Deck 13: Comparative Forms of Doing Business

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/141

العب

ملء الشاشة (f)

Deck 13: Comparative Forms of Doing Business

1

A business entity is not always taxed the same way as its legal form.

True

2

A limited liability company (LLC)cannot elect under the check-the-box rules to be taxed as an S corporation.

True

3

Each of the following can pass profits and losses through to the owners: general partnership,limited partnership,S corporation,and limited liability company.

True

4

A major benefit of the S corporation election is the general avoidance of double taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

5

A C corporation offers greater flexibility in terms of the types of owners and capital structure than an S corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

6

A limited partner in a limited partnership has limited liability whereas a general partner in a limited partnership has unlimited liability unless the limited partners agree that the general partner will have limited liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

7

Obtaining a deduction on payments made by a C corporation to shareholders is a technique for reducing double taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

8

Lime,Inc. ,has taxable income of $334,000.If Lime is a C corporation,its tax liability must be either $113,510 [($50,000 ´ 15%)+ ($25,000 ´ 25%)+ ($25,000 ´ 34%)+ ($234,000 ´ 39%)] or $116,900.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

9

When a C corporation is classified as a small corporation for AMT purposes,both the corporation and its shareholders are exempt from the AMT.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

10

Depending on the election made under the check-the-box provisions,a limited liability company (LLC)with two or more owners might have to file a Form 1065 or a Form 1120.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

11

An S corporation has a lesser degree of limited liability than a C corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

12

Nontax factors are less important than tax factors in making a business decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

13

The check-the-box Regulations have made it easier for a business entity to be classified as a partnership for Federal income tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

14

C corporations and their shareholders are subject to double taxation.S corporations and their shareholders typically are subject to single taxation.Therefore,for any given amount of corporate taxable income,the combined tax liability of a C corporation and its shareholders will exceed that of an S corporation and its shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

15

If a C corporation has earnings and profits at least equal to the amount of a distribution,the tax consequences to the shareholders are the same,regardless of whether the distribution is classified as a dividend or as a stock redemption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

16

A corporation may alternate between S corporation and C corporation status each year,depending on which results in more tax savings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

17

Daniel,who is single,estimates that the profits of his business for the current tax year will be $100,000.Since the highest tax rate (34%)applicable to corporate taxable income of $100,000 is greater than the highest tax rate (28%)applicable to individual taxable income of $100,000,the Federal income tax liability will be less if Daniel conducts his business as a sole proprietorship rather than as a C corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

18

The § 465 at-risk provision and the § 469 passive activity loss provision have decreased the tax attractiveness of investments in real estate for partnerships and for limited liability companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

19

A limited partnership can indirectly avoid unlimited liability of the general partner if the general partner is a corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

20

A limited liability company (LLC)is a hybrid business form that combines the corporate characteristic of limited liability for the owners with the tax characteristics of a partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

21

Molly transfers land with an adjusted basis of $28,000 and a fair market value of $65,000 to the Sand Partnership for a 30% ownership interest.The land is encumbered by a mortgage of $18,000 which the partnership assumes.Her basis for her ownership interest is $10,000 ($28,000 - $18,000).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

22

Only C corporations are subject to the accumulated earnings tax (i.e. ,S corporations are not).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

23

The tax treatment of S corporation shareholders with respect to fringe benefits is not the same as the tax treatment for C corporation shareholders but is the same as the fringe benefit treatment for partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

24

If lease rental payments to a noncorporate shareholder-lessor are classified as unreasonable,the taxable income of a C corporation decreases and the gross income of the shareholder remains the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

25

The AMT tax rate for a C corporation is less than the regular tax rate for C corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

26

Of the corporate types of entities,all are subject to double taxation on current earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

27

The accumulated earnings tax rate in 2012 is greater than the highest tax rate for a C corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

28

A corporation can avoid the accumulated earnings tax by demonstrating that it has plans to distribute earnings at a later date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

29

C corporations and S corporations can generate an AMT adjustment known as Adjusted Current Earnings (ACE).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

30

An S corporation election for Federal income tax purposes also is effective for all states' income tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

31

The AMT statutory rate for C corporations and for S corporation shareholders on the AMT base is 20%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

32

The ACE adjustment associated with the C corporation AMT can be either positive or negative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

33

Roger owns 40% of the stock of Gold,Inc.(adjusted basis of $800,000).Silver redeems 60% of Roger's shares for $900,000.If the stock redemption qualifies for return of capital treatment,Roger's recognized gain is $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

34

An effective way for all C corporations to avoid double taxation is not to make dividend distributions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

35

In its first year of operations,a corporation projects losses of $125,000.Since losses are involved,the corporation definitely should elect S corporation status.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

36

Actual dividends paid to shareholders result in double taxation.However,deemed dividends (e.g. ,free use of corporate assets by a shareholder)do not result in double taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

37

If the IRS reclassifies debt as equity under § 385,the repayment of the debt by the corporation to the shareholder automatically is treated as a dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

38

Only shareholders who own greater than 10% of an S corporation's stock are treated as partners and,thus,as nonemployees for fringe benefit treatment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

39

An S corporation is not subject to the AMT,but its shareholders are in that the S corporation's AMT adjustments and preferences are passed through to them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

40

With proper tax planning,it is always possible for a C corporation and its shareholders to avoid double taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

41

The profits of a business owned by Taylor (60%)and Maggie (40%)for the current tax year are $100,000.If the business is a C corporation or an S corporation,there is no effect on Taylor's basis in her stock.If the business is a partnership or an LLC,Taylor's basis in her partnership interest or basis in her stock is increased by $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

42

For a limited liability company with 100 unrelated owners:

A)An election can be made to be taxed as a C corporation.

B)An election can be made to be taxed as an S corporation.

C)An election can be made to be taxed as a partnership.

D)Only a.and c.are correct.

E)a. ,b. ,and c.are correct.

A)An election can be made to be taxed as a C corporation.

B)An election can be made to be taxed as an S corporation.

C)An election can be made to be taxed as a partnership.

D)Only a.and c.are correct.

E)a. ,b. ,and c.are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

43

The special allocation opportunities that are available to partnerships are available to S corporations only if affected shareholders elect to do so.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is correct regarding the form for filing the annual Federal income tax return? Business entity form Tax form

A)Sole proprietorship Form 1040-Schedule C

B)Partnership Form 1065P

C)C corporation Form 1120C

D)LLC Form 1120S

E)S corporation Form 1120

A)Sole proprietorship Form 1040-Schedule C

B)Partnership Form 1065P

C)C corporation Form 1120C

D)LLC Form 1120S

E)S corporation Form 1120

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following is not correct with respect to limited liability companies?

A)An advantage of an LLC when compared to a C corporation is the ability to pass tax attributes through to the owners.

B)A disadvantage of a partnership when compared with an LLC is the inability of all the owners to have limited liability.

C)An LLC has greater flexibility than does an S corporation in terms of the number of owners,types of owners,and capital structure.

D)All of the above are correct.

E)All of the above are incorrect.

A)An advantage of an LLC when compared to a C corporation is the ability to pass tax attributes through to the owners.

B)A disadvantage of a partnership when compared with an LLC is the inability of all the owners to have limited liability.

C)An LLC has greater flexibility than does an S corporation in terms of the number of owners,types of owners,and capital structure.

D)All of the above are correct.

E)All of the above are incorrect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

46

Mercedes owns a 30% interest in Magenta Partnership (basis of $52,000)which she sells to Calvin for $65,000.Mercedes' recognized gain of $13,000 will be classified as capital gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

47

Amos contributes land with an adjusted basis of $150,000 and a fair market value of $200,000 to White,Inc. ,an S corporation,in exchange for 50% of the stock of White,Inc.Carol contributes cash of $200,000 for the other 50% of the stock.If White later sells the land for $225,000,$62,500 [$50,000 + 50%($25,000)] is allocated to Amos and $12,500 ($25,000 ´ 50%)is allocated to Carol.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

48

If an individual contributes an appreciated personal use asset to a C corporation in a transaction which qualifies for nonrecognition treatment under § 351,the corporation's basis in the asset is the same as was the shareholder's adjusted basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

49

Wally contributes land (adjusted basis of $30,000;fair market value of $100,000)to an S corporation in a transaction which qualifies under § 351.The corporation subsequently sells the land for $120,000,recognizing a gain of $90,000 ($120,000 - $30,000).If Wally owns 30% of the stock,$76,000 [$70,000 + 30%($20,000)] of the $90,000 recognized gain is allocated to Wally.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

50

To the extent of built-in gain or built-in loss at the time of contribution,partnerships may choose to allocate or not allocate this built-in gain or loss to the contributing partner on the sale of the contributed property by the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following statements is incorrect?

A)The number of owners of an LLC is not limited.

B)If the LLC has three or more corporate characteristics,it will be taxed as a C corporation.

C)An LLC can elect to be taxed as a C corporation or as a partnership.

D)Only a.and c.

E)a. ,b. ,and c.are incorrect.

A)The number of owners of an LLC is not limited.

B)If the LLC has three or more corporate characteristics,it will be taxed as a C corporation.

C)An LLC can elect to be taxed as a C corporation or as a partnership.

D)Only a.and c.

E)a. ,b. ,and c.are incorrect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

52

From the perspective of the seller of a C corporation business whose assets have appreciated,the seller prefers to sell the assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

53

A benefit of an S corporation when compared with a C corporation is that it is subject to Federal income tax only in limited circumstances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

54

A shareholder's basis in the stock of an S corporation is increased by corporate profits and decreased by losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

55

Melinda's basis for her partnership interest is $250,000.If she receives a cash distribution of $290,000,her recognized gain is $40,000 and her basis for her partnership interest is reduced to $0.Melinda is still a partner after the distribution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

56

After a § 721 contribution by a partner to a partnership,the partner's basis for his or her ownership interest is the same as the basis of the assets contributed (no liabilities are involved).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following statements is correct?

A)An S corporation has a greater opportunity to raise capital than does an C corporation.

B)A general partnership has a greater opportunity to raise capital than does a limited partnership.

C)A partnership has a greater opportunity to raise capital than does a sole proprietorship.

D)Only a.and b.are correct.

E)a. ,b. ,and c.are correct.

A)An S corporation has a greater opportunity to raise capital than does an C corporation.

B)A general partnership has a greater opportunity to raise capital than does a limited partnership.

C)A partnership has a greater opportunity to raise capital than does a sole proprietorship.

D)Only a.and b.are correct.

E)a. ,b. ,and c.are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

58

If an S corporation distributes appreciated property as a dividend,it must recognize gain as to the appreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

59

The § 469 passive activity loss rules do not apply to corporations other than S corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

60

Section 1244 ordinary loss treatment is available to shareholders in a C corporation but not to those in an S corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

61

Trolette contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity.If the entity is a C corporation and the transaction qualifies under § 351,the corporation's basis for the property and the shareholder's basis for the stock are: Asset Basis Stock Basis

A)$ 80,000 $100,000

B)$100,000 $ 80,000

C)$ 80,000 $ 80,000

D)$100,000 $100,000

E)None of the above.

A)$ 80,000 $100,000

B)$100,000 $ 80,000

C)$ 80,000 $ 80,000

D)$100,000 $100,000

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

62

Austin is the sole shareholder of Purple,Inc.Purple's accumulated E & P at the beginning of the year is $700,000.Purple's taxable income after paying a salary and bonus to Austin of $100,000 is $500,000.Assume the salary and bonus payment are reasonable.Purple's maximum exposure in calculating accumulated taxable income for purposes of the accumulated earnings tax for the current tax year is:

A)$330,000.

B)$500,000.

C)$600,000.

D)$1,300,000.

E)None of the above.

A)$330,000.

B)$500,000.

C)$600,000.

D)$1,300,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

63

Techniques that can be used to minimize the current period tax liability include:

A)Recognizing the interaction between the regular income tax liability and the alternative minimum tax liability.

B)Utilization of special allocations.

C)Favorable treatment of certain fringe benefits.

D)Minimizing double taxation.

E)All of the above.

A)Recognizing the interaction between the regular income tax liability and the alternative minimum tax liability.

B)Utilization of special allocations.

C)Favorable treatment of certain fringe benefits.

D)Minimizing double taxation.

E)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

64

Barb and Chuck each own one-half the stock of Wren,Inc. ,an S corporation.Each shareholder has a stock basis of $175,000.Wren has no accumulated E & P.Wren's taxable income for the current year is $100,000,and it distributes $75,000 to each shareholder.Barb's stock basis at the end of the year is:

A)$0.

B)$100,000.

C)$150,000.

D)$175,000.

E)None of the above.

A)$0.

B)$100,000.

C)$150,000.

D)$175,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

65

Maria has a 70% ownership interest in a business entity.She is in the 28% tax bracket.The entity incurs $18,000 of meals and lodging expense for Maria,which she believes qualify for exclusion under § 119.Which of the following statements is correct?

A)If the entity is a partnership,the effect of the $18,000 expenditure by the partnership on Maria's tax liability is an increase of $5,040.

B)If the entity is a sole proprietorship,the effect of the $18,000 expenditure by the sole proprietorship on Maria's tax liability is $0.

C)If the entity is a C corporation,the effect of the $18,000 expenditure by the corporation on Maria's tax liability is $0.

D)Only a.and c.are correct.

E)a. ,b. ,and c.are correct.

A)If the entity is a partnership,the effect of the $18,000 expenditure by the partnership on Maria's tax liability is an increase of $5,040.

B)If the entity is a sole proprietorship,the effect of the $18,000 expenditure by the sole proprietorship on Maria's tax liability is $0.

C)If the entity is a C corporation,the effect of the $18,000 expenditure by the corporation on Maria's tax liability is $0.

D)Only a.and c.are correct.

E)a. ,b. ,and c.are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

66

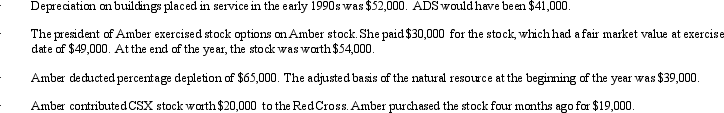

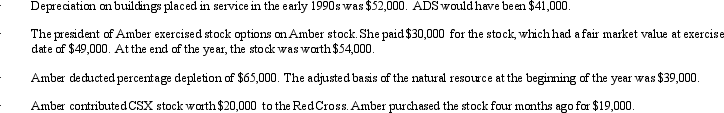

Amber,Inc. ,has taxable income of $212,000.In addition,Amber accumulates the following information which may affect its AMT.  What is Amber's AMTI?

What is Amber's AMTI?

A)$212,000.

B)$233,000.

C)$238,000.

D)$249,000.

E)None of the above

What is Amber's AMTI?

What is Amber's AMTI?A)$212,000.

B)$233,000.

C)$238,000.

D)$249,000.

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

67

Malcomb and Sandra (shareholders)each loan Crow Corporation $50,000 at the market rate of 6% interest.Which of the following statements are false?

A)Crow may deduct the interest expense,and the interest income is taxable to Malcomb and Sandra.

B)When the note principal is repaid,neither Malcomb nor Sandra recognizes gross income from the repayment.

C)If the IRS were successful in reclassifying the notes as equity,the interest payments would not be deductible by Crow,and Malcomb and Sandra would still recognize income.

D)If the IRS were successful in reclassifying the notes as equity,repayment of the note principal to Malcomb and Sandra would not qualify for return of capital treatment and would most likely result in dividend income treatment for Malcomb and Sandra.

E)All of the above are true.

A)Crow may deduct the interest expense,and the interest income is taxable to Malcomb and Sandra.

B)When the note principal is repaid,neither Malcomb nor Sandra recognizes gross income from the repayment.

C)If the IRS were successful in reclassifying the notes as equity,the interest payments would not be deductible by Crow,and Malcomb and Sandra would still recognize income.

D)If the IRS were successful in reclassifying the notes as equity,repayment of the note principal to Malcomb and Sandra would not qualify for return of capital treatment and would most likely result in dividend income treatment for Malcomb and Sandra.

E)All of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

68

Barb and Chuck each have a 50% ownership in Wren Partnership.Each partner has a partnership interest basis of $175,000.Wren's taxable income for the current year is $100,000,and it distributes $75,000 to each partner.Barb's basis in the partnership interest at the end of the year is:

A)$0.

B)$100,000.

C)$150,000.

D)$175,000.

E)None of the above.

A)$0.

B)$100,000.

C)$150,000.

D)$175,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

69

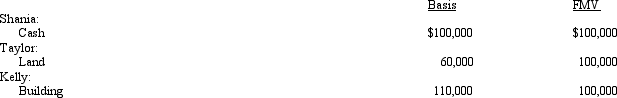

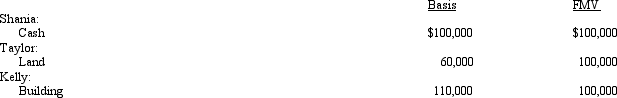

Shania,Taylor,and Kelly form a corporation with the following contributions.

A)If the corporation is a C corporation,Taylor has a recognized gain of $40,000,a stock basis of $100,000,and the corporation has a basis for the land of $100,000.

B)If the corporation is an S corporation,Kelly has a recognized gain or loss of $0,a stock basis of $110,000,and the corporation has a basis for the building of $110,000.

C)If the corporation is a C corporation,Shania has a recognized gain or loss of $0,a stock basis of $100,000,and the corporation has a basis for the cash of $100,000.

D)Only a.and c.are correct.

E)Only b.and c.are correct.

A)If the corporation is a C corporation,Taylor has a recognized gain of $40,000,a stock basis of $100,000,and the corporation has a basis for the land of $100,000.

B)If the corporation is an S corporation,Kelly has a recognized gain or loss of $0,a stock basis of $110,000,and the corporation has a basis for the building of $110,000.

C)If the corporation is a C corporation,Shania has a recognized gain or loss of $0,a stock basis of $100,000,and the corporation has a basis for the cash of $100,000.

D)Only a.and c.are correct.

E)Only b.and c.are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

70

Beige,Inc. ,has 3,000 shares of stock authorized and 1,000 shares outstanding.The shares are owned by Sam (700 shares)and Lois (300 shares).Sam's adjusted basis for his stock is $100,000 and Lois' adjusted basis for her stock is $90,000.Beige's earnings and profits are $500,000.Beige redeems 200 of Lois' shares for $150,000.Determine the amount of Lois' recognized gain (1)if she is Sam's mother and (2)if they are unrelated.

A)$0 and $0.

B)$150,000 and $60,000.

C)$150,000 and $90,000.

D)$50,000 and $150,000.

E)None of the above.

A)$0 and $0.

B)$150,000 and $60,000.

C)$150,000 and $90,000.

D)$50,000 and $150,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

71

Nontax factors that affect the choice of business entity include:

A)Ease of capital formation.

B)Limited liability.

C)Single versus double taxation.

D)Only a.and b.

E)a. ,b. ,and c.

A)Ease of capital formation.

B)Limited liability.

C)Single versus double taxation.

D)Only a.and b.

E)a. ,b. ,and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

72

Robin Company has $100,000 of income before payment of $100,000 of reasonable salaries to its owners/employees (who are in the 33% bracket).Which form of business results in the least amount of combined tax being paid by the company and its owners?

A)Partnership.

B)C corporation.

C)S corporation.

D)a. ,b. ,and c.all result in the same amount of tax.

E)a.and c.result in the least amount of tax.

A)Partnership.

B)C corporation.

C)S corporation.

D)a. ,b. ,and c.all result in the same amount of tax.

E)a.and c.result in the least amount of tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

73

Factors that should be considered in making the S corporation election for the current tax year include the following:

A)Are greater than 50% of the shareholders willing to consent to the election?

B)Can the requirements for qualification be satisfied by the 15th day of the third month of the tax year and also for the period of the tax year that precedes this date?

C)Will the corporation have total capital not in excess of $1 million?

D)Only b.and c.

E)a. ,b. ,and c.

A)Are greater than 50% of the shareholders willing to consent to the election?

B)Can the requirements for qualification be satisfied by the 15th day of the third month of the tax year and also for the period of the tax year that precedes this date?

C)Will the corporation have total capital not in excess of $1 million?

D)Only b.and c.

E)a. ,b. ,and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following statements is correct?

A)The AMT applies to both the individual taxpayer and the C corporation.

B)The individual AMT rates are 26% and 28%.

C)The C corporation AMT rate is 25%.

D)Only a.and b.are correct.

E)a. ,b. ,and c.are correct.

A)The AMT applies to both the individual taxpayer and the C corporation.

B)The individual AMT rates are 26% and 28%.

C)The C corporation AMT rate is 25%.

D)Only a.and b.are correct.

E)a. ,b. ,and c.are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following are "reasonable needs" that will help a corporation in avoiding the accumulated earnings tax?

A)The corporation is opening locations in neighboring cities.

B)Funds are used to make a loan to a major shareholder.

C)The corporation uses funds for the redemption of the stock of a disgruntled shareholder.

D)Not making distributions helps to minimize the combined shareholder/corporation tax liabilities.

E)All of the above.

A)The corporation is opening locations in neighboring cities.

B)Funds are used to make a loan to a major shareholder.

C)The corporation uses funds for the redemption of the stock of a disgruntled shareholder.

D)Not making distributions helps to minimize the combined shareholder/corporation tax liabilities.

E)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following is not a reason why a corporation would want to elect S corporation status?

A)To pass through losses to the shareholders.

B)To avoid the alternative minimum tax at the entity level.

C)To make special allocations of income and expenses to shareholders.

D)To avoid taxation at the entity level.

E)None of the above.

A)To pass through losses to the shareholders.

B)To avoid the alternative minimum tax at the entity level.

C)To make special allocations of income and expenses to shareholders.

D)To avoid taxation at the entity level.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

77

Barb and Chuck each own one-half of the stock of Wren,Inc. ,a C corporation.Each shareholder has a stock basis of $175,000.Wren has accumulated E & P of $300,000.Wren's taxable income for the current year is $100,000,and it distributes $75,000 to each shareholder.Barb's stock basis at the end of the year is:

A)$0.

B)$100,000.

C)$150,000.

D)$175,000.

E)None of the above.

A)$0.

B)$100,000.

C)$150,000.

D)$175,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

78

Arthur is the sole shareholder of Purple,Inc.Purple's taxable income before the payment of Arthur's salary is $300,000.Based on this information,Arthur has the corporation pay him a salary of $200,000 and a bonus of $100,000.A reasonable salary and bonus would be $175,000.Which of the following is correct?

A)The taxable income of Purple,Inc. ,is $0 ($300,000 - $300,000 salary and bonus).

B)The taxable income of Purple,Inc. ,is $100,000 ($300,000 - $200,000).

C)Arthur has salary and bonus income of $300,000.

D)Arthur has salary and bonus income of $175,000 and dividend income of $125,000.

E)None of the above.

A)The taxable income of Purple,Inc. ,is $0 ($300,000 - $300,000 salary and bonus).

B)The taxable income of Purple,Inc. ,is $100,000 ($300,000 - $200,000).

C)Arthur has salary and bonus income of $300,000.

D)Arthur has salary and bonus income of $175,000 and dividend income of $125,000.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

79

Aaron purchases a building for $500,000 which is going to be used by his wholly-owned corporation.Which of the following statements are correct?

A)If Aaron contributes the building to the corporation,there will be no recognition under § 351 and a carryover basis of $500,000.

B)If Aaron leases the building to the corporation,lease-rental payments of $30,000 per year to Aaron will result in a $30,000 deduction for the corporation.

C)If Aaron leases the building to the corporation,lease-rental payments of $30,000 per year to Aaron will result in $30,000 of gross income for Aaron.

D)Leasing the building to the corporation will contribute to the tax avoidance objective of minimizing double taxation.

E)All of the above are correct.

A)If Aaron contributes the building to the corporation,there will be no recognition under § 351 and a carryover basis of $500,000.

B)If Aaron leases the building to the corporation,lease-rental payments of $30,000 per year to Aaron will result in a $30,000 deduction for the corporation.

C)If Aaron leases the building to the corporation,lease-rental payments of $30,000 per year to Aaron will result in $30,000 of gross income for Aaron.

D)Leasing the building to the corporation will contribute to the tax avoidance objective of minimizing double taxation.

E)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

80

Tonya contributes $150,000 to Swan,Inc. ,for 80% of the stock.In addition,she loans Swan $600,000.The maturity date on the loan is 5 years and the interest rate is 6%,the same as the Federal rate.Which of the following statements are correct?

A)If the loan is reclassified as equity under § 385,Swan qualifies for a deduction of $600,000 when the loan is repaid,and Tonya receives dividend income of $600,000 (assuming that Swan's earnings and profits are at least $600,000).

B)If the loan is not reclassified as equity under § 385,Swan can deduct interest expense annually of $36,000,and Tonya includes in gross income annually interest income of $36,000.

C)If the loan is reclassified as equity under § 385,Swan claims no interest deduction,and Tonya recognizes no income.

D)Only a.and b.

E)a. ,b. ,and c.

A)If the loan is reclassified as equity under § 385,Swan qualifies for a deduction of $600,000 when the loan is repaid,and Tonya receives dividend income of $600,000 (assuming that Swan's earnings and profits are at least $600,000).

B)If the loan is not reclassified as equity under § 385,Swan can deduct interest expense annually of $36,000,and Tonya includes in gross income annually interest income of $36,000.

C)If the loan is reclassified as equity under § 385,Swan claims no interest deduction,and Tonya recognizes no income.

D)Only a.and b.

E)a. ,b. ,and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck