Deck 5: Relevant Information for Decision Making With a Focus on Pricing Decisions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/136

العب

ملء الشاشة (f)

Deck 5: Relevant Information for Decision Making With a Focus on Pricing Decisions

1

When managers use the decision process to make decisions,which information is used to make predictions about the amount of expected sales for Product XYZ?

A) historical data from the accounting system only

B) data outside the accounting system only

C) data outside the organization only

D) A and B

A) historical data from the accounting system only

B) data outside the accounting system only

C) data outside the organization only

D) A and B

D

2

Relevant information is the historical costs and revenues that differ due to alternative courses of action.

False

3

In determining whether to purchase a labor-saving machine,extreme resistance to the machine by employees would be a(n)________.

A) relevant qualitative factor

B) relevant quantitative factor

C) irrelevant qualitative factor

D) irrelevant quantitative factor

A) relevant qualitative factor

B) relevant quantitative factor

C) irrelevant qualitative factor

D) irrelevant quantitative factor

A

4

In considering whether to produce a single product,the associated direct materials and direct labor costs would probably be ________.

A) relevant qualitative factors

B) relevant quantitative factors

C) irrelevant qualitative factors

D) irrelevant quantitative factors

A) relevant qualitative factors

B) relevant quantitative factors

C) irrelevant qualitative factors

D) irrelevant quantitative factors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

5

Historical or past information can have an indirect bearing on a manager's decision because ________.

A) the past decision resulted in a favorable outcome

B) it can help predict the future

C) the past decision resulted in a bonus for the manager

D) the manager wants to repeat the past decisions made some of the time

A) the past decision resulted in a favorable outcome

B) it can help predict the future

C) the past decision resulted in a bonus for the manager

D) the manager wants to repeat the past decisions made some of the time

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

6

A manager is trying to decide which product to emphasize in promotion and advertising efforts.Following the decision process used by managers,predictions about the amounts of future sales of the two products are used as input to the ________.

A) prediction model

B) prediction method

C) decision model

D) evaluation model

A) prediction model

B) prediction method

C) decision model

D) evaluation model

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

7

Cantrall Company is trying to decide which product to manufacture.Expected direct materials costs are $4.00 per unit for each product.The expected direct labor costs are $2.00 per unit for one product and $4.00 per unit for another product.In choosing between the two products,the direct materials costs are ________ and the direct labor costs are ________.

A) relevant; irrelevant

B) irrelevant; relevant

C) relevant; relevant

D) irrelevant; irrelevant

A) relevant; irrelevant

B) irrelevant; relevant

C) relevant; relevant

D) irrelevant; irrelevant

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

8

When managers use the decision process to make decisions,what is the output after using the prediction method?

A) decision

B) implementation

C) predictions

D) evaluation

A) decision

B) implementation

C) predictions

D) evaluation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

9

Information is relevant in business decisions if it is a(n)________.

A) expected future revenue or it differs among alternatives

B) expected future revenue and it differs among alternatives

C) past revenue and it differs among alternatives

D) expected future revenue that differs from past revenue

A) expected future revenue or it differs among alternatives

B) expected future revenue and it differs among alternatives

C) past revenue and it differs among alternatives

D) expected future revenue that differs from past revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

10

What are the qualitative aspects of a decision?

A) those which are not relevant to a decision

B) those with a concrete dollar amount

C) those for which measurement in dollars and cents is difficult and imprecise

D) those which are always relevant to a decision

A) those which are not relevant to a decision

B) those with a concrete dollar amount

C) those for which measurement in dollars and cents is difficult and imprecise

D) those which are always relevant to a decision

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

11

In decision making situations,________ aspects may dominate quantitative aspects in many decisions.

A) relevant

B) precision

C) accuracy

D) qualitative

A) relevant

B) precision

C) accuracy

D) qualitative

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

12

Historical data may have a direct bearing on a decision made today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

13

When managers make decisions,the accountant's primary role is ________.

A) making the decision

B) providing information that may be useful to the manager

C) uncertain because it depends on the decision being made

D) uncertain because it depends on the manager

A) making the decision

B) providing information that may be useful to the manager

C) uncertain because it depends on the decision being made

D) uncertain because it depends on the manager

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

14

If perfectly accurate and relevant information is not available for decision making,the accountant should consider using information that is ________.

A) precise but irrelevant

B) imprecise but irrelevant

C) imprecise but relevant

D) imprecise but timely

A) precise but irrelevant

B) imprecise but irrelevant

C) imprecise but relevant

D) imprecise but timely

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

15

Historical or past information has no ________ bearing on a decision made by management.Historical or past information can have a(n)________ bearing on a decision made by management.

A) indirect; direct

B) direct; indirect

C) measurable; material

D) material; significant

A) indirect; direct

B) direct; indirect

C) measurable; material

D) material; significant

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following statements is FALSE about information used for decision making?

A) Precise but irrelevant information is worthless for decision making.

B) Imprecise but relevant information can be useful for decision making.

C) Relevant information must be reasonably accurate but not precisely so.

D) Relevant information must be totally accurate or it is useless.

A) Precise but irrelevant information is worthless for decision making.

B) Imprecise but relevant information can be useful for decision making.

C) Relevant information must be reasonably accurate but not precisely so.

D) Relevant information must be totally accurate or it is useless.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

17

When managers make decisions,the decision process used has the following steps in the order of occurrence:

A) Historical and Other Information, Prediction Model, Prediction, Decision Model, Decision, Implementation, Feedback

B) Historical and Other Information, Decision Model, Prediction Method, Implementation, Decision, Feedback

C) Historical and Other Information, Decision Model, Prediction Method, Decision, Implementation, Feedback

D) Historical and Other Information, Prediction Method, Prediction, Decision Model, Decision, Implementation, Feedback

A) Historical and Other Information, Prediction Model, Prediction, Decision Model, Decision, Implementation, Feedback

B) Historical and Other Information, Decision Model, Prediction Method, Implementation, Decision, Feedback

C) Historical and Other Information, Decision Model, Prediction Method, Decision, Implementation, Feedback

D) Historical and Other Information, Prediction Method, Prediction, Decision Model, Decision, Implementation, Feedback

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

18

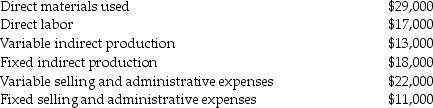

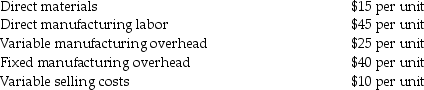

A company is trying to decide which product to manufacture.The following information is available:

Which product cost is irrelevant to the decision?

A) Direct Materials 1

B) Direct Materials 2

C) Direct Materials 3

D) Direct Labor

Which product cost is irrelevant to the decision?

A) Direct Materials 1

B) Direct Materials 2

C) Direct Materials 3

D) Direct Labor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

19

Relevant information refers to ________ that will differ among the alternative courses of action.

A) future costs only

B) future revenues only

C) past costs and revenues

D) future costs and revenues

A) future costs only

B) future revenues only

C) past costs and revenues

D) future costs and revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

20

When managers make decisions,the accountant is seen as the technical expert on financial analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

21

Fixed selling expenses affect the calculation of ________ on the contribution income statement.

Fixed selling expenses do NOT affect the calculation of ________ on the absorption income statement.

A) contribution margin; gross margin

B) gross margin; contribution margin

C) operating income; gross margin

D) operating income; contribution margin

Fixed selling expenses do NOT affect the calculation of ________ on the absorption income statement.

A) contribution margin; gross margin

B) gross margin; contribution margin

C) operating income; gross margin

D) operating income; contribution margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

22

Qualitative aspects of information are those for which measurement in dollars and cents is easy and precise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

23

Variable administrative expenses affect the calculation of ________ on the contribution income

Statement.Variable administrative expenses do NOT affect the calculation of ________ on the absorption income statement.

A) gross margin; contribution margin

B) contribution margin; gross margin

C) operating income; contribution margin

D) gross margin; operating income

Statement.Variable administrative expenses do NOT affect the calculation of ________ on the absorption income statement.

A) gross margin; contribution margin

B) contribution margin; gross margin

C) operating income; contribution margin

D) gross margin; operating income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

24

Imprecise but relevant information can be useful.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

25

Variable selling expenses affect the calculation of ________ on the contribution income statement.Variable selling expenses do NOT affect the calculation of ________ on the absorption income statement.

A) gross margin; contribution margin

B) operating income; contribution margin

C) contribution margin; gross margin

D) gross margin; operating income

A) gross margin; contribution margin

B) operating income; contribution margin

C) contribution margin; gross margin

D) gross margin; operating income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

26

The contribution approach to the income statement emphasizes the distinction between ________.

A) value chain functions

B) different functional areas in a firm

C) different business segments

D) variable and fixed costs

A) value chain functions

B) different functional areas in a firm

C) different business segments

D) variable and fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

27

The degree to which information is relevant or precise often depends on the degree to which it is qualitative or quantitative.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

28

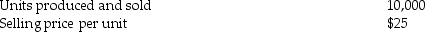

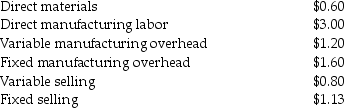

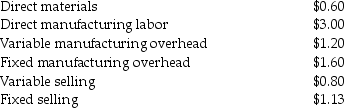

Santana Company has no beginning and ending inventories,and reports the following information for its only product:

Santana Company uses the absorption approach to prepare the income statement.What is the product cost per unit?

A) $11.00

B) $11.25

C) $12.00

D) $12.75

Santana Company uses the absorption approach to prepare the income statement.What is the product cost per unit?

A) $11.00

B) $11.25

C) $12.00

D) $12.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

29

Under the contribution approach to the income statement,the difference between sales and ________ is contribution margin.

A) cost of goods sold

B) manufacturing costs

C) all variable expenses

D) all fixed expenses

A) cost of goods sold

B) manufacturing costs

C) all variable expenses

D) all fixed expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

30

It is misleading to use the absorption costing income statement to predict the effect of changes in sales volume because ________.

A) variable production costs per unit do not change with small changes in sales volume

B) total fixed production costs do not change with small changes in sales volume

C) fixed production costs per unit do not change with small changes in sales volume

D) total variable production costs do not change with small changes in sales volume

A) variable production costs per unit do not change with small changes in sales volume

B) total fixed production costs do not change with small changes in sales volume

C) fixed production costs per unit do not change with small changes in sales volume

D) total variable production costs do not change with small changes in sales volume

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

31

Accountants are sometimes forced to trade relevant information for accurate information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

32

Under absorption costing,all ________ costs are product or inventoriable costs.

A) indirect production

B) direct and indirect production

C) direct production

D) selling and administrative

A) indirect production

B) direct and indirect production

C) direct production

D) selling and administrative

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

33

Fixed indirect production costs affect the calculation of ________ on the absorption income statement.Fixed indirect production costs do NOT affect the calculation of ________ on the contribution income statement.

A) contribution margin; gross margin

B) gross margin; contribution margin

C) operating income; gross margin

D) contribution margin; operating income

A) contribution margin; gross margin

B) gross margin; contribution margin

C) operating income; gross margin

D) contribution margin; operating income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

34

For internal decision-making purposes,many companies use the income statement using the ________ approach.For external reporting,most companies use the income statement using the ________ approach.

A) absorption; absorption

B) absorption; contribution

C) contribution; absorption

D) full costing; variable costing

A) absorption; absorption

B) absorption; contribution

C) contribution; absorption

D) full costing; variable costing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

35

Precise but irrelevant information is worthless for decision making.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

36

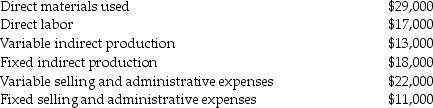

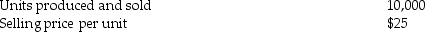

Camile Company has no beginning and ending inventories,and reports the following data about its only product:

Camile Company uses the absorption approach to prepare the income statement.What is the product cost per unit?

A) $20

B) $25

C) $27.50

D) $32.50

Camile Company uses the absorption approach to prepare the income statement.What is the product cost per unit?

A) $20

B) $25

C) $27.50

D) $32.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

37

Qualitative aspects of information can carry more weight than quantitative aspects in a business decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

38

Using absorption costing,the primary classifications of costs on the income statement are by ________.

A) cost behavior patterns

B) manufacturing departments

C) major management functions

D) manufacturing segments

A) cost behavior patterns

B) manufacturing departments

C) major management functions

D) manufacturing segments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

39

The contribution approach to the income statement offers several benefits to decision makers.Which of the following is NOT a benefit of this approach?

A) This approach makes it easier to understand the impact of changes in sales volume on operating income.

B) This approach stresses the role of fixed costs in operating income.

C) This approach is used with CVP analysis.

D) This approach is accepted by U.S. Generally Accepted Accounting Principles.

A) This approach makes it easier to understand the impact of changes in sales volume on operating income.

B) This approach stresses the role of fixed costs in operating income.

C) This approach is used with CVP analysis.

D) This approach is accepted by U.S. Generally Accepted Accounting Principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

40

Sanchez Company has no beginning and ending inventories,and reports the following data about its only product:

Sanchez Company uses the absorption approach to prepare the income statement.What is the manufacturing cost of goods sold?

A) $270,000

B) $300,000

C) $390,000

D) $500,000

Sanchez Company uses the absorption approach to prepare the income statement.What is the manufacturing cost of goods sold?

A) $270,000

B) $300,000

C) $390,000

D) $500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

41

Zeman Company has no beginning and ending inventories,and reports the following data about its only product:

Zeman Company uses the contribution approach to prepare the income statement.What is the contribution margin?

A) $150,000

B) $190,000

C) $250,000

D) $370,000

Zeman Company uses the contribution approach to prepare the income statement.What is the contribution margin?

A) $150,000

B) $190,000

C) $250,000

D) $370,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

42

Margaret Company has been producing and selling 100,000 units per year.They have excess capacity,and there are no beginning and ending inventories.The following budget was prepared for the next year:

Required:

A) Prepare an income statement using the contribution approach.

B) Prepare an income statement using the absorption approach.

Required:

A) Prepare an income statement using the contribution approach.

B) Prepare an income statement using the absorption approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

43

On the income statement,the absorption approach separates manufacturing costs from ________.

A) some nonmanufacturing costs

B) all nonmanufacturing costs

C) all variable costs

D) all fixed costs

A) some nonmanufacturing costs

B) all nonmanufacturing costs

C) all variable costs

D) all fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

44

Latinovich Company has no beginning and ending inventories,and reports the following data about its only product:

Latinovich Company uses the contribution approach to prepare the income statement.What is the contribution margin?

A) $600,000

B) $910,000

C) $930,000

D) $1,090,000

Latinovich Company uses the contribution approach to prepare the income statement.What is the contribution margin?

A) $600,000

B) $910,000

C) $930,000

D) $1,090,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

45

Franklin Company uses activity-based costing,and normally produces 1,000,000 units per month.At this level of production,the costs per unit are as follows:

For 1,000,000 units,500 setups are required at a cost of $6,000 per setup.The company has received a special order for 100,000 units at $22 per unit.The company has excess capacity.The company estimates that 5 setups will be required for the special order.What is the cost of the special order?

A) $2,100,000

B) $2,130,000

C) $2,400,000

D) $2, 430,000

For 1,000,000 units,500 setups are required at a cost of $6,000 per setup.The company has received a special order for 100,000 units at $22 per unit.The company has excess capacity.The company estimates that 5 setups will be required for the special order.What is the cost of the special order?

A) $2,100,000

B) $2,130,000

C) $2,400,000

D) $2, 430,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

46

The ________ approach is useful for short-run pricing decisions and the ________ approach is useful for long-run pricing decisions.

A) contribution; absorption

B) absorption; contribution

C) full costing; target costing

D) full costing; contribution

A) contribution; absorption

B) absorption; contribution

C) full costing; target costing

D) full costing; contribution

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

47

Gonzalez Company has no beginning and ending inventories,and reports the following data about its only product:

Gonzalez Company uses the absorption approach to prepare the income statement.What is the gross margin?

A) $0

B) $20,000

C) $100,000

D) $120,000

Gonzalez Company uses the absorption approach to prepare the income statement.What is the gross margin?

A) $0

B) $20,000

C) $100,000

D) $120,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

48

Under absorption costing,fixed manufacturing costs are used to calculate ________ on the income statement.

A) contribution margin

B) manufacturing cost of goods sold

C) total variable costs

D) total fixed costs

A) contribution margin

B) manufacturing cost of goods sold

C) total variable costs

D) total fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

49

When absorption costing is used for the income statement,the difference between sales and ________ is gross margin.

A) manufacturing cost of goods sold

B) selling expenses

C) selling and administrative expenses

D) variable expenses

A) manufacturing cost of goods sold

B) selling expenses

C) selling and administrative expenses

D) variable expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

50

Garcia Company has no beginning and ending inventories,and reports the following data about its only product:

Garcia Company uses the absorption approach to prepare the income statement.What is the operating income?

A) $2,060,000

B) $2,120,000

C) $2,240,000

D) $2,970,000

Garcia Company uses the absorption approach to prepare the income statement.What is the operating income?

A) $2,060,000

B) $2,120,000

C) $2,240,000

D) $2,970,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

51

The absorption approach to the income statement emphasizes the distinction between fixed and variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

52

The absorption costing approach to the income statement is used by companies for external financial reporting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

53

In special order situations,unit costs are useful for predicting total ________.In special order situations,unit costs are not useful for predicting total ________.

A) mixed costs; step costs

B) step costs; mixed costs

C) variable costs; fixed costs

D) fixed costs; variable costs

A) mixed costs; step costs

B) step costs; mixed costs

C) variable costs; fixed costs

D) fixed costs; variable costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

54

Schaefer Company has no beginning and ending inventories,and reports the following data about its only product:

Schaefer Company uses the contribution approach to prepare the income statement.What is the contribution margin?

A) $100,000

B) $140,000

C) $200,000

D) $220,000

Schaefer Company uses the contribution approach to prepare the income statement.What is the contribution margin?

A) $100,000

B) $140,000

C) $200,000

D) $220,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

55

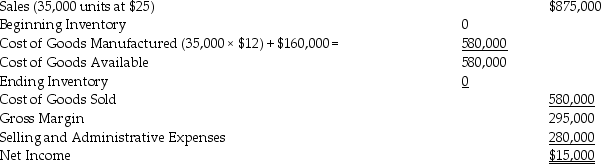

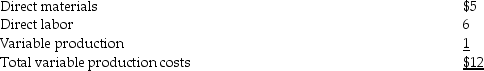

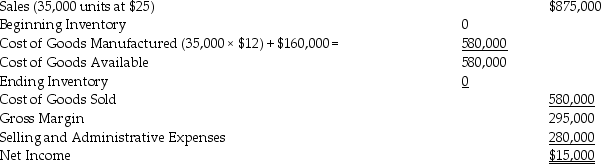

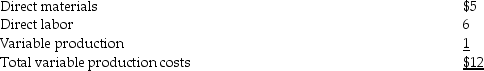

Whitney Company has just completed its first year of operations.The company's accountant has prepared an absorption costing income statement for the year as seen below:

The variable production costs per unit are determined as follows:

The company's fixed production costs are $160,000 per year.The company's selling and administrative expenses consist of $210,000 per year in fixed expenses and $2 per unit in variable expenses.

Required:

Prepare the company's income statement in the contribution format.

The variable production costs per unit are determined as follows:

The company's fixed production costs are $160,000 per year.The company's selling and administrative expenses consist of $210,000 per year in fixed expenses and $2 per unit in variable expenses.

Required:

Prepare the company's income statement in the contribution format.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

56

When evaluating short-term special order decisions,which of the following types of income statements should be used?

A) method used for external reporting

B) method that follows U.S. Generally Accepted Accounting Principles

C) absorption approach

D) contribution approach

A) method used for external reporting

B) method that follows U.S. Generally Accepted Accounting Principles

C) absorption approach

D) contribution approach

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

57

Stewart Company has no beginning and ending inventories,and reports the following information about its only product:

Required:

A) Prepare an income statement using the contribution approach.

B) Prepare an income statement using the absorption approach.

Required:

A) Prepare an income statement using the contribution approach.

B) Prepare an income statement using the absorption approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

58

Winter Company has no beginning and ending inventories,and reports the following data about its only product:

Winter Company uses the absorption approach to prepare the income statement.What is the gross margin?

A) $740,000

B) $1,040,000

C) $1,100,000

D) $1,160,000

Winter Company uses the absorption approach to prepare the income statement.What is the gross margin?

A) $740,000

B) $1,040,000

C) $1,100,000

D) $1,160,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

59

On the income statement,the contribution margin is computed using variable manufacturing costs and variable selling and administrative costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

60

Gomez Company has no beginning and ending inventories,and reports the following data about its only product:

Gomez Company uses the contribution approach to prepare the income statement.What is the operating income?

A) $1,890,000

B) $2,100,000

C) $2,190,000

D) $2,250,000

Gomez Company uses the contribution approach to prepare the income statement.What is the operating income?

A) $1,890,000

B) $2,100,000

C) $2,190,000

D) $2,250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

61

In imperfect competition,firms should produce and sell units until the ________ equals the ________.

A) average revenue; marginal cost

B) marginal revenue; average revenue

C) average revenue; average cost

D) marginal revenue; marginal cost

A) average revenue; marginal cost

B) marginal revenue; average revenue

C) average revenue; average cost

D) marginal revenue; marginal cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

62

Wisconsin Company has a current production capacity level of 200,000 units per month.At this level of production,variable costs are $1.00 per unit and fixed costs are $0.50 per unit.Current monthly sales are 164,500 units.Gates Company has contacted Wisconsin Company about purchasing 20,000 units at $2.00 each.Current sales would not be affected by the special order and no additional fixed costs would be incurred on the special order.Variable costs would increase $0.10 per unit with the special order.If the order is accepted,what is Wisconsin Company's increase in operating income?

A) $8,000

B) $18,000

C) $20,000

D) $24,000

A) $8,000

B) $18,000

C) $20,000

D) $24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

63

Kansas Company uses activity-based costing.The company produces and sells 20,000 units at $22 per unit.Kansas Company's product cost is calculated as follows:

A total of 500 setups at a cost of $120 per setup are required to produce the 20,000 units.Kansas Company has received a special order to sell 5,000 units at $12 per unit.Kansas Company has excess capacity available,but these 5,000 units would require 60 setups.If Kansas Company accepts the special order,what is the increase or decrease in net income?

A) $0

B) decrease $5,000

C) decrease $15,000

D) increase $2,800

A total of 500 setups at a cost of $120 per setup are required to produce the 20,000 units.Kansas Company has received a special order to sell 5,000 units at $12 per unit.Kansas Company has excess capacity available,but these 5,000 units would require 60 setups.If Kansas Company accepts the special order,what is the increase or decrease in net income?

A) $0

B) decrease $5,000

C) decrease $15,000

D) increase $2,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

64

Each month Fig Company produces 11,000 units of a product that sells for $18 per unit,and has variable costs of $12 per unit.Total fixed costs for the month are $77,000.A special order is received for 5,000 units at a price of $14 per unit.Fig Company has adequate capacity for the special order.If Fig Company accepts the special order,what is the profit to Fig Company from the special order?

A) $0

B) $10,000

C) $22,000

D) $99,000

A) $0

B) $10,000

C) $22,000

D) $99,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

65

In imperfect competition,if prices have little or no effect on sales volume,demand is ________.

A) stable

B) uniform

C) highly elastic

D) highly inelastic

A) stable

B) uniform

C) highly elastic

D) highly inelastic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

66

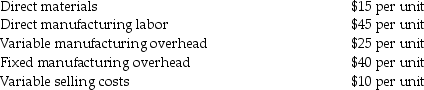

Texas Company produces and sells 22,000 units of a single product.Costs associated with this level of production are as follows:

The product normally sells for $160 per unit.Texas Company has received a special order to sell 2,000 units at $120 per unit.With the special order,variable selling costs will increase by $5 per unit to $15 per unit.Texas Company has excess production capacity.

Required:

Compute the amount by which the operating income of Texas Company would change if the special order was accepted.

The product normally sells for $160 per unit.Texas Company has received a special order to sell 2,000 units at $120 per unit.With the special order,variable selling costs will increase by $5 per unit to $15 per unit.Texas Company has excess production capacity.

Required:

Compute the amount by which the operating income of Texas Company would change if the special order was accepted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

67

Oak Creek Company uses activity-based costing,and normally produces 1,000,000 units per month.At this level of production,the costs per unit are as follows:

For 1,000,000 units,500 setups are required at a cost of $10,000 per setup.The company has received a special order for 100,000 units at $22 per unit.The company has excess capacity.The company estimates that 5 setups will be required for the special order.Variable selling costs of $1 per unit will also be incurred for the special order.What is the cost of the special order?

A) $2,300,000

B) $2,350,000

C) $2,700,000

D) $2,800,000

For 1,000,000 units,500 setups are required at a cost of $10,000 per setup.The company has received a special order for 100,000 units at $22 per unit.The company has excess capacity.The company estimates that 5 setups will be required for the special order.Variable selling costs of $1 per unit will also be incurred for the special order.What is the cost of the special order?

A) $2,300,000

B) $2,350,000

C) $2,700,000

D) $2,800,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

68

Dakota Company has been producing and selling 42,000 hats a year.There are no beginning and ending inventories.The Dakota Corporation has the capacity to produce 52,000 hats.The following data is available:

If a special order is accepted for 10,000 hats at a price of $25 per unit,net income would ________.

A) increase by $20,000

B) increase by $50,000

C) increase by $90,000

D) decrease by $24,000

If a special order is accepted for 10,000 hats at a price of $25 per unit,net income would ________.

A) increase by $20,000

B) increase by $50,000

C) increase by $90,000

D) decrease by $24,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

69

Minnesota Company has no beginning and ending inventories,and has the following data about its only product:

Assume there is excess capacity.The company has received a special order for 1,000 units at $60.00 per unit.If the special order is accepted,what will be the effect on net income?

A) net income increases by $3,000

B) net income increases by $6,000

C) net income increases by $10,000

D) net income increases by $15,220

Assume there is excess capacity.The company has received a special order for 1,000 units at $60.00 per unit.If the special order is accepted,what will be the effect on net income?

A) net income increases by $3,000

B) net income increases by $6,000

C) net income increases by $10,000

D) net income increases by $15,220

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

70

Each month Newton Company produces 30,000 units of a product that has variable costs of $70 per unit.Total fixed costs for the month are $99,000.A special order is received for 1,000 units at a price of $80 per unit.Newton Company has adequate capacity for the special order.If Newton Company accepts the special order,what is the profit to Newton Company from the special order?

A) $0

B) $6,700

C) $7,000

D) $10,000

A) $0

B) $6,700

C) $7,000

D) $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

71

Surly Company makes small boats.The company produces and sells 5,500 boats per year at a selling price of $160 per boat.Surly Company has excess capacity and is trying to get special orders.A new retailer wants to purchase 1,000 boats for $125 per boat.Surly Company is going to decline the special order because it costs $130 to make a single boat as seen below:

Required:

A) Should Surly Company reject the special order from the new retailer? Why?

B) How much will Surly's net income increase with the special offer?

Required:

A) Should Surly Company reject the special order from the new retailer? Why?

B) How much will Surly's net income increase with the special offer?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

72

In managerial accounting,________ can be a reasonable approximation of marginal cost in many situations.

A) fixed cost

B) mixed cost

C) step cost

D) variable cost

A) fixed cost

B) mixed cost

C) step cost

D) variable cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

73

In perfect competition,all firms charge the same market price.The only decision for managers is ________.

A) how to minimize costs

B) how to maximize average revenue

C) how much to produce

D) how to minimize marginal costs

A) how to minimize costs

B) how to maximize average revenue

C) how much to produce

D) how to minimize marginal costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

74

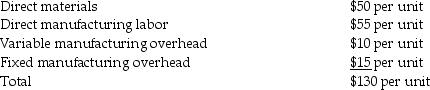

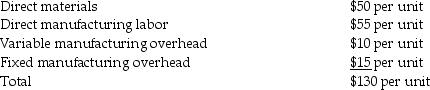

Stangle Company manufactures ties.When 28,000 ties are produced,the costs per unit are:

The ties normally sell for $22 each.The company has received a special order for 2,000 ties at $8.00 per tie.The company will incur an additional variable selling cost of $1.50 per unit with the special order.The company has excess capacity.

Required:

Compute the amount by which the operating income would change if the order were accepted.

The ties normally sell for $22 each.The company has received a special order for 2,000 ties at $8.00 per tie.The company will incur an additional variable selling cost of $1.50 per unit with the special order.The company has excess capacity.

Required:

Compute the amount by which the operating income would change if the order were accepted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

75

Arkansas Company has no beginning and ending inventories,and has obtained the following data for its only product:

Assume there is excess capacity.There is a special order outstanding for 1,000 units at $40.00 per unit.If Arkansas Company accepts the special order,net income would ________.

A) increase by $40,000

B) increase by $11,250

C) decrease by $28,750

D) decrease by $10,000

Assume there is excess capacity.There is a special order outstanding for 1,000 units at $40.00 per unit.If Arkansas Company accepts the special order,net income would ________.

A) increase by $40,000

B) increase by $11,250

C) decrease by $28,750

D) decrease by $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following items is usually NOT important to special order decisions?

A) affect of special order on regular business

B) whether idle capacity is available

C) total fixed costs

D) increase in variable costs per unit due to special order

A) affect of special order on regular business

B) whether idle capacity is available

C) total fixed costs

D) increase in variable costs per unit due to special order

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

77

A small appliance manufacturer is deciding whether to accept or reject a special order for 1,750 appliances.There is sufficient capacity available for the special order.What is relevant information for the decision whether to accept or reject the special order?

A) the cost of the parts for the 1,750 appliances

B) the supervisor's salary in the production area

C) the depreciation on assembly equipment

D) the accountant's salary

A) the cost of the parts for the 1,750 appliances

B) the supervisor's salary in the production area

C) the depreciation on assembly equipment

D) the accountant's salary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

78

Missouri Company has a current production capacity level of 200,000 units per month.At this level of production,variable costs are $0.60 per unit and fixed costs are $0.50 per unit.Current monthly sales are 173,000 units.Gates Company has contacted Missouri Company about purchasing 20,000 units at $1.00 each.Current sales would not be affected by the special order and no additional fixed costs would be incurred on the special order.If the order is accepted,what is Missouri Company's change in profits?

A) $8,000 increase

B) $8,000 decrease

C) $10,000 increase

D) $10,000 decrease

A) $8,000 increase

B) $8,000 decrease

C) $10,000 increase

D) $10,000 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

79

Nebraska Company uses activity-based costing.The company produces and sells 20,000 units at $20 per unit.Nebraska Company's product cost is calculated as follows:

A total of 500 setups at a cost of $120 per setup are required to produce the 20,000 units.Nebraska Company has received a special order to sell 5,000 units at $11 per unit.Nebraska Company has excess capacity available,but these 5,000 units would require 60 setups.If Nebraska Company accepts the special order,what is Nebraska's increase in net income?

A) increase $5,000

B) increase $7,800

C) decrease $2,800

D) decrease $5,000

A total of 500 setups at a cost of $120 per setup are required to produce the 20,000 units.Nebraska Company has received a special order to sell 5,000 units at $11 per unit.Nebraska Company has excess capacity available,but these 5,000 units would require 60 setups.If Nebraska Company accepts the special order,what is Nebraska's increase in net income?

A) increase $5,000

B) increase $7,800

C) decrease $2,800

D) decrease $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck

80

In a special order decision,which of the following costs are usually irrelevant to the decision?

A) variable manufacturing costs

B) fixed manufacturing costs

C) variable selling costs

D) variable indirect production costs

A) variable manufacturing costs

B) fixed manufacturing costs

C) variable selling costs

D) variable indirect production costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 136 في هذه المجموعة.

فتح الحزمة

k this deck