Deck 18: Working Capital Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/146

العب

ملء الشاشة (f)

Deck 18: Working Capital Management

1

Within the context of working capital management:

A)as the firm increases its investment in working capital,there is a corresponding increase in its profits.

B)current liabilities provide a flexible means of financing the firm's fluctuating needs for assets.

C)the use of current liabilities or short-term debt as opposed to long-term debt subjects the firm to less risk of illiquidity.

D)all of the above.

A)as the firm increases its investment in working capital,there is a corresponding increase in its profits.

B)current liabilities provide a flexible means of financing the firm's fluctuating needs for assets.

C)the use of current liabilities or short-term debt as opposed to long-term debt subjects the firm to less risk of illiquidity.

D)all of the above.

B

2

An increase in ________ would increase net working capital.

A)plant and equipment

B)accounts payable

C)accounts receivable

D)both B and C

A)plant and equipment

B)accounts payable

C)accounts receivable

D)both B and C

C

3

In general,the greater a firm's reliance upon short-term debt or current liabilities,the lower the:

A)liquidity.

B)flexibility.

C)certainty of interest costs.

D)both A and C.

A)liquidity.

B)flexibility.

C)certainty of interest costs.

D)both A and C.

D

4

Which of the following will reduce the liquidity of a firm? An increase in:

A)short-term notes payable.

B)accounts payable.

C)current assets.

D)both A and B.

A)short-term notes payable.

B)accounts payable.

C)current assets.

D)both A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

5

J.B.'s Wholesale Club has current assets of $12.25 million and current liabilities of $14 million.Which of the following is possible.

A)J.B.makes efficient use of its current assets.

B)J.B.may be at some risk of being unable to pay its bills.

C)J.B.appears to be overinvesting in current assets.

D)Either or both A and B may be true.

A)J.B.makes efficient use of its current assets.

B)J.B.may be at some risk of being unable to pay its bills.

C)J.B.appears to be overinvesting in current assets.

D)Either or both A and B may be true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

6

Within the context of working capital management,the risk-return trade-off involves an increased risk of illiquidity versus increased profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

7

The risk of a firm not being able to pay its bills on time is called:

A)illiquidity.

B)insolvency.

C)capital inadequacy.

D)float.

A)illiquidity.

B)insolvency.

C)capital inadequacy.

D)float.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

8

Net working capital refers to which of the following?

A)Current assets

B)Current assets minus current liabilities

C)Current assets minus inventory

D)Current assets divided by current liabilities

E)Current assets minus inventory divided by current liabilities

A)Current assets

B)Current assets minus current liabilities

C)Current assets minus inventory

D)Current assets divided by current liabilities

E)Current assets minus inventory divided by current liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is most likely to occur if a firm under-invests in net working capital?

A)The firm might not have sufficient cash to pay its bill in a timely manner.

B)The firm might not have adequate inventory to meet the needs of its customers.

C)The firm could be losing sales because its terms of sale are too strict.

D)All of the above.

A)The firm might not have sufficient cash to pay its bill in a timely manner.

B)The firm might not have adequate inventory to meet the needs of its customers.

C)The firm could be losing sales because its terms of sale are too strict.

D)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

10

A decrease in ________ would increase net working capital.

A)accounts payable

B)accounts receivable

C)cash

D)equipment

A)accounts payable

B)accounts receivable

C)cash

D)equipment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

11

Total assets must equal the sum of which sources of financing?

A)Spontaneous

B)Temporary

C)Permanent

D)Spontaneous,temporary and permanent

A)Spontaneous

B)Temporary

C)Permanent

D)Spontaneous,temporary and permanent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following could offset the higher risk exposure a company would face if it s current ratio and net working capital were relatively low.?

A)Its current assets would need to be highly liquid.

B)Its accounts receivable collection policy could increase the average collection period.

C)It could offer no discounts for early payment by its customers.

D)It could buy back some of its shares in the open market in order to reduce its equity.

A)Its current assets would need to be highly liquid.

B)Its accounts receivable collection policy could increase the average collection period.

C)It could offer no discounts for early payment by its customers.

D)It could buy back some of its shares in the open market in order to reduce its equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

13

P.Noel's Inc.'s current ratio is 2.Current liabilities are $500,000.P.Noel's current assets equal ________ and net working capital is ________.

A)$500,000 and $1,000,000

B)$500,000 and $250,000

C)$1,000,000 and $500,000

D)$500,000 and $500,000

A)$500,000 and $1,000,000

B)$500,000 and $250,000

C)$1,000,000 and $500,000

D)$500,000 and $500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

14

An increase in ________ would increase a firm's liquidity.

A)notes payable

B)inventories

C)cash

D)both B and C

A)notes payable

B)inventories

C)cash

D)both B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

15

Net working capital provides a very useful summary measure of a firm's short-term financing decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

16

Working capital refers to investment in current assets,while net working capital is the difference between current assets and current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is most likely to occur if a firm over-invests in net working capital?

A)The current ratio will be lower than it should be.

B)The quick ratio will be lower than it should be.

C)The return on investment will be lower than it should be.

D)The times interest earned ratio will be lower than it should be.

A)The current ratio will be lower than it should be.

B)The quick ratio will be lower than it should be.

C)The return on investment will be lower than it should be.

D)The times interest earned ratio will be lower than it should be.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following would be considered an issue that is related to the management of working capital?

A)How much inventory should the firm maintain?

B)How should a firm finance its current assets?

C)To whom should the firm grant trade credit?

D)All of the above

A)How much inventory should the firm maintain?

B)How should a firm finance its current assets?

C)To whom should the firm grant trade credit?

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

19

Solstice Corporation has current assets of $10 million and current liabilities of $8 million.Solstice's current ratio is ________ and its net working capital is ________.

A)1.25,$10 million

B)1.25,$2 million

C)2,$1.25 million

D).8, ($2 million)

A)1.25,$10 million

B)1.25,$2 million

C)2,$1.25 million

D).8, ($2 million)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

20

Managing a firm's liquidity is basically the same as managing a firm's net working capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

21

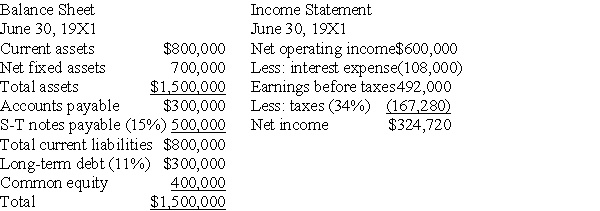

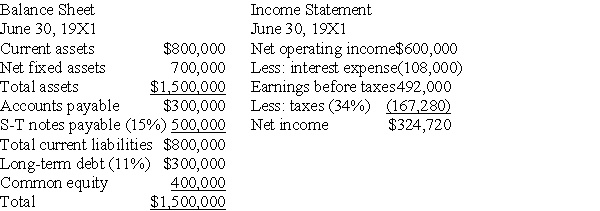

On June 30,19X1,the Alexander Bosh Coffee Co.'s balance sheet and income statement are as follows:

a.Calculate the current ratio and net working capital for Alexander Bosh.

b.Recalculate the ratios from (a)and assess the change in the firm's liquidity if the firm plans to issue $500,000 in common stock and use the proceeds to retire the firm's notes payable.

c.What effect would the change proposed in question b have on return on common equity (net income/common equity)?

a.Calculate the current ratio and net working capital for Alexander Bosh.

b.Recalculate the ratios from (a)and assess the change in the firm's liquidity if the firm plans to issue $500,000 in common stock and use the proceeds to retire the firm's notes payable.

c.What effect would the change proposed in question b have on return on common equity (net income/common equity)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

22

What is the conventional method for financing permanent levels of accounts receivable and inventory?

A)Bonds and equity

B)Short-term loans

C)Accounts payable and accrued expenses

D)Equity only

A)Bonds and equity

B)Short-term loans

C)Accounts payable and accrued expenses

D)Equity only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

23

Accounts payable is considered a:

A)spontaneous liability.

B)temporary financing source.

C)permanent financing source.

D)both A and B.

A)spontaneous liability.

B)temporary financing source.

C)permanent financing source.

D)both A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is considered to be a spontaneous source of financing?

A)Operating leases

B)Accounts receivable

C)Inventory

D)Accounts payable

A)Operating leases

B)Accounts receivable

C)Inventory

D)Accounts payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

25

Current assets of NorthPole.com at the end of each quarter were: 1st quarter $1.3 million,2nd quarter $1.7 million,3rd quarter $1.5 million and 4th quarter $2.2 million.The best estimate for North Pole's permanent current assets is:

A)$2.2 million.

B)$1.675 million.

C)$1.3 million.

D)$0.9 million.

A)$2.2 million.

B)$1.675 million.

C)$1.3 million.

D)$0.9 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

26

Disadvantages of using current liabilities as opposed to long-term debt include:

A)greater risk of illiquidity.

B)uncertainty of interest costs.

C)higher cash flow exposure.

D)both A and B.

A)greater risk of illiquidity.

B)uncertainty of interest costs.

C)higher cash flow exposure.

D)both A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is NOT a spontaneous source of financing?

A)Accrued salaries payable

B)Loans secured by accounts receivable

C)Accrued taxes payable

D)Accounts payable

A)Accrued salaries payable

B)Loans secured by accounts receivable

C)Accrued taxes payable

D)Accounts payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

28

According to the self-liquidating debt principle permanent assets should be financed with ________ liabilities.

A)permanent

B)spontaneous

C)current

D)fixed

A)permanent

B)spontaneous

C)current

D)fixed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

29

Spontaneous sources of financing include:

A)marketable securities.

B)accruals.

C)bonds.

D)commercial paper.

A)marketable securities.

B)accruals.

C)bonds.

D)commercial paper.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

30

Gamma,Inc.plans to sell $1 million in 270-day-maturity commercial paper on which it will pay discounted interest at an annual rate of 12%.In addition,Gamma expects to incur a cost of $1,000 in dealer placement fees and other expenses to issue the paper.What is the effective cost of the paper to Gamma?

A)12.22%

B)12.78%

C)13.20%

D)13.35%

A)12.22%

B)12.78%

C)13.20%

D)13.35%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

31

A toy manufacturer following the self-liquidating debt.principle will generally finance seasonal inventory build-up prior to the Christmas season with:

A)common stock.

B)selling equipment.

C)trade credit.

D)preferred stock.

A)common stock.

B)selling equipment.

C)trade credit.

D)preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

32

With respect to working capital policy,firms most often employ:

A)a cautious approach which finances short-term assets with long-term financing.

B)the principle of self-liquidating debt.

C)an aggressive approach which finances long-term assets with short-term financing.

D)the principle of liquidity optimization.

A)a cautious approach which finances short-term assets with long-term financing.

B)the principle of self-liquidating debt.

C)an aggressive approach which finances long-term assets with short-term financing.

D)the principle of liquidity optimization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

33

Commercial paper:

A)rates are generally higher than rates on bank loans and comparable sources of short-term financing.

B)generally has a minimum compensating balance requirement.

C)offers the firm with very large credit needs a single source for all its short-term financing.

D)has all of the properties stated above.

A)rates are generally higher than rates on bank loans and comparable sources of short-term financing.

B)generally has a minimum compensating balance requirement.

C)offers the firm with very large credit needs a single source for all its short-term financing.

D)has all of the properties stated above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

34

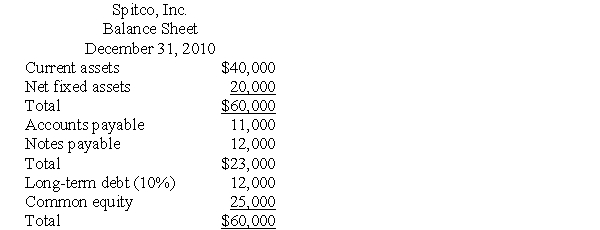

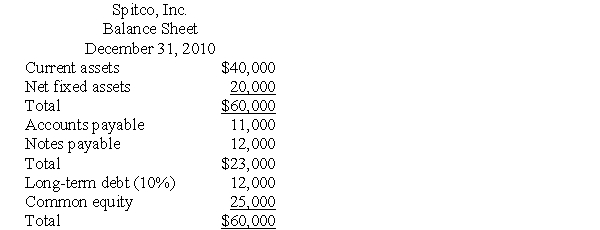

The December 31,1995 balance sheet for Spitco,Inc.is presented below.

a.Calculate Spitco's current ratio,and net working capital.

b.Spitco feels that its current ratio is too far below the industry average of 2.40.To improve their liquidity,the treasurer of Spitco has devised a plan to issue $12,000 in long-term debt at 12% and pay off its notes payable.The funds would be invested in marketable securities at 7% interest when not needed to finance the firm's seasonal asset needs.The notes payable would remain outstanding through the year.Assume this plan had been implemented for 2010.Calculate what the firm's current ratio,and net working capital would have been.

c.Did Spitco improve their liquidity? What do you think happened to Spitco's return on investment?

a.Calculate Spitco's current ratio,and net working capital.

b.Spitco feels that its current ratio is too far below the industry average of 2.40.To improve their liquidity,the treasurer of Spitco has devised a plan to issue $12,000 in long-term debt at 12% and pay off its notes payable.The funds would be invested in marketable securities at 7% interest when not needed to finance the firm's seasonal asset needs.The notes payable would remain outstanding through the year.Assume this plan had been implemented for 2010.Calculate what the firm's current ratio,and net working capital would have been.

c.Did Spitco improve their liquidity? What do you think happened to Spitco's return on investment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is most consistent with the self-liquidating debt principle in working capital management?

A)Fixed assets should be financed with short-term notes payable.

B)Inventory should be financed with preferred stock.

C)Accounts receivable should be financed with short-term lines of credit.

D)Borrow on a floating rate basis to finance investments in permanent assets.

A)Fixed assets should be financed with short-term notes payable.

B)Inventory should be financed with preferred stock.

C)Accounts receivable should be financed with short-term lines of credit.

D)Borrow on a floating rate basis to finance investments in permanent assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is NOT considered a permanent source of financing?

A)Corporate bonds

B)Common stock

C)Preferred stock

D)Commercial paper

A)Corporate bonds

B)Common stock

C)Preferred stock

D)Commercial paper

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

37

With regard to the self-liquidating debt,which of the following assets should be financed with permanent sources of financing?

A)Machinery

B)Expansion of inventory to meet seasonal demands

C)Machinery and expansion of inventory to meet seasonal demands

D)Minimum level of accounts receivable required year round,machinery,and minimum level of cash required for year-round operations

A)Machinery

B)Expansion of inventory to meet seasonal demands

C)Machinery and expansion of inventory to meet seasonal demands

D)Minimum level of accounts receivable required year round,machinery,and minimum level of cash required for year-round operations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is most likely to be a temporary source of financing?

A)Commercial paper

B)Preferred stock

C)Long-term debt

D)All of the above

A)Commercial paper

B)Preferred stock

C)Long-term debt

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

39

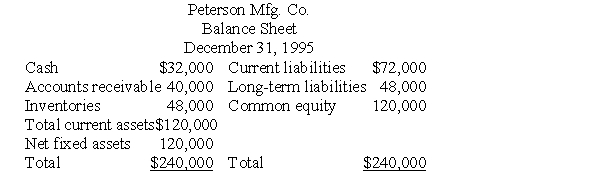

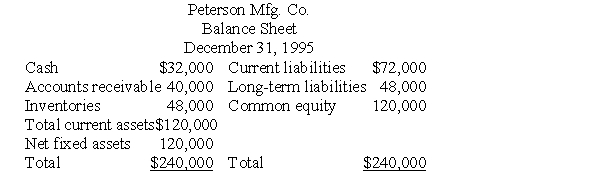

The balance sheet for Peterson Manufacturing Company is presented below.

During 2009,the firm earned $28,000 after taxes based on net sales of $480,000.

a.Calculate Peterson's current ratio and net working capital.

b.Assume that Peterson's uses $20,000 of its cash to reduce current liabilities.Recompute the current ratio and net working capital.

c.What effect,if any,does the change proposed in question b have on Peterson's liquidity.

During 2009,the firm earned $28,000 after taxes based on net sales of $480,000.

a.Calculate Peterson's current ratio and net working capital.

b.Assume that Peterson's uses $20,000 of its cash to reduce current liabilities.Recompute the current ratio and net working capital.

c.What effect,if any,does the change proposed in question b have on Peterson's liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

40

A quite risky working capital management policy would have a high ratio of:

A)short-term debt to bonds and equity.

B)short-term debt to total debt.

C)bonds to property,plant,and equipment.

D)short-term debt to equity.

A)short-term debt to bonds and equity.

B)short-term debt to total debt.

C)bonds to property,plant,and equipment.

D)short-term debt to equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

41

All else equal,which of the following is the most likely to occur if actual sales are much less than forecasted sales?

A)The company will be in a better position to pay down most of its debt.

B)The firm's actual investment in inventory will be unchanged from the amount forecasted.

C)Accounts receivable will rise significantly above the forecast.

D)The company might face a cash flow crunch.

A)The company will be in a better position to pay down most of its debt.

B)The firm's actual investment in inventory will be unchanged from the amount forecasted.

C)Accounts receivable will rise significantly above the forecast.

D)The company might face a cash flow crunch.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

42

Short-term debt is frequently less expensive because it provides the borrower more security.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

43

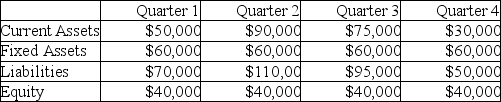

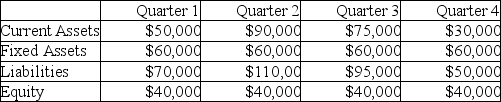

Summary data from the quarterly balance sheets of ACH Air Conditioners are shown below.

.

a.If ACH follows the self liquidating debt principle,how much long-term debt will be used to finance current assets? Explain your answer briefly.

b.What would be the highest and lowest levels of temporary debt?

.

a.If ACH follows the self liquidating debt principle,how much long-term debt will be used to finance current assets? Explain your answer briefly.

b.What would be the highest and lowest levels of temporary debt?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

44

Accrued wages are considered an unsecured,non-spontaneous source of financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

45

King Co.'s inventory turnover ratio is 12.It's inventory conversion period is:

A)12 days.

B)30.4 days.

C)2.5 days.

D)There is not enough information.

A)12 days.

B)30.4 days.

C)2.5 days.

D)There is not enough information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

46

If management expects interest rates to rise and credit to tighten in the near future,it should consider:

A)increasing its use of commercial paper and loans secured by current assets.

B)decreasing the use of spontaneous financing.

C)decreasing the level of permanent financing.

D)increasing the level of permanent financing.

A)increasing its use of commercial paper and loans secured by current assets.

B)decreasing the use of spontaneous financing.

C)decreasing the level of permanent financing.

D)increasing the level of permanent financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

47

Issuers of commercial paper usually maintain lines of credit with banks to back up their short-term financing needs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following is a spontaneous source of financing?

A)Accrued wages

B)Preferred stock

C)Trade credit

D)Both A and C

A)Accrued wages

B)Preferred stock

C)Trade credit

D)Both A and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

49

The use of short-term debt provides flexibility in financing since the firm is only paying interest when it is actually using the borrowed funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

50

The primary sources of collateral for short-term secured loans are accounts receivable and inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

51

Increasing the use of short-term debt versus long-term debt financing will increase profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

52

Within the context of working capital management,the risk-return trade-off involves an increased risk of illiquidity versus increased profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

53

L.Stevens Inc.uses long-term to cover its peak level of current assets.When it does not need the money to finance inventories and accounts receivable,it invests the excess funds in short-term certificates of deposit.What are the advantages and disadvantages of this policy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

54

Trade credit is a source of spontaneous financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

55

Trade credit appears on a company's balance sheet as accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

56

Trade credit is an example of which of the following sources of financing?

A)Spontaneous

B)Temporary

C)Permanent

D)Both A and B

A)Spontaneous

B)Temporary

C)Permanent

D)Both A and B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following types of financing offers the firm the greatest degree of flexibility?

A)Bonds

B)Preferred stock

C)Short-term lines of credit

D)Long-term notes payable

A)Bonds

B)Preferred stock

C)Short-term lines of credit

D)Long-term notes payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

58

Prince Co.'s inventory turnover ratio is 30.4.It's inventory conversion period is:

A)12 days.

B)30.4 days.

C)2.5 days.

D)There is not enough information.

A)12 days.

B)30.4 days.

C)2.5 days.

D)There is not enough information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

59

A firm can reduce net working capital by substituting long-term financing,such as bonds,with short-term financing,such as a one-year notes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

60

Notes payable is a spontaneous source of financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

61

As the inventory turnover ratio decreases,the inventory conversion cycle increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following statements regarding a line of credit is true?

A)The purpose for which the money is being borrowed must be stated by the borrower.

B)A line of credit agreement usually fixes the interest rate that will be applied to any extensions of credit.

C)A line of credit agreement is a legal commitment on the part of the bank to provide the stated credit.

D)Such agreements usually cover the borrower's fiscal year.

A)The purpose for which the money is being borrowed must be stated by the borrower.

B)A line of credit agreement usually fixes the interest rate that will be applied to any extensions of credit.

C)A line of credit agreement is a legal commitment on the part of the bank to provide the stated credit.

D)Such agreements usually cover the borrower's fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

63

Becker.com has an inventory turnover ratio of 52,an accounts receivable balance of $365,000,average daily credit sales of $36,500,accounts payable of $182,500 and cost of goods sold of $7,993,500.What is Becker's cash conversion cycle to the nearest day?

A)17 days

B)61 days

C)27 days

D)-27 days

A)17 days

B)61 days

C)27 days

D)-27 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

64

The correct equation for calculating the cost of short-term credit is:

A)rate = interest/(principal × time).

B)rate = (principal × time)/interest.

C)rate = principal/(time × interest).

D)rate = principal × interest × time.

A)rate = interest/(principal × time).

B)rate = (principal × time)/interest.

C)rate = principal/(time × interest).

D)rate = principal × interest × time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

65

Becker.com has an inventory turnover ratio of 52,an accounts receivable balance of $365,000,average daily credit sales of $36,500,accounts payable of $182,500 and cost of goods sold of $7,993,500.What is Becker's operating cycle to the nearest day?

A)17 days

B)61 days

C)27 days

D)-27 days

A)17 days

B)61 days

C)27 days

D)-27 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

66

Abbot Corporation has an average collection period of 49 days,an inventory conversion period of 83 days,and a payables deferrable period of 36 days.What is Abbott's cash conversion cycle?

A)96 days

B)70 days

C)85 days

D)132 days

A)96 days

B)70 days

C)85 days

D)132 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

67

The operating cycle can never be longer than the cash conversion cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

68

A firm buys on terms of 3/10,net 30.What is the cost of trade credit under these terms?

A)55.7%

B)47.4%

C)31.5%

D)23.2%

A)55.7%

B)47.4%

C)31.5%

D)23.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

69

It is not possible to have a negative cash conversion cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

70

Frosty's Frozen Food Inc.'s inventory balance is $1.22 million.Frosty's Cost of Good's Sold is $30.4 million.It's inventory conversion period:

A)12 days.

B)24.92 days.

C)14.65 days.

D)299.2 days.

A)12 days.

B)24.92 days.

C)14.65 days.

D)299.2 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

71

Increasing the accounts payable deferral period also increases the cash conversion cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

72

ViteS Equipment Company has increased its inventory turnover ratio from 12 to 18.By how many days has it reduced the operating cycle?

A)20 days

B)6 days

C)10 days

D)1.5 days

A)20 days

B)6 days

C)10 days

D)1.5 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

73

A& B Global's annual credit sales are $18 million;the accounts receivable balance is $1.5 million;the cost of goods sold is $12.6 million;the inventory balance is $350,000,and the balance in accounts payable is $700,000.

a.Compute A&B's operating cycle.

b.Compute A&B's cash conversion cycle.

a.Compute A&B's operating cycle.

b.Compute A&B's cash conversion cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which item would constitute poor collateral for an inventory loan?

A)Lumber

B)Vegetables

C)Copper

D)Chemicals

A)Lumber

B)Vegetables

C)Copper

D)Chemicals

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

75

Clark Corporation has an average collection period of 7 days,an inventory conversion period of 30 days,and a payables deferrable period of 60 days.What is Clark's cash conversion cycle?

A)97 days

B)37 days

C)23 days

D)-23 days

A)97 days

B)37 days

C)23 days

D)-23 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

76

Clark Corporation has an average collection period of 7 days,an inventory conversion period of 30 days,and a payables deferrable period of 60 days.What is Clark's operating cycle?

A)97 days

B)37 days

C)23 days

D)-23 days

A)97 days

B)37 days

C)23 days

D)-23 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following is an advantage of using commercial paper for short-term credit?

A)The ability of some firms to obtain large amounts of credit

B)A readily available source of credit for most firms

C)It is a type of free credit

D)It can be issued for very small amounts

A)The ability of some firms to obtain large amounts of credit

B)A readily available source of credit for most firms

C)It is a type of free credit

D)It can be issued for very small amounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

78

Abbot Corporation has an average collection period of 49 days,an inventory conversion period of 83 days,and a payables deferrable period of 36 days.What is Abbott's operating cycle?

A)96 days

B)70 days

C)85 days

D)132 days

A)96 days

B)70 days

C)85 days

D)132 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

79

Queen Co.'s balance in accounts receivable is $240,000.Annual credit sales are $2,880,000.Queen's average collection period is:

A)12 days.

B)30.4 days.

C)2.5 days.

D)There is not enough information.

A)12 days.

B)30.4 days.

C)2.5 days.

D)There is not enough information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

80

Currier & Ive's Lithography has a Cost of Goods Sold of $60.8 million.The company's accounts payable balance is $7.5 million.It's accounts payable deferral period is:

A)81 days.

B)45 days.

C)8.11 days.

D)48.7 days.

A)81 days.

B)45 days.

C)8.11 days.

D)48.7 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck