Deck 2: Financial Planning Skills

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/31

العب

ملء الشاشة (f)

Deck 2: Financial Planning Skills

1

Mr Rolf Weasley has recently purchased $12,000 worth of shares in Perloins Ltd. Given the relative risk exposure of Perloins Ltd., Rolf expects an annual rate of return on the investment of 9% p.a. compounded at regular intervals of 4 months. Approximately how much would Rolf expect to realise from the sale of his investment in 5 years from now?

A) $13,911

B) $18,463

C) $18,696

D) $43,710

A) $13,911

B) $18,463

C) $18,696

D) $43,710

C

2

If you were to deposit $850 today into an investment account earning 6% p.a. compounded annually, approximately how much will you have in your account at the end of 5 years?

A) $1,165

B) $1,137

C) $1,206

D) $620

A) $1,165

B) $1,137

C) $1,206

D) $620

B

3

An ordinary annuity is characterised by:

A) a series of cash flows that are identical in amount and occur at the end of consecutive time periods.

B) a series of cash flows that are identical in amount and occur at the start of consecutive time periods .

C) a single cash flow that occurs at the end of a particular time period and is accumulated over multiple time periods.

D) none of the above.

A) a series of cash flows that are identical in amount and occur at the end of consecutive time periods.

B) a series of cash flows that are identical in amount and occur at the start of consecutive time periods .

C) a single cash flow that occurs at the end of a particular time period and is accumulated over multiple time periods.

D) none of the above.

A

4

A period of negative savings where income does not meet the required level of expenditures could also be regarded as a(n):

A) asset.

B) increase in equity.

C) savings surplus.

D) savings deficit.

A) asset.

B) increase in equity.

C) savings surplus.

D) savings deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

5

Credit card facilities in Australia are currently characterised by:

A) providing borrowers with an open-ended credit facility.

B) borrowers being required to make a monthly payment based on the outstanding credit card balance.

C) providing lenders in recent years with a higher source of fee revenue from this source than from home loans.

D) all of the above.

A) providing borrowers with an open-ended credit facility.

B) borrowers being required to make a monthly payment based on the outstanding credit card balance.

C) providing lenders in recent years with a higher source of fee revenue from this source than from home loans.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

6

A personal balance sheet would not generally include:

A) dividends received during a period.

B) a motor vehicle.

C) a collection of rare banknotes.

D) both a and b

A) dividends received during a period.

B) a motor vehicle.

C) a collection of rare banknotes.

D) both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

7

Approximately how much would you currently pay for an investment at a discount rate of 11% p.a. which produces an end of year cash inflow of $160 each year for 3 years?

A) $369

B) $391

C) $480

D) $1,480

A) $369

B) $391

C) $480

D) $1,480

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

8

An investor is seeking to make an investment decision over a 4-year term between alternative fixed interest securities of equivalent risk with each providing accumulated interest amounts on maturity. The ABC security offers a fixed interest rate of 8% for a 3-year maturity whereas the XYX security offers a fixed interest rate of 9% for a 4-year maturity. What initial calculation should be the basis for the decision-making between the securities?

A) to calculate a forward rate for year 4 of the XYX security

B) to calculate a forward rate for year 4 of the ABC security

C) to calculate a forward rate for year 3 of the ABC security

D) none of the above

A) to calculate a forward rate for year 4 of the XYX security

B) to calculate a forward rate for year 4 of the ABC security

C) to calculate a forward rate for year 3 of the ABC security

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

9

The relationship of the effects of taxation and positive rates of inflation on investment returns for a fixed interest security will be:

A) positive for both taxation and positive rates of inflation.

B) inverse for taxation and positive for positive rates of inflation.

C) inverse for both taxation and positive rates of inflation.

D) none of the above.

A) positive for both taxation and positive rates of inflation.

B) inverse for taxation and positive for positive rates of inflation.

C) inverse for both taxation and positive rates of inflation.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

10

Mr & Mrs Kelso are seeking a loan to buy a caravan to use to travel around Australia. The on-road cost of the caravan is $35,000. The loan details they have been provided from Ezy Credit are that the interest rate charged will be 9% p.a. and require end-of-month repayments over a 4-year term. The initial fees that form part of the loan arrangement are an establishment fee of $750 as well as a brokerage fee to Ezy Credit calculated as 2% of the loan value. Given that Mr & Mrs Kelso wish to borrow all the funds required to obtain the caravan what will be the approximate end-of-month loan repayment?

A) $612.80

B) $894.60

C) $907.80

D) $938.35

A) $612.80

B) $894.60

C) $907.80

D) $938.35

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

11

The greater the initial investment the:

A) greater the future value at a given interest rate and given number of periods.

B) lower the future value at a given interest rate and given number of periods.

C) future value will be the same at a given interest rate and given number of periods.

D) none of the above.

A) greater the future value at a given interest rate and given number of periods.

B) lower the future value at a given interest rate and given number of periods.

C) future value will be the same at a given interest rate and given number of periods.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following items would not generally be included in the calculation of an individual's liquidity ratio?

A) the total outstanding balance of a 25-year mortgage loan taken out in the last year

B) debt repayments over the next 12 months

C) amount of an outstanding telephone account

D) both a and c

A) the total outstanding balance of a 25-year mortgage loan taken out in the last year

B) debt repayments over the next 12 months

C) amount of an outstanding telephone account

D) both a and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

13

In the calculation of the savings ratio, savings is defined as:

A) the amount left over after deducting all expenditures from income.

B) the balance of an individual's funds on deposit at a bank at the end of a period.

C) the amount left over after deducting expenditure from income after we add back items that may be regarded as an investment.

D) both a and b

A) the amount left over after deducting all expenditures from income.

B) the balance of an individual's funds on deposit at a bank at the end of a period.

C) the amount left over after deducting expenditure from income after we add back items that may be regarded as an investment.

D) both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

14

A loan is made to a borrower at a specified nominal interest rate. In order for the loan to be fully repaid over a specified term:

A) periodic repayments would be the same whether they were made at the start or end of each period.

B) periodic repayments would be greater if they were made at the start rather than at the end of each period.

C) periodic repayments would be greater if they were made at the end rather than at the start of each period.

D) whether periodic repayments would be greater if they were made at the start or at the end of each period would depend on the specified interest rate.

A) periodic repayments would be the same whether they were made at the start or end of each period.

B) periodic repayments would be greater if they were made at the start rather than at the end of each period.

C) periodic repayments would be greater if they were made at the end rather than at the start of each period.

D) whether periodic repayments would be greater if they were made at the start or at the end of each period would depend on the specified interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

15

NPV is:

A) the comparison of what is proposed to be outlaid or invested in today's dollars with what the investment is predicted to return in today's dollars.

B) the sum of the future value of cash inflows less cash outflows.

C) both a and b

D) positive at all discount rates greater than the IRR.

A) the comparison of what is proposed to be outlaid or invested in today's dollars with what the investment is predicted to return in today's dollars.

B) the sum of the future value of cash inflows less cash outflows.

C) both a and b

D) positive at all discount rates greater than the IRR.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

16

The NPV of an investment requiring an initial outlay of $10,000 at a discount rate of 6% which provides end-of-year cash flows of; year 1 - $3,000 (inflow), year 2 - $11,000 (inflow), year 3 - $1,500 (outflow) and year 4 - $7,000 (inflow) will be approximately:

A) $6,163.

B) $6,905.

C) $9,424.

D) $19,500.

A) $6,163.

B) $6,905.

C) $9,424.

D) $19,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is generally true about the calculation of an individual's equity or net worth ratio?

A) For a young person or couple, it is expected that their equity ratio would be relatively low as they are likely to have a relatively high level of debt.

B) For a young person or couple, it is expected that their equity ratio would be relatively high as they are likely to have a relatively low level of debt.

C) The ratio shows the percentage of net worth to total assets.

D) Both a and c

A) For a young person or couple, it is expected that their equity ratio would be relatively low as they are likely to have a relatively high level of debt.

B) For a young person or couple, it is expected that their equity ratio would be relatively high as they are likely to have a relatively low level of debt.

C) The ratio shows the percentage of net worth to total assets.

D) Both a and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

18

The debt-service ratio shows monthly debt commitments as a percentage of:

A) before-tax monthly income.

B) total liabilities.

C) after-tax monthly income.

D) none of the above.

A) before-tax monthly income.

B) total liabilities.

C) after-tax monthly income.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

19

An investment providing a nominal interest rate of 6% p.a. compounded monthly is equivalent to an effective interest rate of:

A) less than 6%.

B) equal to 6%.

C) more or less than 6% depending on the investment term .

D) none of the above.

A) less than 6%.

B) equal to 6%.

C) more or less than 6% depending on the investment term .

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

20

A rational response in relation to an investment involving time preference for money issues is to prefer to receive a given sum of money earlier rather than later because:

A) there is a greater chance that the entity promising you the money may not fulfil the promise the longer the waiting period.

B) the earlier the money is received the earlier the ability to reinvest and earn a rate of return on such funds.

C) the earlier the money is received the earlier the ability to use the funds for current consumption.

D) all of the above.

A) there is a greater chance that the entity promising you the money may not fulfil the promise the longer the waiting period.

B) the earlier the money is received the earlier the ability to reinvest and earn a rate of return on such funds.

C) the earlier the money is received the earlier the ability to use the funds for current consumption.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

21

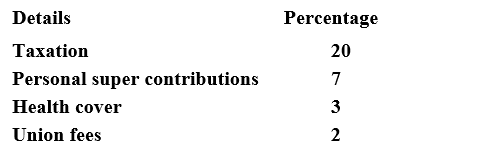

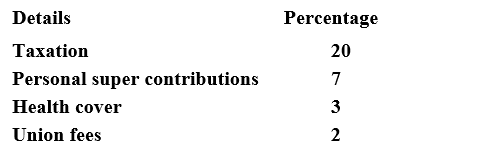

One of your financial planning clients, Ms Yvette Bordeaux has asked you to prepare specified personal financial statements on her behalf. Yvette is a 33 year-old employed landscape gardener and has a gross income of $55,000 for the 2014 financial year. In addition, Yvette's employer also contributes 9.25% of her gross income into a personal superannuation fund that you have set up to fund her retirement. Fortnightly salary deductions (based on gross income) for Yvette are as follows:

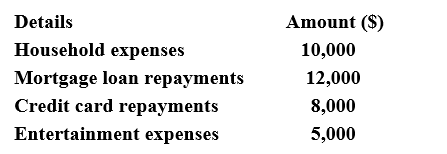

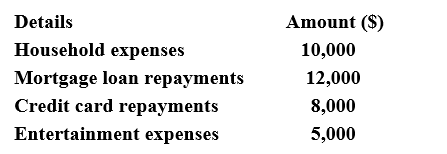

Other expenditures incurred by Yvette for the 2014 financial year are as follows:

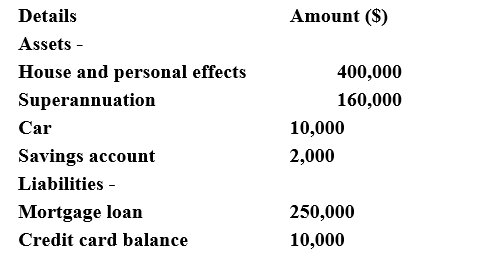

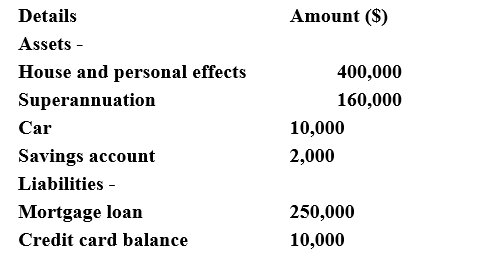

Yvette has also provided a list of her assets and liabilities based on the information that she currently has available as shown below:

(a) Prepare a personal cash flow budget for Yvette for the 2014 financial year based on the information provided.

(b) Prepare a current personal balance sheet for Yvette based on the information provided.

Other expenditures incurred by Yvette for the 2014 financial year are as follows:

Yvette has also provided a list of her assets and liabilities based on the information that she currently has available as shown below:

(a) Prepare a personal cash flow budget for Yvette for the 2014 financial year based on the information provided.

(b) Prepare a current personal balance sheet for Yvette based on the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

22

Briefly explain the relationship between the 'time preference for money' concept and opportunity costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

23

You were looking for a loan and had secured the following three quotes from local banks.

1) bank A: 10.45% p.a., compounded monthly

2) bank B: 10.6% p.a., compounded quarterly

3) bank C: 11% p.a., compounded annually

Which bank offers the best loan deal?

1) bank A: 10.45% p.a., compounded monthly

2) bank B: 10.6% p.a., compounded quarterly

3) bank C: 11% p.a., compounded annually

Which bank offers the best loan deal?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

24

Outline circumstances where the NPV form of investment analysis is preferred to using the IRR method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

25

Outline the concept of a household's net worth and discuss some of the principal items that are likely to form part of this calculation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

26

Anne Herriman is seeking to purchase a motor vehicle for approximately $10,000 and requires finance in order to complete the purchase. She has recently visited the following financiers who have each approved finance for an amount of $10,000 on the following terms and conditions:

Ezy Credit: 3 year loan with end of month repayments of $350 and a loan establishment fee of $100 payable upon loan acceptance, Spinner Financing: 2 year loan with end of month repayments of $500, and Low Doc Loans: 3 year loan with end of quarter repayments of $1,050 and a loan establishment fee of $150 payable upon loan acceptance.

As Anne has become confused as to which finance alternative is best given the different terms and conditions of each financier she has sought your assistance and advice.

a) On what financial basis should Anne seek to differentiate and select between the different financiers?

b) With the assistance of a financial calculator and your previous discussion in part (a) of this question, advise Anne as to the preferred finance alternative.

Ezy Credit: 3 year loan with end of month repayments of $350 and a loan establishment fee of $100 payable upon loan acceptance, Spinner Financing: 2 year loan with end of month repayments of $500, and Low Doc Loans: 3 year loan with end of quarter repayments of $1,050 and a loan establishment fee of $150 payable upon loan acceptance.

As Anne has become confused as to which finance alternative is best given the different terms and conditions of each financier she has sought your assistance and advice.

a) On what financial basis should Anne seek to differentiate and select between the different financiers?

b) With the assistance of a financial calculator and your previous discussion in part (a) of this question, advise Anne as to the preferred finance alternative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

27

Ms. Alicia Weir has been able to accumulate $10,000 in savings from her end-of-month salary and is seeking to invest this amount plus the regular monthly salary savings of $400 into a suitable investment. Given her risk profile, the People's Preference Credit Union has been selected as the best financial intermediary to place her funds. The credit union has offered her a high-interest savings account with an interest rate of 8% compounded monthly for the next 4 years for the investment of Alicia's accumulated and ongoing savings.

a) What effective interest rate will Alicia be earning on her funds?

b) What is the expected balance of the high-interest savings account at the end of the 4-year term?

a) What effective interest rate will Alicia be earning on her funds?

b) What is the expected balance of the high-interest savings account at the end of the 4-year term?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

28

Briefly outline a situation where a reverse mortgage may be a suitable option for a person.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

29

As an experienced financial adviser you are often asked to provide assistance to people who are contemplating taking out a new credit card or transferring their existing credit card facilities from one lender to another. Often the lender provides 'financial incentives' to the applicant to encourage them to undertake such borrowing arrangements including; credit limit increases, honeymoon rates and cash back offers. Outline what these 'financial incentives' provide to the potential applicant and the considerations that they should assess prior to undertaking any of these credit arrangements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

30

Ms Claire Samba is assessing a proposed 4-year investment requiring an initial outlay of $200,000. From her analysis she has predicted future end-of-year operating cash flows arising from the investment as follows: year 1 - $12,000 (cash inflow); year 2 - $30,000 (cash inflow); year 3 - $60,000 (cash inflow) and year 4 - $25,000 (cash outflow).

At the end of year 4 Claire also expects to realise $280,000 from the sale of the investment. As Claire's trusted adviser you have assessed the risk of the investment being 9% p.a. compounded monthly.

Would you recommend Claire proceed with the investment based on the information provided?

At the end of year 4 Claire also expects to realise $280,000 from the sale of the investment. As Claire's trusted adviser you have assessed the risk of the investment being 9% p.a. compounded monthly.

Would you recommend Claire proceed with the investment based on the information provided?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck

31

Mr Rick Martinio is seeking to invest $50,000 today over a 5-year period to obtain the maximum possible fixed interest return. All interest accrued from each fixed interest investment will be payable upon maturity of the investment. The Wacpac Bank has offered Rick an interest rate of 5% p.a. compounded on a 6-monthly basis over a 3-year period. This bank charges an exit fee of $300 on the maturity of any fixed interest investment. At the end of year 3 Rick expects to be able to reinvest the accumulated proceeds into a 2-year fixed interest investment with Wacpac at an annual interest rate of 7% p.a. Rick has also been provided a quote from the National Provincial Bank which provides for a 4-year fixed interest investment at a rate of 6% p.a. and charges a one-off fee of $600 for any fixed interest investments undertaken by an entity within a 5-year period. Both banks offer fixed interest investments having terms of 1 to 4 years.

What interest rate would Rick need to earn in year 5 with the National Provincial Bank in order to be competitive with the fixed interest investment offerings of the Wacpac Bank? Hint: Use a financial calculator to assist if seeking to calculate an Internal Rate of Return (IRR).

What interest rate would Rick need to earn in year 5 with the National Provincial Bank in order to be competitive with the fixed interest investment offerings of the Wacpac Bank? Hint: Use a financial calculator to assist if seeking to calculate an Internal Rate of Return (IRR).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 31 في هذه المجموعة.

فتح الحزمة

k this deck