Deck 15: Basic Accounting: Concepts, techniques, and Conventions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

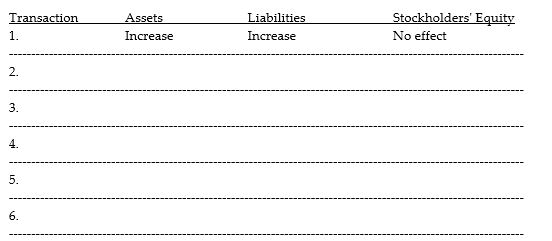

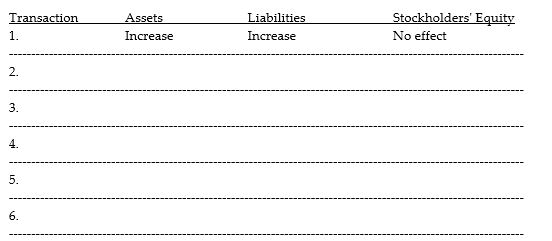

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/150

العب

ملء الشاشة (f)

Deck 15: Basic Accounting: Concepts, techniques, and Conventions

1

In a corporation,stockholders' equity has two parts called ________ and ________.

A) dividends; net profit

B) paid in capital; dividends

C) net profit; retained earnings

D) paid-in capital; retained earnings

A) dividends; net profit

B) paid in capital; dividends

C) net profit; retained earnings

D) paid-in capital; retained earnings

D

2

I want to know where a company stands financially at December 31,2014.Which financial statement should I use?

A) statement of cash flows

B) statement of stockholders' equity

C) statement of retained earnings

D) balance sheet

A) statement of cash flows

B) statement of stockholders' equity

C) statement of retained earnings

D) balance sheet

D

3

Economic resources that a company owns and expects to provide future benefits are called ________.

A) stockholders' equity

B) assets

C) liabilities

D) retained earnings

A) stockholders' equity

B) assets

C) liabilities

D) retained earnings

B

4

The main sections of the balance sheet include ________.

A) revenues, assets and liabilities

B) assets, liabilities and expenses

C) expenses, revenues and stockholders' equity

D) assets, liabilities and stockholders' equity

A) revenues, assets and liabilities

B) assets, liabilities and expenses

C) expenses, revenues and stockholders' equity

D) assets, liabilities and stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

5

Accounting information only helps assess past financial performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

6

The ownership claim arising from the reinvestment of previous profits is called ________.

A) net assets

B) stockholders' equity

C) investment income

D) retained earnings

A) net assets

B) stockholders' equity

C) investment income

D) retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

7

A transaction is any event that affects the financial position of an organization and requires recording.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

8

For a corporation,the excess of assets over liabilities are called ________.

A) retained earnings

B) paid-in capital

C) common stock

D) stockholders' equity

A) retained earnings

B) paid-in capital

C) common stock

D) stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

9

The income statement summarizes a company's operating performance ________ and the balance sheet shows a company's financial position ________.

A) at a point in time; over a period of time

B) at a point in time; at a point in time

C) over a period of time; over a period of time

D) over a period of time; at a point in time

A) at a point in time; over a period of time

B) at a point in time; at a point in time

C) over a period of time; over a period of time

D) over a period of time; at a point in time

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

10

An entity's economic obligations to nonowners are called ________.

A) owners' equity

B) liabilities

C) assets

D) retained earnings

A) owners' equity

B) liabilities

C) assets

D) retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

11

A corporation is not a separate legal entity from its owners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which financial statement discloses the economic resources of the organization and the claims against those resources?

A) income statement

B) statement of cash flows

C) statement of retained earnings

D) balance sheet

A) income statement

B) statement of cash flows

C) statement of retained earnings

D) balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

13

Liabilities are economic resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

14

What do liabilities and stockholders' equity have in common?

A) They are both held by nonowners of the company.

B) They are both held by owners of the company.

C) They are both creditors.

D) They are both claims on a company's assets

A) They are both held by nonowners of the company.

B) They are both held by owners of the company.

C) They are both creditors.

D) They are both claims on a company's assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which financial statement summarizes the operating performance of a company over a period of time?

A) statement of cash flows

B) statement of stockholders' equity

C) balance sheet

D) income statement

A) statement of cash flows

B) statement of stockholders' equity

C) balance sheet

D) income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

16

The statement of financial position is also called the ________.

A) income statement

B) statement of cash flows

C) statement of retained earnings

D) balance sheet

A) income statement

B) statement of cash flows

C) statement of retained earnings

D) balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following statements is FALSE?

A) Assets are economic resources that are expected to provide future benefits.

B) Liabilities are economic obligations or claims against the assets of an organization by nonowners.

C) Assets must always equal the sum of liabilities and owners' equity.

D) Owners' equity equals the sum of assets and liabilities.

A) Assets are economic resources that are expected to provide future benefits.

B) Liabilities are economic obligations or claims against the assets of an organization by nonowners.

C) Assets must always equal the sum of liabilities and owners' equity.

D) Owners' equity equals the sum of assets and liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

18

Any event that affects the financial position of an organization and requires recording is called a(n)________.

A) transaction

B) account

C) posting

D) recognition principle

A) transaction

B) account

C) posting

D) recognition principle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

19

The balance sheet shows a company's financial status at only one point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

20

The ownership claim arising from funds contributed by the owners of the business is called ________.

A) liabilities

B) retained earnings

C) note payable

D) paid-in capital

A) liabilities

B) retained earnings

C) note payable

D) paid-in capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

21

A cash payment on accounts payable will ________.

A) increase assets and increase liabilities

B) increase assets and increase stockholders' equity

C) decrease assets and decrease liabilities

D) decrease assets and increase stockholders' equity

A) increase assets and increase liabilities

B) increase assets and increase stockholders' equity

C) decrease assets and decrease liabilities

D) decrease assets and increase stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

22

Amounts owed to vendors for purchases on credit are called ________.Amounts due from customers for credit sales are called ________.

A) accounts payable; notes receivable

B) notes payable; notes receivable

C) accounts payable; accounts receivable

D) debt payable; debt receivable

A) accounts payable; notes receivable

B) notes payable; notes receivable

C) accounts payable; accounts receivable

D) debt payable; debt receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

23

The acquisition of inventory on account will ________.

A) increase assets and decrease stockholders' equity

B) decrease assets and decrease liabilities

C) increase assets and increase liabilities

D) increase assets and increase stockholders' equity

A) increase assets and decrease stockholders' equity

B) decrease assets and decrease liabilities

C) increase assets and increase liabilities

D) increase assets and increase stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

24

Owners' equity represents the excess cash a company has made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

25

The acquisition of inventory for cash will ________.

A) increase liabilities and decrease stockholders' equity

B) decrease assets and decrease liabilities

C) increase assets and decrease liabilities

D) increase assets and decrease assets

A) increase liabilities and decrease stockholders' equity

B) decrease assets and decrease liabilities

C) increase assets and decrease liabilities

D) increase assets and decrease assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

26

Consider a firm that provides services to customers.To record revenue,which of the following conditions must be met?

A) the firm must render the services only

B) the firm must render the services and receive cash or a promise of payment in the future

C) the firm must render the services and receive cash

D) the firm must promise to render the services in the future and receive cash

A) the firm must render the services only

B) the firm must render the services and receive cash or a promise of payment in the future

C) the firm must render the services and receive cash

D) the firm must promise to render the services in the future and receive cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

27

The following information was extracted from the accounting records of Kristie Company:

At December 31,2015,what is the total amount of liabilities?

A) $45,000

B) $150,000

C) $157,000

D) $272,000

At December 31,2015,what is the total amount of liabilities?

A) $45,000

B) $150,000

C) $157,000

D) $272,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

28

Cash collections from customers who purchased goods on credit will decrease ________.

A) Accounts Receivable

B) Accounts Payable

C) Cash

D) Retained Earnings

A) Accounts Receivable

B) Accounts Payable

C) Cash

D) Retained Earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

29

Decreases in ownership claims arising from the delivery of goods are called ________.

A) revenues

B) profits

C) liabilities

D) expenses

A) revenues

B) profits

C) liabilities

D) expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

30

The following information was extracted from the accounting records of Vogel Company:

At the beginning of the period,what is the total amount of liabilities?

A) $65,000

B) $100,000

C) $155,000

D) $245,000

At the beginning of the period,what is the total amount of liabilities?

A) $65,000

B) $100,000

C) $155,000

D) $245,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

31

Stockholders' equity is composed of paid-in capital and retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

32

The following information was extracted from the accounting records of Brankov Company:

At the end of the period,what is the total amount of stockholders' equity?

A) $65,000

B) $135,000

C) $390,000

D) $435,000

At the end of the period,what is the total amount of stockholders' equity?

A) $65,000

B) $135,000

C) $390,000

D) $435,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following statements report the amount of net income earned by a company for a period of time?

A) balance sheet and income statement only

B) income statement and statement of cash flows only

C) income statement, statement of retained earnings and statement of stockholders' equity

D) balance sheet and statement of cash flows only

A) balance sheet and income statement only

B) income statement and statement of cash flows only

C) income statement, statement of retained earnings and statement of stockholders' equity

D) balance sheet and statement of cash flows only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following explains the change in Retained Earnings from the beginning of the year to the end of the year?

A) revenues and expenses

B) contributions by owners

C) purchases of inventory

D) a purchase of a plant asset

A) revenues and expenses

B) contributions by owners

C) purchases of inventory

D) a purchase of a plant asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

35

A sale of inventory results in a(n)________ in stockholders' equity equal to the selling price of the inventory.A sale of inventory also results in a(n)________ in stockholders' equity equal to the cost of the inventory sold.

A) decrease; increase

B) increase; increase

C) increase; decrease

D) decrease; decrease

A) decrease; increase

B) increase; increase

C) increase; decrease

D) decrease; decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

36

Increases in revenues will ________.Increases in expenses will ________ .

A) increase Retained Earnings; increase Retained Earnings

B) increase Retained Earnings; decrease Retained Earnings

C) decrease Paid in Capital; decrease Paid in Capital

D) increase assets; increase liabilities

A) increase Retained Earnings; increase Retained Earnings

B) increase Retained Earnings; decrease Retained Earnings

C) decrease Paid in Capital; decrease Paid in Capital

D) increase assets; increase liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

37

Liabilities are the entity's economic obligations to owners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

38

Increases in ownership claims arising from the delivery of goods are called ________.

A) expenses

B) profits

C) assets

D) revenues

A) expenses

B) profits

C) assets

D) revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

39

A stockholders contributed $100,000 in exchange for stock in the company.What is the effect of this transaction?

A) assets increase and liabilities increase

B) assets increase and revenues increase

C) expenses increase and revenues increase

D) assets increase and paid-in capital increases

A) assets increase and liabilities increase

B) assets increase and revenues increase

C) expenses increase and revenues increase

D) assets increase and paid-in capital increases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

40

For a corporation,assets must equal liabilities plus paid-in capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

41

The balance sheet is not linked to the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

42

For nonprofit organizations,the stockholders' equity section of the balance sheet is replaced with ________.

A) retained earnings

B) partners' capital

C) partners' withdrawals

D) net assets

A) retained earnings

B) partners' capital

C) partners' withdrawals

D) net assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

43

Amounts due from customers are called accounts payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

44

The excess of revenues over expenses is called a net profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following is(are)a deficiency(deficiencies)of cash-basis accounting?

A) it omits key revenues and expenses from the balance sheet

B) it fails to match revenues and expenses to measure economic performance

C) it omits key assets and key liabilities from the balance sheet

D) B and C

A) it omits key revenues and expenses from the balance sheet

B) it fails to match revenues and expenses to measure economic performance

C) it omits key assets and key liabilities from the balance sheet

D) B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

46

The following information was extracted from the accounting records of Yamaguchi Company:

At December 31,2014,what is the total amount of liabilities?

A) $45,000

B) $150,000

C) $157,000

D) $272,000

At December 31,2014,what is the total amount of liabilities?

A) $45,000

B) $150,000

C) $157,000

D) $272,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

47

When a company purchases inventory for cash,the net effect on the amount of total assets is zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

48

For nonprofit organizations,the income statement is ________.

A) used

B) replaced with the statement of stockholders' equity

C) replaced with the statement of activities

D) replaced with the statement of cash flows

A) used

B) replaced with the statement of stockholders' equity

C) replaced with the statement of activities

D) replaced with the statement of cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

49

Under accrual basis accounting,we record expenses when ________.

A) a company pays cash to a supplier

B) a company incurs a liability

C) a company uses resources

D) a company pays cash to anyone

A) a company pays cash to a supplier

B) a company incurs a liability

C) a company uses resources

D) a company pays cash to anyone

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

50

Revenue and expense accounts are permanent stockholders' equity accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

51

Patrick Company had the following transactions:

1)The owner started the company by investing $10,000 of cash.

2)The company paid $2,000 for six months of rent.The rent was paid in advance.

3)The company acquired $3,300 in inventory and put one-third of the purchase on account.The company paid $2,200 cash.

4)The company sold inventory costing $1,400 for $2,900 on account.

After all these transactions,what is the balance in the cash account?

A) $1,600

B) $2,900

C) $5,800

D) $8,000

1)The owner started the company by investing $10,000 of cash.

2)The company paid $2,000 for six months of rent.The rent was paid in advance.

3)The company acquired $3,300 in inventory and put one-third of the purchase on account.The company paid $2,200 cash.

4)The company sold inventory costing $1,400 for $2,900 on account.

After all these transactions,what is the balance in the cash account?

A) $1,600

B) $2,900

C) $5,800

D) $8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

52

Cudahy Company had the following transactions:

1)The owner started the company by investing $10,000 of cash.

2)The company paid $2,000 for six months of rent.The rent was paid in advance.

3)The company acquired $3,000 in inventory for cash.

4)The company sold inventory costing $1,400 for $2,900 on account.

After all these transactions,what is the balance in the cash account?

A) $2,100

B) $3,500

C) $5,000

D) $8,000

1)The owner started the company by investing $10,000 of cash.

2)The company paid $2,000 for six months of rent.The rent was paid in advance.

3)The company acquired $3,000 in inventory for cash.

4)The company sold inventory costing $1,400 for $2,900 on account.

After all these transactions,what is the balance in the cash account?

A) $2,100

B) $3,500

C) $5,000

D) $8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

53

The cash basis of accounting recognizes the impact of transactions in the period when ________.

A) revenues and expenses occur

B) cash is received or disbursed

C) the accounting equation changes

D) assets or liabilities change

A) revenues and expenses occur

B) cash is received or disbursed

C) the accounting equation changes

D) assets or liabilities change

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

54

Under accrual basis accounting,we record revenue when ________.

A) cash is received from customers

B) cash is received for any reason

C) it meets the criteria for revenue recognition

D) a company receives cash from a customer on account

A) cash is received from customers

B) cash is received for any reason

C) it meets the criteria for revenue recognition

D) a company receives cash from a customer on account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

55

The income statement measures performance over a given amount of time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

56

Revenues do not affect stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

57

The following transactions occurred at Clarkson Company:

1.The company acquired $200 of inventory on credit.

2.The company rendered services billed at $100 on account.

3.The company paid $175 in accounts payable.

4.The company's owner invested $375 in cash.

5.The company acquired equipment costing $575 on account.

6.The company paid $25 for inventory.

Required:

In the chart below,indicate if each transaction increases,decreases or has no effect on Assets,Liabilities and Stockholders' Equity.

1.The company acquired $200 of inventory on credit.

2.The company rendered services billed at $100 on account.

3.The company paid $175 in accounts payable.

4.The company's owner invested $375 in cash.

5.The company acquired equipment costing $575 on account.

6.The company paid $25 for inventory.

Required:

In the chart below,indicate if each transaction increases,decreases or has no effect on Assets,Liabilities and Stockholders' Equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

58

The activity of Sterling Company for the month of April is presented below:

Using the accrual basis of accounting,the total expenses for Sterling Company for the month of April is ________.

A) $62,000

B) $78,000

C) $80,000

D) $86,000

Using the accrual basis of accounting,the total expenses for Sterling Company for the month of April is ________.

A) $62,000

B) $78,000

C) $80,000

D) $86,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

59

Nicholson Company sold inventory costing $1,000 for $3,000 on account.Nicholson Company operates under the accrual basis.What effect will the transaction have on the liabilities and owners' equity of the company?

A) liabilities will decrease by $2,000

B) liabilities will increase by $2,000

C) owners' equity will increase by $2,000

D) owners' equity will increase by $3,000

A) liabilities will decrease by $2,000

B) liabilities will increase by $2,000

C) owners' equity will increase by $2,000

D) owners' equity will increase by $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

60

A cash payment of accounts payable does not affect stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

61

On June 1,2012,a company borrows $100,000 on a 10% note due to a bank in one year.What amount of interest expense is reported for the year ending December 31,2012?

A) $5,000

B) $5,833

C) $1,000

D) $10,000

A) $5,000

B) $5,833

C) $1,000

D) $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

62

The activity of Vegas Company for the month of April is given below:

Using the cash basis of accounting,the total expenses for Vegas Company for the month of April are ________.

A) $35,000

B) $78,000

C) $80,000

D) $95,000

Using the cash basis of accounting,the total expenses for Vegas Company for the month of April are ________.

A) $35,000

B) $78,000

C) $80,000

D) $95,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

63

On January 1,Latinovich Company paid $16,000 for rent.The rent covers the period January 1 through April 30.Latinovich Company recorded Prepaid Rent of $16,000.What is the balance in the Prepaid Rent account on April 1?

A) 0

B) $4,000

C) $8,000

D) $12,000

A) 0

B) $4,000

C) $8,000

D) $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

64

Under the accrual basis of accounting,the impact of transactions is recorded when cash is received or paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

65

On May 1,Gomez Company paid $36,000 for rent.The rent covers the period May 1 through August 31.Gomez Company recorded Prepaid Rent of $36,000.What is the balance in the Prepaid Rent account on June 1?

A) $0

B) $9,000

C) $18,000

D) $27,000

A) $0

B) $9,000

C) $18,000

D) $27,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

66

Journal entries for the expiration of unexpired assets are usually made before the related cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

67

Given below are the activities of the Phoenix Company:

Using the accrual basis of accounting,the total revenues for Phoenix Company are ________.

A) $46,000

B) $90,000

C) $100,000

D) $173,000

Using the accrual basis of accounting,the total revenues for Phoenix Company are ________.

A) $46,000

B) $90,000

C) $100,000

D) $173,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

68

On April 1,2012,Company Z lends $200,000 to Company Y on a 8% note.For the six months ending June 30,2012,what amount of interest revenue will Company Z report on this note?

A) $4,000

B) $8,000

C) $12,000

D) $16,000

A) $4,000

B) $8,000

C) $12,000

D) $16,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

69

An example of an explicit transaction is ________.

A) recording depreciation expense

B) paying cash for three months' rent in advance

C) accruing wages expense at the end of the month

D) accruing interest expense at the end of the year

A) recording depreciation expense

B) paying cash for three months' rent in advance

C) accruing wages expense at the end of the month

D) accruing interest expense at the end of the year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

70

Adjusting entries at the end of an accounting period record explicit transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

71

Source documents are associated with ________.

A) Generally Accepted Accounting Principles

B) implicit transactions

C) explicit transactions

D) compound entries

A) Generally Accepted Accounting Principles

B) implicit transactions

C) explicit transactions

D) compound entries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

72

On May 1,Gonzalez Company paid $36,000 for rent.The rent covers the period May 1 through August 31.Gonzalez Company recorded Prepaid Rent of $36,000.What is the Rent Expense for the period,May 1 through June 30?

A) $0

B) $9,000

C) $18,000

D) $27,000

A) $0

B) $9,000

C) $18,000

D) $27,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

73

On July 1,Singh Company paid 6 months' insurance in advance.The policy covers the period of July 1 through December 31.The total payment was $5,400.At the time of the payment,the company set up the Prepaid Insurance account for $5,400.What is the balance in the Prepaid Insurance account on August 31?

A) 0

B) $1,800

C) $2,700

D) $3,600

A) 0

B) $1,800

C) $2,700

D) $3,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

74

On July 1,2012,Slowinski Company borrows $100,000 on a 10% note due to a bank in one year.The accounts of Slowinski Company are affected by the adjusting entry at December 31,2012 in which of the following ways?

A) increase assets and decrease expenses

B) increase assets and increase liabilities

C) increase expenses and increase liabilities

D) increase expenses and increase stockholders' equity

A) increase assets and decrease expenses

B) increase assets and increase liabilities

C) increase expenses and increase liabilities

D) increase expenses and increase stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

75

Given below are the activities of the Tamara Company:

Using the cash basis of accounting,the total revenues for Tamara Company are ________.

A) $56,000

B) $86,000

C) $90,000

D) $173,000

Using the cash basis of accounting,the total revenues for Tamara Company are ________.

A) $56,000

B) $86,000

C) $90,000

D) $173,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

76

An example of an implicit transaction is cash received on account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

77

On April 1,2012,Company X lends $200,000 to Company Y on a 8% note.On April 1,2012,which of the following accounts of Company X will be affected by this transaction?

A) Cash and Note Payable

B) Cash and Note Receivable

C) Cash and Interest Revenue

D) Cash and Interest Expense

A) Cash and Note Payable

B) Cash and Note Receivable

C) Cash and Interest Revenue

D) Cash and Interest Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

78

Under the cash basis of accounting,expenses are matched with the revenues they help generate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

79

On March 1,a landlord received $10,000 rent for the month of April.On April 1,the landlord will ________.

A) decrease Cash and increase Rent Revenue

B) decrease Cash and increase Unearned Rent Revenue

C) decrease Paid-in Capital and increase Interest Revenue

D) decrease Unearned Rent Revenue and increase Rent Revenue

A) decrease Cash and increase Rent Revenue

B) decrease Cash and increase Unearned Rent Revenue

C) decrease Paid-in Capital and increase Interest Revenue

D) decrease Unearned Rent Revenue and increase Rent Revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck

80

On March 1,a landlord received $10,000 rent for the month of April.On March 1,the landlord will ________.

A) increase Cash and increase Rent Revenue

B) increase Cash and increase Unearned Rent Revenue

C) increase Cash and increase Paid-in Capital

D) increase Rent Expense and decrease Cash

A) increase Cash and increase Rent Revenue

B) increase Cash and increase Unearned Rent Revenue

C) increase Cash and increase Paid-in Capital

D) increase Rent Expense and decrease Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 150 في هذه المجموعة.

فتح الحزمة

k this deck