Deck 2: Transaction Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/179

العب

ملء الشاشة (f)

Deck 2: Transaction Analysis

1

Which of the following business events would NOT be recorded in a company's accounting records?

A) The company paid a monthly utility bill.

B) The company issued 100 shares of common stock.

C) The company purchased two acres of land for future plant expansion.

D) The company signed a contract to provide services in the next accounting period.

A) The company paid a monthly utility bill.

B) The company issued 100 shares of common stock.

C) The company purchased two acres of land for future plant expansion.

D) The company signed a contract to provide services in the next accounting period.

D

2

If a company declares and pays a dividend to its stockholders, both cash and expenses will decrease.

False

3

Which of the following is a liability account?

A) Retained Earnings

B) Accrued Liabilities

C) Accounts Receivable

D) Prepaid Expenses

A) Retained Earnings

B) Accrued Liabilities

C) Accounts Receivable

D) Prepaid Expenses

B

4

All of the following accounts would be considered assets EXCEPT for:

A) Cash.

B) Retained Earnings.

C) Prepaid Expenses.

D) Notes Receivable.

A) Cash.

B) Retained Earnings.

C) Prepaid Expenses.

D) Notes Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

5

Goods purchased on account for future use in the business, such as store supplies, are called:

A) accrued liabilities.

B) expenses.

C) revenues.

D) prepaid expenses.

A) accrued liabilities.

B) expenses.

C) revenues.

D) prepaid expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

6

Every transaction has two sides-you give something and you receive something.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

7

A record of all the changes in a particular asset, liability, or stockholders' equity during a period is called a(n):

A) transaction.

B) trial balance.

C) journal.

D) account.

A) transaction.

B) trial balance.

C) journal.

D) account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

8

Income statement data appears as revenues and expenses under Retained Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

9

Notes payable, accounts payable, taxes payable and salaries payable are all examples of:

A) liabilities.

B) revenues.

C) expenses.

D) assets.

A) liabilities.

B) revenues.

C) expenses.

D) assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

10

A transaction is any event that has a financial impact on the business that can be

measured reliably.

measured reliably.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

11

The account is the basic summary device of accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

12

An accounts receivable usually specifies an interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which account includes bank account balances?

A) Accounts Receivable

B) Notes Receivable

C) Cash

D) Prepaid Expenses

A) Accounts Receivable

B) Notes Receivable

C) Cash

D) Prepaid Expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following is NOT a business transaction?

A) The company sells goods on account.

B) The company buys land for cash.

C) The company is featured in a magazine article.

D) The company sells stock for cash.

A) The company sells goods on account.

B) The company buys land for cash.

C) The company is featured in a magazine article.

D) The company sells stock for cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

15

Assets include cash, land, and accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

16

Any event that has a financial impact on the business and can be measured reliably is a(n):

A) expense.

B) transaction.

C) asset.

D) journal.

A) expense.

B) transaction.

C) asset.

D) journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

17

Prepaid expenses are an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

18

Transactions:

A) must be recorded for every company event.

B) provide objective information about the financial impact on a company.

C) are recorded only if the amounts are significant to the company.

D) only have one side that needs to be recorded.

A) must be recorded for every company event.

B) provide objective information about the financial impact on a company.

C) are recorded only if the amounts are significant to the company.

D) only have one side that needs to be recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is a correct statement?

A) Shareholders' equity is also called Proprietorship Equity.

B) A proprietorship has more than one capital account.

C) A partnership has a separate owner's equity account for each partner.

D) Retained earnings is the owner's investment in the corporation.

A) Shareholders' equity is also called Proprietorship Equity.

B) A proprietorship has more than one capital account.

C) A partnership has a separate owner's equity account for each partner.

D) Retained earnings is the owner's investment in the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

20

The rules for recording accounting transactions include all of the following EXCEPT:

A) Every transaction's net amount on the left side of the equation must equal the net amount on the right side of the equation.

B) Total assets must always equal total liabilities plus total equity.

C) Every transaction affects the financial statements of the business.

D) Both sides of the accounting equation must be affected.

A) Every transaction's net amount on the left side of the equation must equal the net amount on the right side of the equation.

B) Total assets must always equal total liabilities plus total equity.

C) Every transaction affects the financial statements of the business.

D) Both sides of the accounting equation must be affected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

21

When a company incurs additional debt, which type of account is increased?

A) Expense account

B) Retained earnings

C) Liability account

D) Common Stock account

A) Expense account

B) Retained earnings

C) Liability account

D) Common Stock account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

22

Muddle Company performs a service for one of its customers and immediately collects the cash. This transaction will:

A) have no effect on liabilities.

B) decrease net income.

C) decrease Retained Earnings.

D) increase Accounts Receivable.

A) have no effect on liabilities.

B) decrease net income.

C) decrease Retained Earnings.

D) increase Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

23

The payment of salaries to employees would:

A) increase assets and increase liabilities.

B) decrease net income and decrease assets.

C) increase liabilities and increase net income.

D) decrease assets and increase liabilities.

A) increase assets and increase liabilities.

B) decrease net income and decrease assets.

C) increase liabilities and increase net income.

D) decrease assets and increase liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

24

When services are performed on account:

A) cash is increased.

B) revenue will not be recorded until the cash is received from the customer.

C) accounts receivable is increased.

D) accounts payable is increased.

A) cash is increased.

B) revenue will not be recorded until the cash is received from the customer.

C) accounts receivable is increased.

D) accounts payable is increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

25

Generally companies will prepare financial statements:

A) after every transaction.

B) only when both the balance sheet and income statement are affected.

C) at the end of the accounting period.

D) at the close of every business day.

A) after every transaction.

B) only when both the balance sheet and income statement are affected.

C) at the end of the accounting period.

D) at the close of every business day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

26

A company performed services for a customer for cash. This transaction increased assets and:

A) decreased equity.

B) increased liabilities.

C) increased expenses.

D) increased revenues.

A) decreased equity.

B) increased liabilities.

C) increased expenses.

D) increased revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

27

When cash is paid for utilities:

A) stockholders' equity is decreased.

B) expenses are decreased.

C) assets are increased.

D) liabilities are increased.

A) stockholders' equity is decreased.

B) expenses are decreased.

C) assets are increased.

D) liabilities are increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following transactions will increase Stockholders' Equity?

A) The company pays a dividend to its shareholders.

B) The company issues common stock to new shareholders.

C) The president of the company buys a new personal automobile.

D) The company makes a payment on account.

A) The company pays a dividend to its shareholders.

B) The company issues common stock to new shareholders.

C) The president of the company buys a new personal automobile.

D) The company makes a payment on account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

29

If a company buys inventory on account:

A) cash would decrease.

B) accounts payable would increase.

C) net income would increase.

D) common Stock would decrease.

A) cash would decrease.

B) accounts payable would increase.

C) net income would increase.

D) common Stock would decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

30

A company received cash in exchange for issuing stock. This transaction increased assets and:

A) increased expenses.

B) increased revenues.

C) increased liabilities.

D) increased equity.

A) increased expenses.

B) increased revenues.

C) increased liabilities.

D) increased equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

31

The debt created by a business when it makes a purchase on account is a(n):

A) revenue.

B) prepaid expense.

C) account receivable.

D) account payable.

A) revenue.

B) prepaid expense.

C) account receivable.

D) account payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

32

Purchasing supplies on account would:

A) increase total assets and decrease total liabilities.

B) increase total liabilities and decrease total assets.

C) increase total assets and increase total liabilities.

D) increase total liabilities and increase stockholders' equity.

A) increase total assets and decrease total liabilities.

B) increase total liabilities and decrease total assets.

C) increase total assets and increase total liabilities.

D) increase total liabilities and increase stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

33

Company Z sells land for the same amount it paid for it three years ago. When the company records this transaction:

A) assets and stockholders' equity are increased.

B) one asset is increased and another asset is decreased.

C) one liability is increased and another liability is decreased.

D) assets are increased and liabilities are decreased.

A) assets and stockholders' equity are increased.

B) one asset is increased and another asset is decreased.

C) one liability is increased and another liability is decreased.

D) assets are increased and liabilities are decreased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

34

When a business purchases land on account:

A) both assets and stockholders' equity are increased.

B) assets are decreased and stockholder's equity is increased.

C) both assets and liabilities are increased.

D) assets are increased and liabilities are decreased.

A) both assets and stockholders' equity are increased.

B) assets are decreased and stockholder's equity is increased.

C) both assets and liabilities are increased.

D) assets are increased and liabilities are decreased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

35

When a company borrows cash from the bank:

A) total assets remain the same.

B) liabilities are increased.

C) retained earnings is decreased.

D) total liabilities remain the same.

A) total assets remain the same.

B) liabilities are increased.

C) retained earnings is decreased.

D) total liabilities remain the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

36

A company paid cash for an amount owed to a creditor. This transaction decreased cash and:

A) decreased revenues.

B) decreased liabilities.

C) decreased expenses.

D) increased expenses.

A) decreased revenues.

B) decreased liabilities.

C) decreased expenses.

D) increased expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following transactions will increase one asset and decrease another asset?

A) The purchase of office supplies on account.

B) The performance of services on account.

C) The purchase of equipment for cash.

D) The performance of services for cash.

A) The purchase of office supplies on account.

B) The performance of services on account.

C) The purchase of equipment for cash.

D) The performance of services for cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

38

When a company pays an amount it owes a creditor:

A) assets are decreased and net income is decreased.

B) assets are decreased and liabilities are increased.

C) liabilities are decreased and net income is increased.

D) assets are decreased and liabilities are decreased.

A) assets are decreased and net income is decreased.

B) assets are decreased and liabilities are increased.

C) liabilities are decreased and net income is increased.

D) assets are decreased and liabilities are decreased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

39

A company performs services for a client on account. When the company receives the cash from the customer one month later:

A) a revenue account is increased.

B) a liability account is decreased.

C) an asset account is increased.

D) an expense account is decreased.

A) a revenue account is increased.

B) a liability account is decreased.

C) an asset account is increased.

D) an expense account is decreased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

40

Paying a repair bill as soon as it was received would:

A) increase expenses.

B) increase liabilities.

C) increase owners' equity.

D) decrease revenues.

A) increase expenses.

B) increase liabilities.

C) increase owners' equity.

D) decrease revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

41

Performing services on account:

A) decreases both assets and liabilities.

B) increases assets and decreases stockholders' equity.

C) decreases revenues and decreases stockholders' equity.

D) increases both net income and stockholders' equity.

A) decreases both assets and liabilities.

B) increases assets and decreases stockholders' equity.

C) decreases revenues and decreases stockholders' equity.

D) increases both net income and stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following transactions would decrease an asset and decrease stockholders' equity?

A) The payment of an account payable

B) The performance of a service for a client on account

C) The borrowing of money from the bank for thirty days

D) The declaration and payment of a dividend to the shareholders

A) The payment of an account payable

B) The performance of a service for a client on account

C) The borrowing of money from the bank for thirty days

D) The declaration and payment of a dividend to the shareholders

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

43

When preparing the financial statements:

A) assets, liabilities, and revenues are reported on the balance sheet.

B) the balance sheet reports the beginning balance of retained earnings.

C) assets, liabilities, and stockholders' equity are reported on the balance sheet.

D) assets, liabilities, and dividends are reported on the balance sheet.

A) assets, liabilities, and revenues are reported on the balance sheet.

B) the balance sheet reports the beginning balance of retained earnings.

C) assets, liabilities, and stockholders' equity are reported on the balance sheet.

D) assets, liabilities, and dividends are reported on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

44

An important fact to remember when analyzing the transactions of a company is that:

A) the income statement data appears under Common Stock.

B) the balance sheet data includes the ending balances of the asset, liabilities and revenues of the company.

C) dividends are added when computing the ending balance of retained earnings.

D) the income statement includes revenues and expenses.

A) the income statement data appears under Common Stock.

B) the balance sheet data includes the ending balances of the asset, liabilities and revenues of the company.

C) dividends are added when computing the ending balance of retained earnings.

D) the income statement includes revenues and expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

45

A company had credit sales of $30,000 and cash sales of $10,000 during the month of May. Also during May, the company paid wages of $1,000 and utilities of $800. It also received payments from customers on account totaling $4,000. At the beginning of May, the company had a cash balance of $25,000. What is the company's cash balance at the end of May?

A) $23,200

B) $25,000

C) $37,200

D) $65,000

A) $23,200

B) $25,000

C) $37,200

D) $65,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

46

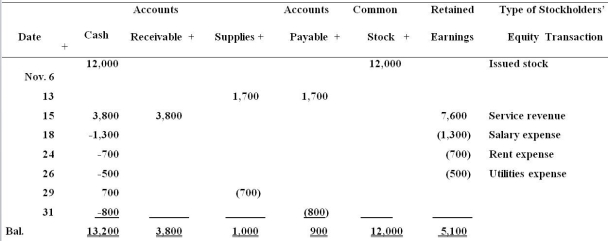

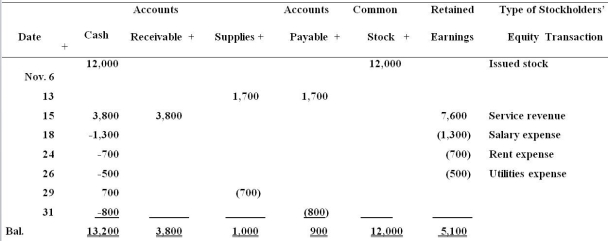

The transactions of the Morton Company for the month of November are summarized below:

REQUIRED:

REQUIRED:

Answer the following questions about Morton Company:

1. How much are total assets?

2. How much does the business expect to collect from customers?

3. How much does the business owe?

4. How much net income or net loss did Morton Company have for the month of November?

REQUIRED:

REQUIRED:Answer the following questions about Morton Company:

1. How much are total assets?

2. How much does the business expect to collect from customers?

3. How much does the business owe?

4. How much net income or net loss did Morton Company have for the month of November?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

47

Lucy Morton opened an engineering office and titled the business Engineering Enterprises P.C. During its first month of operations, it completed the following transactions: I. Lucy invested $30,000 in the business, which in turn issued common stock to her.

II) The business purchased equipment on account for $6,000.

II) The business provided engineering services on account, $10,000.

III) The business paid salaries to the receptionist, $1,000.

IV) The business received cash from a customer as payment on account $6,000.

V) The business borrowed $8,000 from the bank, issuing a note payable.

Total assets would be:

A) $30,000.

B) $37,000.

C) $47,000.

D) $61,000.

II) The business purchased equipment on account for $6,000.

II) The business provided engineering services on account, $10,000.

III) The business paid salaries to the receptionist, $1,000.

IV) The business received cash from a customer as payment on account $6,000.

V) The business borrowed $8,000 from the bank, issuing a note payable.

Total assets would be:

A) $30,000.

B) $37,000.

C) $47,000.

D) $61,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

48

To compute ending retained earnings on the statement of retained earnings:

A) net income is added to the beginning retained earnings and dividends are subtracted from the beginning retained earnings.

B) net income and dividends are both added to beginning retained earnings.

C) net loss and dividends are both added to beginning retained earnings.

D) net income or net loss does not affect retained earnings.

A) net income is added to the beginning retained earnings and dividends are subtracted from the beginning retained earnings.

B) net income and dividends are both added to beginning retained earnings.

C) net loss and dividends are both added to beginning retained earnings.

D) net income or net loss does not affect retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

49

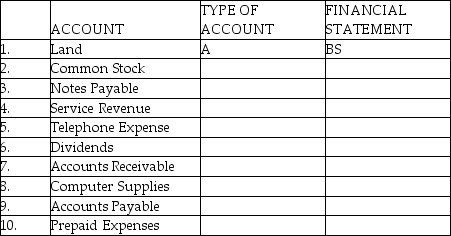

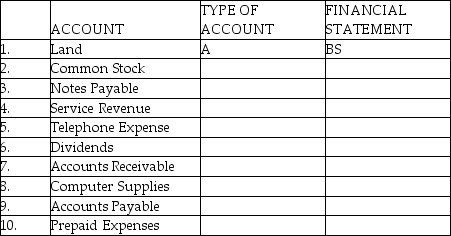

Indicate whether the account is an asset (A), liability (L), stockholders' equity (SE), revenue (R) or expense (E) account. Also indicate if the account would appear on the Balance Sheet (BS) or Income Statement (IS) or the Statement of Retained Earnings (SRE) The first account has been completed for you.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

50

ABC Company began business in June when stockholders invested $80,000 in the business, which in turn issued its common stock to them. ABC Company then purchased a building for $40,000 cash and inventory for $20,000 cash, performed services for clients for $10,000 cash, purchased supplies for $5,000 cash, and paid utilities of $2,000 cash. What is the amount of total assets?

A) $80,000

B) $88,000

C) $108,000

D) $163,000

A) $80,000

B) $88,000

C) $108,000

D) $163,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

51

When preparing the financial statements:

A) the balance sheet lists the balance of the asset accounts at the end of the period.

B) retained earnings is included in common stock.

C) data for the statement of cash flows can be found under the retained earnings account.

D) data for the income statement is found under the Cash account.

A) the balance sheet lists the balance of the asset accounts at the end of the period.

B) retained earnings is included in common stock.

C) data for the statement of cash flows can be found under the retained earnings account.

D) data for the income statement is found under the Cash account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

52

A company completed the following transactions during the month of October: I. Purchased office supplies on account, $4,000.

II) Provided services for cash, $10,000.

III) Provided services on account, $12,000.

IV) Collected cash from a customer on account $7,000.

V) Paid the monthly rent of $3,000.

What was the company's total revenue for the month?

A) $10,000

B) $22,000

C) $29,000

D) $36,000

II) Provided services for cash, $10,000.

III) Provided services on account, $12,000.

IV) Collected cash from a customer on account $7,000.

V) Paid the monthly rent of $3,000.

What was the company's total revenue for the month?

A) $10,000

B) $22,000

C) $29,000

D) $36,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

53

Cash dividends paid to stockholders will:

A) increase assets and decrease liabilities.

B) increase assets and increase liabilities.

C) have no effect on stockholders' equity or revenues.

D) decrease assets and decrease stockholders' equity.

A) increase assets and decrease liabilities.

B) increase assets and increase liabilities.

C) have no effect on stockholders' equity or revenues.

D) decrease assets and decrease stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

54

A company completed the following transactions during the month of October: I. Purchased office supplies on account, $4,000.

II) Provided services for cash, $10,000.

III) Provided services on account, $12,000.

IV) Collected cash from a customer on account $7,000.

V) Paid the monthly rent of $3,000.

What was the company's net income for the month?

A) $0

B) $10,000

C) $19,000

D) $22,000

II) Provided services for cash, $10,000.

III) Provided services on account, $12,000.

IV) Collected cash from a customer on account $7,000.

V) Paid the monthly rent of $3,000.

What was the company's net income for the month?

A) $0

B) $10,000

C) $19,000

D) $22,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

55

Receiving a payment from a customer on account:

A) increases stockholders' equity.

B) has no effect on total assets.

C) decreases stockholders' equity.

D) decreases liabilities.

A) increases stockholders' equity.

B) has no effect on total assets.

C) decreases stockholders' equity.

D) decreases liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

56

The double-entry system of accounting records the dual effects on the entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

57

Lucy Morton opened an engineering office and titled the business Engineering Enterprises P.C. During its first month of operations, it completed the following transactions: I. Lucy invested $30,000 in the business, which in turn issued common stock to her.

II) The business purchased equipment on account for $6,000.

II) The business provided engineering services on account, $10,000.

III) The business paid salaries to the receptionist, $1,000.

IV) The business received cash from a customer as payment on account $6,000.

V) The business borrowed $8,000 from the bank, issuing a note payable.

Total liabilities would be:

A) $0.

B) $6,000.

C) $14,000.

D) $20,000.

II) The business purchased equipment on account for $6,000.

II) The business provided engineering services on account, $10,000.

III) The business paid salaries to the receptionist, $1,000.

IV) The business received cash from a customer as payment on account $6,000.

V) The business borrowed $8,000 from the bank, issuing a note payable.

Total liabilities would be:

A) $0.

B) $6,000.

C) $14,000.

D) $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

58

Record the effects of the following transactions on the accounting equation. After recording the transactions, compute the ending balances of the equation to prove it balances.

1. A business received $10,000 and issued common stock.

2. Paid $2,000 monthly rent for office space.

3. Purchased $3,000 of office equipment, paying cash.

4. Purchased $500 of office supplies on account.

5. Recorded $4,000 of revenue, receiving cash.

6. Performed $1,500 of services on account.

7. Paid utilities expense of $900.

8. Collected cash from a customer on account, $1,000.

9. Borrowed $10,000 from the bank and signed a note payable.

1. A business received $10,000 and issued common stock.

2. Paid $2,000 monthly rent for office space.

3. Purchased $3,000 of office equipment, paying cash.

4. Purchased $500 of office supplies on account.

5. Recorded $4,000 of revenue, receiving cash.

6. Performed $1,500 of services on account.

7. Paid utilities expense of $900.

8. Collected cash from a customer on account, $1,000.

9. Borrowed $10,000 from the bank and signed a note payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

59

A company had credit sales of $30,000 and cash sales of $10,000 during the month of May. Also during May, the company paid wages of $1,000 and utilities of $800. It also received payments from customers on account totaling $4,000. What was the company's net income for the month?

A) $10,000

B) $38,200

C) $41,000

D) $44,000

A) $10,000

B) $38,200

C) $41,000

D) $44,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

60

To compute the ending balance of retained earnings:

A) the beginning balance in retained earnings will be zero for a new business.

B) net income for the period is subtracted from the beginning balance.

C) dividends are added to the beginning balance.

D) common stock sold during the period is added to the beginning balance.

A) the beginning balance in retained earnings will be zero for a new business.

B) net income for the period is subtracted from the beginning balance.

C) dividends are added to the beginning balance.

D) common stock sold during the period is added to the beginning balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

61

All business transactions involve an increase in at least one account and a decrease in at least one other account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

62

Revenues and expenses are specialized stockholders' equity accounts, all having debit balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

63

Double-entry accounting affects at least three accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

64

An important rule of debits and credits is:

A) credits increase a liability account.

B) debits decrease an asset account

C) revenues are increased by a debit.

D) expenses are increased by a credit.

A) credits increase a liability account.

B) debits decrease an asset account

C) revenues are increased by a debit.

D) expenses are increased by a credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following is a correct statement?

A) Revenues are decreased with a credit.

B) Expenses are increased with a credit.

C) Dividends are a negative equity account.

D) Dividends decrease net income.

A) Revenues are decreased with a credit.

B) Expenses are increased with a credit.

C) Dividends are a negative equity account.

D) Dividends decrease net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which accounts are increased by debits?

A) Cash and accounts payable

B) Salaries expense and common stock.

C) Accounts receivable and utilities expense

D) Accounts payable and service revenue

A) Cash and accounts payable

B) Salaries expense and common stock.

C) Accounts receivable and utilities expense

D) Accounts payable and service revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

67

If the credits to an account exceed the debits to the account, the account will have a credit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

68

An important rule to remember when working with T accounts is:

A) when you debit an account, you are entering an amount of the right-hand side of the T account.

B) an increase to accounts payable will be recorded as a debit.

C) to credit an account means to enter an amount on the right-hand side of the T account.

D) the debit side of a T account is on the right-hand side of the T account for liabilities and revenues.

A) when you debit an account, you are entering an amount of the right-hand side of the T account.

B) an increase to accounts payable will be recorded as a debit.

C) to credit an account means to enter an amount on the right-hand side of the T account.

D) the debit side of a T account is on the right-hand side of the T account for liabilities and revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

69

Increases in stockholders' equity that result from delivering goods or services to customers are:

A) assets.

B) revenues.

C) expenses.

D) liabilities.

A) assets.

B) revenues.

C) expenses.

D) liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

70

An important rule to remember when analyzing the impact of business transactions on accounts is:

A) net income increases stockholders' equity.

B) if expenses exceed revenues, the company will have a net income.

C) a net loss does not affect stockholders' equity.

D) stockholders' equity includes the two categories of income statement accounts, revenues and liabilities.

A) net income increases stockholders' equity.

B) if expenses exceed revenues, the company will have a net income.

C) a net loss does not affect stockholders' equity.

D) stockholders' equity includes the two categories of income statement accounts, revenues and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

71

All stockholders' equity accounts are increased by debits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

72

Assets, expenses, and dividends are all increased by debits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

73

An account with a normal debit balance is most often an asset or revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

74

The left side of a T-account is always the:

A) increase side.

B) decrease side.

C) debit side.

D) credit side.

A) increase side.

B) decrease side.

C) debit side.

D) credit side.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

75

The left hand side of a T account is the debit side and the right hand side is the credit side.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following statement about the rules of debits and credits is correct?

A) An asset is increased by a debit.

B) Dividends are decreased by debits.

C) A liability is increased by a debit.

D) Revenue is increased by a debit.

A) An asset is increased by a debit.

B) Dividends are decreased by debits.

C) A liability is increased by a debit.

D) Revenue is increased by a debit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following is a true statement regarding T accounts?

A) The transaction needs to be analyzed to determine which accounts are affected before entering amounts in the T accounts.

B) If a company pays cash, an amount would be entered on the left side of the T account.

C) T accounts are only used to record complex transactions.

D) To debit an asset, an amount is entered on the left side of the T account and to debit a liability an amount is entered on the right side of the T account.

A) The transaction needs to be analyzed to determine which accounts are affected before entering amounts in the T accounts.

B) If a company pays cash, an amount would be entered on the left side of the T account.

C) T accounts are only used to record complex transactions.

D) To debit an asset, an amount is entered on the left side of the T account and to debit a liability an amount is entered on the right side of the T account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

78

The account title appears at the top of the T.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

79

The amount remaining in an account is called its balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck

80

Accounts payable is increased with a credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 179 في هذه المجموعة.

فتح الحزمة

k this deck