Deck 4: Cost Management Systems and Activity-Based Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/143

العب

ملء الشاشة (f)

Deck 4: Cost Management Systems and Activity-Based Costing

1

Which of the following statements about cost accounting systems is FALSE?

A) The cost accounting system provides the cost data that managers use for decision making.

B) The cost accounting system is the most fundamental component of a cost management system.

C) A cost accounting system that provides accurate information is a key success factor for all types of organizations.

D) Some types of organizations do not need cost accounting systems.

A) The cost accounting system provides the cost data that managers use for decision making.

B) The cost accounting system is the most fundamental component of a cost management system.

C) A cost accounting system that provides accurate information is a key success factor for all types of organizations.

D) Some types of organizations do not need cost accounting systems.

D

2

Investors need more detailed information about products or services than managers.

False

3

The process of collecting costs by some natural classification is called ________.

A) cost accounting

B) cost allocation

C) cost accumulation

D) cost assignment

A) cost accounting

B) cost allocation

C) cost accumulation

D) cost assignment

C

4

To support managers' decisions,accountants develop cost management systems that are ________.

A) also used by external users such as investors and lenders

B) computer programs with specialized accounting language

C) a collection of tools and techniques that identify how decisions affect costs

D) composed of at least 400 cost pools

A) also used by external users such as investors and lenders

B) computer programs with specialized accounting language

C) a collection of tools and techniques that identify how decisions affect costs

D) composed of at least 400 cost pools

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

5

To determine the cost of serving a specific type of customer,such as the retail customer,which of the following are followed?

A) first step, cost assignment and second step, cost allocation

B) first step, cost accumulation and second step, cost assignment

C) first step, cost allocation and second step, cost apportionment

D) first step, cost absorption and second step, cost attribution

A) first step, cost assignment and second step, cost allocation

B) first step, cost accumulation and second step, cost assignment

C) first step, cost allocation and second step, cost apportionment

D) first step, cost absorption and second step, cost attribution

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

6

What is an example of a tool or technique that is used in a cost management system?

A) retail method

B) lower of cost or market rule

C) conservatism principle

D) cost-volume-profit analysis

A) retail method

B) lower of cost or market rule

C) conservatism principle

D) cost-volume-profit analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

7

A cost management system provides ________.

A) measures of inventory value and cost of goods sold for financial reporting

B) cost information for strategic management decisions

C) cost information for operational control

D) all of the above

A) measures of inventory value and cost of goods sold for financial reporting

B) cost information for strategic management decisions

C) cost information for operational control

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following statements is FALSE?

A) A cost may be defined as a sacrifice or giving up of resources for a particular purpose.

B) Costs are frequently measured by the monetary units that must be paid for goods and services.

C) Only manufacturing firms need some form of cost accounting.

D) A cost accounting system typically has two processes that include cost accumulation and cost assignment.

A) A cost may be defined as a sacrifice or giving up of resources for a particular purpose.

B) Costs are frequently measured by the monetary units that must be paid for goods and services.

C) Only manufacturing firms need some form of cost accounting.

D) A cost accounting system typically has two processes that include cost accumulation and cost assignment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

9

External users of financial reports need ________ measures of inventory and cost of goods sold.Internal users of financial reports need ________ cost information about products.

A) strategic; operational

B) operational; strategic

C) aggregate; detailed

D) detailed; aggregate

A) strategic; operational

B) operational; strategic

C) aggregate; detailed

D) detailed; aggregate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is an example of a strategic management decision that uses cost information?

A) determining the ending balance of Merchandise Inventory for financial reporting to external users

B) determining the product mix

C) assessing a cost control program in a factory

D) determining the amount of Cost of Goods Sold for financial reporting to external users

A) determining the ending balance of Merchandise Inventory for financial reporting to external users

B) determining the product mix

C) assessing a cost control program in a factory

D) determining the amount of Cost of Goods Sold for financial reporting to external users

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

11

A cost management system provides information for strategic management decisions and financial reporting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

12

An example of a strategic management decision is the establishment of a pricing policy for a new product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

13

A product such as Sure-Fine Graham Crackers,and a customer such as an Internet customer,are both examples of ________.

A) cost accounting

B) cost management system

C) cost assignment

D) cost objects

A) cost accounting

B) cost management system

C) cost assignment

D) cost objects

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

14

An example of a strategic management decision is the decision to outsource a particular value-chain function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following types of organizations need cost accounting?

A) manufacturing firms and service organizations only

B) service organizations and nonprofit organizations only

C) manufacturing firms and nonprofit organizations only

D) all types of organizations

A) manufacturing firms and service organizations only

B) service organizations and nonprofit organizations only

C) manufacturing firms and nonprofit organizations only

D) all types of organizations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is an example of a strategic management decision that uses cost information?

A) determination of Cost of Goods Sold for the income statement

B) identification of value-chain function to outsource

C) evaluation of operational cost control program

D) assessment of process improvement efforts in quality control

A) determination of Cost of Goods Sold for the income statement

B) identification of value-chain function to outsource

C) evaluation of operational cost control program

D) assessment of process improvement efforts in quality control

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

17

If the Machining Department is the cost object,attaching costs to the Machining Department is called ________.

A) cost pooling

B) cost accumulation

C) cost assignment

D) applying a cost driver

A) cost pooling

B) cost accumulation

C) cost assignment

D) applying a cost driver

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

18

To determine the cost of a product,which of the following are followed?

A) first step, cost assignment and second step, cost allocation

B) first step, cost accumulation and second step, cost assignment

C) first step, cost allocation and second step, cost apportionment

D) first step, cost absorption and second step, cost attribution

A) first step, cost assignment and second step, cost allocation

B) first step, cost accumulation and second step, cost assignment

C) first step, cost allocation and second step, cost apportionment

D) first step, cost absorption and second step, cost attribution

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

19

An example of a strategic management decision is the selection of the product mix that maximizes profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following is an example of using cost information for operational control?

A) determination of Cost of Goods Sold for the income statement

B) identification of capital assets to acquire for expansion purposes

C) selection of value-chain function to emphasize in corporate mission

D) evaluation of process improvement efforts in a manufacturing process

A) determination of Cost of Goods Sold for the income statement

B) identification of capital assets to acquire for expansion purposes

C) selection of value-chain function to emphasize in corporate mission

D) evaluation of process improvement efforts in a manufacturing process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of these costs is a direct cost for a manufactured wood chair?

A) Rent Expense for factory building

B) Depreciation Expense on factory equipment

C) Wood used to manufacture chair

D) Salary Expense of factory supervisor

A) Rent Expense for factory building

B) Depreciation Expense on factory equipment

C) Wood used to manufacture chair

D) Salary Expense of factory supervisor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

22

A cost accounting system typically includes two processes: cost allocation and cost determination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

23

To assign indirect costs to cost objects,which of the following methods is used?

A) cost pooling

B) cost accumulation

C) cost allocation

D) cost tracing

A) cost pooling

B) cost accumulation

C) cost allocation

D) cost tracing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

24

The cost object is an upholstered chair made by craftsmen in a factory.An accountant can identify the amount and cost of fabric used to manufacture the chair.This is called ________ a ________ to a cost object.

A) assigning; indirect cost

B) allocating; indirect cost

C) allocating; direct cost

D) tracing; direct cost

A) assigning; indirect cost

B) allocating; indirect cost

C) allocating; direct cost

D) tracing; direct cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

25

Customers,departments and territories are examples of cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following types of costs cannot be specifically and exclusively identified with a cost object in an economically feasible manner?

A) variable costs

B) fixed costs

C) direct costs

D) indirect costs

A) variable costs

B) fixed costs

C) direct costs

D) indirect costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

27

When allocating indirect production costs to cost objects,most cost-allocation bases are ________.

A) assigned to a cost object

B) accumulated for a cost object

C) traced to the cost object

D) cost drivers

A) assigned to a cost object

B) accumulated for a cost object

C) traced to the cost object

D) cost drivers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

28

Accountants initially collect costs by some natural classification such as activities performed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

29

Cost accounting is that part of the cost management system that measures costs for the sole purpose of financial reporting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following costs is a direct cost for a manufactured product?

A) Depreciation Expense on factory equipment used for several products

B) Wages Expense of an assembly worker who works specifically on the product

C) Accountants who determine the product costs for all the products manufactured

D) Factory Supervisor Salary Expense where the supervisor oversees the production of several different types of products

A) Depreciation Expense on factory equipment used for several products

B) Wages Expense of an assembly worker who works specifically on the product

C) Accountants who determine the product costs for all the products manufactured

D) Factory Supervisor Salary Expense where the supervisor oversees the production of several different types of products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

31

An allocated cost is a(n)________ assigned to a cost object using a ________.

A) direct cost; cost-allocation base

B) indirect cost; cost-allocation base

C) direct cost; cost pool

D) indirect cost; cost pool

A) direct cost; cost-allocation base

B) indirect cost; cost-allocation base

C) direct cost; cost pool

D) indirect cost; cost pool

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

32

A cost is a sacrifice of resources for a particular purpose.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

33

When allocating indirect production costs to cost objects,which of the following is/are a cost-allocation base(s)?

A) some measure of input or output that determines the amount of cost to be allocated to a cost object

B) a measure used to assign indirect costs to cost objects

C) a measure used to assign direct costs to cost objects

D) A and B

A) some measure of input or output that determines the amount of cost to be allocated to a cost object

B) a measure used to assign indirect costs to cost objects

C) a measure used to assign direct costs to cost objects

D) A and B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

34

How do we assign indirect costs to cost objects?

A) based on the proportion of indirect costs to total costs

B) based on the proportion of indirect costs to direct costs

C) in proportion to the cost object's use of a cost-allocation base

D) based on the amount of direct cost used by the cost object

A) based on the proportion of indirect costs to total costs

B) based on the proportion of indirect costs to direct costs

C) in proportion to the cost object's use of a cost-allocation base

D) based on the amount of direct cost used by the cost object

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

35

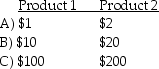

The monthly indirect production cost is Depreciation Expense on Assembly Equipment of $100,000.The cost allocation base is number of machine hours.The expected level of production in a month is 10,000 machine hours.What is the amount of indirect production cost per unit assigned to Product 1 and Product 2.Product 1 requires 10 machine hours per unit.Product 2 requires 20 machine hours per unit.

D) none of the above

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

36

Company activities such as processing orders,billing customers,and moving materials can be cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

37

Cost assignment is attaching costs to one or more cost objects,such as activities and departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

38

Today,in most manufacturing companies,workers oversee automated production processes that produce many different products.With respect to the products manufactured,the labor costs are considered to be ________.

A) direct labor costs

B) indirect production costs

C) direct production costs

D) period costs

A) direct labor costs

B) indirect production costs

C) direct production costs

D) period costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

39

When assigning indirect costs to a cost object,an ideal cost-allocation base measures ________.

A) the proportion of indirect costs to direct costs

B) the extent a particular cost is caused by a cost object

C) multiple cost drivers

D) the proportion of direct costs to indirect costs

A) the proportion of indirect costs to direct costs

B) the extent a particular cost is caused by a cost object

C) multiple cost drivers

D) the proportion of direct costs to indirect costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

40

A cost object is anything for which a separate measurement of costs is desired.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

41

A century ago,a large proportion of labor costs were direct costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

42

Costs that can be allocated to a cost object are called direct costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

43

Depreciation expense on assembly equipment used for several products is an example of a direct cost for a manufactured product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is NOT a stated purpose of cost allocation?

A) Predict the economic effects of strategic and operational control decisions.

B) Obtain reimbursement.

C) Provide motivation to managers.

D) Determine product cost.

A) Predict the economic effects of strategic and operational control decisions.

B) Obtain reimbursement.

C) Provide motivation to managers.

D) Determine product cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

45

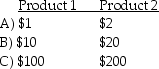

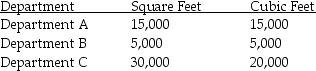

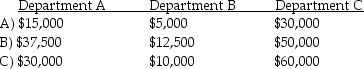

Rent Expense on the Factory Building of $100,000 is allocated to three departments.The cost-allocation base for this expense is number of square feet,which equals 50,000 square feet.Information for the three departments housed in the factory building are as follows:

How much Rent Expense is allocated to the three departments?

D) none of the above

How much Rent Expense is allocated to the three departments?

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

46

When determining the cost of a product,which of the following costs is often not allocated?

A) Customer Service Expense

B) Research and Development Expense

C) Marketing Expense

D) Administrative Salaries Expense

A) Customer Service Expense

B) Research and Development Expense

C) Marketing Expense

D) Administrative Salaries Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

47

If the Production Department is the cost object,the salary of the factory supervisor is a(n)________ cost for the department.If the product made in the factory is the cost object,the salary of the factory supervisor is a(n)________ cost for the product.

A) direct; indirect

B) indirect; direct

C) direct; direct

D) indirect, indirect

A) direct; indirect

B) indirect; direct

C) direct; direct

D) indirect, indirect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

48

If fixed production costs are not allocated to manufactured products,this conveys the idea that ________.

A) fixed costs are not necessary to manufacture a product.

B) fixed costs are necessary to manufacture a product.

C) variable costs are less important than fixed costs to manufacture a product.

D) fixed costs are more important than variable costs to manufacture a product.

A) fixed costs are not necessary to manufacture a product.

B) fixed costs are necessary to manufacture a product.

C) variable costs are less important than fixed costs to manufacture a product.

D) fixed costs are more important than variable costs to manufacture a product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

49

When companies develop cost management systems,which of the following purposes of cost allocation usually dominates?

A) to predict the economic effects of strategic and operational control decisions

B) to provide the desired motivation and to give feedback for performance evaluation

C) to compute income and asset valuations for financial reporting

D) to justify costs or obtain reimbursement

A) to predict the economic effects of strategic and operational control decisions

B) to provide the desired motivation and to give feedback for performance evaluation

C) to compute income and asset valuations for financial reporting

D) to justify costs or obtain reimbursement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

50

What is the final step in the four-step process to allocate indirect costs to cost objects?

A) Accumulate indirect costs for a period of time in a cost pool.

B) Select an allocation base for each cost pool.

C) Multiply the percentage of total cost-allocation units used for each cost object by the total costs in the cost pool to determine the cost allocated to each cost object.

D) Measure the units of the cost-allocation base used for each cost object and compute the total units used for all cost objects.

A) Accumulate indirect costs for a period of time in a cost pool.

B) Select an allocation base for each cost pool.

C) Multiply the percentage of total cost-allocation units used for each cost object by the total costs in the cost pool to determine the cost allocated to each cost object.

D) Measure the units of the cost-allocation base used for each cost object and compute the total units used for all cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

51

The wages of the janitor in the factory are direct costs for a manufactured product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

52

Costs can be classified as direct or indirect with respect to a particular cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

53

When a laptop computer is the cost object,the keyboard would be classified as a(n)________.

A) direct cost

B) allocated cost

C) indirect cost

D) unallocated cost

A) direct cost

B) allocated cost

C) indirect cost

D) unallocated cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following purposes of cost allocation provides information for operational control in an organization?

A) to compute income and asset valuations for financial reports

B) to compute Cost of Goods Sold for financial reports

C) to determine the number of cost drivers for a product

D) to provide the desired motivation and to give feedback for performance evaluation

A) to compute income and asset valuations for financial reports

B) to compute Cost of Goods Sold for financial reports

C) to determine the number of cost drivers for a product

D) to provide the desired motivation and to give feedback for performance evaluation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

55

In general,many more costs are direct costs instead of indirect costs when the cost object is a ________ instead of a(n)________.

A) product; department

B) product; activity

C) product; resource

D) department; product

A) product; department

B) product; activity

C) product; resource

D) department; product

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

56

Indirect production costs can be ignored because they do not affect the cost of a product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

57

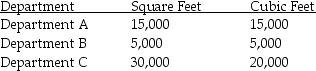

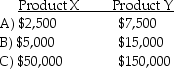

Depreciation Expense on the Heating and Air Conditioning Equipment for the factory of $50,000 is allocated to five departments.The cost-allocation base for this expense is the number of cubic feet,which equals 100,000 cubic feet.Information for five departments is below:

How much Depreciation Expense is allocated to Department A?

A) $2,500

B) $7,500

C) $15,000

D) $18,750

How much Depreciation Expense is allocated to Department A?

A) $2,500

B) $7,500

C) $15,000

D) $18,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

58

When an automobile made in a Toyota factory is the cost object,the wages of the security guard in the factory would probably be classified as a(n)________.

A) direct production cost

B) indirect production cost

C) direct nonproduction cost

D) indirect nonproduction cost

A) direct production cost

B) indirect production cost

C) direct nonproduction cost

D) indirect nonproduction cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

59

When an upholstered chair is the cost object,minor materials,such as tacks and nails,used to manufacture the chair would probably be classified as a(n)________.

A) direct production cost

B) direct nonproduction cost

C) indirect production cost

D) indirect nonproduction cost

A) direct production cost

B) direct nonproduction cost

C) indirect production cost

D) indirect nonproduction cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

60

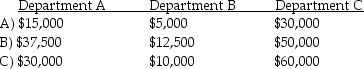

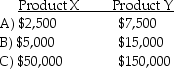

Monthly indirect production costs are $400,000.The cost-allocation base for indirect costs is machine hours.The budgeted capacity for the month is 40,000 machine hours.Product X used 5,000 machine hours,Product Y used 15,000 machine hours and Product Z used 20,000 machine hours.How much of the indirect costs are allocated to Products X and Y?

D) none of the above

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

61

Merchandising and manufacturing companies account for ________ in the same way.

A) design expenses

B) customer service expenses

C) selling expenses

D) all of the above

A) design expenses

B) customer service expenses

C) selling expenses

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

62

Which of the following is NOT an example of indirect production costs?

A) factory supplies

B) depreciation expense on factory building

C) depreciation expense on office equipment in corporate headquarters

D) wages of material handlers in factory

A) factory supplies

B) depreciation expense on factory building

C) depreciation expense on office equipment in corporate headquarters

D) wages of material handlers in factory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

63

A merchandising firm has ________ inventory account(s).A manufacturing firm has ________ inventory account(s).

A) one; three

B) three; one

C) two; three

D) three; three

A) one; three

B) three; one

C) two; three

D) three; three

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

64

Indirect production costs do NOT include ________.

A) property taxes on factory building

B) rent expense on factory building

C) wages of security guards at corporate headquarters

D) wages of forklift truck operators in assembly area

A) property taxes on factory building

B) rent expense on factory building

C) wages of security guards at corporate headquarters

D) wages of forklift truck operators in assembly area

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

65

When looking at a manufactured product,an example of an inventoriable cost is ________.

A) depreciation expense on office equipment in corporate office

B) insurance expense on vehicles used by sales staff

C) wages of plant security guard

D) clerical salaries in corporate office

A) depreciation expense on office equipment in corporate office

B) insurance expense on vehicles used by sales staff

C) wages of plant security guard

D) clerical salaries in corporate office

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

66

Indirect manufacturing costs are the same as manufacturing overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

67

Goods undergoing the production process but not fully complete are called ________.

A) Merchandise Inventory

B) Raw Materials Inventory

C) Finished Goods Inventory

D) Work-in-Process Inventory

A) Merchandise Inventory

B) Raw Materials Inventory

C) Finished Goods Inventory

D) Work-in-Process Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

68

An unallocated cost in one company may be an allocated cost in another company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

69

Due to the decline in indirect costs in most companies,allocating indirect costs is no longer necessary to determine accurate product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

70

For manufacturing companies,an example of a period cost is ________.

A) direct materials

B) research and development expense

C) direct labor

D) factory overhead

A) direct materials

B) research and development expense

C) direct labor

D) factory overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

71

Unallocated costs ________.

A) are not recorded in the cost accounting system

B) do not have cost drivers that can be used to relate the costs to cost objects

C) have a direct relationship to a cost object

D) have an identifiable relationship with a cost object

A) are not recorded in the cost accounting system

B) do not have cost drivers that can be used to relate the costs to cost objects

C) have a direct relationship to a cost object

D) have an identifiable relationship with a cost object

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

72

Allocation of costs to cost objects may be described as absorb or apply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

73

In a merchandising company,________.

A) selling and administrative costs are period costs

B) insurance expense on the corporate building is a product cost

C) Work-In-Process Inventory may be present

D) Finished Goods Inventory may be present

A) selling and administrative costs are period costs

B) insurance expense on the corporate building is a product cost

C) Work-In-Process Inventory may be present

D) Finished Goods Inventory may be present

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

74

Companies must assign all nonproduction costs to cost objects for internal management purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

75

Companies must assign all production-related costs to cost objects for external financial reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

76

Factory overhead does NOT include ________.

A) electricity bill in factory

B) insurance Expense on factory building

C) supplies used in factory

D) wages of janitors in corporate headquarters

A) electricity bill in factory

B) insurance Expense on factory building

C) supplies used in factory

D) wages of janitors in corporate headquarters

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

77

In a manufacturing company,________.

A) inventoriable costs only become an expense when the company sells the inventory

B) inventoriable costs become an expense as soon as the company finishes manufacturing the product

C) there is only one inventory account

D) period expenses are reported as expenses in a future period

A) inventoriable costs only become an expense when the company sells the inventory

B) inventoriable costs become an expense as soon as the company finishes manufacturing the product

C) there is only one inventory account

D) period expenses are reported as expenses in a future period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

78

The number of cubic feet is a logical cost driver for allocating depreciation expense of heating equipment to cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

79

In general,more costs are direct when a department is the cost object than when a product or service is the cost object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck

80

A cost pool is a group of individual costs that is allocated to cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 143 في هذه المجموعة.

فتح الحزمة

k this deck