Deck 7: Plant Assets, Natural Resources, Intangibles

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/211

العب

ملء الشاشة (f)

Deck 7: Plant Assets, Natural Resources, Intangibles

1

Company A purchased a used piece of equipment. All of the following costs should be included in the cost of the equipment EXCEPT for:

A) insurance while in transit.

B) sales tax paid.

C) installation costs.

D) maintenance costs after the equipment is up and running.

A) insurance while in transit.

B) sales tax paid.

C) installation costs.

D) maintenance costs after the equipment is up and running.

D

2

The cost of assets purchased together in a lump sum should be allocated using the market value of each of the assets.

True

3

The cost of a building will include the costs to renovate the building for its intended use.

True

4

The cost of leasehold improvements should be depreciated over the life of the improvement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

5

The only plant asset that does not depreciate is:

A) office supplies.

B) furniture.

C) land.

D) patents.

A) office supplies.

B) furniture.

C) land.

D) patents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is a natural resource?

A) patents

B) timber

C) gas reserves

D) both B and C

A) patents

B) timber

C) gas reserves

D) both B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

7

Long-lived tangible assets that are used in the operation of the business are called:

A) intangible assets.

B) natural resources.

C) plant assets.

D) goodwill.

A) intangible assets.

B) natural resources.

C) plant assets.

D) goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

8

An asset with no physical form, but that has special rights to current and expected future benefits is a(n):

A) intangible asset.

B) natural resource.

C) plant asset.

D) fixed asset.

A) intangible asset.

B) natural resource.

C) plant asset.

D) fixed asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

9

The cost of land may include the cost of any back property taxes that the purchaser pays.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

10

Costs of land improvements are included in the land account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

11

An example of an intangible asset is:

A) land.

B) equipment.

C) coal mine.

D) goodwill.

A) land.

B) equipment.

C) coal mine.

D) goodwill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following should be included in the cost of land?

A) Construction cost of a parking lot

B) Landscaping

C) Real estate brokerage commission

D) Lighting

A) Construction cost of a parking lot

B) Landscaping

C) Real estate brokerage commission

D) Lighting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

13

ABC Company purchased land with an old building that they plan on demolishing so that they can construct a new, modern building. The cost of demolishing the building will be part of the cost of the:

A) new building.

B) old building.

C) land.

D) land improvements.

A) new building.

B) old building.

C) land.

D) land improvements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

14

Land improvements are not subject to depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

15

Any cost to get machinery up and running and ready for its intended use should be part of the cost of the asset and depreciated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

16

The cost of any plant asset is the sum of all of the costs incurred to bring the asset to its intended use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

17

The cost of land includes the cost of fencing and paving.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

18

If a company buys equipment and land in a lump-sum purchase for cash, total assets increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

19

Company B purchased some land and is preparing the land for a new building. Company B should include which of the following in the cost of the land?

A) Cost of driveways

B) Cost of fencing

C) Cost of sprinkler systems for the shrubbery

D) Grading and clearing the land

A) Cost of driveways

B) Cost of fencing

C) Cost of sprinkler systems for the shrubbery

D) Grading and clearing the land

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

20

All amounts paid to acquire a plant asset and to get it ready for its intended use are referred to as:

A) set up costs.

B) expenditures.

C) maintenance expense.

D) the cost of an asset.

A) set up costs.

B) expenditures.

C) maintenance expense.

D) the cost of an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

21

Tanner Company acquired equipment #1, equipment #2, and equipment #3, for $600,000. Equipment #1 is appraised at $240,000, equipment # 2 is appraised at $310,000 and equipment #3 is appraised for $110,000.The cost of equipment #2 is:

A) $220,218.

B) $200,000.

C) $281,818.

D) $310,000.

A) $220,218.

B) $200,000.

C) $281,818.

D) $310,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

22

Bixby Corporation purchased land and a building for $800,000. An appraisal indicates that the land's value is $400,000 and the building's value is $500,000. When recording this transaction Galaxy should debit:

A) Land for $800,000.

B) Building for $355,555.

C) Land Improvement-Building for $500,000.

D) Building for $444,444.

A) Land for $800,000.

B) Building for $355,555.

C) Land Improvement-Building for $500,000.

D) Building for $444,444.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

23

The distinction between a capital expenditure and an expense can be difficult to determine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

24

A machine is purchased for $70,000. The transportation costs were $4,000, installation costs were $1,000 and taxes on the purchase price were $700. The cost basis of the machine is:

A) $70,000.

B) $74,000.

C) $75,700.

D) none of the above.

A) $70,000.

B) $74,000.

C) $75,700.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

25

Delivery Company Corporation purchased a delivery van for $32,500. Delivery Company also paid $1,200 in sales taxes. After driving the van for 5,000 miles, a flat tire needed to be repaired at a cost of $60.The cost of the van is:

A) $32,500.

B) $32,560.

C) $33,700.

D) $33,760.

A) $32,500.

B) $32,560.

C) $33,700.

D) $33,760.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

26

Determine the cost of the dump truck, based upon the following data:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

27

The Spa Company purchased land, buildings and equipment for $830,000. The land has been appraised at $300,000, the buildings at $510,000 and the equipment at $90,000. The journal entry to record this transaction will include a debit to:

A) land for $300,000.

B) land for $470,333.

C) building for $470,333.

D) equipment for $276,667.

A) land for $300,000.

B) land for $470,333.

C) building for $470,333.

D) equipment for $276,667.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

28

Although located on the land, they are subject to decay and their cost is depreciated. This is the definition of:

A) land improvements.

B) plant and equipment.

C) buildings.

D) land.

A) land improvements.

B) plant and equipment.

C) buildings.

D) land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

29

The Meat Company purchased assets for a lump sum price of $1,000,000. The assets purchased had an appraised value of:

Prepare the appropriate journal entry if The Meat Company paid cash for this transaction.

Prepare the appropriate journal entry if The Meat Company paid cash for this transaction.

Prepare the appropriate journal entry if The Meat Company paid cash for this transaction.

Prepare the appropriate journal entry if The Meat Company paid cash for this transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

30

Many companies will have a policy of expensing all items above a certain dollar amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

31

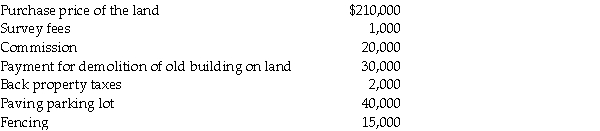

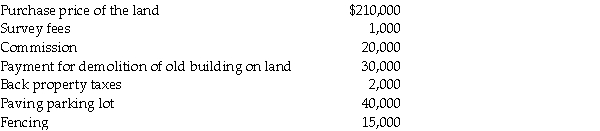

Determine the cost of the land, based upon the following data:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

32

The ________ method is used to allocate the cost of assets acquired in a lump-sum purchase.

A) book-value

B) cost

C) per capita

D) relative-sales-value

A) book-value

B) cost

C) per capita

D) relative-sales-value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

33

Land, buildings and equipment are acquired for a lump sum of $850,000. The market values of the three assets are, respectively, $250,000, $480,000 and $180,000. What is the cost assigned to the equipment?

A) $150,132

B) $168,132

C) $180,000

D) $209,590

A) $150,132

B) $168,132

C) $180,000

D) $209,590

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

34

The cost of installing lights in the parking lot should be recorded as:

A) land.

B) land improvements.

C) building.

D) equipment.

A) land.

B) land improvements.

C) building.

D) equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following should be included in the cost of equipment?

A) Freight costs to deliver the equipment

B) Installation costs for the equipment

C) Testing costs to get the equipment ready for use

D) All of the above

A) Freight costs to deliver the equipment

B) Installation costs for the equipment

C) Testing costs to get the equipment ready for use

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

36

A lump-sum purchase of assets:

A) requires the company to record the assets bought as a single asset.

B) requires the company to divided the total cost among the various assets according to their historical cost.

C) uses the market values of the assets to determine the cost of each individual asset.

D) is also known as the group purchase of assets.

A) requires the company to record the assets bought as a single asset.

B) requires the company to divided the total cost among the various assets according to their historical cost.

C) uses the market values of the assets to determine the cost of each individual asset.

D) is also known as the group purchase of assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following costs should NOT be added to the cost of the machine?

A) The cost of transporting the machine to its setup location

B) The cost of insurance for the machine while it is in-transit

C) The cost of a special platform for the machine

D) The cost of oiling the machine after it has been used for two years

A) The cost of transporting the machine to its setup location

B) The cost of insurance for the machine while it is in-transit

C) The cost of a special platform for the machine

D) The cost of oiling the machine after it has been used for two years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

38

Land is purchased for $543,710. Back taxes paid by the purchaser were $8,500; total costs to demolish an existing building and clear the land were $215,000, and costs of paving the parking lot were $106,000. What is the cost of the land?

A) $543,710

B) $649,710

C) $767,210

D) $873,210

A) $543,710

B) $649,710

C) $767,210

D) $873,210

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

39

Auto Shop, Inc., incurred the following costs in acquiring plant assets:

a. Purchased land for a $100,000 down payment and signed a $75,000 note payable for the balance.

b. Delinquent property tax of $2,500 and legal fees of $1,000 had to be paid before the land could be purchased.

c. $12,000 was paid to demolish an unwanted building on the land.

d. Architect fee of $7,000 was paid for the design of a new office building.

e. An office building was constructed at a cost of $500,000.

f. Interest cost on a construction loan for the building totaled $6,000

g. $17,500 was paid for fencing, $12,000 was paid for landscaping, and $55,000 was paid for paving the parking lot.

Determine the cost of the land, land improvements, and building.

a. Purchased land for a $100,000 down payment and signed a $75,000 note payable for the balance.

b. Delinquent property tax of $2,500 and legal fees of $1,000 had to be paid before the land could be purchased.

c. $12,000 was paid to demolish an unwanted building on the land.

d. Architect fee of $7,000 was paid for the design of a new office building.

e. An office building was constructed at a cost of $500,000.

f. Interest cost on a construction loan for the building totaled $6,000

g. $17,500 was paid for fencing, $12,000 was paid for landscaping, and $55,000 was paid for paving the parking lot.

Determine the cost of the land, land improvements, and building.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

40

A company recently purchased a building that it plans to renovate to get ready for use in its operations. All expenditures to repair and renovate the existing building for its intended use are charged to:

A) land.

B) land improvements.

C) land improvements expense.

D) building.

A) land.

B) land improvements.

C) land improvements expense.

D) building.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

41

An expenditure that increases an asset's capacity or extends its useful life is a(n):

A) capital expenditure.

B) expense.

C) addition.

D) improvement.

A) capital expenditure.

B) expense.

C) addition.

D) improvement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

42

Costs that do not extend the asset's capacity or its useful life, but merely maintain the asset or restore it to working order are recorded as:

A) capital expenditures.

B) expenses.

C) additions.

D) improvements.

A) capital expenditures.

B) expenses.

C) additions.

D) improvements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

43

The units-of-production method is an accelerated depreciation method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

44

On June 1, Puff's Trucking Company paid $3,000 to overhaul the engine on a delivery truck to allow it to be used for two additional years. It also paid $75 for an oil change on the truck. Which of the following statements is true?

A) The $3,000 is a capital expenditure and the $75 is an expense.

B) The $3,000 is an expense and the $75 is a capital expenditure.

C) Both items are capital expenditures.

D) Both items are expenses.

A) The $3,000 is a capital expenditure and the $75 is an expense.

B) The $3,000 is an expense and the $75 is a capital expenditure.

C) Both items are capital expenditures.

D) Both items are expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

45

WorldCom committed financial statement fraud by:

A) expensing items that should have been capitalized.

B) understating net income.

C) using IFRS to make the company look better.

D) capitalizing items that should have been expensed.

A) expensing items that should have been capitalized.

B) understating net income.

C) using IFRS to make the company look better.

D) capitalizing items that should have been expensed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is a correct statement regarding the expensing or capitalization of items?

A) Most companies expense all material costs above a certain amount, even if they are capital items.

B) A conservative policy regarding expensing of items is one that avoids understating assets.

C) The distinction between a capital expenditure and an immediate expense is clear cut.

D) A conservative policy regarding expensing of items is one that avoids overstating profits.

A) Most companies expense all material costs above a certain amount, even if they are capital items.

B) A conservative policy regarding expensing of items is one that avoids understating assets.

C) The distinction between a capital expenditure and an immediate expense is clear cut.

D) A conservative policy regarding expensing of items is one that avoids overstating profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

47

Book value equals the cost of the asset less the total accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

48

The depreciation process follows the matching principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

49

Capital expenditures are not immediately expensed because these items:

A) do not extend the life of an asset.

B) return an asset to its prior condition.

C) increase the asset's capacity.

D) do all of the above.

A) do not extend the life of an asset.

B) return an asset to its prior condition.

C) increase the asset's capacity.

D) do all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

50

If a company capitalizes a cost that should have been expensed:

A) expenses will be overstated in the year of the error.

B) net income will be understated in the year of the error.

C) assets will be overstated.

D) revenues will be overstated.

A) expenses will be overstated in the year of the error.

B) net income will be understated in the year of the error.

C) assets will be overstated.

D) revenues will be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

51

Obsolescence may cause an asset's useful life to be longer than the asset's physical life.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

52

The journal entry to record an addition to an office building would include:

A) credit to depreciation expense.

B) credit to accumulated depreciation.

C) debit to repair expense.

D) debit to office building.

A) credit to depreciation expense.

B) credit to accumulated depreciation.

C) debit to repair expense.

D) debit to office building.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following costs associated with a delivery van should be capitalized? I. The van is repainted.

II) The van's transmission is completely overhauled to extend useful life for two years.

III) The van is modified for a specific use.

A) I and II

B) I and III

C) II and III

D) All of these answers are correct.

II) The van's transmission is completely overhauled to extend useful life for two years.

III) The van is modified for a specific use.

A) I and II

B) I and III

C) II and III

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

54

Costs that extend an asset's useful life should be capitalized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

55

Company A replaced the tires and painted several of its vehicles during the year. These costs should be:

A) debited to Equipment.

B) depreciated over the life of the vehicles.

C) credited to Accumulated Depreciation.

D) debited to Repair Expense.

A) debited to Equipment.

B) depreciated over the life of the vehicles.

C) credited to Accumulated Depreciation.

D) debited to Repair Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

56

The normal balance of the accumulated depreciation account is a debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

57

If an expenditure it capitalized, it is:

A) debited to an expense account.

B) debited to an asset account.

C) credited to an asset account.

D) credited to an expense account.

A) debited to an expense account.

B) debited to an asset account.

C) credited to an asset account.

D) credited to an expense account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

58

Treating a capital expenditure as an immediate expense:

A) overstates assets and overstates owners' equity.

B) overstates expenses and understates net income.

C) understates expenses and overstates owners' equity.

D) understates expenses and understates assets.

A) overstates assets and overstates owners' equity.

B) overstates expenses and understates net income.

C) understates expenses and overstates owners' equity.

D) understates expenses and understates assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

59

The Accumulated Depreciation account is an income statement account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

60

Pat's Pets recently paid to have the engine in its delivery van overhauled. The estimated useful life of the van was originally estimated to be 4 years. The overhaul is expected to extend the useful life of the van to 10 years. The overhaul is regarded as a(n):

A) revenue expenditure.

B) capital expenditure.

C) equity expenditure.

D) matching expenditure.

A) revenue expenditure.

B) capital expenditure.

C) equity expenditure.

D) matching expenditure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

61

The three depreciation methods allocate different amounts of depreciation to each period, but all result in the same total amount of depreciation over the life of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

62

It is illegal to use one method of depreciation for financial purposes and another method for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

63

All of the following are needed to measure depreciation, EXCEPT for:

A) cost.

B) market value.

C) estimated useful life.

D) estimated residual value.

A) cost.

B) market value.

C) estimated useful life.

D) estimated residual value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

64

Depreciation expense decreases both assets and equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

65

The use of the straight-line method of computing depreciation increases a company's tax liability, thereby increasing the company's cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

66

In the units-of production method, a fixed amount of depreciation is assigned to each unit of output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

67

An asset is ________ when another asset can do the job more efficiently.

A) fully depreciated

B) old

C) physically worn

D) obsolete

A) fully depreciated

B) old

C) physically worn

D) obsolete

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following depreciation methods best applies to those assets that generate greater revenue earlier in their useful lives?

A) Straight-line method

B) Depletion method

C) Double-declining-balance method

D) Units-of-production method

A) Straight-line method

B) Depletion method

C) Double-declining-balance method

D) Units-of-production method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

69

The depreciation process attempts to match the:

A) salvage value of the asset and the future market value of the asset.

B) book value and the current market value of the asset.

C) cost of the asset and the cash required to replace the asset.

D) revenues earned by the asset and the cost of the asset.

A) salvage value of the asset and the future market value of the asset.

B) book value and the current market value of the asset.

C) cost of the asset and the cash required to replace the asset.

D) revenues earned by the asset and the cost of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

70

Changes in accounting estimates are not allowed under the consistency principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

71

The book value of an asset cannot be less than its residual value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

72

Since depreciation is an estimate, depreciation must be computed for the entire year, regardless of when the asset was purchased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

73

Double-declining-balance depreciation computes total depreciation by multiplying the asset's cost by two times the straight-line rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

74

The process of depreciating an asset over its useful life is an application of the ________ principle.

A) full disclosure

B) revenue recognition

C) historical cost

D) matching

A) full disclosure

B) revenue recognition

C) historical cost

D) matching

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

75

Under the double-declining balance method of depreciation, residual value is initially ignored.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

76

Depreciation expense:

A) allocates a portion of the cost of an asset against the revenue the asset helps earn each period.

B) is not required for plant assets according to GAAP.

C) is reported on the balance sheet.

D) is required for land according to GAAP.

A) allocates a portion of the cost of an asset against the revenue the asset helps earn each period.

B) is not required for plant assets according to GAAP.

C) is reported on the balance sheet.

D) is required for land according to GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

77

At the end of its useful life, the book value of an asset must be zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

78

The process of allocating the cost of a plant asset to expense over the period in which the asset is used is called:

A) amortization.

B) allocation.

C) depreciation.

D) disclosure.

A) amortization.

B) allocation.

C) depreciation.

D) disclosure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

79

Double-declining balance depreciation:

A) is an accelerated method of depreciation.

B) ignores the residual value in computing depreciation, except during the last year.

C) is based on book value.

D) is all of the above.

A) is an accelerated method of depreciation.

B) ignores the residual value in computing depreciation, except during the last year.

C) is based on book value.

D) is all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck

80

The straight-line method must be used for computing depreciation for income tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 211 في هذه المجموعة.

فتح الحزمة

k this deck