Deck 11: Multinational Accounting: Foreign Currency Transactions and Financial Instruments

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/74

العب

ملء الشاشة (f)

Deck 11: Multinational Accounting: Foreign Currency Transactions and Financial Instruments

1

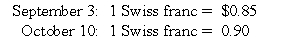

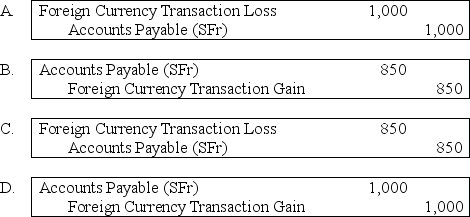

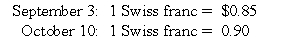

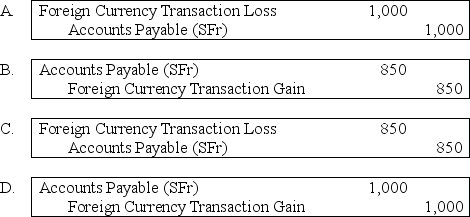

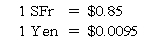

On September 3,20X8,Jackson Corporation purchases goods for a U.S.dollar equivalent of $17,000 from a Swiss company.The transaction is denominated in Swiss francs (SFr).The payment is made on October 10.The exchange rates were:

What entry is required to revalue foreign currency payable to U.S.dollar equivalent value on October 10?

What entry is required to revalue foreign currency payable to U.S.dollar equivalent value on October 10?

A

2

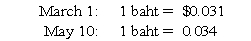

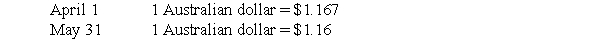

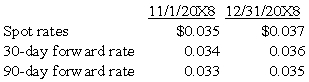

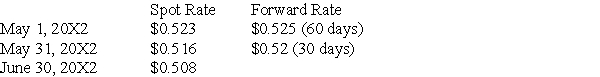

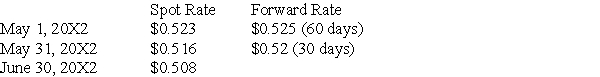

Suppose the direct foreign exchange rates in U.S. dollars are as follows:

1 Swiss franc = $1.0371

1 Swedish krona = $0.1526

Based on the information given above,how many Swiss francs are required to purchase goods costing $5,000 U.S.?

A) 32,785

B) 5,186

C) 4,821

D) 763

1 Swiss franc = $1.0371

1 Swedish krona = $0.1526

Based on the information given above,how many Swiss francs are required to purchase goods costing $5,000 U.S.?

A) 32,785

B) 5,186

C) 4,821

D) 763

B

3

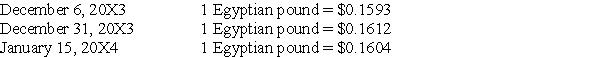

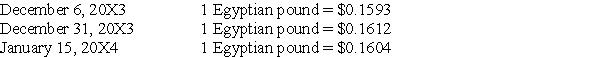

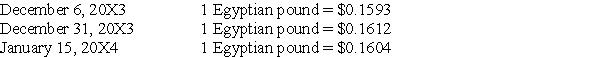

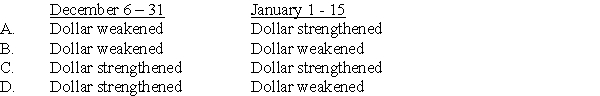

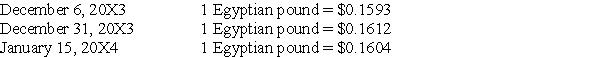

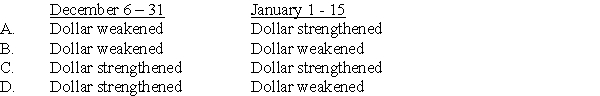

Highland Company sold goods to an Egyptian company for 350,000 Egyptian pounds on December 6, 20X3, with payment due on January 15, 20X4. The exchange rates were as follows:

Based on the preceding information,what is Highland's overall net gain or net loss from its foreign currency exposure related to this transaction?

A) $280 loss

B) $302 loss

C) $385 gain

D) $665 gain

Based on the preceding information,what is Highland's overall net gain or net loss from its foreign currency exposure related to this transaction?

A) $280 loss

B) $302 loss

C) $385 gain

D) $665 gain

C

4

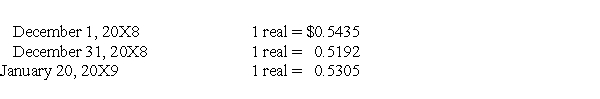

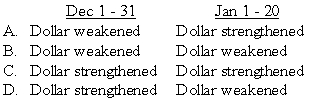

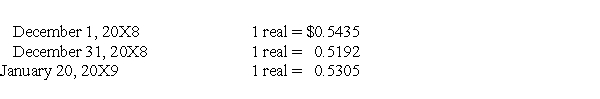

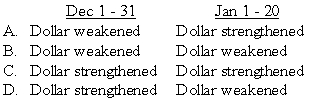

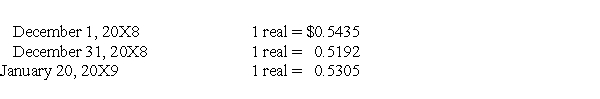

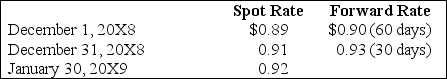

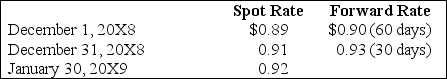

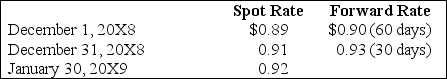

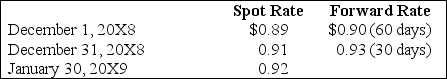

Heavy Company sold metal scrap to a Brazilian company for 200,000 Brazilian reals on December 1, 20X8, with payment due on January 20, 20X9. The exchange rates were:

Based on the preceding information,which of the following is true of dollar's movement vis-à-vis Brazilian real during the period?

Based on the preceding information,which of the following is true of dollar's movement vis-à-vis Brazilian real during the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

5

Suppose the direct foreign exchange rates in U.S. dollars are:

1 Singapore dollar = $0.7025

1 Cyprus pound = $2.5132

Based on the information given above,how many U.S.dollars must be paid for a purchase of citrus fruits costing 10,000 Cyprus pounds?

A) $25,132

B) $15,132

C) $3,979

D) $35,775

1 Singapore dollar = $0.7025

1 Cyprus pound = $2.5132

Based on the information given above,how many U.S.dollars must be paid for a purchase of citrus fruits costing 10,000 Cyprus pounds?

A) $25,132

B) $15,132

C) $3,979

D) $35,775

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

6

Suppose the direct foreign exchange rates in U.S. dollars are:

1 Singapore dollar = $0.7025

1 Cyprus pound = $2.5132

Based on the information given above,how many Singapore dollars are required to purchase goods costing 10,000 US dollars?

A) 7,025

B) 14,235

C) 17,655

D) 2,975

1 Singapore dollar = $0.7025

1 Cyprus pound = $2.5132

Based on the information given above,how many Singapore dollars are required to purchase goods costing 10,000 US dollars?

A) 7,025

B) 14,235

C) 17,655

D) 2,975

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

7

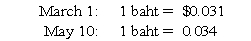

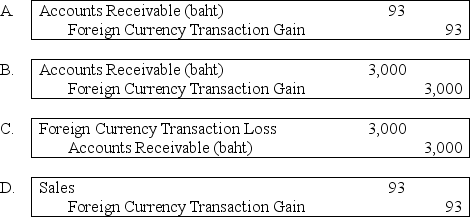

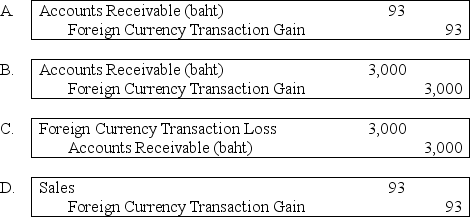

On March 1,20X8,Wilson Corporation sold goods for a U.S.dollar equivalent of $31,000 to a Thai company.The transaction is denominated in Thai baht.The payment is received on May 10.The exchange rates were:

What entry is required to revalue foreign currency payable to U.S.dollar equivalent value on May 10?

What entry is required to revalue foreign currency payable to U.S.dollar equivalent value on May 10?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

8

Upon arrival in Chile,Karen exchanged $1,000 of U.S.currency into 480,000 Chilean Pesos.While returning after her two month visit,she exchanged her remaining 50,000 Pesos into $100 of U.S.currency.What amount of gain or a loss did Karen experience on the 50,000 pesos she held during her visit and converted to U.S.dollars at the departure date?

A) Loss of $4.

B) Gain of $4.

C) Loss of $6.

D) No gain or loss.

A) Loss of $4.

B) Gain of $4.

C) Loss of $6.

D) No gain or loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

9

Mint Corporation has several transactions with foreign entities.Each transaction is denominated in the local currency unit of the country in which the foreign entity is located.On November 2,20X8,Mint sold confectionary items to a foreign company at a price of LCU 23,000 when the direct exchange rate was 1 LCU = $1.08.The account has not been settled as of December 31,20X8,when the exchange rate has increased to 1 LCU = $1.10.The foreign exchange gain or loss on Mint's records at year-end for this transaction will be:

A) $460 loss

B) $387 loss

C) $387 gain

D) $460 gain

A) $460 loss

B) $387 loss

C) $387 gain

D) $460 gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

10

Suppose the direct foreign exchange rates in U.S. dollars are as follows:

1 Swiss franc = $1.0371

1 Swedish krona = $0.1526

Based on the information given above,how many U.S.dollars must be paid for a purchase of goods costing 20,000 Swedish krona?

A) $131,062

B) $20,742

C) $19,285

D) $3.052

1 Swiss franc = $1.0371

1 Swedish krona = $0.1526

Based on the information given above,how many U.S.dollars must be paid for a purchase of goods costing 20,000 Swedish krona?

A) $131,062

B) $20,742

C) $19,285

D) $3.052

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

11

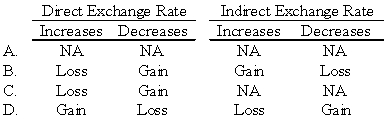

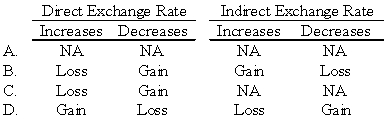

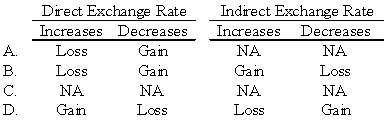

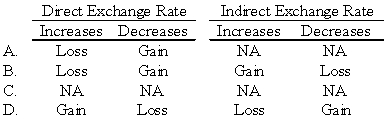

Chicago based Corporation X has a number of importing transactions with companies based in UK.Importing activities result in payables.If the settlement currency is the British Pound,which of the following will happen by changes in the direct or indirect exchange rates?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

12

Suppose the direct foreign exchange rates in U.S. dollars are:

1 Singapore dollar = $0.7025

1 Cyprus pound = $2.5132

Based on the information given above,the indirect exchange rates for the Singapore dollar and the Cyprus Pound (from a U.S.perspective)are:

A) 1.7655 Singapore dollars and 1.4235 Cyprus pounds respectively.

B) 0.2975 Singapore dollars and 1.5132 Cyprus pounds respectively.

C) 2.1622 Singapore dollars and 0.4625 Cyprus pounds respectively.

D) 1.4235 Singapore dollars and 0.3979 Cyprus pounds respectively.

1 Singapore dollar = $0.7025

1 Cyprus pound = $2.5132

Based on the information given above,the indirect exchange rates for the Singapore dollar and the Cyprus Pound (from a U.S.perspective)are:

A) 1.7655 Singapore dollars and 1.4235 Cyprus pounds respectively.

B) 0.2975 Singapore dollars and 1.5132 Cyprus pounds respectively.

C) 2.1622 Singapore dollars and 0.4625 Cyprus pounds respectively.

D) 1.4235 Singapore dollars and 0.3979 Cyprus pounds respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

13

Highland Company sold goods to an Egyptian company for 350,000 Egyptian pounds on December 6, 20X3, with payment due on January 15, 20X4. The exchange rates were as follows:

Based on the preceding information,which of the following is true of the dollar's movement vis-à-vis the Egyptian pound during the period?

Based on the preceding information,which of the following is true of the dollar's movement vis-à-vis the Egyptian pound during the period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

14

If 1 British pound can be exchanged for 180 cents of U.S.currency,what fraction should be used to compute the indirect quotation of the exchange rate expressed in British pounds?

A) 1/180

B) 1/.56

C) 1.8/1

D) 1/1.8

A) 1/180

B) 1/.56

C) 1.8/1

D) 1/1.8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

15

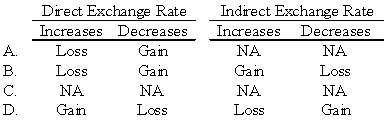

Corporation X has a number of exporting transactions with companies based in Vietnam.Exporting activities result in receivables.If the settlement currency is the US dollar,which of the following will happen by changes in the direct or indirect exchange rates?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

16

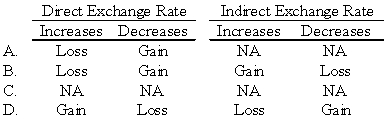

Chicago based Corporation X has a number of exporting transactions with companies based in Sweden.Exporting activities result in receivables.If the settlement currency is the Swedish Krona,which of the following will happen by changes in the direct or indirect exchange rates?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

17

Suppose the direct foreign exchange rates in U.S. dollars are as follows:

1 Swiss franc = $1.0371

1 Swedish krona = $0.1526

Based on the information given above,the indirect exchange rates for the Swiss franc and the Swedish krona (from a U.S.perspective)are

A) 0.9642 Swiss francs and 6.5531 Swedish krona respectively.

B) 1.6893 Swiss francs and 5.2563 Swedish krona respectively.

C) 1.0371 Swiss francs and 0.1527 Swedish krona respectively.

D) 0.8372 Swiss francs and 4.2713 Swedish krona respectively.

1 Swiss franc = $1.0371

1 Swedish krona = $0.1526

Based on the information given above,the indirect exchange rates for the Swiss franc and the Swedish krona (from a U.S.perspective)are

A) 0.9642 Swiss francs and 6.5531 Swedish krona respectively.

B) 1.6893 Swiss francs and 5.2563 Swedish krona respectively.

C) 1.0371 Swiss francs and 0.1527 Swedish krona respectively.

D) 0.8372 Swiss francs and 4.2713 Swedish krona respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

18

Heavy Company sold metal scrap to a Brazilian company for 200,000 Brazilian reals on December 1, 20X8, with payment due on January 20, 20X9. The exchange rates were:

Based on the preceding information,what is the Heavy's overall net gain or net loss from its foreign currency exposure related to this transaction?

A) $4,860 loss

B) $2,600 loss

C) $9,018 gain

D) $2,260 gain

Based on the preceding information,what is the Heavy's overall net gain or net loss from its foreign currency exposure related to this transaction?

A) $4,860 loss

B) $2,600 loss

C) $9,018 gain

D) $2,260 gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

19

Mint Corporation has several transactions with foreign entities.Each transaction is denominated in the local currency unit of the country in which the foreign entity is located.On October 1,20X8,Mint purchased confectionary items from a foreign company at a price of LCU 5,000 when the direct exchange rate was 1 LCU = $1.20.The account has not been settled as of December 31,20X8,when the exchange rate has decreased to 1 LCU = $1.10.The foreign exchange gain or loss on Mint's records at year-end for this transaction will be:

A) $500 loss

B) $500 gain

C) $378 gain

D) $5,500 loss

A) $500 loss

B) $500 gain

C) $378 gain

D) $5,500 loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

20

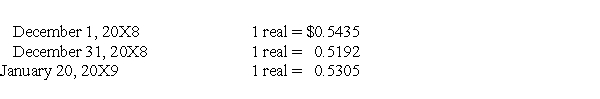

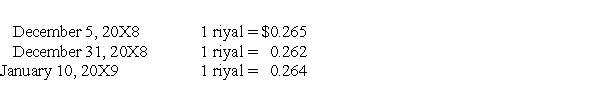

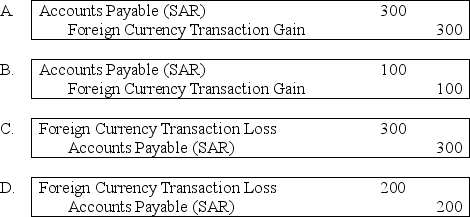

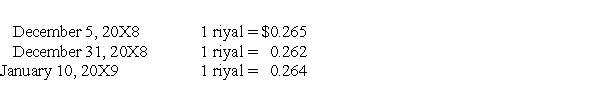

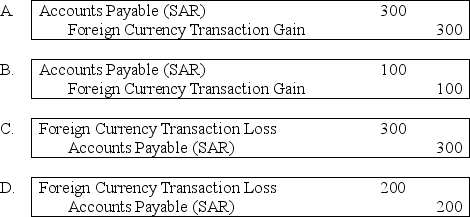

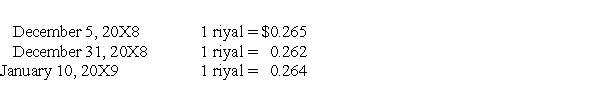

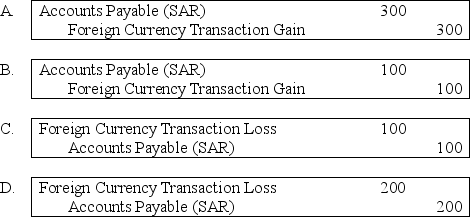

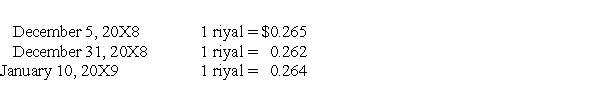

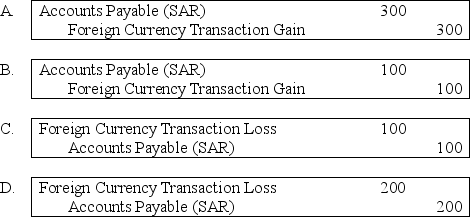

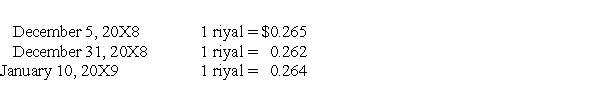

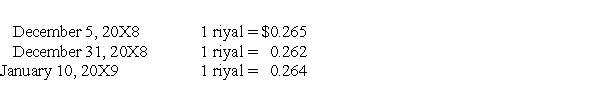

On December 5, 20X8, Texas based Imperial Corporation purchased goods from a Saudi Arabian firm for 100,000 riyals (SAR), to be paid on January 10, 20X9. The transaction is denominated in Saudi riyals. Imperial's fiscal year ends on December 31, and its reporting currency is the U.S. dollar. The exchange rates are:

Based on the preceding information,what journal entry would Imperial make on December 31,20X8,to revalue foreign currency payable to equivalent U.S.dollar value?

Based on the preceding information,what journal entry would Imperial make on December 31,20X8,to revalue foreign currency payable to equivalent U.S.dollar value?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

21

On December 5, 20X8, Texas based Imperial Corporation purchased goods from a Saudi Arabian firm for 100,000 riyals (SAR), to be paid on January 10, 20X9. The transaction is denominated in Saudi riyals. Imperial's fiscal year ends on December 31, and its reporting currency is the U.S. dollar. The exchange rates are:

Based on the preceding information,what journal entry would Imperial make on January 10,20X9,to revalue foreign currency payable to equivalent U.S.dollar value?

Based on the preceding information,what journal entry would Imperial make on January 10,20X9,to revalue foreign currency payable to equivalent U.S.dollar value?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

22

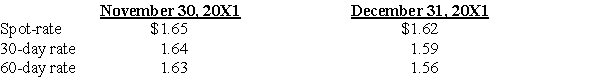

Hunt Co.purchased merchandise for 300,000 British pounds from a vendor in London on November 30,20X1.Payment in British pounds was due on January 30,20X2.The exchange rates to purchase one pound were as follows:

In its December 31,Year One,income statement,what amount should Hunt report as foreign exchange gain?

A) $9,000

B) $12,000

C) $6,000

D) $0

In its December 31,Year One,income statement,what amount should Hunt report as foreign exchange gain?

A) $9,000

B) $12,000

C) $6,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

23

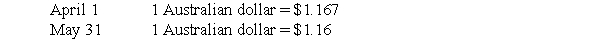

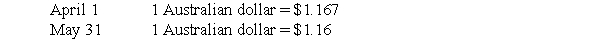

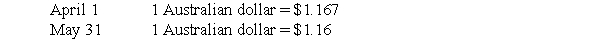

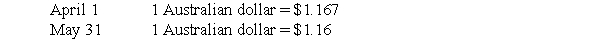

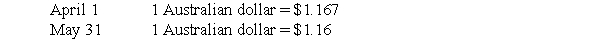

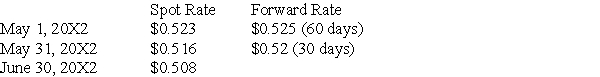

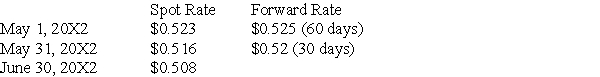

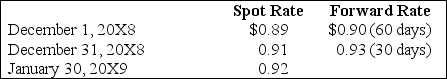

Robert Company sold inventory to an Australian company for 50,000 Australian dollars on April 1, 20X0 with settlement to be in 60 days. On the same date, Robert entered into a 60-day forward contract to sell 50,000 Australian dollars at a forward rate of $1.164 in order to manage its exposed foreign currency receivable. The forward contract is not designated as a hedge. The spot rates were as follows:

Based on the preceding information,what is the overall effect on net income of Robert's use of the forward exchange contract?

A) No effect

B) Net loss of $150

C) Net loss of $200

D) Net gain of $350

Based on the preceding information,what is the overall effect on net income of Robert's use of the forward exchange contract?

A) No effect

B) Net loss of $150

C) Net loss of $200

D) Net gain of $350

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

24

Company X denominated a December 1,20X9,purchase of goods in a currency other than its functional currency.The transaction resulted in a payable fixed in terms of the amount of foreign currency,and was paid on the settlement date,January 10,2010.Exchange rates moved unfavorably at December 31,20X9,resulting in a loss that should:

A) be included as a separate component of stockholders' equity at Dec. 31, 20X9.

B) be included as a component of income from continuing operations for 20X9.

C) be included as a deferred charge at December 31, 20X9.

D) not be reported until January 10, 2010, the settlement date.

A) be included as a separate component of stockholders' equity at Dec. 31, 20X9.

B) be included as a component of income from continuing operations for 20X9.

C) be included as a deferred charge at December 31, 20X9.

D) not be reported until January 10, 2010, the settlement date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

25

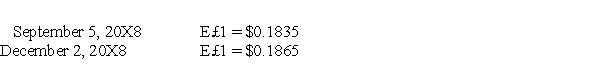

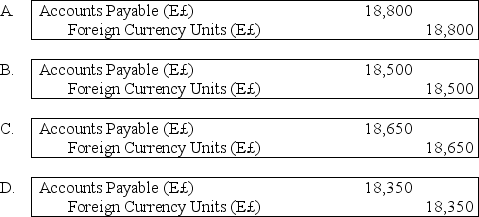

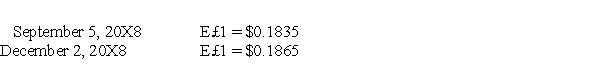

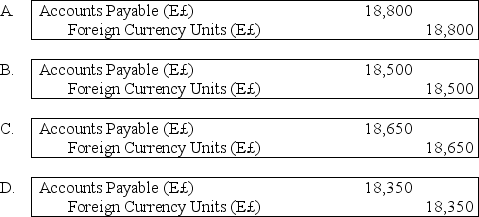

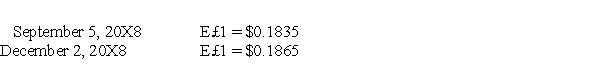

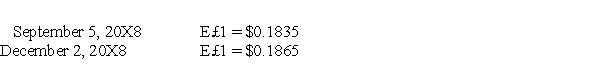

Spartan Company purchased interior decoration material from Egypt for 100,000 Egyptian pounds on September 5, 20X8, with payment due on December 2, 20X8. Additionally, on September 5, Spartan acquired a 90-day forward contract to purchase 100,000 Egyptian pounds of E£ = $.1850. The forward contract was acquired to manage the exposed net liability position in Egyptian pounds, but it was not designated as a hedge. The spot rates were:

Based on the preceding information,what is the entry required to settle foreign currency payable on December 2?

Based on the preceding information,what is the entry required to settle foreign currency payable on December 2?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

26

On December 5, 20X8, Texas based Imperial Corporation purchased goods from a Saudi Arabian firm for 100,000 riyals (SAR), to be paid on January 10, 20X9. The transaction is denominated in Saudi riyals. Imperial's fiscal year ends on December 31, and its reporting currency is the U.S. dollar. The exchange rates are:

Based on the preceding information,what was the overall foreign currency gain or loss on the accounts payable transaction?

A) $300 loss

B) $200 loss

C) $100 gain

D) $200 gain

Based on the preceding information,what was the overall foreign currency gain or loss on the accounts payable transaction?

A) $300 loss

B) $200 loss

C) $100 gain

D) $200 gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

27

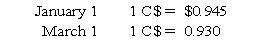

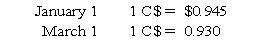

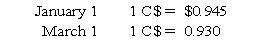

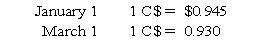

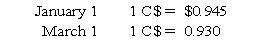

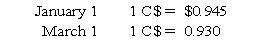

Myway Company sold equipment to a Canadian company for 100,000 Canadian dollars (C$) on January 1, 20X9 with settlement to be in 60 days. On the same date, Myway entered into a 60-day forward contract to sell 100,000 Canadian dollars at a forward rate of 1 C$ = $.94 in order to manage its exposed foreign currency receivable. The forward contract is not designated as a hedge. The spot rates were:

Based on the preceding information,had Myway not used the forward exchange contract,net income for the year would have:

A) increased by $1,000.

B) increased by $500.

C) decreased by $1,000.

D) decreased by $1,500.

Based on the preceding information,had Myway not used the forward exchange contract,net income for the year would have:

A) increased by $1,000.

B) increased by $500.

C) decreased by $1,000.

D) decreased by $1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

28

Detroit based Auto Corporation,purchased ancillaries from a Japanese firm on December 1,20X8,for 1,000,000 Yen,when the spot rate for Yen was $.0095.On December 31,20X8,the spot rate stood at $.0096.On January 10,20X9 Auto paid 1,000,000 Yen acquired at a rate of $.0094.Auto's income statements should report a foreign exchange gain or loss for the years ended December 31,20X8 and 20X9 of:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

29

Robert Company sold inventory to an Australian company for 50,000 Australian dollars on April 1, 20X0 with settlement to be in 60 days. On the same date, Robert entered into a 60-day forward contract to sell 50,000 Australian dollars at a forward rate of $1.164 in order to manage its exposed foreign currency receivable. The forward contract is not designated as a hedge. The spot rates were as follows:

Based on the preceding information,the entry to revalue the foreign currency payable to current U.S.dollar value on May 31 will include a

A) credit to Foreign Currency Transaction Gain for $350.

B) credit to Foreign Currency Transaction Gain for $200.

C) debit to Foreign Currency Transaction Loss for $550.

D) debit to Foreign Currency Transaction Loss for $350.

Based on the preceding information,the entry to revalue the foreign currency payable to current U.S.dollar value on May 31 will include a

A) credit to Foreign Currency Transaction Gain for $350.

B) credit to Foreign Currency Transaction Gain for $200.

C) debit to Foreign Currency Transaction Loss for $550.

D) debit to Foreign Currency Transaction Loss for $350.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

30

Myway Company sold equipment to a Canadian company for 100,000 Canadian dollars (C$) on January 1, 20X9 with settlement to be in 60 days. On the same date, Myway entered into a 60-day forward contract to sell 100,000 Canadian dollars at a forward rate of 1 C$ = $.94 in order to manage its exposed foreign currency receivable. The forward contract is not designated as a hedge. The spot rates were:

Based on the preceding information,what is the overall effect on net income of Myway's use of the forward exchange contract?

A) Net loss of $1,000

B) Net gain of $1,500

C) Net loss of $500

D) No effect

Based on the preceding information,what is the overall effect on net income of Myway's use of the forward exchange contract?

A) Net loss of $1,000

B) Net gain of $1,500

C) Net loss of $500

D) No effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

31

Robert Company sold inventory to an Australian company for 50,000 Australian dollars on April 1, 20X0 with settlement to be in 60 days. On the same date, Robert entered into a 60-day forward contract to sell 50,000 Australian dollars at a forward rate of $1.164 in order to manage its exposed foreign currency receivable. The forward contract is not designated as a hedge. The spot rates were as follows:

Based on the preceding information,had Robert not used the forward exchange contract,what would have been the foreign currency transaction gain or loss for the year?

A) Gain of $200

B) Gain of $150

C) Loss of $350

D) Loss of $200

Based on the preceding information,had Robert not used the forward exchange contract,what would have been the foreign currency transaction gain or loss for the year?

A) Gain of $200

B) Gain of $150

C) Loss of $350

D) Loss of $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

32

On September 1,20X1,Bain Corp.received an order for equipment from a foreign customer for 300,000 local currency units (LCU)when the U.S.dollar equivalent was $96,000.Bain shipped the equipment on October 15,20X1,and billed the customer for 300,000 LCU when the U.S.dollar equivalent was $100,000.Bain received the customer's remittance in full on November 16,20X1,and sold the 300,000 LCU for $105,000.In its income statement for the year ended December 31,20X1,Bain should report a foreign exchange gain of

A) $9,000

B) $4,000

C) $0

D) $5,000

A) $9,000

B) $4,000

C) $0

D) $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

33

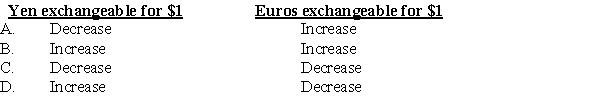

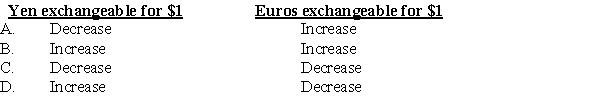

Sphinx Co.(Sphinx)records its transactions in U.S.dollars.A sale of goods resulted in a receivable denominated in Japanese yen,and a purchase of goods resulted in a payable denominated in Euros.Sphinx recorded a foreign exchange transaction gain on collection of the receivable and an exchange transaction loss on the settlement of the payable.The exchange rates are expressed as so many units of foreign currency to one dollar.Did the number of foreign currency units exchangeable for a dollar increase or decrease between the contract and settlement dates?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

34

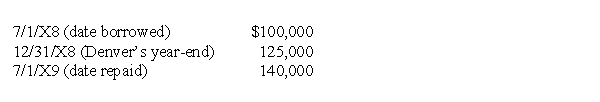

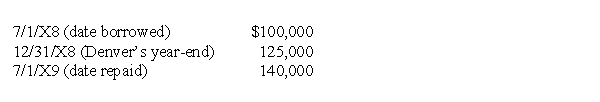

On November 1,20X8,Denver Company borrowed 500,000 local currency units (LCU)from a foreign lender evidenced by an interest-bearing note due on November 1,20X9,which is denominated in the currency of the lender.The U.S.dollar equivalent of the note principal was as follows:  In its income statement for 20X9,what amount should Denver include as a foreign exchange gain or loss on the note principal?

In its income statement for 20X9,what amount should Denver include as a foreign exchange gain or loss on the note principal?

A) 15,000 gain

B) 25,000 gain

C) 15,000 loss

D) 40,000 loss

In its income statement for 20X9,what amount should Denver include as a foreign exchange gain or loss on the note principal?

In its income statement for 20X9,what amount should Denver include as a foreign exchange gain or loss on the note principal?A) 15,000 gain

B) 25,000 gain

C) 15,000 loss

D) 40,000 loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

35

Spartan Company purchased interior decoration material from Egypt for 100,000 Egyptian pounds on September 5, 20X8, with payment due on December 2, 20X8. Additionally, on September 5, Spartan acquired a 90-day forward contract to purchase 100,000 Egyptian pounds of E£ = $.1850. The forward contract was acquired to manage the exposed net liability position in Egyptian pounds, but it was not designated as a hedge. The spot rates were:

Based on the preceding information,in the entry made on December 2nd to revalue foreign currency receivable to current equivalent U.S.dollar value,

A) Accounts Payable will be debited for $18,350.

B) Foreign Currency Units will be debited for $18,500.

C) Foreign Currency Transaction Gain will be credited for $150.

D) Other Comprehensive Income will be credited for $300.

Based on the preceding information,in the entry made on December 2nd to revalue foreign currency receivable to current equivalent U.S.dollar value,

A) Accounts Payable will be debited for $18,350.

B) Foreign Currency Units will be debited for $18,500.

C) Foreign Currency Transaction Gain will be credited for $150.

D) Other Comprehensive Income will be credited for $300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

36

On November 6,20X7,Zucor Corp.purchased merchandise from an unaffiliated foreign company for 50,000 units of the foreign company's local currency.On that date,the spot rate was $1.259.Zucor paid the bill in full three months later when the spot rate was $1.258.The spot rate was $1.255 on December 31,20X7.What amount should Zucor report as a foreign currency transaction gain in its income statement for the year ended December 31,20X7?

A) $0

B) $50

C) $150

D) $200

A) $0

B) $50

C) $150

D) $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

37

Taste Bits Inc. purchased chocolates from Switzerland for 200,000 Swiss francs (SFr) on December 1, 20X8. Payment is due on January 30, 20X9. On December 1, 20X8, the company also entered into a 60-day forward contract to purchase 100,000 Swiss francs. The forward contract is not designated as a hedge. The rates were as follows:

Based on the preceding information,the entries on December 31,20X8,include a:

A) Credit to Foreign Currency Payable to Exchange Broker, $4,000.

B) Debit to Foreign Currency Receivable from Exchange Broker, $6,000.

C) Debit to Foreign Currency Receivable from Exchange Broker, $186,000.

D) Debit to Foreign Currency Transaction Gain, $4,000.

Based on the preceding information,the entries on December 31,20X8,include a:

A) Credit to Foreign Currency Payable to Exchange Broker, $4,000.

B) Debit to Foreign Currency Receivable from Exchange Broker, $6,000.

C) Debit to Foreign Currency Receivable from Exchange Broker, $186,000.

D) Debit to Foreign Currency Transaction Gain, $4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

38

On September 22,20X1,Yumi Corp.purchased merchandise from an unaffiliated foreign company for 10,000 units of the foreign company's local currency.On that date,the spot rate was $.55.Yumi paid the bill in full,six months later,on March 20,20X2,when the spot rate was $.65.The spot rate was $.70 on December 31,20X1.What amount should Yumi report as a foreign currency transaction loss in its income statement for the year ended December 31,20X1?

A) $500

B) $0

C) $1,500

D) $1,000

A) $500

B) $0

C) $1,500

D) $1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

39

Myway Company sold equipment to a Canadian company for 100,000 Canadian dollars (C$) on January 1, 20X9 with settlement to be in 60 days. On the same date, Myway entered into a 60-day forward contract to sell 100,000 Canadian dollars at a forward rate of 1 C$ = $.94 in order to manage its exposed foreign currency receivable. The forward contract is not designated as a hedge. The spot rates were:

Based on the preceding information,the entry to revalue foreign currency payable to current U.S.dollar value on March 1 will have:

A) a credit to Foreign Currency Transaction Gain for $1,500.

B) a debit to Foreign Currency Transaction Loss for $2,500.

C) a debit to Foreign Currency Transaction Loss for $1,500.

D) a credit to Foreign Currency Transaction Gain for $1,000.

Based on the preceding information,the entry to revalue foreign currency payable to current U.S.dollar value on March 1 will have:

A) a credit to Foreign Currency Transaction Gain for $1,500.

B) a debit to Foreign Currency Transaction Loss for $2,500.

C) a debit to Foreign Currency Transaction Loss for $1,500.

D) a credit to Foreign Currency Transaction Gain for $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

40

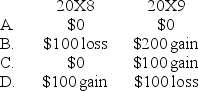

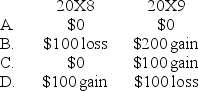

Levin company entered into a forward contract to speculate in the foreign currency.It sold 100,000 foreign currency units under a contract dated November 1,20X8,for delivery on January 31,20X9:  In its income statement for the year ended December 31,20X8,what amount of loss should Levin report from this forward contract?

In its income statement for the year ended December 31,20X8,what amount of loss should Levin report from this forward contract?

A) $0

B) $300

C) $200

D) $100

In its income statement for the year ended December 31,20X8,what amount of loss should Levin report from this forward contract?

In its income statement for the year ended December 31,20X8,what amount of loss should Levin report from this forward contract?A) $0

B) $300

C) $200

D) $100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

41

On September 1,20X1,Brady Corp.entered into a foreign exchange contract for speculative purposes by purchasing 50,000 deutsche marks for delivery in 60 days.The rates to exchange $1 for 1 deutsche mark follow:

In its September 30,20X1 income statement,what amount should Brady report as foreign exchange loss?

A) $1,000

B) $2,500

C) $1,500

D) $500

In its September 30,20X1 income statement,what amount should Brady report as foreign exchange loss?

A) $1,000

B) $2,500

C) $1,500

D) $500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

42

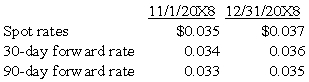

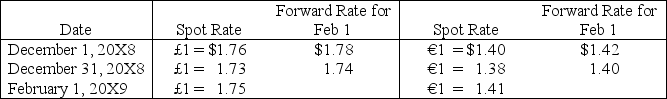

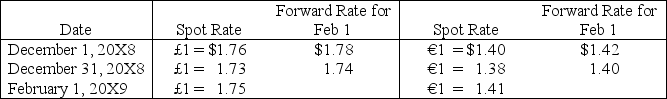

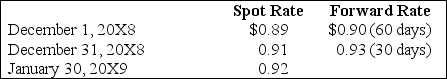

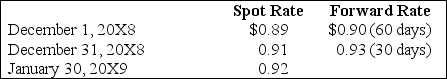

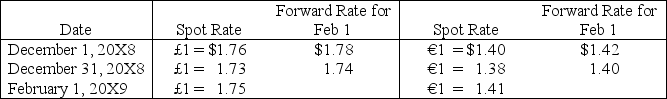

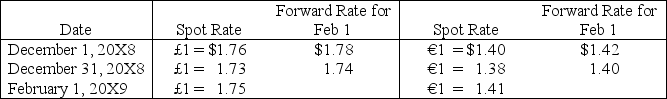

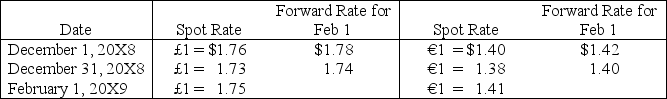

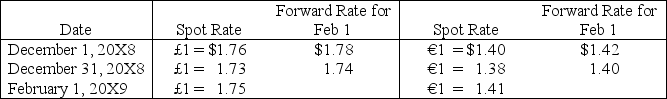

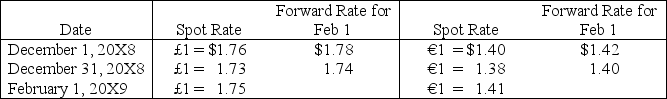

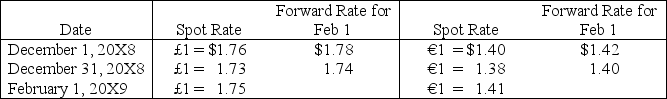

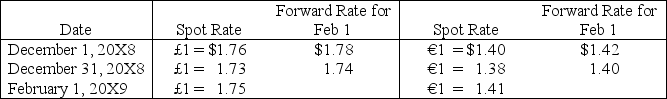

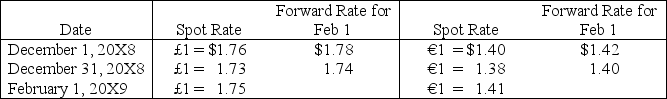

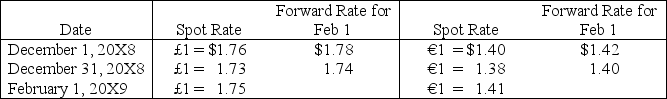

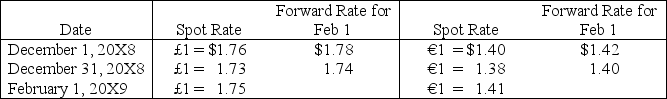

On December 1, 20X8, Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78. On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Based on the preceding information,what is the net gain or loss on the euro speculative contract?

A) $8,000 gain

B) $6,000 gain

C) $3,000 loss

D) $1,000 loss

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.Based on the preceding information,what is the net gain or loss on the euro speculative contract?

A) $8,000 gain

B) $6,000 gain

C) $3,000 loss

D) $1,000 loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

43

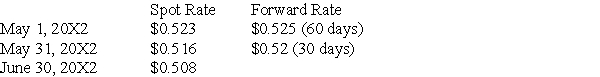

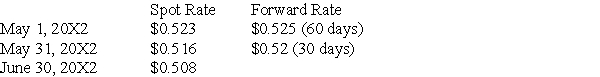

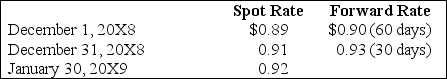

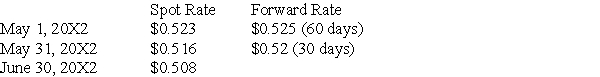

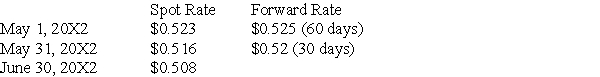

Tinitoys, Inc., a domestic company, purchased inventory from a Brazilian company for 500,000 Brazilian reals (Br. reals) on May 1, 20X2. Payment is due on June 30, 20X2. On May 1, 20X2, Tinitoys also entered into a 60-day forward contract to purchase 500,000 Brazilian reals. The forward contract is not designated as a hedge. Tinitoys' fiscal year ends on May 31. The direct exchange rates were as follows:

Based on the preceding information,the entries on May 31,20X2,include a

A) credit to Foreign Currency Payable to Exchange Broker, $3,500.

B) debit to Foreign Currency Transaction Loss, $3,500.

C) credit to Foreign Currency Receivable from Exchange Broker, $2,500.

D) credit to Foreign Currency Receivable from Exchange Broker, $260,000.

Based on the preceding information,the entries on May 31,20X2,include a

A) credit to Foreign Currency Payable to Exchange Broker, $3,500.

B) debit to Foreign Currency Transaction Loss, $3,500.

C) credit to Foreign Currency Receivable from Exchange Broker, $2,500.

D) credit to Foreign Currency Receivable from Exchange Broker, $260,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

44

Taste Bits Inc. purchased chocolates from Switzerland for 200,000 Swiss francs (SFr) on December 1, 20X8. Payment is due on January 30, 20X9. On December 1, 20X8, the company also entered into a 60-day forward contract to purchase 100,000 Swiss francs. The forward contract is not designated as a hedge. The rates were as follows:

Based on the preceding information,the entries on January 30,20X9,include a:

A) Debit to Dollars Payable to Exchange Broker, $180,000.

B) Credit to Cash, $184,000.

C) Credit to Premium on Forward Contract, $4,000.

D) Credit to Foreign Currency Receivable from Exchange Broker, $180,000.

Based on the preceding information,the entries on January 30,20X9,include a:

A) Debit to Dollars Payable to Exchange Broker, $180,000.

B) Credit to Cash, $184,000.

C) Credit to Premium on Forward Contract, $4,000.

D) Credit to Foreign Currency Receivable from Exchange Broker, $180,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

45

All of the following are management tools available for a U.S.company to hedge its net investment in a foreign affiliate except for:

A) Forward exchange contracts

B) Foreign currency commitments

C) Intercompany financing arrangements including intercompany transactions

D) None of the above.

A) Forward exchange contracts

B) Foreign currency commitments

C) Intercompany financing arrangements including intercompany transactions

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following observations is true of forward contracts?

A) Substantial margin is required to initiate a contract.

B) Must be completed either with the underlying's future delivery or net cash settlement.

C) Cannot be customized; for a specific amount at a specific date.

D) Usually settled with a net cash amount prior to maturity date.

A) Substantial margin is required to initiate a contract.

B) Must be completed either with the underlying's future delivery or net cash settlement.

C) Cannot be customized; for a specific amount at a specific date.

D) Usually settled with a net cash amount prior to maturity date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

47

On December 1, 20X8, Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78. On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Based on the preceding information,what is the effect of the British pound speculative contract on 20X8 net income?

A) $10,000 gain

B) $6,000 gain

C) $8,000 gain

D) $2,000 loss

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.Based on the preceding information,what is the effect of the British pound speculative contract on 20X8 net income?

A) $10,000 gain

B) $6,000 gain

C) $8,000 gain

D) $2,000 loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

48

Tinitoys, Inc., a domestic company, purchased inventory from a Brazilian company for 500,000 Brazilian reals (Br. reals) on May 1, 20X2. Payment is due on June 30, 20X2. On May 1, 20X2, Tinitoys also entered into a 60-day forward contract to purchase 500,000 Brazilian reals. The forward contract is not designated as a hedge. Tinitoys' fiscal year ends on May 31. The direct exchange rates were as follows:

Based on the preceding information,the entries on June 30,20X2,include a

A) debit to Dollars Payable to Exchange Broker, $262,500.

B) credit to Cash, $254,000.

C) credit to Premium on Forward Contract, $6,000.

D) credit to Foreign Currency Receivable from Exchange Broker, $262,500.

Based on the preceding information,the entries on June 30,20X2,include a

A) debit to Dollars Payable to Exchange Broker, $262,500.

B) credit to Cash, $254,000.

C) credit to Premium on Forward Contract, $6,000.

D) credit to Foreign Currency Receivable from Exchange Broker, $262,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

49

On December 1, 20X8, Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78. On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Based on the preceding information,what is the net gain or loss on the British pound speculative contract?

A) $8,000 gain

B) $6,000 gain

C) $3,000 loss

D) $10,000 gain

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.Based on the preceding information,what is the net gain or loss on the British pound speculative contract?

A) $8,000 gain

B) $6,000 gain

C) $3,000 loss

D) $10,000 gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

50

All of the following are true statements when measuring hedge effectiveness except:

A) Effectiveness means there is an approximate offset with the range of 80% to 125% of the changes in the fair value of the cash flows

B) Effectiveness means there is an approximate offset in fair value to the risk being hedged.

C) A Company may elect to choose from several different measures for assessing hedge effectiveness.

D) Effectiveness must be assessed at least annually when the company reports their annual financial statements.

A) Effectiveness means there is an approximate offset with the range of 80% to 125% of the changes in the fair value of the cash flows

B) Effectiveness means there is an approximate offset in fair value to the risk being hedged.

C) A Company may elect to choose from several different measures for assessing hedge effectiveness.

D) Effectiveness must be assessed at least annually when the company reports their annual financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

51

Taste Bits Inc. purchased chocolates from Switzerland for 200,000 Swiss francs (SFr) on December 1, 20X8. Payment is due on January 30, 20X9. On December 1, 20X8, the company also entered into a 60-day forward contract to purchase 100,000 Swiss francs. The forward contract is not designated as a hedge. The rates were as follows:

Based on the preceding information,the entries on January 30,20X9,include a:

A) Credit to Foreign Currency Units (SFr), $184,000.

B) Credit to Cash, $180,000.

C) Debit to Foreign Currency Transaction Loss, $4,000.

D) Debit to Dollars Payable to Exchange Broker, $184,000.

Based on the preceding information,the entries on January 30,20X9,include a:

A) Credit to Foreign Currency Units (SFr), $184,000.

B) Credit to Cash, $180,000.

C) Debit to Foreign Currency Transaction Loss, $4,000.

D) Debit to Dollars Payable to Exchange Broker, $184,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

52

Taste Bits Inc. purchased chocolates from Switzerland for 200,000 Swiss francs (SFr) on December 1, 20X8. Payment is due on January 30, 20X9. On December 1, 20X8, the company also entered into a 60-day forward contract to purchase 100,000 Swiss francs. The forward contract is not designated as a hedge. The rates were as follows:

Based on the preceding information,the entries on January 30,20X9,include a:

A) Debit to Dollars Payable to Exchange Broker, $184,000.

B) Credit to Foreign Currency Transaction Gain, $4,000.

C) Credit to Foreign Currency Receivable from Exchange Broker, $180,000.

D) Debit to Foreign Currency Units (SFr), $184,000.

Based on the preceding information,the entries on January 30,20X9,include a:

A) Debit to Dollars Payable to Exchange Broker, $184,000.

B) Credit to Foreign Currency Transaction Gain, $4,000.

C) Credit to Foreign Currency Receivable from Exchange Broker, $180,000.

D) Debit to Foreign Currency Units (SFr), $184,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

53

On December 1, 20X8, Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78. On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Based on the preceding information,what is the overall effect of speculation on 20X8 net income?

A) $4,000 gain

B) $6,000 gain

C) $8,000 loss

D) $8,000 gain

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.Based on the preceding information,what is the overall effect of speculation on 20X8 net income?

A) $4,000 gain

B) $6,000 gain

C) $8,000 loss

D) $8,000 gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

54

Tinitoys, Inc., a domestic company, purchased inventory from a Brazilian company for 500,000 Brazilian reals (Br. reals) on May 1, 20X2. Payment is due on June 30, 20X2. On May 1, 20X2, Tinitoys also entered into a 60-day forward contract to purchase 500,000 Brazilian reals. The forward contract is not designated as a hedge. Tinitoys' fiscal year ends on May 31. The direct exchange rates were as follows:

Based on the preceding information,the entries on June 30,20X2,include a

A) credit to Foreign Currency Transaction Gain, $6,000.B. debit to Dollars Payable to Exchange Broker, $254,000.

C) debit to Foreign Currency Units (Br. reals), $254,000.

D) credit to Foreign Currency Receivable from Exchange Broker, $262,500.

Based on the preceding information,the entries on June 30,20X2,include a

A) credit to Foreign Currency Transaction Gain, $6,000.B. debit to Dollars Payable to Exchange Broker, $254,000.

C) debit to Foreign Currency Units (Br. reals), $254,000.

D) credit to Foreign Currency Receivable from Exchange Broker, $262,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

55

On December 1, 20X8, Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78. On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Based on the preceding information,what is the effect of the euro speculative contract on 20X9 net income?

A) $4,000 loss

B) $1,000 gain

C) $8,000 gain

D) $2,000 loss

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.Based on the preceding information,what is the effect of the euro speculative contract on 20X9 net income?

A) $4,000 loss

B) $1,000 gain

C) $8,000 gain

D) $2,000 loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

56

Tinitoys, Inc., a domestic company, purchased inventory from a Brazilian company for 500,000 Brazilian reals (Br. reals) on May 1, 20X2. Payment is due on June 30, 20X2. On May 1, 20X2, Tinitoys also entered into a 60-day forward contract to purchase 500,000 Brazilian reals. The forward contract is not designated as a hedge. Tinitoys' fiscal year ends on May 31. The direct exchange rates were as follows:

Based on the preceding information,the entries on June 30,20X2,include a

A) debit to Foreign Currency Transaction Loss, $4,000

B) credit to Foreign Currency Units (Br. reals), $262,500

C) credit to Cash, $262,500.

D) debit to Dollars Payable to Exchange Broker, $254,000

Based on the preceding information,the entries on June 30,20X2,include a

A) debit to Foreign Currency Transaction Loss, $4,000

B) credit to Foreign Currency Units (Br. reals), $262,500

C) credit to Cash, $262,500.

D) debit to Dollars Payable to Exchange Broker, $254,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

57

On December 1, 20X8, Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78. On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Based on the preceding information,what is the overall effect of speculation on 20X9 net income?

A) $1,000 loss

B) $6,000 gain

C) $3,000 loss

D) $8,000 gain

The rates are as follows:

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.

Hedge had no other speculation transactions in 20X8 and 20X9. Ignore taxes.Based on the preceding information,what is the overall effect of speculation on 20X9 net income?

A) $1,000 loss

B) $6,000 gain

C) $3,000 loss

D) $8,000 gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

58

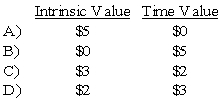

The fair market value of a near-month call option with a strike price of $45 is $5, when the stock is trading at $48.

Based on the preceding information,which of the following is true of the intrinsic and time values associated with this option.

A) Option A

B) Option B

C) Option C

D) Option D

Based on the preceding information,which of the following is true of the intrinsic and time values associated with this option.

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

59

An investor purchases a put option with a strike price of $100 for $3.This option is considered "in the money" if the underlying is trading:

A) below $100.

B) at $100.

C) above $100.

D) above $103.

A) below $100.

B) at $100.

C) above $100.

D) above $103.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

60

The fair market value of a near-month call option with a strike price of $45 is $5, when the stock is trading at $48.

Based on the preceding information,the call option:

A) has no intrinsic value currently.

B) is at the money.

C) is out of the money.

D) is in the money.

Based on the preceding information,the call option:

A) has no intrinsic value currently.

B) is at the money.

C) is out of the money.

D) is in the money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

61

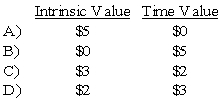

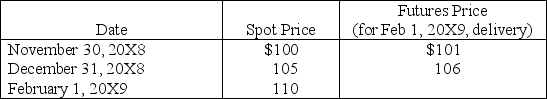

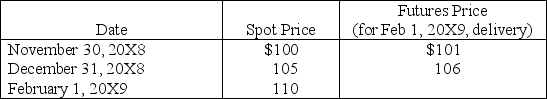

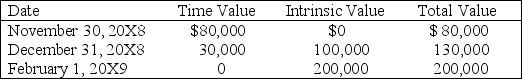

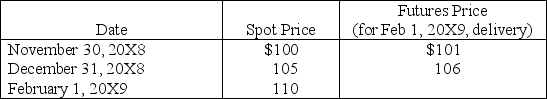

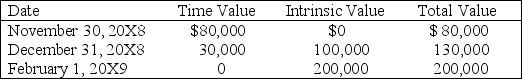

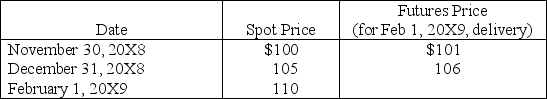

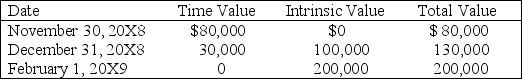

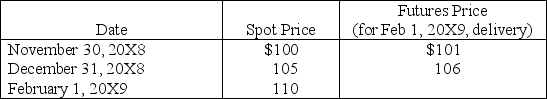

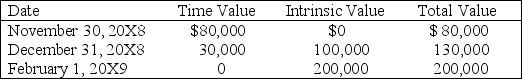

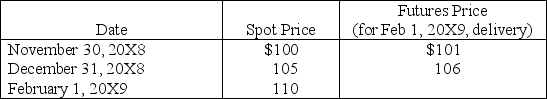

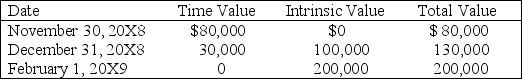

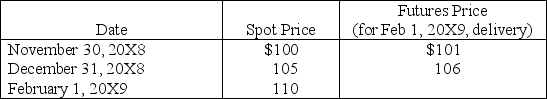

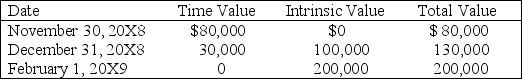

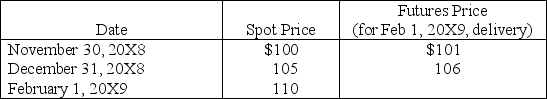

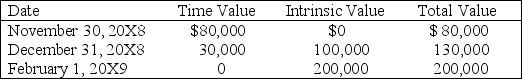

Spiralling crude oil prices prompted AMAR Company to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 20X8, AMAR purchases call options for 20,000 barrels of oil at $100 per barrel at a premium of $4 per barrel, with a February 1, 20X9, call date. The following is the pricing information for the term of the call:

The information for the change in the fair value of the options follows:

The information for the change in the fair value of the options follows:

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

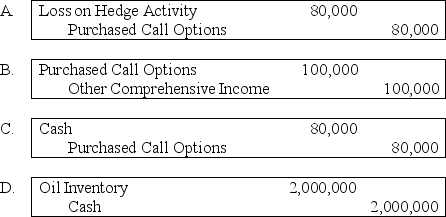

Based on the preceding information,which of the following entries will be required on February 1,20X9?

The information for the change in the fair value of the options follows:

The information for the change in the fair value of the options follows: On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.Based on the preceding information,which of the following entries will be required on February 1,20X9?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

62

Spiralling crude oil prices prompted AMAR Company to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 20X8, AMAR purchases call options for 20,000 barrels of oil at $100 per barrel at a premium of $4 per barrel, with a February 1, 20X9, call date. The following is the pricing information for the term of the call:

The information for the change in the fair value of the options follows:

The information for the change in the fair value of the options follows:

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

Based on the preceding information,the entries made on April 1,20X9 will include:

A) a debit to Other Comprehensive Income for $200,000.

B) a debit to Cost of Goods Sold for $2,240,000.

C) a credit to Oil Inventory for $2,240,000.

D) a credit to Cost of Goods Sold for $100,000.

The information for the change in the fair value of the options follows:

The information for the change in the fair value of the options follows: On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.Based on the preceding information,the entries made on April 1,20X9 will include:

A) a debit to Other Comprehensive Income for $200,000.

B) a debit to Cost of Goods Sold for $2,240,000.

C) a credit to Oil Inventory for $2,240,000.

D) a credit to Cost of Goods Sold for $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

63

Company X issues variable-rate debt but wishes to fix its interest rates because it believes the variable rate may increase.Company Y has a fixed-rate bond but is looking for a variable-rate interest because it assumes the interest rates may decrease.The two companies agree to exchange cash flows.Such an arrangement is called:

A) a futures contract.

B) a forward contract.

C) a swap.

D) an option.

A) a futures contract.

B) a forward contract.

C) a swap.

D) an option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

64

Spiralling crude oil prices prompted AMAR Company to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 20X8, AMAR purchases call options for 20,000 barrels of oil at $100 per barrel at a premium of $4 per barrel, with a February 1, 20X9, call date. The following is the pricing information for the term of the call:

The information for the change in the fair value of the options follows:

The information for the change in the fair value of the options follows:

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

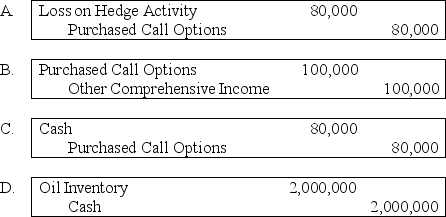

Based on the preceding information,which of the following adjusting entries would be required on December 31,20X8?

The information for the change in the fair value of the options follows:

The information for the change in the fair value of the options follows: On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.Based on the preceding information,which of the following adjusting entries would be required on December 31,20X8?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

65

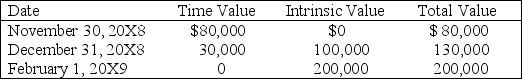

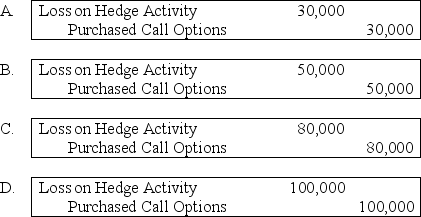

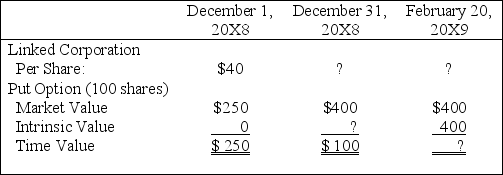

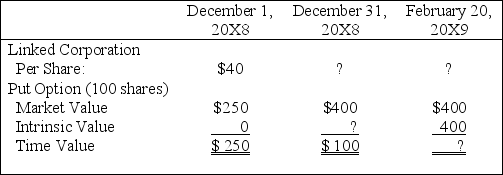

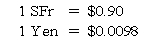

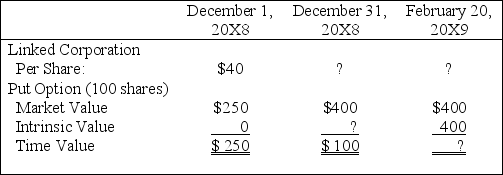

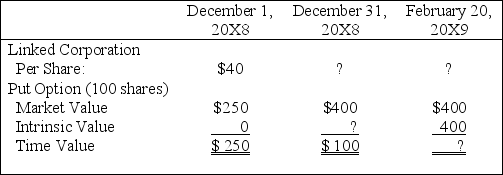

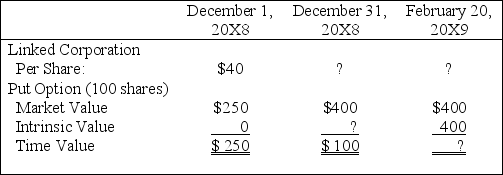

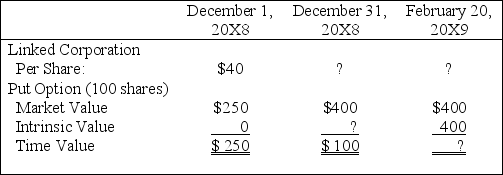

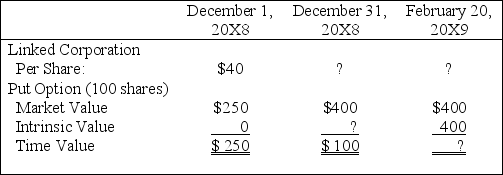

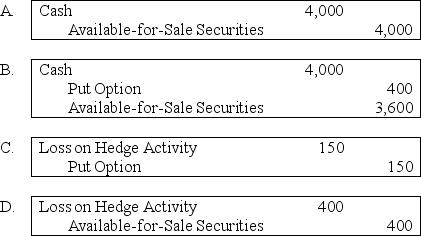

On December 1, 20X8, Winston Corporation acquired 100 shares of Linked Corporation at a cost of $40 per share. Winston classifies them as available-for-sale securities. On this same date, it decides to hedge against a possible decline in the value of the securities by purchasing, at a cost of $250, an at-the-money put option to sell the 100 shares at $40 per share. The option expires on February 20, 20X9. Selected information concerning the fair values of the investment and the options follow:

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Based on the preceding information,what is the market price of Linked Corporation stock on December 31,20X8?

A) $40

B) $37

C) $36

D) $38

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.Based on the preceding information,what is the market price of Linked Corporation stock on December 31,20X8?

A) $40

B) $37

C) $36

D) $38

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

66

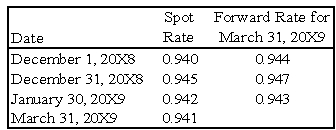

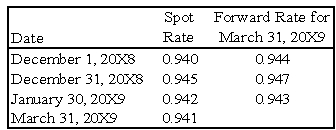

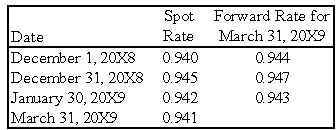

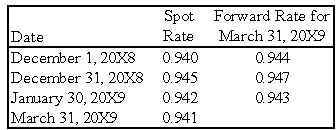

On December 1,20X8,Denizen Corporation entered into a 120-day forward contract to purchase 200,000 Canadian dollars (C$).Denizen's fiscal year ends on December 31.The forward contract was to hedge an anticipated purchase of electronic goods on January 30,20X9.The purchase took place on January 30,with payment due on March 31,20X9.The derivative is designated as a cash flow hedge.The company uses the forward exchange rate to measure hedge effectiveness.The direct exchange rates follow:

Required:

Prepare all journal entries for Denizen Corporation.

Problem 74 (continued):

Required:

Prepare all journal entries for Denizen Corporation.

Problem 74 (continued):

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following observations is true of futures contracts?

A) Contracted through a dealer, usually a bank.

B) Customized to meet contracting company's terms and needs.

C) Typically no margin deposit required.

D) Traded on an exchange and acquired through an exchange broker

A) Contracted through a dealer, usually a bank.

B) Customized to meet contracting company's terms and needs.

C) Typically no margin deposit required.

D) Traded on an exchange and acquired through an exchange broker

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

68

On December 1,20X8,Denizen Corporation entered into a 120-day forward contract to purchase 200,000 Canadian dollars (C$).Denizen's fiscal year ends on December 31.The forward contract was to hedge a firm commitment agreement made on December 1,20X8,to purchase electronic goods on January 30,with payment due on March 31,20X8.The derivative is designated as a fair value hedge.The direct exchange rates follow:

Required:

Prepare all journal entries for Denizen Corporation.

Required:

Prepare all journal entries for Denizen Corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

69

Spiralling crude oil prices prompted AMAR Company to purchase call options on oil as a price-risk-hedging device to hedge the expected increase in prices on an anticipated purchase of oil. On November 30, 20X8, AMAR purchases call options for 20,000 barrels of oil at $100 per barrel at a premium of $4 per barrel, with a February 1, 20X9, call date. The following is the pricing information for the term of the call:

The information for the change in the fair value of the options follows:

The information for the change in the fair value of the options follows:

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

Based on the preceding information,in the entry to record the increase in the intrinsic value of the options on December 31,20X8,

A) Purchased Call Options will be credited for $100,000.

B) Purchased Call Options will be debited for $130,000.

C) Retained Earnings will be credited for $100,000.

D) Other Comprehensive Income will be credited for $100,000.

The information for the change in the fair value of the options follows:

The information for the change in the fair value of the options follows: On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.

On February 1, 20X9, AMAR sells the options at their value on that date and acquires 20,000 barrels of oil at the spot price. On April 1, 20X9, AMAR sells the oil for $112 per barrel.Based on the preceding information,in the entry to record the increase in the intrinsic value of the options on December 31,20X8,

A) Purchased Call Options will be credited for $100,000.

B) Purchased Call Options will be debited for $130,000.

C) Retained Earnings will be credited for $100,000.

D) Other Comprehensive Income will be credited for $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

70

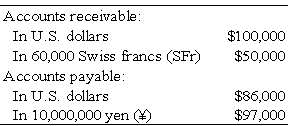

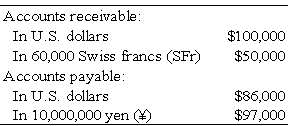

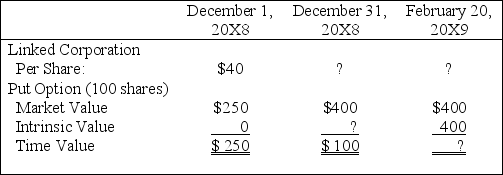

Quantum Company imports goods from different countries.Some transactions are denominated in U.S.dollars and others in foreign currencies.A summary of accounts receivable and accounts payable on December 31,20X8,before adjustments for the effects of changes in exchange rates during 20X8,follows:

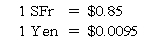

The spot rates on December 31,208,were:

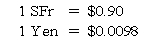

The average exchange rates during the collection and payment period in 20X9 are:

Required:

1.Prepare the adjusting entries on December 31,20X8.

2.Record the collection of the accounts receivable and the payment of the accounts payable in 20X9.

3.What was the foreign currency gain or loss on the accounts receivable transaction denominated in SFr for the year ended December 31,20X8? For the year ended December 31,20X9? Overall for this transaction?

4.What was the foreign currency gain or loss on the accounts receivable transaction denominated in ¥? For the year ended December 31,20X8? For the year ended December 31,20X9? Overall for this transaction?

Problem 71 (continued):

The spot rates on December 31,208,were:

The average exchange rates during the collection and payment period in 20X9 are:

Required:

1.Prepare the adjusting entries on December 31,20X8.

2.Record the collection of the accounts receivable and the payment of the accounts payable in 20X9.

3.What was the foreign currency gain or loss on the accounts receivable transaction denominated in SFr for the year ended December 31,20X8? For the year ended December 31,20X9? Overall for this transaction?

4.What was the foreign currency gain or loss on the accounts receivable transaction denominated in ¥? For the year ended December 31,20X8? For the year ended December 31,20X9? Overall for this transaction?

Problem 71 (continued):

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

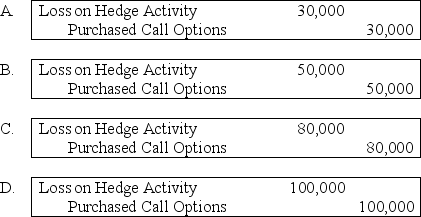

71

On December 1, 20X8, Winston Corporation acquired 100 shares of Linked Corporation at a cost of $40 per share. Winston classifies them as available-for-sale securities. On this same date, it decides to hedge against a possible decline in the value of the securities by purchasing, at a cost of $250, an at-the-money put option to sell the 100 shares at $40 per share. The option expires on February 20, 20X9. Selected information concerning the fair values of the investment and the options follow:

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

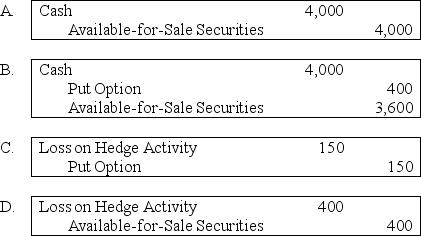

Based on the preceding information,the journal entry made on December 31,20X8 to record decrease in the time value of the options will include:

A) a debit to Loss on Hedge Activity for $150.

B) a credit to Put Option for $300.

C) a debit to Loss on Hedge Activity for $300.

D) a credit to Put Option for $100.

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.Based on the preceding information,the journal entry made on December 31,20X8 to record decrease in the time value of the options will include:

A) a debit to Loss on Hedge Activity for $150.

B) a credit to Put Option for $300.

C) a debit to Loss on Hedge Activity for $300.

D) a credit to Put Option for $100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

72

On December 1, 20X8, Winston Corporation acquired 100 shares of Linked Corporation at a cost of $40 per share. Winston classifies them as available-for-sale securities. On this same date, it decides to hedge against a possible decline in the value of the securities by purchasing, at a cost of $250, an at-the-money put option to sell the 100 shares at $40 per share. The option expires on February 20, 20X9. Selected information concerning the fair values of the investment and the options follow:

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Based on the preceding information,what is the market price of Linked Corporation stock on February 20,20X9?

A) $35

B) $37

C) $36

D) $40

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.Based on the preceding information,what is the market price of Linked Corporation stock on February 20,20X9?

A) $35

B) $37

C) $36

D) $40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

73

On December 1, 20X8, Winston Corporation acquired 100 shares of Linked Corporation at a cost of $40 per share. Winston classifies them as available-for-sale securities. On this same date, it decides to hedge against a possible decline in the value of the securities by purchasing, at a cost of $250, an at-the-money put option to sell the 100 shares at $40 per share. The option expires on February 20, 20X9. Selected information concerning the fair values of the investment and the options follow:

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

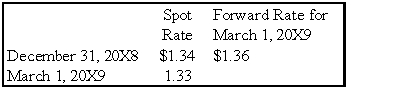

Based on the preceding information,which of the following journal entries will be made on February 20,20X9?

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.

Assume that Winston exercises the put option and sells Linked shares on February 20, 20X9.Based on the preceding information,which of the following journal entries will be made on February 20,20X9?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

74

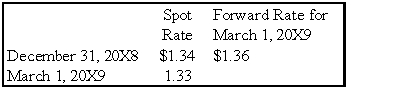

On December 1,20X8,Secure Company bought a 90-day forward contract to purchase 200,000 euros (€)at a forward rate of €1 = $1.35 when the spot rate was $1.33.Other exchange rates were as follows:

Required

1.Prepare all journal entries related to Secure Company's foreign currency speculation from December 1,20X8,through March 1,20X9,assuming the fiscal year ends on December 31,20X8.

2.Did the company gain or lose on its purchase of the forward contract?

Required

1.Prepare all journal entries related to Secure Company's foreign currency speculation from December 1,20X8,through March 1,20X9,assuming the fiscal year ends on December 31,20X8.

2.Did the company gain or lose on its purchase of the forward contract?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck