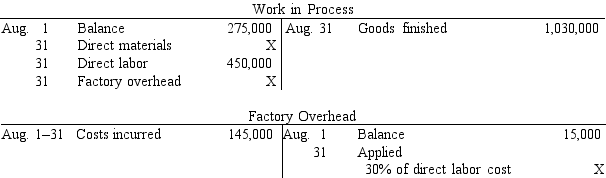

Selected accounts with amounts omitted are as follows  If the balance of Work in Process at August 31 is $220,000, what was the amount debited to Work in Process for direct materials in August?

If the balance of Work in Process at August 31 is $220,000, what was the amount debited to Work in Process for direct materials in August?

A)$390,000

B)$170,000

C)$525,000

D)$580,000

If the balance of Work in Process at August 31 is $220,000, what was the amount debited to Work in Process for direct materials in August?

If the balance of Work in Process at August 31 is $220,000, what was the amount debited to Work in Process for direct materials in August?A)$390,000

B)$170,000

C)$525,000

D)$580,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

78

The document authorizing the issuance of materials from the storeroom is a

A)materials requisition

B)purchase requisition

C)receiving report

D)purchase order

A)materials requisition

B)purchase requisition

C)receiving report

D)purchase order

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

79

The details concerning the costs incurred on each job order are accumulated in a work in process account and supported by a

A)stock ledger

B)materials ledger

C)cost ledger

D)creditors ledger

A)stock ledger

B)materials ledger

C)cost ledger

D)creditors ledger

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck

80

The basis for recording direct and indirect labor costs incurred is a summary of the period's

A)job order cost sheets

B)time tickets

C)employees' earnings records

D)clock cards

A)job order cost sheets

B)time tickets

C)employees' earnings records

D)clock cards

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 195 في هذه المجموعة.

فتح الحزمة

k this deck