Deck 9: Capital Investment Decisions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

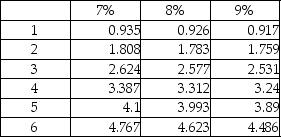

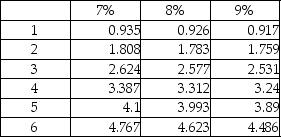

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/122

العب

ملء الشاشة (f)

Deck 9: Capital Investment Decisions

1

Two methods of analyzing potential capital investments-payback and accounting rate of return-ignore the time value of money.

True

2

Which of the following best describes a post-audit in capital budgeting?

A) an audit of an operating unit of a company

B) an audit performed after financial statements have been issued

C) an analysis of an investment's cash flows prior to committing to the initial investment

D) a comparison of actual results of capital investments with projected results

A) an audit of an operating unit of a company

B) an audit performed after financial statements have been issued

C) an analysis of an investment's cash flows prior to committing to the initial investment

D) a comparison of actual results of capital investments with projected results

D

3

The accounting rate of return method uses accrual-based accounting income.

True

4

The payback method and the accounting rate of return method are often used to perform an initial screening of investments, rather than a detailed, in-depth analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

5

The acquisition or construction of a capital asset is known as a capital investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is true of projecting future cash flows of an investment?

A) Information on cash flow will also include non-cash transactions like depreciation.

B) Cash inflows and cash outflows are treated separately, rather than being netted together.

C) Cash flows are projected by accounting personnel without considering input from other business functions.

D) The initial investment is always treated separately from all other cash flows.

A) Information on cash flow will also include non-cash transactions like depreciation.

B) Cash inflows and cash outflows are treated separately, rather than being netted together.

C) Cash flows are projected by accounting personnel without considering input from other business functions.

D) The initial investment is always treated separately from all other cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

7

Most capital budgeting methods focus on cash flows rather than book income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following two methods are typically used for initial screening of investments, rather than for detailed, in-depth analysis?

A) payback and accounting rate of return

B) net present value and payback

C) internal rate of return and net present value

D) accounting rate of return and net present value

A) payback and accounting rate of return

B) net present value and payback

C) internal rate of return and net present value

D) accounting rate of return and net present value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is a capital budgeting method that is used to screen potential investments?

A) return on assets

B) acid test ratio

C) accounting rate of return

D) debt-to-equity ratio

A) return on assets

B) acid test ratio

C) accounting rate of return

D) debt-to-equity ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

10

Net present value and internal rate of return consider the time value of money, so they are appropriate for longer-term capital investments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

11

To determine the investment's net cash inflows, the inflows are netted against the investment's initial cash outflow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is a capital budgeting method?

A) return on assets

B) net present value

C) inventory turnover

D) return on equity

A) return on assets

B) net present value

C) inventory turnover

D) return on equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following describes the word "capital budgeting"?

A) It involves budgeting for yearly operational expenses.

B) It involves preparing the sales budget for the coming year.

C) It involves deciding among various long-term investment decisions.

D) It involves analyzing various alternatives of financing available to a company.

A) It involves budgeting for yearly operational expenses.

B) It involves preparing the sales budget for the coming year.

C) It involves deciding among various long-term investment decisions.

D) It involves analyzing various alternatives of financing available to a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

14

Payback provides management with valuable information about the time period within which the cash invested will be recouped.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

15

Capital rationing is a process adopted when a company has limited resources, and it must find ways to reduce operating expenses in all of its divisions and units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

16

An operational asset used for a long period of time is known as a capital asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following best describes the term "capital rationing"?

A) a method of determining the period within which the cash invested is recouped

B) a process of ranking and choosing among alternative capital investments based on the availability of funds

C) a method which shows the effect of the investment on the company's accrual-based income

D) a process of controlling operating costs when adequate funds are not available

A) a method of determining the period within which the cash invested is recouped

B) a process of ranking and choosing among alternative capital investments based on the availability of funds

C) a method which shows the effect of the investment on the company's accrual-based income

D) a process of controlling operating costs when adequate funds are not available

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

18

The payback period and accounting rate of return (ARR) methods are suitable to investments with a short time span.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

19

A post-audit in capital budgeting is a comparison of actual results of capital investments with the projected results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

20

The last step in the capital budgeting process is control which compares the actual results with the projected results. These comparisons are known as:

A) cash inflows.

B) post-audits.

C) ranks.

D) cash outflows

A) cash inflows.

B) post-audits.

C) ranks.

D) cash outflows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

21

The payback considers only those cash flows that occur during the payback period and ignores any cash flows that occur after that period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is a capital budgeting method that ignores the time value of money?

A) payback

B) internal rate of return

C) return on assets

D) net present value

A) payback

B) internal rate of return

C) return on assets

D) net present value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

23

Flip Flop company is considering investing in production-management software that costs $600,000, has $60,000 residual value, and should lead to cost savings of $150,000 per year for its five-year life. Calculate the average amount invested in the asset that should be used for calculating the accounting rate of return?

A) $660,000

B) $600,000

C) $330,000

D) $60,000

A) $660,000

B) $600,000

C) $330,000

D) $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

24

The accounting rate of return method of analyzing a potential capital investment considers the time value of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

25

The payback method uses discounted cash flows to make investment decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

26

The payback method can only be used when the net cash inflows from a capital investment are the same for each period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

27

The accounting rate of return method and the payback method are often used as preliminary screening measures, but are insufficient to fully evaluate a capital investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which capital budgeting method uses accrual accounting, rather than net cash flows, as a basis for calculations?

A) payback

B) accounting rate of return

C) net present value

D) internal rate of return

A) payback

B) accounting rate of return

C) net present value

D) internal rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

29

The accounting rate of return method focuses on net operating income instead of net cash inflow generated by an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

30

The accounting rate of return is also known as average rate of return or annual rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

31

Net cash inflows from a capital investment arise from an increase in revenues, a decrease in expenses, or both.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

32

Cortes Company is considering three investment opportunities with the following payback periods: Use the decision rule for payback to rank the projects from most desirable to least desirable, all else being equal.

A) Y, Z, X

B) X, Y, Z

C) Z, Y, X

D) Y, X, Z

A) Y, Z, X

B) X, Y, Z

C) Z, Y, X

D) Y, X, Z

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

33

Capital budgeting is:

A) the process of planning the investment in long-term assets.

B) preparing the budget for operating expenses.

C) the process of evaluating the profitability of a business.

D) the process of making pricing decisions for products.

A) the process of planning the investment in long-term assets.

B) preparing the budget for operating expenses.

C) the process of evaluating the profitability of a business.

D) the process of making pricing decisions for products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

34

The accounting rate of return method evaluates the lifetime return of an asset, whereas return on investment evaluates an annual return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

35

A major criticism of the payback method is that it focuses only on time to recover the investment, and ignores profitability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

36

Newman Automobiles Manufacturing is considering two alternative investment proposals with the following data:

- Calculate the payback period for Proposal X.

A) 5 years

B) 4 years

C) 8 years

D) 10 years

- Calculate the payback period for Proposal X.

A) 5 years

B) 4 years

C) 8 years

D) 10 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

37

The accounting rate of return is calculated by dividing the average annual operating income by the average amount invested.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

38

All else being equal, investments with longer payback periods are preferable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

39

The payback method is the most thorough and comprehensive way to choose the best investment among alternatives, than any other capital budgeting methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

40

The payback method ignores cash flows that an asset generates, whereas the accounting rate of return includes them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

41

A company is evaluating three possible investments. Following information is provided by the company. What is the payback period for Project A? (Assume that the company uses the straight-line depreciation method.)

A) 3.0 years

B) 2.0 years

C) 4.0 years

D) 5.0 years

A) 3.0 years

B) 2.0 years

C) 4.0 years

D) 5.0 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

42

Caliber Company is considering the purchase of a new machine costing $800,000. The company's management is estimating that the new machine will generate additional cash flows of $180,000 a year for ten years and have a salvage value of $50,000 at the end of ten years. What is the machine's payback period?

A) 4.44 years

B) 6.77 years

C) 3.33 years

D) 5.33 years

A) 4.44 years

B) 6.77 years

C) 3.33 years

D) 5.33 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

43

A company is evaluating three possible investments. Each uses straight-line method of depreciation. Following information is provided by the company.

- What is the accounting rate of return for Project C?

A) 15%

B) 12%

C) 18%

D) 10%

- What is the accounting rate of return for Project C?

A) 15%

B) 12%

C) 18%

D) 10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

44

Paramount Company is considering purchasing new equipment costing $700,000. The company's management has estimated that the equipment will generate cash flows as follows: Residual value is zero. What is the payback period?

A) 4.5 years

B) 3.2 years

C) 3.5 years

D) 3.8 years

A) 4.5 years

B) 3.2 years

C) 3.5 years

D) 3.8 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

45

Clapton Corporation is considering an investment in new equipment costing $900,000. The equipment will be depreciated on a straight-line basis over a ten-year life and is expected to have a salvage value of $90,000. The equipment is expected to generate net cash flows of $140,000 for each of the first five years and $100,000 for each of the last five years. What is the accounting rate of return associated with the equipment investment?

A) 8.89%

B) 9.23%

C) 8.52%

D) 7.88%

A) 8.89%

B) 9.23%

C) 8.52%

D) 7.88%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

46

Logy Inc. is evaluating two possible investments in depreciable plant assets. The company uses the straight-line method of depreciation. The following information is available:

-Calculate the payback period for Investment B.

A) 3 years

B) 2 years

C) 4 years

D) 5 years

-Calculate the payback period for Investment B.

A) 3 years

B) 2 years

C) 4 years

D) 5 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

47

The fact that invested cash earns income over time is called the time value of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

48

An annuity refers to a series of equal cash flows received or paid annually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

49

A company is evaluating three possible investments. Each uses straight-line method of depreciation. Following information is provided by the company.

-What is the accounting rate of return for Project B?

A) 15.08%

B) 10.214%

C) 15.45%

D) 14.54%

-What is the accounting rate of return for Project B?

A) 15.08%

B) 10.214%

C) 15.45%

D) 14.54%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

50

Nylan Company is considering an investment in new equipment costing $850,000. The equipment will be depreciated on a straight-line basis over a five-year life and is expected to have a salvage value of $50,000. The equipment is expected to generate net cash inflows of $1,000,000 in total during the five years life. What is the accounting rate of return associated with the equipment investment?

A) 9.99%

B) 8.89%

C) 7.56%

D) 9.32%

A) 9.99%

B) 8.89%

C) 7.56%

D) 9.32%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

51

The following details are provided by a manufacturing company. Calculate the payback period for the investment.

A) 2.5 years

B) 2.83 year

C) 3.0 years

D) 3.5 years

A) 2.5 years

B) 2.83 year

C) 3.0 years

D) 3.5 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

52

Compound interest assumes that all interest earned will be reinvested at the same rate of interest at which the investment was originally made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

53

Logy Inc. is evaluating two possible investments in depreciable plant assets. The company uses the straight-line method of depreciation. The following information is available:

-Calculate the payback period for Investment A.

A) 3 years

B) 4 years

C) 1 year

D) 5 years

-Calculate the payback period for Investment A.

A) 3 years

B) 4 years

C) 1 year

D) 5 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

54

Landmark Company is considering an investment in new equipment costing $500,000. The equipment will be depreciated on a straight-line basis over a five-year life and is expected to generate net cash inflows of $120,000 the first year, $140,000 the second year, and $150,000 every year thereafter until the fifth year. What is the payback period for this investment? The residual value is zero.

A) 4.5 years

B) 3.6 years

C) 2.9 years

D) 3.2 years

A) 4.5 years

B) 3.6 years

C) 2.9 years

D) 3.2 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

55

Dartis Company is considering investing in a specialized equipment costing $600,000. The equipment has a useful life of 5 years and a residual value of $60,000. Depreciation is calculated using the straight-line method. The expected net cash inflows from the investment are given below. What is the accounting rate of return on the investment?

A) 7.95%

B) 8.78%

C) 8.48%

D) 9.25%

A) 7.95%

B) 8.78%

C) 8.48%

D) 9.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

56

Compound interest means that interest is calculated only on the principal amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

57

Newman Automobiles Manufacturing is considering two alternative investment proposals with the following data:

-Calculate accounting rate of return for Proposal Y.

A) 8.95%

B) 10.21%

C) 7.50%

D) 6.57%

-Calculate accounting rate of return for Proposal Y.

A) 8.95%

B) 10.21%

C) 7.50%

D) 6.57%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

58

All else being equal, the shorter the investment period, the higher the total amount of interest earned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following capital budgeting methods uses accrual accounting information?

A) payback

B) accounting rate of return

C) net present value

D) internal rate of return

A) payback

B) accounting rate of return

C) net present value

D) internal rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

60

Software Hub is deciding whether to purchase new accounting software. The cost of the software package is $55,000, and its expected life is 10 years. The payback for this investment is four years. Assuming equal yearly cash flows, what are the expected annual net cash savings from the new software? (Assume the investment has zero salvage value.)

A) $5,500

B) $37,800

C) $13,750

D) $220,000

A) $5,500

B) $37,800

C) $13,750

D) $220,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

61

John wins the lottery and has the following three payout options for after-tax prize money: 1. $50,000 per year at the end of each of the next six years

2) $300,000 (lump sum) now

3) $500,000 (lump sum) six years from now

The required rate of return is 9%. What is the present value if he selects the third option? Round to nearest whole dollar.

Present value of $1:

A) $250,000

B) $230,000

C) $238,400

D) $298,000

2) $300,000 (lump sum) now

3) $500,000 (lump sum) six years from now

The required rate of return is 9%. What is the present value if he selects the third option? Round to nearest whole dollar.

Present value of $1:

A) $250,000

B) $230,000

C) $238,400

D) $298,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

62

Management's minimum desired rate of return on a capital investment is known as the return on investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

63

The residual value is discounted as a single lump sum because it will be received only once at the end of life of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

64

Nylan Manufacturing is considering two alternative investment proposals with the following details: What is the total present value of future cash inflows from Proposal Y?

Present value of annuity of $1:

A) $266,750

B) $291,600

C) $290,000

D) $250,000

Present value of annuity of $1:

A) $266,750

B) $291,600

C) $290,000

D) $250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

65

Zane has received a prize which entitles him to receive annual payments of $10,000 for the next 10 years. Which of the following is to be referred to in order to calculate the total value of the prize today?

A) Present Value of $1

B) Present Value of an Annuity of $1

C) Future Value of $1

D) Future Value of an Annuity of $1

A) Present Value of $1

B) Present Value of an Annuity of $1

C) Future Value of $1

D) Future Value of an Annuity of $1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following most accurately describes the term annuity?

A) an investment which produces increasing cash flows overtime

B) an installment loan with amortizing principal payments

C) a stream of equal installments of cash flows made at equal time intervals

D) a term life insurance policy

A) an investment which produces increasing cash flows overtime

B) an installment loan with amortizing principal payments

C) a stream of equal installments of cash flows made at equal time intervals

D) a term life insurance policy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

67

Lara is going to receive $10,000 a year at the end of each of the next five years from her insurer to meet her education cost. Using a discount rate of 14%, the present value of the receipts can be stated as:

A) PV = $10,000 (Annuity FV factor, i = 14%, n = 5).

B) PV = $10,000 (PV factor, i = 14%, n = 5).

C) PV = $10,000 (Annuity PV factor, i = 14%, n = 5).

D) PV = $10,000 (FV factor, i = 14%, n = 5).

A) PV = $10,000 (Annuity FV factor, i = 14%, n = 5).

B) PV = $10,000 (PV factor, i = 14%, n = 5).

C) PV = $10,000 (Annuity PV factor, i = 14%, n = 5).

D) PV = $10,000 (FV factor, i = 14%, n = 5).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

68

Net present value is defined as the difference between the present value of the project's net cash inflows and the cost of investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

69

Arriyana has just received an inheritance of $100,000, and she would like to put it into an investment portfolio for 20 years. Which of the following would be useful to calculate the value of the investment at the end of 20 years?

A) Present Value of $1

B) Present Value of an Annuity of $1

C) Future Value of $1

D) Future Value of an Annuity of $1

A) Present Value of $1

B) Present Value of an Annuity of $1

C) Future Value of $1

D) Future Value of an Annuity of $1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

70

John wins the lottery and has the following three payout options for after-tax prize money: 1. $150,000 per year at the end of each of the next six years

2) $300,000 (lump sum) now

3) $500,000 (lump sum) six years from now

The required rate of return is 9%. What is the present value if he selects the first option? Round to nearest whole dollar.

Present value of annuity of $1:

Present value of $1:

A) $750,000

B) $672,900

C) $450,000

D) $450,050

2) $300,000 (lump sum) now

3) $500,000 (lump sum) six years from now

The required rate of return is 9%. What is the present value if he selects the first option? Round to nearest whole dollar.

Present value of annuity of $1:

Present value of $1:

A) $750,000

B) $672,900

C) $450,000

D) $450,050

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

71

If $10,000 is invested annually in an account with 7% interest compounded yearly, what will the balance of the account be after six years? Refer to the following Future Value table: Future value of annuity of $1:

A) $79,050

B) $71,530

C) $18,020

D) $83,290

A) $79,050

B) $71,530

C) $18,020

D) $83,290

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

72

John wins the lottery and has the following three payout options for after-tax prize money: 1. $150,000 per year at the end of each of the next six years

2) $300,000 (lump sum) now

3) $500,000 (lump sum) six years from now

The required rate of return is 9%. What is the present value if he selects the second option? Round to nearest whole dollar.

Present value of $1:

A) $650,000

B) $100,000

C) $400,000

D) $300,000

2) $300,000 (lump sum) now

3) $500,000 (lump sum) six years from now

The required rate of return is 9%. What is the present value if he selects the second option? Round to nearest whole dollar.

Present value of $1:

A) $650,000

B) $100,000

C) $400,000

D) $300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following describes the term time value of money?

A) Money can be used only at certain times and only for certain purposes.

B) Money loses its purchasing power over time through inflation.

C) Wasted time can result in wasted money.

D) Value of a dollar received today will be higher than that received after some time.

A) Money can be used only at certain times and only for certain purposes.

B) Money loses its purchasing power over time through inflation.

C) Wasted time can result in wasted money.

D) Value of a dollar received today will be higher than that received after some time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

74

James has just won the lottery after purchasing one $10 lottery ticket. The state offers him the following three payout options for after-tax prize money:

1. $50,000 per year at the end of each of the next six years

2. $300,000 (lump sum) now

3. $400,000 (lump sum) six years from now

Calculate the present value of each scenario using an 8% discount rate. Round to nearest whole dollar.

Present value of annuity of $1:

Present value of $1:

Present value of $1:

1. $50,000 per year at the end of each of the next six years

2. $300,000 (lump sum) now

3. $400,000 (lump sum) six years from now

Calculate the present value of each scenario using an 8% discount rate. Round to nearest whole dollar.

Present value of annuity of $1:

Present value of $1:

Present value of $1:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

75

Paramount Company is considering purchasing new equipment costing $700,000. The management has estimated that the equipment will generate cash flows as follows: Present value of $1:

The company's required rate of return is 8%. Using the factors in the table, calculate the present value of the cash inflows. (Round all calculations to the nearest whole dollar)

A) $890,000

B) $750,000

C) $850,000

D) $841,000

The company's required rate of return is 8%. Using the factors in the table, calculate the present value of the cash inflows. (Round all calculations to the nearest whole dollar)

A) $890,000

B) $750,000

C) $850,000

D) $841,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

76

Paramount Company is considering purchasing new equipment costing $700,000. Company's management has estimated that the equipment will generate cash flows as follows: The company's required rate of return is 10%. Using the factors in the table below, calculate the present value of the cash inflows. Present value of $1:

A) $765,000

B) $768,921

C) $798,650

D) $780,000

A) $765,000

B) $768,921

C) $798,650

D) $780,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

77

Paramount Company is considering purchasing new equipment costing $700,000. Company's management has estimated that the equipment will generate cash flows as follows: Present value of $1:

The company's required rate of return is 9%. Using the factors in the table, calculate the present value of the cash flows.

A) $850,000

B) $819,300

C) $820,500

D) $852,000

The company's required rate of return is 9%. Using the factors in the table, calculate the present value of the cash flows.

A) $850,000

B) $819,300

C) $820,500

D) $852,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

78

Nylan Manufacturing is considering two alternative investment proposals with the following details: What is the total present value of future cash inflows from Proposal X?

Present value of annuity of $1:

Present value of $1:

A) $742,340

B) $650,070

C) $568,650

D) $599,700

Present value of annuity of $1:

Present value of $1:

A) $742,340

B) $650,070

C) $568,650

D) $599,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

79

The only difference between present value and future value is the amount of interest that is earned in the intervening time span.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck

80

If $15,000 is invested annually in an account with 9% interest compounding yearly, what will the balance of the account be after five years? Refer to the following Future Value table: Future value of annuity of $1:

A) $26,180

B) $26,211

C) $58,350

D) $25,125

A) $26,180

B) $26,211

C) $58,350

D) $25,125

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 122 في هذه المجموعة.

فتح الحزمة

k this deck