Deck 16: Understanding Corporate Annual Reports: Basic Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/140

العب

ملء الشاشة (f)

Deck 16: Understanding Corporate Annual Reports: Basic Financial Statements

1

Land is not depreciated.

True

2

Companies do not amortize indefinite-life intangible assets.What do companies do each year for these assets?

A) only report them on the balance sheet

B) only apply an impairment test annually

C) only report them on the statement of stockholders' equity

D) A and B

A) only report them on the balance sheet

B) only apply an impairment test annually

C) only report them on the statement of stockholders' equity

D) A and B

D

3

Which of the following is NOT a current asset?

A) Inventories

B) Prepaid Insurance

C) Supplies

D) Land

A) Inventories

B) Prepaid Insurance

C) Supplies

D) Land

D

4

The net amount a company expects to collects on Accounts Receivable is equal to ________.

A) gross Accounts Receivable

B) Allowance for Doubtful Accounts

C) gross Accounts Receivable minus Allowance for Doubtful Accounts

D) gross Accounts Receivable plus Allowance for Doubtful Accounts

A) gross Accounts Receivable

B) Allowance for Doubtful Accounts

C) gross Accounts Receivable minus Allowance for Doubtful Accounts

D) gross Accounts Receivable plus Allowance for Doubtful Accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

5

Intangible assets are ________.

A) assets with a physical presence

B) assets that can be seen and touched

C) rights to expected future benefits

D) assets with definite lives only

A) assets with a physical presence

B) assets that can be seen and touched

C) rights to expected future benefits

D) assets with definite lives only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

6

Manufacturers have several inventory accounts that do NOT include ________.

A) Finished Goods Inventory

B) Raw Materials Inventory

C) Work in Process Inventory

D) Construction in Process Inventory

A) Finished Goods Inventory

B) Raw Materials Inventory

C) Work in Process Inventory

D) Construction in Process Inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

7

A unit of ending inventory has a cost of $100 per unit.The selling price per unit is $200.The replacement cost per unit is $90.What value is reported for this inventory on the balance sheet?

A) $90

B) $100

C) $110

D) $200

A) $90

B) $100

C) $110

D) $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

8

A company's operating cycle can be longer than one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

9

The amortization of intangible assets applies to ________.

A) Research and Development Costs

B) Goodwill

C) intangible assets with definite lives

D) intangible assets with indefinite lives

A) Research and Development Costs

B) Goodwill

C) intangible assets with definite lives

D) intangible assets with indefinite lives

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

10

The purpose of depreciation is to ________.

A) establish the current replacement cost of a fixed asset

B) accumulate funds to replace a fixed asset

C) set aside cash to replace a fixed asset

D) allocate the original cost of a fixed asset to the periods that benefit from the use of the fixed asset

A) establish the current replacement cost of a fixed asset

B) accumulate funds to replace a fixed asset

C) set aside cash to replace a fixed asset

D) allocate the original cost of a fixed asset to the periods that benefit from the use of the fixed asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

11

Current assets are expected to be converted to cash or sold or consumed within ________.

A) one year or operating cycle if longer than one month

B) one year or operating cycle if longer than one year

C) one year or operating cycle if shorter than one year

D) one fiscal year

A) one year or operating cycle if longer than one month

B) one year or operating cycle if longer than one year

C) one year or operating cycle if shorter than one year

D) one fiscal year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

12

Accounts receivable is a current asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

13

Leasehold Improvements do NOT include ________.

A) painting and decorating of leased property

B) security systems added to leased property

C) bookcases built into walls of leased property

D) furniture used at leased property

A) painting and decorating of leased property

B) security systems added to leased property

C) bookcases built into walls of leased property

D) furniture used at leased property

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following assets is NOT classified as a short-term investment?

A) corporate stocks

B) corporate bonds

C) debt securities issued by governments

D) checking account balance

A) corporate stocks

B) corporate bonds

C) debt securities issued by governments

D) checking account balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

15

Details about Property,Plant and Equipment,such as the age of plant assets and the types of plant assets,are typically reported ________.

A) on the balance sheet

B) on the income statement

C) on the statement of cash flows

D) in a footnote

A) on the balance sheet

B) on the income statement

C) on the statement of cash flows

D) in a footnote

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

16

The Allowance for Bad Debts account is added to the Accounts Receivable account on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

17

On a classified balance sheet,the Equipment account is reduced by ________.

A) Allowance for Bad Debts

B) Allowance for Doubtful Accounts

C) Accumulated Depreciation

D) Depreciation Expense

A) Allowance for Bad Debts

B) Allowance for Doubtful Accounts

C) Accumulated Depreciation

D) Depreciation Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is NOT a tangible asset?

A) inventories

B) land

C) equipment

D) goodwill

A) inventories

B) land

C) equipment

D) goodwill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

19

Freight and installation costs are added to the cost of equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

20

Goodwill remains on a company's books until ________.

A) accountants amortize it

B) accountants depreciate it

C) management sells it

D) management determines its value is impaired

A) accountants amortize it

B) accountants depreciate it

C) management sells it

D) management determines its value is impaired

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

21

The account Unearned Revenue is a revenue account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

22

It is December 31,2014.A Note Payable is due in five annual installments beginning on December 31,2015.On the balance sheet dated December 31,2014,the Note Payable is classified as ________.

A) current liability only

B) long-term liability only

C) current and long-term liability

D) owners' equity

A) current liability only

B) long-term liability only

C) current and long-term liability

D) owners' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

23

Working capital is equal to current assets plus current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

24

Current liabilities are debts due within the ________ year or within the normal operating cycle if ________.

A) past; longer than a year

B) next; longer than a year

C) past; shorter than a year

D) next; shorter than a year

A) past; longer than a year

B) next; longer than a year

C) past; shorter than a year

D) next; shorter than a year

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

25

Assume you are preparing a balance sheet dated December 31,2014.Which of the following is NOT a long-term liability?

A) bonds payable due June 30, 2016

B) bonds payable due June 30, 2015

C) bonds payable due December 31, 2016

D) bonds payable due December 31, 2020

A) bonds payable due June 30, 2016

B) bonds payable due June 30, 2015

C) bonds payable due December 31, 2016

D) bonds payable due December 31, 2020

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

26

Damon Company sold 10,000 shares of $1 par value common stock.The selling price was $9.00 per share.After the sale,what is the capital in excess of par value?

A) $80,000

B) $90,000

C) $100,000

D) $110,000

A) $80,000

B) $90,000

C) $100,000

D) $110,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

27

Accrued interest payable is a long-term liability because it relates to a long-term bond payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

28

Convertible bonds allow a bondholder to exchange ________.

A) unsecured bonds for secured bonds

B) unsubordinated bonds for subordinated bonds

C) common stock for bonds

D) bonds for mortgage bonds

A) unsecured bonds for secured bonds

B) unsubordinated bonds for subordinated bonds

C) common stock for bonds

D) bonds for mortgage bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

29

Accounts payable,wages payable and income taxes payable are all considered to be current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

30

How should Unearned Rent Revenue be classified on a balance sheet at December 31,2013? The rental contract covers the period,January 1,2013 through December 31,2015.

A) current liability only

B) long-term liability only

C) current and long-term liability

D) current asset only

A) current liability only

B) long-term liability only

C) current and long-term liability

D) current asset only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

31

Goodwill is amortized for financial statement purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

32

Preferred stock has priority over common stock in ________.

A) voting rights

B) distribution of assets in liquidation

C) payment of dividends

D) B and C

A) voting rights

B) distribution of assets in liquidation

C) payment of dividends

D) B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

33

Deferred tax liabilities are ________.

A) expected increases in future income taxes due to past transactions

B) expected decreases in future income taxes due to past transactions

C) expected increases in future income taxes due to future transactions

D) expected decreases in future income taxes due to future transactions

A) expected increases in future income taxes due to past transactions

B) expected decreases in future income taxes due to past transactions

C) expected increases in future income taxes due to future transactions

D) expected decreases in future income taxes due to future transactions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

34

Some intangible assets are depreciated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

35

Research and development costs are expensed when incurred for financial statement purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following items is NOT a component of stockholders' equity?

A) paid-in capital

B) retained earnings

C) accumulated other comprehensive income

D) deferred income tax liabilities

A) paid-in capital

B) retained earnings

C) accumulated other comprehensive income

D) deferred income tax liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

37

Leasehold improvements are amortized annually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

38

An example of secured bonds is ________.

A) debentures

B) zero coupon bonds

C) mortgage bonds

D) serial bonds

A) debentures

B) zero coupon bonds

C) mortgage bonds

D) serial bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

39

What is Other Comprehensive Income?

A) unrealized gains and loss that are reported on the Statement of Retained Earnings

B) unrealized gains and losses that are reported on the traditional Income Statement

C) unrealized gains and losses that are reported on the Balance Sheet

D) unrealized gains and losses that are not reported on the financial statements

A) unrealized gains and loss that are reported on the Statement of Retained Earnings

B) unrealized gains and losses that are reported on the traditional Income Statement

C) unrealized gains and losses that are reported on the Balance Sheet

D) unrealized gains and losses that are not reported on the financial statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

40

Unsecured debt holders are creditors who have ________.

A) a specific claim against particular assets

B) a specific claim against fixed assets only

C) a general claim against fixed assets only

D) a general claim against total assets

A) a specific claim against particular assets

B) a specific claim against fixed assets only

C) a general claim against fixed assets only

D) a general claim against total assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

41

What is earnings per share?

A) net income divided by weighted average number of preferred shares outstanding

B) net income divided by weighted average number of common shares outstanding

C) net income plus the weighted average number of common and preferred shares outstanding

D) net income plus the weighted average number of bonds outstanding

A) net income divided by weighted average number of preferred shares outstanding

B) net income divided by weighted average number of common shares outstanding

C) net income plus the weighted average number of common and preferred shares outstanding

D) net income plus the weighted average number of bonds outstanding

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

42

Joe Anthony Company recently issued 20,000 shares of $1.00 par value common stock for $40,000.This transaction will increase the ________.

A) Common stock account by $20,000

B) Common stock account by $40,000

C) Paid in capital in excess of par account by $40,000

D) Retained earnings account by $40,000

A) Common stock account by $20,000

B) Common stock account by $40,000

C) Paid in capital in excess of par account by $40,000

D) Retained earnings account by $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

43

Par value is the value that is printed on the face of the stock certificate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

44

Treasury stock is a deduction from total stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

45

________ summarizes the results of the basic operating activities of a company.

A) Gross margin

B) Gross profit

C) Net profit

D) Operating income

A) Gross margin

B) Gross profit

C) Net profit

D) Operating income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

46

When calculating diluted earnings per share,which of the following items is NOT considered?

A) number of common shares outstanding

B) additional common shares from conversion of convertible securities

C) additional common shares from exercise of stock options

D) number of common shares authorized to be issued

A) number of common shares outstanding

B) additional common shares from conversion of convertible securities

C) additional common shares from exercise of stock options

D) number of common shares authorized to be issued

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

47

Preferred stockholders receive cash dividends before common stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

48

Nonoperating items on a multiple-step income statement do NOT include ________.

A) interest income

B) interest expense

C) gain from disposal of a fixed asset

D) selling expenses

A) interest income

B) interest expense

C) gain from disposal of a fixed asset

D) selling expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

49

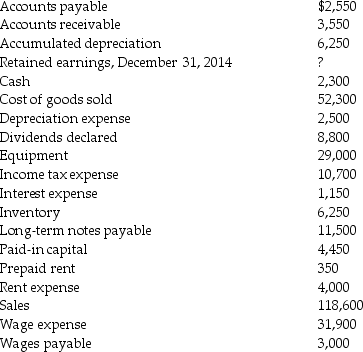

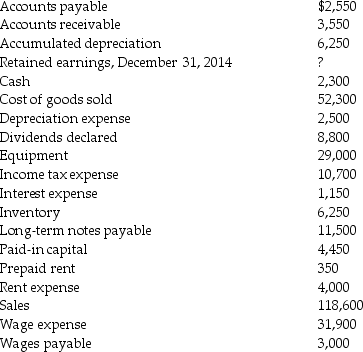

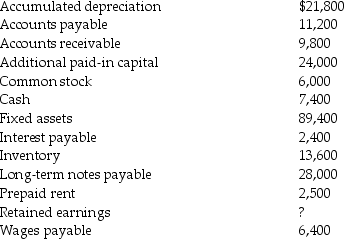

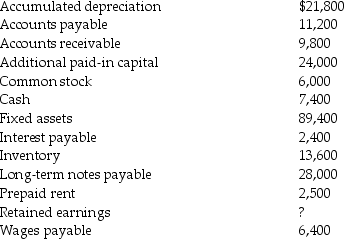

The balances on December 31,2015 are available for Jennifer Company:

Required:

Prepare a classified balance sheet at December 31,2015.

Required:

Prepare a classified balance sheet at December 31,2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

50

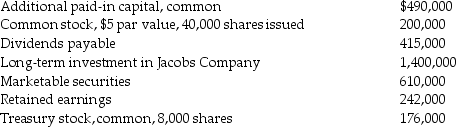

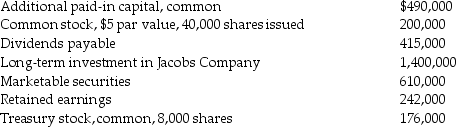

The following information is available for Anderson Company at December 31,2016:

Required:

Prepare the stockholders' equity section of a classified balance sheet at December 31,2016.Assume 400,000 shares of common stock are authorized to be issued.

Required:

Prepare the stockholders' equity section of a classified balance sheet at December 31,2016.Assume 400,000 shares of common stock are authorized to be issued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

51

A company's treasury stock is outstanding but not issued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

52

A nonoperating item on a multiple-step income statement that reflects financial decisions is ________.

A) gain from sale of inventory

B) interest expense

C) income tax expense

D) operating profit

A) gain from sale of inventory

B) interest expense

C) income tax expense

D) operating profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

53

Johnson Company's capital stock is currently trading for $22 per share.The following accounts appear on the balance sheet:

The only transaction affecting the accounts was one issue of the company's common stock.What was the original selling price of the common stock?

A) $6.00 per share

B) $20.00 per share

C) $22.00 per share

D) $26.00 per share

The only transaction affecting the accounts was one issue of the company's common stock.What was the original selling price of the common stock?

A) $6.00 per share

B) $20.00 per share

C) $22.00 per share

D) $26.00 per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

54

Sanders Company had the following data for the year ending December 31,2014:

What is the net income for the year ending December 31,2014?

A) $400

B) $3,400

C) $6,000

D) $6,400

What is the net income for the year ending December 31,2014?

A) $400

B) $3,400

C) $6,000

D) $6,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

55

A multiple step income statement has several measures of profit that do NOT include ________.

A) operating income

B) gross margin

C) income before taxes

D) cost of sales

A) operating income

B) gross margin

C) income before taxes

D) cost of sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

56

Treasury stock is shown on the balance sheets as a deduction from ________.

A) total assets

B) total liabilities

C) total current assets

D) total stockholders' equity

A) total assets

B) total liabilities

C) total current assets

D) total stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

57

The limited liability of stockholders in a corporation means that ________.

A) the company's creditors cannot seek payment from the stockholders as individuals if the corporation cannot pay its debt

B) the company's creditors cannot receive more than the face value of their debt

C) the short-term creditors have to be paid before the long-term creditors

D) the long-term creditors have to be paid before the short-term creditors

A) the company's creditors cannot seek payment from the stockholders as individuals if the corporation cannot pay its debt

B) the company's creditors cannot receive more than the face value of their debt

C) the short-term creditors have to be paid before the long-term creditors

D) the long-term creditors have to be paid before the short-term creditors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

58

What is gross margin?

A) sales minus operating expenses

B) sales minus other expenses

C) sales minus cost of goods sold

D) sales plus other income

A) sales minus operating expenses

B) sales minus other expenses

C) sales minus cost of goods sold

D) sales plus other income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

59

Treasury stock is ________.

A) unissued shares of stock

B) the number of shares of stock that cannot be sold in the future

C) shares of stock held in other companies for investment purposes

D) shares of stock already issued that are later repurchased by the corporation that originally issued them

A) unissued shares of stock

B) the number of shares of stock that cannot be sold in the future

C) shares of stock held in other companies for investment purposes

D) shares of stock already issued that are later repurchased by the corporation that originally issued them

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

60

The following balances are available for Thompson Company on December 31,2015:

Required:

Prepare a classified balance sheet at December 31,2015.

Required:

Prepare a classified balance sheet at December 31,2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

61

The ending retained earnings balance of Brothers Company is $700,000.During the current year,net income is $370,000 and dividends declared are $150,000.What is the beginning balance in retained earnings?

A) $480,000

B) $580,000

C) $800,000

D) $1,060,000

A) $480,000

B) $580,000

C) $800,000

D) $1,060,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

62

Cash dividends are reported as an expense on the Income Statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

63

Cash receipts of interest income are reported in the ________ section of the statement of cash flows.The direct method is used.

A) operating activities

B) investing activities

C) financing activities

D) noncash investing and financing activities

A) operating activities

B) investing activities

C) financing activities

D) noncash investing and financing activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

64

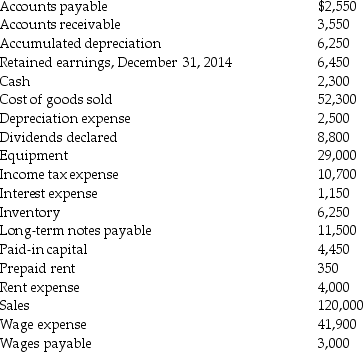

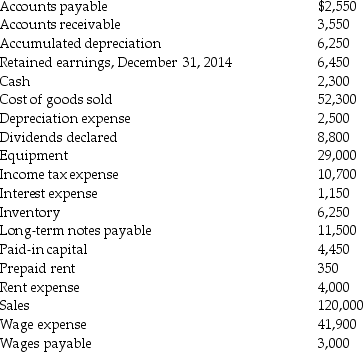

The balances on December 31,2015 are available for Matthew Company:

Required:

Prepare a multiple-step income statement for the year ended December 31,2015.

Required:

Prepare a multiple-step income statement for the year ended December 31,2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

65

A payment on bonds payable will be reported in the ________ section of the statement of cash flows.

A) operating activities only

B) investing activities

C) financing activities

D) noncash investing and financing activities

A) operating activities only

B) investing activities

C) financing activities

D) noncash investing and financing activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

66

Wheel Company has the following balances at December 31,2015:

Required:

Prepare a multiple-step income statement for the year ended December 31,2015.

Required:

Prepare a multiple-step income statement for the year ended December 31,2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

67

Dividends paid are reported on the Retained Earnings Statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

68

Mary Company had the following data available:

What is the balance in Retained Earnings on December 31,2015?

A) $23,400

B) $42,400

C) $52,400

D) $66,400

What is the balance in Retained Earnings on December 31,2015?

A) $23,400

B) $42,400

C) $52,400

D) $66,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

69

The cash paid to settle a long-term note payable is included in the ________ section of the statement of cash flows.

A) operating

B) investing

C) financing

D) noncash

A) operating

B) investing

C) financing

D) noncash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

70

The statement of changes in stockholders' equity shows the changes in ________.

A) retained earnings only

B) dividends only

C) each of the stockholders' equity accounts

D) fixed assets only

A) retained earnings only

B) dividends only

C) each of the stockholders' equity accounts

D) fixed assets only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following events do NOT affect cash flows from operating activities? Assume the direct method is used.

A) cash sale of merchandise inventory

B) cash purchase of equipment

C) cash purchase of inventory

D) cash paid for employees' wages

A) cash sale of merchandise inventory

B) cash purchase of equipment

C) cash purchase of inventory

D) cash paid for employees' wages

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

72

Cash dividends declared are an addition to Retained Earnings on the Retained Earnings Statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

73

The last line item on an income statement is earnings per share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

74

The inventory method a company uses does not affect its income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

75

Cash payments for interest expense are reported in the ________ section of the statement of cash flows.The direct method is used.

A) operating activities

B) investing activities

C) financing activities

D) noncash investing and financing activities

A) operating activities

B) investing activities

C) financing activities

D) noncash investing and financing activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

76

Operating income summarizes the results of basic operating activities of a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

77

Nonoperating items on a multiple-step income statement include interest expense and interest income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

78

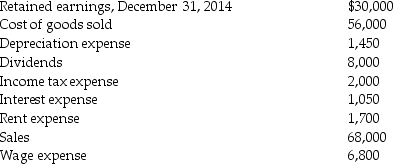

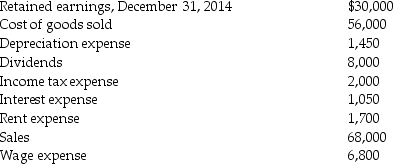

Selected items from the financial statements for Lorna Company are listed below:

Lorna Company has 5,000 common shares outstanding during the year.What are the earnings per share for the year ended December 31,2014?

A) $12.00

B) $15.00

C) $20.00

D) $25.00

Lorna Company has 5,000 common shares outstanding during the year.What are the earnings per share for the year ended December 31,2014?

A) $12.00

B) $15.00

C) $20.00

D) $25.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

79

Gross profit equals sales minus cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck

80

Michael Company had the following data:

What is the balance in Retained Earnings on December 31,2015?

A) $61,000

B) $63,000

C) $65,000

D) $74,000

What is the balance in Retained Earnings on December 31,2015?

A) $61,000

B) $63,000

C) $65,000

D) $74,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 140 في هذه المجموعة.

فتح الحزمة

k this deck