Deck 4: Security Market Indexes and Index Funds

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

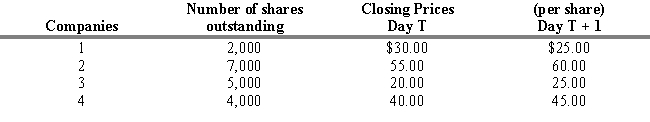

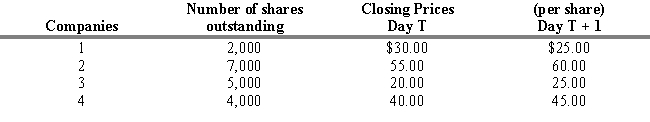

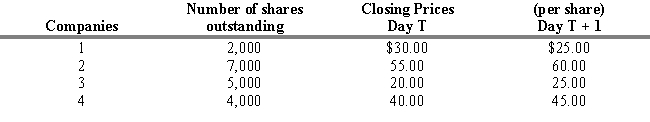

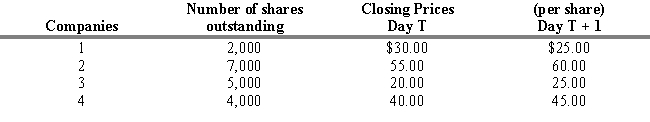

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/89

العب

ملء الشاشة (f)

Deck 4: Security Market Indexes and Index Funds

1

The Standard & Poor's 500 index is an example of a value weighted index.

True

2

To solve comparability problems across countries, global equity indexes with consistent sample selection, weighting, and computational procedures have been developed.

True

3

The Morgan Stanley group index for Europe, Australia, and the Far East (EAFE) is a price weighted index.

False

4

A bond market index is easier to create than a stock market index because the universe of bonds is much broader than that of stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

5

When constructing an index, a small percentage of the total population will provide valid indications of the behavior of the total population if the sample is properly selected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

6

The major U.S. stock indexes are highly correlated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

7

The general purpose of a market indicator series is to provide an overall indication of aggregate market changes or movements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

8

The Standard & Poor's International Index consists of three international, 19 national, and 38 international industry indexes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

9

A price-weighted index such as the DJIA is a geometric mean of current stock prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

10

The Dow Jones Industrial Average is a value weighted average.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

11

A price weighted series is disproportionately influenced by larger capitalization companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

12

The Dow Jones Industrial Average has been criticized for being blue-chip biased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

13

Unlike the Dow Jones Industrial Average, the Nikkei-Dow Jones Average is price weighted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

14

A two for one stock split causes the divisor in a price-weighted series to decline.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

15

The New York Stock Exchange Index is based on a sample of all of the New York Stock Exchange stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

16

Bond-market indicator series have been around much longer than stock-market indicator series.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

17

An equally weighted indicator series is also known as an unweighted indicator series.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

18

A value weighted index automatically adjusts for stock splits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

19

An aggregate market index can be used as a benchmark to judge the performance of professional money managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

20

It is easier to construct an indicator series for bonds because of their relatively stable returns pattern.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

21

The most common way to test a portfolio manager's performance is to compare the portfolio return to a benchmark.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which is an example of a Style Index?

A) small-cap growth

B) mid-cap value

C) small-cap value

D) mid-cap growth

E) All of these are correct.

A) small-cap growth

B) mid-cap value

C) small-cap value

D) mid-cap growth

E) All of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

23

There are no composite series currently available that will measure the performance of all securities (i.e. stocks and bonds) in a given country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is NOT a global equity indicator series?

A) Morgan Stanley Capital International Indexes

B) Dow Jones World Stock Index

C) FT/S & P-Actuaries World Indexes

D) Merrill Lynch-Wilshire World Indexes

E) Brinson Partner Global Security Market Index (GSMI)

A) Morgan Stanley Capital International Indexes

B) Dow Jones World Stock Index

C) FT/S & P-Actuaries World Indexes

D) Merrill Lynch-Wilshire World Indexes

E) Brinson Partner Global Security Market Index (GSMI)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is NOT a value-weighted series?

A) NASDAQ Industrial Index

B) Dow Jones Industrial Average

C) Wilshire 5000 Equity Index

D) American Stock Exchange Series

E) NASDAQ Composite Index

A) NASDAQ Industrial Index

B) Dow Jones Industrial Average

C) Wilshire 5000 Equity Index

D) American Stock Exchange Series

E) NASDAQ Composite Index

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

26

A properly selected sample for use in constructing a market indicator series will consider the sample's source, size, and

A) breadth.

B) average beta.

C) value.

D) variability.

E) dividend record.

A) breadth.

B) average beta.

C) value.

D) variability.

E) dividend record.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

27

For an indexed portfolio, the fund manager will typically attempt to replicate the composition of the particular index exactly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

28

What effect does a stock substitution or stock split have on a price-weighted series?

A) Index remains the same; divisor will increase/decrease.

B) Divisor remains the same; index will increase/decrease.

C) Index and divisor will both remain the same.

D) Index and divisor will both reflect the changes (immediately).

E) None of these are correct.

A) Index remains the same; divisor will increase/decrease.

B) Divisor remains the same; index will increase/decrease.

C) Index and divisor will both remain the same.

D) Index and divisor will both reflect the changes (immediately).

E) None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

29

The NYSE series should have higher rates of return and risk measures than the AMEX and OTC series.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

30

Exchange-Traded Funds (ETF) are depository receipts that give investors a pro rata claim on the capital gains and cash flows of securities held by financial institutions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

31

A benchmark measures the performance by portfolio managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

32

In a price weighted average stock market indicator series, the following type of stock has the greatest influence:

A) the stock with the highest price.

B) the stock with the lowest price.

C) the stock with the highest market capitalization.

D) the stock with the lowest market capitalization.

E) the stock with the highest P/E ratio.

A) the stock with the highest price.

B) the stock with the lowest price.

C) the stock with the highest market capitalization.

D) the stock with the lowest market capitalization.

E) the stock with the highest P/E ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

33

The Value Line Composite Average is calculated using the ____ of percentage price changes.

A) arithmetic average

B) harmonic average

C) expected value

D) geometric average

E) logarithmic average

A) arithmetic average

B) harmonic average

C) expected value

D) geometric average

E) logarithmic average

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

34

Of the following indices, which includes the most comprehensive list of stocks?

A) New York Exchange Index

B) Standard and Poor's Index

C) American Stock Exchange Index

D) NASDAQ Series Index

E) Wilshire Equity Index

A) New York Exchange Index

B) Standard and Poor's Index

C) American Stock Exchange Index

D) NASDAQ Series Index

E) Wilshire Equity Index

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

35

In a value weighted index,

A) exchange rate fluctuations have a large impact.

B) exchange rate fluctuations have a small impact.

C) large companies have a disproportionate influence on the index.

D) small companies have an exaggerated effect on the index.

E) None of these are correct.

A) exchange rate fluctuations have a large impact.

B) exchange rate fluctuations have a small impact.

C) large companies have a disproportionate influence on the index.

D) small companies have an exaggerated effect on the index.

E) None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

36

The correlations among the U.S. investment-grade-bond series were very high because all rates of return for investment-grade bonds over time are impacted by common macroeconomic variables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

37

There is a high correlation between the Wilshire 5000 index and the alternative NYSE series (S&P 500 and the NYSE), which represents the substantial influence of large NYSE stocks on the Wilshire 5000 index.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

38

The low correlations between the U.S. and Japan confirm the benefit of global diversification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is NOT a use of security market indicator series?

A) to use as a benchmark of individual portfolio performance

B) to develop an index portfolio

C) to determine factors influencing aggregate security price movements

D) to use in the measurement of systematic risk

E) to use in the measurement of diversifiable risk

A) to use as a benchmark of individual portfolio performance

B) to develop an index portfolio

C) to determine factors influencing aggregate security price movements

D) to use in the measurement of systematic risk

E) to use in the measurement of diversifiable risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

40

An example of a value weighted stock market indicator series is the

A) Dow Jones Industrial Average.

B) Nikkei Dow Jones Average.

C) S & P 500 Index.

D) Value Line Index.

E) Shearson Lehman Hutton Index.

A) Dow Jones Industrial Average.

B) Nikkei Dow Jones Average.

C) S & P 500 Index.

D) Value Line Index.

E) Shearson Lehman Hutton Index.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

41

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a value weighted index for Jan. 13th if the initial index value is 100.

A) 111.54

B) 100

C) 102.31

D) 123.07

E) 143.25

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a value weighted index for Jan. 13th if the initial index value is 100.

A) 111.54

B) 100

C) 102.31

D) 123.07

E) 143.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which index is created by first deriving the initial total market value of all stocks used in the index?

A) equally-weighted index.

B) price-weighted index.

C) unweighted index.

D) value-weighted index.

E) over-weighted index.

A) equally-weighted index.

B) price-weighted index.

C) unweighted index.

D) value-weighted index.

E) over-weighted index.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

43

Index movements are influenced by differential prices of the components in a(n)

A) equally-weighted index.

B) price-weighted index.

C) unweighted index.

D) value-weighted index.

E) over-weighted index.

A) equally-weighted index.

B) price-weighted index.

C) unweighted index.

D) value-weighted index.

E) over-weighted index.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

44

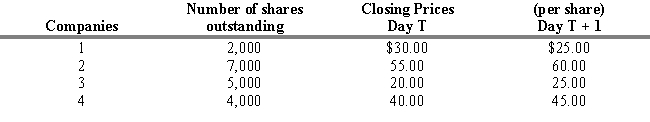

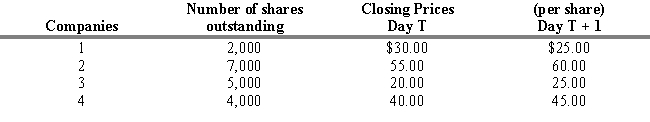

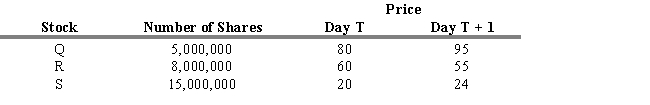

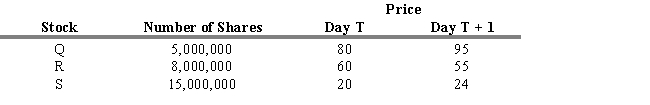

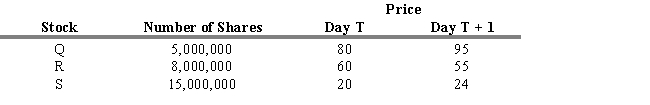

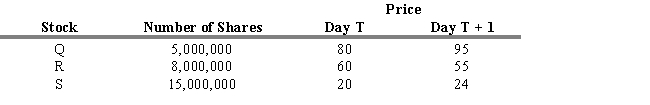

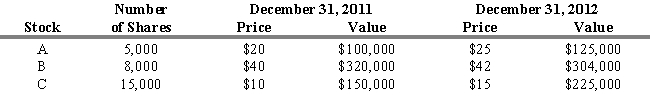

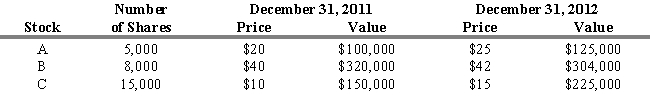

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

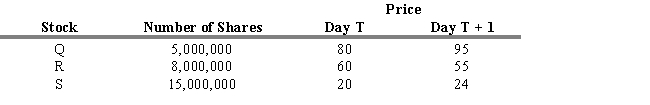

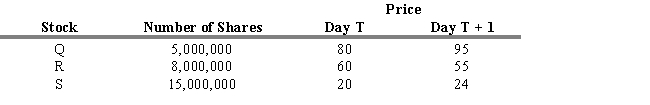

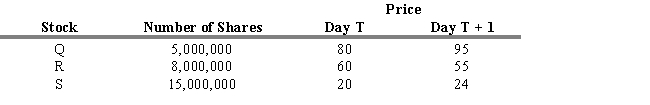

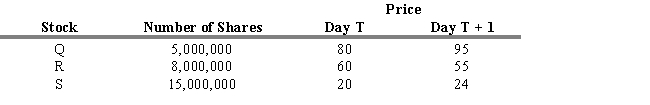

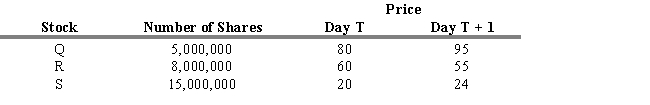

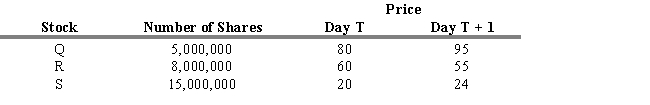

Refer to Exhibit 4.1. For a value-weighted series, assume that Day T is the base period and the base value is 100. What is the new index value for Day T + 1, and what is the percentage change in the index from Day T?

A) 106.33, 6.33 percent

B) 107.48, 7.48 percent

C) 109.93, 9.93 percent

D) 108.7, 8.7 percent

E) 107.56, 7.3 percent

Refer to Exhibit 4.1. For a value-weighted series, assume that Day T is the base period and the base value is 100. What is the new index value for Day T + 1, and what is the percentage change in the index from Day T?

A) 106.33, 6.33 percent

B) 107.48, 7.48 percent

C) 109.93, 9.93 percent

D) 108.7, 8.7 percent

E) 107.56, 7.3 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

45

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 4.1. Assume that a stock price-weighted indicator consisted of the four issues with their prices. What are the values of the stock indicator for Day T and T + 1, and what is the percentage change?

A) 36.25, 38.75, 6.9 percent

B) 38.75, 36.25, -6.9 percent

C) 100, 106.9, 6.9 percent

D) 107.48, 106.33, 1.15 percent

E) 106.9, 100, 5.7 percent

-Refer to Exhibit 4.1. Assume that a stock price-weighted indicator consisted of the four issues with their prices. What are the values of the stock indicator for Day T and T + 1, and what is the percentage change?

A) 36.25, 38.75, 6.9 percent

B) 38.75, 36.25, -6.9 percent

C) 100, 106.9, 6.9 percent

D) 107.48, 106.33, 1.15 percent

E) 106.9, 100, 5.7 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

46

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. What is the divisor at the beginning of January 14th?

A) 3.0

B) 2.5

C) 2.2734

D) 1.9375

E) 3.2852

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. What is the divisor at the beginning of January 14th?

A) 3.0

B) 2.5

C) 2.2734

D) 1.9375

E) 3.2852

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

47

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 4.1. Compute an unweighted price indicator series, using geometric means. What is the percentage change in the index from Day T to Day T+1? Assume a base index value of 100 on Day T.

A) 5.35 percent

B) 7.48 percent

C) 9.93 percent

D) 6.33 percent

E) 0 percent

Refer to Exhibit 4.1. Compute an unweighted price indicator series, using geometric means. What is the percentage change in the index from Day T to Day T+1? Assume a base index value of 100 on Day T.

A) 5.35 percent

B) 7.48 percent

C) 9.93 percent

D) 6.33 percent

E) 0 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

48

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a value weighted index for Jan. 14th if the initial index value is 100.

A) 100

B) 102.31

C) 123.07

D) 111.54

E) 121.32

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a value weighted index for Jan. 14th if the initial index value is 100.

A) 100

B) 102.31

C) 123.07

D) 111.54

E) 121.32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

49

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a price weighed average for January 15th.

A) 30

B) 36.13

C) 32

D) 34

E) 37

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a price weighed average for January 15th.

A) 30

B) 36.13

C) 32

D) 34

E) 37

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

50

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a value weighted index for January 15th if the initial index value is 100.

A) 102.31

B) 100

C) 123.07

D) 111.54

E) 121.32

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a value weighted index for January 15th if the initial index value is 100.

A) 102.31

B) 100

C) 123.07

D) 111.54

E) 121.32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

51

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

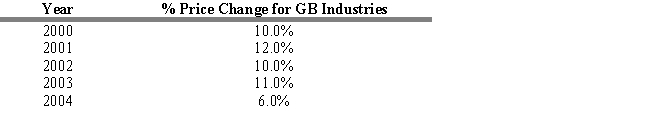

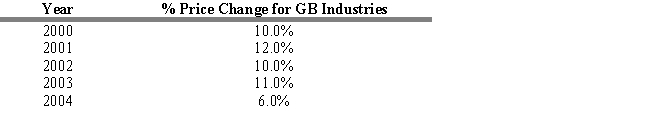

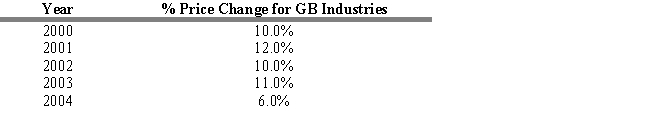

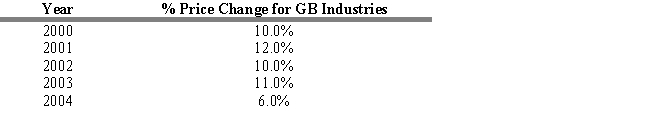

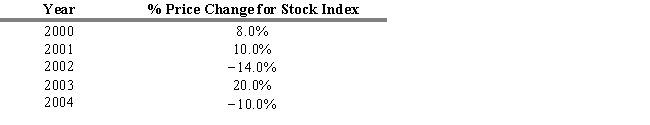

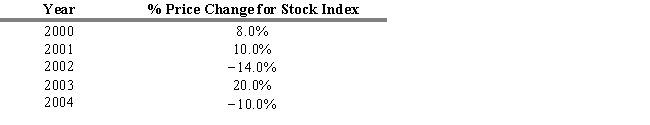

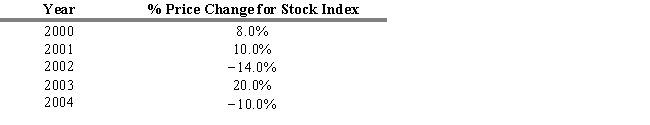

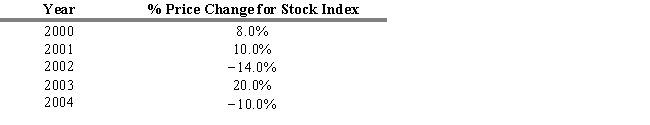

Refer to Exhibit 4.3. Calculate the average annual rate of change for GB Industries for the five-year period using the geometric mean.

A) 9.7800%

B) 0.0978%

C) 9.0700%

D) 0.0970%

E) 3.6400%

Refer to Exhibit 4.3. Calculate the average annual rate of change for GB Industries for the five-year period using the geometric mean.

A) 9.7800%

B) 0.0978%

C) 9.0700%

D) 0.0970%

E) 3.6400%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

52

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a value weighted index for January 16th if the initial index value is 100.

A) 123.07

B) 100.00

C) 102.31

D) 111.54

E) 121.32

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a value weighted index for January 16th if the initial index value is 100.

A) 123.07

B) 100.00

C) 102.31

D) 111.54

E) 121.32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

53

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a price weighted average for January 14th.

A) 32

B) 30

C) 36.13

D) 34

E) 37

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a price weighted average for January 14th.

A) 32

B) 30

C) 36.13

D) 34

E) 37

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

54

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a price weighted average for January 16th.

A) 30

B) 32

C) 34

D) 36.13

E) No37

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a price weighted average for January 16th.

A) 30

B) 32

C) 34

D) 36.13

E) No37

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the fundamental factors was NOT used in the Fundamental Index created by Research Affiliates, Inc.?

A) sales

B) profits (cash flow)

C) leverage (debt/equity)

D) net assets (book value)

E) dividends

A) sales

B) profits (cash flow)

C) leverage (debt/equity)

D) net assets (book value)

E) dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

56

The actual index movements are typically based on the arithmetic mean of the percent changes in price or value for the stocks in the

A) equally-weighted index.

B) price-weighted index.

C) unweighted index.

D) value-weighted index.

E) over-weighted index.

A) equally-weighted index.

B) price-weighted index.

C) unweighted index.

D) value-weighted index.

E) over-weighted index.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

57

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a price weighted average for January 13th.

A) 32

B) 30

C) 36.13

D) 34

E) 56

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. Calculate a price weighted average for January 13th.

A) 32

B) 30

C) 36.13

D) 34

E) 56

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

58

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005

**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. What is the divisor at the beginning of January 16th?

A) 1.9375

B) 3.0

C) 2.5

D) 2.2734

E) 3.2852

*2:1 Split on Stock Z after Close on Jan. 13, 2005

*2:1 Split on Stock Z after Close on Jan. 13, 2005**3:1 Split on Stock X after Close on Jan. 15, 2005

The base date for index calculations is January 13, 2005

Refer to Exhibit 4.2. What is the divisor at the beginning of January 16th?

A) 1.9375

B) 3.0

C) 2.5

D) 2.2734

E) 3.2852

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

59

A style index created to track ethical funds is known as the

A) green index.

B) SRI index.

C) EAFE index.

D) freedom index.

E) ethical index.

A) green index.

B) SRI index.

C) EAFE index.

D) freedom index.

E) ethical index.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

60

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 4.3. Calculate the average annual rate of change for GB Industries for the five-year period using the arithmetic mean.

A) 0.098%

B) 9.80%

C) 8.50%

D) 8.00%

E) 89.00%

Refer to Exhibit 4.3. Calculate the average annual rate of change for GB Industries for the five-year period using the arithmetic mean.

A) 0.098%

B) 9.80%

C) 8.50%

D) 8.00%

E) 89.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

61

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 4.6. Calculate a value weighted average for Day T + 1. Assume a base index value of 100 on Day T.

A) 46.20

B) 53.33

C) 54.12

D) 92.39

E) 108.23

Refer to Exhibit 4.6. Calculate a value weighted average for Day T + 1. Assume a base index value of 100 on Day T.

A) 46.20

B) 53.33

C) 54.12

D) 92.39

E) 108.23

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

62

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the percentage return in the price weighted series for the period Dec 31, 2000 to Dec 31, 2004.

A) 12.68 percent

B) 20.00 percent

C) 21.76 percent

D) 33.33 percent

E) 40.00 percent

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the percentage return in the price weighted series for the period Dec 31, 2000 to Dec 31, 2004.

A) 12.68 percent

B) 20.00 percent

C) 21.76 percent

D) 33.33 percent

E) 40.00 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

63

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the price weighted series for Dec 31, 2003, after the splits.

A) 72.5

B) 100.0

C) 119.25

D) 121.25

E) 81.69

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the price weighted series for Dec 31, 2003, after the splits.

A) 72.5

B) 100.0

C) 119.25

D) 121.25

E) 81.69

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

64

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the unweighted index for Dec 31, 2003, prior to the splits. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 100.0

B) 200.0

C) 150.0

D) 120.0

E) 175.0

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the unweighted index for Dec 31, 2003, prior to the splits. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 100.0

B) 200.0

C) 150.0

D) 120.0

E) 175.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

65

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the value weighted index for Dec 31, 2003, after the splits. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 72.5

B) 81.69

C) 100.0

D) 120.0

E) 121.25

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the value weighted index for Dec 31, 2003, after the splits. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 72.5

B) 81.69

C) 100.0

D) 120.0

E) 121.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

66

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 4.6. Calculate a price weighted average for Day T.

A) 46.20

B) 53.33

C) 54.12

D) 92.39

E) 108.23

Refer to Exhibit 4.6. Calculate a price weighted average for Day T.

A) 46.20

B) 53.33

C) 54.12

D) 92.39

E) 108.23

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

67

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 4.4. Calculate the average annual rate of change for this index for the five-year period using the geometric mean.

A) 0.09%

B) 1.99%

C) 3.99%

D) 4.50%

E) 4.67%

Refer to Exhibit 4.4. Calculate the average annual rate of change for this index for the five-year period using the geometric mean.

A) 0.09%

B) 1.99%

C) 3.99%

D) 4.50%

E) 4.67%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

68

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the percentage return in the unweighted index (geometric mean) for the period Dec 31, 2003 to Dec 31, 2004. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 19.25 percent

B) 21.25 percent

C) 51.25 percent

D) 5.25 percent

E) 100.25 percent

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the percentage return in the unweighted index (geometric mean) for the period Dec 31, 2003 to Dec 31, 2004. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 19.25 percent

B) 21.25 percent

C) 51.25 percent

D) 5.25 percent

E) 100.25 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

69

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the price weighted series for Dec 31, 2004.

A) 121.25

B) 119.25

C) 100.0

D) 72.5

E) 81.69

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the price weighted series for Dec 31, 2004.

A) 121.25

B) 119.25

C) 100.0

D) 72.5

E) 81.69

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

70

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 4.6. Compute the geometric mean of the price change of Stocks Q, R, and S from days T to T + 1.

A) 9.32 percent

B) 10.14 percent

C) 15.57 percent

D) 30.63 percent

E) 54.37 percent

Refer to Exhibit 4.6. Compute the geometric mean of the price change of Stocks Q, R, and S from days T to T + 1.

A) 9.32 percent

B) 10.14 percent

C) 15.57 percent

D) 30.63 percent

E) 54.37 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

71

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 4.6. If an equal-weighted index is constructed on Day T with $10,000 in each stock, what is the percentage change in wealth for this index on Day T + 1? Assume a base index value of 100 on Day T.

A) 8.65 percent

B) 10.14 percent

C) 15.69 percent

D) 30.42 percent

E) 47.08 percent

Refer to Exhibit 4.6. If an equal-weighted index is constructed on Day T with $10,000 in each stock, what is the percentage change in wealth for this index on Day T + 1? Assume a base index value of 100 on Day T.

A) 8.65 percent

B) 10.14 percent

C) 15.69 percent

D) 30.42 percent

E) 47.08 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

72

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the percentage return in the value weighted index for the period Dec 31, 2003 to Dec 31, 2004.

A) 12.68 percent

B) 20.00 percent

C) 21.76 percent

D) 33.33 percent

E) 40.00 percent

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the percentage return in the value weighted index for the period Dec 31, 2003 to Dec 31, 2004.

A) 12.68 percent

B) 20.00 percent

C) 21.76 percent

D) 33.33 percent

E) 40.00 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

73

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the unweighted index for Dec 31, 2003, after the splits. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 110.0

B) 200.0

C) 100.0

D) 120.0

E) 150.0

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the unweighted index for Dec 31, 2003, after the splits. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 110.0

B) 200.0

C) 100.0

D) 120.0

E) 150.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

74

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 4.6. Compute the arithmetic mean of the price change of Stocks Q, R, and S from days T to T + 1.

A) 8.65 percent

B) 10.14 percent

C) 15.69 percent

D) 30.42 percent

E) 47.08 percent

Refer to Exhibit 4.6. Compute the arithmetic mean of the price change of Stocks Q, R, and S from days T to T + 1.

A) 8.65 percent

B) 10.14 percent

C) 15.69 percent

D) 30.42 percent

E) 47.08 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

75

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 4.4. Calculate the average annual rate of change for this index for the five-year period using the arithmetic mean.

A) 0.28%

B) 1.28%

C) 2.80%

D) 3.58%

E) 6.38%

Refer to Exhibit 4.4. Calculate the average annual rate of change for this index for the five-year period using the arithmetic mean.

A) 0.28%

B) 1.28%

C) 2.80%

D) 3.58%

E) 6.38%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

76

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the value weighted index for Dec 31, 2004. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 121.25

B) 100.0

C) 81.69

D) 72.5

E) 120.0

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the value weighted index for Dec 31, 2004. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 121.25

B) 100.0

C) 81.69

D) 72.5

E) 120.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

77

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the price weighted series for Dec 31, 2003, prior to the splits.

A) 81.69

B) 100.0

C) 72.5

D) 121.25

E) 119.25

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the price weighted series for Dec 31, 2003, prior to the splits.

A) 81.69

B) 100.0

C) 72.5

D) 121.25

E) 119.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

78

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Refer to Exhibit 4.7. What would be the total percentage change in an equally weighted portfolio of ABC?

A) 13.33 percent

B) 18.67 percent

C) 23.41 percent

D) 26.67 percent

E) 36.83 percent

Refer to Exhibit 4.7. What would be the total percentage change in an equally weighted portfolio of ABC?

A) 13.33 percent

B) 18.67 percent

C) 23.41 percent

D) 26.67 percent

E) 36.83 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

79

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the value weighted index for Dec 31, 2003, prior to the splits. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 120.0

B) 81.69

C) 72.5

D) 100.0

E) 121.25

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the value weighted index for Dec 31, 2003, prior to the splits. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 120.0

B) 81.69

C) 72.5

D) 100.0

E) 121.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck

80

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the unweighted index (geometric mean) for Dec 31, 2004. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 119.25

B) 121.25

C) 151.25

D) 95.25

E) 100.25

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Stocks W and X had 2 for 1 splits after the close on Dec 31, 2003.

Refer to Exhibit 4.5. Calculate the unweighted index (geometric mean) for Dec 31, 2004. Assume a base index value of 100. The base year is Dec 31, 2003.

A) 119.25

B) 121.25

C) 151.25

D) 95.25

E) 100.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 89 في هذه المجموعة.

فتح الحزمة

k this deck