Deck 2: Consolidation of Financial Information

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/116

العب

ملء الشاشة (f)

Deck 2: Consolidation of Financial Information

1

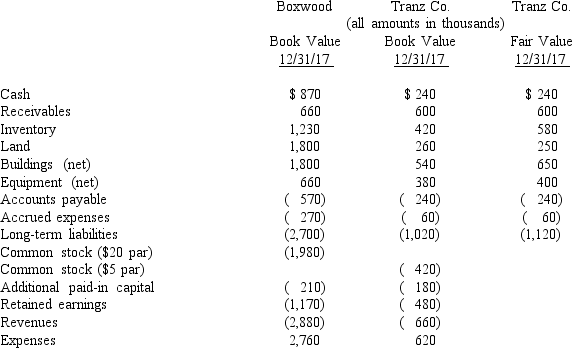

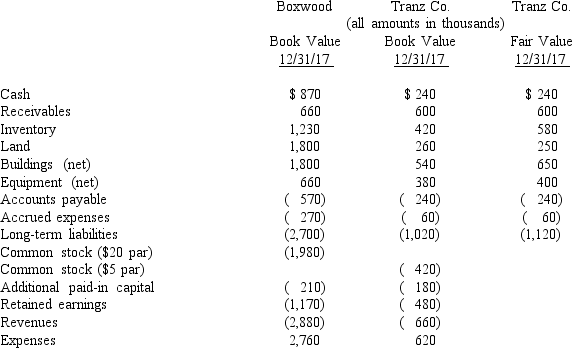

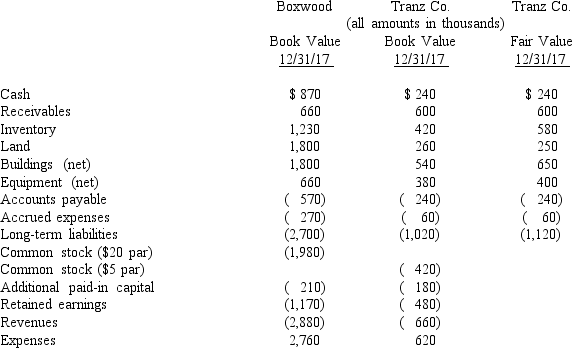

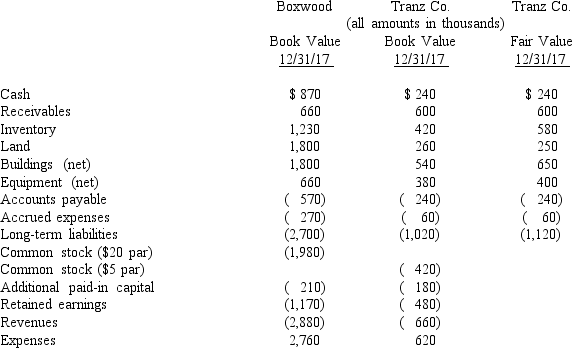

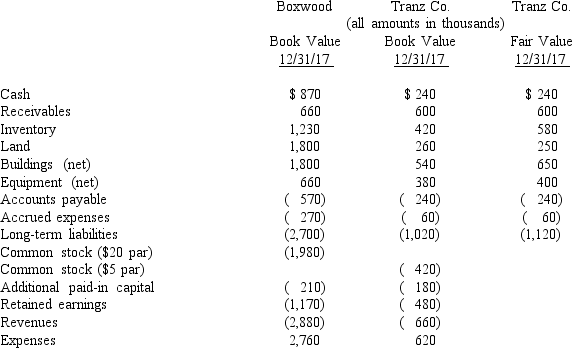

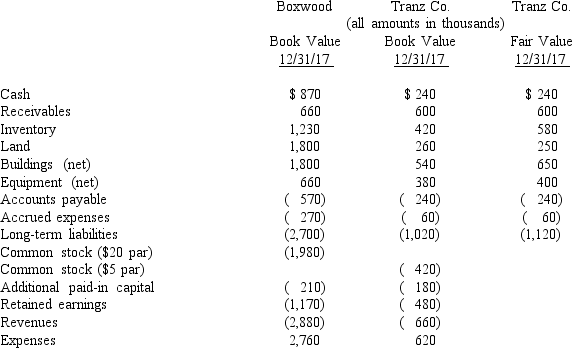

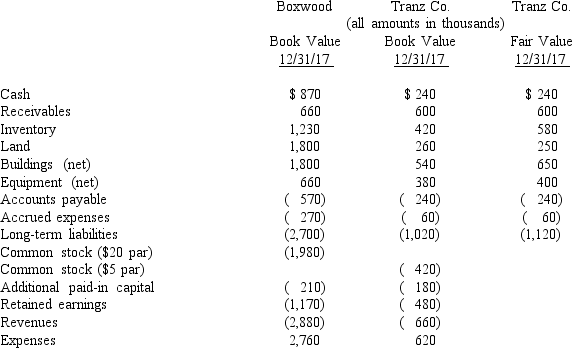

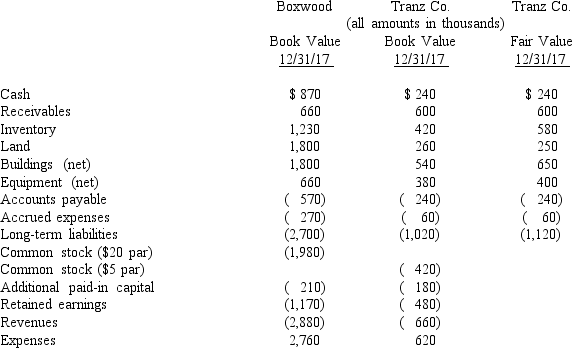

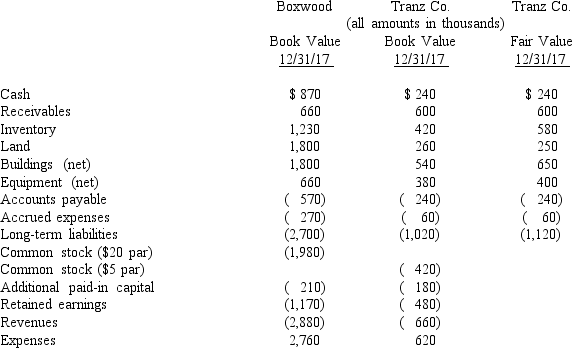

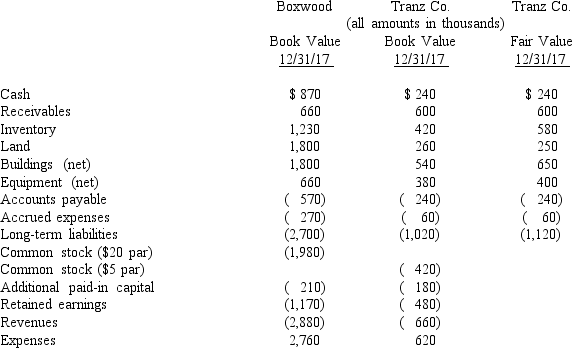

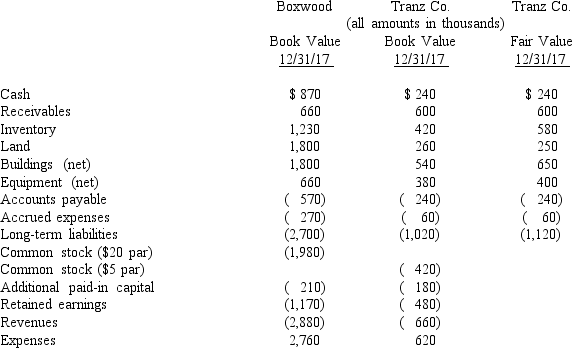

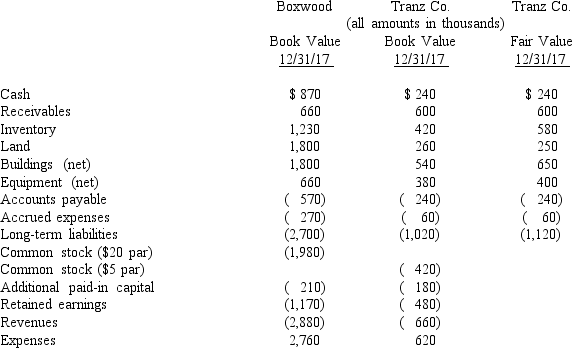

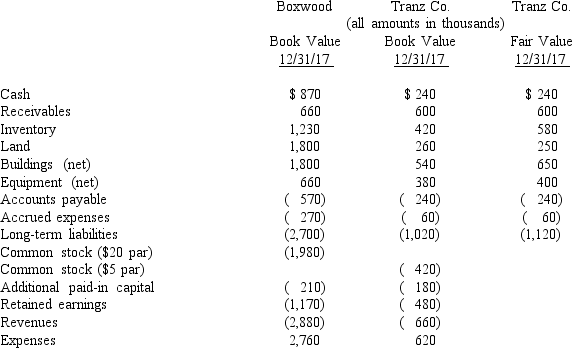

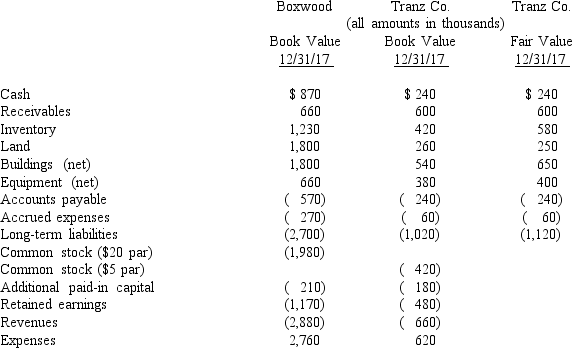

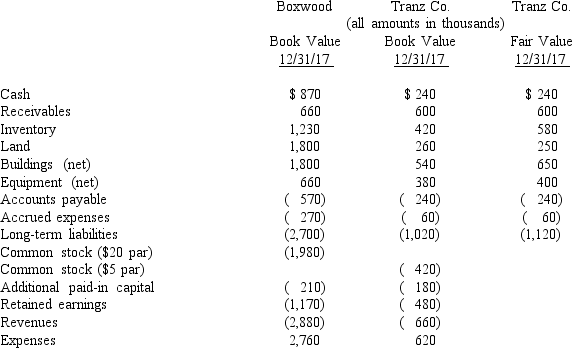

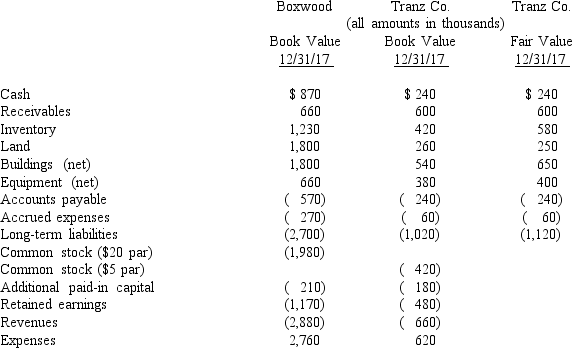

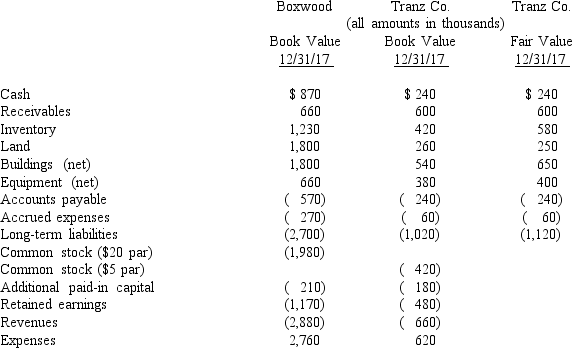

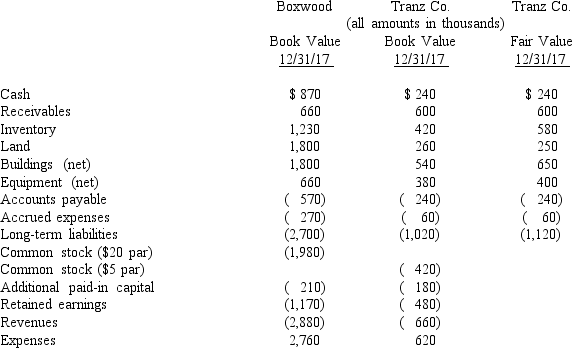

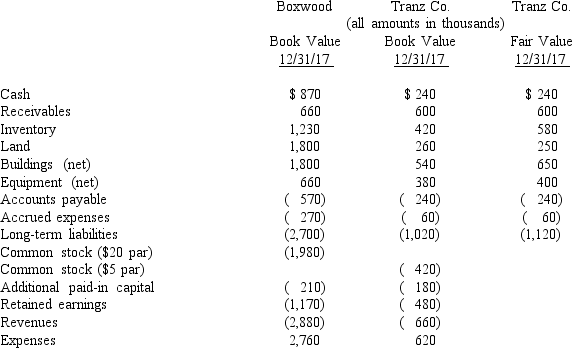

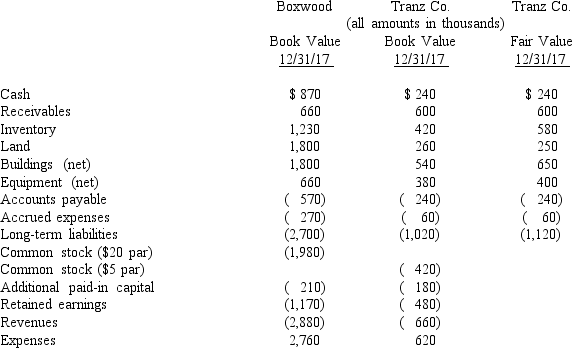

REFERENCE: 02-01

Bullen Inc.acquired 100% of the voting common stock of Vicker Inc.on January 1,2018.The book value and fair value of Vicker's accounts on that date (prior to creating the combination)are as follows,along with the book value of Bullen's accounts:

-Assume that Bullen issued 12,000 shares of common stock with a $5 par value and a $47 fair value for all of the outstanding stock of Vicker.What is the consolidated balance for Land as a result of this acquisition transaction?

A)$460,000.

B)$510,000.

C)$500,000.

D)$520,000.

E)$490,000.

Bullen Inc.acquired 100% of the voting common stock of Vicker Inc.on January 1,2018.The book value and fair value of Vicker's accounts on that date (prior to creating the combination)are as follows,along with the book value of Bullen's accounts:

-Assume that Bullen issued 12,000 shares of common stock with a $5 par value and a $47 fair value for all of the outstanding stock of Vicker.What is the consolidated balance for Land as a result of this acquisition transaction?

A)$460,000.

B)$510,000.

C)$500,000.

D)$520,000.

E)$490,000.

$520,000.

2

In a business combination where a subsidiary retains its incorporation and which is accounted for under the acquisition method,how should stock issuance costs and direct combination costs be treated?

A)Stock issuance costs and direct combination costs are expensed as incurred.

B)Direct combination costs are ignored,and the stock issuance costs result in a reduction to additional paid-in capital.

C)Direct combination costs are expensed as incurred and stock issuance costs result in a reduction to additional paid-in capital.

D)Both are treated as part of the acquisition consideration transferred.

E)Both reduce additional paid-in capital.

A)Stock issuance costs and direct combination costs are expensed as incurred.

B)Direct combination costs are ignored,and the stock issuance costs result in a reduction to additional paid-in capital.

C)Direct combination costs are expensed as incurred and stock issuance costs result in a reduction to additional paid-in capital.

D)Both are treated as part of the acquisition consideration transferred.

E)Both reduce additional paid-in capital.

C

3

Direct combination costs and amounts incurred to register and issue stock in connection with a business combination.How should those costs be accounted for in a pre-2009 business combination?

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

B

4

How are direct and indirect costs accounted for when applying the acquisition method for a business combination?

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following examples accurately describes a difference in the types of business combinations?

A)A statutory merger can only be effected through an asset acquisition while a statutory consolidation can only be effected through a capital stock acquisition.

B)A statutory merger can only be effected through a capital stock acquisition while a statutory consolidation can only be effected through an asset acquisition.

C)A statutory merger requires the dissolution of the acquired company while a statutory consolidation requires dissolution of the companies involved in the combination following the transfer of assets or stock to a newly formed entity.

D)A statutory consolidation requires dissolution of the acquired company while a statutory merger does not require dissolution.

E)Both a statutory merger and a statutory consolidation can only be effected through an asset acquisition but only a statutory consolidation requires dissolution of the acquired company.

A)A statutory merger can only be effected through an asset acquisition while a statutory consolidation can only be effected through a capital stock acquisition.

B)A statutory merger can only be effected through a capital stock acquisition while a statutory consolidation can only be effected through an asset acquisition.

C)A statutory merger requires the dissolution of the acquired company while a statutory consolidation requires dissolution of the companies involved in the combination following the transfer of assets or stock to a newly formed entity.

D)A statutory consolidation requires dissolution of the acquired company while a statutory merger does not require dissolution.

E)Both a statutory merger and a statutory consolidation can only be effected through an asset acquisition but only a statutory consolidation requires dissolution of the acquired company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

6

What is the primary difference between: (i)accounting for a business combination when the subsidiary is dissolved;and (ii)accounting for a business combination when the subsidiary retains its incorporation?

A)If the subsidiary is dissolved,it will not be operated as a separate division.

B)If the subsidiary is dissolved,assets and liabilities are consolidated at their book values.

C)If the subsidiary retains its incorporation,there will be no goodwill associated with the acquisition.

D)If the subsidiary retains its incorporation,assets and liabilities are consolidated at their book values.

E)If the subsidiary retains its incorporation,the consolidation is not formally recorded in the accounting records of the acquiring company.

A)If the subsidiary is dissolved,it will not be operated as a separate division.

B)If the subsidiary is dissolved,assets and liabilities are consolidated at their book values.

C)If the subsidiary retains its incorporation,there will be no goodwill associated with the acquisition.

D)If the subsidiary retains its incorporation,assets and liabilities are consolidated at their book values.

E)If the subsidiary retains its incorporation,the consolidation is not formally recorded in the accounting records of the acquiring company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following statements is true regarding the acquisition method of accounting for a business combination?

A)The combination must involve the exchange of equity securities only.

B)The transaction establishes an acquisition fair value basis for the company being acquired.

C)The two companies may be about the same size,and it is difficult to determine the acquired company and the acquiring company.

D)The transaction may be considered to be the uniting of the ownership interests of the companies involved.

E)The acquired subsidiary must be smaller in size than the acquiring parent.

A)The combination must involve the exchange of equity securities only.

B)The transaction establishes an acquisition fair value basis for the company being acquired.

C)The two companies may be about the same size,and it is difficult to determine the acquired company and the acquiring company.

D)The transaction may be considered to be the uniting of the ownership interests of the companies involved.

E)The acquired subsidiary must be smaller in size than the acquiring parent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

8

According to GAAP,which of the following is true with respect to the pooling of interest method of accounting for business combinations?

A)It was the only method used prior to 2002.

B)It must be used for all new acquisitions.

C)GAAP allowed its use prior to 2002.

D)It,or the acquisition method,may be used at the acquirer's discretion.

E)GAAP requires it to be used instead of the acquisition method for business combinations for which $50 billion or more in consideration is transferred.

A)It was the only method used prior to 2002.

B)It must be used for all new acquisitions.

C)GAAP allowed its use prior to 2002.

D)It,or the acquisition method,may be used at the acquirer's discretion.

E)GAAP requires it to be used instead of the acquisition method for business combinations for which $50 billion or more in consideration is transferred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

9

REFERENCE: 02-01

Bullen Inc.acquired 100% of the voting common stock of Vicker Inc.on January 1,2018.The book value and fair value of Vicker's accounts on that date (prior to creating the combination)are as follows,along with the book value of Bullen's accounts:

-Assume that Bullen paid a total of $480,000 in cash for all of the shares of Vicker.In addition,Bullen paid $35,000 for secretarial and management time allocated to the acquisition transaction.What will be the balance in consolidated goodwill?

A)$ 0.

B)$20,000.

C)$35,000.

D)$55,000.

E)$65,000.

Bullen Inc.acquired 100% of the voting common stock of Vicker Inc.on January 1,2018.The book value and fair value of Vicker's accounts on that date (prior to creating the combination)are as follows,along with the book value of Bullen's accounts:

-Assume that Bullen paid a total of $480,000 in cash for all of the shares of Vicker.In addition,Bullen paid $35,000 for secretarial and management time allocated to the acquisition transaction.What will be the balance in consolidated goodwill?

A)$ 0.

B)$20,000.

C)$35,000.

D)$55,000.

E)$65,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

10

REFERENCE: 02-02

Prior to being united in a business combination,Botkins Inc.and Volkerson Corp.had the following stockholders' equity figures: Botkins issued 56,000 new shares of its common stock valued at $3.25 per share for all of the outstanding stock of Volkerson.

-Assume that Botkins acquired Volkerson on January 1,2017 and that Volkerson maintains a separate corporate existence.At what amount did Botkins record the investment in Volkerson?

A)$ 56,000.

B)$182,000.

C)$209,000.

D)$261,000.

E)$312,000.

Prior to being united in a business combination,Botkins Inc.and Volkerson Corp.had the following stockholders' equity figures: Botkins issued 56,000 new shares of its common stock valued at $3.25 per share for all of the outstanding stock of Volkerson.

-Assume that Botkins acquired Volkerson on January 1,2017 and that Volkerson maintains a separate corporate existence.At what amount did Botkins record the investment in Volkerson?

A)$ 56,000.

B)$182,000.

C)$209,000.

D)$261,000.

E)$312,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

11

Acquired in-process research and development is considered as

A)A definite-lived asset subject to amortization.

B)A definite-lived asset subject to testing for impairment.

C)An indefinite-lived asset subject to amortization.

D)An indefinite-lived asset subject to testing for impairment.

E)A research and development expense at the date of acquisition.

A)A definite-lived asset subject to amortization.

B)A definite-lived asset subject to testing for impairment.

C)An indefinite-lived asset subject to amortization.

D)An indefinite-lived asset subject to testing for impairment.

E)A research and development expense at the date of acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

12

REFERENCE: 02-01

Bullen Inc.acquired 100% of the voting common stock of Vicker Inc.on January 1,2018.The book value and fair value of Vicker's accounts on that date (prior to creating the combination)are as follows,along with the book value of Bullen's accounts:

-Assume that Bullen issued 12,000 shares of common stock with a $5 par value and a $47 fair value for all of the outstanding shares of Vicker.What will be the consolidated Additional Paid-In Capital and Retained Earnings (January 1,2018 balances)as a result of this acquisition transaction?

A)$60,000 and $490,000.

B)$60,000 and $250,000.

C)$380,000 and $250,000.

D)$524,000 and $250,000.

E)$524,000 and $420,000.

Bullen Inc.acquired 100% of the voting common stock of Vicker Inc.on January 1,2018.The book value and fair value of Vicker's accounts on that date (prior to creating the combination)are as follows,along with the book value of Bullen's accounts:

-Assume that Bullen issued 12,000 shares of common stock with a $5 par value and a $47 fair value for all of the outstanding shares of Vicker.What will be the consolidated Additional Paid-In Capital and Retained Earnings (January 1,2018 balances)as a result of this acquisition transaction?

A)$60,000 and $490,000.

B)$60,000 and $250,000.

C)$380,000 and $250,000.

D)$524,000 and $250,000.

E)$524,000 and $420,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

13

In an acquisition where 100% control is acquired,how would the land accounts of the parent and the land accounts of the subsidiary be reported on consolidated financial statements?

A)

B)

C)

D)

E)

A)

B)

C)

D)

E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

14

REFERENCE: 02-01

Bullen Inc.acquired 100% of the voting common stock of Vicker Inc.on January 1,2018.The book value and fair value of Vicker's accounts on that date (prior to creating the combination)are as follows,along with the book value of Bullen's accounts:

-Assume that Bullen issued preferred stock with a par value of $240,000 and a fair value of $500,000 for all of the outstanding shares of Vicker in an acquisition business combination.What will be the balance in the consolidated Inventory and Land accounts?

A)$440,000,$496,000.

B)$440,000,$520,000.

C)$425,000,$505,000.

D)$400,000,$500,000.

E)$427,000,$510,000.

Bullen Inc.acquired 100% of the voting common stock of Vicker Inc.on January 1,2018.The book value and fair value of Vicker's accounts on that date (prior to creating the combination)are as follows,along with the book value of Bullen's accounts:

-Assume that Bullen issued preferred stock with a par value of $240,000 and a fair value of $500,000 for all of the outstanding shares of Vicker in an acquisition business combination.What will be the balance in the consolidated Inventory and Land accounts?

A)$440,000,$496,000.

B)$440,000,$520,000.

C)$425,000,$505,000.

D)$400,000,$500,000.

E)$427,000,$510,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

15

Lisa Co.paid cash for all of the voting common stock of Victoria Corp.Victoria will continue to exist as a separate corporation.Entries for the consolidation of Lisa and Victoria would be recorded in

A)A worksheet.

B)Lisa's general journal.

C)Victoria's general journal.

D)Victoria's secret consolidation journal.

E)The general journals of both companies.

A)A worksheet.

B)Lisa's general journal.

C)Victoria's general journal.

D)Victoria's secret consolidation journal.

E)The general journals of both companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

16

Using the acquisition method for a business combination,goodwill is generally calculated as the:

A)Cost of the investment less the subsidiary's book value at the beginning of the year.

B)Cost of the investment less the subsidiary's book value at the acquisition date.

C)Cost of the investment less the subsidiary's fair value at the beginning of the year.

D)Cost of the investment less the subsidiary's fair value at acquisition date.

E)Zero,it is no longer allowed under federal law.

A)Cost of the investment less the subsidiary's book value at the beginning of the year.

B)Cost of the investment less the subsidiary's book value at the acquisition date.

C)Cost of the investment less the subsidiary's fair value at the beginning of the year.

D)Cost of the investment less the subsidiary's fair value at acquisition date.

E)Zero,it is no longer allowed under federal law.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

17

REFERENCE: 02-01

Bullen Inc.acquired 100% of the voting common stock of Vicker Inc.on January 1,2018.The book value and fair value of Vicker's accounts on that date (prior to creating the combination)are as follows,along with the book value of Bullen's accounts:

-Assume that Bullen issued 12,000 shares of common stock,with a $5 par value and a $47 fair value,to obtain all of Vicker's outstanding stock.In this acquisition transaction,how much goodwill should be recognized?

A)$144,000.

B)$104,000.

C)$ 64,000.

D)$ 60,000.

E)$ 0.

Bullen Inc.acquired 100% of the voting common stock of Vicker Inc.on January 1,2018.The book value and fair value of Vicker's accounts on that date (prior to creating the combination)are as follows,along with the book value of Bullen's accounts:

-Assume that Bullen issued 12,000 shares of common stock,with a $5 par value and a $47 fair value,to obtain all of Vicker's outstanding stock.In this acquisition transaction,how much goodwill should be recognized?

A)$144,000.

B)$104,000.

C)$ 64,000.

D)$ 60,000.

E)$ 0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

18

With respect to recognizing and measuring the fair value of a business combination in accordance with the acquisition method of accounting,which of the following should the acquirer consider when determining fair value?

A)Only assets received by the acquirer.

B)Only consideration transferred by the acquirer.

C)The consideration transferred by the acquirer plus the fair value of assets received less liabilities assumed.

D)The par value of stock transferred by the acquirer,and the book value of identifiable assets transferred by the entity acquired.

E)The book value of identifiable assets transferred to the acquirer as part of the business combination less any liabilities assumed.

A)Only assets received by the acquirer.

B)Only consideration transferred by the acquirer.

C)The consideration transferred by the acquirer plus the fair value of assets received less liabilities assumed.

D)The par value of stock transferred by the acquirer,and the book value of identifiable assets transferred by the entity acquired.

E)The book value of identifiable assets transferred to the acquirer as part of the business combination less any liabilities assumed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

19

A statutory merger is a(n)

A)Business combination in which only one of the two companies continues to exist as a legal corporation.

B)Business combination in which both companies continue to exist.

C)Acquisition of a competitor.

D)Acquisition of a supplier or a customer.

E)Legal proposal to acquire outstanding shares of the target's stock.

A)Business combination in which only one of the two companies continues to exist as a legal corporation.

B)Business combination in which both companies continue to exist.

C)Acquisition of a competitor.

D)Acquisition of a supplier or a customer.

E)Legal proposal to acquire outstanding shares of the target's stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

20

At the date of an acquisition which is not a bargain purchase,the acquisition method

A)Consolidates the subsidiary's assets at fair value and the liabilities at book value.

B)Consolidates all subsidiary assets and liabilities at book value.

C)Consolidates all subsidiary assets and liabilities at fair value.

D)Consolidates current assets and liabilities at book value,and long-term assets and liabilities at fair value.

E)Consolidates the subsidiary's assets at book value and the liabilities at fair value.

A)Consolidates the subsidiary's assets at fair value and the liabilities at book value.

B)Consolidates all subsidiary assets and liabilities at book value.

C)Consolidates all subsidiary assets and liabilities at fair value.

D)Consolidates current assets and liabilities at book value,and long-term assets and liabilities at fair value.

E)Consolidates the subsidiary's assets at book value and the liabilities at fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following statements is true?

A)The pooling of interests for business combinations is an alternative to the acquisition method.

B)The purchase method for business combinations is an alternative to the acquisition method.

C)Neither the purchase method nor the pooling of interests method is allowed for new business combinations.

D)Any previous business combination originally accounted for under purchase or pooling of interests accounting method will now be accounted for under the acquisition method of accounting for business combinations.

E)Companies previously using the purchase or pooling of interests accounting method must report a change in accounting principle when consolidating those subsidiaries with new acquisition combinations.

A)The pooling of interests for business combinations is an alternative to the acquisition method.

B)The purchase method for business combinations is an alternative to the acquisition method.

C)Neither the purchase method nor the pooling of interests method is allowed for new business combinations.

D)Any previous business combination originally accounted for under purchase or pooling of interests accounting method will now be accounted for under the acquisition method of accounting for business combinations.

E)Companies previously using the purchase or pooling of interests accounting method must report a change in accounting principle when consolidating those subsidiaries with new acquisition combinations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

22

REFERENCE: 02-03

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated expenses for 2018.

A)$1,980.

B)$2,005.

C)$2,040.

D)$2,380.

E)$2,405.

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated expenses for 2018.

A)$1,980.

B)$2,005.

C)$2,040.

D)$2,380.

E)$2,405.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following statements is true regarding a statutory consolidation?

A)The original companies dissolve while remaining as separate divisions of a newly created company.

B)Both companies remain in existence as legal corporations with one corporation now a subsidiary of the acquiring company.

C)The acquired company dissolves as a separate corporation and becomes a division of the acquiring company.

D)The acquiring company acquires the stock of the acquired company as an investment.

E)A statutory consolidation is no longer a legal option.

A)The original companies dissolve while remaining as separate divisions of a newly created company.

B)Both companies remain in existence as legal corporations with one corporation now a subsidiary of the acquiring company.

C)The acquired company dissolves as a separate corporation and becomes a division of the acquiring company.

D)The acquiring company acquires the stock of the acquired company as an investment.

E)A statutory consolidation is no longer a legal option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

24

REFERENCE: 02-03

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated equipment (net)account at December 31,2018.

A)$2,100.

B)$3,500.

C)$3,300.

D)$3,000.

E)$3,200.

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated equipment (net)account at December 31,2018.

A)$2,100.

B)$3,500.

C)$3,300.

D)$3,000.

E)$3,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

25

REFERENCE: 02-03

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated revenues for 2018.

A)$2,700.

B)$ 720.

C)$ 920.

D)$3,300.

E)$1,540.

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated revenues for 2018.

A)$2,700.

B)$ 720.

C)$ 920.

D)$3,300.

E)$1,540.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

26

REFERENCE: 02-03

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the goodwill arising from this acquisition at December 31,2018.

A)$ 0.

B)$100.

C)$125.

D)$160.

E)$ 45.

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the goodwill arising from this acquisition at December 31,2018.

A)$ 0.

B)$100.

C)$125.

D)$160.

E)$ 45.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

27

REFERENCE: 02-03

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated receivables and inventory for 2018.

A)$1,200.

B)$1,515.

C)$1,540.

D)$1,800.

E)$2,140.

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated receivables and inventory for 2018.

A)$1,200.

B)$1,515.

C)$1,540.

D)$1,800.

E)$2,140.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is a not a reason for a business combination to take place?

A)Cost savings through elimination of duplicate facilities.

B)Quick entry for new and existing products into domestic and foreign markets.

C)Diversification of business risk.

D)Vertical integration.

E)Increase in stock price of the acquired company.

A)Cost savings through elimination of duplicate facilities.

B)Quick entry for new and existing products into domestic and foreign markets.

C)Diversification of business risk.

D)Vertical integration.

E)Increase in stock price of the acquired company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

29

In a transaction accounted for using the acquisition method where consideration transferred is less than fair value of net assets acquired,which statement is true?

A)Negative goodwill is recorded.

B)A deferred credit is recorded.

C)A gain on bargain purchase is recorded.

D)Long-term assets of the acquired company are reduced in proportion to their fair values.Any excess is recorded as a deferred credit.

E)Long-term assets and liabilities of the acquired company are reduced in proportion to their fair values.Any excess is recorded as gain.

A)Negative goodwill is recorded.

B)A deferred credit is recorded.

C)A gain on bargain purchase is recorded.

D)Long-term assets of the acquired company are reduced in proportion to their fair values.Any excess is recorded as a deferred credit.

E)Long-term assets and liabilities of the acquired company are reduced in proportion to their fair values.Any excess is recorded as gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

30

REFERENCE: 02-03

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Assuming that Corr retains a separate corporate existence after this acquisition,at what amount is the investment recorded on Goodwin's books?

A)$1,540.

B)$1,800.

C)$1,860.

D)$1,825.

E)$1,625.

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Assuming that Corr retains a separate corporate existence after this acquisition,at what amount is the investment recorded on Goodwin's books?

A)$1,540.

B)$1,800.

C)$1,860.

D)$1,825.

E)$1,625.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

31

REFERENCE: 02-03

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated cash account at December 31,2018.

A)$460.

B)$425.

C)$400.

D)$435.

E)$240.

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated cash account at December 31,2018.

A)$460.

B)$425.

C)$400.

D)$435.

E)$240.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

32

REFERENCE: 02-03

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-In this acquisition business combination,what total amount of common stock and additional paid-in capital should Goodwin recognize on its consolidated financial statements?

A)$ 265.

B)$1,165.

C)$1,200.

D)$1,235.

E)$1,765.

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-In this acquisition business combination,what total amount of common stock and additional paid-in capital should Goodwin recognize on its consolidated financial statements?

A)$ 265.

B)$1,165.

C)$1,200.

D)$1,235.

E)$1,765.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

33

REFERENCE: 02-02

Prior to being united in a business combination,Botkins Inc.and Volkerson Corp.had the following stockholders' equity figures: Botkins issued 56,000 new shares of its common stock valued at $3.25 per share for all of the outstanding stock of Volkerson.

-Assume that Botkins acquired Volkerson on January 1,2017.Immediately afterwards,what is the value of the consolidated Common Stock?

A)$456,000.

B)$402,000.

C)$274,000.

D)$276,000.

E)$330,000.

Prior to being united in a business combination,Botkins Inc.and Volkerson Corp.had the following stockholders' equity figures: Botkins issued 56,000 new shares of its common stock valued at $3.25 per share for all of the outstanding stock of Volkerson.

-Assume that Botkins acquired Volkerson on January 1,2017.Immediately afterwards,what is the value of the consolidated Common Stock?

A)$456,000.

B)$402,000.

C)$274,000.

D)$276,000.

E)$330,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following statements is true regarding a statutory merger?

A)The original companies dissolve while remaining as separate divisions of a newly created company.

B)Both companies remain in existence as legal corporations with one corporation now a subsidiary of the acquiring company.

C)The acquired company dissolves as a separate corporation and becomes a division of the acquiring company.

D)The acquiring company acquires the stock of the acquired company as an investment.

E)A statutory merger is no longer a legal option.

A)The original companies dissolve while remaining as separate divisions of a newly created company.

B)Both companies remain in existence as legal corporations with one corporation now a subsidiary of the acquiring company.

C)The acquired company dissolves as a separate corporation and becomes a division of the acquiring company.

D)The acquiring company acquires the stock of the acquired company as an investment.

E)A statutory merger is no longer a legal option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following statements is true regarding the acquisition method of accounting for a business combination?

A)Net assets of the acquired company are reported at their fair values.

B)Net assets of the acquired company are reported at their book values.

C)Any goodwill associated with the acquisition is reported as a development cost.

D)The acquisition can only be effected by a mutual exchange of voting common stock.

E)Indirect costs of the combination reduce additional paid-in capital.

A)Net assets of the acquired company are reported at their fair values.

B)Net assets of the acquired company are reported at their book values.

C)Any goodwill associated with the acquisition is reported as a development cost.

D)The acquisition can only be effected by a mutual exchange of voting common stock.

E)Indirect costs of the combination reduce additional paid-in capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

36

In a transaction accounted for using the acquisition method where consideration transferred exceeds book value of the acquired company,which statement is true for the acquiring company with regard to its investment?

A)Net assets of the acquired company are revalued to their fair values and any excess of consideration transferred over fair value of net assets acquired is allocated to goodwill.

B)Net assets of the acquired company are maintained at book value and any excess of consideration transferred over book value of net assets acquired is allocated to goodwill.

C)Acquired assets are revalued to their fair values.Acquired liabilities are maintained at book values.Any excess is allocated to goodwill.

D)Acquired long-term assets are revalued to their fair values.Any excess is allocated to goodwill.

A)Net assets of the acquired company are revalued to their fair values and any excess of consideration transferred over fair value of net assets acquired is allocated to goodwill.

B)Net assets of the acquired company are maintained at book value and any excess of consideration transferred over book value of net assets acquired is allocated to goodwill.

C)Acquired assets are revalued to their fair values.Acquired liabilities are maintained at book values.Any excess is allocated to goodwill.

D)Acquired long-term assets are revalued to their fair values.Any excess is allocated to goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

37

Chapel Hill Company had common stock of $350,000 and retained earnings of $490,000.Blue Town Inc.had common stock of $700,000 and retained earnings of $980,000.On January 1,2018,Blue Town issued 34,000 shares of common stock with a $12 par value and a $35 fair value for all of Chapel Hill Company's outstanding common stock.This combination was accounted for using the acquisition method.Immediately after the combination,what was the amount of total consolidated net assets?

A)$2,520,000.

B)$1,190,000.

C)$1,680,000.

D)$2,870,000.

E)$2,030,000.

A)$2,520,000.

B)$1,190,000.

C)$1,680,000.

D)$2,870,000.

E)$2,030,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

38

REFERENCE: 02-03

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated buildings (net)account at December 31,2018.

A)$2,700.

B)$3,370.

C)$3,300.

D)$3,260.

E)$3,340.

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated buildings (net)account at December 31,2018.

A)$2,700.

B)$3,370.

C)$3,300.

D)$3,260.

E)$3,340.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

39

REFERENCE: 02-03

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated common stock account at December 31,2018.

A)$1,080.

B)$1,480.

C)$1,380.

D)$2,280.

E)$2,680.

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated common stock account at December 31,2018.

A)$1,080.

B)$1,480.

C)$1,380.

D)$2,280.

E)$2,680.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

40

REFERENCE: 02-03

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consideration transferred for this acquisition at December 31,2018.

A)$ 900.

B)$1,165.

C)$1,200.

D)$1,765.

E)$1,800.

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consideration transferred for this acquisition at December 31,2018.

A)$ 900.

B)$1,165.

C)$1,200.

D)$1,765.

E)$1,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

41

REFERENCE: 02-06

The financial balances for the Atwood Company and the Franz Company as of December 31,2018,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume an acquisition business combination took place at December 31,2018.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands)and direct costs of $10 (in thousands)were paid.

-Compute consolidated inventory at the date of the acquisition.

A)$1,650.

B)$1,810.

C)$1,230.

D)$ 580.

E)$1,830.

The financial balances for the Atwood Company and the Franz Company as of December 31,2018,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31,2018.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands)and direct costs of $10 (in thousands)were paid.

-Compute consolidated inventory at the date of the acquisition.

A)$1,650.

B)$1,810.

C)$1,230.

D)$ 580.

E)$1,830.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

42

REFERENCE: 02-06

The financial balances for the Atwood Company and the Franz Company as of December 31,2018,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume an acquisition business combination took place at December 31,2018.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands)and direct costs of $10 (in thousands)were paid.

-Compute the consolidated common stock at the date of acquisition.

A)$1,000.

B)$2,980.

C)$2,400.

D)$3,400.

E)$3,730.

The financial balances for the Atwood Company and the Franz Company as of December 31,2018,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31,2018.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands)and direct costs of $10 (in thousands)were paid.

-Compute the consolidated common stock at the date of acquisition.

A)$1,000.

B)$2,980.

C)$2,400.

D)$3,400.

E)$3,730.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

43

REFERENCE: 02-05

Carnes has the following account balances as of December 31,2017 before an acquisition transaction takes place.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000,respectively.On December 31,2017,Riley Company issues 30,000 shares of its $10 par value ($25 fair value)common stock in exchange for all of the shares of Carnes' common stock.Riley paid $10,000 for costs to issue the new shares of stock.Before the acquisition,Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

-At the date of acquisition,by how much does Riley's additional paid-in capital increase or decrease?

A)$ 0.

B)$440,000 increase.

C)$450,000 increase.

D)$640,000 increase.

E)$650,000 decrease.

Carnes has the following account balances as of December 31,2017 before an acquisition transaction takes place.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000,respectively.On December 31,2017,Riley Company issues 30,000 shares of its $10 par value ($25 fair value)common stock in exchange for all of the shares of Carnes' common stock.Riley paid $10,000 for costs to issue the new shares of stock.Before the acquisition,Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

-At the date of acquisition,by how much does Riley's additional paid-in capital increase or decrease?

A)$ 0.

B)$440,000 increase.

C)$450,000 increase.

D)$640,000 increase.

E)$650,000 decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

44

REFERENCE: 02-05

Carnes has the following account balances as of December 31,2017 before an acquisition transaction takes place.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000,respectively.On December 31,2017,Riley Company issues 30,000 shares of its $10 par value ($25 fair value)common stock in exchange for all of the shares of Carnes' common stock.Riley paid $10,000 for costs to issue the new shares of stock.Before the acquisition,Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

-What will be the consolidated additional paid-in capital as a result of this acquisition?

A)$440,000.

B)$740,000.

C)$750,000.

D)$940,000.

E)$950,000.

Carnes has the following account balances as of December 31,2017 before an acquisition transaction takes place.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000,respectively.On December 31,2017,Riley Company issues 30,000 shares of its $10 par value ($25 fair value)common stock in exchange for all of the shares of Carnes' common stock.Riley paid $10,000 for costs to issue the new shares of stock.Before the acquisition,Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

-What will be the consolidated additional paid-in capital as a result of this acquisition?

A)$440,000.

B)$740,000.

C)$750,000.

D)$940,000.

E)$950,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

45

REFERENCE: 02-04

On January 1,2018,the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this acquisition.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows: Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-If Osorio retains a separate corporate existence,what amount was recorded as the investment in Osorio?

A)$930.

B)$820.

C)$800.

D)$835.

E)$815.

On January 1,2018,the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this acquisition.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows: Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-If Osorio retains a separate corporate existence,what amount was recorded as the investment in Osorio?

A)$930.

B)$820.

C)$800.

D)$835.

E)$815.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

46

REFERENCE: 02-06

The financial balances for the Atwood Company and the Franz Company as of December 31,2018,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume an acquisition business combination took place at December 31,2018.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands)and direct costs of $10 (in thousands)were paid.

-Compute consolidated land at the date of the acquisition.

A)$2,060.

B)$1,800.

C)$ 260.

D)$2,050.

E)$2,070.

The financial balances for the Atwood Company and the Franz Company as of December 31,2018,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31,2018.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands)and direct costs of $10 (in thousands)were paid.

-Compute consolidated land at the date of the acquisition.

A)$2,060.

B)$1,800.

C)$ 260.

D)$2,050.

E)$2,070.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

47

REFERENCE: 02-05

Carnes has the following account balances as of December 31,2017 before an acquisition transaction takes place.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000,respectively.On December 31,2017,Riley Company issues 30,000 shares of its $10 par value ($25 fair value)common stock in exchange for all of the shares of Carnes' common stock.Riley paid $10,000 for costs to issue the new shares of stock.Before the acquisition,Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

-What will the consolidated common stock account be as a result of this acquisition?

A)$ 300,000.

B)$ 990,000.

C)$1,000,000.

D)$1,590,000.

E)$1,600,000.

Carnes has the following account balances as of December 31,2017 before an acquisition transaction takes place.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000,respectively.On December 31,2017,Riley Company issues 30,000 shares of its $10 par value ($25 fair value)common stock in exchange for all of the shares of Carnes' common stock.Riley paid $10,000 for costs to issue the new shares of stock.Before the acquisition,Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

-What will the consolidated common stock account be as a result of this acquisition?

A)$ 300,000.

B)$ 990,000.

C)$1,000,000.

D)$1,590,000.

E)$1,600,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

48

REFERENCE: 02-06

The financial balances for the Atwood Company and the Franz Company as of December 31,2018,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume an acquisition business combination took place at December 31,2018.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands)and direct costs of $10 (in thousands)were paid.

-Compute the amount of the consideration transferred by Atwood to acquire Franz.

A)$1,750.

B)$1,760.

C)$1,775.

D)$1,300.

E)$1,120.

The financial balances for the Atwood Company and the Franz Company as of December 31,2018,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balanceAssume an acquisition business combination took place at December 31,2018.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands)and direct costs of $10 (in thousands)were paid.

-Compute the amount of the consideration transferred by Atwood to acquire Franz.

A)$1,750.

B)$1,760.

C)$1,775.

D)$1,300.

E)$1,120.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

49

REFERENCE: 02-04

On January 1,2018,the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this acquisition.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows: Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-Compute the amount of consolidated equipment at date of acquisition.

A)$480.

B)$580.

C)$559.

D)$570.

E)$560.

On January 1,2018,the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this acquisition.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows: Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-Compute the amount of consolidated equipment at date of acquisition.

A)$480.

B)$580.

C)$559.

D)$570.

E)$560.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

50

REFERENCE: 02-05

Carnes has the following account balances as of December 31,2017 before an acquisition transaction takes place.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000,respectively.On December 31,2017,Riley Company issues 30,000 shares of its $10 par value ($25 fair value)common stock in exchange for all of the shares of Carnes' common stock.Riley paid $10,000 for costs to issue the new shares of stock.Before the acquisition,Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

-On December 31,2017,assuming that Cames will retain its separate corporate existence,what value is assigned to Riley's investment account?

A)$ 150,000.

B)$ 300,000.

C)$ 750,000.

D)$ 760,000.

E)$1,350,000.

Carnes has the following account balances as of December 31,2017 before an acquisition transaction takes place.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000,respectively.On December 31,2017,Riley Company issues 30,000 shares of its $10 par value ($25 fair value)common stock in exchange for all of the shares of Carnes' common stock.Riley paid $10,000 for costs to issue the new shares of stock.Before the acquisition,Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

-On December 31,2017,assuming that Cames will retain its separate corporate existence,what value is assigned to Riley's investment account?

A)$ 150,000.

B)$ 300,000.

C)$ 750,000.

D)$ 760,000.

E)$1,350,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

51

REFERENCE: 02-04

On January 1,2018,the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this acquisition.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows: Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-Compute the amount of consolidated cash after recording the acquisition transaction.

A)$220.

B)$185.

C)$200.

D)$205.

E)$215.

On January 1,2018,the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this acquisition.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows: Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-Compute the amount of consolidated cash after recording the acquisition transaction.

A)$220.

B)$185.

C)$200.

D)$205.

E)$215.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

52

REFERENCE: 02-04

On January 1,2018,the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this acquisition.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows: Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-Compute the amount of consolidated additional paid-in capital at date of acquisition.

A)$1,080.

B)$1,420.

C)$1,065.

D)$1,425.

E)$1,440.

On January 1,2018,the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this acquisition.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows: Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-Compute the amount of consolidated additional paid-in capital at date of acquisition.

A)$1,080.

B)$1,420.

C)$1,065.

D)$1,425.

E)$1,440.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

53

REFERENCE: 02-04

On January 1,2018,the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this acquisition.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows: Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-Compute the amount of consolidated common stock at date of acquisition.

A)$370.

B)$570.

C)$610.

D)$330.

E)$530.

On January 1,2018,the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company.To acquire these shares,Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share.Moody paid $20 to lawyers,accountants,and brokers for assistance in bringing about this acquisition.Another $15 was paid in connection with stock issuance costs.Prior to these transactions,the balance sheets for the two companies were as follows: Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio,three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10,Land by $40,and Buildings by $60.

-Compute the amount of consolidated common stock at date of acquisition.

A)$370.

B)$570.

C)$610.

D)$330.

E)$530.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 116 في هذه المجموعة.

فتح الحزمة

k this deck

54

REFERENCE: 02-03

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.

In connection with the business combination,Goodwin paid $25 to a broker for arranging the transaction and $35 in stock issuance costs.At the time of the transaction,Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated additional paid-in capital at December 31,2018.

A)$ 810.

B)$1,350.

C)$1,675.

D)$1,910.

E)$1,875.

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,2018,prior to the business combination whereby Goodwin acquired Corr,are as follows (in thousands):

On December 31,2018,Goodwin obtained a loan for $600 and used the proceeds,along with the transfer of 30 shares of its $10 par value common stock,in exchange for all of Corr's common stock.At the time of the transaction,Goodwin's common stock had a fair value of $40 per share.