Deck 7: Investment Decision Rules

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

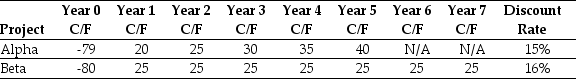

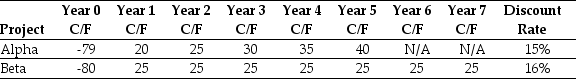

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

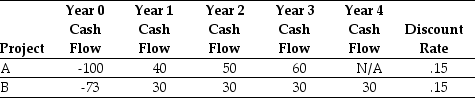

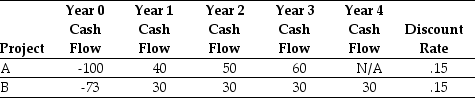

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

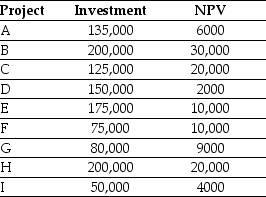

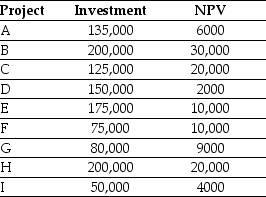

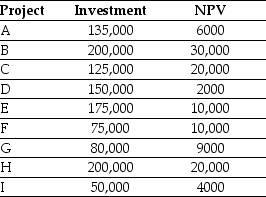

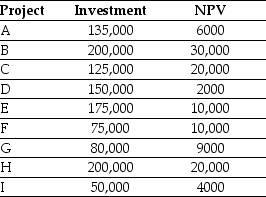

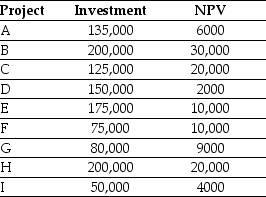

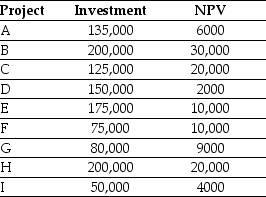

سؤال

سؤال

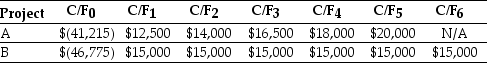

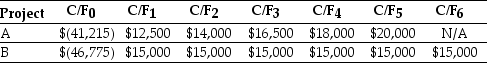

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/86

العب

ملء الشاشة (f)

Deck 7: Investment Decision Rules

1

The IRR of Palin's book deal is closest to:

A)-27.25%

B)-37.50%

C)27.25%

D)37.50%

A)-27.25%

B)-37.50%

C)27.25%

D)37.50%

-27.25%

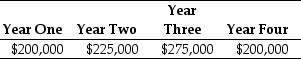

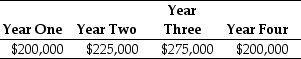

2

The NPV for this project is closest to:

A)$29,200

B)$39,500

C)$129,200

D)$139,500

A)$29,200

B)$39,500

C)$129,200

D)$139,500

$39,500

3

Assuming that Palin's cost of capital is 10%,then the NPV of her book deal is closest to:

A)$2.00 million

B)$2.20 million

C)$3.00 million

D)$3.75 million

A)$2.00 million

B)$2.20 million

C)$3.00 million

D)$3.75 million

$3.75 million

4

Assuming that Dewey's cost of capital is 12% EAR,then the IRR of his retainer offer is closest to:

A)-39.3%

B)-3.3%

C)20.0%

D)39.3%

A)-39.3%

B)-3.3%

C)20.0%

D)39.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

5

Assuming that Dewey's cost of capital is 12% EAR,then the NPV of his retainer offer is closest to:

A)-$7500

B)-$7400

C)$6000

D)$7400

A)-$7500

B)-$7400

C)$6000

D)$7400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

6

The NPV for this project is closest to:

A)$176,270

B)$123,420

C)$450,000

D)$179,590

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

7

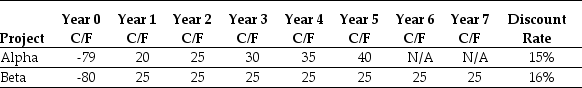

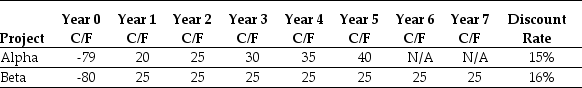

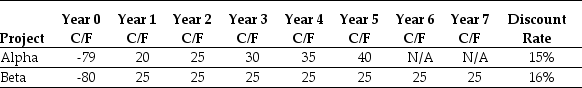

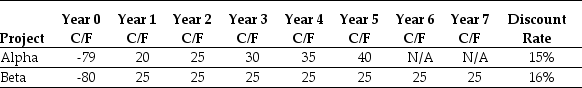

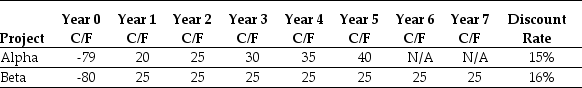

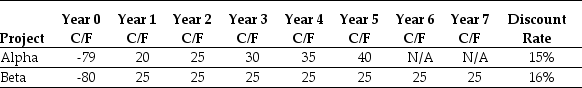

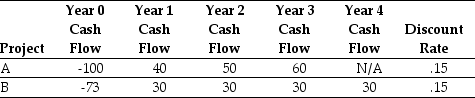

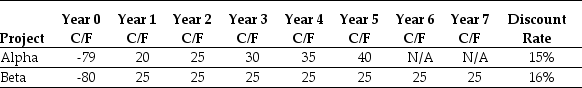

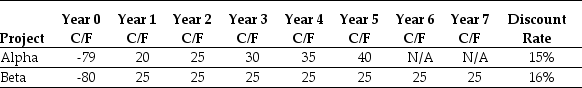

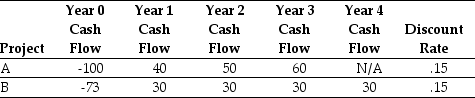

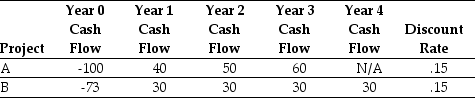

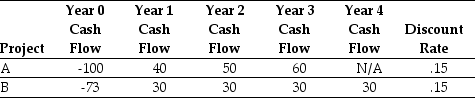

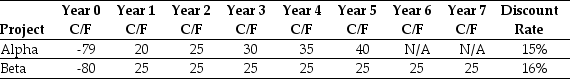

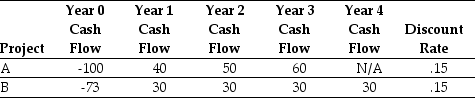

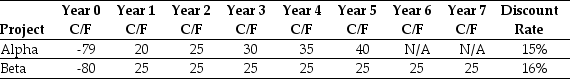

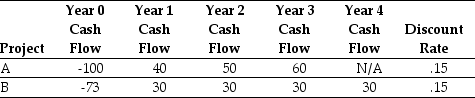

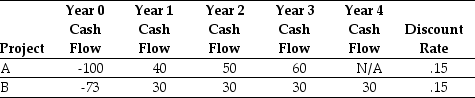

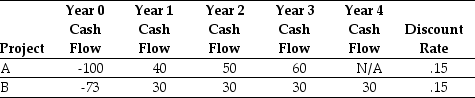

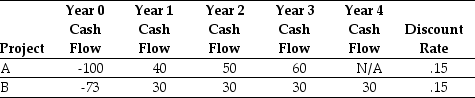

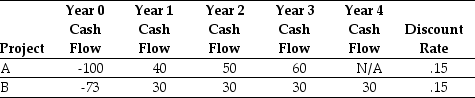

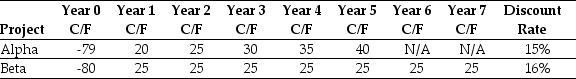

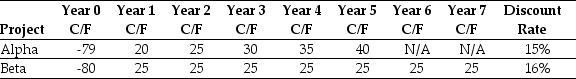

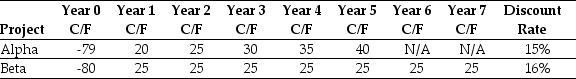

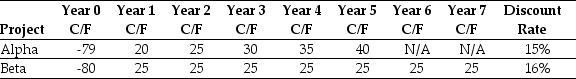

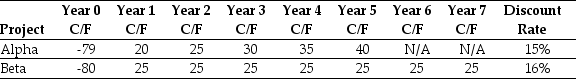

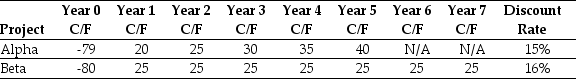

Use the table for the question(s)below.

Consider the following two projects:

The NPV for project Alpha is closest to:

A)$20.96

B)$16.92

C)$24.01

D)$14.41

Consider the following two projects:

The NPV for project Alpha is closest to:

A)$20.96

B)$16.92

C)$24.01

D)$14.41

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following statements is FALSE?

A)About 75% of firms surveyed used the NPV rule for making investment decisions.

B)If you are unsure of your cost of capital estimate,it is important to determine how sensitive your analysis is to errors in this estimate.

C)To decide whether to invest using the NPV rule,we need to know the cost of capital.

D)NPV is positive only for discount rates greater than the internal rate of return.

A)About 75% of firms surveyed used the NPV rule for making investment decisions.

B)If you are unsure of your cost of capital estimate,it is important to determine how sensitive your analysis is to errors in this estimate.

C)To decide whether to invest using the NPV rule,we need to know the cost of capital.

D)NPV is positive only for discount rates greater than the internal rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

9

Use the table for the question(s)below.

Consider the following two projects:

The NPV of Larry's three movie Larry Boy offer is closest to:

A)3.5 million

B)-1.6 million

C)1.6 million

D)-1.0 million

Consider the following two projects:

The NPV of Larry's three movie Larry Boy offer is closest to:

A)3.5 million

B)-1.6 million

C)1.6 million

D)-1.0 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following statements is FALSE?

A)In general,the difference between the cost of capital and the IRR is the maximum amount of estimation error in the cost of capital estimate that can exist without altering the original decision.

B)The IRR can provide information on how sensitive your analysis is to errors in the estimate of your cost of capital.

C)If you are unsure of your cost of capital estimate,it is important to determine how sensitive your analysis is to errors in this estimate.

D)If the cost of capital estimate is more than the IRR,the NPV will be positive.

A)In general,the difference between the cost of capital and the IRR is the maximum amount of estimation error in the cost of capital estimate that can exist without altering the original decision.

B)The IRR can provide information on how sensitive your analysis is to errors in the estimate of your cost of capital.

C)If you are unsure of your cost of capital estimate,it is important to determine how sensitive your analysis is to errors in this estimate.

D)If the cost of capital estimate is more than the IRR,the NPV will be positive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

11

Use the table for the question(s)below.

Consider the following two projects:

The NPV for Boulderado's snowboard project is closest to:

A)$228,900

B)$46,900

C)$51,600

D)$23,800

Consider the following two projects:

The NPV for Boulderado's snowboard project is closest to:

A)$228,900

B)$46,900

C)$51,600

D)$23,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

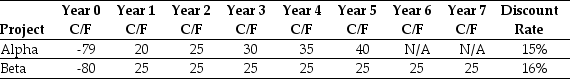

12

Use the table for the question(s)below.

Consider the following two projects:

The NPV of project B is closest to:

A)12.6

B)23.3

C)12.0

D)15.0

Consider the following two projects:

The NPV of project B is closest to:

A)12.6

B)23.3

C)12.0

D)15.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

13

Use the table for the question(s)below.

Consider the following two projects:

The NPV for project Beta is closest to:

A)$24.01

B)$16.92

C)$20.96

D)$14.41

Consider the following two projects:

The NPV for project Beta is closest to:

A)$24.01

B)$16.92

C)$20.96

D)$14.41

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

14

The decision you should take regarding this project is

A)reject the project since the NPV is negative.

B)reject the project since the NPV is positive.

C)accept the project since the IRR < 20%.

D)accept the project since the IRR > 20%.

A)reject the project since the NPV is negative.

B)reject the project since the NPV is positive.

C)accept the project since the IRR < 20%.

D)accept the project since the IRR > 20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

15

The NPV profile graphs:

A)the project's NPV over a range of discount rates.

B)the project's IRR over a range of discount rates.

C)the project's cash flows over a range of NPVs.

D)the project's IRR over a range of NPVs.

A)the project's NPV over a range of discount rates.

B)the project's IRR over a range of discount rates.

C)the project's cash flows over a range of NPVs.

D)the project's IRR over a range of NPVs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

16

The IRR for this project is closest to:

A)15.60%

B)18.95%

C)20.00%

D)25.85%

A)15.60%

B)18.95%

C)20.00%

D)25.85%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

17

Assume that once her book is finished,it is expected to generate royalties of $5 million in the first year (paid at the end of the year)and these royalties are expected to decrease by 40% per year in perpetuity.Assuming that Palin's cost of capital is 10% and given these royalties payments,the NPV of Palin's book deal is closest to:

A)$3.75 million

B)$12.20 million

C)$13.00 million

D)$13.75 million

A)$3.75 million

B)$12.20 million

C)$13.00 million

D)$13.75 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

18

The NPV profile:

A)shows the payback period-the point at which NPV is positive.

B)shows the internal rate of return-the point at which NPV is zero.

C)shows the NPV over a range of discount rates.

D)B and C are correct.

A)shows the payback period-the point at which NPV is positive.

B)shows the internal rate of return-the point at which NPV is zero.

C)shows the NPV over a range of discount rates.

D)B and C are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

19

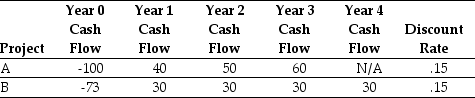

Use the table for the question(s)below.

Consider the following two projects:

The NPV of project A is closest to:

A)12.0

B)12.6

C)15.0

D)42.9

Consider the following two projects:

The NPV of project A is closest to:

A)12.0

B)12.6

C)15.0

D)42.9

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

20

Use the table for the question(s)below.

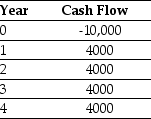

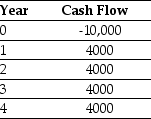

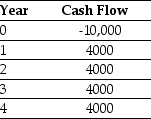

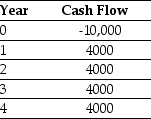

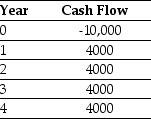

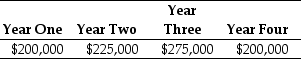

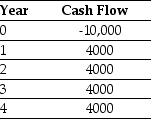

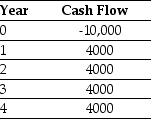

Consider a project with the following cash flows:

If the appropriate discount rate for this project is 15%,then the NPV is closest to:

A)$6000

B)-$867

C)$1420

D)$867

Consider a project with the following cash flows:

If the appropriate discount rate for this project is 15%,then the NPV is closest to:

A)$6000

B)-$867

C)$1420

D)$867

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

21

Use the table for the question(s)below.

Consider the following two projects:

The internal rate of return (IRR)for project B is closest to:

A)21.6%

B)23.3%

C)42.9%

D)7.7%

Consider the following two projects:

The internal rate of return (IRR)for project B is closest to:

A)21.6%

B)23.3%

C)42.9%

D)7.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

22

Larry should:

A)reject the offer because the NPV < 0.

B)accept the offer even though the IRR < 10%,because the NPV > 0.

C)reject the offer because the IRR < 10%.

D)accept the offer because the IRR > 0%.

A)reject the offer because the NPV < 0.

B)accept the offer even though the IRR < 10%,because the NPV > 0.

C)reject the offer because the IRR < 10%.

D)accept the offer because the IRR > 0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

23

The maximum number of IRRs that could exist for project B is:

A)3

B)1

C)2

D)0

A)3

B)1

C)2

D)0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following statements is correct?

A)You should accept project A since its IRR > 15%.

B)You should reject project B since its NPV > 0.

C)Your should accept project A since its NPV < 0.

D)You should accept project B since its IRR < 15%.

A)You should accept project A since its IRR > 15%.

B)You should reject project B since its NPV > 0.

C)Your should accept project A since its NPV < 0.

D)You should accept project B since its IRR < 15%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

25

When using the internal rate of return (IRR)investment rule,we compare:

A)the average return on the investment opportunity to returns on all other investment opportunities in the market.

B)the average return on the investment opportunity to returns on other alternatives in the market with equivalent risk and maturity.

C)the NPV of the investment opportunity to the average return on the investment opportunity.

D)the average return on the investment opportunity to the risk-free rate of return.

A)the average return on the investment opportunity to returns on all other investment opportunities in the market.

B)the average return on the investment opportunity to returns on other alternatives in the market with equivalent risk and maturity.

C)the NPV of the investment opportunity to the average return on the investment opportunity.

D)the average return on the investment opportunity to the risk-free rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements is correct?

A)You should invest in project Beta since NPVBeta > 0.

B)You should invest in project Alpha since IRRAlpha > IRRBeta.

C)Your should invest in project Alpha since NPVAlpha < 0.

D)You should invest in project Beta since IRRBeta > 0.

A)You should invest in project Beta since NPVBeta > 0.

B)You should invest in project Alpha since IRRAlpha > IRRBeta.

C)Your should invest in project Alpha since NPVAlpha < 0.

D)You should invest in project Beta since IRRBeta > 0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

27

Use the table for the question(s)below.

Consider the following two projects:

The internal rate of return (IRR)for project Alpha is closest to:

A)25.0%

B)22.2%

C)24.5%

D)22.7%

Consider the following two projects:

The internal rate of return (IRR)for project Alpha is closest to:

A)25.0%

B)22.2%

C)24.5%

D)22.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

28

Calculate the IRR for the snow board project and use it to determine the maximum deviation allowable in the cost of capital estimate that leaves the investment decision unchanged.The maximum deviation allowable is closest to:

A)11.0%

B)0.0%

C)2.5%

D)1.0%

A)11.0%

B)0.0%

C)2.5%

D)1.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

29

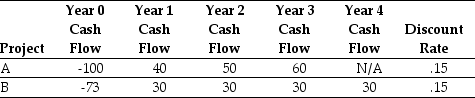

Use the table for the question(s)below.

Consider the following two projects:

The internal rate of return (IRR)for project A is closest to:

A)7.7%

B)21.6%

C)23.3%

D)42.9%

Consider the following two projects:

The internal rate of return (IRR)for project A is closest to:

A)7.7%

B)21.6%

C)23.3%

D)42.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following statements is FALSE?

A)The IRR investment rule states you should turn down any investment opportunity where the IRR is less than the opportunity cost of capital.

B)The IRR investment rule states that you should take any investment opportunity where the IRR exceeds the opportunity cost of capital.

C)Since the IRR rule is based upon the rate at which the NPV equals zero,like the NPV decision rule,the IRR decision rule will always identify the correct investment decisions.

D)There are situations in which multiple IRRs exist.

A)The IRR investment rule states you should turn down any investment opportunity where the IRR is less than the opportunity cost of capital.

B)The IRR investment rule states that you should take any investment opportunity where the IRR exceeds the opportunity cost of capital.

C)Since the IRR rule is based upon the rate at which the NPV equals zero,like the NPV decision rule,the IRR decision rule will always identify the correct investment decisions.

D)There are situations in which multiple IRRs exist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

31

Use the table for the question(s)below.

Consider a project with the following cash flows:

Assume the appropriate discount rate for this project is 15%.The IRR for this project is closest to:

A)21%

B)22%

C)15%

D)60%

Consider a project with the following cash flows:

Assume the appropriate discount rate for this project is 15%.The IRR for this project is closest to:

A)21%

B)22%

C)15%

D)60%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

32

The internal rate of return rule can result in the wrong decision if the projects being compared have:

A)differences in scale.

B)differences in timing.

C)differences in NPV.

D)A and B are correct.

A)differences in scale.

B)differences in timing.

C)differences in NPV.

D)A and B are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

33

One of the IRRs for Rearden's mining operation is closest to:

A)0%

B)10.6%

C)12.4%

D)72.0%

A)0%

B)10.6%

C)12.4%

D)72.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following statements is FALSE?

A)The IRR investment rule will identify the correct decision in many,but not all,situations.

B)By setting the NPV equal to zero and solving for r,we find the IRR.

C)If you are unsure of your cost of capital estimate,it is important to determine how sensitive your analysis is to errors in this estimate.

D)The simplest investment rule is the NPV investment rule.

A)The IRR investment rule will identify the correct decision in many,but not all,situations.

B)By setting the NPV equal to zero and solving for r,we find the IRR.

C)If you are unsure of your cost of capital estimate,it is important to determine how sensitive your analysis is to errors in this estimate.

D)The simplest investment rule is the NPV investment rule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

35

The IRR for this project is closest to:

A)18.9%

B)22.7%

C)34.1%

D)39.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

36

The IRR for Larry's three movie deal offer is closest to:

A)3.5%

B)1.6%

C)-3.5%

D)-1.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

37

The IRR for Boulderado's snowboard project is closest to:

A)10.4%

B)10.0%

C)11.0%

D)15.1%

A)10.4%

B)10.0%

C)11.0%

D)15.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

38

Assuming that Dewey's cost of capital is 12% EAR,then the number of potential IRRs that exist for this problem is equal to:

A)0

B)1

C)2

D)12

A)0

B)1

C)2

D)12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

39

Use the table for the question(s)below.

Consider the following two projects:

The internal rate of return (IRR)for project Beta is closest to:

A)25.0%

B)22.7%

C)24.5%

D)22.2%

Consider the following two projects:

The internal rate of return (IRR)for project Beta is closest to:

A)25.0%

B)22.7%

C)24.5%

D)22.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

40

The number of potential IRRs that exist for Rearden's mining operation is equal to:

A)0

B)1

C)2

D)12

A)0

B)1

C)2

D)12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

41

An incremental IRR of Project B over Project A is closest to:

A)12.6%

B)23.3%

C)1.7%

D)17.3%

A)12.6%

B)23.3%

C)1.7%

D)17.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

42

You are trying to decide between three mutually exclusive investment opportunities.The most appropriate tool for identifying the correct decision is:

A)NPV.

B)profitability index.

C)IRR.

D)incremental IRR.

A)NPV.

B)profitability index.

C)IRR.

D)incremental IRR.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following statements is FALSE?

A)The payback investment rule is based on the notion that an opportunity that pays back its initial investments quickly is a good idea.

B)An IRR will always exist for an investment opportunity.

C)A NPV will always exist for an investment opportunity.

D)In general,there can be as many IRRs as the number of times the project's cash flows change sign over time.

A)The payback investment rule is based on the notion that an opportunity that pays back its initial investments quickly is a good idea.

B)An IRR will always exist for an investment opportunity.

C)A NPV will always exist for an investment opportunity.

D)In general,there can be as many IRRs as the number of times the project's cash flows change sign over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following statements is FALSE?

A)It is possible that an IRR does not exist for an investment opportunity.

B)If the payback period is less than a pre-specified length of time,you accept the project.

C)The internal rate of return (IRR)investment rule is based upon the notion that if the return on other alternatives is greater than the return on the investment opportunity,you should undertake the investment opportunity.

D)It is possible that there is no discount rate that will set the NPV equal to zero.

A)It is possible that an IRR does not exist for an investment opportunity.

B)If the payback period is less than a pre-specified length of time,you accept the project.

C)The internal rate of return (IRR)investment rule is based upon the notion that if the return on other alternatives is greater than the return on the investment opportunity,you should undertake the investment opportunity.

D)It is possible that there is no discount rate that will set the NPV equal to zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

45

Use the table for the question(s)below.

Consider the following two projects:

Assume that projects A and B are mutually exclusive.The correct investment decision and the best rational for that decision is to:

A)invest in project A since NPVB < NPVA.

B)invest in project B since IRRB > IRRA.

C)invest in project B since NPVB > NPVA.

D)invest in project A since NPVA > 0.

Consider the following two projects:

Assume that projects A and B are mutually exclusive.The correct investment decision and the best rational for that decision is to:

A)invest in project A since NPVB < NPVA.

B)invest in project B since IRRB > IRRA.

C)invest in project B since NPVB > NPVA.

D)invest in project A since NPVA > 0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

46

Explain why the NPV decision rule might provide Larry with a different decision outcome than the IRR rule when evaluating Larry's three movie deal offer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following statements is FALSE?

A)The incremental IRR need not exist.

B)If a change in the timing of the cash flows does not affect the NPV,then the change in timing will not impact the IRR.

C)Although the incremental IRR rule can provide a reliable method for choosing among projects,it can be difficult to apply correctly.

D)When projects are mutually exclusive,it is not enough to determine which projects have positive NPVs.

A)The incremental IRR need not exist.

B)If a change in the timing of the cash flows does not affect the NPV,then the change in timing will not impact the IRR.

C)Although the incremental IRR rule can provide a reliable method for choosing among projects,it can be difficult to apply correctly.

D)When projects are mutually exclusive,it is not enough to determine which projects have positive NPVs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following statements is FALSE?

A)The incremental IRR investment rule applies the IRR rule to the difference between the cash flows of the two mutually exclusive alternatives.

B)When a manager must choose among mutually exclusive investments,the NPV rule provides a straightforward answer.

C)The likelihood of multiple IRRs is greater with the regular IRR rule than with the incremental IRR rule.

D)Problems can arise using the IRR method when the mutually exclusive investments have differences in scale.

A)The incremental IRR investment rule applies the IRR rule to the difference between the cash flows of the two mutually exclusive alternatives.

B)When a manager must choose among mutually exclusive investments,the NPV rule provides a straightforward answer.

C)The likelihood of multiple IRRs is greater with the regular IRR rule than with the incremental IRR rule.

D)Problems can arise using the IRR method when the mutually exclusive investments have differences in scale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following statements is FALSE?

A)The payback rule is useful in cases where the cost of making an incorrect decision might not be large enough to justify the time required for calculating the NPV.

B)The payback rule is reliable because it considers the time value of money and depends on the cost of capital.

C)For most investment opportunities,expenses occur initially and cash is received later.

D)Fifty percent of firms surveyed reported using the payback rule for making decisions.

A)The payback rule is useful in cases where the cost of making an incorrect decision might not be large enough to justify the time required for calculating the NPV.

B)The payback rule is reliable because it considers the time value of money and depends on the cost of capital.

C)For most investment opportunities,expenses occur initially and cash is received later.

D)Fifty percent of firms surveyed reported using the payback rule for making decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following statements is FALSE?

A)In general,the IRR rule works for a stand-alone project if all of the project's positive cash flows precede its negative cash flows.

B)There is no easy fix for the IRR rule when there are multiple IRRs.

C)The payback rule is primarily used because of its simplicity.

D)No investment rule that ignores the set of alternative investment alternatives can be optimal.

A)In general,the IRR rule works for a stand-alone project if all of the project's positive cash flows precede its negative cash flows.

B)There is no easy fix for the IRR rule when there are multiple IRRs.

C)The payback rule is primarily used because of its simplicity.

D)No investment rule that ignores the set of alternative investment alternatives can be optimal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the table for the question(s)below.

Consider the following two projects:

The payback period for project A is closest to:

A)2.0 years

B)2.4 years

C)2.5 years

D)2.2 years

Consider the following two projects:

The payback period for project A is closest to:

A)2.0 years

B)2.4 years

C)2.5 years

D)2.2 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

52

Use the table for the question(s)below.

Consider the following two projects:

The payback period for project B is closest to:

A)2.5 years

B)2.0 years

C)2.2 years

D)2.4 years

Consider the following two projects:

The payback period for project B is closest to:

A)2.5 years

B)2.0 years

C)2.2 years

D)2.4 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following statements is FALSE?

A)When using the incremental IRR rule,you must keep track of which project is the incremental project and ensure that the incremental cash flows are initially positive and then become negative.

B)Picking one project over another simply because it has a larger IRR can lead to mistakes.

C)Problems arise using the IRR method when the mutually exclusive investments have differences in scale.

D)When the risks of two projects are different,only the NPV rule will give a reliable answer.

A)When using the incremental IRR rule,you must keep track of which project is the incremental project and ensure that the incremental cash flows are initially positive and then become negative.

B)Picking one project over another simply because it has a larger IRR can lead to mistakes.

C)Problems arise using the IRR method when the mutually exclusive investments have differences in scale.

D)When the risks of two projects are different,only the NPV rule will give a reliable answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

54

The payback period for Rearden's mining operation is closest to:

A)5.00 years

B)6.00 years

C)6.25 years

D)6.50 years

A)5.00 years

B)6.00 years

C)6.25 years

D)6.50 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following statements is FALSE?

A)Problems can arise using the IRR method when the mutually exclusive investments have different cash flow patterns.

B)The IRR is affected by the scale of the investment opportunity.

C)Multiple incremental IRRs might exist.

D)The incremental IRR rule assumes that the riskiness of the two projects is the same.

A)Problems can arise using the IRR method when the mutually exclusive investments have different cash flow patterns.

B)The IRR is affected by the scale of the investment opportunity.

C)Multiple incremental IRRs might exist.

D)The incremental IRR rule assumes that the riskiness of the two projects is the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

56

Use the table for the question(s)below.

Consider a project with the following cash flows:

Assume the appropriate discount rate for this project is 15%.The payback period for this project is closest to:

A)3.0

B)2.5

C)2.0

D)4.0

Consider a project with the following cash flows:

Assume the appropriate discount rate for this project is 15%.The payback period for this project is closest to:

A)3.0

B)2.5

C)2.0

D)4.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

57

Use the table for the question(s)below.

Consider the following two projects:

The payback period for project Alpha is closest to:

A)3.2 years

B)2.9 years

C)3.1 years

D)2.6 years

Consider the following two projects:

The payback period for project Alpha is closest to:

A)3.2 years

B)2.9 years

C)3.1 years

D)2.6 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the table for the question(s)below.

Consider the following two projects:

The payback period for project Beta is closest to:

A)2.9 years

B)3.1 years

C)2.6 years

D)3.2 years

Consider the following two projects:

The payback period for project Beta is closest to:

A)2.9 years

B)3.1 years

C)2.6 years

D)3.2 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

59

The payback period for this project is closest to:

A)2.1 years

B)3.0 years

C)2.0 years

D)2.2 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

60

Consider two mutually exclusive projects A & B.If you subtract the cash flows of opportunity B from the cash flows of opportunity A,then you should:

A)take opportunity A if the regular IRR exceeds the cost of capital.

B)take opportunity A if the incremental IRR exceeds the cost of capital.

C)take opportunity B if the regular IRR exceeds the cost of capital.

D)take opportunity B if the incremental IRR exceeds the cost of capital.

A)take opportunity A if the regular IRR exceeds the cost of capital.

B)take opportunity A if the incremental IRR exceeds the cost of capital.

C)take opportunity B if the regular IRR exceeds the cost of capital.

D)take opportunity B if the incremental IRR exceeds the cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

61

When choosing between projects,an alternative to comparing their IRRs is:

A)to compute the incremental IRR,which tells us the discount rate at which it becomes profitable to switch from one project to the other.

B)to compute the incremental payback period,which tells us the number of years during which it becomes profitable to switch from one project to the other.

C)to compute the incremental NPV,which tells us the discount rate at which it becomes profitable to switch from one project to the other.

D)There is no alternative selection criterion to comparing IRRs.

A)to compute the incremental IRR,which tells us the discount rate at which it becomes profitable to switch from one project to the other.

B)to compute the incremental payback period,which tells us the number of years during which it becomes profitable to switch from one project to the other.

C)to compute the incremental NPV,which tells us the discount rate at which it becomes profitable to switch from one project to the other.

D)There is no alternative selection criterion to comparing IRRs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

62

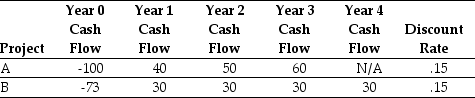

Use the table for the question(s)below.

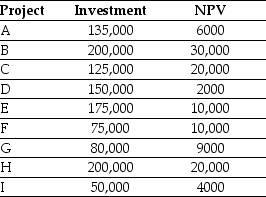

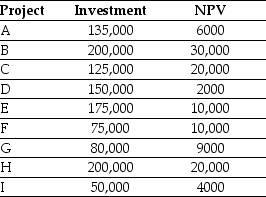

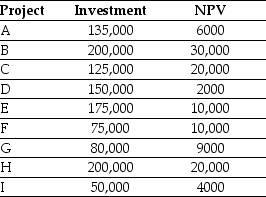

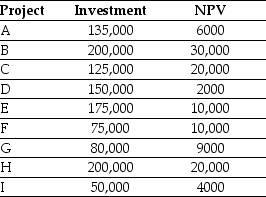

Consider the following list of projects:

Assuming that your capital is constrained,which project should you invest in first?

A)Project C

B)Project G

C)Project B

D)Project F

Consider the following list of projects:

Assuming that your capital is constrained,which project should you invest in first?

A)Project C

B)Project G

C)Project B

D)Project F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

63

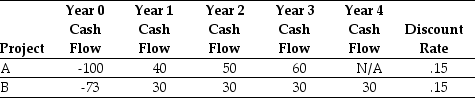

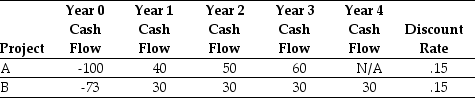

If the discount rate for project A is 16%,then what is the NPV for project A?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

64

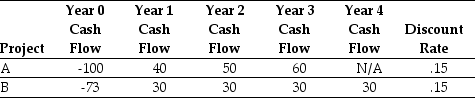

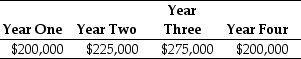

Use the table for the question(s)below.

Consider two mutually exclusive projects with the following cash flows:

You are considering using the incremental IRR approach to decide between the two mutually exclusive projects A & B.How many potential incremental IRRs could there be?

A)3

B)0

C)2

D)1

Consider two mutually exclusive projects with the following cash flows:

You are considering using the incremental IRR approach to decide between the two mutually exclusive projects A & B.How many potential incremental IRRs could there be?

A)3

B)0

C)2

D)1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

65

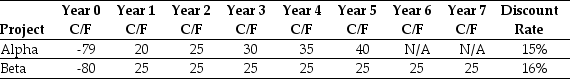

Use the table for the question(s)below.

Consider the following two projects:

Assume that projects Alpha and Beta are mutually exclusive.Which of the following statements is true regarding the investment decision tools' suitability for deciding between projects Alpha & Beta?

A)The incremental IRR should not be used since the projects have different lives.

B)The incremental IRR should not be used since the projects have different discount rates.

C)The incremental IRR should not be used since the projects have different cash flow patterns.

D)Both the NPV and incremental IRR approaches are appropriate to solve this problem.

Consider the following two projects:

Assume that projects Alpha and Beta are mutually exclusive.Which of the following statements is true regarding the investment decision tools' suitability for deciding between projects Alpha & Beta?

A)The incremental IRR should not be used since the projects have different lives.

B)The incremental IRR should not be used since the projects have different discount rates.

C)The incremental IRR should not be used since the projects have different cash flow patterns.

D)Both the NPV and incremental IRR approaches are appropriate to solve this problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

66

The maximum number of incremental IRRs that could exist for project B over project A is:

A)1

B)2

C)0

D)3

A)1

B)2

C)0

D)3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

67

Use the table for the question(s)below.

Consider the following two projects:

The profitability index for project B is closest to:

A)23.34

B)12.64

C)0.17

D)0.12

Consider the following two projects:

The profitability index for project B is closest to:

A)23.34

B)12.64

C)0.17

D)0.12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

68

Use the table for the question(s)below.

Consider the following list of projects:

Assuming that your capital is constrained,so that you only have $600,000 available to invest in projects,which projects should you invest in and in what order?

A)CBFH

B)CBGF

C)BCFG

D)CBFG

Consider the following list of projects:

Assuming that your capital is constrained,so that you only have $600,000 available to invest in projects,which projects should you invest in and in what order?

A)CBFH

B)CBGF

C)BCFG

D)CBFG

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

69

Use the table for the question(s)below.

Consider the following two projects:

The profitability index for project A is closest to:

A)0.12

B)21.65

C)0.17

D)12.04

Consider the following two projects:

The profitability index for project A is closest to:

A)0.12

B)21.65

C)0.17

D)12.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following statements is FALSE?

A)The profitability index measures the value created in terms of NPV per unit of resource consumed.

B)The profitability index is the ratio of value created to resources consumed.

C)The profitability index can be easily adapted for determining the correct investment decisions when multiple resource constraints exist.

D)The profitability index measures the "bang for your buck."

A)The profitability index measures the value created in terms of NPV per unit of resource consumed.

B)The profitability index is the ratio of value created to resources consumed.

C)The profitability index can be easily adapted for determining the correct investment decisions when multiple resource constraints exist.

D)The profitability index measures the "bang for your buck."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

71

Use the table for the question(s)below.

Consider the following list of projects:

Assuming that your capital is constrained,which investment tool should you use to determine the correct investment decisions?

A)Profitability Index

B)Incremental IRR

C)NPV

D)IRR

Consider the following list of projects:

Assuming that your capital is constrained,which investment tool should you use to determine the correct investment decisions?

A)Profitability Index

B)Incremental IRR

C)NPV

D)IRR

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

72

Assuming that the discount rate for project A is 16% and the discount rate for B is 15%,then given that these are mutually exclusive projects,which project would you take and why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

73

Use the table for the question(s)below.

Consider the following list of projects:

Assuming that your capital is constrained,which project should you invest in last?

A)Project A

B)Project I

C)Project D

D)Project C

Consider the following list of projects:

Assuming that your capital is constrained,which project should you invest in last?

A)Project A

B)Project I

C)Project D

D)Project C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following statements is FALSE?

A)If there is a fixed supply of a resource available,you should rank projects by the profitability index,selecting the project with the lowest profitability index first and working your way down the list until the resource is consumed.

B)Practitioners often use the profitability index to identify the optimal combination of projects when there is a fixed supply of resources.

C)If there is a fixed supply of resources available,so that you cannot undertake all possible opportunities,then simply picking the highest NPV opportunity might not lead to the best decision.

D)The profitability index is calculated as the NPV divided by the resources consumed by the project.

A)If there is a fixed supply of a resource available,you should rank projects by the profitability index,selecting the project with the lowest profitability index first and working your way down the list until the resource is consumed.

B)Practitioners often use the profitability index to identify the optimal combination of projects when there is a fixed supply of resources.

C)If there is a fixed supply of resources available,so that you cannot undertake all possible opportunities,then simply picking the highest NPV opportunity might not lead to the best decision.

D)The profitability index is calculated as the NPV divided by the resources consumed by the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

75

Use the table for the question(s)below.

Consider the following list of projects:

Assuming that your capital is constrained,what is the fifth project that you should invest in?

A)Project H

B)Project I

C)Project B

D)Project A

Consider the following list of projects:

Assuming that your capital is constrained,what is the fifth project that you should invest in?

A)Project H

B)Project I

C)Project B

D)Project A

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

76

Use the table for the question(s)below.

Consider the following two projects:

Assume that projects Alpha and Beta are mutually exclusive.The correct investment decision and the best rational for that decision is to:

A)invest in project Beta since NPVBeta > 0.

B)invest in project Alpha since NPVBeta < NPVAlpha.

C)invest in project Beta since IRRB > IRRA.

D)invest in project Beta since NPVBeta > NPVAlpha > 0.

Consider the following two projects:

Assume that projects Alpha and Beta are mutually exclusive.The correct investment decision and the best rational for that decision is to:

A)invest in project Beta since NPVBeta > 0.

B)invest in project Alpha since NPVBeta < NPVAlpha.

C)invest in project Beta since IRRB > IRRA.

D)invest in project Beta since NPVBeta > NPVAlpha > 0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

77

If the discount rate for project B is 15%,then what is the NPV for project B?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

78

What is one of the incremental IRRs for project B over project A? Would you feel comfortable basing your decision on the incremental IRR?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

79

Use the table for the question(s)below.

Consider a project with the following cash flows:

Assume the appropriate discount rate for this project is 15%.The profitability index for this project is closest to:

A).14

B).22

C).60

D).15

Consider a project with the following cash flows:

Assume the appropriate discount rate for this project is 15%.The profitability index for this project is closest to:

A).14

B).22

C).60

D).15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck

80

You are opening up a brand new retail strip mall.You presently have more potential retail outlets wanting to locate in your mall than you have space available.What is the most appropriate tool to use if you are trying to determine the optimal allocation of your retail space?

A)IRR

B)Payback period

C)NPV

D)Profitability index

A)IRR

B)Payback period

C)NPV

D)Profitability index

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 86 في هذه المجموعة.

فتح الحزمة

k this deck