Deck 1: Business Combinations: New Rules for a Long-Standing Business Practice

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/48

العب

ملء الشاشة (f)

Deck 1: Business Combinations: New Rules for a Long-Standing Business Practice

1

When determining the fair values of assets acquired in an acquisition, the highest level of measurement per GAAP is

A)adjusted market value based on prices of similar assets.

B)unadjusted market values in an actively traded market.

C)based on discounted cash flows.

D)the entity's best estimate of an exit or sale value.

A)adjusted market value based on prices of similar assets.

B)unadjusted market values in an actively traded market.

C)based on discounted cash flows.

D)the entity's best estimate of an exit or sale value.

B

2

A tax advantage of business combination can occur when the existing owner of a company sells out and receives:

A)cash to defer the taxable gain as a "tax-free reorganization."

B)stock to defer the taxable gain as a "tax-free reorganization."

C)cash to create a taxable gain.

D)stock to create a taxable gain.

A)cash to defer the taxable gain as a "tax-free reorganization."

B)stock to defer the taxable gain as a "tax-free reorganization."

C)cash to create a taxable gain.

D)stock to create a taxable gain.

B

3

An economic advantage of a business combination includes:

A)Utilizing duplicative assets.

B)Creating separate management teams.

C)Shared fixed costs.

D)Horizontally combining levels within the marketing chain.

A)Utilizing duplicative assets.

B)Creating separate management teams.

C)Shared fixed costs.

D)Horizontally combining levels within the marketing chain.

C

4

ABC Co.is acquiring XYZ Inc.XYZ has the following intangible assets:

Patent on a product that is deemed to have no useful life .

Customer list with an observable fair value of .

A 5-year operating lease with favorable terms having a discounted present value of .

Identifiable research and development costs of .

ABC will record how much for acquired Intangible Assets from the purchase of XYZ Inc?

A)$168,000

B)$58,000

C)$158,000

D)$150,000

Patent on a product that is deemed to have no useful life .

Customer list with an observable fair value of .

A 5-year operating lease with favorable terms having a discounted present value of .

Identifiable research and development costs of .

ABC will record how much for acquired Intangible Assets from the purchase of XYZ Inc?

A)$168,000

B)$58,000

C)$158,000

D)$150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

5

One large bank's acquisition of another bank would be an example of a:

A)market extension merger.

B)conglomerate merger.

C)product extension merger.

D)horizontal merger.

A)market extension merger.

B)conglomerate merger.

C)product extension merger.

D)horizontal merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following would not be considered an identifiable intangible asset?

A)Assembled workforce

B)Customer lists

C)Production backlog

D)Internet domain name

A)Assembled workforce

B)Customer lists

C)Production backlog

D)Internet domain name

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

7

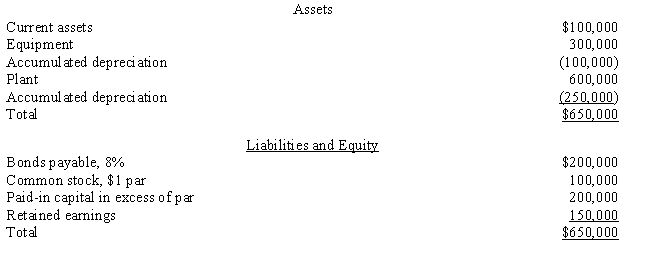

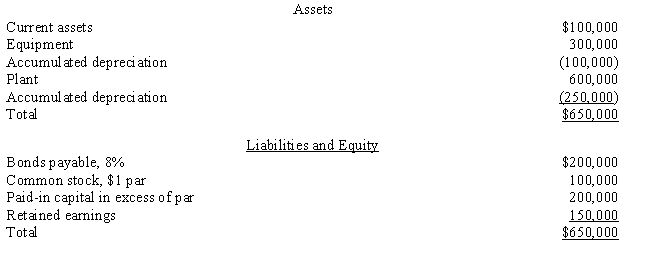

Cozzi Company is being purchased and has the following balance sheet as of the purchase date:

The price paid for Cozzi's net assets is $500,000.The fixed assets have a fair value of $220,000, and the liabilities have a fair value of $110,000.The amount of goodwill to be recorded in the purchase is:

A)$0

B)$150,000

C)$170,000

D)$190,000

The price paid for Cozzi's net assets is $500,000.The fixed assets have a fair value of $220,000, and the liabilities have a fair value of $110,000.The amount of goodwill to be recorded in the purchase is:

A)$0

B)$150,000

C)$170,000

D)$190,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

8

Crystal Co.purchased all of the common stock of Sill Corp.on January 1 of the current year.Five years prior to the acquisition, Sill Corp.had issued 30-year bonds bearing an interest rate of 8%.At the time of the acquisition, the prevailing interest rate for similar bonds was 5%.These bonds should be included in the consolidated balance sheet at

A)face value.

B)at a value higher than Sill's recorded value due to the change in interest rates.

C)at a value lower than Sill's recorded value due to the change in interest rates.

D)at Sill's recorded value.

A)face value.

B)at a value higher than Sill's recorded value due to the change in interest rates.

C)at a value lower than Sill's recorded value due to the change in interest rates.

D)at Sill's recorded value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

9

A large nation-wide bank's acquisition of a major investment advisory firm would be an example of a:

A)market extension merger.

B)conglomerate merger.

C)product extension merger.

D)horizontal merger.

A)market extension merger.

B)conglomerate merger.

C)product extension merger.

D)horizontal merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

10

A building materials company's acquisition of a television station would be an example of a:

A)market extension merger.

B)conglomerate merger.

C)product extension merger.

D)horizontal merger.

A)market extension merger.

B)conglomerate merger.

C)product extension merger.

D)horizontal merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

11

Acquisition costs such as the fees of accountants and lawyers that were necessary to negotiate and consummate the purchase are

A)recorded as a deferred asset and amortized over a period not to exceed 15 years

B)expensed if immaterial but capitalized and amortized if over 2% of the acquisition price

C)expensed in the period of the purchase

D)included as part of the price paid for the company purchased

A)recorded as a deferred asset and amortized over a period not to exceed 15 years

B)expensed if immaterial but capitalized and amortized if over 2% of the acquisition price

C)expensed in the period of the purchase

D)included as part of the price paid for the company purchased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

12

Publics Company acquired the net assets of Citizen Company during 2016.The purchase price was $800,000.On the date of the transaction, Citizen had no long-term investments in marketable equity securities and $400,000 in liabilities, of which the fair value approximated book value.The fair value of Citizen's assets on the acquisition date was as follows:

How should Publics account for the difference between the fair value of the net assets acquired and the acquisition price of $800,000?

A)Retained earnings should be reduced by $200,000.

B)A $600,000 gain on acquisition of business should be recognized.

C)A $200,000 gain on acquisition of business should be recognized.

D)A deferred credit of $200,000 should be set up and subsequently amortized to future net income over a period not to exceed 40 years.

How should Publics account for the difference between the fair value of the net assets acquired and the acquisition price of $800,000?

A)Retained earnings should be reduced by $200,000.

B)A $600,000 gain on acquisition of business should be recognized.

C)A $200,000 gain on acquisition of business should be recognized.

D)A deferred credit of $200,000 should be set up and subsequently amortized to future net income over a period not to exceed 40 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

13

Goodwill results when:

A)a controlling interest is acquired.

B)the price of the acquisition exceeds the sum of the fair values of the net identifiable assets acquired.

C)the fair value of net assets acquired exceeds the acquisition price.

D)the price of the acquisition exceeds the book value of an acquired company.

A)a controlling interest is acquired.

B)the price of the acquisition exceeds the sum of the fair values of the net identifiable assets acquired.

C)the fair value of net assets acquired exceeds the acquisition price.

D)the price of the acquisition exceeds the book value of an acquired company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following costs of a business combination can be deducted from the value assigned to paid-in capital in excess of par?

A)Direct and indirect acquisition costs.

B)Direct acquisition costs.

C)Direct acquisition costs and stock issue costs if stock is issued as consideration.

D)Stock issue costs if stock is issued as consideration.

A)Direct and indirect acquisition costs.

B)Direct acquisition costs.

C)Direct acquisition costs and stock issue costs if stock is issued as consideration.

D)Stock issue costs if stock is issued as consideration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

15

A contingent liability of an acquiree

A)refers to future consideration due that is part of the acquisition agreement.

B)is recorded when it is probable that future events will confirm its existence.

C)may be recorded beyond the measurement period under certain circumstances.

D)should be recorded even if the amount cannot be reasonably estimated.

A)refers to future consideration due that is part of the acquisition agreement.

B)is recorded when it is probable that future events will confirm its existence.

C)may be recorded beyond the measurement period under certain circumstances.

D)should be recorded even if the amount cannot be reasonably estimated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

16

Larry's Liquor acquired the net assets of Drake's Drinks in exchange for cash.The acquisition price exceeds the fair value of the net assets acquired.How should Larry's Liquor determine the amounts to be reported for the plant and equipment, and for long-term debt of the acquired Drake's Drinks?

Plant and Equipment Long-Term Debt

A) Fair value Drake's carrying amount

B) ?Fair value Fair value

C) ?Drake's carrying amount Fair value

D) ?Drake's carrying amount Drake's carrying amount

Plant and Equipment Long-Term Debt

A) Fair value Drake's carrying amount

B) ?Fair value Fair value

C) ?Drake's carrying amount Fair value

D) ?Drake's carrying amount Drake's carrying amount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

17

ACME Co.paid $110,000 for the net assets of Comb Corp.At the time of the acquisition the following information was available related to Comb's balance sheet:

What is the amount recorded by ACME for the Building

A)$110,000

B)$20,000

C)$80,000

D)$100,000

What is the amount recorded by ACME for the Building

A)$110,000

B)$20,000

C)$80,000

D)$100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

18

A controlling interest in a company implies that the parent company

A)owns all of the subsidiary's stock.

B)has acquired a majority of the subsidiary's common stock.

C)has paid cash for a majority of the subsidiary's stock.

D)has transferred common stock for a majority of the subsidiary's outstanding bonds and debentures.

A)owns all of the subsidiary's stock.

B)has acquired a majority of the subsidiary's common stock.

C)has paid cash for a majority of the subsidiary's stock.

D)has transferred common stock for a majority of the subsidiary's outstanding bonds and debentures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

19

A(n) ________________ occurs when the management of the target company purchases a controlling interest in that company and the company incurs a significant amount of debt as a result.

A)greenmail

B)statutory merger

C)poison pill

D)leveraged buyout

A)greenmail

B)statutory merger

C)poison pill

D)leveraged buyout

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

20

Some advantages of obtaining control by acquiring a controlling interest in stock include all but:

A)Negotiations are made directly with the acquiree's management.

B)The legal liability of each corporation is limited to its own assets.

C)The cost may be lower since only a controlling interest in the assets, not the total assets, is acquired.

D)Tax advantages may result from preservation of the legal entities.

A)Negotiations are made directly with the acquiree's management.

B)The legal liability of each corporation is limited to its own assets.

C)The cost may be lower since only a controlling interest in the assets, not the total assets, is acquired.

D)Tax advantages may result from preservation of the legal entities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

21

On January 1, 2016, Honey Bee Corporation purchased the net assets of Green Hornet Company for $1,500,000.On this date, a condensed balance sheet for Green Hornet showed:

?

?

Required:

?

Record the entry on Honey Bee's books for the acquisition of Green Hornet's net assets.?

?

?

Required:

?

Record the entry on Honey Bee's books for the acquisition of Green Hornet's net assets.?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

22

On January 1, 2016, Zebb and Nottle Companies had condensed balance sheets as shown below:

?

?

Required:

?

Record the acquisition of Nottle's net assets, the issuance of the stock and/or payment of cash, and payment of the related costs.Assume that Zebb issued 30,000 shares of new common stock with a fair value of $25 per share and paid $500,000 cash for all of the net assets of Nottle.Acquisition costs of $50,000 and stock issuance costs of $20,000 were paid in cash.Current assets had a fair value of $650,000, plant and equipment had a fair value of $900,000, and long-term debt had a fair value of $330,000.

?

?

?

Required:

?

Record the acquisition of Nottle's net assets, the issuance of the stock and/or payment of cash, and payment of the related costs.Assume that Zebb issued 30,000 shares of new common stock with a fair value of $25 per share and paid $500,000 cash for all of the net assets of Nottle.Acquisition costs of $50,000 and stock issuance costs of $20,000 were paid in cash.Current assets had a fair value of $650,000, plant and equipment had a fair value of $900,000, and long-term debt had a fair value of $330,000.

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

23

Orbit Inc.purchased Planet Co.on January 1, 2015.At that time an existing patent having a 5-year estimated life was assigned a provisional value of $10,000 and goodwill was assigned a value of $100,000.By the end of fiscal year 2015, better information was available that indicated the fair value of the patent was $20,000.How should intangible assets be reported at the beginning of fiscal year 2016??

A)?Goodwill $100,000 Patent $10,000

B)?Goodwill $90,000 Patent $16,000

C)?Goodwill $84,000 Patent $16,000

D)?Goodwill $90,000 Patent $20,000

A)?Goodwill $100,000 Patent $10,000

B)?Goodwill $90,000 Patent $16,000

C)?Goodwill $84,000 Patent $16,000

D)?Goodwill $90,000 Patent $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

24

When measuring the fair value of the acquired company as the price paid by the acquirer, the price calculation needs to consider the following EXCEPT for:

A)the estimated value of contingent consideration like assets or stock at a later date if specified events occur like targeted sales or income performance

B)the costs of accomplishing the acquisition, such as accounting and legal fees

C)common agreements like targeted sales or income performance by the acquire company are acceptable for valuation

D)issue costs from the stock of the acquirer may be expensed or they can be deducted from the value assigned to paid-in capital in excess of par only

A)the estimated value of contingent consideration like assets or stock at a later date if specified events occur like targeted sales or income performance

B)the costs of accomplishing the acquisition, such as accounting and legal fees

C)common agreements like targeted sales or income performance by the acquire company are acceptable for valuation

D)issue costs from the stock of the acquirer may be expensed or they can be deducted from the value assigned to paid-in capital in excess of par only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

25

Orbit Inc.purchased Planet Co.on January 1, 2016.At that time an existing patent having a 5-year life was not recorded as a separately identified intangible asset.At the end of fiscal year 2015, it is determined the patent is valued at $20,000, and goodwill has a book value of $100,000.How should intangible assets be reported at the beginning of fiscal year 2016??

A)?Goodwill $100,000 Patent $0

B)?Goodwill $100,000 Patent $20,000

C)?Goodwill $80,000 Patent $20,000

D)?Goodwill $80,000 Patent $16,000

A)?Goodwill $100,000 Patent $0

B)?Goodwill $100,000 Patent $20,000

C)?Goodwill $80,000 Patent $20,000

D)?Goodwill $80,000 Patent $16,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

26

Jones company acquired Jackson Company for $2,000,000 cash.At that time, the fair value of recorded assets and liabilities was $1,500,000 and $250,000, respectively.Jackson also had in-process research and development projects valued at $150,000 and its pension plan's projected benefit obligation exceeded the plan assets by $50,000.What was the amount of the goodwill related to the acquisition?

A)$750,000

B)$50,000

C)$250,000

D)$650,000

A)$750,000

B)$50,000

C)$250,000

D)$650,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

27

Balter Inc.acquired Jersey Company on January 1, 2016.When the purchase occurred Jersey Company had the following information related to fixed assets:

The building has a 10-year remaining useful life and the equipment has a 5-year remaining useful life.The fair value of the assets on that date were:

What is the 2016 depreciation expense Balter will record related to purchasing Jersey Company

A)$8,000

B)$15,000

C)$28,000

D)$30,000

The building has a 10-year remaining useful life and the equipment has a 5-year remaining useful life.The fair value of the assets on that date were:

What is the 2016 depreciation expense Balter will record related to purchasing Jersey Company

A)$8,000

B)$15,000

C)$28,000

D)$30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

28

Vibe Company purchased the net assets of Atlantic Company in a business combination accounted for as a purchase.As a result, goodwill was recorded.For tax purposes, this combination was considered to be a tax-free merger.Included in the assets is a building with an appraised value of $210,000 on the date of the business combination.This asset had a net book value of $70,000.The building had an adjusted tax basis to Atlantic (and to Vibe as a result of the merger) of $120,000.Assuming a 40% income tax rate, at what amount should Vibe record this building on its books after the purchase?

A)?$174,000 $ 0

B)?$140,000 $36,000

C)?$210,000 $90,000

D)?$210,000 $36,000

A)?$174,000 $ 0

B)?$140,000 $36,000

C)?$210,000 $90,000

D)?$210,000 $36,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

29

On January 1, 16 Brown Inc.acquired Larson Company's net assets in exchange for Brown's common stock with a par value of $100,000 and a fair value of $800,000.Brown also paid $10,000 in direct acquisition costs and $15,000 in stock issuance costs.

?

On this date, Larson's condensed account balances showed the following:

?

?

Required:

?

Record Brown's purchase of Larson Company's net assets.

?

?

On this date, Larson's condensed account balances showed the following:

?

?

Required:

?

Record Brown's purchase of Larson Company's net assets.

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

30

ACME Co.paid $110,000 for the net assets of Comb Corp.At the time of the acquisition the following information was available related to Comb's balance sheet:

What is the amount of gain or loss on disposal of business should Comb Corp.recognize?

A)Gain of $60,000

B)Gain of $60,000.

C)Loss of $30,000

D)Loss of $60,000

What is the amount of gain or loss on disposal of business should Comb Corp.recognize?

A)Gain of $60,000

B)Gain of $60,000.

C)Loss of $30,000

D)Loss of $60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

31

Jones Company acquired Jackson Company for $2,000,000 cash.At that time, the fair value of recorded assets and liabilities was $1,500,000 and $250,000, respectively.Jackson also had unrecorded copyrights valued at $150,000 and its direct costs related to the acquisition were $50,000.What was the amount of the goodwill related to the acquisition?

A)$600,000

B)$650,000

C)$550,000

D)$700,000

A)$600,000

B)$650,000

C)$550,000

D)$700,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

32

Polk issues common stock to acquire all the assets of the Sam Company on January 1, 2016.There is a contingent share agreement, which states that if the income of the Sam Division exceeds a certain level during 2016 and 2017, additional shares will be issued on January 1, 2018.The impact of issuing the additional shares is to

A)increase the price assigned to fixed assets.

B)have no effect on asset values, but to reassign the amounts assigned to equity accounts.

C)reduce retained earnings.

D)record additional goodwill.

A)increase the price assigned to fixed assets.

B)have no effect on asset values, but to reassign the amounts assigned to equity accounts.

C)reduce retained earnings.

D)record additional goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

33

Jones Company acquired Jackson Company for $2,000,000 cash.At that time, the fair value of recorded assets and liabilities was $1,500,000 and $250,000, respectively.If Jackson meets specified sales targets, Jones is required to pay an additional $200,000 in cash per the acquisition agreement.Jones estimates the probability of this to be 50%.The direct costs related to the acquisition were $50,000.What was the amount of the goodwill related to the acquisition?

A)$900,000

B)$950,000

C)$850,000

D)$750,000

A)$900,000

B)$950,000

C)$850,000

D)$750,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

34

Rugby, Inc.issues 20,000 shares of $10 par value common stock with a market value of $15 each for Soccer Company.Rugby, Inc.pays related acquisition costs of $50,000.The total fair value of net assets acquired from Soccer Company is $450,000.Which of the following is true related to recording the purchase and related costs:

A)Debit a loss for $150,000 on the acquisition of the business

B)Debit goodwill for $250,000 above par value on the acquisition of the business

C)Credit a gain for $150,000 on the acquisition of the business and capitalize the $55,000 of acquisition costs

D)Credit a gain for $150,000 on the acquisition of the business and expense the acquisition costs.

A)Debit a loss for $150,000 on the acquisition of the business

B)Debit goodwill for $250,000 above par value on the acquisition of the business

C)Credit a gain for $150,000 on the acquisition of the business and capitalize the $55,000 of acquisition costs

D)Credit a gain for $150,000 on the acquisition of the business and expense the acquisition costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

35

In performing the impairment test for goodwill, the company had the following 2016 and 2017 information available.

Assume that the carrying value of the identifiable assets are a reasonable approximation of their fair values.Based upon this information what are the 2016 and 2017 adjustment to goodwill, if any

2016 2017

A)no adjustment $20,000 decrease

B)$10,000 increase $20,000 decrease

C)$10,000 decrease $20,000 decrease

D)$10,000 decrease no adjustment

Assume that the carrying value of the identifiable assets are a reasonable approximation of their fair values.Based upon this information what are the 2016 and 2017 adjustment to goodwill, if any

2016 2017

A)no adjustment $20,000 decrease

B)$10,000 increase $20,000 decrease

C)$10,000 decrease $20,000 decrease

D)$10,000 decrease no adjustment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

36

While performing a goodwill impairment test, the company had the following information:

Based upon this information the proper conclusion is:

A)The company should recognize a goodwill impairment loss of $20,000.

B)Goodwill is not impaired.

C)The company should recognize a goodwill impairment loss of $40,000.

D)The company should recognize a goodwill impairment loss of $60,000.

Based upon this information the proper conclusion is:

A)The company should recognize a goodwill impairment loss of $20,000.

B)Goodwill is not impaired.

C)The company should recognize a goodwill impairment loss of $40,000.

D)The company should recognize a goodwill impairment loss of $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

37

When an acquisition of another company occurs, FASB requires disclosing all of the following except:

A)amounts recorded for each major class of assets and liabilities.

B)information concerning contingent consideration including a description of the arrangements and the range of outcomes.

C)results of operations for the current period if both companies had remained separate.

D)a qualitative description of factors that make up the goodwill recognized.

A)amounts recorded for each major class of assets and liabilities.

B)information concerning contingent consideration including a description of the arrangements and the range of outcomes.

C)results of operations for the current period if both companies had remained separate.

D)a qualitative description of factors that make up the goodwill recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

38

Internet Corporation is considering the acquisition of Homepage Corporation and has obtained the following audited condensed balance sheet:

?

Homepage Corporation

Balance Sheet

December 31, 2016 ?

Internet also acquired the following fair values for Homepage's assets and liabilities:

?

?

Internet and Homepage agree on a price of $280,000 for Homepage's net assets.Prepare the necessary journal entry to record the purchase given the following scenarios:

?

a.Internet pays cash for Homepage Corporation and incurs $5,000 of acquisition costs.?

?

b.Internet issues its $5 par value stock as consideration.The fair value of the stock at the acquisition date is $50 per share.Additionally, Internet incurs $5,000 of security issuance costs.?

?

Homepage Corporation

Balance Sheet

December 31, 2016 ?

Internet also acquired the following fair values for Homepage's assets and liabilities:

?

?

Internet and Homepage agree on a price of $280,000 for Homepage's net assets.Prepare the necessary journal entry to record the purchase given the following scenarios:

?

a.Internet pays cash for Homepage Corporation and incurs $5,000 of acquisition costs.?

?

b.Internet issues its $5 par value stock as consideration.The fair value of the stock at the acquisition date is $50 per share.Additionally, Internet incurs $5,000 of security issuance costs.?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following income factors should not be considered in expected future income when estimating the value of goodwill?

A)sales for the period

B)income tax expense

C)extraordinary items

D)cost of goods sold

A)sales for the period

B)income tax expense

C)extraordinary items

D)cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

40

ACME Co.paid $110,000 for the net assets of Comb Corp.At the time of the acquisition the following information was available related to Comb's balance sheet:

What is the amount of goodwill or gain related to the acquisition??

A)Goodwill of $70,000

B)Goodwill of $30,000

C)A gain of $30,000

D)A gain of $70,000

What is the amount of goodwill or gain related to the acquisition??

A)Goodwill of $70,000

B)Goodwill of $30,000

C)A gain of $30,000

D)A gain of $70,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

41

Diamond acquired Heart's net assets.At the time of the acquisition Heart's Balance sheet was as follows:

?

Fair values on the date of acquisition:

?

?

Required:

?

Record the entry for the purchase of the net assets of Heart by Diamond at the following cash prices:

?

a.$700,000

b.$300,000

?

?

Fair values on the date of acquisition:

?

?

Required:

?

Record the entry for the purchase of the net assets of Heart by Diamond at the following cash prices:

?

a.$700,000

b.$300,000

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

42

Poplar Corp.acquires the net assets of Sapling Company, which has the following balance sheet:

?

?

Fair values on the date of acquisition:

?

?

If Poplar paid $300,000 what journal entries would be recorded by both Poplar Corp.and Sapling Company?

?

?

?

Fair values on the date of acquisition:

?

?

If Poplar paid $300,000 what journal entries would be recorded by both Poplar Corp.and Sapling Company?

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

43

Goodwill is an intangible asset.There are a variety of recommendations about how intangible assets should be included in the financial statements.Discuss the recommendations for proper disclosure of goodwill.Include a comparison with disclosure of other intangible assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

44

The Blue Reef Company purchased the net assets of the Pink Coral Company on January 1, 2016, and made the following entry to record the purchase:

?

?

Required:

?

Make the required entry on January 1, 2018, assuming that additional shares would be issued on that date to compensate for any fall in the value of Blue Reef common stock below $16 per share.The settlement would be to cure the deficiency by issuing added shares based on their fair value on January 1, 2018.The fair price of the shares on January 1, 2018 was $10.

?

?

?

Required:

?

Make the required entry on January 1, 2018, assuming that additional shares would be issued on that date to compensate for any fall in the value of Blue Reef common stock below $16 per share.The settlement would be to cure the deficiency by issuing added shares based on their fair value on January 1, 2018.The fair price of the shares on January 1, 2018 was $10.

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

45

While acquisitions are often friendly, there are numerous occasions when a party does not want to be acquired.Discuss possible defensive strategies that firms can implement to fend off a hostile takeover attempt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

46

The Chan Corporation purchased the net assets (existing liabilities were assumed) of the Don Company for $900,000 cash.The balance sheet for the Don Company on the date of acquisition showed the following:

?

?

Required:

Required:

?

The equipment has a fair value of $300,000, and the plant assets have a fair value of $500,000.Assume that the Chan Corporation has an effective tax rate of 40%.Prepare the entry to record the purchase of the Don Company for each of the following separate cases with specific added information:

?

a.The sale is a nontaxable exchange to the seller that limits the buyer to depreciation and amortization on only book value for tax purposes.?

?

b.The bonds have a current fair value of $190,000.The transaction is a taxable exchange.?

?

c.There are $100,000 of prior-year losses that can be used to claim a tax refund.The transaction is a taxable exchange.?

?

d.There are $150,000 of past losses that can be carried forward to future years to offset taxes that will be due.The transaction is a taxable exchange.?

?

?

Required:

Required:?

The equipment has a fair value of $300,000, and the plant assets have a fair value of $500,000.Assume that the Chan Corporation has an effective tax rate of 40%.Prepare the entry to record the purchase of the Don Company for each of the following separate cases with specific added information:

?

a.The sale is a nontaxable exchange to the seller that limits the buyer to depreciation and amortization on only book value for tax purposes.?

?

b.The bonds have a current fair value of $190,000.The transaction is a taxable exchange.?

?

c.There are $100,000 of prior-year losses that can be used to claim a tax refund.The transaction is a taxable exchange.?

?

d.There are $150,000 of past losses that can be carried forward to future years to offset taxes that will be due.The transaction is a taxable exchange.?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

47

On January 1, 2016 the fair values of Pink Coral's net assets were as follows:

?

?

On January 1, 2016, Blue Reef Company purchased the net assets of the Pink Coral Company by issuing 100,000 shares of its $1 par value stock when the fair value of the stock was $6.20.It was further agreed that Blue Reef would pay an additional amount on January 1, 2018, if the average income during the 2-year period of 2016-2017 exceeded $80,000 per year.The expected value of this consideration was calculated as $184,000; the measurement period is one year.Blue Reef paid $15,000 in professional fees to negotiate the purchase and construct the acquisition agreement and $10,000 in stock issuance costs.

?

Required: Prepare Blue Reef's entries:

a) on January 1, 2016 to record the acquisition

b) on August 1, 2016 to revise the contingent consideration to $170,000

c) on January 1, 2016 to settle the contingent consideration clause of the agreement for $175,000

?

?

?

On January 1, 2016, Blue Reef Company purchased the net assets of the Pink Coral Company by issuing 100,000 shares of its $1 par value stock when the fair value of the stock was $6.20.It was further agreed that Blue Reef would pay an additional amount on January 1, 2018, if the average income during the 2-year period of 2016-2017 exceeded $80,000 per year.The expected value of this consideration was calculated as $184,000; the measurement period is one year.Blue Reef paid $15,000 in professional fees to negotiate the purchase and construct the acquisition agreement and $10,000 in stock issuance costs.

?

Required: Prepare Blue Reef's entries:

a) on January 1, 2016 to record the acquisition

b) on August 1, 2016 to revise the contingent consideration to $170,000

c) on January 1, 2016 to settle the contingent consideration clause of the agreement for $175,000

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck

48

On January 1, July 1, and December 31, 2016, a condensed trial balance for Nelson Company showed the following debits and (credits):

?

?

Assume that, on July 1, 2016, Systems Corporation purchased the net assets of Nelson Company for $750,000 in cash.On this date, the fair values for certain net assets were:

?

?

Nelson Company's books were NOT closed on June 30, 2016.

?

For all of 2016, Systems' revenues and expenses were $1,500,000 and $1,200,000, respectively.

?

Required:

?

?

?

Assume that, on July 1, 2016, Systems Corporation purchased the net assets of Nelson Company for $750,000 in cash.On this date, the fair values for certain net assets were:

?

?

Nelson Company's books were NOT closed on June 30, 2016.

?

For all of 2016, Systems' revenues and expenses were $1,500,000 and $1,200,000, respectively.

?

Required:

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 48 في هذه المجموعة.

فتح الحزمة

k this deck