Deck 11: Translation of Foreign Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/79

العب

ملء الشاشة (f)

Deck 11: Translation of Foreign Financial Statements

1

The functional currency approach adopted by FASB 52 requires:

A)separate statements be maintained by the domestic parent company and the foreign branch both in their own currencies

B)separate statements be maintained by the domestic parent company and the foreign branch with the foreign branch translated into the functional currency

C)results from foreign currency changes to be ignored

D)a focus on whether the domestic reporting entity's cash flows will be indirectly or directly affected by changes in the exchange rates of the foreign entity's currency

A)separate statements be maintained by the domestic parent company and the foreign branch both in their own currencies

B)separate statements be maintained by the domestic parent company and the foreign branch with the foreign branch translated into the functional currency

C)results from foreign currency changes to be ignored

D)a focus on whether the domestic reporting entity's cash flows will be indirectly or directly affected by changes in the exchange rates of the foreign entity's currency

D

2

Changes in the functional currency of a subsidiary

A)are not permitted.

B)are accounted for retroactively.

C)are accounted for prospectively.

D)are reported as extraordinary items.

A)are not permitted.

B)are accounted for retroactively.

C)are accounted for prospectively.

D)are reported as extraordinary items.

C

3

If currency exchange rate changes impact potential cash flows available to the parent and the parent's economic well-being:

A)the functional currency of the subsidiary is the foreign currency.

B)translation gains or losses should be included in net income.

C)the financial relationships as measured in the translated statements are the same as those measured in the foreign currency.

D)the parent may adopt a change in the subsidiary's functional currency.

A)the functional currency of the subsidiary is the foreign currency.

B)translation gains or losses should be included in net income.

C)the financial relationships as measured in the translated statements are the same as those measured in the foreign currency.

D)the parent may adopt a change in the subsidiary's functional currency.

B

4

Rhante is a German company wholly owned by a U.S.firm.Its inventory is valued at the lower of cost or market, with cost being measured by the average cost method.Purchases of inventory occur evenly throughout the period.In 2005 Rhante's ending inventory was 50,000 euros at cost and 48,000 euros at market.Assume the following exchange rates: ?

Determine the translated value of Rhante's inventory to be included in the consolidated balance sheet for the U.S.parent given Rhante's functional currency is the euro.

A)$73,440

B)$76,500

C)$69,600

D)$72,500

Determine the translated value of Rhante's inventory to be included in the consolidated balance sheet for the U.S.parent given Rhante's functional currency is the euro.

A)$73,440

B)$76,500

C)$69,600

D)$72,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

5

Patents are on the books of a British subsidiary of a U.S.firm at a value of 50,000 pounds.The patents were acquired in 2016 when the exchange rate was 1 pound = $1.50.The British subsidiary was acquired by the U.S.firm in 20X0 when the exchange rate was 1 pound = $1.40.The exchange rate on December 31, 2017, the date of the most current balance sheet, is 1 pound = $1.55.The average rate of exchange for 2017 is $1.53.Assuming the pound is the functional currency of the subsidiary, what exchange rate will be used to translate patents for the consolidated statements dated December 31, 2017?

A)$1.40

B)$1.50

C)$1.53

D)$1.55

A)$1.40

B)$1.50

C)$1.53

D)$1.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

6

When may the translation adjustment resulting from translating financial statements using the current or functional method be recognized in income?

A)When there is an accumulated other comprehensive deficit that exceeds retained earnings.

B)When the parent disposes of its interest in the subsidiary.

C)When the functional currency changes to the reporting currency.

D)None of the above is correct.

A)When there is an accumulated other comprehensive deficit that exceeds retained earnings.

B)When the parent disposes of its interest in the subsidiary.

C)When the functional currency changes to the reporting currency.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

7

If a subsidiary's functional currency is not the local currency in which it operates, but the parent's reporting currency:

A)the foreign subsidiary's translated financial statements are identical to the statements that would have resulted if the transactions had been recorded in dollars.

B)the translation adjustment is recorded as a component of other comprehensive income.

C)there is no indication that exchange rate changes will impact the subsidiary's or the parent's cash flows or equity.

D)None of the above is correct.

A)the foreign subsidiary's translated financial statements are identical to the statements that would have resulted if the transactions had been recorded in dollars.

B)the translation adjustment is recorded as a component of other comprehensive income.

C)there is no indication that exchange rate changes will impact the subsidiary's or the parent's cash flows or equity.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

8

In which of the following circumstances surrounding a Mexican subsidiary of an U.S.parent is the peso most likely to be considered the functional currency?

A)Sales are made globally and collected in U.S.dollars.Plant uses local materials and labor and pays in pesos.Intercompany transaction volume is high.

B)The Mexican subsidiary sells product only in Mexico and receives pesos.The materials and labor are also secured in Mexico and paid for with pesos.

C)The Mexican subsidiary receives their debt capital from a U.S.bank in dollars and products produced are sold globally for U.S.dollars.

D)Raw materials are acquired from the parent and paid for in U.S.dollars.Labor is acquired locally and paid in pesos.Financing is secured from the parent in U.S.dollars.

A)Sales are made globally and collected in U.S.dollars.Plant uses local materials and labor and pays in pesos.Intercompany transaction volume is high.

B)The Mexican subsidiary sells product only in Mexico and receives pesos.The materials and labor are also secured in Mexico and paid for with pesos.

C)The Mexican subsidiary receives their debt capital from a U.S.bank in dollars and products produced are sold globally for U.S.dollars.

D)Raw materials are acquired from the parent and paid for in U.S.dollars.Labor is acquired locally and paid in pesos.Financing is secured from the parent in U.S.dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

9

Assuming that the functional currency of a foreign subsidiary is the local currency, which of the following accounts would be translated at the current rate?

A)Additional Paid-in Capital

B)Retained Earnings

C)Allowance for Doubtful Accounts

D)Cost of Goods Sold

A)Additional Paid-in Capital

B)Retained Earnings

C)Allowance for Doubtful Accounts

D)Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following best describes the normal required method of accounting for statements of foreign entities whose functional currency is the foreign entity's local currency, and in which a U.S.firm has an equity interest?

A)The functional method

B)The monetary-nonmonetary method

C)The current-noncurrent method

D)The temporal method

A)The functional method

B)The monetary-nonmonetary method

C)The current-noncurrent method

D)The temporal method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

11

Exchange rates will not usually directly affect the cash flows of the parent entity in which of the following cases?

A)The foreign entity operates in a currency other than its own.

B)The foreign entity operates in its local currency.

C)The foreign entity functions in a currency other than its local currency.

D)The foreign entity functions in the parent's currency.

A)The foreign entity operates in a currency other than its own.

B)The foreign entity operates in its local currency.

C)The foreign entity functions in a currency other than its local currency.

D)The foreign entity functions in the parent's currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

12

A U.S.firm owns 100% of a Japanese automobile manufacturer.The cost of automobile parts is typically 75% of the firm's total product.In which of the following circumstances would neither the U.S.dollar nor the Japanese yen be considered the functional currency?

A)The Japanese firm buys German automobile parts with euros to produce cars sold in Latin America for dollars.

B)The Japanese firm buys German automobile parts with dollars to produce cars sold in Latin America for dollars.

C)The Japanese firm buys German automobile parts with euros to produce cars sold in Latin America for euros.

D)The FASB requires that either the parent's or the subsidiary's local currency be used as the functional currency.

A)The Japanese firm buys German automobile parts with euros to produce cars sold in Latin America for dollars.

B)The Japanese firm buys German automobile parts with dollars to produce cars sold in Latin America for dollars.

C)The Japanese firm buys German automobile parts with euros to produce cars sold in Latin America for euros.

D)The FASB requires that either the parent's or the subsidiary's local currency be used as the functional currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

13

Assuming that a foreign entity is deemed to be operating in an environment dominated by the local currency, the entity's assets are translated using

A)the current rate.

B)a simple average rate.

C)a weighted average rate.

D)a historical rate.

A)the current rate.

B)a simple average rate.

C)a weighted average rate.

D)a historical rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following suggests that the foreign entity's functional currency is the parent's currency?

A)Intercompany transaction volume is low.

B)Debt is serviced through local operations.

C)There is an active and primarily local market.

D)Sale prices are influenced by international factors.

A)Intercompany transaction volume is low.

B)Debt is serviced through local operations.

C)There is an active and primarily local market.

D)Sale prices are influenced by international factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

15

The translation (re-measurere-measurement) adjustment reported in a translation when the functional currency is not the foreign currency is included

A)as a separate component of other comprehensive income

B)in the current liability section of the balance sheet as deferred revenue

C)in the calculation of net income

D)none of the above

A)as a separate component of other comprehensive income

B)in the current liability section of the balance sheet as deferred revenue

C)in the calculation of net income

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

16

If the translation process is sound, it should:

A)provide information that is compatible with the expected economic effects of rate changes.

B)reflect in the financial statements the financial results of the company in conformity to the accounting principles of the country in which the subsidiary is located.

C)result in translation adjustments that are relatively consistent in amount.

D)None of the above is correct.

A)provide information that is compatible with the expected economic effects of rate changes.

B)reflect in the financial statements the financial results of the company in conformity to the accounting principles of the country in which the subsidiary is located.

C)result in translation adjustments that are relatively consistent in amount.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

17

When preparing a foreign affiliate's financial statements for consolidation, the first step is to:

A)review the regulations of the country in which the affiliate is located to determine if consolidation is legal.

B)adjust the financial statements to conform to generally accepted accounting principles.

C)determine the affiliate's functional currency.

D)translate the financial statements into the parent's currency.

A)review the regulations of the country in which the affiliate is located to determine if consolidation is legal.

B)adjust the financial statements to conform to generally accepted accounting principles.

C)determine the affiliate's functional currency.

D)translate the financial statements into the parent's currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following correctly addresses how international accounting standards differ from U.S.GAAP as they pertain to translation of foreign financial statements using the current or functional method?

A)The difference resulting from translation is recognized in income rather than other comprehensive income.

B)The methodology varies in that historical rates are used for certain nonmonetary assets.

C)The difference resulting from translation may be recognized in income for reasons besides the parent's disposal of the foreign entity.

D)There are no differences.

A)The difference resulting from translation is recognized in income rather than other comprehensive income.

B)The methodology varies in that historical rates are used for certain nonmonetary assets.

C)The difference resulting from translation may be recognized in income for reasons besides the parent's disposal of the foreign entity.

D)There are no differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

19

When the functional currency is the foreign entity's currency:

A)exchange rate changes do not affect the economic well-being of the parent

B)the subsidiary operates as an entity, independent of the parent

C)exchange rate changes do not have immediate impact on the cash flows of the parent

D)All of the above are correct

A)exchange rate changes do not affect the economic well-being of the parent

B)the subsidiary operates as an entity, independent of the parent

C)exchange rate changes do not have immediate impact on the cash flows of the parent

D)All of the above are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

20

A foreign subsidiary of Dallas Jeans Corp.(a U.S.firm) has certain balance sheet accounts on December 31, 2019.The functional currency and currency of record is the peso and the parent's books are kept in U.S.dollars.Information relating to these accounts in U.S.dollars is as follows: ?

What amount should be included as total assets on Dallas Jean's balance sheet on December 31, 2019 as the result of the above information?

A)$645,000

B)$765,000

C)$770,000

D)$785,000

What amount should be included as total assets on Dallas Jean's balance sheet on December 31, 2019 as the result of the above information?

A)$645,000

B)$765,000

C)$770,000

D)$785,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

21

Assuming that a foreign entity is deemed to be operating in an environment dominated by the local currency, the entity's capital stock is translated using

A)the current rate.

B)a simple average rate.

C)a weighted average rate.

D)a historical rate.

A)the current rate.

B)a simple average rate.

C)a weighted average rate.

D)a historical rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

22

Consider the consolidation process for a foreign subsidiary: When the excess of cost over book value is attributable to identifiable assets, those assets are adjusted in the "distribution" elimination entry by an amount that is calculated as

A)the difference between cost and fair value as measured in the foreign currency

B)the difference between cost and fair value as measured in the foreign currency multiplied by the historical exchange rate

C)the difference between cost and fair value as measured in the foreign currency multiplied by the weighted-average exchange rate

D)the difference between cost and fair value as measured in the foreign currency multiplied by the current exchange rate

A)the difference between cost and fair value as measured in the foreign currency

B)the difference between cost and fair value as measured in the foreign currency multiplied by the historical exchange rate

C)the difference between cost and fair value as measured in the foreign currency multiplied by the weighted-average exchange rate

D)the difference between cost and fair value as measured in the foreign currency multiplied by the current exchange rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is true concerning the accounting for a foreign investment under the cost method?

A)Investment income is translated at the exchange rate on the dividend declaration date.

B)Investment income is translated using the average exchange rate for the year.

C)Investment income is based on the investee's net income adjusted for the excess of purchase price over book value.

D)Investment income is based on the investee's net income without adjusting for the excess of purchase price over book value.

A)Investment income is translated at the exchange rate on the dividend declaration date.

B)Investment income is translated using the average exchange rate for the year.

C)Investment income is based on the investee's net income adjusted for the excess of purchase price over book value.

D)Investment income is based on the investee's net income without adjusting for the excess of purchase price over book value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

24

A debit balance in a parent's cumulative translation adjustment after the first year of owning a foreign subsidiary suggests which of the following is true?

A)The exchange rate has strengthened relative to the U.S.dollar.

B)The exchange rate has weakened relative to the U.S.dollar.

C)The foreign entity had net income but there was not a change in exchange rates.

D)The foreign entity had a net loss but there was not a change in exchange rates.

A)The exchange rate has strengthened relative to the U.S.dollar.

B)The exchange rate has weakened relative to the U.S.dollar.

C)The foreign entity had net income but there was not a change in exchange rates.

D)The foreign entity had a net loss but there was not a change in exchange rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

25

A U.S.parent purchased a foreign subsidiary last year at a price in excess of the subsidiary's book value.The subsidiary's functional currency is the foreign currency.This excess is assumed to be traceable to undervalued equipment.When the parent company prepares its elimination entries for the excess, which of the following combinations of exchange rates should be used? ?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

26

If a US.parent loans funds on a long-term basis to a subsidiary denominated in the subsidiary's foreign currency, the effect of rate changes on the loan:

A)are considered foreign currency transaction gains and losses and are included in income.

B)are first offset against other comprehensive income resulting from translation of the foreign entity's financial statements with any excess being included in income.

C)are included in other comprehensive income because the loan is considered a long-term investment transaction.

D)are first offset against any foreign currency transaction gains or losses resulting from other intercompany transactions, with any excess being included in other comprehensive income.

A)are considered foreign currency transaction gains and losses and are included in income.

B)are first offset against other comprehensive income resulting from translation of the foreign entity's financial statements with any excess being included in income.

C)are included in other comprehensive income because the loan is considered a long-term investment transaction.

D)are first offset against any foreign currency transaction gains or losses resulting from other intercompany transactions, with any excess being included in other comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following foreign currency transactions would be included in the equity section of a U.S.firm along with the cumulative translation adjustments?

A)Those used to hedge a net investment in a foreign entity

B)Those used to speculate in foreign exchange rates

C)Those used to hedge an exposed asset or liability position

D)Those used to hedge a future foreign currency commitment

A)Those used to hedge a net investment in a foreign entity

B)Those used to speculate in foreign exchange rates

C)Those used to hedge an exposed asset or liability position

D)Those used to hedge a future foreign currency commitment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

28

The reconciliation of the annual translation adjustment usually includes all of the following, except:

A)net assets at the beginning of the period multiplied by the change in exchange rates during the period.

B)change in net assets (excluding capital transactions) multiplied by the difference between the current rate and the average rate used to translate income.

C)change in net assets (excluding capital transactions) multiplied by the difference between the historical rate and the average rate used to translate income.

D)change in net assets due to capital transactions multiplied by the difference between the current rate and the rate at the time of the capital transaction.

A)net assets at the beginning of the period multiplied by the change in exchange rates during the period.

B)change in net assets (excluding capital transactions) multiplied by the difference between the current rate and the average rate used to translate income.

C)change in net assets (excluding capital transactions) multiplied by the difference between the historical rate and the average rate used to translate income.

D)change in net assets due to capital transactions multiplied by the difference between the current rate and the rate at the time of the capital transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

29

When Palm, Inc.acquired its 100% investment in Star Co, a foreign entity, the excess of cost over book value was 10,000FC.This excess was traceable to a 10-year patent.The elimination entry to amortize the excess will include a(n)

A)debit to amortization expense for 1,000FC multiplied by the current exchange rate

B)debit to amortization expense for 1,000FC multiplied by the weighted-average exchange rate

C)credit to Patent for 1,000FC multiplied by the historical exchange rate

D)credit to Cumulative Translation Adjustment for 1,000FC multiplied by the difference between the historical and weighted-average exchange rate

A)debit to amortization expense for 1,000FC multiplied by the current exchange rate

B)debit to amortization expense for 1,000FC multiplied by the weighted-average exchange rate

C)credit to Patent for 1,000FC multiplied by the historical exchange rate

D)credit to Cumulative Translation Adjustment for 1,000FC multiplied by the difference between the historical and weighted-average exchange rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is not considered when directly computing the translation adjustment for foreign financial statements?

A)Beginning amount of net assets held by the domestic investor

B)Increase or decrease in net assets for the period excluding capital transactions

C)Increase or decrease in net asset as a result of capital transactions

D)All are considered when directly computing the translation adjustment

A)Beginning amount of net assets held by the domestic investor

B)Increase or decrease in net assets for the period excluding capital transactions

C)Increase or decrease in net asset as a result of capital transactions

D)All are considered when directly computing the translation adjustment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

31

Merritt Company prepares consolidated financial statements with its wholly-owned subsidiary, Simon Ltd.Simon's functional currency is the British pound.At the end of the fiscal year, Simon has GBP 50,000 of inventory on hand that it purchased from Merritt when the exchange rate was $1.60 to 1 GBP.Merritt's standard gross profit percentage is 40%.The current rate at December 31 was $1.55 to 1 GBP and the average rate for the year was $1.58 to 1 GBP.

The amount of intercompany profit that should be eliminated from inventory is:

A)$32,000

B)$31,000

C)$31,600

D)$30,000

The amount of intercompany profit that should be eliminated from inventory is:

A)$32,000

B)$31,000

C)$31,600

D)$30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

32

Robbins Corporation has a wholly-owned foreign subsidiary, Bertke, Ltd.Bertke's functional currency is the currency of the country in which it is located.Information extracted from Bertke's financial statements follow: ?

Robbins increased its investment in Bertke on March 31, 2017.Exchange rate information for the period follows:

The amount of the translation adjustment is:

A)$108,400

B)$109,600

C)$99,000

D)$108,800

Robbins increased its investment in Bertke on March 31, 2017.Exchange rate information for the period follows:

The amount of the translation adjustment is:

A)$108,400

B)$109,600

C)$99,000

D)$108,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

33

Kidney Company has a wholly-owned foreign subsidiary which has a $15,000 credit translation adjustment in the current year.Kidney has taken out a loan denominated in the foreign currency in which the subsidiary operates as a hedge of its net investment in the foreign entity.The value of the loan increased $18,000 in the current year.What is the impact of the change in the loan value?

A)Debit other comprehensive income $18,000.

B)Credit other comprehensive income $18,000.

C)Debit other comprehensive income $15,000; debit income $3,000.

D)Debit other comprehensive income $3,000; credit income $15,000.

A)Debit other comprehensive income $18,000.

B)Credit other comprehensive income $18,000.

C)Debit other comprehensive income $15,000; debit income $3,000.

D)Debit other comprehensive income $3,000; credit income $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

34

The eliminations and adjustment entries necessary to consolidate the parent and subsidiary financial statements are translated as follows:

A)all balances, profits, and losses at the current exchange rate on the consolidation date

B)intercompany balances translate at the rates used for other accounts, profits and losses may be translated at an average rate

C)intercompany balances translate at the current rates, profits and losses translate at an average rate

D)none of the above are correct

A)all balances, profits, and losses at the current exchange rate on the consolidation date

B)intercompany balances translate at the rates used for other accounts, profits and losses may be translated at an average rate

C)intercompany balances translate at the current rates, profits and losses translate at an average rate

D)none of the above are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

35

As part of the consolidation process for a partially-held foreign subsidiary, the elimination entry to distribute the excess of cost over book value will include a credit to Cumulative Translation Adjustment-Parent

A)for the amount of excess attributable to identifiable net assets multiplied by the difference between historical and current exchange rates

B)for the amount of excess attributable to identifiable net assets multiplied by the difference between average and current exchange rates

C)for the Parent's portion of the excess attributable to identifiable net assets multiplied by the difference between historical and current exchange rates

D)for the Parent's portion of the excess attributable to identifiable net assets multiplied by the difference between average and current exchange rates

A)for the amount of excess attributable to identifiable net assets multiplied by the difference between historical and current exchange rates

B)for the amount of excess attributable to identifiable net assets multiplied by the difference between average and current exchange rates

C)for the Parent's portion of the excess attributable to identifiable net assets multiplied by the difference between historical and current exchange rates

D)for the Parent's portion of the excess attributable to identifiable net assets multiplied by the difference between average and current exchange rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

36

When Palm, Inc.acquired its 100% investment in Star Co, a foreign entity, the excess of cost over book value was 10,000FC.This excess was traceable to a 10-year patent.The elimination entry to distribute the excess will include a(n)

A)debit to Patent for 10,000FC multiplied by the current exchange rate

B)debit to Patent for 10,000FC multiplied by the historical exchange rate

C)credit to Investment in Star for 10,000FC multiplied by the average exchange rate

D)credit to Cumulative Translation Adjustment for 10,000FC multiplied by the historical exchange rate

A)debit to Patent for 10,000FC multiplied by the current exchange rate

B)debit to Patent for 10,000FC multiplied by the historical exchange rate

C)credit to Investment in Star for 10,000FC multiplied by the average exchange rate

D)credit to Cumulative Translation Adjustment for 10,000FC multiplied by the historical exchange rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

37

When an U.S.investor entity acquires interest in a foreign entity with the payment of foreign currency, the determination of excess is calculated

A)in dollars

B)in the foreign currency

C)in dollars if re-measurere-measurement (historical rate/temporal method) is indicated

D)in the foreign currency if translation (current rate/functional method) is indicated

A)in dollars

B)in the foreign currency

C)in dollars if re-measurere-measurement (historical rate/temporal method) is indicated

D)in the foreign currency if translation (current rate/functional method) is indicated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

38

Sharp Company owns a Japanese subsidiary, whose functional currency is the yen.On October 15, 2018, when the rate of exchange was 121 yen to $1, the Japanese subsidiary declared and paid a dividend to Sharp of 24,000,000 yen.The dividend represented the net income of the foreign subsidiary for the six months ended June 30, 2018, during which time the weighted average of exchange rates was 125 yen to $1.The rate of exchange in effect at December 31, 2018, was 135 yen to $1.What rate of exchange should be used to translate the dividend for the December 31, 2018 financial statements?

A)121 yen to $1

B)125 yen to $1

C)135 yen to $1

D)128 yen to $1

A)121 yen to $1

B)125 yen to $1

C)135 yen to $1

D)128 yen to $1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

39

If the functional currency is determined to not be the foreign entity's local currency, translation is done using

A)the current rate method

B)the functional method

C)the re-measurere-measurement method

D)the derivative method

A)the current rate method

B)the functional method

C)the re-measurere-measurement method

D)the derivative method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

40

Exchange gains and losses resulting from translating (not re-measuring) foreign currency financial statements into U.S.dollars should be included as a(an)

A)a component of other comprehensive income.

B)extraordinary item in the income statement for the period in which the rate changes.

C)ordinary gain/loss item in the income statement.

D)component of operating income.

A)a component of other comprehensive income.

B)extraordinary item in the income statement for the period in which the rate changes.

C)ordinary gain/loss item in the income statement.

D)component of operating income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

41

A U.S.firm purchased 100% of a foreign firm on January 1, 2016, when the foreign firm had the following equity accounts:

?

?

The U.S.firm paid 420,000 FCs for the foreign firm.The payment in excess of book value is traceable to undervalued land owned by the foreign firm.The foreign firm had a net income of 25,000 FCs during 2016.Assume that the following exchange rates are relevant:

?

?

Required:

?

Prepare all the journal entries to record and update the investment account of the U.S.firm and the necessary eliminating and adjusting entries for the 2016 consolidated statement.Assume that the U.S.firm used the simple equity method.

?

?

The U.S.firm paid 420,000 FCs for the foreign firm.The payment in excess of book value is traceable to undervalued land owned by the foreign firm.The foreign firm had a net income of 25,000 FCs during 2016.Assume that the following exchange rates are relevant:

?

?

Required:

?

Prepare all the journal entries to record and update the investment account of the U.S.firm and the necessary eliminating and adjusting entries for the 2016 consolidated statement.Assume that the U.S.firm used the simple equity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

42

Patents are on the books of a British subsidiary of a U.S.firm at a value of 50,000 pounds.The patents were acquired in 2016 when the exchange rate was 1 pound = $1.50.The British subsidiary was acquired by the U.S.firm in 20X0 when the exchange rate was 1 pound = $1.40.The exchange rate on December 31, 2017, the date of the most current balance sheet, is 1 pound = $1.55.The average rate of exchange for 2017 is $1.53.Assuming the dollar is the functional currency of the subsidiary, what exchange rate will be used to re-measure patents for the consolidated statements dated December 31, 2017?

A)$1.40

B)$1.50

C)$1.53

D)$1.55

A)$1.40

B)$1.50

C)$1.53

D)$1.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

43

Abercrombe Co., a U.S.firm, formed a German company in 2017 by purchasing the common stock of the newly formed Dolce Inc.The functional currency of Dolce is the euro.During their first three years, Dolce experienced the following activity in retained earnings:

?

?

The following exchange rates could be relevant:

?

Required:

?

What is the translated December 31, 2019, balance of the retained earnings for Dolce?

?

?

The following exchange rates could be relevant:

?

Required:

?

What is the translated December 31, 2019, balance of the retained earnings for Dolce?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following best describes the measurement of a gain or loss from the sale of a depreciable asset by a foreign subsidiary whose functional currency is not the local currency?

A)Reconstruct the journal entry on the date of the sale using the historical rate for cash and the depreciable asset and its accumulated depreciation.

B)Reconstruct the journal entry on the date of the sale using the current rate for cash and the historical rate for the depreciable asset and its accumulated depreciation.

C)Translate the gain or loss using the historical rate.

D)Translate gains at the current rate and losses at the historical rate.

A)Reconstruct the journal entry on the date of the sale using the historical rate for cash and the depreciable asset and its accumulated depreciation.

B)Reconstruct the journal entry on the date of the sale using the current rate for cash and the historical rate for the depreciable asset and its accumulated depreciation.

C)Translate the gain or loss using the historical rate.

D)Translate gains at the current rate and losses at the historical rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

45

In most cases, which of the following is not a component of translated retained earnings?

A)Translated retained earnings at the end of the prior period

B)Income from the period translated at the historical rate

C)The value of dividends translated at the exchange rate on the date of declaration

D)All are components of translated retained earnings

A)Translated retained earnings at the end of the prior period

B)Income from the period translated at the historical rate

C)The value of dividends translated at the exchange rate on the date of declaration

D)All are components of translated retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

46

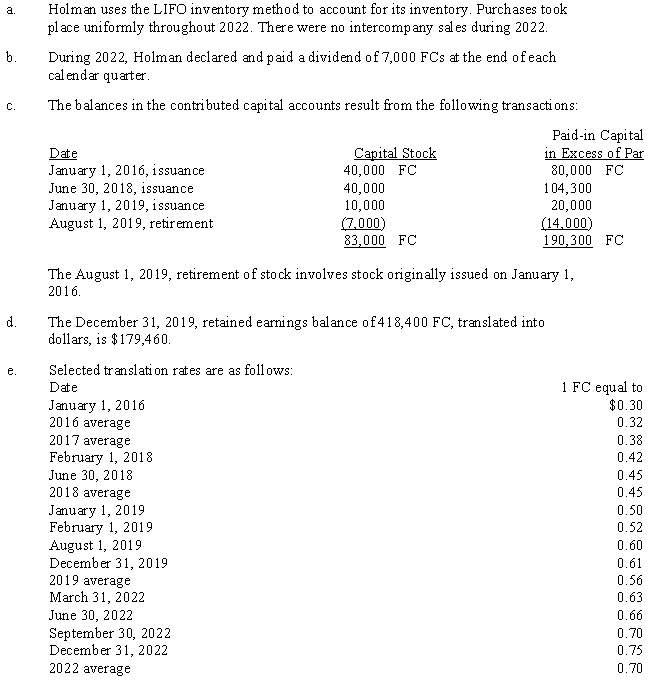

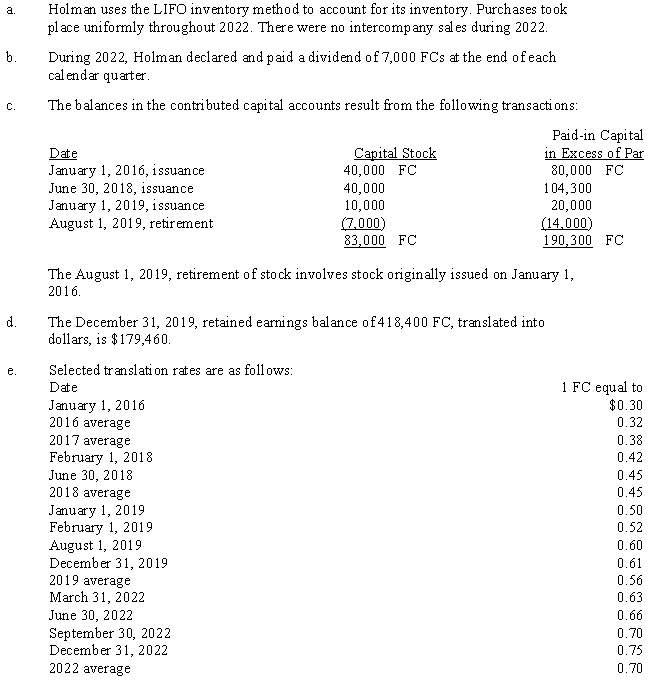

In January, 2016, Dudwil Corporation acquired a foreign subsidiary, Holman Company, by paying cash for all of the outstanding common stock of Holman.On the purchase date, Holman Company's accounts were stated fairly in local currency units (FC).Subsequent sales of Holman's common stock have been purchased by Dudwil to maintain its 100% ownership.

?

Holman's trial balance, in functional currency units (same as the local currency units), on December 31, 2022, follows:

?

?

The following additional information is available:

?

?

Required:

Required:

?

Prepare a schedule to translate the December 31, 2022, trial balance of Holman Company from local currency units to dollars.The schedule should show the trial balance in FCs, the exchange rates, and the trial balance.(Do not extend the trial balance to statement columns.Supporting schedules should be in good form.)

?

Holman's trial balance, in functional currency units (same as the local currency units), on December 31, 2022, follows:

?

?

The following additional information is available:

?

?

Required:

Required:?

Prepare a schedule to translate the December 31, 2022, trial balance of Holman Company from local currency units to dollars.The schedule should show the trial balance in FCs, the exchange rates, and the trial balance.(Do not extend the trial balance to statement columns.Supporting schedules should be in good form.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

47

The adjustment resulting from the re-measurere-measurement of an entity operating in a highly inflationary environment would appear

A)in the stockholders' equity section of the balance sheet.

B)as a component of other comprehensive income.

C)as an ordinary income statement item.

D)as an extraordinary item on the income statement.

A)in the stockholders' equity section of the balance sheet.

B)as a component of other comprehensive income.

C)as an ordinary income statement item.

D)as an extraordinary item on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

48

CableTech, a US corporation, owns 100% of the Canadian company, Fiber Quebec.The Canadian dollar is the currency of record and the functional currency.

?

Required:

?

What currency exchange rate would be used to translate Fiber Quebec's accounts into US Dollars? Choose from current, simple average, weighted average, or historical.

?

a.Prepaid Insurance

b.Land

c.Common Stock

d.Bonds Payable

e.Sales

f.Goodwill

g.Allowance for Doubtful Accounts

h.Deferred Income Taxes

?

Required:

?

What currency exchange rate would be used to translate Fiber Quebec's accounts into US Dollars? Choose from current, simple average, weighted average, or historical.

?

a.Prepaid Insurance

b.Land

c.Common Stock

d.Bonds Payable

e.Sales

f.Goodwill

g.Allowance for Doubtful Accounts

h.Deferred Income Taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

49

A U.S.-owned foreign subsidiary has the following beginning and ending stockholders' equity for 2016:

?

?

The change in common stock resulted from a sale of stock to the parent firm on May 15.The change in retained earnings resulted from a July 1 dividend of 10,000 FC and net income for 2016.Various exchange rates were as follows:

?

?

Required:

?

Compute the 2016 translation adjustment for the foreign subsidiary.

?

?

The change in common stock resulted from a sale of stock to the parent firm on May 15.The change in retained earnings resulted from a July 1 dividend of 10,000 FC and net income for 2016.Various exchange rates were as follows:

?

?

Required:

?

Compute the 2016 translation adjustment for the foreign subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following procedures would be necessary when a Swiss subsidiary maintains its books in euros and its functional currency is Japanese Yen and its parent is a U.S.company?

A)Re-measureRe-measurement from euros to U.S.Dollars

B)Re-measureRe-measurement from euros to Japanese Yen; translate from Yen to U.S.Dollars

C)Re-measureRe-measurement from Yen to euros; translate from euros to U.S.Dollars

D)none of the above

A)Re-measureRe-measurement from euros to U.S.Dollars

B)Re-measureRe-measurement from euros to Japanese Yen; translate from Yen to U.S.Dollars

C)Re-measureRe-measurement from Yen to euros; translate from euros to U.S.Dollars

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

51

Rhante is a German company wholly owned by a U.S.firm.Its inventory is valued at the lower of cost or market, with cost being measured by the average cost method.Purchases of inventory occur evenly throughout the period.In 2005 Rhante's ending inventory was 50,000 euros at cost and 48,000 euros at market.Assume the following exchange rates: ?

Determine the re-measurere-measured value of Rhante's inventory to be included in the consolidated balance sheet for the U.S.parent given Rhante's functional currency is the U.S.dollar.

A)$72,500

B)$73,440

C)$69,600

D)$76,500

Determine the re-measurere-measured value of Rhante's inventory to be included in the consolidated balance sheet for the U.S.parent given Rhante's functional currency is the U.S.dollar.

A)$72,500

B)$73,440

C)$69,600

D)$76,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

52

In a company's disclosure of foreign currency transactions and hedges and translation adjustments, all of the following items should be disclosed except:

A)beginning and ending cumulative translation adjustments.

B)the amount of income taxes for the period allocated to translation adjustments.

C)the amount transferred from cumulative translation adjustment due to changes in foreign exchange rates.

D)the aggregate adjustment for the period resulting from translation adjustment.

A)beginning and ending cumulative translation adjustments.

B)the amount of income taxes for the period allocated to translation adjustments.

C)the amount transferred from cumulative translation adjustment due to changes in foreign exchange rates.

D)the aggregate adjustment for the period resulting from translation adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

53

Sharp Company owns a Japanese subsidiary, whose functional currency is the U.S.dollar.On October 15, 2018, when the rate of exchange was 121 yen to $1, the Japanese subsidiary declared and paid a dividend to Sharp of 24,000,000 yen.The dividend represented the net income of the foreign subsidiary for the six months ended June 30, 2018, during which time the weighted average of exchange rates was 125 yen to $1.The rate of exchange in effect at December 31, 2018, was 135 yen to $1.What rate of exchange should be used to translate the dividend for the December 31, 2018 financial statements?

A)121 yen to $1

B)125 yen to $1

C)135 yen to $1

D)128 yen to $1

A)121 yen to $1

B)125 yen to $1

C)135 yen to $1

D)128 yen to $1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

54

Assuming that the functional currency of a foreign subsidiary is not the local currency, which of the following accounts would be re-measured at the historical rate?

A)Long-term notes payable

B)Accounts Payable

C)Land

D)Sales Revenue

A)Long-term notes payable

B)Accounts Payable

C)Land

D)Sales Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

55

A foreign subsidiary of Dallas Jeans Corp.(a U.S.firm) has certain balance sheet accounts on December 31, 2019.The functional currency is the U.S.dollar and currency of record is the peso and the parent's books are kept in U.S.dollars.Information relating to these accounts in U.S.dollars is as follows: ?

What amount should be included as total assets on Dallas Jean's balance sheet on December 31, 2019 as the result of the above information?

A)$645,000

B)$765,000

C)$770,000

D)$785,000

What amount should be included as total assets on Dallas Jean's balance sheet on December 31, 2019 as the result of the above information?

A)$645,000

B)$765,000

C)$770,000

D)$785,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

56

Green Corporation, a wholly owned British subsidiary of a U.S.firm began the year with 1,300,000 British pounds in net assets.The subsidiary incurred a 65,000 British pound net loss for 2016.The subsidiary issued common stock for 100,000 British pounds on November 15, 2016.Assume the following exchange rates for 2016:

?

?

Required:

?

Compute the translation adjustment for 2016 using the direct method.

?

?

Required:

?

Compute the translation adjustment for 2016 using the direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

57

FASB standards require which of the following disclosures from firms involved in foreign currency transactions?

A)Beginning cumulative translation adjustments.

B)Ending cumulative translation adjustments.

C)The amount of income taxes for the period allocated to translation adjustments.

D)All are required disclosures.

A)Beginning cumulative translation adjustments.

B)Ending cumulative translation adjustments.

C)The amount of income taxes for the period allocated to translation adjustments.

D)All are required disclosures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

58

Patents are on the books of a British subsidiary of a U.S.firm at a value of 50,000 pounds.The patents were acquired in 20X0 when the exchange rate was 1 pound = $1.50.The British subsidiary was acquired by the U.S.firm in 2016 when the exchange rate was 1 pound = $1.40.The exchange rate on December 31, 2017, the date of the most current balance sheet, is 1 pound = $1.55.The average rate of exchange for 2017 is $1.53.Assuming the dollar is the functional currency of the subsidiary, what exchange rate will be used to re-measure patents for the consolidated statements dated December 31, 2017?

A)$1.40

B)$1.50

C)$1.53

D)$1.55

A)$1.40

B)$1.50

C)$1.53

D)$1.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following best describes the accounting for a foreign entity requiring translation or re-measurere-measurement if the local economy is classified as highly inflationary?

A)The entity's financial statements are first adjusted for inflation and then translated into the domestic currency.

B)The entity's financial statements are first adjusted for inflation and then re-measurere-measured into the domestic currency.

C)The unadjusted trial balance is translated if the functional currency is the local currency.

D)The unadjusted trial balance is re-measurere-measured regardless of the functional currency.

A)The entity's financial statements are first adjusted for inflation and then translated into the domestic currency.

B)The entity's financial statements are first adjusted for inflation and then re-measurere-measured into the domestic currency.

C)The unadjusted trial balance is translated if the functional currency is the local currency.

D)The unadjusted trial balance is re-measurere-measured regardless of the functional currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

60

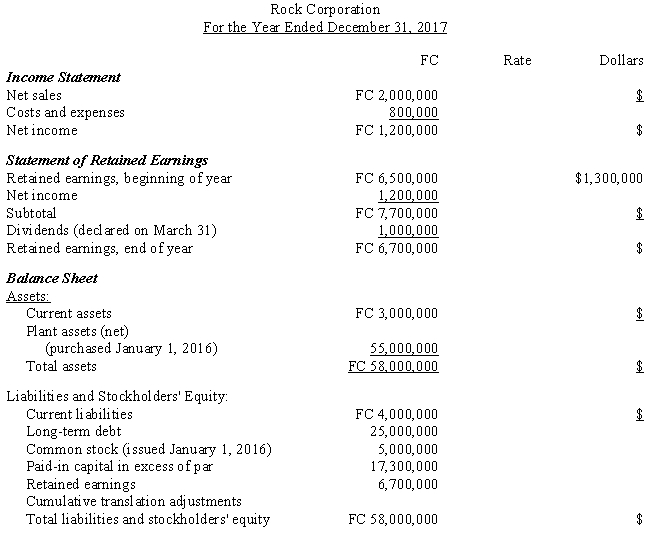

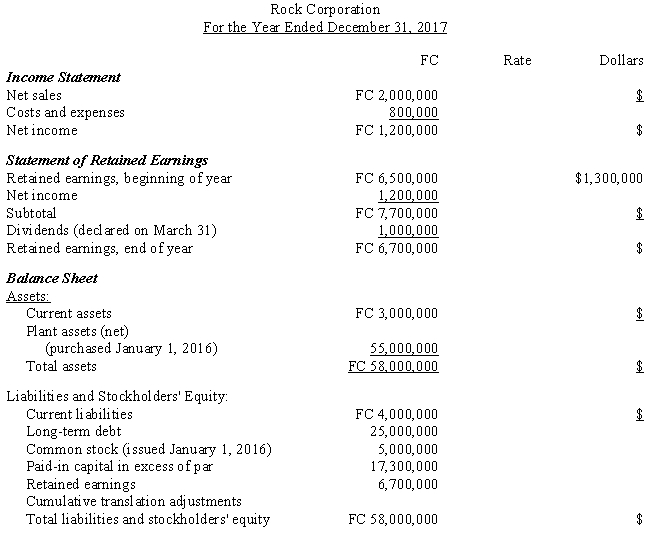

Complete the following worksheet, assuming that on January 1, 2016, Weiss Corporation purchased Rock Corporation.Rock's functional currency is the FC.

?

?

?

?

?

?

?

?

?

?

??

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

61

A foreign subsidiary operates in a highly inflationary economy.The company's December 31, 2017, trial balance includes the following:

?

?

Relevant exchange rates are as follows:

?

?

Required:

?

a.Discuss the criteria that must be satisfied in order to qualify as a highly inflationary economy.?

?

b.Discuss how the re-measurere-measurement of statements of companies operating in such economies affects net income.?

?

c.Calculate the dollar value of the trial balance accounts as of December 31, 2017.?

?

?

?

Relevant exchange rates are as follows:

?

?

Required:

?

a.Discuss the criteria that must be satisfied in order to qualify as a highly inflationary economy.?

?

b.Discuss how the re-measurere-measurement of statements of companies operating in such economies affects net income.?

?

c.Calculate the dollar value of the trial balance accounts as of December 31, 2017.?

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

62

Assume Champ Company will be translating the accounts of its foreign subsidiary, Collier, Ltd.for inclusion in the consolidated financial statements.

?

1) What are the steps to be taken?

?

2) Assuming the functional currency is the currency of the country in which Collier is located, what rates should be used/

?

3) Where should the adjustment, resulting from the translation process, be recognized?

?

1) What are the steps to be taken?

?

2) Assuming the functional currency is the currency of the country in which Collier is located, what rates should be used/

?

3) Where should the adjustment, resulting from the translation process, be recognized?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

63

A French subsidiary of a U.S.firm keeps accounting records in euros.The U.S.dollar is considered the subsidiary's functional currency.Assume the following exchange rates:

?

?

Required:

?

Re-measure the following items from the December 31, 2019 trial balance of the subsidiary:

?

a.Sales made evenly throughout 2019 = 100,000 euros

?

?

?

?

b.Cost of goods sold = 30,000 euros

?

?

?

5,000 euros purchased July 1, 2018

?

?

25,000 euros purchased July 1, 2019

?

?

?

c.Salary expense for 2019 = 40,000 euros

?

?

?

?

d.Land = 1,000,000 euros

?

?

?

200,000 euros purchased January 1, 2018

?

?

800,000 euros purchased July 1, 2019

?

?

Required:

?

Re-measure the following items from the December 31, 2019 trial balance of the subsidiary:

?

a.Sales made evenly throughout 2019 = 100,000 euros

?

?

?

?

b.Cost of goods sold = 30,000 euros

?

?

?

5,000 euros purchased July 1, 2018

?

?

25,000 euros purchased July 1, 2019

?

?

?

c.Salary expense for 2019 = 40,000 euros

?

?

?

?

d.Land = 1,000,000 euros

?

?

?

200,000 euros purchased January 1, 2018

?

?

800,000 euros purchased July 1, 2019

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

64

A Kuwaiti subsidiary of Hiawatha Corp.(a U.S.firm) has certain balance sheet accounts on December 31, 2017.The functional currency is the U.S.dollar and currency of record is the dinar and the parent's books are kept in U.S.dollars.

?

Information relating to these account in U.S.dollars is as follows:

?

?

Required:

?

From the above information, prepare the asset portion of the subsidiary's trial balance.

?

?

Information relating to these account in U.S.dollars is as follows:

?

?

Required:

?

From the above information, prepare the asset portion of the subsidiary's trial balance.

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

65

Discuss the factors that may be considered in determining if a Mexican subsidiary of a U.S.firm has the peso or the dollar as its functional currency.The subsidiary only manufactures component parts that are shipped to the U.S.firm's final production plant in Detroit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

66

An American firm owns 100% of a German firm that had the following transactions occur relative to their equipment account:

?

?

The following exchange rates could be relevant:

?

?

Required:

?

Assuming that the U.S.dollar is the functional currency and that the German firm uses straight-line depreciation over a 5-year period with a 10% salvage value, determine the following for re-measurere-measurement purposes:

?

a.The value of the equipment account on December 31, 2019.?

?

b.The value of the depreciation expense for 2019.?

?

c.The amount of the gain or loss resulting from the July 1, 2019, sale.

?

?

The following exchange rates could be relevant:

?

?

Required:

?

Assuming that the U.S.dollar is the functional currency and that the German firm uses straight-line depreciation over a 5-year period with a 10% salvage value, determine the following for re-measurere-measurement purposes:

?

a.The value of the equipment account on December 31, 2019.?

?

b.The value of the depreciation expense for 2019.?

?

c.The amount of the gain or loss resulting from the July 1, 2019, sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

67

On January 1, 2017, U.S.A.Inc.created an Algerian subsidiary, Niko, Inc.The books are kept in Algerian dinars, but the functional currency is the U.S.dollar.Dividends are paid on December 31, and income is earned evenly throughout the year.The earnings and dividends of Niko in dinars are as follows:

?

?

Exchange rates are given below.

?

?

Required:

?

Calculate the balance in retained earnings for Niko in dollars as of December 31, 2017.

?

?

Exchange rates are given below.

?

?

Required:

?

Calculate the balance in retained earnings for Niko in dollars as of December 31, 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

68

Company A, an American company, owns Company B, a Canadian subsidiary.Company A borrowed 1,000,000 Canadian dollars as a hedge on its net investment in Company B.For 2016, Company A recorded an exchange gain of $40,000 due to exchange rate changes.The 2016 translation adjustment for Company B was a debit of $42,000.

Required:

Describe the accounting treatment required for the hedge on Company A's books.

Required:

Describe the accounting treatment required for the hedge on Company A's books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

69

Assume a foreign subsidiary is formed on January 1, Year 1 when the rate of exchange is 1 foreign currency (FC) = $1.00.On June 30, Year 1, the rate of exchange was 1 FC = $1.25 and on December 31, the rate of exchange was 1 FC = $1.35.The first year resulted in the following transactions:

January 1: The foreign subsidiary received $500,000 equity investment in dollars from the parent company in exchange for common stock.

January 1: The foreign subsidiary purchased machinery for $300,000 and inventory $200,000 for cash.

June 30: The foreign subsidiary sold 50% of the inventory on account for $150,000.

December 31: The receivable from the sale of inventory was fully collected.

Instructions: Make the necessary journal entries to record for the U.S.parent company in U.S.dollars.

January 1: The foreign subsidiary received $500,000 equity investment in dollars from the parent company in exchange for common stock.

January 1: The foreign subsidiary purchased machinery for $300,000 and inventory $200,000 for cash.

June 30: The foreign subsidiary sold 50% of the inventory on account for $150,000.

December 31: The receivable from the sale of inventory was fully collected.

Instructions: Make the necessary journal entries to record for the U.S.parent company in U.S.dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

70

For each of the following account balances, identify the exchange rate used to translate or re-measure.The choices are current exchange rate, historical rate, weighted average, other (specify).

?

?

?

?

?

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

71

Assume a foreign subsidiary is formed on January 1, Year 1 when the rate of exchange is 1 foreign currency (FC) = $1.00.On June 30, Year 1, the rate of exchange was 1 FC = $1.25 and on December 31, the rate of exchange was 1 FC = $1.35.The first year resulted in the following transactions:

January 1: The foreign subsidiary received $500,000 equity investment in dollars from the parent company in exchange for common stock.

January 1: The foreign subsidiary purchased machinery for $300,000 and inventory $200,000 for cash.

June 30: The foreign subsidiary sold 50% of the inventory on account for $150,000.

December 31: The receivable from the sale of inventory was fully collected.

Instructions: Make the necessary journal entries to record for the foreign subsidiary as measured in FC.

January 1: The foreign subsidiary received $500,000 equity investment in dollars from the parent company in exchange for common stock.

January 1: The foreign subsidiary purchased machinery for $300,000 and inventory $200,000 for cash.

June 30: The foreign subsidiary sold 50% of the inventory on account for $150,000.

December 31: The receivable from the sale of inventory was fully collected.

Instructions: Make the necessary journal entries to record for the foreign subsidiary as measured in FC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

72

On January 1, 2016, Rapid Corporation purchased 25% of a foreign firm when its stockholders' equity section totaled 240,000 FCs.Rapid Corporation paid 75,000 FCs, with the excess over book value being attributed to equipment with a 5-year useful life.The foreign firm reported net income of 80,000 FCs for 2016.Relevant exchange rates were as follows:

?

?

Required:

?

Prepare the journal entries necessary to record the events concerning Rapid's investment in the foreign firm.

?

?

Required:

?

Prepare the journal entries necessary to record the events concerning Rapid's investment in the foreign firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

73

On January 1, 2023, Cayane Inc.purchased 90% of a German firm, Brosch Manufacturing when Brosch's equity consisted of the following:

?

?

Cayane paid 810,000 euros for its 90% interest in Brosch.The excess over book value was attributed to a building with a 20-year useful life.Brosch reported net income for 2023 of 150,000 euros.The year-end cumulative translation adjustment is $10,000 credit.Relevant exchange rates are as follows:

?

?

Required:

?

Prepare all the journal entries related to Cayane's investment in Brosch and all the necessary eliminating and adjusting entries for consolidation of Brosch, assuming the use of the simple equity method.

?

?

Cayane paid 810,000 euros for its 90% interest in Brosch.The excess over book value was attributed to a building with a 20-year useful life.Brosch reported net income for 2023 of 150,000 euros.The year-end cumulative translation adjustment is $10,000 credit.Relevant exchange rates are as follows:

?

?

Required:

?

Prepare all the journal entries related to Cayane's investment in Brosch and all the necessary eliminating and adjusting entries for consolidation of Brosch, assuming the use of the simple equity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

74

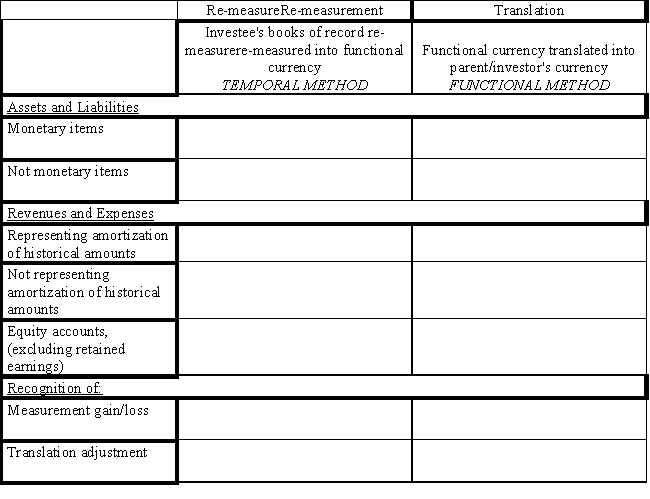

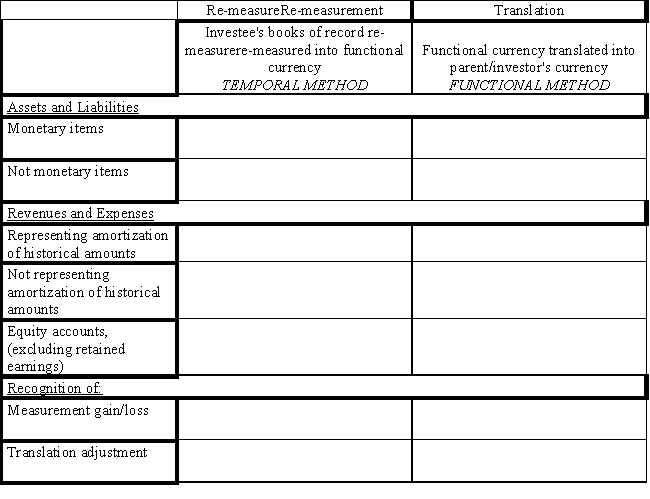

Complete the following table:

?

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

75

Kerry Manufacturing Company is a German subsidiary of a U.S.company.Kerry records its operations and prepares financial statements in euros.However, its functional currency is the British pound.Kerry was organized and acquired by the U.S.company on June 1, 2017.The cumulative translation adjustment as of December 31, 2019, was $79,860.The value of the subsidiary's retained earnings expressed in British pounds and U.S.dollars as of December 31, 2022, was 365,000 pounds and $618,000, respectively.On March 1, 2022, Kerry declared a dividend of 120,000 euros.The trial balance of Kerry in euros as of December 31, 2022, is as follows:

?

?

The marketable securities were acquired on November 1, 2019, and the prepaid insurance was acquired on December 1, 2022.The cost of goods sold and the ending inventory are calculated by the weighted-average method.The underlying costs have been incurred uniformly throughout the year.On June 1, 2017, 60% of the depreciable assets existed, and the balance was acquired on March 1, 2019.The depreciable assets are amortized over a 10-year period by the straight-line method.Of the total depreciation expense, 80% is traceable to the cost of goods sold and the balance is in general expenses.On November 1, 2019, Kerry received a customer prepayment valued at 3,000,000 euros.On February 1, 2022, 2,040,000 euros of the prepayment was earned.The balance remains unearned as of December 31, 2022.

?

Relevant exchange rates are as follows:

?

?

Required:

?

Prepare a re-measurere-measured and translated trial balance of the Kerry Manufacturing Company as of December 31, 2022.Provide supporting schedules.

?

?

The marketable securities were acquired on November 1, 2019, and the prepaid insurance was acquired on December 1, 2022.The cost of goods sold and the ending inventory are calculated by the weighted-average method.The underlying costs have been incurred uniformly throughout the year.On June 1, 2017, 60% of the depreciable assets existed, and the balance was acquired on March 1, 2019.The depreciable assets are amortized over a 10-year period by the straight-line method.Of the total depreciation expense, 80% is traceable to the cost of goods sold and the balance is in general expenses.On November 1, 2019, Kerry received a customer prepayment valued at 3,000,000 euros.On February 1, 2022, 2,040,000 euros of the prepayment was earned.The balance remains unearned as of December 31, 2022.

?

Relevant exchange rates are as follows:

?

?

Required:

?

Prepare a re-measurere-measured and translated trial balance of the Kerry Manufacturing Company as of December 31, 2022.Provide supporting schedules.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

76

List the two primary objectives of translating foreign financial statements according to the FASB #52, which emphasizes the concept of the functional currency.?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

77

Foreign firms operating in highly inflationary economies received special treatment under generally accepted accounting principles (GAAP) relative to translating their financial statements.

?

Required:

?

a.How does the FASB define a highly inflationary economy?

?

?

b.Why is the method typically used for translating foreign entities not permitted for these firms?

?

?

c.What method is used for re-measuring or translating the statements of these firms?

?

?

Required:

?

a.How does the FASB define a highly inflationary economy?

?

?

b.Why is the method typically used for translating foreign entities not permitted for these firms?

?

?

c.What method is used for re-measuring or translating the statements of these firms?

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

78

Renta USA, Inc.formed a foreign subsidiary on January 1, 2016; the subsidiary issued 15,000 of its no-par 10FC stock to Renta.The subsidiary's books are kept in their functional currency.Income earned in 2016 and 2017 totaled 100,000 FC and 120,000 FC, respectively.Dividends of 40,000 FC have been paid on December 31 of each year.In addition, 1,000 shares of common stock (no par) were issued on July 1, 2017 for 20 FC each.

?

Exchange rates relating this foreign currency to U.S.dollars are as follows:

?

Required:

?

Calculate the owners' equity of the subsidiary on December 31, 2017.

?

Exchange rates relating this foreign currency to U.S.dollars are as follows:

?

Required:

?

Calculate the owners' equity of the subsidiary on December 31, 2017.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

79

Hylie, a U.S.corporation, owns 100% of Frosan, a French firm.Assume that the dollar is the functional currency, although the books are kept in euros.

?

Required:

?

What currency exchange rate would be used to re-measure Frosan's balance sheet into U.S.dollars? Choose from current, simple average, weighted average, or historical.

?

a.Cash

b.Accounts Receivable

c.Inventory, carried at cost

d.Equipment

e.Accumulated Depreciation

f.Bonds Payable

g.Common Stock

h.Sales

?

Required:

?

What currency exchange rate would be used to re-measure Frosan's balance sheet into U.S.dollars? Choose from current, simple average, weighted average, or historical.

?

a.Cash

b.Accounts Receivable

c.Inventory, carried at cost

d.Equipment

e.Accumulated Depreciation

f.Bonds Payable

g.Common Stock

h.Sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck