Deck 21: Variable Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

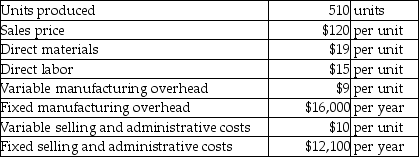

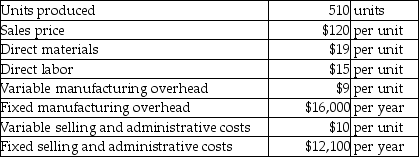

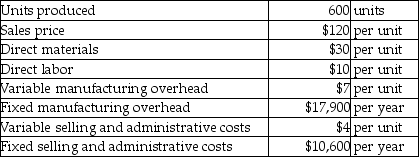

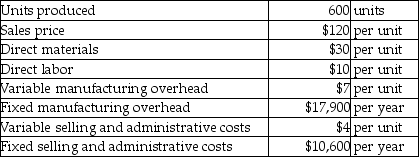

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

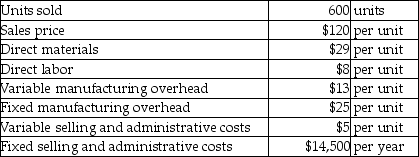

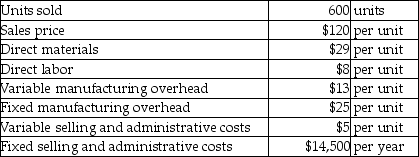

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

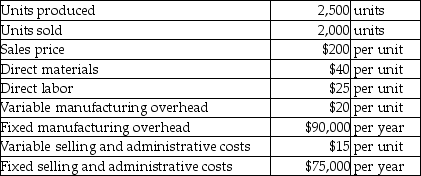

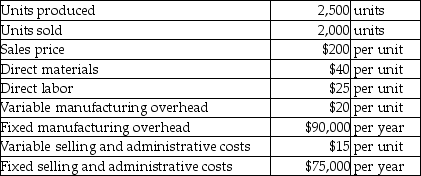

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/148

العب

ملء الشاشة (f)

Deck 21: Variable Costing

1

Absorption costing is required by the Generally Accepted Accounting Principles (GAAP)for financial statements issued to investors,creditors,and other external users.

True

2

Fixed manufacturing overhead is considered a product cost under variable costing.

False

3

In absorption costing,all product costs are recorded first as assets in the inventory accounts.

True

4

Absorption costing considers direct materials,direct labor,variable manufacturing overhead,and fixed manufacturing overhead as product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

5

Variable costing prepares the income statement using the traditional format.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

6

The contribution margin format of the income statement categorizes costs by their behavior.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following statements is true of variable costing?

A)It considers variable manufacturing overhead as period costs.

B)It considers fixed manufacturing overhead as product costs.

C)It considers variable selling and administrative costs as product costs.

D)It considers fixed selling and administrative costs as period costs.

A)It considers variable manufacturing overhead as period costs.

B)It considers fixed manufacturing overhead as product costs.

C)It considers variable selling and administrative costs as product costs.

D)It considers fixed selling and administrative costs as period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

8

Following GAAP,the income statement issued to investors and creditors must ________.

A)be prepared in the traditional format

B)be prepared using variable costing

C)be prepared in the contribution margin format

D)show the value of contribution margin

A)be prepared in the traditional format

B)be prepared using variable costing

C)be prepared in the contribution margin format

D)show the value of contribution margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

9

Absorption costing considers ________ as product costs.

A)variable manufacturing overhead

B)sales salaries and commissions

C)administrative office salaries

D)advertising costs

A)variable manufacturing overhead

B)sales salaries and commissions

C)administrative office salaries

D)advertising costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

10

Under absorption costing,all product costs are first recorded as assets in inventory accounts,and later transferred to the Cost of Goods Sold account when sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

11

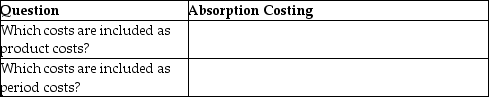

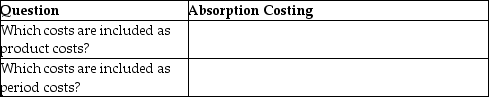

Answer the following absorption costing questions:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

12

Variable costing is used for external reporting purposes,and absorption costing is used for internal decision-making purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

13

The fixed manufacturing overhead is considered a product cost in variable costing and a period cost in absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following statements is true of absorption costing?

A)It considers variable selling and administrative costs as product costs.

B)It considers fixed selling and administrative costs as product costs.

C)It considers fixed manufacturing overhead cost as product costs.

D)It considers variable manufacturing overhead cost as period costs.

A)It considers variable selling and administrative costs as product costs.

B)It considers fixed selling and administrative costs as product costs.

C)It considers fixed manufacturing overhead cost as product costs.

D)It considers variable manufacturing overhead cost as period costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

15

Period costs under the variable costing method include ________.

A)variable manufacturing overhead

B)variable selling and administrative costs

C)direct materials

D)direct labor

A)variable manufacturing overhead

B)variable selling and administrative costs

C)direct materials

D)direct labor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

16

Contribution margin is calculated by deducting the total cost of goods sold from sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is true of the traditional format of the income statement?

A)It is prepared under the variable costing method.

B)It shows contribution margin as a line item.

C)It is not allowed under GAAP.

D)It is prepared under the absorption costing method.

A)It is prepared under the variable costing method.

B)It shows contribution margin as a line item.

C)It is not allowed under GAAP.

D)It is prepared under the absorption costing method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

18

The traditional income statement format is prepared under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

19

The traditional income statement format calculates operating income as gross profit minus selling and administrative expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

20

Absorption costing considers fixed selling and administrative costs as product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

21

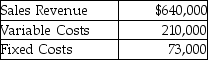

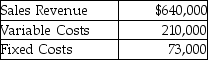

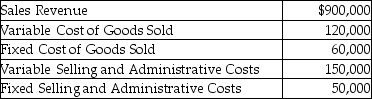

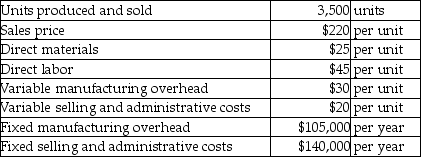

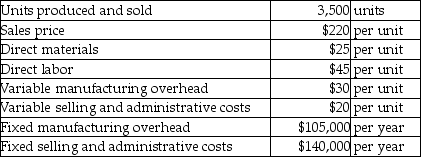

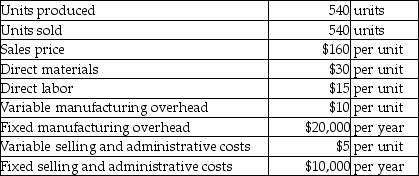

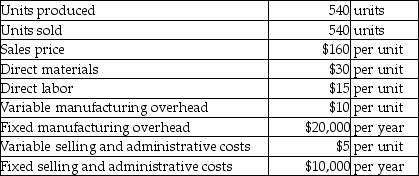

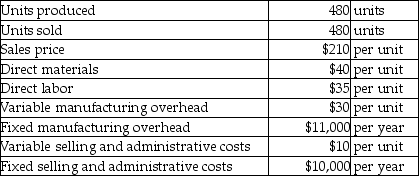

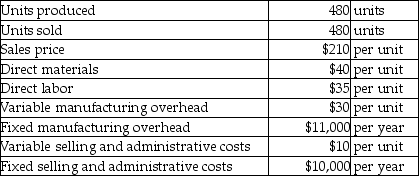

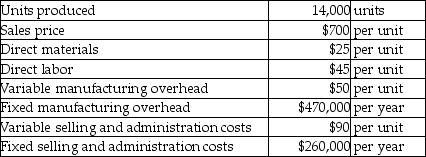

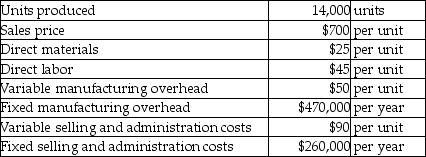

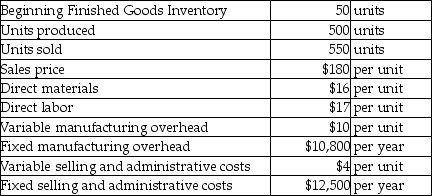

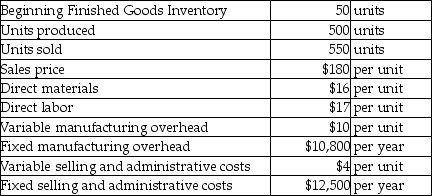

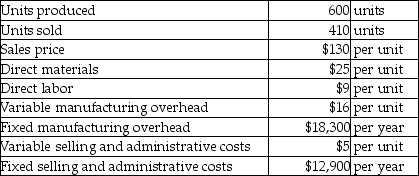

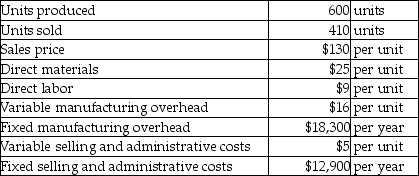

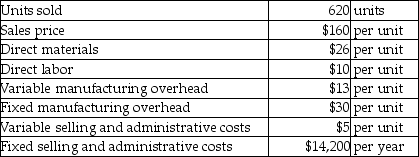

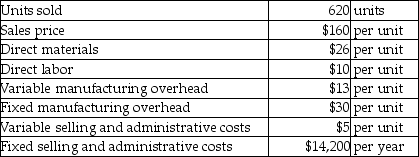

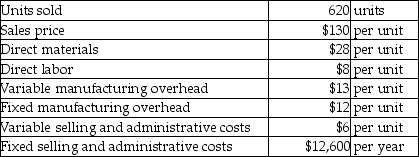

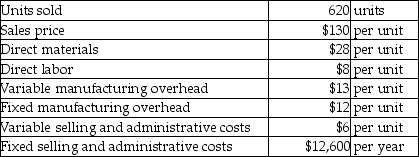

Lilypad Hot Tubs,Inc.reports the following information for August:

Calculate the operating income for August using variable costing.

A)$430,000

B)$567,000

C)$357,000

D)$640,000

Calculate the operating income for August using variable costing.

A)$430,000

B)$567,000

C)$357,000

D)$640,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

22

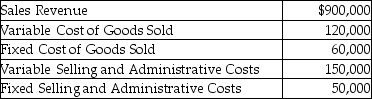

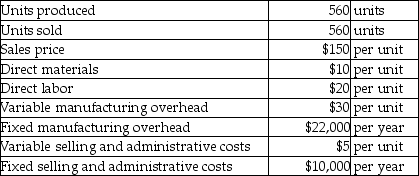

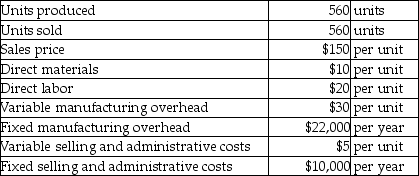

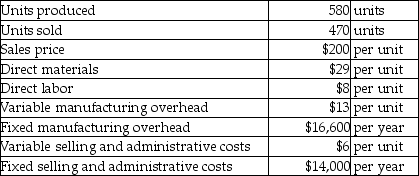

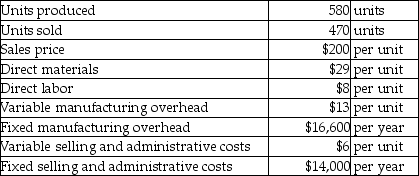

Morwenna,Inc.reports the following information for August:

Calculate the operating income for August using absorption costing.

A)$520,000

B)$270,000

C)$1,100,000

D)$380,000

Calculate the operating income for August using absorption costing.

A)$520,000

B)$270,000

C)$1,100,000

D)$380,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following will appear as a line item in the income statement prepared under variable costing?

A)Contribution Margin

B)Total Cost of Goods Sold

C)Work-in-Process Inventory

D)Gross Profit

A)Contribution Margin

B)Total Cost of Goods Sold

C)Work-in-Process Inventory

D)Gross Profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

24

Variable costing considers direct materials,direct labor,variable manufacturing overhead,and fixed manufacturing overhead as product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

25

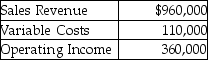

Llywelyn,Inc.reports the following information for July:

What is the total fixed cost using variable costing?

A)$850,000

B)$490,000

C)$250,000

D)$470,000

What is the total fixed cost using variable costing?

A)$850,000

B)$490,000

C)$250,000

D)$470,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

26

Contribution margin is calculated by deducting ________ from sales revenue.

A)total product costs

B)total selling and administrative costs

C)total fixed costs

D)total variable costs

A)total product costs

B)total selling and administrative costs

C)total fixed costs

D)total variable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

27

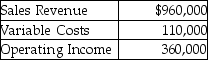

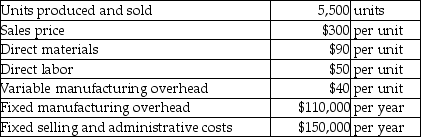

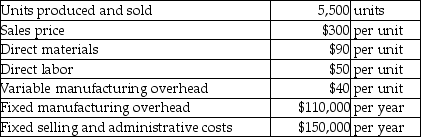

Aqua Primavera,Inc.has provided the following information for the year.

What is the unit product cost using variable costing?

A)$75

B)$85

C)$130

D)$174

What is the unit product cost using variable costing?

A)$75

B)$85

C)$130

D)$174

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

28

Windspring Spas,Inc.reports the following information for August:

Calculate the contribution margin for August.

A)$110,000

B)$430,000

C)$380,000

D)$540,000

Calculate the contribution margin for August.

A)$110,000

B)$430,000

C)$380,000

D)$540,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

29

Gross profit is calculated by deducting ________ from sales revenue.

A)total fixed costs

B)cost of goods sold

C)total variable costs

D)selling and administrative costs

A)total fixed costs

B)cost of goods sold

C)total variable costs

D)selling and administrative costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

30

A variable costing income statement is used for ________.

A)filing income tax returns

B)external reporting purposes

C)determining the amount of gross profit

D)internal decision-making purposes

A)filing income tax returns

B)external reporting purposes

C)determining the amount of gross profit

D)internal decision-making purposes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

31

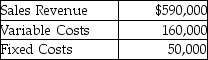

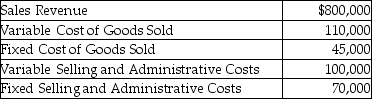

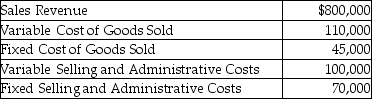

Ceriweden,Inc.has provided the following financial data for the year:

There are no beginning inventories.Prepare an income statement for the year using the traditional format.

There are no beginning inventories.Prepare an income statement for the year using the traditional format.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

32

Arianell,Inc.reports the following information for August:

Calculate the gross profit for August using absorption costing.

A)$730,000

B)$700,000

C)$690,000

D)$645,000

Calculate the gross profit for August using absorption costing.

A)$730,000

B)$700,000

C)$690,000

D)$645,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following will appear as a line item in the traditional format of an income statement?

A)contribution margin

B)total variable costs (manufacturing and non-manufacturing)

C)total fixed costs (manufacturing and non-manufacturing)

D)gross profit

A)contribution margin

B)total variable costs (manufacturing and non-manufacturing)

C)total fixed costs (manufacturing and non-manufacturing)

D)gross profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is considered a period cost in absorption costing?

A)variable manufacturing overhead costs

B)fixed selling and administrative costs

C)fixed manufacturing overhead costs

D)semi-variable manufacturing overhead costs

A)variable manufacturing overhead costs

B)fixed selling and administrative costs

C)fixed manufacturing overhead costs

D)semi-variable manufacturing overhead costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

35

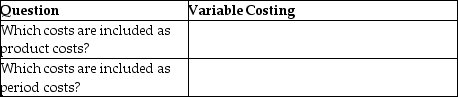

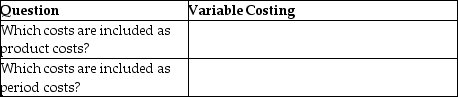

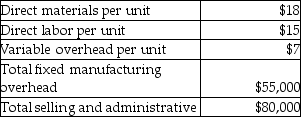

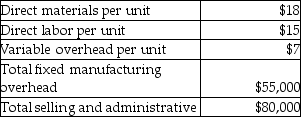

Answer the following variable costing questions:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

36

In variable costing,fixed manufacturing overhead is considered a period cost because ________.

A)these costs are indirectly related to production

B)these are not incurred in the period in which the units are produced

C)these costs are incurred whether or not the company manufactures any goods

D)these costs are direct costs incurred for production

A)these costs are indirectly related to production

B)these are not incurred in the period in which the units are produced

C)these costs are incurred whether or not the company manufactures any goods

D)these costs are direct costs incurred for production

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

37

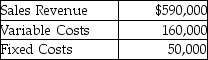

The following data has been provided by Jestina,Inc.for the year.

There are no beginning inventories.Prepare an income statement using the contribution margin format.

There are no beginning inventories.Prepare an income statement using the contribution margin format.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following statements is true of absorption and variable costing methods?

A)Both costing methods consider selling and administrative costs to be period costs.

B)Variable costing considers variable selling and administrative costs to be product costs.

C)Absorption costing considers fixed manufacturing overhead to be period costs.

D)Both costing methods consider fixed manufacturing overhead to be product costs.

A)Both costing methods consider selling and administrative costs to be period costs.

B)Variable costing considers variable selling and administrative costs to be product costs.

C)Absorption costing considers fixed manufacturing overhead to be period costs.

D)Both costing methods consider fixed manufacturing overhead to be product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is considered a period cost under variable costing but not under absorption costing?

A)fixed selling and administrative costs

B)variable manufacturing costs

C)fixed manufacturing overhead

D)variable selling and administrative costs

A)fixed selling and administrative costs

B)variable manufacturing costs

C)fixed manufacturing overhead

D)variable selling and administrative costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

40

Variable costing considers only ________ costs when determining product costs.

A)fixed manufacturing

B)variable manufacturing

C)variable selling and administrative

D)fixed selling and administrative

A)fixed manufacturing

B)variable manufacturing

C)variable selling and administrative

D)fixed selling and administrative

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

41

When there are no units in the beginning Finished Goods Inventory and the units produced are more than the units sold,the operating income will be higher under absorption costing than variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

42

The level of inventory on hand at the end of the year does not affect the amount of operating income calculated under variable costing and absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

43

When all units produced are sold,there is no difference in operating income between absorption costing and variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

44

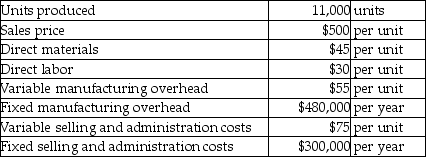

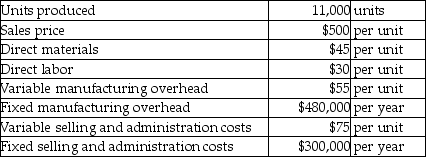

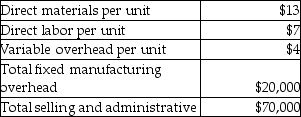

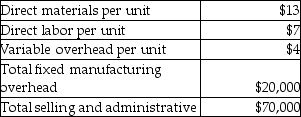

Last year,Adara Company produced 11,000 units and sold 9000 units.The company had no beginning inventory.They incurred the following costs:

Adara's product cost per unit under variable costing is

A)$45

B)$40

C)$46

D)$52

Adara's product cost per unit under variable costing is

A)$45

B)$40

C)$46

D)$52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

45

Amarantha Corp.has provided the following data for the current year.

Calculate the unit product cost using absorption costing and variable costing.

Calculate the unit product cost using absorption costing and variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

46

Sequoyah,Inc.reports the following information:

What is the unit product cost using variable costing?

A)$60

B)$82

C)$55

D)$105

What is the unit product cost using variable costing?

A)$60

B)$82

C)$55

D)$105

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

47

Last year,Adara Company produced 5000 units and sold 3000 units.The company had no beginning inventory.They incurred the following costs:

Adara's product cost per unit under absorption costing is

A)$28

B)$24

C)$31

D)$42

Adara's product cost per unit under absorption costing is

A)$28

B)$24

C)$31

D)$42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

48

Unit product cost calculations using absorption costing do NOT include ________.

A)fixed manufacturing overhead

B)variable manufacturing overhead

C)variable selling and administrative costs

D)direct materials

A)fixed manufacturing overhead

B)variable manufacturing overhead

C)variable selling and administrative costs

D)direct materials

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

49

Petra,Inc.has collected the following data.(There are no beginning inventories. ):

What is the operating income using absorption costing? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A)$39,400

B)$34,600

C)$24,600

D)$29,400

What is the operating income using absorption costing? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A)$39,400

B)$34,600

C)$24,600

D)$29,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

50

In variable costing,the balance of ending Finished Goods Inventory includes fixed manufacturing overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

51

When all the units produced are sold,the operating income calculated under absorption costing is higher when compared to the operating income calculated under variable costing.Assume that there is no beginning Finished Goods Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

52

When there are no beginning or ending balances in Finished Goods Inventory,variable and absorption costing will result in ________.

A)different amounts for ending Work-in-Process Inventory

B)the same operating income

C)different sales revenue

D)different amounts for cost of goods sold

A)different amounts for ending Work-in-Process Inventory

B)the same operating income

C)different sales revenue

D)different amounts for cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

53

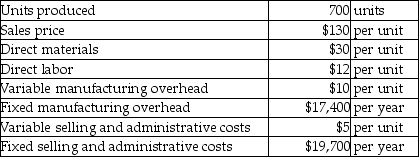

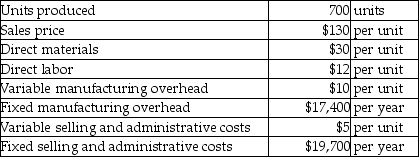

Yancey,Inc.reports the following information:

What is the amount of unit product cost that will be considered for external reporting purposes? (Round any intermediate calculations and your final answer to the nearest cent. )

A)$59.29

B)$69.29

C)$120.00

D)$99.29

What is the amount of unit product cost that will be considered for external reporting purposes? (Round any intermediate calculations and your final answer to the nearest cent. )

A)$59.29

B)$69.29

C)$120.00

D)$99.29

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

54

When all of the units produced are sold,the operating income is the same under both the absorption and variable costing methods.Assume no beginning and ending inventories.Which of the following gives the correct reason for the above statement?

A)All costs incurred have been recorded as expenses.

B)A portion of the fixed manufacturing overhead is still in the Finished Goods Inventory account.

C)All selling and administrative expenses have been recorded as period costs.

D)Fixed manufacturing costs have not been considered when calculating the operating incomes.

A)All costs incurred have been recorded as expenses.

B)A portion of the fixed manufacturing overhead is still in the Finished Goods Inventory account.

C)All selling and administrative expenses have been recorded as period costs.

D)Fixed manufacturing costs have not been considered when calculating the operating incomes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

55

In the variable costing income statement,variable costs are reported separately from fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

56

When there is no beginning Finished Goods Inventory and all the goods that are produced are sold,the operating income ________.

A)will be higher under absorption costing than variable costing

B)will be lower under absorption costing than variable costing

C)will be higher than the gross profit under variable costing

D)will be the same for both absorption costing and variable costing

A)will be higher under absorption costing than variable costing

B)will be lower under absorption costing than variable costing

C)will be higher than the gross profit under variable costing

D)will be the same for both absorption costing and variable costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

57

In its first year of business,Talula,Inc.produced and sold 600 units.If Talula uses variable costing,________.

A)its operating income for the period will be higher than under absorption costing

B)its operating income for the period will be lower than under absorption costing

C)its value of ending Finished Goods Inventory reported in the balance sheet will be higher than under absorption costing

D)its operating income will be the same as under absorption costing

A)its operating income for the period will be higher than under absorption costing

B)its operating income for the period will be lower than under absorption costing

C)its value of ending Finished Goods Inventory reported in the balance sheet will be higher than under absorption costing

D)its operating income will be the same as under absorption costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

58

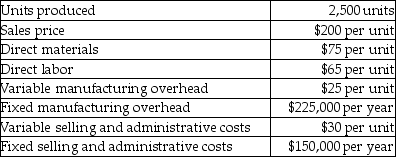

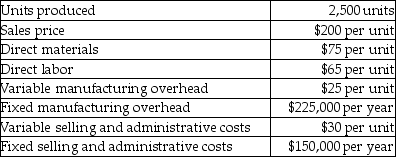

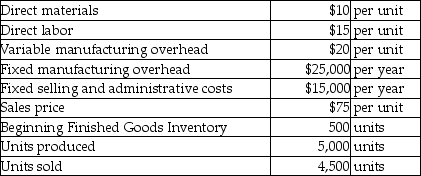

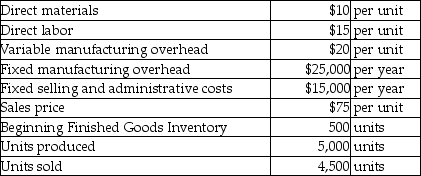

Emerald Pools,Inc.has provided the following information for the year.

What is the unit product cost using absorption costing? (Round any intermediate calculations and your final answer to the nearest dollar. )

A)$70

B)$154

C)$160

D)$120

What is the unit product cost using absorption costing? (Round any intermediate calculations and your final answer to the nearest dollar. )

A)$70

B)$154

C)$160

D)$120

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

59

Mirabella Company assigns direct materials,direct labor and both variable and fixed overhead to its product costs.Mirabella Company is using ________.

A)absorption costing

B)variable costing

C)batch costing

D)composite costing

A)absorption costing

B)variable costing

C)batch costing

D)composite costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is NOT a product cost under variable costing?

A)Direct materials

B)Direct labor

C)Variable manufacturing overhead

D)Fixed manufacturing overhead

A)Direct materials

B)Direct labor

C)Variable manufacturing overhead

D)Fixed manufacturing overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

61

Mackenzie,Inc.has collected the following data.(There are no beginning inventories. )

What is the ending balance in Finished Goods Inventory using absorption costing if 400 units are sold? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A)$7457

B)$15,600

C)$33,001

D)$23,058

What is the ending balance in Finished Goods Inventory using absorption costing if 400 units are sold? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A)$7457

B)$15,600

C)$33,001

D)$23,058

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

62

Comet Canisters,Inc.has collected the following data for the current year:

What is the unit product cost using absorption costing? (Round your answer to the nearest cent. )

A)$93.60

B)$43.00

C)$64.60

D)$48.60

What is the unit product cost using absorption costing? (Round your answer to the nearest cent. )

A)$93.60

B)$43.00

C)$64.60

D)$48.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

63

When production is greater than sales,the operating income will be higher under absorption costing than variable costing.Assume zero beginning and ending inventories.Which of the following gives the correct reason for the above statement?

A)All costs incurred have been recorded as expenses.

B)A portion of the fixed manufacturing overhead is still in the ending Finished Goods Inventory account under absorption costing.

C)All selling and administrative expenses have been recorded as period costs.

D)Fixed manufacturing costs have not been considered when calculating the operating profits.

A)All costs incurred have been recorded as expenses.

B)A portion of the fixed manufacturing overhead is still in the ending Finished Goods Inventory account under absorption costing.

C)All selling and administrative expenses have been recorded as period costs.

D)Fixed manufacturing costs have not been considered when calculating the operating profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

64

When units produced exceed units sold,how does operating income differ between variable costing and absorption costing? Assume no beginning Finished Goods Inventory.Explain your answer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

65

Sutherland,Inc.reports the following information:

There are no beginning inventories.What is the ending balance in Finished Goods Inventory using absorption costing? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A)$7218

B)$3148

C)$5500

D)$8648

There are no beginning inventories.What is the ending balance in Finished Goods Inventory using absorption costing? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A)$7218

B)$3148

C)$5500

D)$8648

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

66

McFarlane,Inc.reports the following information:

There are no beginning inventories.What is the ending balance in Finished Goods Inventory using variable costing?

A)$9500

B)$6460

C)$10,450

D)$15,295

There are no beginning inventories.What is the ending balance in Finished Goods Inventory using variable costing?

A)$9500

B)$6460

C)$10,450

D)$15,295

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

67

In its first year of business,Lakota,Inc.produced 600 units and sold 400 units.If Lakota uses variable costing,________.

A)its operating income for the period will be higher than under absorption costing

B)its operating income for the period will be lower than under absorption costing

C)its value of ending Finished Goods Inventory reported in the balance sheet will be higher than under absorption costing

D)its operating income will be the same as under absorption costing

A)its operating income for the period will be higher than under absorption costing

B)its operating income for the period will be lower than under absorption costing

C)its value of ending Finished Goods Inventory reported in the balance sheet will be higher than under absorption costing

D)its operating income will be the same as under absorption costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

68

Bethel,Inc.has collected the following data.(There are no beginning inventories. )

What is the operating income using variable costing if 500 units are sold?

A)$15,800

B)$45,000

C)$60,000

D)$4200

What is the operating income using variable costing if 500 units are sold?

A)$15,800

B)$45,000

C)$60,000

D)$4200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following costing methods charges all the manufacturing costs to the products?

A)variable costing

B)direct costing

C)absorption costing

D)contribution costing

A)variable costing

B)direct costing

C)absorption costing

D)contribution costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

70

In absorption costing,the manufacturing costs expensed are greater than the amount expensed in variable costing when units produced are less than sold because the units in beginning inventory under absorption costing were assigned a greater cost in the previous accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

71

Alltech Inc.has collected the following data.(There are no beginning inventories. )

What is the operating income using absorption costing if 500 units are sold? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A)$6600

B)$5715

C)$11,171

D)$19,015

What is the operating income using absorption costing if 500 units are sold? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A)$6600

B)$5715

C)$11,171

D)$19,015

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

72

When there are no units in the beginning Finished Goods Inventory and the units produced are more than the units sold,the operating income will be higher under variable costing than absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

73

Docherty,Inc.reports the following information for the year ended December 31:

The operating income calculated using variable costing and absorption costing amounted to $9800 and $11,000,respectively.There were no beginning inventories.Determine the total number of units produced during the year.

A)600 units

B)648 units

C)10 units

D)48 units

The operating income calculated using variable costing and absorption costing amounted to $9800 and $11,000,respectively.There were no beginning inventories.Determine the total number of units produced during the year.

A)600 units

B)648 units

C)10 units

D)48 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

74

Under variable costing,the units in the beginning Finished Goods Inventory contain fixed manufacturing overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

75

Yazzie,Inc.reports the following information for the year ended December 31:

The operating income calculated using variable costing and absorption costing amounted to $9300 and $11,400,respectively.There were no beginning inventories.Determine the total fixed manufacturing overhead that will be expensed under variable costing for the year 2016.

A)$20,700

B)$18,600

C)$34,720

D)$30,380

The operating income calculated using variable costing and absorption costing amounted to $9300 and $11,400,respectively.There were no beginning inventories.Determine the total fixed manufacturing overhead that will be expensed under variable costing for the year 2016.

A)$20,700

B)$18,600

C)$34,720

D)$30,380

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

76

Cinnabar,Inc.has provided the following data for the year:

Requirements:

a)Compute Cinnabar's unit product cost under absorption costing and variable costing.

b)Prepare income statements for Cinnabar using absorption costing and variable costing.

c)Calculate the balance in Finished Goods Inventory using absorption costing and variable costing.

Assume that the production level,costs,and sales prices were the same in the previous year.

Requirements:

a)Compute Cinnabar's unit product cost under absorption costing and variable costing.

b)Prepare income statements for Cinnabar using absorption costing and variable costing.

c)Calculate the balance in Finished Goods Inventory using absorption costing and variable costing.

Assume that the production level,costs,and sales prices were the same in the previous year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

77

In variable costing,all fixed manufacturing overhead costs are expensed in the period incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

78

Iagan,Inc.has collected the following data.(There are no beginning inventories. )

What is the ending balance in Finished Goods Inventory using variable costing if 500 units are sold?

A)$4000

B)$4700

C)$1700

D)$3000

What is the ending balance in Finished Goods Inventory using variable costing if 500 units are sold?

A)$4000

B)$4700

C)$1700

D)$3000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

79

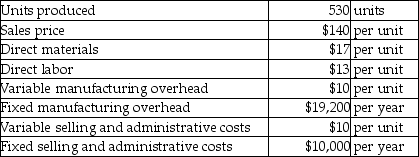

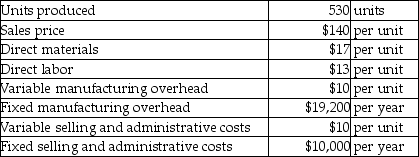

Anatase,Inc.reports the following information:

Assume that the production costs and sales prices were the same in the previous year.Assume no beginning inventories.

Requirements:

a)Calculate unit product cost using absorption costing and variable costing.

b)Calculate the operating income using absorption costing and variable costing.

Assume that the production costs and sales prices were the same in the previous year.Assume no beginning inventories.

Requirements:

a)Calculate unit product cost using absorption costing and variable costing.

b)Calculate the operating income using absorption costing and variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck

80

Locklear,Inc.reports the following information for the year ended December 31:

The operating income calculated using variable costing and absorption costing amounted to $10,000 and $12,700,respectively.There were no beginning inventories.Determine the total fixed manufacturing overhead that will be expensed under absorption costing for the year.

A)$10,140

B)$7440

C)$24,800

D)$30,380

The operating income calculated using variable costing and absorption costing amounted to $10,000 and $12,700,respectively.There were no beginning inventories.Determine the total fixed manufacturing overhead that will be expensed under absorption costing for the year.

A)$10,140

B)$7440

C)$24,800

D)$30,380

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 148 في هذه المجموعة.

فتح الحزمة

k this deck