Deck 17: Property Transactions: Section 1231 and Recapture Provisions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/74

العب

ملء الشاشة (f)

Deck 17: Property Transactions: Section 1231 and Recapture Provisions

1

If there is a net § 1231 loss,it is treated as a long-term capital loss.

False

2

If § 1231 asset casualty gains and losses net to a gain,the gain is treated as a § 1231 gain.

True

3

In the "General Procedure for § 1231 Computation: Step 2.§ 1231 Netting," if the gains exceed the losses,the net gain is offset by the "lookback" nonrecaptured § 1231 losses.

True

4

The Code contains two major depreciation recapture provisions-§§ 1245 and 1250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

5

For § 1245 recapture to apply,accelerated depreciation must have been taken on the property.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

6

Section 1231 applies to the sale or exchange of business properties,but not to personal use activity casualties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

7

Section 1245 generally recaptures as ordinary income the portion of the gain that is equal to the sale price minus the original cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

8

Involuntary conversion gains may be deferred if the proceeds of the involuntary conversion are reinvested.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

9

A race horse must be held more than 18 months to qualify as a § 1231 asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

10

Section 1231 property includes nonpersonal use property where casualty losses exceed casualty gains for the taxable year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

11

Personal use property casualty gains and losses are not subject to the § 1231 rules.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

12

Section 1231 property generally includes certain purchased intangible assets (such as patents and goodwill)that are eligible for amortization and held for more than one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

13

Section 1245 may apply to depreciable farm equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

14

Casualty gains and losses from nonpersonal use assets are not netted against casualty gains and losses from personal use assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

15

Nonrecaptured § 1231 losses from the seven prior tax years may cause current year net § 1231 gain to be treated as ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

16

Rental use depreciable machinery held more than 12 months is an example of a § 1231 asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

17

Section 1231 property generally does not include accounts receivables arising in the ordinary course of business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

18

A personal use property casualty loss is generally deductible only to the extent it exceeds 10% of AGI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

19

An individual business taxpayer owns land on which he grows trees for logging.The land has been held more than 10 years and the trees growing on the land were planted eight years ago.Normally,the timber would be inventory for this taxpayer,but the tax law allows the taxpayer to elect to treat cutting the timber as the disposition of a § 1231 asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

20

Section 1231 property generally does not include musical compositions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

21

White Company acquires a new machine for $35,000 and uses it in White's manufacturing operations.A few months after White places the machine in service,it discovers that the machine is not suitable for White's business.White had fully expensed the machine in the year of acquisition using § 179.White sells the machine for $5,000 in the tax year after it was acquired,but held the machine only for a total of 10 months.What was the tax status of the machine when it was disposed of and the amount of the gain or loss?

A) A capital asset and $5,000 gain.

B) An ordinary asset and $5,000 gain.

C) A § 1231 asset and $5,000 gain.

D) A § 1231 asset and $5,000 loss.

E) None of the above.

A) A capital asset and $5,000 gain.

B) An ordinary asset and $5,000 gain.

C) A § 1231 asset and $5,000 gain.

D) A § 1231 asset and $5,000 loss.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

22

Spencer has an investment in two parcels of vacant land.Parcel 1 is a capital asset and parcel 2 is a § 1231 asset.Spencer already has short-term capital loss for the year he would like to offset with capital gain.Spencer has § 1231 lookback loss that exceeds the gain from the disposition of either land parcel.Spencer only wants to sell one land parcel and each of them would yield the same amount of gain.The gain that would be recognized exceeds the short-term capital loss Spencer already has.Which of the statements below is correct?

A) Spencer will have a net capital loss no matter which land parcel he sells.

B) Spencer will have a net capital loss if he sells parcel 2.

C) Spencer will have a net capital loss if he sells parcel 1.

D) Spencer will have a net capital gain if he sells either parcel 1 or parcel 2.

E) None of the above.

A) Spencer will have a net capital loss no matter which land parcel he sells.

B) Spencer will have a net capital loss if he sells parcel 2.

C) Spencer will have a net capital loss if he sells parcel 1.

D) Spencer will have a net capital gain if he sells either parcel 1 or parcel 2.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

23

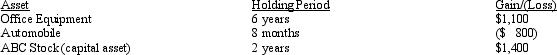

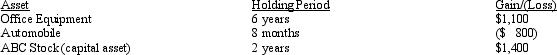

The following assets in Jack's business were sold in 2012:  The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2012 (the year of sale),Jack should report what amount of net capital gain and net ordinary income?

The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2012 (the year of sale),Jack should report what amount of net capital gain and net ordinary income?

A) $1,700 LTCG.

B) $600 LTCG and $300 ordinary gain.

C) $1,400 LTCG and $300 ordinary gain.

D) $2,500 LTCG and $800 ordinary loss.

E) None of the above.

The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2012 (the year of sale),Jack should report what amount of net capital gain and net ordinary income?

The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2012 (the year of sale),Jack should report what amount of net capital gain and net ordinary income?A) $1,700 LTCG.

B) $600 LTCG and $300 ordinary gain.

C) $1,400 LTCG and $300 ordinary gain.

D) $2,500 LTCG and $800 ordinary loss.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

24

Section 1231 lookback losses may convert some or all of § 1250 gain into ordinary income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

25

Vertical,Inc.,has a 2012 net § 1231 gain of $67,000 and had a $22,000 net § 1231 loss in 2011.For 2012,Vertical's net § 1231 gain is treated as:

A) $45,000 long-term capital gain and $22,000 ordinary loss.

B) $67,000 ordinary gain.

C) $45,000 long-term capital gain and $22,000 ordinary gain.

D) $67,000 capital gain.

E) None of the above.

A) $45,000 long-term capital gain and $22,000 ordinary loss.

B) $67,000 ordinary gain.

C) $45,000 long-term capital gain and $22,000 ordinary gain.

D) $67,000 capital gain.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

26

The maximum amount of the unrecaptured § 1250 gain (25% gain)is the depreciation taken on real property sold at a recognized gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

27

An individual had the following gains and losses during 2012 on property held for the long-term holding period: sale of Orange common stock ($8,000 gain); sale of real property used in the taxpayer's business ($1,800 loss); destruction of real property used in the taxpayer's business by fire ($1,000 loss).Which of the following statements is correct?

A) The fire loss would reduce the real property sale loss.

B) The fire loss would reduce the stock sale gain.

C) The sale of real property loss would be netted against the stock sale gain.

D) The sale of real property is a § 1231 loss.

E) None of the above.

A) The fire loss would reduce the real property sale loss.

B) The fire loss would reduce the stock sale gain.

C) The sale of real property loss would be netted against the stock sale gain.

D) The sale of real property is a § 1231 loss.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following assets held by a cash basis accounting firm is a § 1231 asset?

A) An account receivable from a client.

B) A desk used in the business and held more than one year.

C) An investment in Orange Company common stock.

D) A computer used in the business, held more than one year, but fully depreciated under § 179 when acquired.

E) b. and d.

A) An account receivable from a client.

B) A desk used in the business and held more than one year.

C) An investment in Orange Company common stock.

D) A computer used in the business, held more than one year, but fully depreciated under § 179 when acquired.

E) b. and d.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

29

Section 1245 depreciation recapture potential does not carryover from the deceased taxpayer to the beneficiary taxpayer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following would not be included in the netting of § 1231 gains and losses?

A) Personal use property net casualty gain.

B) Section 1231 loss.

C) Section 1231 gain.

D) All of the above.

E) b. and c.

A) Personal use property net casualty gain.

B) Section 1231 loss.

C) Section 1231 gain.

D) All of the above.

E) b. and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

31

Section 1250 depreciation recapture will apply when accelerated depreciation was used on property used outside the United States and the property is sold at a gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

32

Vertigo,Inc.,has a 2012 net § 1231 loss of $64,000 and had a $32,000 net § 1231 gain in 2011.For 2012,Vertigo's net § 1231 loss is treated as:

A) Ordinary loss.

B) Ordinary gain.

C) Capital loss.

D) Capital gain.

E) None of the above.

A) Ordinary loss.

B) Ordinary gain.

C) Capital loss.

D) Capital gain.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following assets held by a retail business is a § 1231 asset?

A) Inventory.

B) A machine used in the business and held less than one year.

C) A factory building used in the business and held more than one year.

D) Accounts receivable.

E) All of the above.

A) Inventory.

B) A machine used in the business and held less than one year.

C) A factory building used in the business and held more than one year.

D) Accounts receivable.

E) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is correct?

A) Improperly classifying a § 1231 loss as a capital loss might affect adjusted gross income.

B) Improperly classifying a capital loss as a § 1231 loss might affect adjusted gross income.

C) Misclassifying a § 1231 gain as a short-term capital gain might affect adjusted gross income.

D) Misclassifying a short-term capital gain as a § 1231 gain might affect adjusted gross income.

E) All of the above.

A) Improperly classifying a § 1231 loss as a capital loss might affect adjusted gross income.

B) Improperly classifying a capital loss as a § 1231 loss might affect adjusted gross income.

C) Misclassifying a § 1231 gain as a short-term capital gain might affect adjusted gross income.

D) Misclassifying a short-term capital gain as a § 1231 gain might affect adjusted gross income.

E) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

35

Property sold to a related party purchaser that is depreciable by the purchaser may cause the seller to have ordinary gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

36

A barn held more than one year and used in a business is destroyed in a tornado.The barn originally cost $356,000 and was fully depreciated using straight-line depreciation.The barn was insured for its $543,000 replacement cost minus a deductible of $1,000.Which of the statements below is correct concerning these facts?

A) The barn was a long-term personal use asset.

B) There is a casualty loss from disposition of the barn.

C) The recognized gain from disposition of the barn is $186,000.

D) The recognized gain from disposition of the barn is subject to special netting rules.

E) c. and d.

A) The barn was a long-term personal use asset.

B) There is a casualty loss from disposition of the barn.

C) The recognized gain from disposition of the barn is $186,000.

D) The recognized gain from disposition of the barn is subject to special netting rules.

E) c. and d.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

37

The § 1245 depreciation recapture potential does not reduce the amount of the charitable contribution deduction under § 170.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

38

Part II of Form 4797 is used to report gains from the sale of depreciable business equipment sold at a gain and held more than one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

39

Verway,Inc.,has a 2012 net § 1231 gain of $55,000 and had a $62,000 net § 1231 loss in 2011.For 2012,Verway's net § 1231 gain is treated as:

A) $55,000 ordinary loss.

B) $55,000 ordinary gain.

C) $55,000 capital loss.

D) $55,000 capital gain.

E) None of the above.

A) $55,000 ordinary loss.

B) $55,000 ordinary gain.

C) $55,000 capital loss.

D) $55,000 capital gain.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

40

Depreciation recapture under § 1245 and § 1250 is reported on Form 4797.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

41

Orange Company had machinery destroyed by a fire on December 23,2012.The machinery had been acquired on April 1,2010,for $49,000 and its adjusted basis was $14,200.The machinery was completely destroyed and Orange received $30,000 of insurance proceeds for the machine and did not replace it.This was Orange's only casualty or theft event for the year.As a result of this event,Orange has:

A) $4,200 ordinary loss.

B) $15,800 § 1245 recapture gain.

C) $14,200 § 1245 recapture gain.

D) $30,000 § 1231 gain.

E) None of the above.

A) $4,200 ordinary loss.

B) $15,800 § 1245 recapture gain.

C) $14,200 § 1245 recapture gain.

D) $30,000 § 1231 gain.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

42

Copper Corporation sold machinery for $27,000 on December 31,2012.The machinery had been purchased on January 2,2009,for $30,000 and had an adjusted basis of $21,000 at the date of the sale.For 2012,what should Copper Corporation report?

A) Ordinary income of $6,000.

B) A § 1231 gain of $3,000 and $3,000 of ordinary income.

C) A § 1231 gain of $6,000.

D) A § 1231 gain of $6,000 and $3,000 of ordinary income.

E) None of the above.

A) Ordinary income of $6,000.

B) A § 1231 gain of $3,000 and $3,000 of ordinary income.

C) A § 1231 gain of $6,000.

D) A § 1231 gain of $6,000 and $3,000 of ordinary income.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

43

Section 1239 (relating to the sale of certain property between related taxpayers)does not apply unless the property:

A) Was depreciated by the transferor.

B) Is depreciable in the hands of the transferee.

C) Is a capital asset.

D) Is real property.

E) None of the above.

A) Was depreciated by the transferor.

B) Is depreciable in the hands of the transferee.

C) Is a capital asset.

D) Is real property.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

44

Red Company had an involuntary conversion on December 23,2012.The machinery had been acquired on April 1,2010,for $49,000 and its adjusted basis was $14,200.The machinery was completely destroyed by fire and Red received $10,000 of insurance proceeds for the machine and did not replace it.This was Red's only casualty or theft event for the year.As a result of this event,Red initially has:

A) $10,000 § 1231 loss.

B) $10,000 § 1245 recapture gain.

C) $4,200 casualty loss.

D) $4,200 § 1231 loss.

E) None of the above.

A) $10,000 § 1231 loss.

B) $10,000 § 1245 recapture gain.

C) $4,200 casualty loss.

D) $4,200 § 1231 loss.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

45

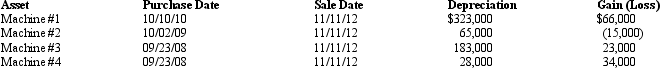

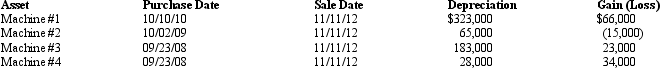

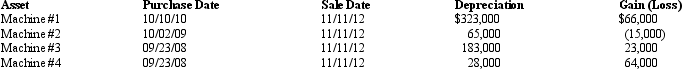

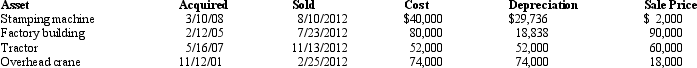

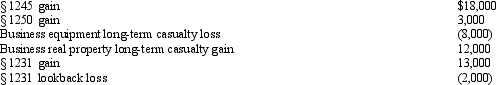

A business taxpayer sold all the depreciable assets of the business,calculated the gains and losses,and would like to know the final character of those gains and losses.The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets.The taxpayer had unrecaptured § 1231 lookback loss of $22,000.What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self-employment tax deduction.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

46

An individual has a $20,000 § 1245 gain,a $15,000 § 1231 gain,a $13,000 § 1231 loss,a $3,000 § 1231 lookback loss,and a $15,000 long-term capital gain.The net long-term capital gain is:

A) $30,000.

B) $40,000.

C) $17,000.

D) $15,000.

E) None of the above.

A) $30,000.

B) $40,000.

C) $17,000.

D) $15,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

47

Assume a building is subject to § 1250 depreciation recapture because it was acquired before 1987 and accelerated depreciation was used to depreciate it.The building is destroyed in a fire and this is the taxpayer's only casualty or theft for the year.In which of the following situations could there be a § 1250 depreciation recapture gain?

A) There is a loss because the insurance recovery is less than the adjusted basis.

B) There is a gain because the insurance recovery exceeds the adjusted basis.

C) Because of the length of time the building has been held, there is no remaining additional depreciation.

D) There is an insurance recovery, the adjusted basis of the building is zero, and straight-line depreciation was used.

E) None of the above.

A) There is a loss because the insurance recovery is less than the adjusted basis.

B) There is a gain because the insurance recovery exceeds the adjusted basis.

C) Because of the length of time the building has been held, there is no remaining additional depreciation.

D) There is an insurance recovery, the adjusted basis of the building is zero, and straight-line depreciation was used.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following real property could be subject to § 1250 depreciation recapture?

A) Leasehold improvements placed in service in 2012 on which § 168(k) additional first-year depreciation was taken.

B) A building acquired in 1997 on which straight-line depreciation was taken.

C) Equipment on which accelerated depreciation was taken.

D) Land which was not depreciated.

E) a. and b.

A) Leasehold improvements placed in service in 2012 on which § 168(k) additional first-year depreciation was taken.

B) A building acquired in 1997 on which straight-line depreciation was taken.

C) Equipment on which accelerated depreciation was taken.

D) Land which was not depreciated.

E) a. and b.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following creates potential § 1245 depreciation recapture and potential § 1231 gain?

A) Depreciable equipment held more than one year and sold for more than its original cost.

B) Amortizable goodwill held more than one year and disposed of for less than its adjusted basis.

C) Land held more than one year and sold for more than was paid for it.

D) Inventory held more than one year and sold for more than was paid for it.

E) None of the above.

A) Depreciable equipment held more than one year and sold for more than its original cost.

B) Amortizable goodwill held more than one year and disposed of for less than its adjusted basis.

C) Land held more than one year and sold for more than was paid for it.

D) Inventory held more than one year and sold for more than was paid for it.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following would extinguish the § 1245 recapture potential?

A) An exchange of depreciable business equipment for like-kind business equipment with gain realized, but not recognized.

B) A nontaxable incorporation under § 351.

C) A nontaxable contribution to a partnership under § 721.

D) A nontaxable reorganization.

E) None of the above.

A) An exchange of depreciable business equipment for like-kind business equipment with gain realized, but not recognized.

B) A nontaxable incorporation under § 351.

C) A nontaxable contribution to a partnership under § 721.

D) A nontaxable reorganization.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

51

An individual has the following recognized gains and losses from disposition of § 1231 assets (all the assets were vacant land): $15,000 gain,$10,000 loss,$25,000 gain,and $2,000 loss.The individual has a $5,500 § 1231 lookback loss.The individual also has a $16,000 net short-term capital loss from the disposition of stock.Which of the following statements is correct?

A) The taxpayer has $5,500 ordinary gain and $6,500 net long-term capital gain.

B) The taxpayer has $12,000 net long-term capital gain.

C) The taxpayer has $28,000 ordinary gain and $16,000 net short-term capital loss.

D) The taxpayer has $5,500 ordinary loss and $6,500 net long-term capital gain.

E) None of the above.

A) The taxpayer has $5,500 ordinary gain and $6,500 net long-term capital gain.

B) The taxpayer has $12,000 net long-term capital gain.

C) The taxpayer has $28,000 ordinary gain and $16,000 net short-term capital loss.

D) The taxpayer has $5,500 ordinary loss and $6,500 net long-term capital gain.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

52

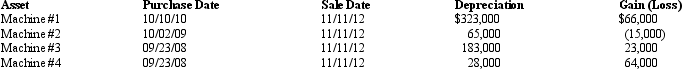

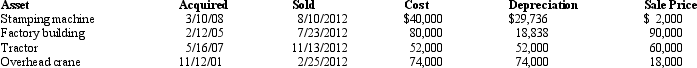

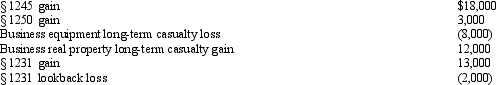

A business taxpayer sold all the depreciable assets of the business,calculated the gains and losses,and would like to know the final character of those gains and losses.The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets.The taxpayer had unrecaptured § 1231 lookback loss of $12,000.What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self-employment tax deduction.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

53

Lynne owns depreciable residential rental real estate which has accumulated depreciation (all from straight-line)of $65,000.If Lynne sold the property,she would have a $53,000 gain.The initial characterization of the gain would be:

A) Section 1245 gain.

B) Section 1231 gain.

C) Section 1250 gain.

D) Section 1239 gain.

E) None of the above.

A) Section 1245 gain.

B) Section 1231 gain.

C) Section 1250 gain.

D) Section 1239 gain.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following events could result in § 1250 depreciation recapture?

A) Sale at a loss of a depreciable business building held more than one year.

B) Sale at a gain of a business building held more than a year on which straight-line depreciation was taken.

C) Sale at a gain of a depreciable business building held for 9 months.

D) Sale at a gain of depreciable equipment held more than a year on which straight-line depreciation was taken.

E) None of the above.

A) Sale at a loss of a depreciable business building held more than one year.

B) Sale at a gain of a business building held more than a year on which straight-line depreciation was taken.

C) Sale at a gain of a depreciable business building held for 9 months.

D) Sale at a gain of depreciable equipment held more than a year on which straight-line depreciation was taken.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

55

Business equipment is purchased on March 10,2011,used in the business until September 29,2011,and sold at a $23,000 loss on October 10,2011.The equipment was not suitable for the work the business had purchased it for.The loss on the disposition should have been reported in the 2011 Form 4797,Part:

A) I.

B) II.

C) III.

D) IV.

E) This transaction would not be reported in the Form 4797.

A) I.

B) II.

C) III.

D) IV.

E) This transaction would not be reported in the Form 4797.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

56

A retail building used in the business of a sole proprietor is sold on March 10,2012,for $342,000.The building was acquired in 2002 for $400,000 and straight-line depreciation of $104,000 had been taken on the building.What is the maximum unrecaptured § 1250 gain from the disposition of this building?

A) $400,000.

B) $322,000.

C) $104,000.

D) $26,000.

E) None of the above.

A) $400,000.

B) $322,000.

C) $104,000.

D) $26,000.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following statements is correct?

A) When depreciable property is gifted to another individual taxpayer, the depreciation recapture potential is extinguished.

B) When depreciable property is inherited by a taxpayer, the depreciation recapture potential is extinguished.

C) When corporate depreciable property is distributed as a dividend, the depreciation recapture potential is generally not recognized.

D) When depreciable property is contributed to charity, the depreciation recapture potential has no effect on the amount of the charitable contribution deduction.

E) All of the above are correct.

A) When depreciable property is gifted to another individual taxpayer, the depreciation recapture potential is extinguished.

B) When depreciable property is inherited by a taxpayer, the depreciation recapture potential is extinguished.

C) When corporate depreciable property is distributed as a dividend, the depreciation recapture potential is generally not recognized.

D) When depreciable property is contributed to charity, the depreciation recapture potential has no effect on the amount of the charitable contribution deduction.

E) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

58

A business machine purchased April 10,2010,for $202,000 was fully depreciated in 2010 using § 179 immediate expensing.On August 15,2012,the machine was sold for $67,000.What is the amount and nature of the gain or loss from disposition of the machine?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

59

Blue Company sold machinery for $45,000 on December 23,2012.The machinery had been acquired on April 1,2010,for $49,000 and its adjusted basis was $14,200.The § 1231 gain,§ 1245 recapture gain,and § 1231 loss from this transaction are:

A) $0 § 1231 gain, $30,800 § 1245 recapture gain, $0 § 1231 loss.

B) $0 § 1231 gain, $0 § 1245 recapture gain, $34,800 § 1231 loss.

C) $4,000 § 1231 gain, $34,800 § 1245 recapture gain, $0 § 1231 loss.

D) $0 § 1231 gain, $34,800 § 1245 recapture gain, $14,200 § 1231 loss.

E) None of the above.

A) $0 § 1231 gain, $30,800 § 1245 recapture gain, $0 § 1231 loss.

B) $0 § 1231 gain, $0 § 1245 recapture gain, $34,800 § 1231 loss.

C) $4,000 § 1231 gain, $34,800 § 1245 recapture gain, $0 § 1231 loss.

D) $0 § 1231 gain, $34,800 § 1245 recapture gain, $14,200 § 1231 loss.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

60

Section 1231 gain that is treated as long-term capital gain carries from the 2011 Form 4797 to the 2011 Form 1040,Schedule D,line ____.

A) 8.

B) 9.

C) 10.

D) 11.

E) None of the above.

A) 8.

B) 9.

C) 10.

D) 11.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

61

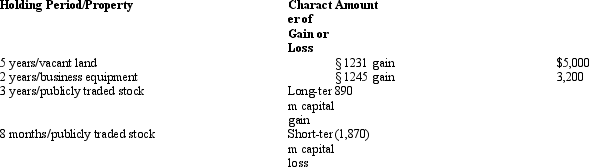

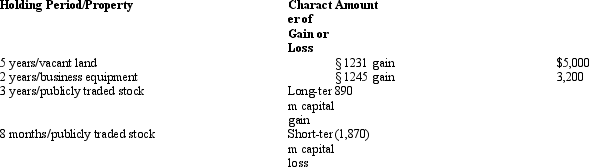

An individual taxpayer has the gains and losses shown below.There are $3,000 of § 1231 lookback losses.What is the net long-term capital gain?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

62

Depreciable personal property was sold at a gain in 2011.On what 2011 form would this transaction be reported,where initially in that form,and what will the form most likely do with the gain?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

63

Why is it generally better to have a net § 1231 gain year followed by a net § 1231 loss year rather than a net § 1231 loss year followed by a net § 1231 gain year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

64

In 2012 Angela,a single taxpayer with no dependents,disposed of for $44,000 a business building which cost $100,000.$60,000 of depreciation had been taken on the building.Angela has a short-term capital loss of $3,000 this year.She has taxable income (not related to property transactions)of $125,000.She has no § 1231 lookback loss.What is the amount and nature of the gain or loss,what is Angela's taxable income,and what is her tax on the taxable income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

65

A business taxpayer trades in a used fully depreciated machine on a replacement machine.Because the machine traded in was worth more than the replacement machine,the taxpayer received cash in the transaction.Assume the used machine originally cost $100,000,was worth $32,000 when it was traded in,and the replacement machine was worth $20,000.Consequently,the taxpayer received $12,000 cash in the transaction.Is there recognized gain in this transaction and,if so,what type of gain?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

66

Jamison owned a rental building (but not the land)that was destroyed by a hurricane.The building was insured and Jamison has a $56,000 gain because his insurance recovery exceeded his adjusted basis for the building.Jamison does not intend to replace the building.Jamison had taken $45,000 of depreciation on the building,has no § 1231 lookback loss,has no other § 1231 transactions for the year,and has no Schedule D transactions for the year.What is the final nature of Jamison's gain for the year and what tax rate(s)apply to the gain?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

67

Describe the circumstances in which the potential § 1245 depreciation recapture is extinguished.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

68

Residential real estate was purchased in 2009 for $345,000,held as rental property,and depreciated straight-line.Assume the land cost was $45,000 and the building cost was $300,000.Depreciation totaled $34,089.The building and land were sold on June 10,2012,for $683,000 total.What is the tax status of the property,the nature of the gain from the disposition,and is any of it § 1250 depreciation recapture gain or unrecaptured § 1250 gain?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

69

Vanna owned an office building that had been held more than one year when it was sold for $567,000.The real estate had an adjusted basis of $45,000 for the land and $233,000 for the building.Straight-line depreciation of $162,000 had been taken on the building.What is the amount and initial character of the gain or loss from disposition of the real estate? Is any of the gain unrecaptured § 1250 (25%)gain?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

70

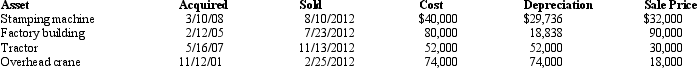

The chart below describes the § 1231 assets sold by the Tan Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $14,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

71

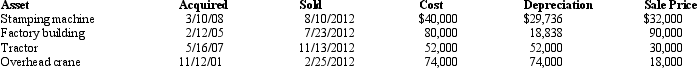

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship)this year.Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year.Assume there is a § 1231 lookback loss of $4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

72

A business machine purchased April 10,2011,for $62,000 was fully depreciated in 2011 using § 179 immediate expensing.On August 15,2012,the sole proprietor who owned the machine gave it to his son.On that date,the machine's fair market value was $57,000.The son did not use the machine in business or hold it as inventory and the machine was sold on November 22,2012,for $53,000.What is the amount and nature of the gain or loss from disposition of the machine? Where is it reported in the son's tax return?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

73

Charmine,a single taxpayer with no dependents,has already incurred a $10,000 § 1231 gain in 2012 and has no § 1231 lookback losses.The taxpayer purchased a business machine for $100,000 five years ago,$70,000 of depreciation has been taken on it,and the machine is now worth $90,000.How will the net § 1231 gain or loss be affected if the taxpayer trades in the business machine for a like-kind business machine and pays an additional $12,000 in cash to obtain the replacement machine? If Charmine already has $322,000 of taxable income which does not include a $10,000 §1231 gain or any capital gains or losses,what is her taxable income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck

74

Betty,a single taxpayer with no dependents,has the gains and losses shown below.Before considering these transactions,Betty has $45,000 of other taxable income.What is the treatment of the gains and losses and what is Betty's taxable income?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 74 في هذه المجموعة.

فتح الحزمة

k this deck