Deck 3: Organizing and Financing a New Venture

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/79

العب

ملء الشاشة (f)

Deck 3: Organizing and Financing a New Venture

1

The marginal tax rate for the first dollar of taxable income is higher for corporations than for individuals.

True

2

The maximum number of owners in a Subchapter S corporation is 150.

False

3

"Certification marks" cover memberships in groups (e.g. ,a sorority or a labor union).

False

4

Based on 2009 tax laws,the highest possible marginal tax table rate is higher for corporations than for individuals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

5

The equity capital sources for a proprietorship are partners,families,and friends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

6

Limited liability in the corporate business structure means creditors can seize only some of the corporation's assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

7

The highest marginal income tax rate for taxable personal income is 45 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

8

Patents,trade secrets,trademarks,and copyrights are intangible assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

9

An employment contract is an agreement between an employer and employee about the terms and conditions of employment including the employee's agreement to keep confidential information secret and to assign ideas and inventions to the employer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

10

Partnerships are treated with pass-through taxation.This means that profits and losses of the business pass directly through to investors on the basis specified in the partnership agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

11

There are four types of "marks" that can be used to try to protect intellectual property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

12

A limited partnership limits certain partners' liabilities to pay the venture's obligations to the amount each paid for their partnership interests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

13

Financial bootstrapping maximizes the need for financial capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

14

The income received by a proprietorship is taxed at personal tax rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

15

In a corporate legal entity,the personal assets of the owners are separate from the business' assets,but the personal liabilities of the owners are not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

16

An S corporation provides unlimited liability for its shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

17

Limited liability companies (LLCs)are owned by shareholders with limited liability and its earnings are taxed at the corporate rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

18

The difference between a limited partnership and a general partnership is that the limited partnership has partners who actively manage the day-to-day operations but also has passive investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

19

The articles of incorporation are the basic legal declarations contained in the corporate charter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

20

Professional corporations (PCs)and service corporations (SCs)are corporate structures that "states" provide for professionals such as physicians,dentists,lawyers,and accountants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

21

"Business method" patents protect a specific way of doing business and the underlying computer codes,programs,and technology.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

22

A copyright must be registered with the U.S.Copyright Office in order for a work to be protected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

23

"Collective marks" cover memberships in groups (e.g. ,a sorority or a labor union).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

24

"Design patents" cover most inventions pertaining to new products,services,and processes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

25

Business angels are wealthy individuals who invest in early-stage ventures in exchange for the excitement of launching the business,as well as a share of the firm's financial gains.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

26

A trademark must be novel in order to receive protection.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

27

A work does not need to be registered to receive copyright protection;the work's creation is enough to provide copyright protection.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which form of business organization is characterized by having the shortest start-up time and lowest legal costs?

A)proprietorship

B)limited partnership

C)corporation

D)subchapter S corporation

E)limited liability corporation

A)proprietorship

B)limited partnership

C)corporation

D)subchapter S corporation

E)limited liability corporation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

29

Nondisclosure agreements prohibit the creator of an idea or other form of intellectual property from sharing it with others once it has been presented the first time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

30

"Certification marks" are intellectual property rights in the form of inventions and information (e.g. ,formulas,processes,customer lists,etc. )not generally known to others.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

31

Most trademarks take the form of names,words,or graphic designs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

32

An idea is enough to be patented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

33

There are four kinds of patents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

34

In which form of business organization are the owners not offered the protection of limited liability?

A)proprietorship

B)limited partnership

C)corporation

D)subchapter S corporation

E)limited liability corporation

A)proprietorship

B)limited partnership

C)corporation

D)subchapter S corporation

E)limited liability corporation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

35

"Business method" is one kind of patent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

36

In which form of business organization is the taxation effects characterized by the income flowing to shareholders taxed at personal tax rates?

A)proprietorship

B)limited partnership

C)corporation

D)subchapter S corporation

E)general partnership

A)proprietorship

B)limited partnership

C)corporation

D)subchapter S corporation

E)general partnership

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

37

Confidential disclosure agreements are used to protect intellectual property when disclosure must be made to an outside individual or organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

38

"Patents" are intellectual property rights granted for inventions that are useful,novel,and obvious.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

39

"Trademarks" are intellectual property rights that allow firms to differentiate their products and services through the use of unique marks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

40

A "color mark" is considered to be one four types of "marks" used to try to protect intellectual property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

41

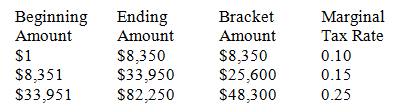

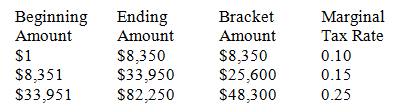

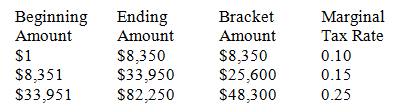

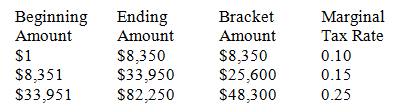

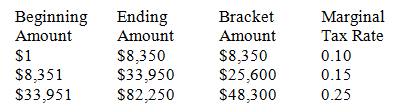

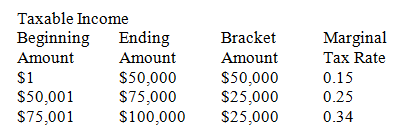

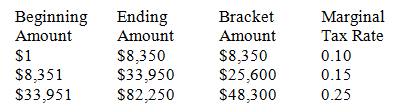

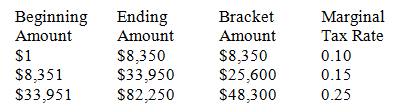

Following is a partial 2009 personal income tax schedule for a single filer:

Taxable Income

The dollar amount of income taxes paid by a single filer who has taxable income of $8,350 would be:

A)$150

B)$835

C)$3,840

D)$4,675

E)$10,385

Taxable Income

The dollar amount of income taxes paid by a single filer who has taxable income of $8,350 would be:

A)$150

B)$835

C)$3,840

D)$4,675

E)$10,385

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following numbers of shareholders is allowed in a Subchapter S (or S)corporation business form?

A)74

B)125

C)130

D)500

A)74

B)125

C)130

D)500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

43

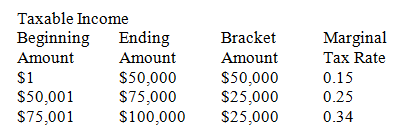

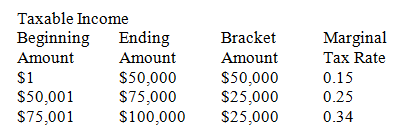

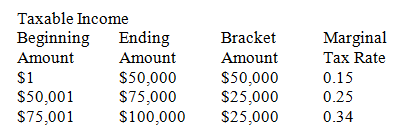

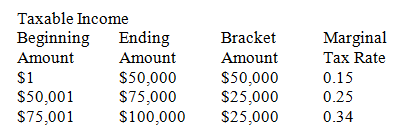

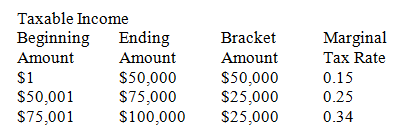

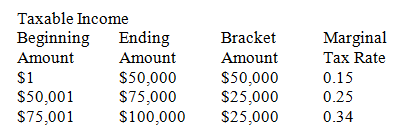

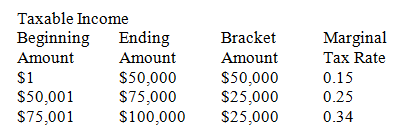

Following is a partial 2009 corporate income tax schedule:

The maximum dollar amount of income taxes in the $75,001-$100,000 bracket paid by a corporation with taxable income of $100,000 would be:

A)$6,250

B)$7,500

C)$8,500

D)$13,750

E)$22,250

The maximum dollar amount of income taxes in the $75,001-$100,000 bracket paid by a corporation with taxable income of $100,000 would be:

A)$6,250

B)$7,500

C)$8,500

D)$13,750

E)$22,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

44

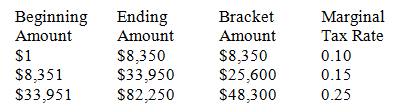

Following is a partial 2009 personal income tax schedule for a single filer:

Taxable Income

The cumulative dollar amount of income taxes paid by a single filer who has taxable income of $33,950 would be:

A)$150

B)$835

C)$3,840

D)$4,675

E)$10,385

Taxable Income

The cumulative dollar amount of income taxes paid by a single filer who has taxable income of $33,950 would be:

A)$150

B)$835

C)$3,840

D)$4,675

E)$10,385

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

45

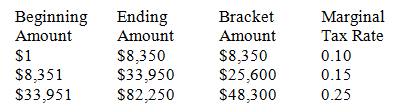

Following is a partial 2009 personal income tax schedule for a single filer:

Taxable Income

The average tax rate for a single filer with taxable income of $33,950 would be:

A)10.0%

B)13.8%

C)15.0%

D)16.7%

E)20.0%

Taxable Income

The average tax rate for a single filer with taxable income of $33,950 would be:

A)10.0%

B)13.8%

C)15.0%

D)16.7%

E)20.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

46

Following is a partial 2009 corporate income tax schedule:

The cumulative dollar amount of income taxes paid by a corporation with taxable income of $75,000 would be:

A)$6,250

B)$7,500

C)$8,500

D)$13,750

E)$22,250

The cumulative dollar amount of income taxes paid by a corporation with taxable income of $75,000 would be:

A)$6,250

B)$7,500

C)$8,500

D)$13,750

E)$22,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which form of business organization is characterized as having unlimited life?

A)proprietorship

B)limited partnership

C)limited liability corporation

D)subchapter S corporation

E)general partnership

A)proprietorship

B)limited partnership

C)limited liability corporation

D)subchapter S corporation

E)general partnership

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

48

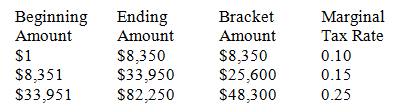

Following is a partial 2009 personal income tax schedule for a single filer:

Taxable Income

The average tax rate for a single filer with taxable income of $82,250 would be:

A)14.7%

B)16.7%

C)20.0%

D)20.4%

E)25.0%

Taxable Income

The average tax rate for a single filer with taxable income of $82,250 would be:

A)14.7%

B)16.7%

C)20.0%

D)20.4%

E)25.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is not a right or a duty of general partners?

A)participation in profits and losses

B)some liability for partnership obligations

C)veto right on new partners

D)eventual return of capital

E)access to partnership books

A)participation in profits and losses

B)some liability for partnership obligations

C)veto right on new partners

D)eventual return of capital

E)access to partnership books

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

50

In a general partnership,legal action that treats all partners equally as a groupis called:

A)joint and several liability

B)joint liability

C)limited liability

D)accrued liability

E)general liability

F)9.Which of the following business organizational forms provides the owners with limited investor liability and passes its income before taxes through to the owners?

A)partnership

B)subchapter S (or S)corporation

C)regular or (C )corporation

D)limited liability company (LLC)

E)both a and b

F)both b and d

A)joint and several liability

B)joint liability

C)limited liability

D)accrued liability

E)general liability

F)9.Which of the following business organizational forms provides the owners with limited investor liability and passes its income before taxes through to the owners?

A)partnership

B)subchapter S (or S)corporation

C)regular or (C )corporation

D)limited liability company (LLC)

E)both a and b

F)both b and d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

51

Following is a partial 2009 corporate income tax schedule:

The average tax rate for a corporation with taxable income of $75,000 would be:

A)15.0%

B)18.3%

C)20.0%

D)22.7%

E)25.0%

The average tax rate for a corporation with taxable income of $75,000 would be:

A)15.0%

B)18.3%

C)20.0%

D)22.7%

E)25.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which form of business organization typically offers the easiest transfer of ownership?

A)proprietorship

B)limited partnership

C)corporation

D)subchapter S corporation

E)general partnership

A)proprietorship

B)limited partnership

C)corporation

D)subchapter S corporation

E)general partnership

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

53

Following is a partial 2009 corporate income tax schedule:

The dollar amount of income taxes paid by a corporation with taxable income of $50,000 would be:

A)$1,500

B)$6,250

C)$7,500

D)$8,500

E)$10,850

The dollar amount of income taxes paid by a corporation with taxable income of $50,000 would be:

A)$1,500

B)$6,250

C)$7,500

D)$8,500

E)$10,850

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

54

Based on 2009 tax schedules,the highest marginal tax rate on personal taxable income is:

A)25.0%

B)28.0%

C)33.0%

D)35.0%

E)40.0%

A)25.0%

B)28.0%

C)33.0%

D)35.0%

E)40.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

55

Based on 2009 tax schedules,the first dollar of personal taxable income is taxed at which of the following marginal tax rates:

A)05.0%

B)10.0%

C)15.0%

D)20.0%

E)25.0%

A)05.0%

B)10.0%

C)15.0%

D)20.0%

E)25.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

56

Following is a partial 2009 personal income tax schedule for a single filer:

Taxable Income

The maximum dollar amount of income taxes in the $33,951-$82,250 "bracket" paid by a single filer with taxable income of $77,100 would be:

A)$150

B)$835

C)$3,840

D)$4,675

E)$12,075

Taxable Income

The maximum dollar amount of income taxes in the $33,951-$82,250 "bracket" paid by a single filer with taxable income of $77,100 would be:

A)$150

B)$835

C)$3,840

D)$4,675

E)$12,075

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

57

Following is a partial 2009 corporate income tax schedule:

The average tax rate for a corporation with taxable income of $100,000 would be:

A)15.0%

B)16.75%

C)20.0%

D)22.25%

E)25.0%

The average tax rate for a corporation with taxable income of $100,000 would be:

A)15.0%

B)16.75%

C)20.0%

D)22.25%

E)25.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

58

Based on 2009 tax schedules,the first dollar of corporate income is taxed at which of the following marginal tax rates:

A)05.0%

B)10.0%

C)15.0%

D)20.0%

E)25.0%

A)05.0%

B)10.0%

C)15.0%

D)20.0%

E)25.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

59

Based on 2009 tax schedules,the highest marginal tax rate on corporate taxable income is:

A)25.0%

B)28.0%

C)35.0%

D)38.0%

E)39.0%

A)25.0%

B)28.0%

C)35.0%

D)38.0%

E)39.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

60

The rules and procedures established to govern the corporation are called the

A)corporate charter

B)articles of incorporation

C)corporate bylaws

D)confidentiality disclosure agreements

E)partnership agreements

A)corporate charter

B)articles of incorporation

C)corporate bylaws

D)confidentiality disclosure agreements

E)partnership agreements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

61

In a general partnership,legal action that treats all partners equally as a groupis called:

A)joint and several liability

B)joint liability

C)limited liability

D)accrued liability

E)general liability

A)joint and several liability

B)joint liability

C)limited liability

D)accrued liability

E)general liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

62

Intellectual property can be protected by all of the following except:

A)patents

B)trademarks

C)legal disclaimers

D)copyrights

E)trade secrets

A)patents

B)trademarks

C)legal disclaimers

D)copyrights

E)trade secrets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

63

Certification marks are typically used to:

A)indicate membership in a trade group

B)indicate a certain brand of service

C)indicate quality

D)are symbols used to associate products to a specific brand

A)indicate membership in a trade group

B)indicate a certain brand of service

C)indicate quality

D)are symbols used to associate products to a specific brand

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following are intellectual property rights to writings in written and electronically stored forms?

A)patents

B)trademarks

C)legal disclaimers

D)copyrights

E)trade secrets

A)patents

B)trademarks

C)legal disclaimers

D)copyrights

E)trade secrets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

65

During the development stage,seed financing chiefly comprises:

A)funds from business angels and venture capitalists

B)the entrepreneur's personal assets

C)funds from family and friends

D)a,b,and c

E)only b and c

A)funds from business angels and venture capitalists

B)the entrepreneur's personal assets

C)funds from family and friends

D)a,b,and c

E)only b and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

66

Patents that cover most inventions pertaining to new products,services,and processes,are referred to as:

A)design patents

B)plant patents

C)utility patents

D)electrical patents

E)mechanical patents

A)design patents

B)plant patents

C)utility patents

D)electrical patents

E)mechanical patents

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

67

Patents are intellectual property rights granted for inventions that are:

A)not useful,novel,and non-obvious

B)not useful,not novel,and obvious

C)useful,novel,and non-obvious

D)useful,not novel,and obvious

A)not useful,novel,and non-obvious

B)not useful,not novel,and obvious

C)useful,novel,and non-obvious

D)useful,not novel,and obvious

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following is not a "type" of mark?

A)Trademark

B)Service mark

C)Collective mark

D)Certification mark

E)Design mark

A)Trademark

B)Service mark

C)Collective mark

D)Certification mark

E)Design mark

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following are intellectual property rights granted for inventions that are useful,novel,and non-obvious?

A)patents

B)trademarks

C)legal disclaimers

D)copyrights

E)trade secrets

A)patents

B)trademarks

C)legal disclaimers

D)copyrights

E)trade secrets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is not a "kind" of patent?

A)Utility

B)Design

C)Mark

D)Plant

E)Business method

A)Utility

B)Design

C)Mark

D)Plant

E)Business method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

71

Wealthy individuals who invest in early stage ventures in exchange for the excitement of launching a business and a share in any financial rewards are known as:

A)creditors

B)white knights

C)corporate raiders

D)business angels

E)stakeholders

A)creditors

B)white knights

C)corporate raiders

D)business angels

E)stakeholders

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

72

Business angels typically initiate their investments during the:

A)early stages of a venture's lifecycle

B)middle stages of a venture's lifecycle

C)maturity stage of a venture's lifecycle

D)all of the above

A)early stages of a venture's lifecycle

B)middle stages of a venture's lifecycle

C)maturity stage of a venture's lifecycle

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following are not sources of seed and start-up financing?

A)family and friends

B)the entrepreneur's physical and financial assets

C)business angels

D)venture capitalists

E)stock and bond markets

A)family and friends

B)the entrepreneur's physical and financial assets

C)business angels

D)venture capitalists

E)stock and bond markets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following forms of protecting intellectual property currently has a protection limit of 20 years?

A)copyrights

B)patents

C)trade secrets

D)trademarks

A)copyrights

B)patents

C)trade secrets

D)trademarks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following forms of protecting intellectual property had its protection limit increased from 17 to 20 years?

A)copyrights

B)trademarks

C)patents

D)trade secrets

A)copyrights

B)trademarks

C)patents

D)trade secrets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following are intellectual property rights in the form of inventions and information such as formulas,processes,and customer lists that are not generally known to others and which convey economic advantage to the holders?

A)patents

B)trademarks

C)legal disclaimers

D)copyrights

E)trade secrets

A)patents

B)trademarks

C)legal disclaimers

D)copyrights

E)trade secrets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following are intellectual property rights that allow firms to differentiate their products and services through the use of unique marks which allow consumers to easily identify the source and quality of the products and services?

A)patents

B)trademarks

C)legal disclaimers

D)copyrights

E)trade secrets

A)patents

B)trademarks

C)legal disclaimers

D)copyrights

E)trade secrets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

78

Intellectual property rights to "writings" in written and electronically-stored forms are protected by:

A)Patents

B)copyrights

C)trade secrets

D)trademarks

A)Patents

B)copyrights

C)trade secrets

D)trademarks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following business organizational forms provides the owners with limited investor liability and passes its income before taxes through to the owners?

A)partnership

B)subchapter S (or S)corporation

C)regular or (C )corporation

D)limited liability company (LLC)

E)both a and b

F)both b and d

A)partnership

B)subchapter S (or S)corporation

C)regular or (C )corporation

D)limited liability company (LLC)

E)both a and b

F)both b and d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck