Deck 6: Deductions and Losses: in General

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/154

العب

ملء الشاشة (f)

Deck 6: Deductions and Losses: in General

1

A taxpayer who claims the standard deduction can also deduct expenses that are classified as deductions from AGI.

False

2

Rob,a shareholder-employee of Falcon,Inc.,receives a $300,000 salary.The IRS classifies $100,000 of this amount as unreasonable compensation.The effect of this reclassification is to decrease Rob's gross income by $100,000 and increase Falcon's gross income by $100,000.

False

3

None of the prepaid rent paid on October 1 by a calendar year cash basis taxpayer for the next 18 months is deductible in the current period.

False

4

Expenses incurred for the production or collection of income generally are deductions from adjusted gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

5

A cash basis taxpayer who charges an expense on a bank credit card is allowed to claim a deduction currently,whereas a cash basis taxpayer who charges an expense on a department store credit card is not allowed to claim a deduction until payment is made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

6

Wally is in the 25% tax bracket.He may receive a different tax benefit for a $1,000 expenditure that is classified as a deduction from AGI than he will receive for a $1,000 expenditure that is classified as a deduction for AGI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

7

Expenses incurred in a trade or business are deductible for AGI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

8

Only certain expenses associated with the production of income are classified as deductions for AGI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

9

For an expense to be deducted,the amount must be paid by the taxpayer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

10

A salary that is classified as unreasonable by the IRS is disallowed as a deduction to the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

11

A loss on the sale of a personal use asset cannot be deducted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

12

All employment related expenses are classified as deductions for AGI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

13

Priscilla incurs qualified moving expenses of $7,000.If she is reimbursed by her employer,the deduction is classified as a deduction for AGI.If not reimbursed,the deduction is classified as an itemized deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

14

Under certain circumstances,a cash method taxpayer must treat prepayments the same as an accrual method taxpayer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

15

The income of a sole proprietorship are reported on Schedule C (Profit or Loss from Business).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

16

The Code defines what constitutes a trade or business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

17

The period in which an accrual basis taxpayer can deduct an expense is determined by applying the economic performance and all events tests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

18

For an expense to be deducted as ordinary,it must be recurring in nature.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

19

Under the "one-year rule" for the current period deduction of prepaid expenses of cash basis taxpayers,the asset must expire or be consumed by the end of the tax year following the year of payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

20

Generally,a closely-held family corporation is not permitted to take a deduction for a salary paid to a family member in calculating corporate taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

21

The ordinary and necessary expenses for operating an illegal gambling operation (excluding such items as fines,bribes,and other illegal payments)are deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

22

Two-thirds of treble damage payments under the antitrust law are deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

23

A bribe paid to a domestic (U.S.)official is not deductible,but it may be possible to deduct a bribe paid to a foreign official.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

24

Legal fees incurred in connection with a criminal defense are not deductible even if the crime is associated with a trade or business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

25

If an item such as property taxes and home mortgage interest exceed the income from a hobby,the excess amount of this item over the hobby income can be deducted if the taxpayer itemizes deductions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

26

A hobby activity can result in all of the hobby income being included in AGI and no deductions being allowed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

27

Legal expenses incurred in connection with rental property are deductions from AGI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

28

If an activity involves horses,a profit in at least two of seven consecutive years meets the presumptive rule of § 183.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

29

The amount of the addition to the reserve for bad debts for an accrual method taxpayer is allowed as a deduction for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

30

Ordinary and necessary business expenses,other than cost of goods sold,of an illegal drug trafficking business do not reduce taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

31

A political contribution to the Democratic Party or the Republican Party is not deductible,but a contribution to the Presidential Election Campaign Fund is deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

32

Deriving a profit in three consecutive years is not irrefutable evidence that an activity is profit seeking and not a hobby.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

33

The legal cost of having a will prepared is not deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

34

Investigation of a business unrelated to one's present business never results in a current period deduction of the entire amount if the amount of the investigation expenses exceeds $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

35

Hollis operates a lawn care service in southeastern Missouri.He incurs $63,000 of expenses determining the feasibility of expanding the business to southwestern Missouri.If he expands the business,the $63,000 is deductible in the current year.If he does not do so,then he must amortize the $63,000 over a 180-month period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

36

Susan is a sales representative for a U.S.weapons manufacturer.She makes a $100,000 "grease" payment to a U.S.government official associated with a weapons purchase by the U.S.Army.She makes a similar payment to a Saudi Arabian government official associated with a similar sale.Neither of these payments is deductible by Susan's employer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

37

Fines and penalties paid for violations of the law (e.g.,illegal dumping of hazardous waste)are deductible only if they relate to a trade or business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

38

If a taxpayer cannot satisfy the three-out-of-five year presumption test associated with hobby losses,then expenses from the activity cannot be deducted in excess of the gross income from the activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

39

The cost of legal advice associated with the preparation of an individual's Federal income tax return is not deductible because it is a personal expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

40

A baseball team that pays a star player an annual salary of $25 million can deduct the entire $25 million as salary expense.If the same amount is paid to the CEO of IBM,only $1 million is deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

41

If a vacation home is classified as primarily personal use,part of the maintenance and utility expenses can be allocated and deducted as a rental expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

42

If a vacation home is used for personal use less than 15 days and is rented for more than 14 days during a year,the property is treated as primarily rental property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

43

A vacation home rented for 180 days and used personally for 16 days is classified in the personal/rental use category.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

44

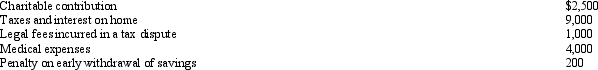

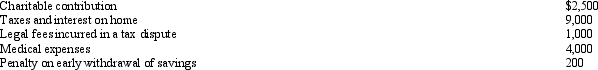

Janice is single,had gross income of $38,000,and incurred the following expenses:  Her AGI is:

Her AGI is:

A) $21,300.

B) $28,800.

C) $32,800.

D) $35,500.

E) $37,800.

Her AGI is:

Her AGI is:A) $21,300.

B) $28,800.

C) $32,800.

D) $35,500.

E) $37,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

45

For individuals who are employees,which of the following is correct?

A) No deductions are classified as deductions for AGI.

B) All deductions are classified as deductions from AGI.

C) Some deductions may be classified as deductions for AGI and some may be classified as deductions from AGI.

D) Only a. and c.

E) None of the above is correct.

A) No deductions are classified as deductions for AGI.

B) All deductions are classified as deductions from AGI.

C) Some deductions may be classified as deductions for AGI and some may be classified as deductions from AGI.

D) Only a. and c.

E) None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

46

Sammie pays his son's real estate taxes.Sammie cannot deduct the real estate taxes,but the son can.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

47

Beulah's personal residence has an adjusted basis of $450,000 and a fair market value of $390,000.Beulah converts the property to rental use on November 1,2011.The vacation home rules that limit the amount of the deduction to the rental income will apply and the adjusted basis for depreciation is $390,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

48

In preparing his 2011 Federal income tax return,Sam,who is not married and using single filing status,incorrectly claimed alimony payments of $12,000 as an itemized deduction (rather than as a deduction for AGI).Sam's AGI is $60,000 and itemized deductions (which consist of the alimony,property taxes,and mortgage interest)are $20,000.Which of the following statements is correct?

A) The error will result in taxable income being overstated.

B) The error will result in taxable income being understated.

C) The error could result in either taxable income being overstated or understated.

D) The error will have no effect on taxable income.

E) None of the above.

A) The error will result in taxable income being overstated.

B) The error will result in taxable income being understated.

C) The error could result in either taxable income being overstated or understated.

D) The error will have no effect on taxable income.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

49

Hobby activity expenses are deductible from AGI to the extent of hobby income.Such expenses not in excess of hobby income are not subject to the 2% of AGI floor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

50

If a vacation home is classified as primarily personal use (i.e.,rented for fewer than 15 days),none of the related expenses can be deducted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

51

Trade and business expenses should be treated as:

A) A deduction from AGI subject to the 2%-of-AGI floor.

B) A deduction from AGI not subject to the 2%-of-AGI floor.

C) Deductible for AGI.

D) An itemized deduction if not reimbursed.

E) None of the above.

A) A deduction from AGI subject to the 2%-of-AGI floor.

B) A deduction from AGI not subject to the 2%-of-AGI floor.

C) Deductible for AGI.

D) An itemized deduction if not reimbursed.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

52

Marge sells land to her adult son,Jason,for its $20,000 appraised value.Her adjusted basis for the land is $25,000.Marge's recognized loss is $0 and Jason's adjusted basis for the land is $25,000 ($20,000 cost + $5,000 disallowed loss of Marge).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

53

The portion of property tax on a vacation home that is attributable to personal use is an itemized deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

54

If a vacation home is a personal/rental residence,no maintenance and utility expenses can be claimed as a deduction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

55

LD Partnership,a cash basis taxpayer,purchases land and a building for $200,000 with $150,000 of the cost being allocated to the building.The gross receipts of the partnership are less than $100,000.LD must capitalize the $50,000 paid for the land,but can deduct the $150,000 paid for the building in the current tax year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

56

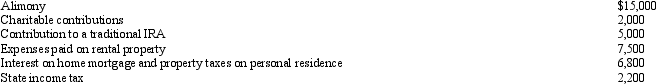

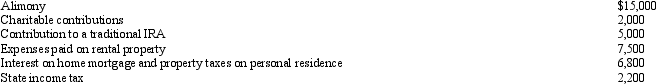

Paul is single,age 63,and has gross income of $70,000.His deductible expenses are as follows:  What is Paul's AGI?

What is Paul's AGI?

A) $31,500.

B) $42,500.

C) $47,500.

D) $50,000.

E) None of the above.

What is Paul's AGI?

What is Paul's AGI?A) $31,500.

B) $42,500.

C) $47,500.

D) $50,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

57

Susan rents part of her personal residence in the summer for 10 days for $1,000.Anne rents all of her personal residence for 3 weeks in December for $2,500.Anne must include the $2,500 in her gross income whereas Susan is not required to include the $1,000 in her gross income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

58

Landscaping expenditures on new rental property are deductible in the year they are paid or incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

59

If a vacation home is classified as primarily rental use,a deduction for all of the rental expenses is allowed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

60

For purposes of the § 267 loss disallowance provision,a taxpayer's aunt is a related party.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

61

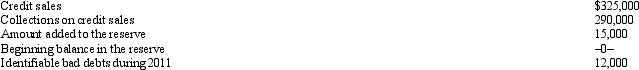

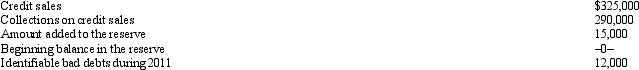

Petal,Inc.is an accrual basis taxpayer.Petal uses the aging approach to calculate the reserve for bad debts.During 2011,the following occur associated with bad debts.  The amount of the deduction for bad debt expense for Petal for 2011 is:

The amount of the deduction for bad debt expense for Petal for 2011 is:

A) $12,000.

B) $15,000.

C) $27,000.

D) $35,000.

E) None of the above.

The amount of the deduction for bad debt expense for Petal for 2011 is:

The amount of the deduction for bad debt expense for Petal for 2011 is:A) $12,000.

B) $15,000.

C) $27,000.

D) $35,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following is correct?

A) A personal casualty loss is classified as a deduction from AGI.

B) Real estate taxes on a taxpayer's personal residence are classified as deductions from AGI.

C) An expense associated with rental property is classified as a deduction from AGI.

D) Only a. and b. are correct.

E) a., b., and c., are correct.

A) A personal casualty loss is classified as a deduction from AGI.

B) Real estate taxes on a taxpayer's personal residence are classified as deductions from AGI.

C) An expense associated with rental property is classified as a deduction from AGI.

D) Only a. and b. are correct.

E) a., b., and c., are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is a deduction from AGI (itemized deduction)?

A) Contribution to a traditional IRA.

B) Roof repairs to a rental home.

C) Safe deposit box rental fee in which stock certificates are stored.

D) Trade or businesss expense.

E) None of the above.

A) Contribution to a traditional IRA.

B) Roof repairs to a rental home.

C) Safe deposit box rental fee in which stock certificates are stored.

D) Trade or businesss expense.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following statements is correct in connection with the investigation of a business?

A) If the taxpayer is not already engaged in the trade or business, the expenses incurred are deductible if the project is abandoned.

B) If the business is acquired, the expenses may be deducted immediately by a taxpayer engaged in a similar trade or business.

C) That business must be related to the taxpayer's present business for any expense ever to be deductible.

D) Regardless of whether the taxpayer is already engaged in the trade or business, the expenses must be capitalized and amortized.

E) None of the above.

A) If the taxpayer is not already engaged in the trade or business, the expenses incurred are deductible if the project is abandoned.

B) If the business is acquired, the expenses may be deducted immediately by a taxpayer engaged in a similar trade or business.

C) That business must be related to the taxpayer's present business for any expense ever to be deductible.

D) Regardless of whether the taxpayer is already engaged in the trade or business, the expenses must be capitalized and amortized.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

65

Tommy,an automobile mechanic employed by an auto dealership,is considering opening a fast food franchise.If Tommy decides not to acquire the fast food franchise,any investigation expenses are:

A) A deduction for AGI.

B) A deduction from AGI, subject to the 2 percent floor.

C) A deduction from AGI, not subject to the 2 percent floor.

D) Deductible up to $5,000 in the current year with the balance being amortized over a 180-month period.

E) Not deductible.

A) A deduction for AGI.

B) A deduction from AGI, subject to the 2 percent floor.

C) A deduction from AGI, not subject to the 2 percent floor.

D) Deductible up to $5,000 in the current year with the balance being amortized over a 180-month period.

E) Not deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

66

Benita incurred a business expense on December 10,2011,which she charged on her bank credit card.She paid the credit card statement which included the charge on January 5,2012.Which of the following is correct?

A) If Benita is a cash method taxpayer, she cannot deduct the expense until 2012.

B) If Benita is an accrual method taxpayer, she can deduct the expense in 2011.

C) If Benita uses the accrual method, she can choose to deduct the expense in either 2011 or 2012.

D) Only b. and c. are correct.

E) a., b., and c. are correct.

A) If Benita is a cash method taxpayer, she cannot deduct the expense until 2012.

B) If Benita is an accrual method taxpayer, she can deduct the expense in 2011.

C) If Benita uses the accrual method, she can choose to deduct the expense in either 2011 or 2012.

D) Only b. and c. are correct.

E) a., b., and c. are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is incorrect?

A) Alimony is a deduction for AGI.

B) The expenses associated with royalty property are a deduction from AGI.

C) Contributions to a traditional IRA are a deduction for AGI.

D) Medical expenses are a deduction from AGI

E) All of the above are correct.

A) Alimony is a deduction for AGI.

B) The expenses associated with royalty property are a deduction from AGI.

C) Contributions to a traditional IRA are a deduction for AGI.

D) Medical expenses are a deduction from AGI

E) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

68

Agnes is the sole shareholder of Violet,Inc.For 2011,she receives from Violet a salary of $200,000 and dividends of $100,000.Violet's taxable income for 2011 is $500,000.On audit,the IRS treats $50,000 of Agnes's salary as unreasonable.Which of the following statements is correct?

A) Agnes's gross income will increase by $50,000 as a result of the IRS adjustment.

B) Violet's taxable income will not be affected by the IRS adjustment.

C) Agnes's gross income will decrease by $50,000 as a result of the IRS adjustment.

D) Violet's taxable income will increase by $50,000 as a result of the IRS adjustment.

E) None of the above is correct.

A) Agnes's gross income will increase by $50,000 as a result of the IRS adjustment.

B) Violet's taxable income will not be affected by the IRS adjustment.

C) Agnes's gross income will decrease by $50,000 as a result of the IRS adjustment.

D) Violet's taxable income will increase by $50,000 as a result of the IRS adjustment.

E) None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

69

Vera is the CEO of Brunettes,a publicly held corporation.For the year,she receives a salary of $900,000,a bonus of $500,000,and contributions to her retirement plan of $42,000.The bonus was awarded at the December board meeting based on Vera's threat to accept a better paying job with a competitor.What amount may Brunettes deduct?

A) $942,000.

B) $1,042,000.

C) $1,400,000.

D) $1,442,000.

E) None of the above.

A) $942,000.

B) $1,042,000.

C) $1,400,000.

D) $1,442,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

70

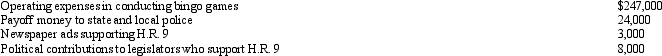

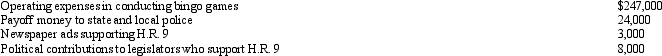

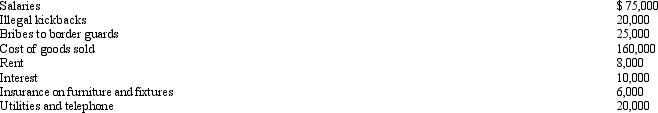

Rex,a cash basis calendar year taxpayer,runs a bingo operation which is illegal under state law.During 2011,a bill designated H.R.9 is introduced into the state legislature which,if enacted,would legitimize bingo games.In 2011,Rex had the following expenses:  Of these expenditures,Rex may deduct:

Of these expenditures,Rex may deduct:

A) $247,000.

B) $250,000.

C) $258,000.

D) $282,000.

E) None of the above.

Of these expenditures,Rex may deduct:

Of these expenditures,Rex may deduct:A) $247,000.

B) $250,000.

C) $258,000.

D) $282,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

71

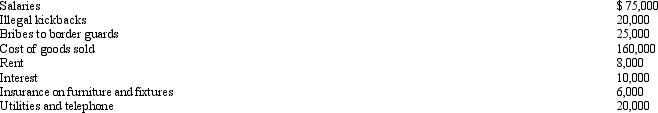

Tom operates an illegal drug-running operation and incurred the following expenses:  Which of the above amounts reduces his taxable income?

Which of the above amounts reduces his taxable income?

A) $0.

B) $160,000.

C) $279,000.

D) $324,000.

E) None of the above.

Which of the above amounts reduces his taxable income?

Which of the above amounts reduces his taxable income?A) $0.

B) $160,000.

C) $279,000.

D) $324,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following cannot be deducted as a § 162 business expense?

A) Expenses of investing in rental property.

B) Charitable contributions made by a sole proprietorship.

C) Fines and penalties.

D) Only a. and c. cannot.

E) a., b., and c. cannot.

A) Expenses of investing in rental property.

B) Charitable contributions made by a sole proprietorship.

C) Fines and penalties.

D) Only a. and c. cannot.

E) a., b., and c. cannot.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

73

Gerald owns an illegal casino.Which of the following expenses incurred in connection with this activity are deductible?

A) Rent.

B) Illegal kickbacks to government officials to stay in business.

C) Fines.

D) Purchase of land for a new building.

E) None of the above.

A) Rent.

B) Illegal kickbacks to government officials to stay in business.

C) Fines.

D) Purchase of land for a new building.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

74

Payments by a cash basis taxpayer of capital expenditures:

A) Must be expensed at the time of payment.

B) Must be expensed by the end of the first year after the asset is acquired.

C) Must be deducted over the actual or statutory life of the asset.

D) Can be deducted in the year the taxpayer chooses.

E) None of the above.

A) Must be expensed at the time of payment.

B) Must be expensed by the end of the first year after the asset is acquired.

C) Must be deducted over the actual or statutory life of the asset.

D) Can be deducted in the year the taxpayer chooses.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

75

Iris,a calendar year cash basis taxpayer,owns and operates several TV rental outlets in Florida,and wants to expand to other states.During 2011,she spends $14,000 to investigate TV rental stores in South Carolina and $9,000 to investigate TV rental stores in Georgia.She acquires the South Carolina operations,but not the outlets in Georgia.As to these expenses,Iris should:

A) Capitalize $14,000 and not deduct $9,000.

B) Expense $23,000 for 2011.

C) Expense $9,000 for 2011 and capitalize $14,000.

D) Capitalize $23,000.

E) None of the above.

A) Capitalize $14,000 and not deduct $9,000.

B) Expense $23,000 for 2011.

C) Expense $9,000 for 2011 and capitalize $14,000.

D) Capitalize $23,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following are deductions for AGI?

A) Mortgage interest on a personal residence.

B) Property taxes on a personal residence.

C) Mortgage interest on a building used in a business.

D) Fines and penalties incurred in a trade or business.

E) None of the above.

A) Mortgage interest on a personal residence.

B) Property taxes on a personal residence.

C) Mortgage interest on a building used in a business.

D) Fines and penalties incurred in a trade or business.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

77

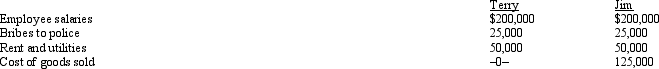

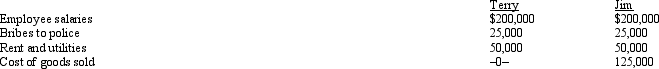

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.  Which of the following statements is correct?

Which of the following statements is correct?

A) Neither Terry nor Jim can deduct any of the above items in calculating the business profit.

B) Terry should report profit from his business of $250,000.

C) Jim should report profit from his business of $500,000.

D) Jim should report profit from his business of $250,000.

E) None of the above.

Which of the following statements is correct?

Which of the following statements is correct?A) Neither Terry nor Jim can deduct any of the above items in calculating the business profit.

B) Terry should report profit from his business of $250,000.

C) Jim should report profit from his business of $500,000.

D) Jim should report profit from his business of $250,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following is deductible as a trade or business expense?

A) A city coroner contributes to the mayor's reelection campaign fund.

B) Illegal bribes and kickbacks paid to a Federal government employee by a corporate executive.

C) Two-thirds of treble damage payments.

D) Fines and penalties paid by a trucking firm for excessive weight and speeding.

E) None of the above.

A) A city coroner contributes to the mayor's reelection campaign fund.

B) Illegal bribes and kickbacks paid to a Federal government employee by a corporate executive.

C) Two-thirds of treble damage payments.

D) Fines and penalties paid by a trucking firm for excessive weight and speeding.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

79

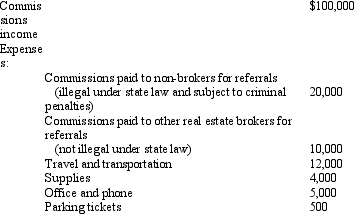

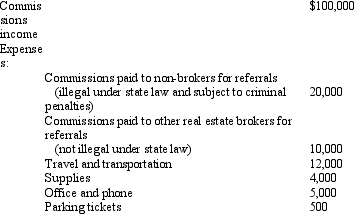

Angela,a real estate broker,had the following income and expenses in her business:  How much net income must Angela report from this business?

How much net income must Angela report from this business?

A) $48,500.

B) $49,000.

C) $60,000.

D) $68,500.

E) $69,000.

How much net income must Angela report from this business?

How much net income must Angela report from this business?A) $48,500.

B) $49,000.

C) $60,000.

D) $68,500.

E) $69,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is not a "trade or business" expense?

A) Interest on business indebtedness.

B) Property taxes on business property.

C) Parking ticket paid on business auto.

D) Depreciation on business property.

E) All of the above are "trade or business" expenses.

A) Interest on business indebtedness.

B) Property taxes on business property.

C) Parking ticket paid on business auto.

D) Depreciation on business property.

E) All of the above are "trade or business" expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 154 في هذه المجموعة.

فتح الحزمة

k this deck