Deck 13: Accounting for Overhead Costs

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/152

العب

ملء الشاشة (f)

Deck 13: Accounting for Overhead Costs

1

Assume machine hours are the cost-allocation base for the budgeted rate for fixed overhead costs.The total fixed overhead cost applied to a product is the result of multiplying the ________ by the ________ for the product.

A) budgeted fixed overhead costs; percent of completion

B) actual fixed overhead rate; budgeted machine hours

C) budgeted fixed overhead costs; budgeted machine hours

D) budgeted fixed overhead rate; actual machine hours used

A) budgeted fixed overhead costs; percent of completion

B) actual fixed overhead rate; budgeted machine hours

C) budgeted fixed overhead costs; budgeted machine hours

D) budgeted fixed overhead rate; actual machine hours used

D

2

The two key items in determining the budgeted factory overhead rate are total budgeted factory overhead costs and ________.

A) actual amount of the cost driver

B) total actual factory overhead costs

C) budgeted cost-allocation base level

D) total estimated factory overhead costs

A) actual amount of the cost driver

B) total actual factory overhead costs

C) budgeted cost-allocation base level

D) total estimated factory overhead costs

C

3

In a clothing factory,clothing items are sewn by hundreds of workers using sewing machines and hand stitching.The sewing machines are used 80 percent of the time it takes to make the clothing items.Overhead costs relate primarily to electricity and indirect materials such as needles,bobbins,thread and thimbles.What is the most appropriate cost-allocation base for applying overhead costs to the clothing items?

A) the number of sewing machines

B) the number of direct labor hours

C) the number of sewing machine hours

D) the number of workers

A) the number of sewing machines

B) the number of direct labor hours

C) the number of sewing machine hours

D) the number of workers

C

4

A company can increase the accuracy of its product cost information by converting indirect costs to direct costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

5

To apply the budgeted overhead costs to a job,the budgeted overhead rate is multiplied by the ________.

A) actual production in units

B) expected production in units

C) actual amount of cost driver used by the job

D) expected amount of cost driver used by the job

A) actual production in units

B) expected production in units

C) actual amount of cost driver used by the job

D) expected amount of cost driver used by the job

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

6

Rocky Company had the following information:

Assume production setups are the cost driver for factory overhead costs.The budgeted factory overhead rate is ________.

A) $6.25 per setup

B) $6.52 per setup

C) $6.78 per setup

D) $7.50 per setup

Assume production setups are the cost driver for factory overhead costs.The budgeted factory overhead rate is ________.

A) $6.25 per setup

B) $6.52 per setup

C) $6.78 per setup

D) $7.50 per setup

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

7

The overhead cost applied to a job is equal to the budgeted overhead rate times the budgeted amount of the cost driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

8

What is the 80-20 rule used when selecting cost allocation bases for the budgeted overhead rate?

A) 80% of the cost-allocation bases drive 20% of the overhead costs

B) 20% of the cost-allocation bases drive 80% of the overhead costs

C) 80% of the overhead rate is determined by 20% of the cost-allocation bases

D) 20% of the overhead rate is determined by 80% of the cost-allocation bases

A) 80% of the cost-allocation bases drive 20% of the overhead costs

B) 20% of the cost-allocation bases drive 80% of the overhead costs

C) 80% of the overhead rate is determined by 20% of the cost-allocation bases

D) 20% of the overhead rate is determined by 80% of the cost-allocation bases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

9

Machine usage in a department causes most of the overhead costs such as depreciation expense,maintenance expense and repair expense.What is the most appropriate cost-allocation base for applying overhead costs to products?

A) the number of machines

B) the salvage value of the machines

C) the average age of the machines

D) the number of machine hours

A) the number of machines

B) the salvage value of the machines

C) the average age of the machines

D) the number of machine hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

10

Green Company had the following information:

Assume direct labor hours are the cost driver for factory overhead costs.The budgeted factory overhead rate is ________.

A) $4.25 per direct labor hour

B) $4.45 per direct labor hour

C) $4.63 per direct labor hour

D) $4.84 per direct labor hour

Assume direct labor hours are the cost driver for factory overhead costs.The budgeted factory overhead rate is ________.

A) $4.25 per direct labor hour

B) $4.45 per direct labor hour

C) $4.63 per direct labor hour

D) $4.84 per direct labor hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

11

Barenz Builders had the following information available for the past twelve months:

Assume the cost driver for factory overhead costs is machine hours and a job uses 10,000 machine hours.The job was budgeted to use 11,000 machine hours.What amount of factory overhead is applied to the job?

A) $20,000

B) $20,250

C) $22,000

D) $22,278

Assume the cost driver for factory overhead costs is machine hours and a job uses 10,000 machine hours.The job was budgeted to use 11,000 machine hours.What amount of factory overhead is applied to the job?

A) $20,000

B) $20,250

C) $22,000

D) $22,278

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

12

Accountants use actual overhead rates when applying overhead costs to jobs as they are completed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

13

If a department identifies more than one cost driver for overhead costs,the department ideally should ________.

A) put 80 percent of the costs into one pool and 20 percent into a second pool

B) select a single cost driver

C) allocate 80 percent of the costs with 20 percent of the cost drivers

D) create as many cost pools as there are cost drivers

A) put 80 percent of the costs into one pool and 20 percent into a second pool

B) select a single cost driver

C) allocate 80 percent of the costs with 20 percent of the cost drivers

D) create as many cost pools as there are cost drivers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

14

The cost-allocation base used for the fixed overhead rate should be ________.

A) underestimated due to the conservatism principle

B) overestimated due to the conservatism principle

C) the most plausible and reliable measure available of the cause and effect relationship between overhead costs and production volume

D) the most plausible and reliable measure available of the relationship between overhead costs and sales

A) underestimated due to the conservatism principle

B) overestimated due to the conservatism principle

C) the most plausible and reliable measure available of the cause and effect relationship between overhead costs and production volume

D) the most plausible and reliable measure available of the relationship between overhead costs and sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

15

Dodge Company had the following information:

Assume machine hours are the cost driver of factory overhead costs.The budgeted factory overhead rate is ________.

A) $2.025 per machine hour

B) $2.05 per machine hour

C) $2.25 per machine hour

D) $2.875 per machine hour

Assume machine hours are the cost driver of factory overhead costs.The budgeted factory overhead rate is ________.

A) $2.025 per machine hour

B) $2.05 per machine hour

C) $2.25 per machine hour

D) $2.875 per machine hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

16

Kingsway Company had the following information available for the past quarter:

Assume the cost driver for factory overhead costs is direct labor hours and a job uses 2,000 direct labor hours.The job was budgeted to use 2,100 direct labor hours.What amount of factory overhead is applied to the job?

A) $7,140

B) $7,500

C) $7,875

D) $8,000

Assume the cost driver for factory overhead costs is direct labor hours and a job uses 2,000 direct labor hours.The job was budgeted to use 2,100 direct labor hours.What amount of factory overhead is applied to the job?

A) $7,140

B) $7,500

C) $7,875

D) $8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

17

When calculating the budgeted overhead rate,the numerator of the fraction is the actual amount of the cost driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

18

USC Company has the following information available:

Assume direct labor hours are the cost driver of factory overhead costs.The budgeted factory overhead rate is ________.

A) $3.57 per direct labor hour

B) $3.81 per direct labor hour

C) $4.00 per direct labor hour

D) $4.50 per direct labor hour

Assume direct labor hours are the cost driver of factory overhead costs.The budgeted factory overhead rate is ________.

A) $3.57 per direct labor hour

B) $3.81 per direct labor hour

C) $4.00 per direct labor hour

D) $4.50 per direct labor hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

19

The budgeted factory overhead rate is computed as ________.

A) actual factory overhead costs divided by actual production in units

B) actual factory overhead costs divided by actual cost driver activity

C) budgeted factory overhead costs divided by actual cost driver activity

D) budgeted factory overhead costs divided by budgeted cost-allocation base level

A) actual factory overhead costs divided by actual production in units

B) actual factory overhead costs divided by actual cost driver activity

C) budgeted factory overhead costs divided by actual cost driver activity

D) budgeted factory overhead costs divided by budgeted cost-allocation base level

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

20

Ideally,if a department has more than one cost-allocation base for overhead costs,it should ________.

A) use only one cost-allocation base with the highest amount of overhead costs

B) use only two cost-allocation bases with the highest amount of overhead costs

C) accumulate a separate cost pool for each cost-allocation base and put the overhead costs into the appropriate cost pool

D) determine the budgeted overhead rate using the budgeted overhead costs and the budgeted amount of only one cost driver

A) use only one cost-allocation base with the highest amount of overhead costs

B) use only two cost-allocation bases with the highest amount of overhead costs

C) accumulate a separate cost pool for each cost-allocation base and put the overhead costs into the appropriate cost pool

D) determine the budgeted overhead rate using the budgeted overhead costs and the budgeted amount of only one cost driver

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

21

In practice,it may be too costly to have several cost-allocation bases for applying overhead costs to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

22

Victor Company incurred actual overhead costs of $297,500 for the year.A budgeted factory overhead rate of 150% of direct labor cost was determined at the beginning of the year.Budgeted factory overhead was $300,000 and budgeted direct labor cost was $200,000.Actual direct labor cost was $205,000 for the year.The factory overhead variance for the year was ________.

A) $2,500 underapplied

B) $2,500 overapplied

C) $10,000 underapplied

D) $10,000 overapplied

A) $2,500 underapplied

B) $2,500 overapplied

C) $10,000 underapplied

D) $10,000 overapplied

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

23

The most important contributor to the variance between actual and applied overhead costs is ________.

A) poor forecasting

B) inefficient use of overhead items

C) price changes in overhead items

D) operating at a different level of volume than the level used as a denominator in calculating the budgeted overhead rate

A) poor forecasting

B) inefficient use of overhead items

C) price changes in overhead items

D) operating at a different level of volume than the level used as a denominator in calculating the budgeted overhead rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

24

The immediate write-off of overhead variances is used because ________.

A) it is simpler

B) the company has probably sold most of the goods produced during the period so prorating the variance to inventory accounts would not produce materially different results

C) the extra overhead costs result from inefficiencies in the current period and therefore do not represent assets

D) all of the above

A) it is simpler

B) the company has probably sold most of the goods produced during the period so prorating the variance to inventory accounts would not produce materially different results

C) the extra overhead costs result from inefficiencies in the current period and therefore do not represent assets

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

25

The cost driver chosen for applying factory overhead costs should be the cost driver that ________.

A) is easiest to understand

B) incurs the least administrative costs

C) is easiest to calculate

D) causes most of the overhead costs

A) is easiest to understand

B) incurs the least administrative costs

C) is easiest to calculate

D) causes most of the overhead costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

26

The excess of applied overhead costs over the actual overhead costs is called ________.

A) overapplied overhead

B) underapplied overhead

C) underbudgeted overhead

D) overestimated overhead

A) overapplied overhead

B) underapplied overhead

C) underbudgeted overhead

D) overestimated overhead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

27

In the immediate write-off of overhead variances,underapplied overhead is regarded as a(n)________.

A) addition to the cost of inventory

B) deduction from the cost of inventory

C) decrease in cost of goods sold

D) increase in cost of goods sold

A) addition to the cost of inventory

B) deduction from the cost of inventory

C) decrease in cost of goods sold

D) increase in cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

28

In practice,companies generally prorate overhead variances when it would materially affect ________ and ________.

A) inventory valuations; stock dividends

B) inventory valuations; cash dividends

C) inventory valuations; net income

D) stock option plans; manager bonuses

A) inventory valuations; stock dividends

B) inventory valuations; cash dividends

C) inventory valuations; net income

D) stock option plans; manager bonuses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

29

When selecting a cost driver for a budgeted overhead rate,no one cost driver is appropriate for all situations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

30

There should be a strong cause-and-effect relationship between factory overhead costs incurred and the cost-allocation base chosen for its application.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

31

When we use an annual overhead rate consistently throughout the year for product costing,without altering it month to month,this is called a(n)________.

A) direct costing system

B) absorption costing system

C) normal costing system

D) constant costing system

A) direct costing system

B) absorption costing system

C) normal costing system

D) constant costing system

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

32

The following information was gathered for all the products made by the Ringaling Company:

Assume the cost driver for factory overhead costs is direct labor hours.What is the amount of overapplied or underapplied overhead?

A) $2,730 underapplied

B) $2,730 overapplied

C) $3,920 underapplied

D) $3,920 overapplied

Assume the cost driver for factory overhead costs is direct labor hours.What is the amount of overapplied or underapplied overhead?

A) $2,730 underapplied

B) $2,730 overapplied

C) $3,920 underapplied

D) $3,920 overapplied

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

33

The most widely used approach to disposing of overhead variances is ________.

A) to allocate it between finished goods inventory, work-in-process inventory and direct materials inventory

B) to allocate it between cost of goods sold, finished goods inventory and work-in-process inventory

C) to allocate it between cost of goods sold, finished goods inventory and direct materials inventory

D) immediate write-off

A) to allocate it between finished goods inventory, work-in-process inventory and direct materials inventory

B) to allocate it between cost of goods sold, finished goods inventory and work-in-process inventory

C) to allocate it between cost of goods sold, finished goods inventory and direct materials inventory

D) immediate write-off

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

34

Under the immediate write-off method of disposing of underapplied or overapplied overhead costs,current net income is ________ by underapplied overhead costs and current net income is ________ by overapplied overhead costs.

A) increased, decreased

B) decreased, increased

C) not affected, not affected

D) none of the above

A) increased, decreased

B) decreased, increased

C) not affected, not affected

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

35

When the actual overhead costs exceed the amount of applied overhead costs,the overhead costs are ________.At the end of the accounting period,accountants dispose of the underapplied or overapplied overhead using ________ or ________.

A) overapplied; proration; immediate write-off

B) underapplied; proration; immediate write-off

C) overapplied; flexible budget variance; proration

D) underapplied; flexible budget variance; immediate write-off

A) overapplied; proration; immediate write-off

B) underapplied; proration; immediate write-off

C) overapplied; flexible budget variance; proration

D) underapplied; flexible budget variance; immediate write-off

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

36

To determine the cost of a manufactured product,a normal costing system uses ________.

A) actual direct material, actual direct labor and actual overhead costs

B) applied direct material, applied direct labor and applied overhead costs

C) applied direct material, applied direct labor and actual overhead costs

D) actual direct materials, actual direct labor and normal applied overhead costs

A) actual direct material, actual direct labor and actual overhead costs

B) applied direct material, applied direct labor and applied overhead costs

C) applied direct material, applied direct labor and actual overhead costs

D) actual direct materials, actual direct labor and normal applied overhead costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

37

The following information was gathered for all the products made by the BBB Company:

Assume the cost driver for factory overhead costs is direct labor hours.What is the amount of overapplied or underapplied overhead?

A) $970 underapplied

B) $970 overapplied

C) $1,830 underapplied

D) $1,830 overapplied

Assume the cost driver for factory overhead costs is direct labor hours.What is the amount of overapplied or underapplied overhead?

A) $970 underapplied

B) $970 overapplied

C) $1,830 underapplied

D) $1,830 overapplied

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

38

Causes for the difference between applied and actual overhead costs do NOT include ________.

A) different number of workdays in different months

B) price changes in individual overhead items

C) inefficient use of overhead items

D) repairs made on a regular, consistent basis

A) different number of workdays in different months

B) price changes in individual overhead items

C) inefficient use of overhead items

D) repairs made on a regular, consistent basis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

39

In the immediate write-off approach to overhead variances,overapplied overhead is regarded as a(n)________.

A) addition to the cost of inventory

B) reduction to the cost of inventory

C) increase in cost of goods sold

D) decrease in cost of goods sold

A) addition to the cost of inventory

B) reduction to the cost of inventory

C) increase in cost of goods sold

D) decrease in cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

40

A department's applied overhead cost will ________ equal the actual overhead cost incurred.

A) always

B) never

C) about fifty percent of the time

D) rarely

A) always

B) never

C) about fifty percent of the time

D) rarely

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

41

Variable costing net income does not equal absorption costing net income due to ________.

A) variable selling costs

B) variable manufacturing overhead costs

C) fixed manufacturing overhead costs

D) variable and fixed manufacturing overhead costs

A) variable selling costs

B) variable manufacturing overhead costs

C) fixed manufacturing overhead costs

D) variable and fixed manufacturing overhead costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

42

The proration method of disposing of an overhead variance prorates the variance among three accounts that include Direct Materials Inventory,Work-in-Process Inventory and Finished Goods Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

43

The immediate write-off method of disposing of underapplied overhead subtracts the dollar amount from Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

44

Under absorption costing,fixed overhead costs applied to products will be included in ________.

A) Cost of Goods Sold on the income statement when the products are sold

B) Ending Inventory on the balance sheet before the products are sold

C) Extraordinary Item on the income statement when the products are sold

D) A and B

A) Cost of Goods Sold on the income statement when the products are sold

B) Ending Inventory on the balance sheet before the products are sold

C) Extraordinary Item on the income statement when the products are sold

D) A and B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

45

Why is absorption costing more widely used than variable costing?

A) Variable costing is not allowed for tax purposes, but absorption costing is allowed.

B) Variable costing is not allowed for external reports, but absorption costing is allowed.

C) Absorption costing removes the impact of changing inventory levels from the financial results.

D) A and B

A) Variable costing is not allowed for tax purposes, but absorption costing is allowed.

B) Variable costing is not allowed for external reports, but absorption costing is allowed.

C) Absorption costing removes the impact of changing inventory levels from the financial results.

D) A and B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

46

The most common reason for a variance between actual overhead costs and applied overhead costs is the actual level of volume does not equal the level used to calculate the budgeted overhead rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

47

The proration method of disposing of overhead variances assigns the variance in proportion to the sizes of the ending account balances of ________.

A) work-in-process inventory, finished goods inventory and direct materials inventory

B) work-in-process inventory, direct materials inventory and cost of goods sold

C) work-in-process inventory and direct materials inventory

D) work-in-process inventory, finished goods inventory and cost of goods sold

A) work-in-process inventory, finished goods inventory and direct materials inventory

B) work-in-process inventory, direct materials inventory and cost of goods sold

C) work-in-process inventory and direct materials inventory

D) work-in-process inventory, finished goods inventory and cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

48

Under variable costing,fixed manufacturing overhead costs are a ________ cost.Under absorption costing,fixed manufacturing overhead costs are a ________ cost.

A) product, period

B) period, product

C) product, product

D) period, period

A) product, period

B) period, product

C) product, product

D) period, period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

49

The only difference between the net income between variable costing and absorption costing is the treatment of ________.

A) variable selling costs

B) variable administrative costs

C) fixed selling costs

D) fixed manufacturing overhead costs

A) variable selling costs

B) variable administrative costs

C) fixed selling costs

D) fixed manufacturing overhead costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

50

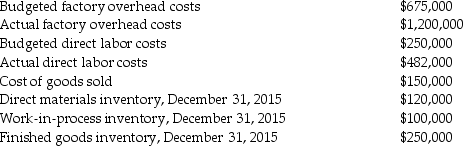

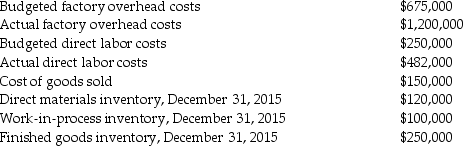

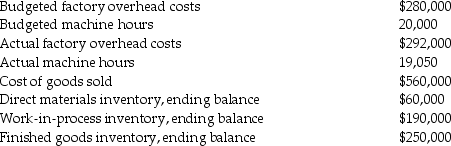

Johannes Corporation uses a budgeted factory overhead rate to apply overhead to production.Direct labor costs are the cost driver for overhead costs.The following data are available for the year ending December 31,2015:

Required:

A) Compute the budgeted factory overhead rate.

B) Compute the applied overhead costs.

C) What is the overhead variance?

D) Prorate the overhead variance to the appropriate accounts.

Required:

A) Compute the budgeted factory overhead rate.

B) Compute the applied overhead costs.

C) What is the overhead variance?

D) Prorate the overhead variance to the appropriate accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

51

When the amount of overhead applied to a product exceeds the amount incurred to make the product,the difference is called overapplied overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

52

The following information was gathered for Edwards Company:

Required:

A) Compute the budgeted factory overhead rate.

B) Compute the factory overhead applied.

C) Compute the amount of underapplied or overapplied factory overhead.

Required:

A) Compute the budgeted factory overhead rate.

B) Compute the factory overhead applied.

C) Compute the amount of underapplied or overapplied factory overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

53

The most widely used approach in disposing of an overhead variance is proration to the affected accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

54

Variable costing considers fixed manufacturing overhead costs as a(n)________.

A) inventoriable cost

B) product cost

C) future cost

D) immediate expense

A) inventoriable cost

B) product cost

C) future cost

D) immediate expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

55

Variable costing is also called ________.

A) functional costing

B) indirect costing

C) absorption costing

D) the contribution approach

A) functional costing

B) indirect costing

C) absorption costing

D) the contribution approach

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

56

In practice,proration of overhead variances among the affected accounts is undertaken when it materially affects inventory valuations and net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

57

Why is variable costing used for internal reports?

A) It can also be used for external reports.

B) It is readily available through most computer systems.

C) It removes the impact of changing inventory levels from the financial results.

D) B and C

A) It can also be used for external reports.

B) It is readily available through most computer systems.

C) It removes the impact of changing inventory levels from the financial results.

D) B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

58

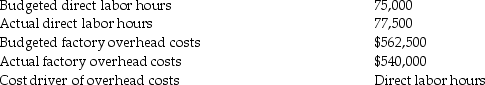

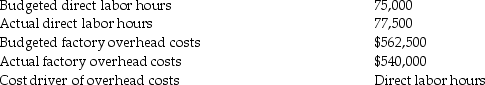

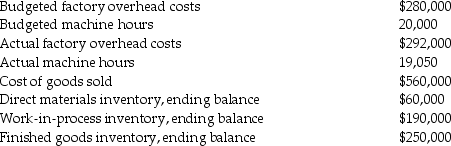

Stanley Company applies overhead based on machine hours.The following data was available:

Required:

A) Compute the budgeted factory overhead rate.

B) Compute the underapplied or overapplied factory overhead.

C) Under the immediate write-off approach to overhead variances, how would you dispose of the overhead variance?

D) If the immediate write-off approach to overhead variances is not used, how would you dispose of the overhead variance?

Required:

A) Compute the budgeted factory overhead rate.

B) Compute the underapplied or overapplied factory overhead.

C) Under the immediate write-off approach to overhead variances, how would you dispose of the overhead variance?

D) If the immediate write-off approach to overhead variances is not used, how would you dispose of the overhead variance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

59

The proration method of disposing of overhead variances prorates the variance based on the beginning of the reporting period account balances in Cost of Goods Sold,Work-in-Process Inventory and Finished Goods Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

60

In determining product costs,variable costing and absorption costing differ in the treatment of ________.

A) variable overhead costs

B) variable selling costs

C) fixed selling costs

D) fixed overhead costs

A) variable overhead costs

B) variable selling costs

C) fixed selling costs

D) fixed overhead costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

61

________ is used for external reporting.

A) Absorption costing

B) Variable costing

C) Direct costing

D) The contribution margin approach

A) Absorption costing

B) Variable costing

C) Direct costing

D) The contribution margin approach

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

62

Stelloh Company reported the following information about the production and sale of its only product during the first month of operations:

Under variable costing,what is the product cost per unit?

A) $30.00

B) $31.25

C) $35.42

D) $39.00

Under variable costing,what is the product cost per unit?

A) $30.00

B) $31.25

C) $35.42

D) $39.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

63

Variable costing is more important for external reports than internal reports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

64

Freund Industries Inc.reported the following information about the production and sale of its only product during the first month of operations:

Under variable costing,what is the product cost per unit?

A) $40.00

B) $42.00

C) $45.00

D) $54.09

Under variable costing,what is the product cost per unit?

A) $40.00

B) $42.00

C) $45.00

D) $54.09

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

65

Joseph Industries Inc.reported the following information about the production and sale of its only product during the first month of operations:

Under variable costing,what is the variable manufacturing cost of goods sold?

A) $45,000

B) $54,000

C) $101,000

D) $119,000

Under variable costing,what is the variable manufacturing cost of goods sold?

A) $45,000

B) $54,000

C) $101,000

D) $119,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

66

The variable-costing method regards fixed manufacturing costs as a period expense when incurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

67

Fixed manufacturing overhead costs are excluded from product costs under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

68

Comerowski Industries Inc.reported the following information about the production and sale of its only product during the first month of operations:

Under variable costing,what is the total contribution margin?

A) $10,500

B) $31,500

C) $49,500

D) $53,000

Under variable costing,what is the total contribution margin?

A) $10,500

B) $31,500

C) $49,500

D) $53,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

69

Dolhun Industries Inc.reported the following information about the production and sale of its only product during the first month of operations:

Under variable costing,the variable manufacturing cost of goods sold is ________.

A) $35,000

B) $37,500

C) $39,000

D) $42,500

Under variable costing,the variable manufacturing cost of goods sold is ________.

A) $35,000

B) $37,500

C) $39,000

D) $42,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

70

Lorna Company reported the following information about the production and sale of its only product during the first month of operations:

Under variable costing,the cost of ending inventory of finished goods is ________.

A) $35,000

B) $37,500

C) $39,000

D) $42,500

Under variable costing,the cost of ending inventory of finished goods is ________.

A) $35,000

B) $37,500

C) $39,000

D) $42,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

71

Seidner Industries reported the following information about the production and sale of its only product during the first month of operations:

Under variable costing,the contribution margin is ________.

A) $32,000

B) $36,000

C) $37,500

D) $39,500

Under variable costing,the contribution margin is ________.

A) $32,000

B) $36,000

C) $37,500

D) $39,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

72

Wininger Incorporated reported the following information about the production and sale of its only product during the first month of operations:

Under variable costing,the product cost per unit is ________.

A) $160

B) $170

C) $200

D) $240

Under variable costing,the product cost per unit is ________.

A) $160

B) $170

C) $200

D) $240

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

73

Marian Industries Inc.reported the following information about the production and sale of its only product during the first month of operations:

Under variable costing,what is the cost of the finished goods ending inventory?

A) $48,000

B) $50,000

C) $54,000

D) $58,000

Under variable costing,what is the cost of the finished goods ending inventory?

A) $48,000

B) $50,000

C) $54,000

D) $58,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

74

Gnat Company reported the following information about the production and sale of its only product during the first month of operations:

Under variable costing,the operating income or loss is ________.

A) $(6,000)

B) $(14,000)

C) $10,000

D) $41,000

Under variable costing,the operating income or loss is ________.

A) $(6,000)

B) $(14,000)

C) $10,000

D) $41,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

75

When the variable costing method is used,fixed factory overhead appears on the income statement as a ________.

A) component of cost of goods sold

B) component of cost of goods sold and production volume variance

C) production volume variance

D) fixed expense

A) component of cost of goods sold

B) component of cost of goods sold and production volume variance

C) production volume variance

D) fixed expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

76

Durante Company reported the following information about the production and sale of its only product during the first month of operations:

Under variable costing,the cost of finished goods ending inventory is ________.

A) $64,000

B) $68,000

C) $80,000

D) $96,000

Under variable costing,the cost of finished goods ending inventory is ________.

A) $64,000

B) $68,000

C) $80,000

D) $96,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

77

Jorgensen Company reported the following information about the production and sale of its only product during the first month of operations:

Under variable costing,the contribution margin is ________.

A) $20,000

B) $40,000

C) $76,000

D) $104,000

Under variable costing,the contribution margin is ________.

A) $20,000

B) $40,000

C) $76,000

D) $104,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

78

Product costs for variable costing include direct materials,direct labor and ________.

A) variable selling costs

B) fixed manufacturing overhead costs

C) variable manufacturing overhead costs

D) variable manufacturing overhead costs plus variable selling costs

A) variable selling costs

B) fixed manufacturing overhead costs

C) variable manufacturing overhead costs

D) variable manufacturing overhead costs plus variable selling costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

79

To compute contribution margin under variable costing,we deduct ________ and ________ from sales.

A) variable manufacturing costs; fixed manufacturing costs

B) variable selling costs; fixed manufacturing costs

C) variable administrative costs; fixed manufacturing overhead costs

D) variable manufacturing costs; variable selling and administrative costs

A) variable manufacturing costs; fixed manufacturing costs

B) variable selling costs; fixed manufacturing costs

C) variable administrative costs; fixed manufacturing overhead costs

D) variable manufacturing costs; variable selling and administrative costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck

80

Kaprelian Company reported the following information about the production and sale of its only product during the first month of operations:

Under variable costing,the variable manufacturing cost of goods sold is ________.

A) $256,000

B) $272,000

C) $320,000

D) $384,000

Under variable costing,the variable manufacturing cost of goods sold is ________.

A) $256,000

B) $272,000

C) $320,000

D) $384,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 152 في هذه المجموعة.

فتح الحزمة

k this deck