Deck 3: How Does an Organization Use Activity-Based Costing to Allocate Overhead Costs

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

Match between columns

الفرضيات:

Storing additional materials for future production.

Storing additional materials for future production.

Designing car seats to maximize comfort.

Designing car seats to maximize comfort.

الردود:

value-added

nonvalue-added

value-added

nonvalue-added

value-added

nonvalue-added

value-added

nonvalue-added

value-added

nonvalue-added

value-added

nonvalue-added

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/71

العب

ملء الشاشة (f)

Deck 3: How Does an Organization Use Activity-Based Costing to Allocate Overhead Costs

1

Total companywide estimated overhead costs will change depending on if plant wide allocation or departmental allocation is used.

False

2

Organizations that use activity-based costing to allocate overhead typically have many different products and complex operations.

True

3

U.S.Generally Accepted Accounting Principles require all manufacturing costs be allocated to products for inventory costing purposes.

True

4

The plantwide approach to allocating overhead is typically the simplest and least expensive approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

5

Facility-level activities are activities required to develop,produce and sell specific types of products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

6

The choice of an allocation method for overhead depends on how managers decide to group costs into cost pools.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

7

Both manufacturing and service organizations use activity-based costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

8

Activity-based costing breaks total estimated overhead costs out into different departments to establish an overhead rate for each department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

9

One important reason that managers allocate overhead costs to products is to promote the efficient use of resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

10

Activity-based costing and activity-based management are two terms used to describe the same concept.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

11

Indirect manufacturing costs are easily traceable to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

12

As costing systems become more complex,they become more expensive to implement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

13

One important reason that managers allocate overhead costs to products is to provide information for decision making.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

14

Organizations can allocate overhead in a variety of ways,resulting in a number of different product costs for the same product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

15

An advantage of using activity-based costing is that it provides detailed information related to production activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

16

It is acceptable to allocate selling costs to products when following U.S.Generally Accepted Accounting Principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

17

Overhead activities that are required to sustain facility operations are called unit-level activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

18

Value-added activities are typically ignored when using activity-based management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

19

Companies that use the least number of cost pools possible tend to have the most accurate overhead allocation process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

20

Companies with one product that requires very little variation in production may not benefit from an ABC system as much as companies with multiple products and complex production processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

21

All of the following are methods of allocating overhead costs except:

A)department allocation.

B)activity-based allocation.

C)plantwide allocation.

D)product allocation.

E)None of the answer choices is correct.

A)department allocation.

B)activity-based allocation.

C)plantwide allocation.

D)product allocation.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

22

Appraisal costs are the same as detection costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

23

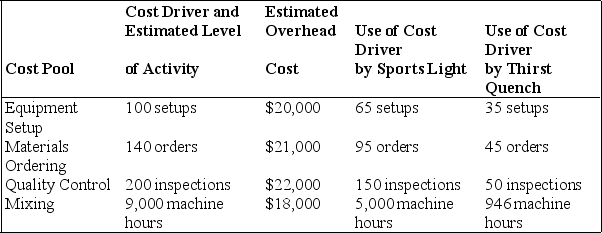

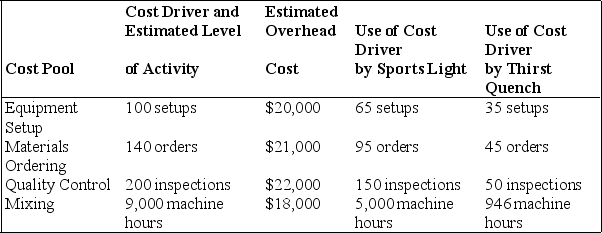

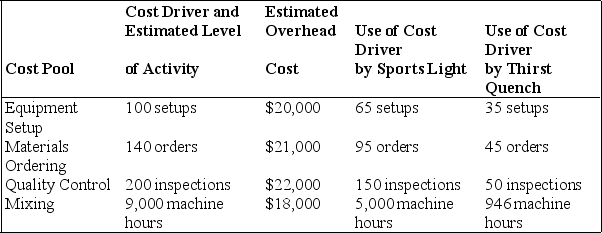

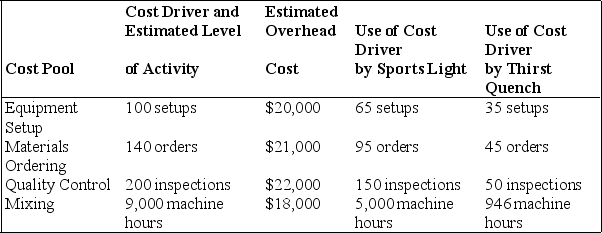

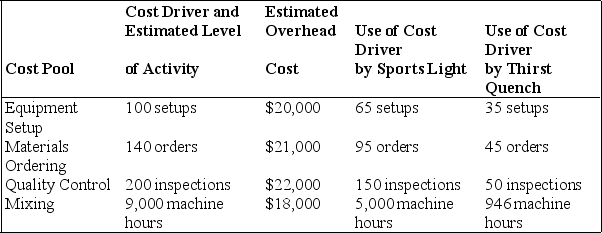

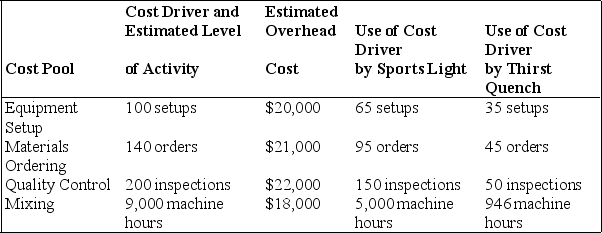

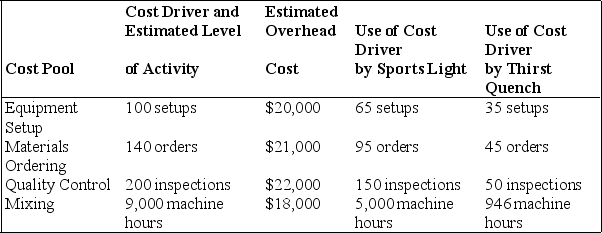

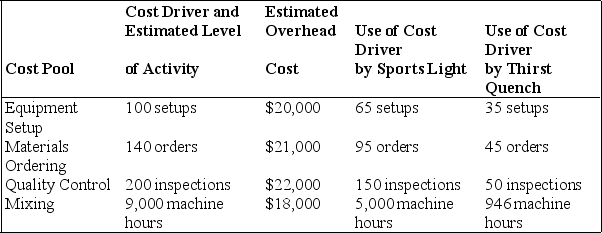

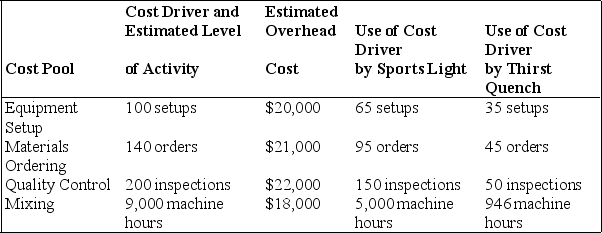

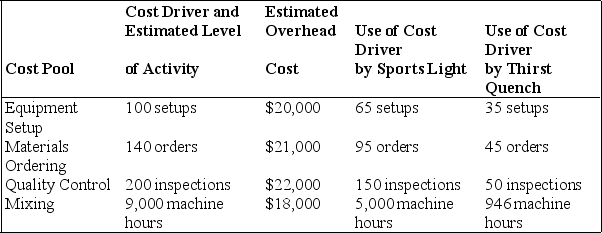

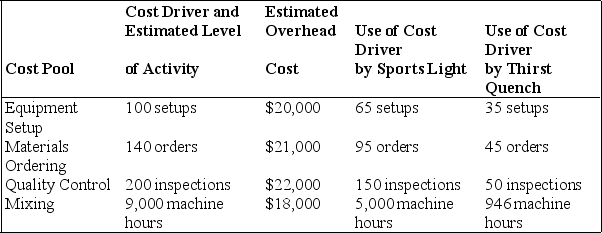

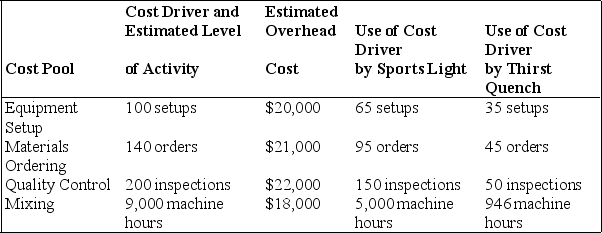

Exhibit 3-1

Hydrate Inc.makes two types of sports drinks and is implementing an activity-based costing system.Previously,all overhead had been applied on the basis of machine hours.The company produces 22,500 units of Sports Light and 42,284 units of Thirst Quench.Additional data is as follows:

Refer to Exhibit 3-1.What is the overhead cost per unit for Thirst Quench using ABC?

A)$2.00

B)$0.86

C)$0.45

D)$0.50

E)None of the answer choices is correct.

Hydrate Inc.makes two types of sports drinks and is implementing an activity-based costing system.Previously,all overhead had been applied on the basis of machine hours.The company produces 22,500 units of Sports Light and 42,284 units of Thirst Quench.Additional data is as follows:

Refer to Exhibit 3-1.What is the overhead cost per unit for Thirst Quench using ABC?

A)$2.00

B)$0.86

C)$0.45

D)$0.50

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

24

Exhibit 3-1

Hydrate Inc.makes two types of sports drinks and is implementing an activity-based costing system.Previously,all overhead had been applied on the basis of machine hours.The company produces 22,500 units of Sports Light and 42,284 units of Thirst Quench.Additional data is as follows:

Refer to Exhibit 3-1.Using ABC,what is the cost per order for the Materials Ordering activity?

A)$462

B)$150

C)$200

D)$110

E)None of the answer choices is correct.

Hydrate Inc.makes two types of sports drinks and is implementing an activity-based costing system.Previously,all overhead had been applied on the basis of machine hours.The company produces 22,500 units of Sports Light and 42,284 units of Thirst Quench.Additional data is as follows:

Refer to Exhibit 3-1.Using ABC,what is the cost per order for the Materials Ordering activity?

A)$462

B)$150

C)$200

D)$110

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is an advantage of using activity-based costing (ABC)?

A)It provides management with simpler,less accurate information than traditional costing methods.

B)Fixed costs are presented on a per unit basis.

C)It tends to provide more accurate product cost information.

D)It is typically inexpensive to implement.

E)None of the answer choices is correct.

A)It provides management with simpler,less accurate information than traditional costing methods.

B)Fixed costs are presented on a per unit basis.

C)It tends to provide more accurate product cost information.

D)It is typically inexpensive to implement.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

26

Gabriel Company uses the department approach for allocating overhead.The Assembly Department uses direct labor hours as its allocation base and the Grinding Department uses machine hours as its allocation base.The data for each is as follows:

What is the allocation rate for each Department (round to the nearest cent)?

A)Assembly = $11.00 per direct labor hour;Grinding = $220.00 per machine hour.

B)Assembly = $0.13 per direct labor hour;Grinding = $0.02 per machine hour.

C)Assembly = $8.00 per direct labor hour;Grinding = $60.00 per machine hour.

D)Assembly = $10.48 per direct labor hour;Grinding = $10.48 per machine hour.

E)None of the answer choices is correct.

What is the allocation rate for each Department (round to the nearest cent)?

A)Assembly = $11.00 per direct labor hour;Grinding = $220.00 per machine hour.

B)Assembly = $0.13 per direct labor hour;Grinding = $0.02 per machine hour.

C)Assembly = $8.00 per direct labor hour;Grinding = $60.00 per machine hour.

D)Assembly = $10.48 per direct labor hour;Grinding = $10.48 per machine hour.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

27

Exhibit 3-1

Hydrate Inc.makes two types of sports drinks and is implementing an activity-based costing system.Previously,all overhead had been applied on the basis of machine hours.The company produces 22,500 units of Sports Light and 42,284 units of Thirst Quench.Additional data is as follows:

Refer to Exhibit 3-1.What is the total overhead cost applied to Thirst Quench using activity-based costing?

A)$52,868

B)$21,142

C)$34,322

D)$10,000

E)None of the answer choices is correct.

Hydrate Inc.makes two types of sports drinks and is implementing an activity-based costing system.Previously,all overhead had been applied on the basis of machine hours.The company produces 22,500 units of Sports Light and 42,284 units of Thirst Quench.Additional data is as follows:

Refer to Exhibit 3-1.What is the total overhead cost applied to Thirst Quench using activity-based costing?

A)$52,868

B)$21,142

C)$34,322

D)$10,000

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

28

Step one of an activity-based costing (ABC)system is to:

A)identify costly production activities.

B)calculate a predetermined overhead rate.

C)identify activity cost pools.

D)identify cost drivers.

E)allocate overhead costs to products.

A)identify costly production activities.

B)calculate a predetermined overhead rate.

C)identify activity cost pools.

D)identify cost drivers.

E)allocate overhead costs to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

29

A collection of overhead costs,typically organized by department or activity,is called a:

A)cost objective.

B)cost driver.

C)cost pool.

D)cost hierarchy.

E)None of the answer choices is correct.

A)cost objective.

B)cost driver.

C)cost pool.

D)cost hierarchy.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following focuses on promoting the efficient use of resources?

A)Reducing quality inspections to minimize allocated quality control department costs.

B)Establishing prices for products.

C)Preparing financial statements for the annual report.

D)Calculating profits for each product so management can decide on which products to promote.

E)None of the answer choices is correct.

A)Reducing quality inspections to minimize allocated quality control department costs.

B)Establishing prices for products.

C)Preparing financial statements for the annual report.

D)Calculating profits for each product so management can decide on which products to promote.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

31

Exhibit 3-1

Hydrate Inc.makes two types of sports drinks and is implementing an activity-based costing system.Previously,all overhead had been applied on the basis of machine hours.The company produces 22,500 units of Sports Light and 42,284 units of Thirst Quench.Additional data is as follows:

Refer to Exhibit 3-1.What is the total overhead cost for Sports Light using ABC?

A)$53,750

B)$57,564

C)$23,945

D)$76,271

E)None of the answer choices is correct.

Hydrate Inc.makes two types of sports drinks and is implementing an activity-based costing system.Previously,all overhead had been applied on the basis of machine hours.The company produces 22,500 units of Sports Light and 42,284 units of Thirst Quench.Additional data is as follows:

Refer to Exhibit 3-1.What is the total overhead cost for Sports Light using ABC?

A)$53,750

B)$57,564

C)$23,945

D)$76,271

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is not an advantage of using activity-based costing (ABC)?

A)ABC cost information tends to be more accurate compared to traditional costing.

B)Managers can use ABC costing to improve efficiency.

C)ABC allows managers to make better product mix decisions.

D)ABC is typically expensive to implement.

E)None of the answer choices is correct.

A)ABC cost information tends to be more accurate compared to traditional costing.

B)Managers can use ABC costing to improve efficiency.

C)ABC allows managers to make better product mix decisions.

D)ABC is typically expensive to implement.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

33

The predetermined overhead rate is calculated as:

A)Estimated Overhead Costs * Estimated Cost Driver Activity.

B)Estimated Overhead Costs / Estimated Cost Driver Activity.

C)Estimated Overhead Costs - Estimated Cost Driver Activity.

D)Estimated Overhead Costs + Estimated Cost Driver Activity.

E)None of the answer choices is correct.

A)Estimated Overhead Costs * Estimated Cost Driver Activity.

B)Estimated Overhead Costs / Estimated Cost Driver Activity.

C)Estimated Overhead Costs - Estimated Cost Driver Activity.

D)Estimated Overhead Costs + Estimated Cost Driver Activity.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is not a reason that managers allocate overhead costs to products?

A)To provide information for decision making.

B)To apply direct labor and direct materials to products.

C)To promote efficient use of resources.

D)To comply with U.S.Generally Accepted Accounting Principles (GAAP).

E)None of the answer choices is correct.

A)To provide information for decision making.

B)To apply direct labor and direct materials to products.

C)To promote efficient use of resources.

D)To comply with U.S.Generally Accepted Accounting Principles (GAAP).

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

35

Eaton Company uses activity-based costing to allocate overhead costs to products.When figuring the cost of ordering raw materials,which of the following is likely the best cost driver for this activity?

A)Number of orders placed.

B)Weight of the parts ordered.

C)Square footage of the purchasing department area.

D)Direct labor cost.

E)None of the answer choices is correct.

A)Number of orders placed.

B)Weight of the parts ordered.

C)Square footage of the purchasing department area.

D)Direct labor cost.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following shows the steps required to implement activity-based costing in the correct order?

A)Allocate overhead costs to products;identify costly activities to complete products;assign overhead costs to activities;identify cost drivers for each activity;and calculate a predetermined overhead rate for each activity.

B)Allocate overhead costs to products;identify cost drivers for each activity;assign overhead costs to activities;identify costly activities to complete products;and calculate a predetermined overhead rate for each activity.

C)Identify costly activities to complete products;assign overhead costs to activities;identify cost drivers for each activity;calculate a predetermined overhead rate for each activity;and allocate overhead costs to products.

D)Identify cost drivers for each activity;assign overhead costs to activities;identify costly activities to complete products;calculate a predetermined overhead rate for each activity;and allocate overhead costs to products.

E)None of the answer choices is correct.

A)Allocate overhead costs to products;identify costly activities to complete products;assign overhead costs to activities;identify cost drivers for each activity;and calculate a predetermined overhead rate for each activity.

B)Allocate overhead costs to products;identify cost drivers for each activity;assign overhead costs to activities;identify costly activities to complete products;and calculate a predetermined overhead rate for each activity.

C)Identify costly activities to complete products;assign overhead costs to activities;identify cost drivers for each activity;calculate a predetermined overhead rate for each activity;and allocate overhead costs to products.

D)Identify cost drivers for each activity;assign overhead costs to activities;identify costly activities to complete products;calculate a predetermined overhead rate for each activity;and allocate overhead costs to products.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

37

Exhibit 3-1

Hydrate Inc.makes two types of sports drinks and is implementing an activity-based costing system.Previously,all overhead had been applied on the basis of machine hours.The company produces 22,500 units of Sports Light and 42,284 units of Thirst Quench.Additional data is as follows:

Refer to Exhibit 3-1.What is the overhead cost per unit for Sports Light when all overhead is applied based on machine hours?

A)$9.00

B)$2.00

C)$13.62

D)$3.60

E)None of the answer choices is correct.

Hydrate Inc.makes two types of sports drinks and is implementing an activity-based costing system.Previously,all overhead had been applied on the basis of machine hours.The company produces 22,500 units of Sports Light and 42,284 units of Thirst Quench.Additional data is as follows:

Refer to Exhibit 3-1.What is the overhead cost per unit for Sports Light when all overhead is applied based on machine hours?

A)$9.00

B)$2.00

C)$13.62

D)$3.60

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

38

Prevention costs are costs for activities that prevent product defects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

39

Exhibit 3-1

Hydrate Inc.makes two types of sports drinks and is implementing an activity-based costing system.Previously,all overhead had been applied on the basis of machine hours.The company produces 22,500 units of Sports Light and 42,284 units of Thirst Quench.Additional data is as follows:

Refer to Exhibit 3-1.What is the total overhead cost applied to Thirst Quench when all overhead is applied based on machine hours?

A)$45,000

B)$617

C)$8,514

D)$2,864

E)None of the answer choices is correct.

Hydrate Inc.makes two types of sports drinks and is implementing an activity-based costing system.Previously,all overhead had been applied on the basis of machine hours.The company produces 22,500 units of Sports Light and 42,284 units of Thirst Quench.Additional data is as follows:

Refer to Exhibit 3-1.What is the total overhead cost applied to Thirst Quench when all overhead is applied based on machine hours?

A)$45,000

B)$617

C)$8,514

D)$2,864

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following would be the best allocation base for the direct materials used by workers to assemble products?

A)Square feet of space occupied.

B)Number of new products.

C)Quantity of materials used.

D)Number of machine setups.

E)None of the answer choices is correct.

A)Square feet of space occupied.

B)Number of new products.

C)Quantity of materials used.

D)Number of machine setups.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following would be the best allocation base for a product designed for a specific customer?

A)Quantity of materials used.

B)Hours of design time.

C)Square feet of space occupied.

D)Number of new products.

E)None of the answer choices is correct.

A)Quantity of materials used.

B)Hours of design time.

C)Square feet of space occupied.

D)Number of new products.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

42

The following estimated overhead cost information is available for Michaels Company for the most recent year.

The company anticipates the following activity levels during the year: 5,000 purchase orders issued;7,000 shipments received;80,000 machine setups performed;and 9,000 inspections conducted.

What is the overhead rate for the quality control activity?

A)$10

B)$80

C)$7

D)$4

E)None of the answer choices is correct.

The company anticipates the following activity levels during the year: 5,000 purchase orders issued;7,000 shipments received;80,000 machine setups performed;and 9,000 inspections conducted.

What is the overhead rate for the quality control activity?

A)$10

B)$80

C)$7

D)$4

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

43

All of the following can be performed using ABC and ABM except:

A)assessing profitability of products.

B)providing product cost information.

C)analyzing production processes.

D)evaluating employee and division performance.

E)All of the choices are correct.

A)assessing profitability of products.

B)providing product cost information.

C)analyzing production processes.

D)evaluating employee and division performance.

E)All of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

44

Companies who want to identify and eliminate non-value-added activities may implement:

A)Traditional costing.

B)Departmental costing.

C)activity-based costing (ABC).

D)activity-based management (ABM).

E)None of the answer choices is correct.

A)Traditional costing.

B)Departmental costing.

C)activity-based costing (ABC).

D)activity-based management (ABM).

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

45

Flannery Inc.produces identical tables in large batches.Which of the following would most likely be a product-level cost for Flannery?

A)Quality control costs.

B)Salaries for purchasing and receiving personnel.

C)Research and development for a new line of tables.

D)Electricity costs for plant machinery.

E)None of the answer choices is correct.

A)Quality control costs.

B)Salaries for purchasing and receiving personnel.

C)Research and development for a new line of tables.

D)Electricity costs for plant machinery.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following items is a unit-level activity?

A)Purchase requisitions issued for raw materials needed to produce groups of products.

B)Direct labor assembling products.

C)Maintenance performed on the factory building.

D)Quality inspections of groups of products.

E)None of the answer choices is correct.

A)Purchase requisitions issued for raw materials needed to produce groups of products.

B)Direct labor assembling products.

C)Maintenance performed on the factory building.

D)Quality inspections of groups of products.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following items is a facility-level activity?

A)Maintenance performed on the factory building.

B)Purchase requisitions issued for raw materials.

C)Direct labor assembling products.

D)Product designed for a specific customer.

E)None of the answer choices is correct.

A)Maintenance performed on the factory building.

B)Purchase requisitions issued for raw materials.

C)Direct labor assembling products.

D)Product designed for a specific customer.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

48

Exhibit 3-2

Dublin Pie Company sells cherry pies and apple pies in bulk online.Estimated overhead costs for 2016 total $600,000.The accountant for Dublin identified the following information for its activity-based costing system.

The estimated activity level for each type of pie and in total is as follows:

-Refer to Exhibit 3-2.What is the total overhead allocated to the purchasing activity associated with Apple Pies?

A)$90,000

B)$24,000

C)$58,500

D)$32,000

E)None of the answer choices is correct.

Dublin Pie Company sells cherry pies and apple pies in bulk online.Estimated overhead costs for 2016 total $600,000.The accountant for Dublin identified the following information for its activity-based costing system.

The estimated activity level for each type of pie and in total is as follows:

-Refer to Exhibit 3-2.What is the total overhead allocated to the purchasing activity associated with Apple Pies?

A)$90,000

B)$24,000

C)$58,500

D)$32,000

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

49

Valor company is planning to implement an activity-based costing"ABC"system to apply overhead costs to products.Three activities were identified and rates were calculated for each activity.

Assume 600 purchase requisitions were processed,1,200 production setups were performed,and 300 products were inspected for the year.Which of the following journal entries would be made by Valor to record the application of overhead?

a.

b.

c.

d.

e.

Assume 600 purchase requisitions were processed,1,200 production setups were performed,and 300 products were inspected for the year.Which of the following journal entries would be made by Valor to record the application of overhead?

a.

b.

c.

d.

e.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

50

Exhibit 3-2

Dublin Pie Company sells cherry pies and apple pies in bulk online.Estimated overhead costs for 2016 total $600,000.The accountant for Dublin identified the following information for its activity-based costing system.

The estimated activity level for each type of pie and in total is as follows:

-Refer to Exhibit 3-2.What is the overhead rate for the purchasing activity?

A)$8.00

B)$3.60

C)$18.00

D)$6.00

E)None of the answer choices is correct.

Dublin Pie Company sells cherry pies and apple pies in bulk online.Estimated overhead costs for 2016 total $600,000.The accountant for Dublin identified the following information for its activity-based costing system.

The estimated activity level for each type of pie and in total is as follows:

-Refer to Exhibit 3-2.What is the overhead rate for the purchasing activity?

A)$8.00

B)$3.60

C)$18.00

D)$6.00

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

51

Exhibit 3-2

Dublin Pie Company sells cherry pies and apple pies in bulk online.Estimated overhead costs for 2016 total $600,000.The accountant for Dublin identified the following information for its activity-based costing system.

The estimated activity level for each type of pie and in total is as follows:

-Refer to Exhibit 3-2.How much total overhead should be assigned to Sales Order 115 for Cherry Pies,if it requires 2 purchase orders for a total of 300 pies (or units)?

A)$12

B)$1,080

C)$18

D)$1,110

E)None of the answer choices is correct.

Dublin Pie Company sells cherry pies and apple pies in bulk online.Estimated overhead costs for 2016 total $600,000.The accountant for Dublin identified the following information for its activity-based costing system.

The estimated activity level for each type of pie and in total is as follows:

-Refer to Exhibit 3-2.How much total overhead should be assigned to Sales Order 115 for Cherry Pies,if it requires 2 purchase orders for a total of 300 pies (or units)?

A)$12

B)$1,080

C)$18

D)$1,110

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following items is not a batch-level activity?

A)Direct materials used by workers to assemble products.

B)Machines set up to produce groups of products.

C)Purchase requisitions issued for raw materials needed to produce groups of products.

D)Quality inspections of groups of products.

E)None of the answer choices is correct.

A)Direct materials used by workers to assemble products.

B)Machines set up to produce groups of products.

C)Purchase requisitions issued for raw materials needed to produce groups of products.

D)Quality inspections of groups of products.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following would most likely be a non-value-added activity?

A)Producing goods.

B)Delivering product to customers.

C)Storing raw materials.

D)Providing customer service.

E)None of the answer choices is correct.

A)Producing goods.

B)Delivering product to customers.

C)Storing raw materials.

D)Providing customer service.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following would most likely be a value-added activity?

A)Waiting for raw materials to arrive.

B)Moving raw materials to production.

C)Storing finished goods.

D)Producing goods.

E)None of the answer choices is correct.

A)Waiting for raw materials to arrive.

B)Moving raw materials to production.

C)Storing finished goods.

D)Producing goods.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following would be the best allocation base for a new product design?

A)Square feet of space occupied.

B)Quantity of materials used.

C)Number of new products.

D)Number of machine setups.

E)None of the answer choices is correct.

A)Square feet of space occupied.

B)Quantity of materials used.

C)Number of new products.

D)Number of machine setups.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following items is not a product or customer-level activity?

A)Product designed for a specific customer.

B)Salary of a supervisor responsible for one product line.

C)New product design.

D)Direct materials used by workers to assemble products.

E)None of the answer choices is correct.

A)Product designed for a specific customer.

B)Salary of a supervisor responsible for one product line.

C)New product design.

D)Direct materials used by workers to assemble products.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following statements best describes the major difference between activity-based costing (ABC)and activity-based management (ABM)?

A)ABC is only used in manufacturing companies,and ABM is only used in service companies.

B)ABC is used in managerial accounting,and ABM is used in financial accounting.

C)The goal of ABC is to accurately measure costs,and the goal of ABM is to manage costly activities.

D)ABC is only used in service companies,and ABM is only used by merchandising companies.

E)None of the answer choices is correct.

A)ABC is only used in manufacturing companies,and ABM is only used in service companies.

B)ABC is used in managerial accounting,and ABM is used in financial accounting.

C)The goal of ABC is to accurately measure costs,and the goal of ABM is to manage costly activities.

D)ABC is only used in service companies,and ABM is only used by merchandising companies.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

58

All of the following are disadvantages of activity-based costing (ABC)except:

A)ABC systems are expensive.

B)ABC systems provide inaccurate product cost data.

C)Companies with one or two products may see little benefit from an ABC system.

D)Unit fixed costs can be misleading.

E)None of the answer choices is correct.

A)ABC systems are expensive.

B)ABC systems provide inaccurate product cost data.

C)Companies with one or two products may see little benefit from an ABC system.

D)Unit fixed costs can be misleading.

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

59

Exhibit 3-2

Dublin Pie Company sells cherry pies and apple pies in bulk online.Estimated overhead costs for 2016 total $600,000.The accountant for Dublin identified the following information for its activity-based costing system.

The estimated activity level for each type of pie and in total is as follows:

-Refer to Exhibit 3-2.What is the overhead rate for the processing activity?

A)$8.00

B)$3.60

C)$18.00

D)$6.00

E)None of the answer choices is correct.

Dublin Pie Company sells cherry pies and apple pies in bulk online.Estimated overhead costs for 2016 total $600,000.The accountant for Dublin identified the following information for its activity-based costing system.

The estimated activity level for each type of pie and in total is as follows:

-Refer to Exhibit 3-2.What is the overhead rate for the processing activity?

A)$8.00

B)$3.60

C)$18.00

D)$6.00

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

60

Exhibit 3-3

Metro Inc.has two production departments (Lamination and Molding)and three service departments (Human Resources,Technology Support,and Purchasing).Service department costs are allocated to production departments using the direct method.The $200,000 costs of Human Resources are allocated based on the number of employees in each production department.The $400,000 costs of Technology Support are allocated based on hours of technology support used by each production department.The $120,000 of Purchasing is allocated on the pounds of raw materials purchased for each production department.Information for each production department is as follows:

-Refer to Exhibit 3-3.Using the direct method of allocating service department costs to production departments,how much of the Human Resource service department costs should be allocated to the Lamination Department?

A)$70,000

B)$150,000

C)$40,000

D)$50,000

E)None of the answer choices is correct.

Metro Inc.has two production departments (Lamination and Molding)and three service departments (Human Resources,Technology Support,and Purchasing).Service department costs are allocated to production departments using the direct method.The $200,000 costs of Human Resources are allocated based on the number of employees in each production department.The $400,000 costs of Technology Support are allocated based on hours of technology support used by each production department.The $120,000 of Purchasing is allocated on the pounds of raw materials purchased for each production department.Information for each production department is as follows:

-Refer to Exhibit 3-3.Using the direct method of allocating service department costs to production departments,how much of the Human Resource service department costs should be allocated to the Lamination Department?

A)$70,000

B)$150,000

C)$40,000

D)$50,000

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

61

Kathy Edwards owns a landscape maintenance service that has two major segments,residential and commercial.Kathy is trying to decide whether she should use traditional costing or activity-based costing,so she develops the following estimates for her analysis and asks you to help.

The business also has overhead costs for equipment maintenance,transportation,and general activities of $360,000.

(1) Using the traditional allocation method, calculate the predetermined overhead rate and allocate the overhead costs to the segments based on labor cost.

(2) What is the income for each segment assuming the company uses traditional costing?

(3) Using activity-based costing, determine the overhead rates for each activity and allocate the overhead costs to each segment.

(4) What is the income for each segment assuming the company uses traditional costing?

(5) What are your recommendations to Kathy?

The business also has overhead costs for equipment maintenance,transportation,and general activities of $360,000.

(1) Using the traditional allocation method, calculate the predetermined overhead rate and allocate the overhead costs to the segments based on labor cost.

(2) What is the income for each segment assuming the company uses traditional costing?

(3) Using activity-based costing, determine the overhead rates for each activity and allocate the overhead costs to each segment.

(4) What is the income for each segment assuming the company uses traditional costing?

(5) What are your recommendations to Kathy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

62

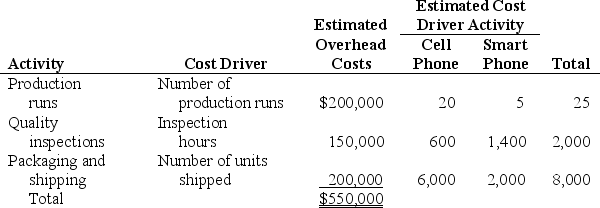

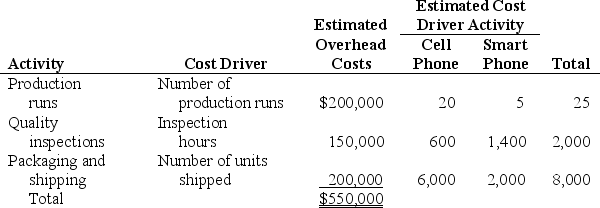

Telecom Company produces a cell phone that sells for $150,and a smart phone that sells for $350.Last year,total overhead costs of $550,000 were allocated based on direct labor hours.A total of 12,000 direct labor hours were required last year to build 6,000 cell phones (2 hours per unit),and 10,000 direct labor hours were required to build 2,000 smart phones (5 hours per unit).Total direct labor and direct materials costs for last year were:

Management of Telecom Company would like to use activity-based costing to allocate overhead rather than using one plantwide rate based on direct labor hours.The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

(1) Calculate the direct materials cost per unit and direct labor cost per unit for each product.

(2) a. Using the plantwide allocation method, calculate the predetermined overhead rate and determine the overhead cost per unit for the cell phone and smart phone products.

b. What is the product cost per unit for the cell phone and smart phone products?

(3) a. Using the activity-based costing allocation method, calculate the predetermined overhead rate for each activity.

b. Using the activity-based costing allocation method, allocate overhead to each product. Determine the overhead cost per unit

c. What is the product cost per unit for the cell phone and smart phone products?

(4) Calculate the per unit profit for each product using the plantwide approach and the activity-based costing approach. Comment on the difference in the results between the two approaches

Management of Telecom Company would like to use activity-based costing to allocate overhead rather than using one plantwide rate based on direct labor hours.The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

(1) Calculate the direct materials cost per unit and direct labor cost per unit for each product.

(2) a. Using the plantwide allocation method, calculate the predetermined overhead rate and determine the overhead cost per unit for the cell phone and smart phone products.

b. What is the product cost per unit for the cell phone and smart phone products?

(3) a. Using the activity-based costing allocation method, calculate the predetermined overhead rate for each activity.

b. Using the activity-based costing allocation method, allocate overhead to each product. Determine the overhead cost per unit

c. What is the product cost per unit for the cell phone and smart phone products?

(4) Calculate the per unit profit for each product using the plantwide approach and the activity-based costing approach. Comment on the difference in the results between the two approaches

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

63

Exhibit 3-3

Metro Inc.has two production departments (Lamination and Molding)and three service departments (Human Resources,Technology Support,and Purchasing).Service department costs are allocated to production departments using the direct method.The $200,000 costs of Human Resources are allocated based on the number of employees in each production department.The $400,000 costs of Technology Support are allocated based on hours of technology support used by each production department.The $120,000 of Purchasing is allocated on the pounds of raw materials purchased for each production department.Information for each production department is as follows:

-Refer to Exhibit 3-3.Using the direct method of allocating service department costs to production departments,how much of the Technology Support service department costs should be allocated to the Lamination Department?

A)$40,000

B)$160,000

C)$80,000

D)$320,000

E)None of the answer choices is correct.

Metro Inc.has two production departments (Lamination and Molding)and three service departments (Human Resources,Technology Support,and Purchasing).Service department costs are allocated to production departments using the direct method.The $200,000 costs of Human Resources are allocated based on the number of employees in each production department.The $400,000 costs of Technology Support are allocated based on hours of technology support used by each production department.The $120,000 of Purchasing is allocated on the pounds of raw materials purchased for each production department.Information for each production department is as follows:

-Refer to Exhibit 3-3.Using the direct method of allocating service department costs to production departments,how much of the Technology Support service department costs should be allocated to the Lamination Department?

A)$40,000

B)$160,000

C)$80,000

D)$320,000

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

64

Match between columns

الفرضيات:

Storing additional materials for future production.

Storing additional materials for future production.

Designing car seats to maximize comfort.

Designing car seats to maximize comfort.

الردود:

value-added

nonvalue-added

value-added

nonvalue-added

value-added

nonvalue-added

value-added

nonvalue-added

value-added

nonvalue-added

value-added

nonvalue-added

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

65

Exhibit 3-3

Metro Inc.has two production departments (Lamination and Molding)and three service departments (Human Resources,Technology Support,and Purchasing).Service department costs are allocated to production departments using the direct method.The $200,000 costs of Human Resources are allocated based on the number of employees in each production department.The $400,000 costs of Technology Support are allocated based on hours of technology support used by each production department.The $120,000 of Purchasing is allocated on the pounds of raw materials purchased for each production department.Information for each production department is as follows:

-Refer to Exhibit 3-3.Using the direct method of allocating service department costs to production departments,how much of the Purchasing service department costs should be allocated to the Lamination Department?

A)$24,000

B)$18,000

C)$84,000

D)$36,000

E)None of the answer choices is correct.

Metro Inc.has two production departments (Lamination and Molding)and three service departments (Human Resources,Technology Support,and Purchasing).Service department costs are allocated to production departments using the direct method.The $200,000 costs of Human Resources are allocated based on the number of employees in each production department.The $400,000 costs of Technology Support are allocated based on hours of technology support used by each production department.The $120,000 of Purchasing is allocated on the pounds of raw materials purchased for each production department.Information for each production department is as follows:

-Refer to Exhibit 3-3.Using the direct method of allocating service department costs to production departments,how much of the Purchasing service department costs should be allocated to the Lamination Department?

A)$24,000

B)$18,000

C)$84,000

D)$36,000

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

66

Exhibit 3-3

Metro Inc.has two production departments (Lamination and Molding)and three service departments (Human Resources,Technology Support,and Purchasing).Service department costs are allocated to production departments using the direct method.The $200,000 costs of Human Resources are allocated based on the number of employees in each production department.The $400,000 costs of Technology Support are allocated based on hours of technology support used by each production department.The $120,000 of Purchasing is allocated on the pounds of raw materials purchased for each production department.Information for each production department is as follows:

-Refer to Exhibit 3-3.Using the direct method of allocating service department costs to production departments,how much of the Technology Support service department costs should be allocated to the Molding Department?

A)$40,000

B)$160,000

C)$80,000

D)$320,000

E)None of the answer choices is correct.

Metro Inc.has two production departments (Lamination and Molding)and three service departments (Human Resources,Technology Support,and Purchasing).Service department costs are allocated to production departments using the direct method.The $200,000 costs of Human Resources are allocated based on the number of employees in each production department.The $400,000 costs of Technology Support are allocated based on hours of technology support used by each production department.The $120,000 of Purchasing is allocated on the pounds of raw materials purchased for each production department.Information for each production department is as follows:

-Refer to Exhibit 3-3.Using the direct method of allocating service department costs to production departments,how much of the Technology Support service department costs should be allocated to the Molding Department?

A)$40,000

B)$160,000

C)$80,000

D)$320,000

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

67

Theron Industries has the following financial data related to its quality control program.

Identify which costs and amounts are prevention,appraisal,internal failure or external failure.

Identify which costs and amounts are prevention,appraisal,internal failure or external failure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

68

Roseville Engineering provides watershed and design services for its customers.Total overhead costs this coming year are expected to be $8,000,000 ($2,000,000 in the Watershed Department,and $6,000,000 in the Design Department).If the company chooses to use the plantwide approach,overhead will be allocated using direct labor costs.Direct labor costs are expected to total $4,000,000.The Watershed Department expects to incur direct labor costs of $500,000,and the Design Department expects to work 120,000 direct labor hours.

a. Assume Roseville Engineering uses the plantwide approach to allocating overhead costs, and uses direct labor costs as the allocation base. Calculate the predetermined overhead rate and explain how this rate will be used to allocate overhead costs.

b. Assume Roseville Engineering uses the department approach for allocating overhead costs rather than the plantwide method. The Watershed Department allocates overhead based on direct labor costs and the Design Department allocates overhead based on direct labor hours. Calculate the predetermined overhead rate for each department and explain how these rates will be used to allocate overhead costs

a. Assume Roseville Engineering uses the plantwide approach to allocating overhead costs, and uses direct labor costs as the allocation base. Calculate the predetermined overhead rate and explain how this rate will be used to allocate overhead costs.

b. Assume Roseville Engineering uses the department approach for allocating overhead costs rather than the plantwide method. The Watershed Department allocates overhead based on direct labor costs and the Design Department allocates overhead based on direct labor hours. Calculate the predetermined overhead rate for each department and explain how these rates will be used to allocate overhead costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

69

Whitney Company has two production departments (P1 and P2)and three service departments (S1,S2,and S3).Service department costs are allocated to production departments using the direct method.The $300,000 costs of department S1 are allocated based on the number of employees in each production department.The $400,000 costs of department S2 are allocated based on the square footage of space occupied by each production department.The $225,000 costs of department S3 are allocated based on hours of technology support used by each production department.Information for each production department is as follows:

a. Calculate the service department costs allocated to each production department.

b. In general, do U.S. Generally Accepted Accounting Principles allow for the allocation of service department costs to production departments for the purpose of valuing inventory?

a. Calculate the service department costs allocated to each production department.

b. In general, do U.S. Generally Accepted Accounting Principles allow for the allocation of service department costs to production departments for the purpose of valuing inventory?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

70

Exhibit 3-3

Metro Inc.has two production departments (Lamination and Molding)and three service departments (Human Resources,Technology Support,and Purchasing).Service department costs are allocated to production departments using the direct method.The $200,000 costs of Human Resources are allocated based on the number of employees in each production department.The $400,000 costs of Technology Support are allocated based on hours of technology support used by each production department.The $120,000 of Purchasing is allocated on the pounds of raw materials purchased for each production department.Information for each production department is as follows:

-Refer to Exhibit 3-3.Using the direct method of allocating service department costs to production departments,how much of the Human Resource service department costs should be allocated to the Molding Department?

A)$70,000

B)$160,000

C)$150,000

D)$50,000

E)None of the answer choices is correct.

Metro Inc.has two production departments (Lamination and Molding)and three service departments (Human Resources,Technology Support,and Purchasing).Service department costs are allocated to production departments using the direct method.The $200,000 costs of Human Resources are allocated based on the number of employees in each production department.The $400,000 costs of Technology Support are allocated based on hours of technology support used by each production department.The $120,000 of Purchasing is allocated on the pounds of raw materials purchased for each production department.Information for each production department is as follows:

-Refer to Exhibit 3-3.Using the direct method of allocating service department costs to production departments,how much of the Human Resource service department costs should be allocated to the Molding Department?

A)$70,000

B)$160,000

C)$150,000

D)$50,000

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck

71

Exhibit 3-3

Metro Inc.has two production departments (Lamination and Molding)and three service departments (Human Resources,Technology Support,and Purchasing).Service department costs are allocated to production departments using the direct method.The $200,000 costs of Human Resources are allocated based on the number of employees in each production department.The $400,000 costs of Technology Support are allocated based on hours of technology support used by each production department.The $120,000 of Purchasing is allocated on the pounds of raw materials purchased for each production department.Information for each production department is as follows:

-Refer to Exhibit 3-3.Using the direct method of allocating service department costs to production departments,how much of the Purchasing service department costs should be allocated to the Molding Department?

A)$84,000

B)$150,000

C)$96,000

D)$36,000

E)None of the answer choices is correct.

Metro Inc.has two production departments (Lamination and Molding)and three service departments (Human Resources,Technology Support,and Purchasing).Service department costs are allocated to production departments using the direct method.The $200,000 costs of Human Resources are allocated based on the number of employees in each production department.The $400,000 costs of Technology Support are allocated based on hours of technology support used by each production department.The $120,000 of Purchasing is allocated on the pounds of raw materials purchased for each production department.Information for each production department is as follows:

-Refer to Exhibit 3-3.Using the direct method of allocating service department costs to production departments,how much of the Purchasing service department costs should be allocated to the Molding Department?

A)$84,000

B)$150,000

C)$96,000

D)$36,000

E)None of the answer choices is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 71 في هذه المجموعة.

فتح الحزمة

k this deck