Deck 8: Subsidiary Equity Transactions, Indirect Subsidiary Ownership, and Subsidiary Ownership of Parent Shares

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/41

العب

ملء الشاشة (f)

Deck 8: Subsidiary Equity Transactions, Indirect Subsidiary Ownership, and Subsidiary Ownership of Parent Shares

1

Apple Inc.owns a 90% interest in Banana Company.Banana Company, in turn, owns a 80% interest in Carrot Company.During 2019, Carrot Company sold $50,000 of merchandise to Apple Inc.at a gross profit of 20%.Of this merchandise, $10,000 was still unsold by Apple Inc.at year end.The adjustment to the controlling interest in consolidated net income for 2019 is ____.

A)$560

B)$1,440

C)$1,600

D)$1,800

A)$560

B)$1,440

C)$1,600

D)$1,800

B

2

On January 1, 2016, Paris Ltd.paid $600,000 for its 75% interest in the Scott Company when Scott had total equity of $550,000.Any excess of cost over book value was attributed to equipment with a 10-year life.On January 1, 2018, Scott Company had the following stockholders' equity:

On January 2, 2018, Scott Company sold 2,500 additional shares of stock for $60 each in a private offering to non-controlling shareholders.As a result of this sale, which of the following changes would appear in the 2018 consolidated statements?

A)$7,500 loss

B)$37,500 loss

C)$37,500 decrease in controlling paid-in capital

D)$7,500 decrease in controlling paid-in capital

On January 2, 2018, Scott Company sold 2,500 additional shares of stock for $60 each in a private offering to non-controlling shareholders.As a result of this sale, which of the following changes would appear in the 2018 consolidated statements?

A)$7,500 loss

B)$37,500 loss

C)$37,500 decrease in controlling paid-in capital

D)$7,500 decrease in controlling paid-in capital

$37,500 decrease in controlling paid-in capital

3

Company P purchased an 80% interest in the Company S on January 1, 2016, for $600,000.Any excess of cost is attributed to the Company's building with a 20-year life.The equity balances of Company S are as follows: ?

The only change in paid-in capital is a result of a 40% stock dividend paid in 2018.The cost to simple equity conversion to bring the investment account to its December 31, 2019, balance is ____.

A)$30,000

B)$136,000

C)$160,000

D)$256,000

The only change in paid-in capital is a result of a 40% stock dividend paid in 2018.The cost to simple equity conversion to bring the investment account to its December 31, 2019, balance is ____.

A)$30,000

B)$136,000

C)$160,000

D)$256,000

$256,000

4

Pepper Company owned 60,000 of Salt Company's 100,000 outstanding shares.On January 2, 2018, Salt purchased 20,000 of its outstanding shares from the NCI for $70,000.Pepper purchased its shares on January 1, 2016, at which time the fair value of Salt exceeded its book value by $50,000.This difference was due to machinery that was undervalued and had a remaining life of 5 years.On December 31, 2017, Salt Company had the following stockholders' equity:

The amount of the adjustment to Pepper's equity would be a:

A)$15,000 increase

B)$3,000 increase

C)$10,500 increase

D)$15,000 decrease

The amount of the adjustment to Pepper's equity would be a:

A)$15,000 increase

B)$3,000 increase

C)$10,500 increase

D)$15,000 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

5

On January 1, 2016, Paris Ltd.paid $600,000 for its 75% interest in the Scott Company when Scott had total equity of $550,000.Any excess of cost over book value was attributed to equipment with a 10-year life.On January 1, 2018, Scott Company had the following stockholders' equity: ?

On January 2, 2018, Scott Company sold 2,500 additional shares of stock for $90 each in a private offering to non-controlling shareholders.As a result of this sale, which of the following changes would appear in the 2018 consolidated statements?

A)$7,500 gain

B)$37,500 loss

C)$7,500 increase in controlling paid-in capital

D)$37,500 decrease in controlling paid-in capital

On January 2, 2018, Scott Company sold 2,500 additional shares of stock for $90 each in a private offering to non-controlling shareholders.As a result of this sale, which of the following changes would appear in the 2018 consolidated statements?

A)$7,500 gain

B)$37,500 loss

C)$7,500 increase in controlling paid-in capital

D)$37,500 decrease in controlling paid-in capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

6

When the parent purchases some newly issued shares of a subsidiary, any adjustments resulting from the subsidiary stock sales should be made

A)at the end of the current fiscal year when the worksheet is prepared.

B)at the time of the sale when the equity method is used.

C)at the time of the sale if the cost method is used.

D)retroactively to the start of the current fiscal year.

A)at the end of the current fiscal year when the worksheet is prepared.

B)at the time of the sale when the equity method is used.

C)at the time of the sale if the cost method is used.

D)retroactively to the start of the current fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

7

When a parent purchases a portion of the newly issued stock of its subsidiary in a private offering and the ownership interest decreases,

A)any difference between the change in equity and the price paid is the excess of cost or book value attributable to the new block.

B)any difference between the change in equity and the price paid is viewed as a gain or loss on the sale of an interest.

C)any difference between the change in equity and the price paid is viewed as a change in paid-in capital or retained earnings.

D)there will be no adjustment.

A)any difference between the change in equity and the price paid is the excess of cost or book value attributable to the new block.

B)any difference between the change in equity and the price paid is viewed as a gain or loss on the sale of an interest.

C)any difference between the change in equity and the price paid is viewed as a change in paid-in capital or retained earnings.

D)there will be no adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

8

When a parent purchases a portion of the newly issued stock of its subsidiary and the parent's percentage of ownership interest remains the same,

A)any difference between the change in equity and the price paid is the excess of cost or book value attributable to the new block.

B)any difference between the change in equity and the price paid is viewed as a gain or loss on the sale of an interest.

C)any difference between the change in equity and the price paid is viewed as a change in paid-in capital or retained earnings.

D)there will be no adjustment to parent's paid-in capital

A)any difference between the change in equity and the price paid is the excess of cost or book value attributable to the new block.

B)any difference between the change in equity and the price paid is viewed as a gain or loss on the sale of an interest.

C)any difference between the change in equity and the price paid is viewed as a change in paid-in capital or retained earnings.

D)there will be no adjustment to parent's paid-in capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

9

Apple Inc.purchased a 70% interest in the Banana Company for $490,000 on January 1, 2018, when Banana Company had the following stockholders' equity:

At the time of Apple's purchase, Banana Company was an 80% owner of the Carrot Company.Also on that date, Carrot Company has a machine that has a market value in excess of book value of $20,000.There is no difference between book and market value for any Banana Company assets.The goodwill that would result from this purchase is ____.

A)$184,000

B)$180,000

C)$140,000

D)$126,000

At the time of Apple's purchase, Banana Company was an 80% owner of the Carrot Company.Also on that date, Carrot Company has a machine that has a market value in excess of book value of $20,000.There is no difference between book and market value for any Banana Company assets.The goodwill that would result from this purchase is ____.

A)$184,000

B)$180,000

C)$140,000

D)$126,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

10

On January 1, 2016, Paul, Inc.acquired a 90% interest in Stephan Company.The $45,000 excess of purchase price (parent's share only) was attributable to goodwill.On January 1, 2018, Stephan Company had the following stockholders' equity:

On January 2, 2018, Stephan sold 2,000 additional shares in a private offering.Stephan issued the new shares for $70 per share; Paul, Inc.purchased 600 of the shares.As a result of this sale, there is a(n)

A)gain on the consolidated income statement of $5,000.

B)decrease in the controlling interest paid-in excess of $5,000.

C)increase in the controlling interest paid-in capital in excess of par of $5,000

D)increase in the controlling interest Retained Earnings of $5,000

On January 2, 2018, Stephan sold 2,000 additional shares in a private offering.Stephan issued the new shares for $70 per share; Paul, Inc.purchased 600 of the shares.As a result of this sale, there is a(n)

A)gain on the consolidated income statement of $5,000.

B)decrease in the controlling interest paid-in excess of $5,000.

C)increase in the controlling interest paid-in capital in excess of par of $5,000

D)increase in the controlling interest Retained Earnings of $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

11

Pepper Company owned 60,000 of Salt Company's 100,000 outstanding shares.On January 2, 2018, Salt purchased 20,000 of its outstanding shares from the NCI for $70,000.Pepper purchased its shares on January 1, 2016, at which time the fair value of Salt exceeded its book value by $50,000.This difference was due to machinery that was undervalued and had a remaining life of 5 years.On December 31, 2017, Salt Company had the following stockholders' equity: ?

Assuming Pepper uses the equity method to account for its investment in Salt, the adjustment to the Pepper's books would include:

A)a credit to Retained Earnings

B)a credit to Paid-in Capital in Excess of Par

C)a credit to Investment of

D)a debit to Paid-in Capital in Excess of Par

Assuming Pepper uses the equity method to account for its investment in Salt, the adjustment to the Pepper's books would include:

A)a credit to Retained Earnings

B)a credit to Paid-in Capital in Excess of Par

C)a credit to Investment of

D)a debit to Paid-in Capital in Excess of Par

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following situations is viewed as the parent having treasury stock?

A)A owns 80% of B, and B owns 70% of C.

B)A owns 80% of B and 20% of C; B owns 70% of C.

C)A owns 80% of B, and B owns 20% of A.

D)None of the above.

A)A owns 80% of B, and B owns 70% of C.

B)A owns 80% of B and 20% of C; B owns 70% of C.

C)A owns 80% of B, and B owns 20% of A.

D)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

13

Able Company owns an 80% interest in Barns Company and a 20% interest in Carns Company.Barns owns a 40% interest in Carns Company.

A)Carn will not be included in the consolidation process

B)Carn will be included in the consolidation process; 20% of prior period amortizations will be distributed to Retained Earnings-Carns

C)Carn will be included in the consolidation process; 40% of prior period amortizations will be distributed to Retained Earnings-Carns

D)Carn will be included in the consolidation process; NCI will be allocated 6.4% of prior-period profits originated by Carns

A)Carn will not be included in the consolidation process

B)Carn will be included in the consolidation process; 20% of prior period amortizations will be distributed to Retained Earnings-Carns

C)Carn will be included in the consolidation process; 40% of prior period amortizations will be distributed to Retained Earnings-Carns

D)Carn will be included in the consolidation process; NCI will be allocated 6.4% of prior-period profits originated by Carns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

14

On January 1, 2016, Paul, Inc.acquired a 90% interest in Stephan Company.The $45,000 excess of purchase price (parent's share only) was attributable to goodwill.On January 1, 2018, Stephan Company had the following stockholders' equity: ?

On January 2, 2018, Stephan sold 2,000 additional shares in a private offering.Stephan issued the new shares for $80 per share; Paul, Inc.purchased all the shares.What is the journal entry that Paul will prepare to record this investment?

?

a.

b.

c.

d.

On January 2, 2018, Stephan sold 2,000 additional shares in a private offering.Stephan issued the new shares for $80 per share; Paul, Inc.purchased all the shares.What is the journal entry that Paul will prepare to record this investment?

?

a.

b.

c.

d.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

15

A parent company owns a 100% interest in a subsidiary.Recently, the subsidiary paid a 10% stock dividend.The dividend should be recorded on the books of the parent

A)at the par value or stated value of the shares received.

B)at the market value of the shares on the date of declaration.

C)at the market value of the shares on the date of distribution.

D)merely as a memo entry indicating that the cost of the original investment now is allocated to a greater number of shares.

A)at the par value or stated value of the shares received.

B)at the market value of the shares on the date of declaration.

C)at the market value of the shares on the date of distribution.

D)merely as a memo entry indicating that the cost of the original investment now is allocated to a greater number of shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

16

Company P owns 80% of the 10,000 outstanding common stock of Company S.If Company S issues 2,500 added shares of common stock, and Company P purchases some of the newly issued shares, which of the following statements is true?

A)Other than recording the purchase, there is no adjustment to the controlling interest if the parent purchases all the shares issued.

B)Other than recording the purchase, there is no adjustment to the controlling interest if the parent does not purchase any of the shares issued.

C)Other than recording the purchase, there is no adjustment to the controlling interest if the parent purchases 80% of the shares issued.

D)There is a new excess of cost over book value or excess of book value over cost if the parent purchases 80% of the newly issued shares.

A)Other than recording the purchase, there is no adjustment to the controlling interest if the parent purchases all the shares issued.

B)Other than recording the purchase, there is no adjustment to the controlling interest if the parent does not purchase any of the shares issued.

C)Other than recording the purchase, there is no adjustment to the controlling interest if the parent purchases 80% of the shares issued.

D)There is a new excess of cost over book value or excess of book value over cost if the parent purchases 80% of the newly issued shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

17

Pepper Company owns 60,000 of Salt Company's 100,000 outstanding shares.This year, Salt purchased 20,000 of its outstanding shares from the NCI for $70,000.Pepper's interest after the treasury stock purchase is:

A)60%.

B)80%.

C)50%.

D)75%.

A)60%.

B)80%.

C)50%.

D)75%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

18

Consolidated statements for X, Y, and Z are proper if

A)X owns 100% of the outstanding common stock of Y and 49% of Z; M owns 51% of Z.

B)X owns 100% of the outstanding common stock of Y and 75% of Z; X bought the stock of Z one month before the statement date and sold it 6 weeks later.

C)X owns 100% of the outstanding stock of Y; Y owns 75% of Z.

D)There is no interrelation of financial control among X, Y, and Z; however, they are contemplating the joint purchase of 100% of the outstanding stock of D.

A)X owns 100% of the outstanding common stock of Y and 49% of Z; M owns 51% of Z.

B)X owns 100% of the outstanding common stock of Y and 75% of Z; X bought the stock of Z one month before the statement date and sold it 6 weeks later.

C)X owns 100% of the outstanding stock of Y; Y owns 75% of Z.

D)There is no interrelation of financial control among X, Y, and Z; however, they are contemplating the joint purchase of 100% of the outstanding stock of D.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

19

When a parent purchases a portion of the newly issued stock of its subsidiary and the ownership interest increases,

A)any difference between the change in equity and the price paid is the excess of cost or book value attributable to the new block.

B)any difference between the change in equity and the price paid is viewed as a gain or loss on the sale of an interest.

C)any difference between the change in equity and the price paid is viewed as a change in paid-in capital or retained earnings.

D)there will be no adjustment.

A)any difference between the change in equity and the price paid is the excess of cost or book value attributable to the new block.

B)any difference between the change in equity and the price paid is viewed as a gain or loss on the sale of an interest.

C)any difference between the change in equity and the price paid is viewed as a change in paid-in capital or retained earnings.

D)there will be no adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

20

Able Company owns an 80% interest in Barns Company and a 20% interest in Carns Company.Barns owns a 40% interest in Carns Company.The reported income of Carns is $20,000 for 2019.Which of the following shows how it will be distributed? ?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

21

Company P had 300,000 shares of common stock outstanding.It owned 80% of the outstanding common stock of S.S owned 20,000 shares of P common stock.In the consolidated balance sheet, Company P's outstanding common stock may be shown as

A)285,000 shares.

B)300,000 shares.

C)300,000 shares, less 20,000 shares of treasury stock.

D)300,000 shares, footnoted to indicate that S holds 20,000 shares.

A)285,000 shares.

B)300,000 shares.

C)300,000 shares, less 20,000 shares of treasury stock.

D)300,000 shares, footnoted to indicate that S holds 20,000 shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

22

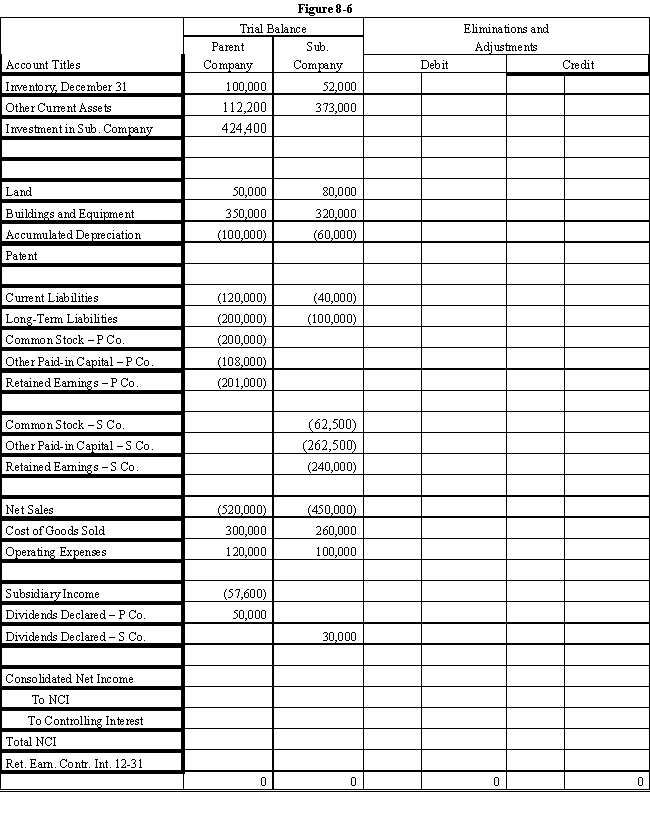

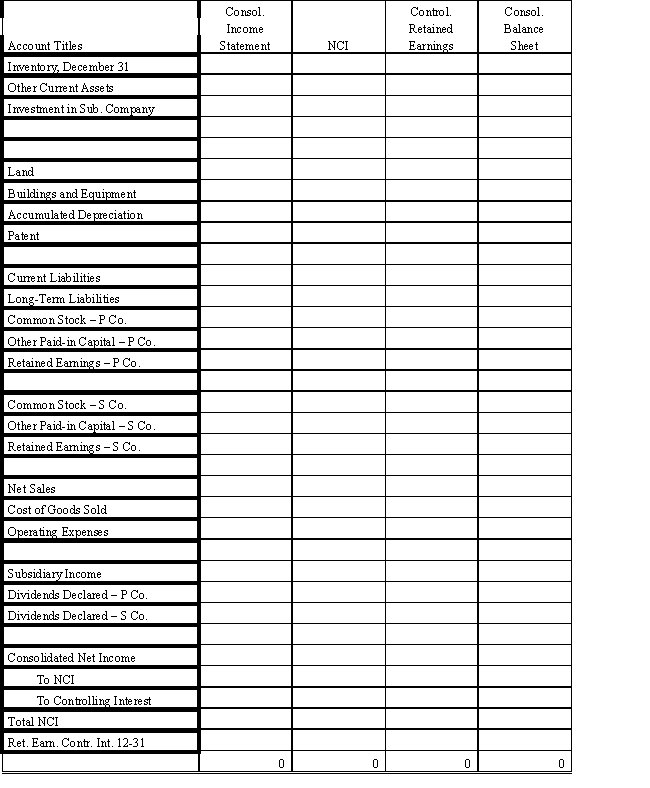

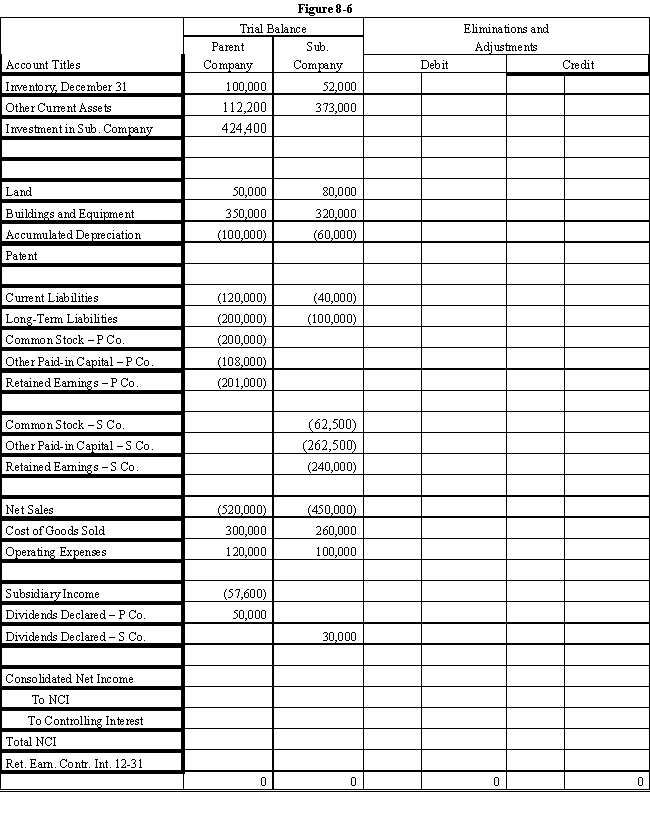

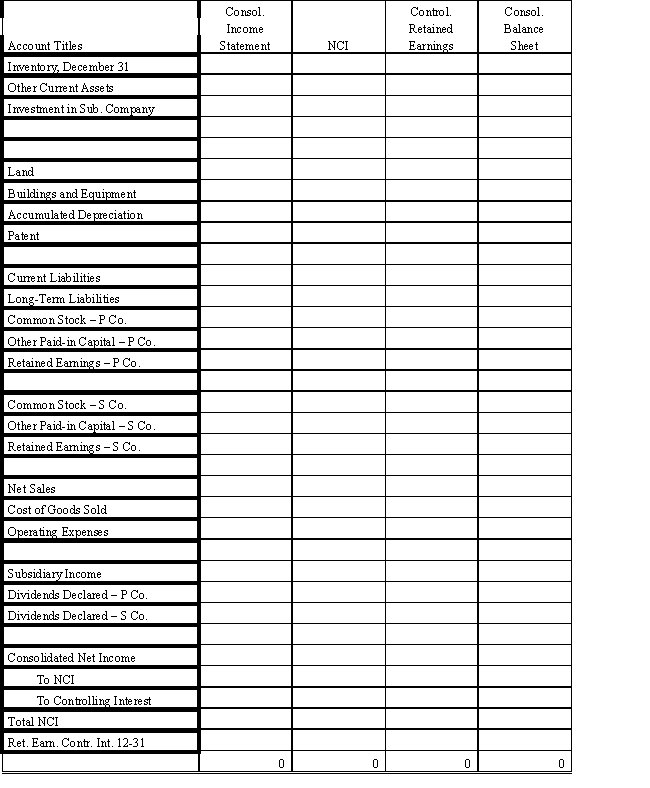

On January 1, 2016, Parent Company purchased 8,000 shares of the common stock of Subsidiary Company for $350,000.On this date, Subsidiary had 20,000 shares of $5 par common stock authorized, 10,000 shares issued and outstanding.Other paid-in capital and retained earnings were $150,000 and $200,000 respectively.On January 1, 2016, any excess of cost over book value is due to a patent, to be amortized over 15 years.Parent Company uses the simple equity method to account for its investment in Sub.

?

Subsidiary's net income and dividends for two years were:

?

?

On January 1, 2017, Subsidiary Company sold an additional 2,500 shares of common stock to non-controlling shareholders for $50 per share.

?

In the last quarter of 2017, Subsidiary Company sold goods to Parent Company for $40,000.Subsidiary's usual gross profit on intercompany sales is 40%.On December 31, $7,500 of these goods are still in Parent's ending inventory.

?

Required:

?

Complete the Figure 8-6 worksheet for consolidated financial statements for 2017.

?

?

?

Subsidiary's net income and dividends for two years were:

?

?

On January 1, 2017, Subsidiary Company sold an additional 2,500 shares of common stock to non-controlling shareholders for $50 per share.

?

In the last quarter of 2017, Subsidiary Company sold goods to Parent Company for $40,000.Subsidiary's usual gross profit on intercompany sales is 40%.On December 31, $7,500 of these goods are still in Parent's ending inventory.

?

Required:

?

Complete the Figure 8-6 worksheet for consolidated financial statements for 2017.

?

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

23

A owns 80% of B and 20% of C.B owns 32% of C, and C owns 10% of A.Which interest will be considered NCI in the consolidated balance sheet?

A)20% of B and 48% of C

B)10% of A

C)10% of A and 48% of C

D)There will not be a non-controlling interest.

A)20% of B and 48% of C

B)10% of A

C)10% of A and 48% of C

D)There will not be a non-controlling interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

24

Manke Company owns a 90% interest in Neske Company.Neske, in turn, owns a 10% interest in Manke.Neske has 10,000 common stock shares outstanding, and Manke has 20,000 common stock shares outstanding.How many shares would each firm show as outstanding in the consolidated balance sheet, under the treasury stock method?

A)Manke, 20,000

B)Manke, 20,000; Neske, 1,000

C)Manke, 18,000; Neske, 1,000

D)Manke, 18,000

A)Manke, 20,000

B)Manke, 20,000; Neske, 1,000

C)Manke, 18,000; Neske, 1,000

D)Manke, 18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

25

On January 1, 2016, Parent Company purchased 9,000 shares of the common stock of Subsidiary Company for $405,000.On this date, Subsidiary had 20,000 shares of $5 par common stock authorized, 10,000 shares issued and outstanding.Other paid-in capital and retained earnings were $150,000 and $200,000 respectively.On January 1, 2016, any excess of cost over book value is due to a patent, to be amortized over 10 years.

?

Subsidiary's net income and dividends for two years were:

?

?

On January 1, 2017, Subsidiary Company sold an additional 2,000 shares of common stock for $50 per share.Parent purchased 1,200 shares of the new issue, and non-controlling shareholders purchased the other 800.

?

For both 2016 and 2017, Parent Company has applied the simple equity method.

?

Required:

?

a.Prepare a schedule that measures Parent's change in interest ownership effective with Sub's issuance of the 2,000 shares and Parent's acquisition of 1,200 of those shares.?

b.Prepare Parent's journal entry to record its purchase of the 1,200 shares on 1/1/17

?

c.Prepare a schedule showing the 12/31/17 balance of Parent's Investment in Sub account

?

Subsidiary's net income and dividends for two years were:

?

?

On January 1, 2017, Subsidiary Company sold an additional 2,000 shares of common stock for $50 per share.Parent purchased 1,200 shares of the new issue, and non-controlling shareholders purchased the other 800.

?

For both 2016 and 2017, Parent Company has applied the simple equity method.

?

Required:

?

a.Prepare a schedule that measures Parent's change in interest ownership effective with Sub's issuance of the 2,000 shares and Parent's acquisition of 1,200 of those shares.?

b.Prepare Parent's journal entry to record its purchase of the 1,200 shares on 1/1/17

?

c.Prepare a schedule showing the 12/31/17 balance of Parent's Investment in Sub account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

26

On 1/1/16 Poncho acquired an 80% interest in Stroller for $560,000 when Stroller's equity consisted of $530,000 paid-in capital and $100,000 Retained Earnings.Any excess of purchase price over was attributed to goodwill.

?

On January 1, 2021, Stroller had the following stockholders' equity:

?

On January 2, 2021, Company S sold 1,000 additional shares to non-controlling shareholders in a public offering for $50 per share.Stroller's net income for 2021 was 80,000.Poncho uses the simple equity method to record its investment in Stroller.

?

Required:

a.Prepare Poncho's journal entry to adjust its Investment in Stroller account on January 2, 2021.Assume that Poncho has $500,000 additional paid-in capital.

b.Determine the carrying value of Poncho's Investment in Stroller account on December 31, 2021.

?

On January 1, 2021, Stroller had the following stockholders' equity:

?

On January 2, 2021, Company S sold 1,000 additional shares to non-controlling shareholders in a public offering for $50 per share.Stroller's net income for 2021 was 80,000.Poncho uses the simple equity method to record its investment in Stroller.

?

Required:

a.Prepare Poncho's journal entry to adjust its Investment in Stroller account on January 2, 2021.Assume that Poncho has $500,000 additional paid-in capital.

b.Determine the carrying value of Poncho's Investment in Stroller account on December 31, 2021.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

27

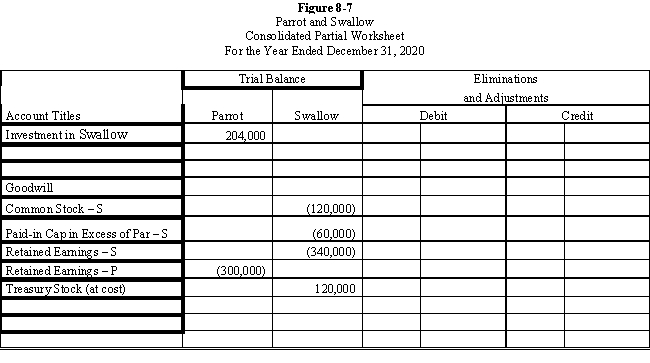

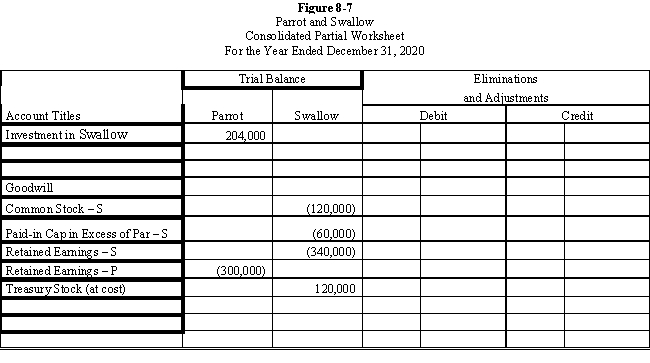

Parrot, Inc.purchased a 60% interest in Swallow Company on January 1, 2016, for $204,000.Any excess of cost was attributable to goodwill.

?

On January 1, 2019, Swallow purchased 2,400 of its shares held by non-controlling stockholders for $50 per share.Swallow equity balances on various dates were as follows:

?

?

Parrot maintains its investment at cost; Swallow recorded the purchase of its shares as treasury stock at cost.

?

Required:

?

Prepare the necessary determination and distribution of excess schedules and all Figure 8-7 worksheet eliminations and adjustments on the following partial worksheet prepared on December 31, 2020:

?

?

?

On January 1, 2019, Swallow purchased 2,400 of its shares held by non-controlling stockholders for $50 per share.Swallow equity balances on various dates were as follows:

?

?

Parrot maintains its investment at cost; Swallow recorded the purchase of its shares as treasury stock at cost.

?

Required:

?

Prepare the necessary determination and distribution of excess schedules and all Figure 8-7 worksheet eliminations and adjustments on the following partial worksheet prepared on December 31, 2020:

?

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

28

When a subsidiary owns shares of the parent, the subsidiary's investment account

A)should be accounted for using the equity method.

B)is not eliminated so the subsidiary's investment in the parent is displayed on the balance sheet.

C)is maintained at its original cost since the shares have no claim on income.

D)may be accounted for using the cost, equity or sophisticated equity method.

A)should be accounted for using the equity method.

B)is not eliminated so the subsidiary's investment in the parent is displayed on the balance sheet.

C)is maintained at its original cost since the shares have no claim on income.

D)may be accounted for using the cost, equity or sophisticated equity method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

29

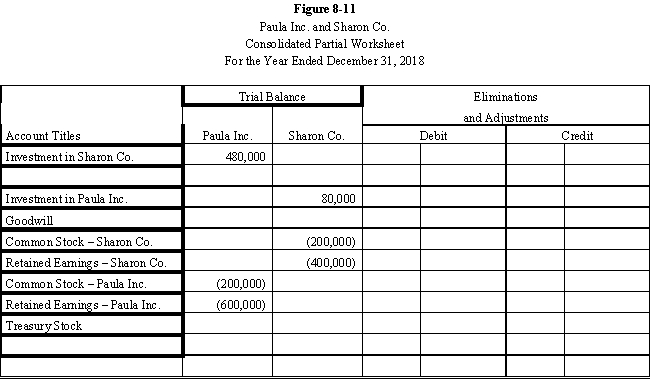

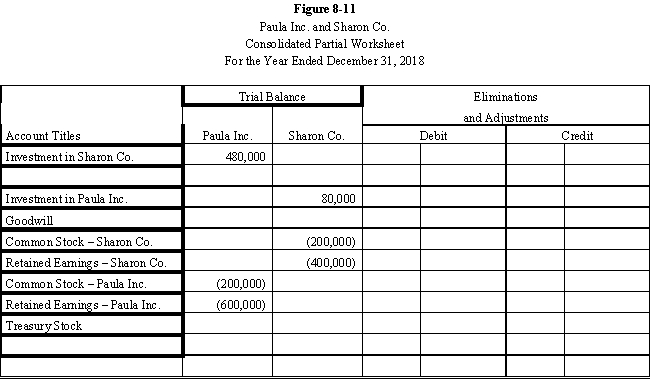

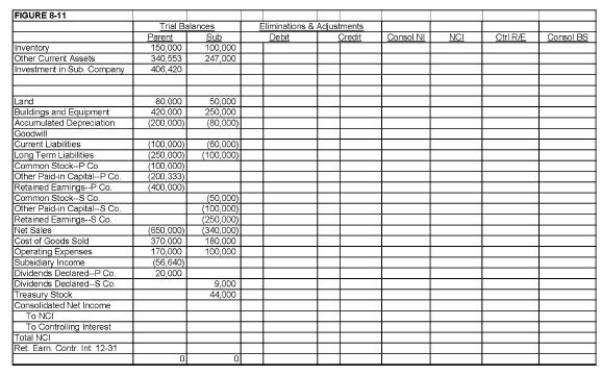

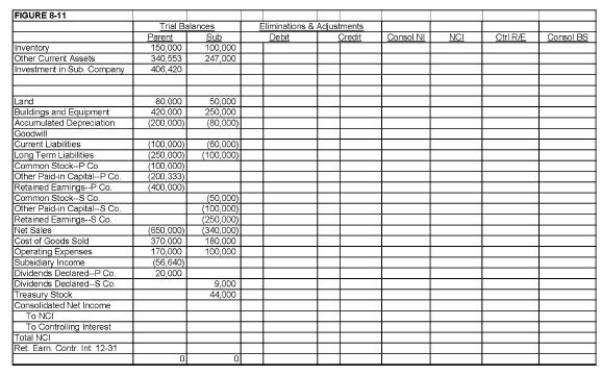

Paula Inc.purchased an 80% interest in the Sharon Co.for $480,000 on January 1, 2016, when Sharon Co.had the following stockholders' equity:

?

?

Any excess is attributable to goodwill.

?

On January 1, 2018, Sharon Co.purchased a 10% interest in the Paula Inc.at a price equal to book value.Both firms maintain investments under the cost method.

?

Required:

?

a.Complete the Figure 8-11 partial worksheet for December 31, 2018, assuming the use of the treasury stock method.?

?

b.Calculate the distribution of income for 2018, assuming that internally generated net income is $50,000 for Paula and $20,000 for Sharon.?

?

?

?

Any excess is attributable to goodwill.

?

On January 1, 2018, Sharon Co.purchased a 10% interest in the Paula Inc.at a price equal to book value.Both firms maintain investments under the cost method.

?

Required:

?

a.Complete the Figure 8-11 partial worksheet for December 31, 2018, assuming the use of the treasury stock method.?

?

b.Calculate the distribution of income for 2018, assuming that internally generated net income is $50,000 for Paula and $20,000 for Sharon.?

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

30

When a subsidiary issues a stock dividend, an amount equal to the fair value of the shares should be removed from retained earnings and transferred to paid-in-capital in excess of par, if the distribution:

A)is less than 20% of the previously outstanding shares.

B)exceeds 20% of the previously outstanding shares.

C)is more than 50% of the previously outstanding shares.

D)does not exceed 20% to 25% of the previously outstanding shares.

A)is less than 20% of the previously outstanding shares.

B)exceeds 20% of the previously outstanding shares.

C)is more than 50% of the previously outstanding shares.

D)does not exceed 20% to 25% of the previously outstanding shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

31

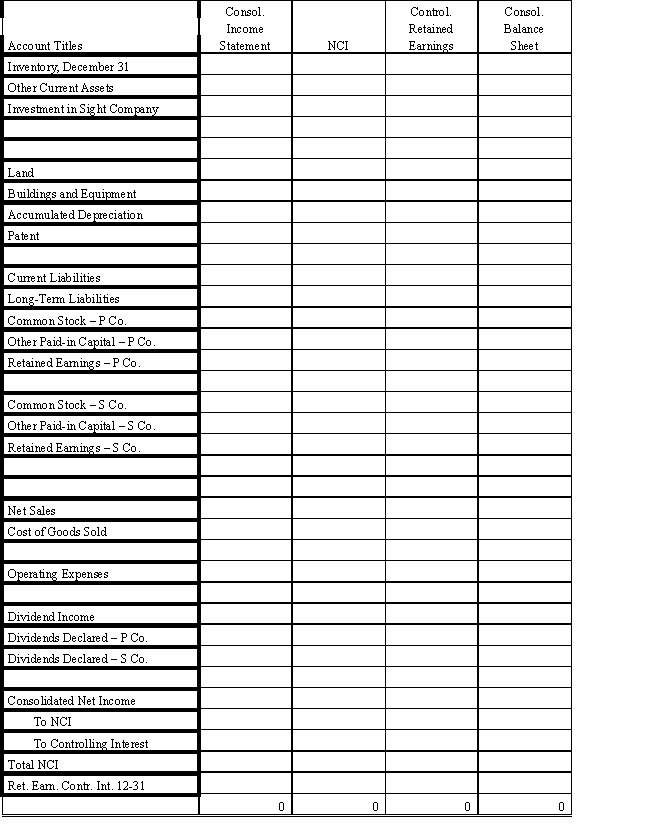

On January 1, 2016, Parent Company purchased 85% of the common stock, 8,500 shares, of Subsidiary Company for $317,500.On this date, Subsidiary had common stock, other paid-in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively.Any excess of cost over book value is due to goodwill.

?

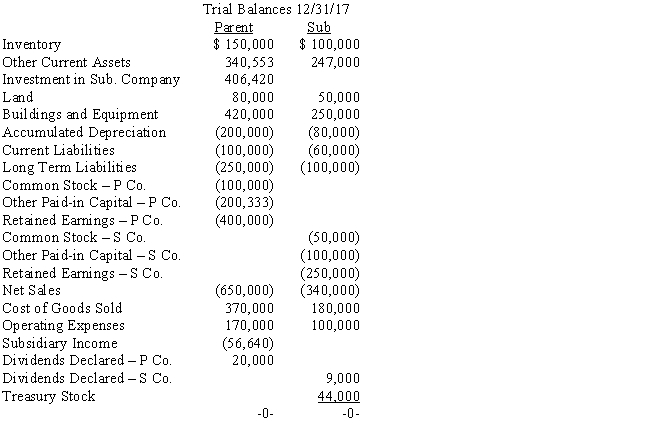

On January 1, 2017, Subsidiary purchased, from its non-controlling shareholders, 1,000 shares of its common stock, 10% of the stock outstanding on that date.The price paid was $44,000.The trial balances of Parent and Sub as of 12/31/17 are given below:

?

?

Required (round all amounts to whole dollars; round percentages to one decimal: XX.X%)

Required (round all amounts to whole dollars; round percentages to one decimal: XX.X%)

a.Prepare the D&D schedule for the 1/1/16 acquisition.

b.Prepare a schedule to determine the change in Parent's interest in Sub.

c.Prepare the journal entry the parent needed to adjust its interest in Sub.(Note that it has already been included in the parent's trial balance.)

d.Prepare, in journal form, all elimination entries necessary for the 12/31/17 consolidation worksheet.?

?

On January 1, 2017, Subsidiary purchased, from its non-controlling shareholders, 1,000 shares of its common stock, 10% of the stock outstanding on that date.The price paid was $44,000.The trial balances of Parent and Sub as of 12/31/17 are given below:

?

?

Required (round all amounts to whole dollars; round percentages to one decimal: XX.X%)

Required (round all amounts to whole dollars; round percentages to one decimal: XX.X%) a.Prepare the D&D schedule for the 1/1/16 acquisition.

b.Prepare a schedule to determine the change in Parent's interest in Sub.

c.Prepare the journal entry the parent needed to adjust its interest in Sub.(Note that it has already been included in the parent's trial balance.)

d.Prepare, in journal form, all elimination entries necessary for the 12/31/17 consolidation worksheet.?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

32

On January 1, 2016, Parent Company purchased 8,000 shares of the common stock of Subsidiary Company for $350,000.On this date, Subsidiary had 20,000 shares of $5 par common stock authorized, 10,000 shares issued and outstanding.Other paid-in capital and retained earnings were $150,000 and $200,000 respectively.On January 1, 2016, any excess of cost over book value is due to a patent, to be amortized over 15 years.Parent Company uses the simple equity method to account for its investment in Sub.

?

Subsidiary's net income and dividends for two years were:

?

?

On January 1, 2017, Subsidiary Company sold an additional 2,500 shares of common stock to non-controlling shareholders for $50 per share.

?

In the last quarter of 2017, Subsidiary Company sold goods to Parent Company for $40,000.Subsidiary's usual gross profit on intercompany sales is 40%.On December 31, $7,500 of these goods are still in Parent's ending inventory.

?

Required: Prepare the following items

a.Determination and distribution schedule effective 1/1/16

?

?

b.Parent's journal entry to record change in ownership interest due to Sub's issuance of additional shares on 1/1/17.Support with schedule of Parent's ownership interest before and after the 1/1/17 issuance.?

?

c.All necessary elimination entries necessary to prepare the consolidating worksheet on 12/31/17

?

?

Subsidiary's net income and dividends for two years were:

?

?

On January 1, 2017, Subsidiary Company sold an additional 2,500 shares of common stock to non-controlling shareholders for $50 per share.

?

In the last quarter of 2017, Subsidiary Company sold goods to Parent Company for $40,000.Subsidiary's usual gross profit on intercompany sales is 40%.On December 31, $7,500 of these goods are still in Parent's ending inventory.

?

Required: Prepare the following items

a.Determination and distribution schedule effective 1/1/16

?

?

b.Parent's journal entry to record change in ownership interest due to Sub's issuance of additional shares on 1/1/17.Support with schedule of Parent's ownership interest before and after the 1/1/17 issuance.?

?

c.All necessary elimination entries necessary to prepare the consolidating worksheet on 12/31/17

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

33

Plum Inc.acquired 90% of the capital stock of Sterling Co.on 1/1/16 at a cost of $540,000.On this date Sterling had equipment (10-year life) carried at $200,000 under market and total equity amounting to $350,000.

On 1/1/16 Sterling acquired 5% (10,000 shares) of Plum's outstanding common stock for $3 per share.Internally generated net income was $50,000 for Plum and $40,000 for Sterling.

Consolidated net income for 2017 is

A)$90,000

B)$86,000

C)$83,500

D)$70,000

On 1/1/16 Sterling acquired 5% (10,000 shares) of Plum's outstanding common stock for $3 per share.Internally generated net income was $50,000 for Plum and $40,000 for Sterling.

Consolidated net income for 2017 is

A)$90,000

B)$86,000

C)$83,500

D)$70,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

34

a.What would be Company P's investment balance given the following information:

Company P's ownership interest of Company S is 90%.The original cost of the investment is $500,000.The beginning retained earnings of Company S in prior to a dividend was $100,000 and two years later retained earnings of Company S was $280,000.

b.Record the journal entry to record equity income under the simple equity method at the end of two years for Company P, assuming the second year's income for Company S was $100,000 and no dividend declarations were made.

Company P's ownership interest of Company S is 90%.The original cost of the investment is $500,000.The beginning retained earnings of Company S in prior to a dividend was $100,000 and two years later retained earnings of Company S was $280,000.

b.Record the journal entry to record equity income under the simple equity method at the end of two years for Company P, assuming the second year's income for Company S was $100,000 and no dividend declarations were made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

35

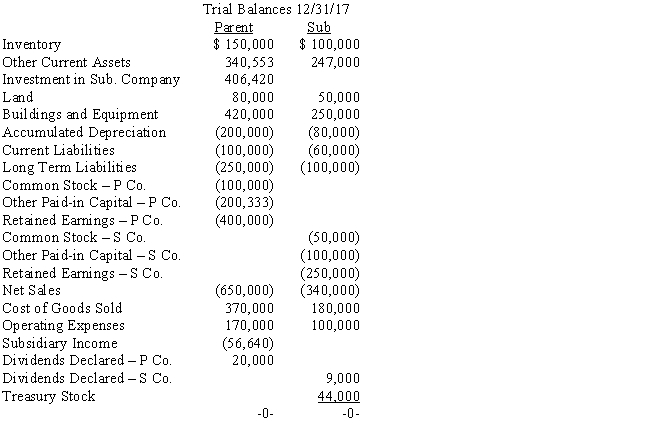

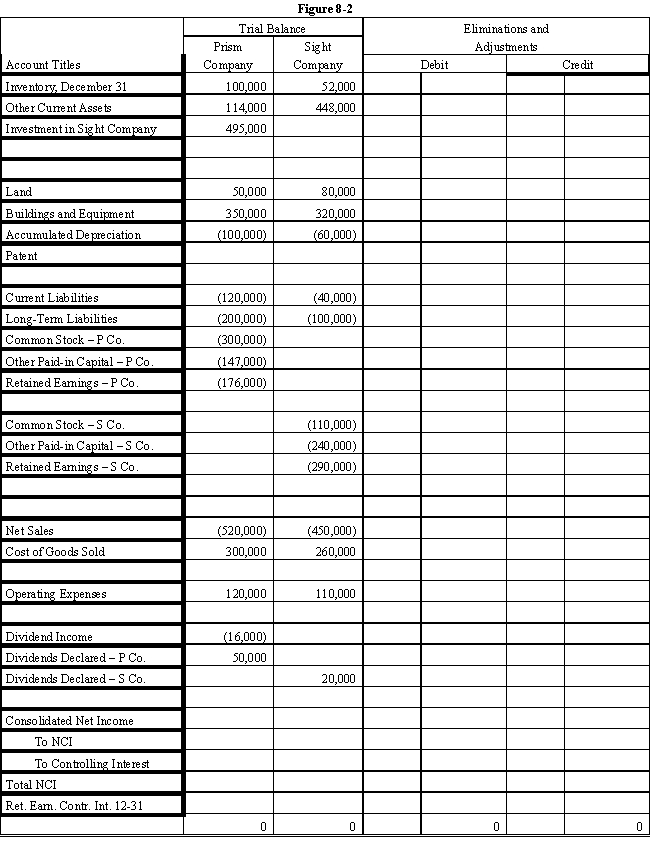

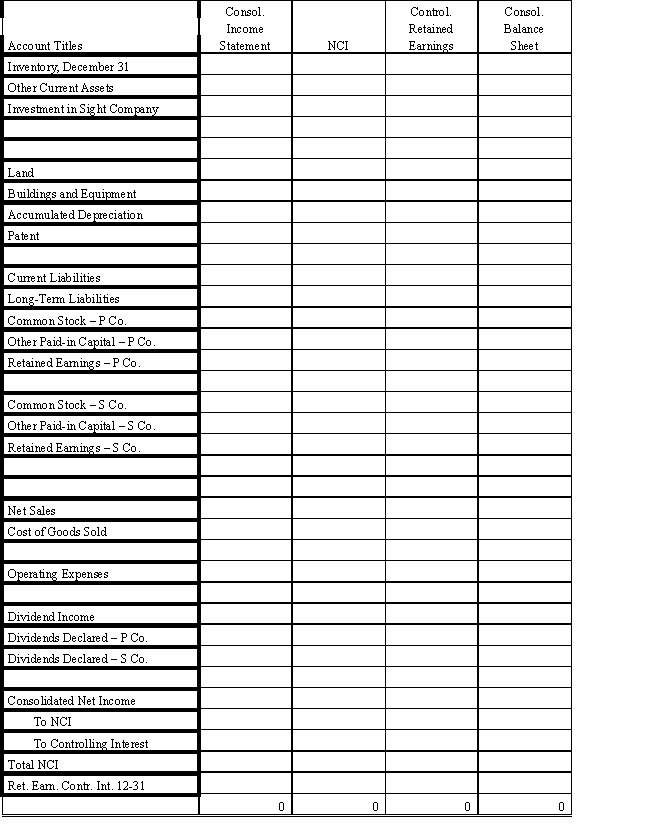

On January 1, 2016, Prism Company purchased 7,500 shares of the common stock of Sight Company for $495,000.On this date, Sight had 20,000 shares of $10 par common stock authorized, 10,000 shares issued and outstanding.Other paid-in capital and retained earnings were $200,000 and $300,000 respectively.On January 1, 2016, any excess of cost over book value is due to a patent, to be amortized over 15 years.

?

Sight's net income and dividends for two years were:

?

?

In November 2016, Sight Company declared a 10% stock dividend at a time when the market price of its common stock was $50 per share.The stock dividend was distributed on December 31, 2016.

?

For both 2016 and 2017, Prism Company has accounted for its investment in Sight using the cost method.

?

During 2016, Sight Company sold goods to Prism Company for $40,000, of which $10,000 was on hand on December 31, 2016.During 2017, Sight sold goods to Prism for $60,000 of which $15,000 was on hand on December 31, 2017.Sight's gross profit on intercompany sales is 40%.

?

Required:

?

Complete the Figure 8-2 worksheet for consolidated financial statements for 2017.

?

?

?

?

?

Sight's net income and dividends for two years were:

?

?

In November 2016, Sight Company declared a 10% stock dividend at a time when the market price of its common stock was $50 per share.The stock dividend was distributed on December 31, 2016.

?

For both 2016 and 2017, Prism Company has accounted for its investment in Sight using the cost method.

?

During 2016, Sight Company sold goods to Prism Company for $40,000, of which $10,000 was on hand on December 31, 2016.During 2017, Sight sold goods to Prism for $60,000 of which $15,000 was on hand on December 31, 2017.Sight's gross profit on intercompany sales is 40%.

?

Required:

?

Complete the Figure 8-2 worksheet for consolidated financial statements for 2017.

?

?

?

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

36

Plum Inc.acquired 90% of the capital stock of Sterling Co.on 1/1/16 at a cost of $540,000.On this date Sterling had equipment (10-year life) carried at $200,000 under market and total equity amounting to $350,000.

On 1/1/16 Sterling acquired 5% (10,000 shares) of Plum's outstanding common stock for $3 per share.Internally generated net income was $50,000 for Plum and $40,000 for Sterling.The non-controlling interest in consolidated net income is

A)$2,000

B)$18,000

C)$7,500

D)$6,800

On 1/1/16 Sterling acquired 5% (10,000 shares) of Plum's outstanding common stock for $3 per share.Internally generated net income was $50,000 for Plum and $40,000 for Sterling.The non-controlling interest in consolidated net income is

A)$2,000

B)$18,000

C)$7,500

D)$6,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

37

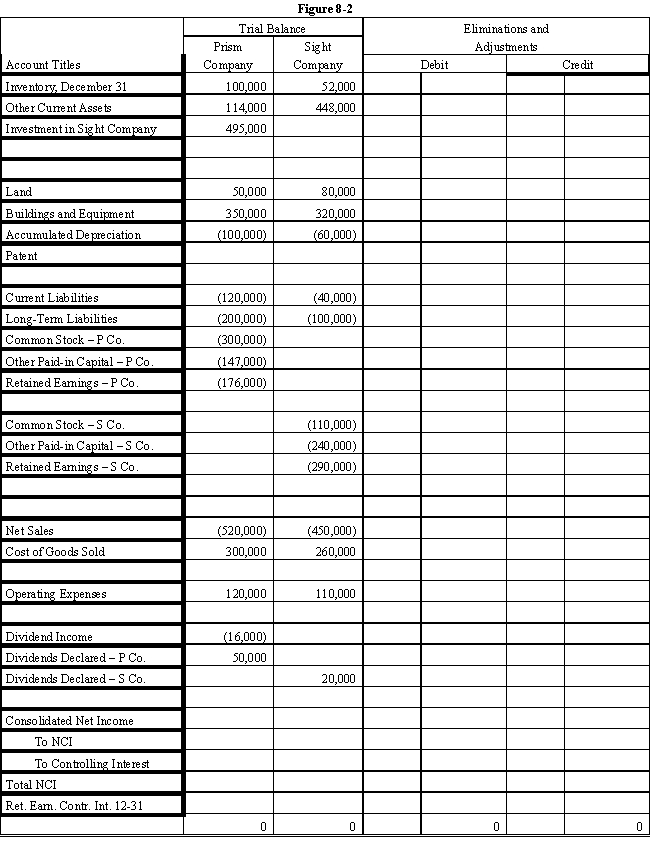

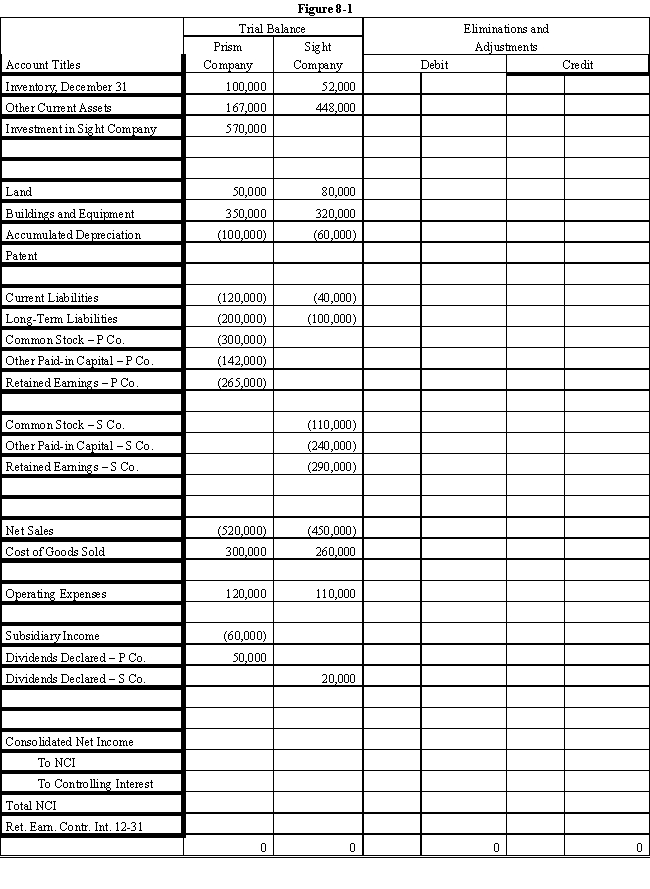

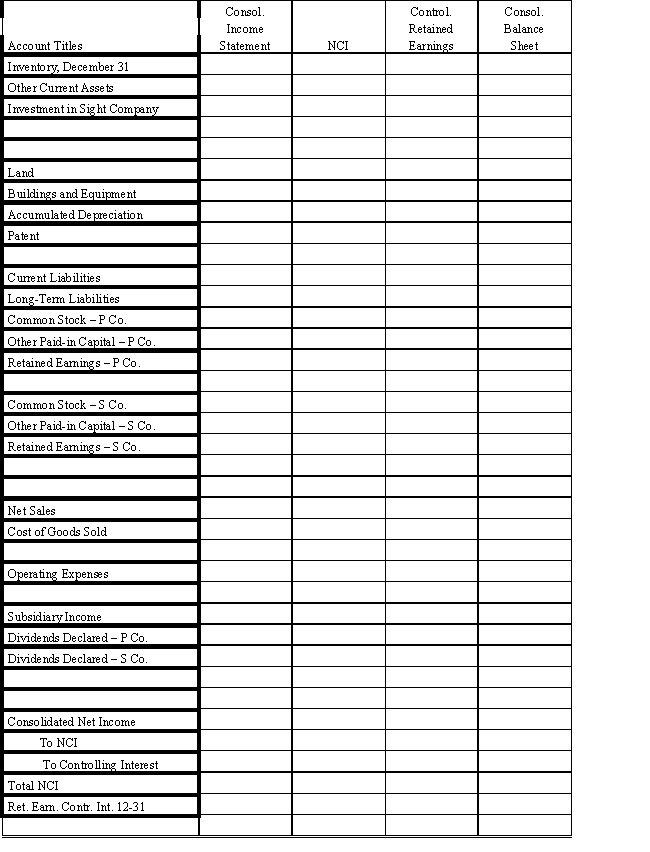

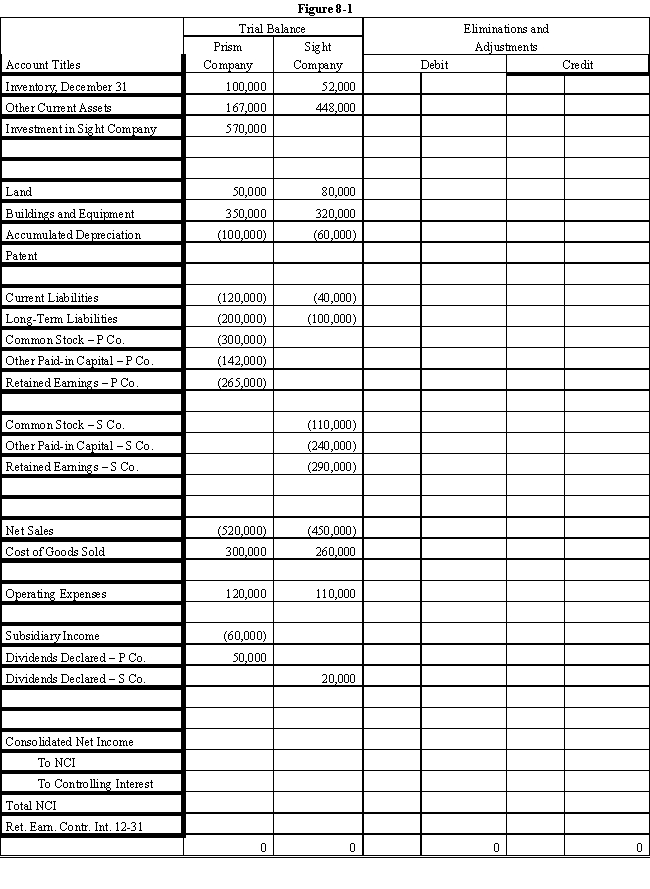

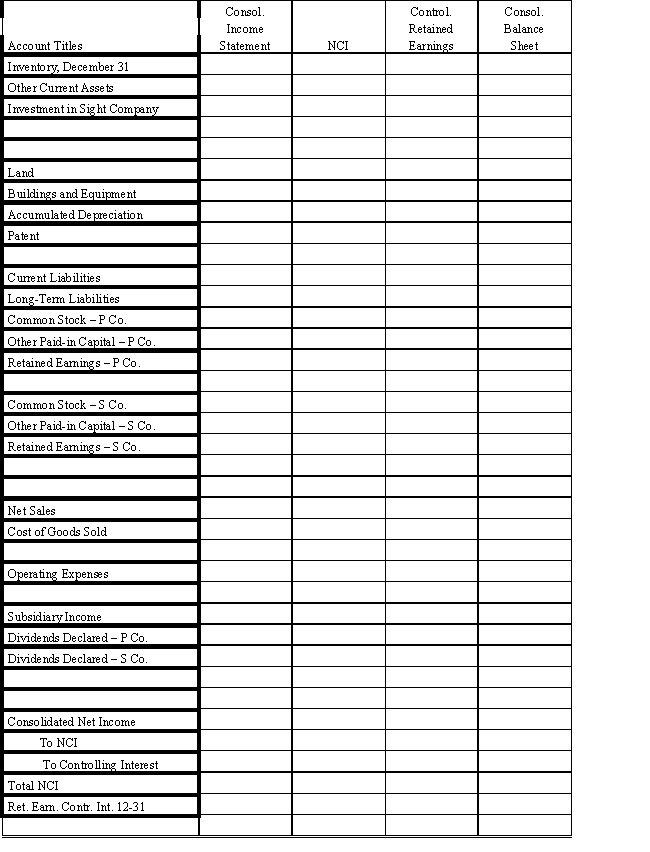

On January 1, 2016, Prism Company purchased 7,500 shares of the common stock of Sight Company for $495,000.On this date, Sight had 20,000 shares of $10 par common stock authorized, 10,000 shares issued and outstanding.Other paid-in capital and retained earnings were $200,000 and $300,000 respectively.On January 1, 2016, any excess of cost over book value is due to a patent, to be amortized over 15 years.

?

Sight's net income and dividends for two years were:

?

?

In November 2016, Sight Company declared a 10% stock dividend at a time when the market price of its common stock was $50 per share.The stock dividend was distributed on December 31, 2016.

?

For both 2016 and 2017, Prism Company has accounted for its investment in Sight Company using the simple equity method.

?

During 2016, Sight Company sold goods to Prism Company for $40,000, of which $10,000 was on hand on December 31, 2016.During 2017, Sight sold goods to Prism for $60,000 of which $15,000 was on hand on December 31, 2017.Sight's gross profit on intercompany sales is 40%.

?

Required:

?

Complete the Figure 8-1 worksheet for consolidated financial statements for 2017.

?

?

?

?

?

Sight's net income and dividends for two years were:

?

?

In November 2016, Sight Company declared a 10% stock dividend at a time when the market price of its common stock was $50 per share.The stock dividend was distributed on December 31, 2016.

?

For both 2016 and 2017, Prism Company has accounted for its investment in Sight Company using the simple equity method.

?

During 2016, Sight Company sold goods to Prism Company for $40,000, of which $10,000 was on hand on December 31, 2016.During 2017, Sight sold goods to Prism for $60,000 of which $15,000 was on hand on December 31, 2017.Sight's gross profit on intercompany sales is 40%.

?

Required:

?

Complete the Figure 8-1 worksheet for consolidated financial statements for 2017.

?

?

?

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

38

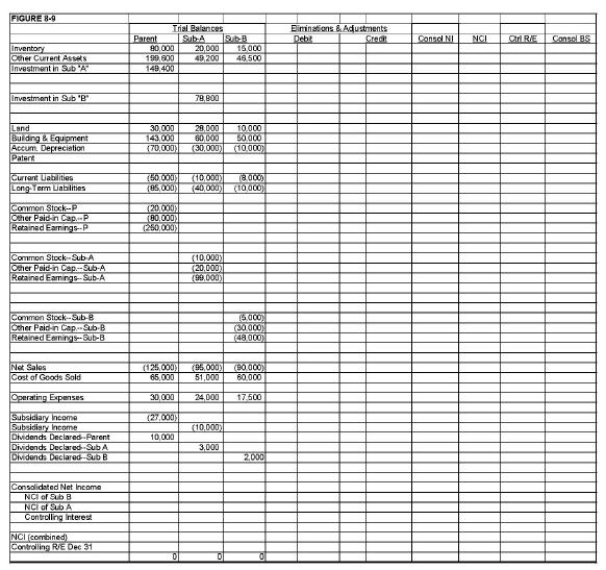

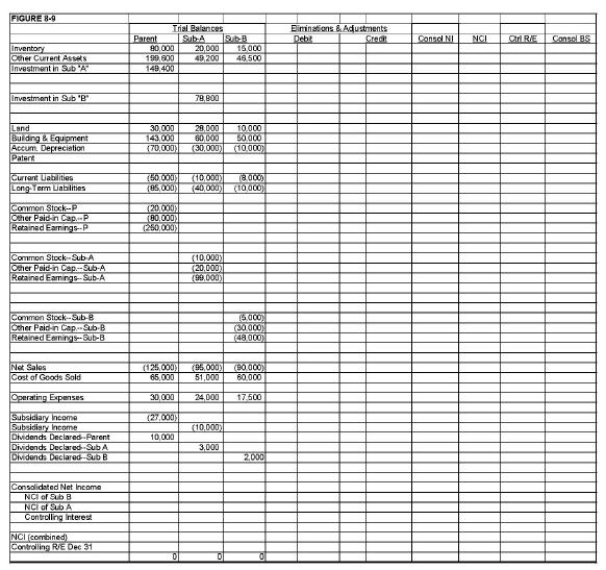

On January 1, 2016, Parent Company purchased 90% of the common stock of Sub-A Company for $90,000.On this date, Sub-A had common stock, other paid-in capital, and retained earnings of $10,000, $20,000, and $60,000 respectively.

On January 1, 2017, Sub-A Company purchased 80% of the common stock of Sub-B Company for $64,000.On this date, Sub-B Company had common stock, other paid-in capital, and retained earnings of $5,000, $30,000, and $40,000 respectively.

Any excess of cost over book value on either purchase is due to a patent, to be amortized over ten years.

Both Parent and Sub-A have accounted for their investments using the simple equity method.

During 2017, Sub-B sold merchandise to Sub-A for $20,000, of which one-fourth is still held by Sub-B on December 31, 2017.Sub-B's usual gross profit is 40%.During 2018, Sub-B sold more goods to Sub-A for $30,000, of which $10,000 is still on hand on December 31, 2018.

Required:

Complete the Figure 8-9 worksheet for consolidated financial statements for 2018.

On January 1, 2017, Sub-A Company purchased 80% of the common stock of Sub-B Company for $64,000.On this date, Sub-B Company had common stock, other paid-in capital, and retained earnings of $5,000, $30,000, and $40,000 respectively.

Any excess of cost over book value on either purchase is due to a patent, to be amortized over ten years.

Both Parent and Sub-A have accounted for their investments using the simple equity method.

During 2017, Sub-B sold merchandise to Sub-A for $20,000, of which one-fourth is still held by Sub-B on December 31, 2017.Sub-B's usual gross profit is 40%.During 2018, Sub-B sold more goods to Sub-A for $30,000, of which $10,000 is still on hand on December 31, 2018.

Required:

Complete the Figure 8-9 worksheet for consolidated financial statements for 2018.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

39

On January 1, 2016, Parent Company purchased 85% of the common stock, 8,500 shares, of Subsidiary Company for $317,500.On this date, Subsidiary had common stock, other paid-in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively.Any excess of cost over book value is due to goodwill.

?

On January 1, 2017, Subsidiary purchased, from its non-controlling shareholders, 1,000 shares of its common stock, 10% of the stock outstanding on that date.The price paid was $44,000.

?

Required (round all amounts to whole dollars; round percentages to one decimal: XX.X%)

a.Prepare an analysis to determine Parent's revised ownership interest following Sub's treasury stock transaction.

b.Complete the Figure 8-11 worksheet for consolidated financial statements for 2017

?

?

On January 1, 2017, Subsidiary purchased, from its non-controlling shareholders, 1,000 shares of its common stock, 10% of the stock outstanding on that date.The price paid was $44,000.

?

Required (round all amounts to whole dollars; round percentages to one decimal: XX.X%)

a.Prepare an analysis to determine Parent's revised ownership interest following Sub's treasury stock transaction.

b.Complete the Figure 8-11 worksheet for consolidated financial statements for 2017

?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

40

When a subsidiary purchases shares of the parent, on a consolidated basis:

A)a determination and distribution schedule must be completed to determine if goodwill is present.

B)it is considered to be the parent's purchase of treasury stock.

C)an elimination entry must be made for the subsidiary's share of the parent's income.

D)None of the above is correct.

A)a determination and distribution schedule must be completed to determine if goodwill is present.

B)it is considered to be the parent's purchase of treasury stock.

C)an elimination entry must be made for the subsidiary's share of the parent's income.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

41

Two types of intercompany stock purchases significantly complicate the consolidation process.The first occurs when the subsidiary issues added shares of stock in a public issue and the parent buys a portion of the shares.The second occurs when the subsidiary purchases outstanding shares of the parent company.

?

Required:

?

a.Discuss the current theoretical consolidation procedure for situations in which the parent buys a portion of the newly issued subsidiary shares that is (1) equal to its existing ownership percentage, (2) greater than its existing ownership percentage, and (3) less than its existing ownership percentage.?

?

b.Discuss the most widely supported, current theoretical consolidation procedures used when the subsidiary purchases outstanding common stock shares of the parent.?

?

Required:

?

a.Discuss the current theoretical consolidation procedure for situations in which the parent buys a portion of the newly issued subsidiary shares that is (1) equal to its existing ownership percentage, (2) greater than its existing ownership percentage, and (3) less than its existing ownership percentage.?

?

b.Discuss the most widely supported, current theoretical consolidation procedures used when the subsidiary purchases outstanding common stock shares of the parent.?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck