Deck 1: The Investment Setting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/72

العب

ملء الشاشة (f)

Deck 1: The Investment Setting

1

An individual who selects the investment that offers greater certainty when everything else is the same is known as a risk averse investor.

True

2

The rate of exchange between future consumption and current consumption is the

A) nominal risk-free rate.

B) coefficient of investment exchange.

C) pure rate of interest.

D) consumption/investment paradigm.

E) expected rate of return.

A) nominal risk-free rate.

B) coefficient of investment exchange.

C) pure rate of interest.

D) consumption/investment paradigm.

E) expected rate of return.

C

3

The two most common calculations investors use to measure return performance are arithmetic means and geometric means.

True

4

Two measures of the risk premium are the standard deviation and the variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

5

An investment is the current commitment of dollars over time to derive future payments to compensate the investor for the time funds are committed, the expected rate of inflation, and the uncertainty of future payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

6

In the phrase "nominal risk-free rate," nominal means

A) computed.

B) historical.

C) market.

D) average.

E) risk adverse.

A) computed.

B) historical.

C) market.

D) average.

E) risk adverse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

7

The coefficient of variation is the expected return divided by the standard deviation of the expected return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

8

If a significant change is noted in the yield of a T-bill, the change is most likely attributable to a

A) downturn in the economy.

B) static economy.

C) change in the expected rate of inflation.

D) change in the real rate of interest.

E) change in risk aversion.

A) downturn in the economy.

B) static economy.

C) change in the expected rate of inflation.

D) change in the real rate of interest.

E) change in risk aversion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

9

The line that reflects the combination of risk and return available on alternative investments is referred to as the security market line (SML).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

10

Nominal rates are averages of all possible real rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

11

The geometric mean of a series of returns is always larger than the arithmetic mean, and the difference increases with the volatility of the series.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

12

The real risk-free rate is affected by two factors:

A) the relative ease or tightness in capital markets and the expected rate of inflation.

B) the expected rate of inflation and the set of investment opportunities available in the economy.

C) the relative ease or tightness in capital markets and the set of investment opportunities available in the economy.

D) time preference for income consumption and the relative ease or tightness in capital markets.

E) time preference for income consumption and the set of investment opportunities available in the economy.

A) the relative ease or tightness in capital markets and the expected rate of inflation.

B) the expected rate of inflation and the set of investment opportunities available in the economy.

C) the relative ease or tightness in capital markets and the set of investment opportunities available in the economy.

D) time preference for income consumption and the relative ease or tightness in capital markets.

E) time preference for income consumption and the set of investment opportunities available in the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

13

The variance of expected returns is equal to the square root of the expected returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

14

The expected return is the average of all possible returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

15

The risk premium is a function of the volatility of operating earnings, sales volatility, and inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

16

The arithmetic mean is a superior measure of the long-term performance because it indicates the compound annual rate of return based on the ending value of the investment versus its beginning value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

17

The holding period return (HPR) is equal to the holding period yield (HPY) stated as a percentage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

18

Investors are willing to forgo current consumption in order to increase future consumption for a nominal rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

19

The rate of exchange between certain future dollars and certain current dollars is known as the pure rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

20

The basic trade-off in the investment process is

A) between the anticipated rate of return for a given investment instrument and its degree of risk.

B) between understanding the nature of a particular investment and having the opportunity to purchase it.

C) between high returns available on single instruments and the diversification of instruments into a portfolio.

D) between the desired level of investment and possessing the resources necessary to carry it out.

E) None of these are correct.

A) between the anticipated rate of return for a given investment instrument and its degree of risk.

B) between understanding the nature of a particular investment and having the opportunity to purchase it.

C) between high returns available on single instruments and the diversification of instruments into a portfolio.

D) between the desired level of investment and possessing the resources necessary to carry it out.

E) None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

21

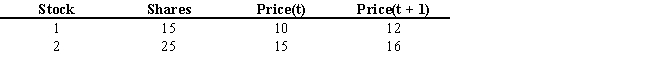

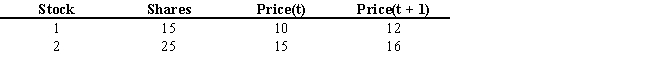

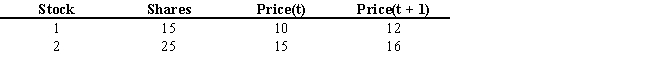

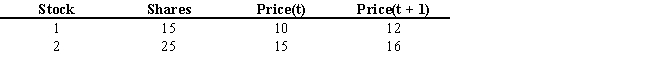

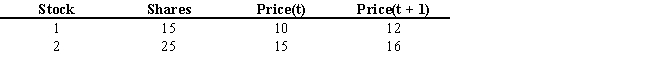

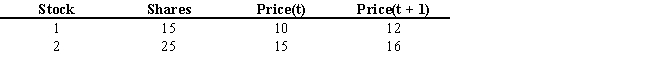

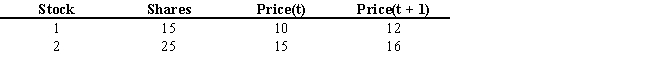

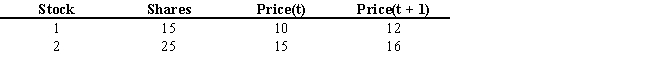

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Assume that you hold a two-stock portfolio. You are provided with the following information on your holdings:

Refer to Exhibit 1.6. Calculate the HPY for stock 2.

A) 5%

B) 6%

C) 7%

D) 8%

E) 10%

Assume that you hold a two-stock portfolio. You are provided with the following information on your holdings:

Refer to Exhibit 1.6. Calculate the HPY for stock 2.

A) 5%

B) 6%

C) 7%

D) 8%

E) 10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

22

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Assume that during the past year the consumer price index increased by 1.5 percent and the securities listed below returned the following nominal rates of return.

Refer to Exhibit 1.5. What are the real rates of return for each of these securities?

A) 4.29% and 6.32%

B) 1.23% and 4.29%

C) 3.20% and 6.32%

D) 1.23% and 3.20%

E) 3.75% and 5.75%

Assume that during the past year the consumer price index increased by 1.5 percent and the securities listed below returned the following nominal rates of return.

Refer to Exhibit 1.5. What are the real rates of return for each of these securities?

A) 4.29% and 6.32%

B) 1.23% and 4.29%

C) 3.20% and 6.32%

D) 1.23% and 3.20%

E) 3.75% and 5.75%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

23

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The common stock of XMen Inc. had the following historic prices.

Refer to Exhibit 1.3. What was your geometric mean annual yield for the investment in XMen?

A) 0.25

B) 0.40

C) 1.8

D) 0.1247

E) 0.1462

The common stock of XMen Inc. had the following historic prices.

Refer to Exhibit 1.3. What was your geometric mean annual yield for the investment in XMen?

A) 0.25

B) 0.40

C) 1.8

D) 0.1247

E) 0.1462

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

24

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The common stock of XMen Inc. had the following historic prices.

Refer to Exhibit 1.3. What was your annual holding period yield (Annual HPY)?

A) 0.1462

B) 0.1247

C) 1.8

D) 0.40

E) 0.25

The common stock of XMen Inc. had the following historic prices.

Refer to Exhibit 1.3. What was your annual holding period yield (Annual HPY)?

A) 0.1462

B) 0.1247

C) 1.8

D) 0.40

E) 0.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

25

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Assume you bought 100 shares of NewTech common stock on January 15, 2003 at $50.00 per share and sold it on January 15, 2004 for $40.00 per share.

-Refer to Exhibit 1.1. What was your holding period yield?

A) -10%

B) -0.8

C) 25%

D) 0.8

E) -20%

Assume you bought 100 shares of NewTech common stock on January 15, 2003 at $50.00 per share and sold it on January 15, 2004 for $40.00 per share.

-Refer to Exhibit 1.1. What was your holding period yield?

A) -10%

B) -0.8

C) 25%

D) 0.8

E) -20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

26

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

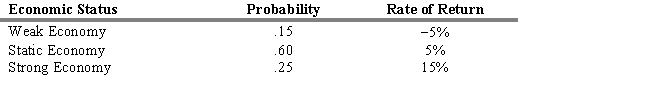

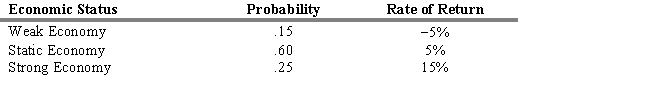

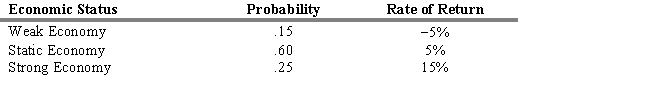

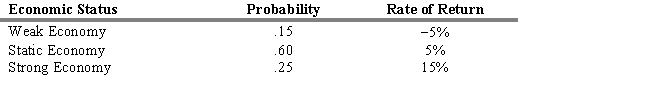

You have concluded that next year the following relationships are possible:

Refer to Exhibit 1.4. Compute the coefficient of variation for your portfolio.

A) 0.043

B) 0.12

C) 1.40

D) 0.69

E) 1.04

You have concluded that next year the following relationships are possible:

Refer to Exhibit 1.4. Compute the coefficient of variation for your portfolio.

A) 0.043

B) 0.12

C) 1.40

D) 0.69

E) 1.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

27

The coefficient of variation is a measure of

A) central tendency.

B) absolute variability.

C) absolute dispersion.

D) relative variability.

E) relative return.

A) central tendency.

B) absolute variability.

C) absolute dispersion.

D) relative variability.

E) relative return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

28

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The common stock of XMen Inc. had the following historic prices.

Refer to Exhibit 1.3. What was your holding period return for the time period of 3/1/1999 to 3/1/2004?

A) 0.1247

B) 1.8

C) 0.1462

D) 0.40

E) 0.25

The common stock of XMen Inc. had the following historic prices.

Refer to Exhibit 1.3. What was your holding period return for the time period of 3/1/1999 to 3/1/2004?

A) 0.1247

B) 1.8

C) 0.1462

D) 0.40

E) 0.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

29

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Assume that you hold a two-stock portfolio. You are provided with the following information on your holdings:

Refer to Exhibit 1.6. Calculate the market weights for stock 1 and 2 based on period t values.

A) 39%for stock 1 and 61% for stock 2

B) 50% for stock 1 and 50% for stock 2

C) 71% for stock 1 and 29% for stock 2

D) 29% for stock 1 and 71% for stock 2

E) 30% for stock 1 and 82% for stock 2

Assume that you hold a two-stock portfolio. You are provided with the following information on your holdings:

Refer to Exhibit 1.6. Calculate the market weights for stock 1 and 2 based on period t values.

A) 39%for stock 1 and 61% for stock 2

B) 50% for stock 1 and 50% for stock 2

C) 71% for stock 1 and 29% for stock 2

D) 29% for stock 1 and 71% for stock 2

E) 30% for stock 1 and 82% for stock 2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

30

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Assume you bought 100 shares of NewTech common stock on January 15, 2003 at $50.00 per share and sold it on January 15, 2004 for $40.00 per share.

-Refer to Exhibit 1.1. What was your holding period return?

A) -10%

B) -0.8

C) 25%

D) 0.8

E) -20%

Assume you bought 100 shares of NewTech common stock on January 15, 2003 at $50.00 per share and sold it on January 15, 2004 for $40.00 per share.

-Refer to Exhibit 1.1. What was your holding period return?

A) -10%

B) -0.8

C) 25%

D) 0.8

E) -20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

31

The nominal risk-free rate of interest is a function of the

A) real risk-free rate and the investment's variance.

B) prime rate and the rate of inflation.

C) T-bill rate plus the inflation rate.

D) tax free rate plus the rate of inflation.

E) real risk-free rate and the rate of inflation.

A) real risk-free rate and the investment's variance.

B) prime rate and the rate of inflation.

C) T-bill rate plus the inflation rate.

D) tax free rate plus the rate of inflation.

E) real risk-free rate and the rate of inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

32

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Assume that you hold a two-stock portfolio. You are provided with the following information on your holdings:

Refer to Exhibit 1.6. Calculate the HPY for the portfolio.

A) 10.6%

B) 6.95%

C) 13.5%

D) 10%

E) 15.7%

Assume that you hold a two-stock portfolio. You are provided with the following information on your holdings:

Refer to Exhibit 1.6. Calculate the HPY for the portfolio.

A) 10.6%

B) 6.95%

C) 13.5%

D) 10%

E) 15.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

33

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Suppose you bought a GM corporate bond on January 25, 2001 for $750 and solid it on January 25, 2004 for $650.00.

-Refer to Exhibit 1.2. What was your annual holding period return?

A) 0.8667

B) -0.1333

C) 0.0333

D) 0.9534

E) -0.0466

Suppose you bought a GM corporate bond on January 25, 2001 for $750 and solid it on January 25, 2004 for $650.00.

-Refer to Exhibit 1.2. What was your annual holding period return?

A) 0.8667

B) -0.1333

C) 0.0333

D) 0.9534

E) -0.0466

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

34

The ____ the variance of returns, everything else remaining constant, the ____ the dispersion of expectations and the ____ the risk.

A) larger, greater, lower

B) larger, smaller, higher

C) larger, greater, higher

D) smaller, greater, lower

E) smaller, greater, greater

A) larger, greater, lower

B) larger, smaller, higher

C) larger, greater, higher

D) smaller, greater, lower

E) smaller, greater, greater

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

35

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Suppose you bought a GM corporate bond on January 25, 2001 for $750 and solid it on January 25, 2004 for $650.00.

-Refer to Exhibit 1.2. What was your annual holding period yield?

A) -0.0466

B) -0.1333

C) 0.0333

D) 0.3534

E) 0.8667

Suppose you bought a GM corporate bond on January 25, 2001 for $750 and solid it on January 25, 2004 for $650.00.

-Refer to Exhibit 1.2. What was your annual holding period yield?

A) -0.0466

B) -0.1333

C) 0.0333

D) 0.3534

E) 0.8667

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

36

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The common stock of XMen Inc. had the following historic prices.

Refer to Exhibit 1.3. What was your arithmetic mean annual yield for the investment in XMen Industries?

A) 0.1462

B) 0.1247

C) 1.8

D) 0.40

E) 0.25

The common stock of XMen Inc. had the following historic prices.

Refer to Exhibit 1.3. What was your arithmetic mean annual yield for the investment in XMen Industries?

A) 0.1462

B) 0.1247

C) 1.8

D) 0.40

E) 0.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

37

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Assume that you hold a two-stock portfolio. You are provided with the following information on your holdings:

Refer to Exhibit 1.6. Calculate the HPY for stock 1.

A) 10%

B) 20%

C) 15%

D) 12%

E) 7%

Assume that you hold a two-stock portfolio. You are provided with the following information on your holdings:

Refer to Exhibit 1.6. Calculate the HPY for stock 1.

A) 10%

B) 20%

C) 15%

D) 12%

E) 7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

38

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Assume that during the past year the consumer price index increased by 1.5 percent and the securities listed below returned the following nominal rates of return.

Refer to Exhibit 1.5. If next year the real rates all rise by 10 percent while inflation climbs from 1.5 percent to 2.5 percent, what will be the nominal rate of return on each security?

A) 1.24% and 1.52%

B) 1.35% and 3.52%

C) 3.89% and 6.11%

D) 3.52% and 3.89%

E) 1.17% and 6.11%

Assume that during the past year the consumer price index increased by 1.5 percent and the securities listed below returned the following nominal rates of return.

Refer to Exhibit 1.5. If next year the real rates all rise by 10 percent while inflation climbs from 1.5 percent to 2.5 percent, what will be the nominal rate of return on each security?

A) 1.24% and 1.52%

B) 1.35% and 3.52%

C) 3.89% and 6.11%

D) 3.52% and 3.89%

E) 1.17% and 6.11%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

39

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You have concluded that next year the following relationships are possible:

Refer to Exhibit 1.4. Compute the standard deviation of the rate of return for the one-year period.

A) 0.65%

B) 1.45%

C) 4.0%

D) 6.25%

E) 6.4%

You have concluded that next year the following relationships are possible:

Refer to Exhibit 1.4. Compute the standard deviation of the rate of return for the one-year period.

A) 0.65%

B) 1.45%

C) 4.0%

D) 6.25%

E) 6.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

40

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You have concluded that next year the following relationships are possible:

![<strong>USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) You have concluded that next year the following relationships are possible: Refer to Exhibit 1.4. What is your expected rate of return [E(R<sub>i</sub>)] for next year?</strong> A) 4.25% B) 6.00% C) 6.25% D) 7.75% E) 8.00%](https://d2lvgg3v3hfg70.cloudfront.net/TB6829/11ea87ad_a330_39f8_b530_35637c43da0e_TB6829_00_TB6829_00_TB6829_00.jpg)

Refer to Exhibit 1.4. What is your expected rate of return [E(Ri)] for next year?

A) 4.25%

B) 6.00%

C) 6.25%

D) 7.75%

E) 8.00%

You have concluded that next year the following relationships are possible:

![<strong>USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) You have concluded that next year the following relationships are possible: Refer to Exhibit 1.4. What is your expected rate of return [E(R<sub>i</sub>)] for next year?</strong> A) 4.25% B) 6.00% C) 6.25% D) 7.75% E) 8.00%](https://d2lvgg3v3hfg70.cloudfront.net/TB6829/11ea87ad_a330_39f8_b530_35637c43da0e_TB6829_00_TB6829_00_TB6829_00.jpg)

Refer to Exhibit 1.4. What is your expected rate of return [E(Ri)] for next year?

A) 4.25%

B) 6.00%

C) 6.25%

D) 7.75%

E) 8.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

41

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You purchased 100 shares of GE common stock on January 1, for $29 a share. A year later you received $1.25 in dividends per share and you sold it for $28 a share.

Refer to Exhibit 1.7. Calculate your holding period return (HPR) for this investment in GE stock.

A) 0.9655

B) 1.0086

C) 1.0357

D) 1.0804

E) 1.0973

You purchased 100 shares of GE common stock on January 1, for $29 a share. A year later you received $1.25 in dividends per share and you sold it for $28 a share.

Refer to Exhibit 1.7. Calculate your holding period return (HPR) for this investment in GE stock.

A) 0.9655

B) 1.0086

C) 1.0357

D) 1.0804

E) 1.0973

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

42

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Consider the following information

Nominal annual return on U.S. government T-bills for year 2018 = 3.5%

Nominal annual return on U.S. government long-term bonds for year 2018 = 4.75%

Nominal annual return on U.S. large-cap stocks for year 2018= 8.75%

Consumer price index January 1, 2018 = 165

Consumer price index December 31, 2018 = 169

Refer to Exhibit 1.10. Compute the rate of inflation for the year 2018.

A) 2.42%

B) 4.0%

C) 1.69%

D) 1.24%

E) 0%

Consider the following information

Nominal annual return on U.S. government T-bills for year 2018 = 3.5%

Nominal annual return on U.S. government long-term bonds for year 2018 = 4.75%

Nominal annual return on U.S. large-cap stocks for year 2018= 8.75%

Consumer price index January 1, 2018 = 165

Consumer price index December 31, 2018 = 169

Refer to Exhibit 1.10. Compute the rate of inflation for the year 2018.

A) 2.42%

B) 4.0%

C) 1.69%

D) 1.24%

E) 0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

43

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The annual rates of return of Stock Z for the last four years are 0.10, 0.15, -0.05, and 0.20, respectively.

-Refer to Exhibit 1.8. Compute the arithmetic mean annual rate of return for Stock Z.

A) 0.03

B) 0.04

C) 0.06

D) 0.10

E) 0.40

The annual rates of return of Stock Z for the last four years are 0.10, 0.15, -0.05, and 0.20, respectively.

-Refer to Exhibit 1.8. Compute the arithmetic mean annual rate of return for Stock Z.

A) 0.03

B) 0.04

C) 0.06

D) 0.10

E) 0.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

44

If over the past 20 years the annual returns on the S&P 500 market index averaged 12 percent with a standard deviation of 18 percent, what was the coefficient of variation?

A) 0.6

B) 0.6%

C) 1.5

D) 1.5%

E) 0.66%

A) 0.6

B) 0.6%

C) 1.5

D) 1.5%

E) 0.66%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following is NOT a component of the risk premium?

A) business risk

B) financial risk

C) liquidity risk

D) exchange rate risk

E) unsystematic market risk

A) business risk

B) financial risk

C) liquidity risk

D) exchange rate risk

E) unsystematic market risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

46

Given investments A and B with the following risk return characteristics, which one would you prefer and why?

A) Investment A because it has the highest expected return.

B) Investment A because it has the lowest relative risk.

C) Investment B because it has the lowest absolute risk.

D) Investment B because it has the lowest coefficient of variation.

E) Investment A because it has the highest coefficient of variation.

A) Investment A because it has the highest expected return.

B) Investment A because it has the lowest relative risk.

C) Investment B because it has the lowest absolute risk.

D) Investment B because it has the lowest coefficient of variation.

E) Investment A because it has the highest coefficient of variation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

47

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information:

Nominal return on risk-free asset = 4.5%

Expected return for asset i = 12.75%

Expected return on the market portfolio = 9.25%

Refer to Exhibit 1.9. Calculate the risk premium for the market portfolio.

A) 4.5%

B) 8.25%

C) 4.75%

D) 3.5%

E) 0%

You are provided with the following information:

Nominal return on risk-free asset = 4.5%

Expected return for asset i = 12.75%

Expected return on the market portfolio = 9.25%

Refer to Exhibit 1.9. Calculate the risk premium for the market portfolio.

A) 4.5%

B) 8.25%

C) 4.75%

D) 3.5%

E) 0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

48

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Consider the following information

Nominal annual return on U.S. government T-bills for year 2018 = 3.5%

Nominal annual return on U.S. government long-term bonds for year 2018 = 4.75%

Nominal annual return on U.S. large-cap stocks for year 2018= 8.75%

Consumer price index January 1, 2018 = 165

Consumer price index December 31, 2018 = 169

-Refer to Exhibit 1.10. Calculate the annual real rate of return for U.S. T-bills.

A) 2.26%

B) 1.81%

C) -0.5%

D) 1.05%

E) 0%

Consider the following information

Nominal annual return on U.S. government T-bills for year 2018 = 3.5%

Nominal annual return on U.S. government long-term bonds for year 2018 = 4.75%

Nominal annual return on U.S. large-cap stocks for year 2018= 8.75%

Consumer price index January 1, 2018 = 165

Consumer price index December 31, 2018 = 169

-Refer to Exhibit 1.10. Calculate the annual real rate of return for U.S. T-bills.

A) 2.26%

B) 1.81%

C) -0.5%

D) 1.05%

E) 0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is not a component of the required rate of return?

A) expected rate of inflation

B) time value of money

C) risk

D) holding period return

E) nominal returns

A) expected rate of inflation

B) time value of money

C) risk

D) holding period return

E) nominal returns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

50

The ability to sell an asset quickly at a fair price is associated with

A) business risk.

B) liquidity risk.

C) exchange rate risk.

D) financial risk.

E) market risk.

A) business risk.

B) liquidity risk.

C) exchange rate risk.

D) financial risk.

E) market risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

51

The variability of operating earnings is associated with

A) business risk.

B) liquidity risk.

C) exchange rate risk.

D) financial risk.

E) market risk.

A) business risk.

B) liquidity risk.

C) exchange rate risk.

D) financial risk.

E) market risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

52

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The annual rates of return of Stock Z for the last four years are 0.10, 0.15, -0.05, and 0.20, respectively.

-Refer to Exhibit 1.8. Compute the coefficient of variation for Stock Z.

A) 0.837

B) 0.935

C) 1.070

D) 1.145

E) 1.281

The annual rates of return of Stock Z for the last four years are 0.10, 0.15, -0.05, and 0.20, respectively.

-Refer to Exhibit 1.8. Compute the coefficient of variation for Stock Z.

A) 0.837

B) 0.935

C) 1.070

D) 1.145

E) 1.281

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

53

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You purchased 100 shares of GE common stock on January 1, for $29 a share. A year later you received $1.25 in dividends per share and you sold it for $28 a share.

-Refer to Exhibit 1.7. Calculate your holding period yield (HPY) for this investment in GE stock.

A) -0.0345

B) -0.0090

C) 0.0086

D) 0.0643

E) 0.0804

You purchased 100 shares of GE common stock on January 1, for $29 a share. A year later you received $1.25 in dividends per share and you sold it for $28 a share.

-Refer to Exhibit 1.7. Calculate your holding period yield (HPY) for this investment in GE stock.

A) -0.0345

B) -0.0090

C) 0.0086

D) 0.0643

E) 0.0804

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

54

Economists project the long-run real growth rate for the next five years to be 2.5 percent and the average annual rate of inflation over this five-year period to be 3 percent. What is the expected nominal rate of return over the next five years?

A) 0.500 percent

B) 1.056 percent

C) 2.750 percent

D) 5.500 percent

E) 5.575 percent

A) 0.500 percent

B) 1.056 percent

C) 2.750 percent

D) 5.500 percent

E) 5.575 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

55

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Consider the following information

Nominal annual return on U.S. government T-bills for year 2018 = 3.5%

Nominal annual return on U.S. government long-term bonds for year 2018 = 4.75%

Nominal annual return on U.S. large-cap stocks for year 2018= 8.75%

Consumer price index January 1, 2018 = 165

Consumer price index December 31, 2018 = 169

Refer to Exhibit 1.10. Calculate the annual real rate of return for U.S. long-term bonds.

A) 3.06%

B) 2.27%

C) 2.51%

D) 3.5%

E) 0%

Consider the following information

Nominal annual return on U.S. government T-bills for year 2018 = 3.5%

Nominal annual return on U.S. government long-term bonds for year 2018 = 4.75%

Nominal annual return on U.S. large-cap stocks for year 2018= 8.75%

Consumer price index January 1, 2018 = 165

Consumer price index December 31, 2018 = 169

Refer to Exhibit 1.10. Calculate the annual real rate of return for U.S. long-term bonds.

A) 3.06%

B) 2.27%

C) 2.51%

D) 3.5%

E) 0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

56

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The annual rates of return of Stock Z for the last four years are 0.10, 0.15, -0.05, and 0.20, respectively.

-Refer to Exhibit 1.8. Compute the geometric mean rate of return for Stock Z.

A) 0.051

B) 0.074

C) 0.096

D) 0.150

E) 1.090

The annual rates of return of Stock Z for the last four years are 0.10, 0.15, -0.05, and 0.20, respectively.

-Refer to Exhibit 1.8. Compute the geometric mean rate of return for Stock Z.

A) 0.051

B) 0.074

C) 0.096

D) 0.150

E) 1.090

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

57

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

The annual rates of return of Stock Z for the last four years are 0.10, 0.15, -0.05, and 0.20, respectively.

-Refer to Exhibit 1.8. Compute the standard deviation of the annual rate of return for Stock Z.

A) 0.0070

B) 0.0088

C) 0.0837

D) 0.0935

E) 0.1145

The annual rates of return of Stock Z for the last four years are 0.10, 0.15, -0.05, and 0.20, respectively.

-Refer to Exhibit 1.8. Compute the standard deviation of the annual rate of return for Stock Z.

A) 0.0070

B) 0.0088

C) 0.0837

D) 0.0935

E) 0.1145

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

58

The total risk for a security can be measured by its

A) beta with the market portfolio.

B) systematic risk.

C) standard deviation of returns.

D) unsystematic risk.

E) alpha with the market portfolio.

A) beta with the market portfolio.

B) systematic risk.

C) standard deviation of returns.

D) unsystematic risk.

E) alpha with the market portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

59

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

You are provided with the following information:

Nominal return on risk-free asset = 4.5%

Expected return for asset i = 12.75%

Expected return on the market portfolio = 9.25%

Refer to Exhibit 1.9. Calculate the risk premium for asset i.

A) 4.5%

B) 8.25%

C) 4.75%

D) 3.5%

E) 0%

You are provided with the following information:

Nominal return on risk-free asset = 4.5%

Expected return for asset i = 12.75%

Expected return on the market portfolio = 9.25%

Refer to Exhibit 1.9. Calculate the risk premium for asset i.

A) 4.5%

B) 8.25%

C) 4.75%

D) 3.5%

E) 0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

60

The uncertainty of investment returns associated with how a firm finances its investments is known as

A) business risk.

B) liquidity risk.

C) exchange rate risk.

D) financial risk.

E) market risk.

A) business risk.

B) liquidity risk.

C) exchange rate risk.

D) financial risk.

E) market risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

61

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Consider the following information

Nominal annual return on U.S. government T-bills for year 2018 = 3.5%

Nominal annual return on U.S. government long-term bonds for year 2018 = 4.75%

Nominal annual return on U.S. large-cap stocks for year 2018= 8.75%

Consumer price index January 1, 2018 = 165

Consumer price index December 31, 2018 = 169

Refer to Exhibit 1.10. Calculate the annual real rate of return for U.S. large-cap stocks.

A) 7.06%

B) 6.18%

C) 4.75%

D) 3.75%

E) 0%

Consider the following information

Nominal annual return on U.S. government T-bills for year 2018 = 3.5%

Nominal annual return on U.S. government long-term bonds for year 2018 = 4.75%

Nominal annual return on U.S. large-cap stocks for year 2018= 8.75%

Consumer price index January 1, 2018 = 165

Consumer price index December 31, 2018 = 169

Refer to Exhibit 1.10. Calculate the annual real rate of return for U.S. large-cap stocks.

A) 7.06%

B) 6.18%

C) 4.75%

D) 3.75%

E) 0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following is least likely to move a firm's position to the right on the Security Market Line (SML)?

A) an increase in the firm's beta

B) adding more financial debt to the firm's balance sheet relative to equity

C) changing the business strategy to include new product lines with more volatile expected cash flows

D) Investors perceive the stock as being riskier.

E) an increase in the risk-free required rate of return

A) an increase in the firm's beta

B) adding more financial debt to the firm's balance sheet relative to equity

C) changing the business strategy to include new product lines with more volatile expected cash flows

D) Investors perceive the stock as being riskier.

E) an increase in the risk-free required rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

63

Sources of risk for an investment include

A) variance of returns and business risk.

B) coefficient of variation of returns and financial risk.

C) business risk and financial risk.

D) variance of returns and coefficient of variation of returns.

E) variance of returns and economic risk.

A) variance of returns and business risk.

B) coefficient of variation of returns and financial risk.

C) business risk and financial risk.

D) variance of returns and coefficient of variation of returns.

E) variance of returns and economic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

64

Two factors that influence the nominal risk-free rate are

A) the relative ease or tightness in capital markets and the expected rate of inflation.

B) the expected rate of inflation and the set of investment opportunities available in the economy.

C) the relative ease or tightness in capital markets and the set of investment opportunities available in the economy.

D) time preference for income consumption and the relative ease or tightness in capital markets.

E) time preference for income consumption and the set of investment opportunities available in the economy.

A) the relative ease or tightness in capital markets and the expected rate of inflation.

B) the expected rate of inflation and the set of investment opportunities available in the economy.

C) the relative ease or tightness in capital markets and the set of investment opportunities available in the economy.

D) time preference for income consumption and the relative ease or tightness in capital markets.

E) time preference for income consumption and the set of investment opportunities available in the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

65

Measures of risk for an investment include

A) variance of returns and business risk.

B) coefficient of variation of returns and financial risk.

C) business risk and financial risk.

D) variance of returns and coefficient of variation of returns.

E) variance of returns and economic risk.

A) variance of returns and business risk.

B) coefficient of variation of returns and financial risk.

C) business risk and financial risk.

D) variance of returns and coefficient of variation of returns.

E) variance of returns and economic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

66

A decrease in the expected real growth in the economy, all other things constant, will cause the security market line to

A) shift up.

B) shift down.

C) have a steeper slope.

D) have a flatter slope.

E) remain unchanged.

A) shift up.

B) shift down.

C) have a steeper slope.

D) have a flatter slope.

E) remain unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

67

All of the following are major sources of uncertainty EXCEPT

A) business risk.

B) financial risk.

C) default risk.

D) country risk.

E) liquidity risk.

A) business risk.

B) financial risk.

C) default risk.

D) country risk.

E) liquidity risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

68

Unsystematic risk refers to risk that is

A) undiversifiable.

B) diversifiable.

C) due to fundamental risk factors.

D) due to market risk.

E) unexplainable.

A) undiversifiable.

B) diversifiable.

C) due to fundamental risk factors.

D) due to market risk.

E) unexplainable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

69

What will happen to the security market line (SML) if the following events occur, other things constant: (1) inflation expectations increase, and (2) investors become more risk averse?

A) shift up and keep the same slope

B) shift up and have less slope

C) shift up and have a steeper slope

D) shift down and keep the same slope

E) shift down and have less slope

A) shift up and keep the same slope

B) shift up and have less slope

C) shift up and have a steeper slope

D) shift down and keep the same slope

E) shift down and have less slope

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

70

The security market line (SML) graphs the expected relationship between

A) business risk and financial risk.

B) systematic risk and unsystematic risk.

C) risk and return.

D) systematic risk and unsystematic return.

E) real and nominal returns.

A) business risk and financial risk.

B) systematic risk and unsystematic risk.

C) risk and return.

D) systematic risk and unsystematic return.

E) real and nominal returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

71

A decrease in the market risk premium, all other things constant, will cause the security market line to

A) shift up.

B) shift down.

C) have a steeper slope.

D) have a flatter slope.

E) remain unchanged.

A) shift up.

B) shift down.

C) have a steeper slope.

D) have a flatter slope.

E) remain unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck

72

Modern portfolio theory assumes that most investors are

A) risk averse.

B) risk neutral.

C) risk seekers.

D) risk tolerant.

E) risk embracing.

A) risk averse.

B) risk neutral.

C) risk seekers.

D) risk tolerant.

E) risk embracing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 72 في هذه المجموعة.

فتح الحزمة

k this deck