Deck 12: Interim Reporting and Disclosures About Segments of an Enterprise

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

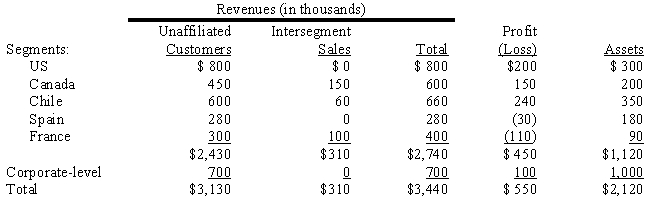

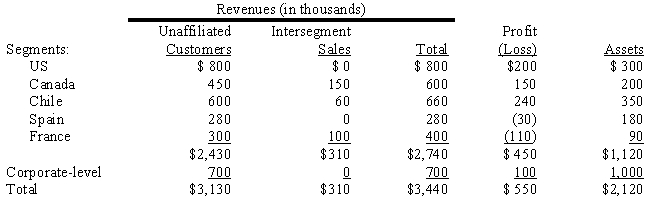

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/63

العب

ملء الشاشة (f)

Deck 12: Interim Reporting and Disclosures About Segments of an Enterprise

1

The primary emphasis of interim reporting is on:

A)interim cash flow

B)the interim statement of financial position

C)interim retained earnings

D)interim income data

A)interim cash flow

B)the interim statement of financial position

C)interim retained earnings

D)interim income data

D

2

Non-ordinary items resulting in income or loss

A)include unusual but not infrequent gains.

B)are treated the same as ordinary items when calculating the effective tax rate.

C)are always treated as a total group when calculating the effective rate for the quarter.

D)are always excluded from interim reporting.

A)include unusual but not infrequent gains.

B)are treated the same as ordinary items when calculating the effective tax rate.

C)are always treated as a total group when calculating the effective rate for the quarter.

D)are always excluded from interim reporting.

A

3

Saunders Corp., which accounts for inventory using the LIFO method, had 2,000 units in beginning inventory at a cost of $40 and had purchased 500 more for $43.During the quarter, 1,300 units were sold.It is expected that the ending inventory at year end will be 1,800 units as Saunders anticipates purchasing additional units for $45.The debit to cost of goods sold for the quarter would be:

A)$53,500

B)$56,500

C)$55,000

D)$58,500

A)$53,500

B)$56,500

C)$55,000

D)$58,500

A

4

When a company makes a second quarter decision to discontinue a segment, the first quarter tax expense:

A)Results are not restated.

B)is split between the tax expense calculated on restated quarter one income from continuing operations and the discontinued segment by subtracting the tax expenses calculated on the restated first quarter income from the original tax expense calculated for the first quarter, before the decision was made.

C)is used to determine the incremental tax effect.

D)is recalculated using a new tax rate and first period results are restated.

A)Results are not restated.

B)is split between the tax expense calculated on restated quarter one income from continuing operations and the discontinued segment by subtracting the tax expenses calculated on the restated first quarter income from the original tax expense calculated for the first quarter, before the decision was made.

C)is used to determine the incremental tax effect.

D)is recalculated using a new tax rate and first period results are restated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

5

Saunders Corp., which accounts for inventory using the LIFO method, had 2,000 units in beginning inventory at a cost of $40 and had purchased 500 more for $43.During the quarter, 1,300 units were sold.It is expected that the ending inventory at year end will be 1,800 units as Saunders anticipates purchasing additional units for $45.The excess replacement cost for temporary liquidation for the quarter would be:

A)$3,000

B)$6,000

C)$1,200

D)$3,600

A)$3,000

B)$6,000

C)$1,200

D)$3,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

6

Cammy Company had inventory at the end of the first quarter having a cost of $420,000 and a market value of $410,000.Cammy recognized a $10,000 loss in its first quarter financial statements due to market declines.At the end of the second quarter, the inventory had a cost of $450,000, and a market value of $480,000.Cammy's action in the second quarter should be:

A)nothing.

B)recognize a $30,000 gain due to market recoveries.

C)recognize a $10,000 gain due to market recoveries.

D)recognize a recovery based on the first quarter write-down multiplied by the gross profit percentage.

A)nothing.

B)recognize a $30,000 gain due to market recoveries.

C)recognize a $10,000 gain due to market recoveries.

D)recognize a recovery based on the first quarter write-down multiplied by the gross profit percentage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

7

The incremental income tax effect utilized to determine the tax effect of an extraordinary item is calculated by:

A)applying the estimated effective tax rate against the amount of the extraordinary item

B)the difference between the gross tax calculated on continuing operations and the gross tax on income from all sources

C)the difference between the estimated net tax calculated on the projected annual income from continuing operations and the estimated net tax calculated on projected annual income, including the non-ordinary items

D)none of the above.

A)applying the estimated effective tax rate against the amount of the extraordinary item

B)the difference between the gross tax calculated on continuing operations and the gross tax on income from all sources

C)the difference between the estimated net tax calculated on the projected annual income from continuing operations and the estimated net tax calculated on projected annual income, including the non-ordinary items

D)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following best describes the treatment given a change in accounting principles made during the second quarter?

A)The cumulative effect should be recognized in the quarter in which the decision to change is made.

B)Regardless of the quarter of change, the recognition is deferred until year end.

C)All prior interim periods are retrospectively restated.

D)Interim periods prior to the period of change are not restated.

A)The cumulative effect should be recognized in the quarter in which the decision to change is made.

B)Regardless of the quarter of change, the recognition is deferred until year end.

C)All prior interim periods are retrospectively restated.

D)Interim periods prior to the period of change are not restated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

9

During the first quarter, a company's application of lower of cost or market methods indicated a $150,000 loss from a temporary market decline, which is expected to be restored in the fiscal year.During the second quarter, the market reversed the decline.Which of the following situations indicates a proper treatment of these facts?

A)A $37,500 loss recognized in the first quarter and no recovery recognized in the second quarter.

B)A $150,000 loss recognized in the first quarter and a $90,000 recovery in the second quarter.

C)A $150,000 loss recognized in the first quarter and a $50,000 recovery in the second quarter.

D)No loss recognized in the first quarter and no recovery recognized in the second quarter.

A)A $37,500 loss recognized in the first quarter and no recovery recognized in the second quarter.

B)A $150,000 loss recognized in the first quarter and a $90,000 recovery in the second quarter.

C)A $150,000 loss recognized in the first quarter and a $50,000 recovery in the second quarter.

D)No loss recognized in the first quarter and no recovery recognized in the second quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

10

In order to generate interim financial reports that contain a reasonable portion of annual expenses, which of the following statements is true?

A)An allocation of a portion of an annual bonus would be made as an interim adjustment.

B)Any adjustments for inventory shrinkage would be deferred to year end.

C)An annual insurance premium would be expensed when paid.

D)None of the above are true

A)An allocation of a portion of an annual bonus would be made as an interim adjustment.

B)Any adjustments for inventory shrinkage would be deferred to year end.

C)An annual insurance premium would be expensed when paid.

D)None of the above are true

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

11

For interim reporting, which of the following statements is true?

A)Under a standard cost system, unplanned or unanticipated variances should be deferred at interim reporting dates.

B)Under the LIFO method, recognition of layer liquidations, thought to be temporary, are postponed by using replacement cost in the calculation of interim cost of goods sold.

C)Under the lower of cost or market determination of ending inventory, a gain may not be recognized in an interim period.

D)All of these statements are true.

A)Under a standard cost system, unplanned or unanticipated variances should be deferred at interim reporting dates.

B)Under the LIFO method, recognition of layer liquidations, thought to be temporary, are postponed by using replacement cost in the calculation of interim cost of goods sold.

C)Under the lower of cost or market determination of ending inventory, a gain may not be recognized in an interim period.

D)All of these statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

12

Harrison Company paid the annual fee of $30,000 for an equipment maintenance contract on July 1, the first day of its second quarter and incurred research costs in the same quarter of $12,000.The research did not prove to be fruitful.Harrison should recognize the following expense amount in the second quarter:

A)$10,500

B)$11,500

C)$19,500

D)$42,000

A)$10,500

B)$11,500

C)$19,500

D)$42,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

13

If a company is utilizing LIFO inventory costing, what might be the effect on the calculation of Cost of Goods sold in an interim financial statement?

A)cost of goods sold is calculated on a historical cost basis only

B)the interim cost of goods sold includes the replacement cost of temporarily liquidated inventory

C)cost of goods sold is not adjusted for any changes due to liquidation of LIFO inventory

D)any of the effects of liquidation are deferred until year end

A)cost of goods sold is calculated on a historical cost basis only

B)the interim cost of goods sold includes the replacement cost of temporarily liquidated inventory

C)cost of goods sold is not adjusted for any changes due to liquidation of LIFO inventory

D)any of the effects of liquidation are deferred until year end

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

14

Abel Corporation sold equipment in the first quarter of 2016 at a $150,000 loss.How much of the loss should appear in the 2016 second- and third-quarter income?

A)$37,500 and $37,500

B)$50,000 and $50,000

C)$0 and $0

D)$100,000 and $0

A)$37,500 and $37,500

B)$50,000 and $50,000

C)$0 and $0

D)$100,000 and $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following statements is not true concerning the determination of the effective tax rate to be used for interim reporting?

A)Tax rate changes should not be accounted for retroactively.

B)The effective tax rate for the entire year should be estimated.

C)The effective tax rate should reflect anticipated tax credits.

D)The estimated tax rate should reflect extraordinary items.

A)Tax rate changes should not be accounted for retroactively.

B)The effective tax rate for the entire year should be estimated.

C)The effective tax rate should reflect anticipated tax credits.

D)The estimated tax rate should reflect extraordinary items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following statements about interim reporting is false?

A)If a company reports year-to-date financial information for the current year, it also must report the last twelve month-to-date information.

B)Under some circumstances, a company can restate the financial information of an earlier current-year quarter.

C)The gross profit method may be used for interim periods when taking a physical inventory would be too costly.

D)A company should allocate a portion of its estimated year-end inventory adjustment to each interim period.

A)If a company reports year-to-date financial information for the current year, it also must report the last twelve month-to-date information.

B)Under some circumstances, a company can restate the financial information of an earlier current-year quarter.

C)The gross profit method may be used for interim periods when taking a physical inventory would be too costly.

D)A company should allocate a portion of its estimated year-end inventory adjustment to each interim period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

17

The tax benefit associated with a year-to-date operating loss should be recognized if:

A)the loss may be carried back to offset two prior years of income.

B)it is more likely than not that the benefit will be realized during the year.

C)it is more likely than not that the benefit will be realized against future income.

D)all of the above.

A)the loss may be carried back to offset two prior years of income.

B)it is more likely than not that the benefit will be realized during the year.

C)it is more likely than not that the benefit will be realized against future income.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

18

Abitz Corporation has the following pretax operating income in its first three quarters of 2016.The effective tax rate for each quarter is provided.Determine the third quarter income tax or benefit. ?

A)$3,750

B)$15,000

C)$15,750

D)$20,000

A)$3,750

B)$15,000

C)$15,750

D)$20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following best describes the proper accounting for interim financial reports?

A)The interim period is viewed as an integral part of the annual accounting period.

B)The interim period is viewed as a distinct, independent accounting period.

C)Interim reports should include the same level of disclosure as annual reports.

D)Net income should be computed on the cash basis except for sales, cost of goods sold, and depreciation.

A)The interim period is viewed as an integral part of the annual accounting period.

B)The interim period is viewed as a distinct, independent accounting period.

C)Interim reports should include the same level of disclosure as annual reports.

D)Net income should be computed on the cash basis except for sales, cost of goods sold, and depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following best describes how the tax benefit resulting from the extraordinary loss in an interim period is recognized?

A)The tax benefit is recognized in the period in which it occurs using the estimated effective rate.

B)The tax benefit is recognized in the period in which it occurs using the average tax rate for all income.

C)The tax benefit is allocated over the current and remaining periods using the estimated effective rate.

D)The tax benefit is recognized only if, more likely than not, the loss may be offset against income.

A)The tax benefit is recognized in the period in which it occurs using the estimated effective rate.

B)The tax benefit is recognized in the period in which it occurs using the average tax rate for all income.

C)The tax benefit is allocated over the current and remaining periods using the estimated effective rate.

D)The tax benefit is recognized only if, more likely than not, the loss may be offset against income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

21

Ansfield, Inc.has several potentially reportable segments.The following financial information has been determined for the current fiscal year: ?

The minimum amount of assets a segment must have to qualify as reportable is ____.

A)$4,500,000

B)$5,000,000

C)$37,500,000

D)The answer cannot be determined from the information given.

The minimum amount of assets a segment must have to qualify as reportable is ____.

A)$4,500,000

B)$5,000,000

C)$37,500,000

D)The answer cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

22

The management approach to segmental reporting

A)focuses on how management organizes information for internal decision making.

B)requires that the company's chief executive officer decide what segments will be reported.

C)separates the costs of management from the costs of operations to determine segment profit or loss.

D)is required only in the United States.

A)focuses on how management organizes information for internal decision making.

B)requires that the company's chief executive officer decide what segments will be reported.

C)separates the costs of management from the costs of operations to determine segment profit or loss.

D)is required only in the United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is not considered when determining whether an operating segment qualifies as a reportable segment?

A)revenue of the segment

B)the assets of the segment

C)the shareholders' equity of the segment

D)the absolute amount of its profit or loss

A)revenue of the segment

B)the assets of the segment

C)the shareholders' equity of the segment

D)the absolute amount of its profit or loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

24

In determining if two operating segments may be combined into one, which of the following factors should be considered?

A)similarities regarding profit margins

B)whether the nature of the products and services is similar

C)whether there is a similar amount of intracompany sales

D)whether there is a similar number of employees

A)similarities regarding profit margins

B)whether the nature of the products and services is similar

C)whether there is a similar amount of intracompany sales

D)whether there is a similar number of employees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

25

Ansfield, Inc.has several potentially reportable segments.The following financial information has been determined for the current fiscal year: ?

The minimum amount of revenues a segment must have to qualify as reportable is ____.

A)$700,000

B)$800,000

C)$820,000

D)The answer cannot be determined from the information given.

The minimum amount of revenues a segment must have to qualify as reportable is ____.

A)$700,000

B)$800,000

C)$820,000

D)The answer cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is not required to be disclosed on an entity-wide basis if it has not been disclosed in the segment disclosures?

A)Revenues from external customers for each product group.

B)Long-lived assets located domestically and in foreign countries.

C)Revenues from external customers located domestically and in foreign countries.

D)Total assets located domestically and in foreign countries.

A)Revenues from external customers for each product group.

B)Long-lived assets located domestically and in foreign countries.

C)Revenues from external customers located domestically and in foreign countries.

D)Total assets located domestically and in foreign countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following items should be disclosed with interim data?

A)basic and diluted earnings per share

B)contingent items

C)changes in accounting estimates

D)all of the above

A)basic and diluted earnings per share

B)contingent items

C)changes in accounting estimates

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

28

A corporation made up of an automobile manufacturer, a plastics maker, a spark plug manufacturer, a steel mill, and a battery maker is an example of a

A)horizontally-integrated company.

B)vertically-integrated company.

C)diversified company.

D)conglomerate.

A)horizontally-integrated company.

B)vertically-integrated company.

C)diversified company.

D)conglomerate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

29

A reconciliation of the revenue, profit and loss and asset amounts presented for reportable segments to the respective consolidated amounts for the entity:

A)is not required if all segments are considered reportable.

B)is also required for other significant items presented by segments, such as depreciation and amortization.

C)is required only if the entity elects to use the management approach to determine its operating segments.

D)None of the above is correct.

A)is not required if all segments are considered reportable.

B)is also required for other significant items presented by segments, such as depreciation and amortization.

C)is required only if the entity elects to use the management approach to determine its operating segments.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

30

With regard to major customers, which of the following items is not true?

A)If it qualifies, the federal government is considered a single major customer.

B)The total amount of the sales to each major customer must be disclosed.

C)The names of the major customers must be disclosed.

D)The identity of the segments making the sales must be disclosed.

A)If it qualifies, the federal government is considered a single major customer.

B)The total amount of the sales to each major customer must be disclosed.

C)The names of the major customers must be disclosed.

D)The identity of the segments making the sales must be disclosed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

31

Assume there is an interim year-to-date operating loss and a potential tax benefit associated with this loss.Which of the following is true?

A)The year-to-date loss is completely deductible at year end.

B)The benefit associated with a year-to-date loss should be recognized if it is expected to be realized during the year and the benefit is recognizable as a deferred tax asset at the end of the year.

C)No interim year-to-date losses can be carried back against any prior year's income.

D)A current year-to-date interim loss may not be offset entirely by income in later interim periods of the current fiscal year.

A)The year-to-date loss is completely deductible at year end.

B)The benefit associated with a year-to-date loss should be recognized if it is expected to be realized during the year and the benefit is recognizable as a deferred tax asset at the end of the year.

C)No interim year-to-date losses can be carried back against any prior year's income.

D)A current year-to-date interim loss may not be offset entirely by income in later interim periods of the current fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

32

Ansfield, Inc.has several potentially reportable segments.The following financial information has been determined for the current fiscal year: ?

For Ansfield, Inc.to report a significant portion of its financial information as segments, its segments, in total, must represent

A)$37,500,000 in assets.

B)$6,000,000 in revenues.

C)$1,125,000 in operating income before taxes.

D)The answer cannot be determined from the information given.

For Ansfield, Inc.to report a significant portion of its financial information as segments, its segments, in total, must represent

A)$37,500,000 in assets.

B)$6,000,000 in revenues.

C)$1,125,000 in operating income before taxes.

D)The answer cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

33

It is possible for segments to qualify as reportable, but not represent a material portion of the enterprise.What test is applied to ensure the segments reported represent a significant portion of enterprise activity?

A)Combined external segment revenues for reportable segments exceed 75% of internal and external segment revenues.

B)Total internal and external segment revenue exceeds 75% of total consolidated revenue.

C)Total external segment revenue of the reportable segments exceeds 75% of consolidated revenue.

D)Total segment assets of the reportable segments exceeds 75% of total consolidated assets.

A)Combined external segment revenues for reportable segments exceed 75% of internal and external segment revenues.

B)Total internal and external segment revenue exceeds 75% of total consolidated revenue.

C)Total external segment revenue of the reportable segments exceeds 75% of consolidated revenue.

D)Total segment assets of the reportable segments exceeds 75% of total consolidated assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

34

The acquisition of a paper mill by a large publishing company is an example of

A)horizontal integration.

B)vertical integration.

C)diversification.

D)consolidation.

A)horizontal integration.

B)vertical integration.

C)diversification.

D)consolidation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

35

Two or more operating segments can be combined into a single operating segment, if they share similarities in the following area EXCEPT for:

A)They have the same type of class of customer for their products and services.

B)The production processes are of the same nature.

C)They share the same accounting periods and are consistent in their accounting methods.

D)They share the same distribution channels of their products and/or services.

A)They have the same type of class of customer for their products and services.

B)The production processes are of the same nature.

C)They share the same accounting periods and are consistent in their accounting methods.

D)They share the same distribution channels of their products and/or services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

36

Abbott Inc.began the year with 750 units of inventory valued at $20 each under LIFO.During the first quarter, 300 units were purchased at $25 each and another 250 units were purchased at $28 each.Assume that 200 units are on hand at the end of the first quarter and that the current replacement cost is $30 per unit.

?

Required:

?

If Abbott plans to have 500 units on hand at year end, determine the cost of goods sold for the first quarter.

?

Required:

?

If Abbott plans to have 500 units on hand at year end, determine the cost of goods sold for the first quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

37

Ansfield, Inc.has several potentially reportable segments.The following financial information has been determined for the current fiscal year: ?

The minimum amount of profit or loss a segment must have to qualify as reported is ____.

A)$100,000

B)$135,000

C)$150,000

D)The answer cannot be determined from the information given.

The minimum amount of profit or loss a segment must have to qualify as reported is ____.

A)$100,000

B)$135,000

C)$150,000

D)The answer cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is not required to be disclosed for a reportable segment?

A)The measure of profit or loss that is reviewed by the chief operating decision maker.

B)Segment assets.

C)Segment liabilities.

D)Types of products and services from which the segment derives revenue.

A)The measure of profit or loss that is reviewed by the chief operating decision maker.

B)Segment assets.

C)Segment liabilities.

D)Types of products and services from which the segment derives revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is not a limitation on the number of reportable segments?

A)Consistency, i.e., the number of reportable segments this period, must be the same as last period.

B)Usually the number of segments should not exceed 10.

C)At least 75% of the combined revenue of sales to unaffiliated firms should be traceable to reportable segments.

D)None of the above is a limitation.

A)Consistency, i.e., the number of reportable segments this period, must be the same as last period.

B)Usually the number of segments should not exceed 10.

C)At least 75% of the combined revenue of sales to unaffiliated firms should be traceable to reportable segments.

D)None of the above is a limitation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

40

In determining whether a segment should be reported, a profit and loss test can be used.The test selects segments for reporting by:

A)only including profitable segments.

B)comparing the absolute value of a segment's profit or loss to 10% of all segments cumulative profit or cumulative loss, whichever is higher.

C)comparing the absolute value of a segment's profit or loss to 10% of all segments combined profits and losses.

D)comparing the profit or loss of a segment to 10% of all segment external revenue.

A)only including profitable segments.

B)comparing the absolute value of a segment's profit or loss to 10% of all segments cumulative profit or cumulative loss, whichever is higher.

C)comparing the absolute value of a segment's profit or loss to 10% of all segments combined profits and losses.

D)comparing the profit or loss of a segment to 10% of all segment external revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

41

East Company, a highly diversified corporation, reports the results of operations quarterly.At the beginning of the third quarter, management decided to discontinue its recreational division.At this time, a formal plan was authorized, calling for disposal by year end.Results for the current year, excluding taxes, are as follows:

?

?

The following additional information was provided:

?

a.The first two quarters include results of operations of the discontinued segment.The segment reported first and second quarter pretax losses of $8,000 and $12,000, respectively.?

?

b.The estimated annual income tax rate in the first and second quarters was 35%.Because of the decision to discontinue, the revised annual effective tax rate was determined to be 40%.?

Required:

?

For each quarter, present the results of operations and the related tax expense or tax benefit.Where applicable, include the original and restated amounts in the presentation.

?

?

The following additional information was provided:

?

a.The first two quarters include results of operations of the discontinued segment.The segment reported first and second quarter pretax losses of $8,000 and $12,000, respectively.?

?

b.The estimated annual income tax rate in the first and second quarters was 35%.Because of the decision to discontinue, the revised annual effective tax rate was determined to be 40%.?

Required:

?

For each quarter, present the results of operations and the related tax expense or tax benefit.Where applicable, include the original and restated amounts in the presentation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

42

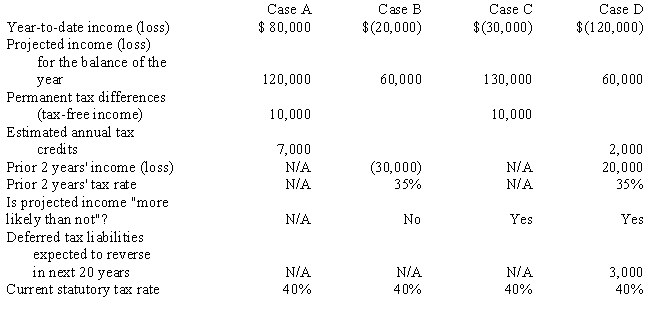

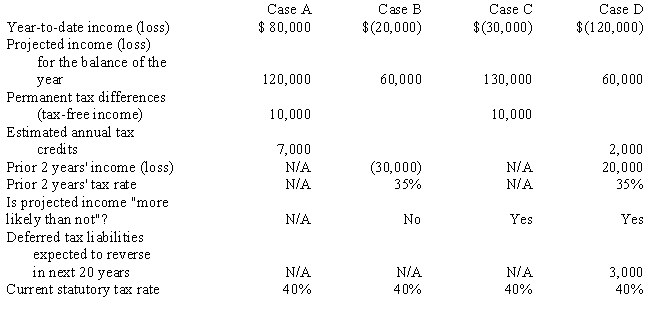

Consider the following:

?

?

Case Income (loss) for quarters 1 through 4 is , and , respectively. Future projected income for the year is uncertain at the end of quarters 1 and 2. Annual income at the end of quarter 3 is estimated to be . No carryback benefit exists, and any future annual benefit is uncertain.

Case B Assume the same facts as in Case A. However, at the end of quarters 1 through 3 , annual income is estimated to be .

Case C Quarterly income (loss) levels were , ( , and . A yearly operating loss of was anticipated throughout the year. Frior years' income of is avail able for carryback. The same tax rates were relevant to the carryback period Required:

?

For cases A through C, complete the schedule that follows: Assume that the statutory tax rate is 15% on the first $50,000 of income, 25% on the next $25,000, and 30% on income in excess of $75,000.

?

?

?

Case Income (loss) for quarters 1 through 4 is , and , respectively. Future projected income for the year is uncertain at the end of quarters 1 and 2. Annual income at the end of quarter 3 is estimated to be . No carryback benefit exists, and any future annual benefit is uncertain.

Case B Assume the same facts as in Case A. However, at the end of quarters 1 through 3 , annual income is estimated to be .

Case C Quarterly income (loss) levels were , ( , and . A yearly operating loss of was anticipated throughout the year. Frior years' income of is avail able for carryback. The same tax rates were relevant to the carryback period Required:

?

For cases A through C, complete the schedule that follows: Assume that the statutory tax rate is 15% on the first $50,000 of income, 25% on the next $25,000, and 30% on income in excess of $75,000.

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

43

Information about the seven segments of the Kenny Corporation is presented below.Determine which of the segments are reportable and why.

?

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

44

Scott Inc.expects to have financial income of $375,000 for 2016 and estimates annual tax credits of $22,500.Included in Scott's income is interest income on municipal securities, which is not taxable, totaling $45,000 and meals and entertainment expenses of $62,500 of which 50% are not deductible under current tax code.Assume that the graduated tax rate schedule is as follows:

?

?

Required:

?

Determine the tax expense for the first quarter, assuming that taxable income is $85,000.

?

?

Required:

?

Determine the tax expense for the first quarter, assuming that taxable income is $85,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

45

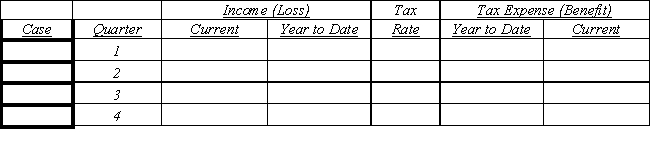

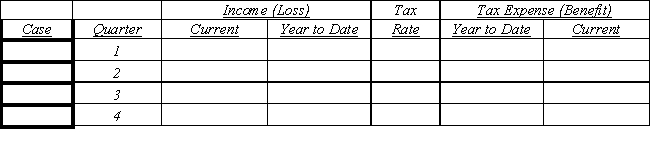

For each of the following independent cases, determine the estimated effective tax rate to be used for the current quarter's interim statements.

?

?

?

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

46

Allee Co.has pretax, ordinary income of $7,000 and $38,000 in the first and second quarters, respectively.The projected ordinary income for the third and fourth quarters is $60,000 and $30,000.Occurring in the second quarter is a pretax, non-ordinary loss of $50,000 and pretax non-ordinary income of $35,000.The statutory tax rate is 15% on the first $50,000, 22% on the next $50,000, and 28% on income over $100,000.

Required:

Determine the tax impact traceable to the non-ordinary income and non-ordinary loss.

Required:

Determine the tax impact traceable to the non-ordinary income and non-ordinary loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

47

Lancaster Inc.expects to have taxable income of $275,000 for 2016 and a tax credit of $12,250.Assume that the graduated tax rate schedule is as follows:

?

?

Required:

?

Determine the tax expense for the first quarter, assuming that taxable income is $65,000.

?

?

Required:

?

Determine the tax expense for the first quarter, assuming that taxable income is $65,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

48

Cracker Corporation's first-quarter 2019, pretax income is $55,000.The company anticipates an annual tax credit of $15,500.Cracker is projecting income for the remaining three quarters of $135,000.For the second quarter of 2019, Cracker reports $85,000 of pretax income with a projected pre-tax income for the remainder of the year of $165,000.Cracker does not have any permanent differences between taxable income and financial income.

?

In the second quarter, Cracker suffers an uninsured loss of one of its warehouses.The loss is determined to be unusual in nature and infrequent in occurrence.The amount of the loss is determined to be $140,000.

?

The current tax schedule is:

?

Required:

?

Calculate the first and second quarter interim tax expenses on continuing income and on the non-ordinary item.

?

?

In the second quarter, Cracker suffers an uninsured loss of one of its warehouses.The loss is determined to be unusual in nature and infrequent in occurrence.The amount of the loss is determined to be $140,000.

?

The current tax schedule is:

?

Required:

?

Calculate the first and second quarter interim tax expenses on continuing income and on the non-ordinary item.

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

49

Adam Enterprise includes seven industry segments.Operating profits (losses) relating to those segments are:

?

?

Required:

?

Based only on the above operating profit (loss) information, which of Adam's segments would be reported separately?

?

?

Required:

?

Based only on the above operating profit (loss) information, which of Adam's segments would be reported separately?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

50

The following lists account titles found on the books of Icell Corporation:

?

a.Research and Development

b.Inventory

c.Annual Bonuses

d.Unfavorable Materials Usage Variance

?

Required:

?

Discuss how each of these items is accounted for in interim financial statements.?

?

a.Research and Development

b.Inventory

c.Annual Bonuses

d.Unfavorable Materials Usage Variance

?

Required:

?

Discuss how each of these items is accounted for in interim financial statements.?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

51

Futura Corporation reported pretax net income of $30,000 in the first quarter of 2016.The company anticipated pretax net income of $90,000 for the year.During the second quarter, after issuing the first-quarter interim statement, Futura decided to discontinue its electronics division and adopted a formal plan for its disposal.

?

During the first quarter, the electronics division reported a pretax loss of $70,000 and estimated a $270,000 operating loss for the year.During the second quarter, the division experienced an operating loss of $35,000 prior to the measurement date and $8,000 in the remainder of that quarter.The anticipated loss on the disposal of that division's assets was $40,000.

?

Futura had a flat 25% tax rate for 2016.The firm is expecting a $5,000 tax credit attributed to operations outside of the electronic division.Second-quarter pretax income for the non-electronics operations was $40,000.As of the end of the second quarter, annual pretax income of $225,000 was anticipated for continuing operations.

?

Required:

?

In good form, prepare a schedule showing the income (loss) and tax expense (benefit) determination for the first quarter, the restated first quarter, and the second quarter.

?

During the first quarter, the electronics division reported a pretax loss of $70,000 and estimated a $270,000 operating loss for the year.During the second quarter, the division experienced an operating loss of $35,000 prior to the measurement date and $8,000 in the remainder of that quarter.The anticipated loss on the disposal of that division's assets was $40,000.

?

Futura had a flat 25% tax rate for 2016.The firm is expecting a $5,000 tax credit attributed to operations outside of the electronic division.Second-quarter pretax income for the non-electronics operations was $40,000.As of the end of the second quarter, annual pretax income of $225,000 was anticipated for continuing operations.

?

Required:

?

In good form, prepare a schedule showing the income (loss) and tax expense (benefit) determination for the first quarter, the restated first quarter, and the second quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

52

Egan Company, a publicly-traded company, divides its operations into several operating segments.Determine which of the following segments are reportable and reconcile the reportable segments to the consolidated revenues and profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

53

The management of Trident, Inc.is trying to determine if three of the company's non-reportable segments should be combined into one single segment for reporting purposes.In what five ways must these segments be similar in order to be reported as one?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

54

Millstone Company's first-quarter 2018, pretax income is $25,000.The company anticipates an annual tax credit of $5,500.Millstone is projecting income for the remaining three quarters of $95,000.For the second quarter of 2019, Millstone reports $55,000 of pretax income with a projected pre-tax income for the remainder of the year of $65,000.Millstone does not have any permanent differences between taxable income and financial income.

?

In the second quarter, Millstone decided to change their depreciation method used for financial reporting purposes.The change in depreciation methods has the following effect on the calculation and projection of income for Millstone:

?

?

The effect of the change on prior years is a decrease to retained earnings of $30,000.

?

The current tax schedule is:

?

Required:

?

Calculate the first and second quarter interim tax expenses on continuing income.

?

In the second quarter, Millstone decided to change their depreciation method used for financial reporting purposes.The change in depreciation methods has the following effect on the calculation and projection of income for Millstone:

?

?

The effect of the change on prior years is a decrease to retained earnings of $30,000.

?

The current tax schedule is:

?

Required:

?

Calculate the first and second quarter interim tax expenses on continuing income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

55

Discuss the criteria emphasized in the "management approach" that is used to define operating segments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

56

The following events took place in Morgan Corporation's second quarter.

?

a.An expired insurance policy was replaced by a $12,000, 12-month policy.?

?

b.Morgan sold marketable securities at a $10,000 gain.?

?

c.Research and development costs of $15,000, which were expected to benefit the company over the next 12 months, were incurred.?

?

d.On the first day of the quarter, Morgan signed a one-year, $100,000 bank note carrying an 8% interest rate.?

?

e.Used equipment with a book value of $36,000 was sold for $18,000.?

Required:

?

Determine the effect of the above events on Morgan Corporation's second-quarter income.

?

a.An expired insurance policy was replaced by a $12,000, 12-month policy.?

?

b.Morgan sold marketable securities at a $10,000 gain.?

?

c.Research and development costs of $15,000, which were expected to benefit the company over the next 12 months, were incurred.?

?

d.On the first day of the quarter, Morgan signed a one-year, $100,000 bank note carrying an 8% interest rate.?

?

e.Used equipment with a book value of $36,000 was sold for $18,000.?

Required:

?

Determine the effect of the above events on Morgan Corporation's second-quarter income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

57

Corriveau Industries decided to switch from an accelerated depreciation method to a straight-line method in the second quarter of 2016.This is classified as a cumulative effect of a change in accounting principle.The first-quarter, pretax income reported was $30,000, and projected pretax income for 2016 was $90,000.If Corriveau had used straight-line depreciation for the quarter, pretax income would have been $35,000 and projected pretax income for 2016 would have been $110,000.The cumulative effect on prior years from the change is a $50,000 increase in retained earnings.The second-quarter income using straight-line depreciation is $20,000, and the expected annual earnings continue to be $110,000.Assume that Corriveau is subject to a flat 25% statutory tax rate for 2016.Corriveau is expecting $5,000 of tax-free income during the third and fourth quarters of 2016.

Required:

For all categories of income, calculate the interim tax expense for the first quarter, first quarter restated, and second quarter.

Required:

For all categories of income, calculate the interim tax expense for the first quarter, first quarter restated, and second quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

58

Santas Corporation is a diversified firm with operations in the United States, Canada, Chile, Spain, and France, each of which qualifies as a geographic segment.Data with respect to those segments follows:

?

?

Required:

Required:

?

Determine which of the Santas segments would be reportable segments, and explain why.

?

?

?

Required:

Required:?

Determine which of the Santas segments would be reportable segments, and explain why.

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

59

A list of selected information from Aanstad Inc.follows.Regarding its first-quarter performance for 2016,

?

a.Sales were $750,000.?

?

b.Cost of goods sold was $502,500.?

?

c.Total depreciation expense was $75,000 (part of selling and administrative expenses).As of the beginning of the first quarter, Aanstad began using straight-line depreciation.Had they used the old accelerated method, the current depreciation would have been $80,000.?

?

d.Other selling and administrative expenses were $30,000 excluding advertising expense.Two quarters of advertising were prepaid at $18,000 at the start of the first quarter.?

?

e.The cost of goods sold includes a favorable volume variance of $100,000.The volume variance is expected to be offset by the slow activity anticipated in the fourth quarter.?

?

f.Aanstad's estimated effective tax rate is 25%.g.Aanstad's retained earnings at the end of the fourth quarter, 20X0 were $234,000.

?

a.Sales were $750,000.?

?

b.Cost of goods sold was $502,500.?

?

c.Total depreciation expense was $75,000 (part of selling and administrative expenses).As of the beginning of the first quarter, Aanstad began using straight-line depreciation.Had they used the old accelerated method, the current depreciation would have been $80,000.?

?

d.Other selling and administrative expenses were $30,000 excluding advertising expense.Two quarters of advertising were prepaid at $18,000 at the start of the first quarter.?

?

e.The cost of goods sold includes a favorable volume variance of $100,000.The volume variance is expected to be offset by the slow activity anticipated in the fourth quarter.?

?

f.Aanstad's estimated effective tax rate is 25%.g.Aanstad's retained earnings at the end of the fourth quarter, 20X0 were $234,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

60

Explain the difference in the independent and integral viewpoints of accounting for interim periods.Which method best describes the accepted accounting practice for interim financial reporting?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

61

Stidham Company is a large international company with diversified operating segments.These segments include the following:

A.Manufacturing processes in the United States and Europe that produce rubber-coated metal automotive parts which are sold to automobile manufacturers and automotive repair retail shops in the United States, Europe and Japan.

B.Manufacturing processes in the United States that batteries used in military and commercial satellites, and for other military purposes.These products are made of lithium and nickel compounds and are sold primarily to United States government agencies, European governmental agencies and selected commercial customers in the United States and Europe.

C.Manufacturing processes in the United States and Latin America that produce precision-machined automotive parts which are sold to international and American automobile manufacturers, but are shipped only to plants located in the United States and Latin America.

D.Manufacturing processes in the United States that produce traditional acid batteries for commercial applications such as toys and emergency lighting systems.The products are sold primarily in the United States and Asia.

E.Processes where rare minerals are refined and distributed internationally for use in producing solar panels used to power space craft, items used to absorb radiation in nuclear power plants and military optical equipment.Customers are primarily United States and selected European governmental agencies, and selected commercial customers in the United States and Europe.

Given the management approach, discuss various ways in which the segments might be structured.

A.Manufacturing processes in the United States and Europe that produce rubber-coated metal automotive parts which are sold to automobile manufacturers and automotive repair retail shops in the United States, Europe and Japan.

B.Manufacturing processes in the United States that batteries used in military and commercial satellites, and for other military purposes.These products are made of lithium and nickel compounds and are sold primarily to United States government agencies, European governmental agencies and selected commercial customers in the United States and Europe.

C.Manufacturing processes in the United States and Latin America that produce precision-machined automotive parts which are sold to international and American automobile manufacturers, but are shipped only to plants located in the United States and Latin America.

D.Manufacturing processes in the United States that produce traditional acid batteries for commercial applications such as toys and emergency lighting systems.The products are sold primarily in the United States and Asia.

E.Processes where rare minerals are refined and distributed internationally for use in producing solar panels used to power space craft, items used to absorb radiation in nuclear power plants and military optical equipment.Customers are primarily United States and selected European governmental agencies, and selected commercial customers in the United States and Europe.

Given the management approach, discuss various ways in which the segments might be structured.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

62

In addition to disclosures about reportable segments, companies are required to provide enterprise-wide disclosures.Describe the information included in enterprise-wide disclosures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

63

For purposes of interim reporting, US-GAAP permits certain modifications to year-end inventory rules.

?

Required:

?

Comment on the acceptability of the following independent situations concerning inventory valuation for an interim period:

?

a.Management believes that since its firm does not have a perpetual inventory system, it would be too costly to take a physical inventory.Consequently, management has suggested to the accounting department that they estimate ending inventory.?

?

b.Since the LIFO inventory base was liquidated in the first quarter, management has recommended that the accounting department switch to FIFO valuation of inventory.?

?

c.Since the first quarter is a slow period for a manufacturing firm, management has suggested that the unfavorable volume variances from the firm's standard cost system be deferred until year end.

?

Required:

?

Comment on the acceptability of the following independent situations concerning inventory valuation for an interim period:

?

a.Management believes that since its firm does not have a perpetual inventory system, it would be too costly to take a physical inventory.Consequently, management has suggested to the accounting department that they estimate ending inventory.?

?

b.Since the LIFO inventory base was liquidated in the first quarter, management has recommended that the accounting department switch to FIFO valuation of inventory.?

?

c.Since the first quarter is a slow period for a manufacturing firm, management has suggested that the unfavorable volume variances from the firm's standard cost system be deferred until year end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck