Deck 7: Advanced Interpretation of Company and Group Accounts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/25

العب

ملء الشاشة (f)

Deck 7: Advanced Interpretation of Company and Group Accounts

1

Which of the following would not form part of the financial statements?

A) Statement of changes in equity

B) Cash flow statement

C) Income statement

D) Directors' remuneration report

A) Statement of changes in equity

B) Cash flow statement

C) Income statement

D) Directors' remuneration report

D

2

The following segmental information is provided for Powerage Ltd.

Which segment would you suggest needs to become more profitable?

A) Audio America

B) Audio Europe

C) Visual America

D) Visual Europe

Which segment would you suggest needs to become more profitable?

A) Audio America

B) Audio Europe

C) Visual America

D) Visual Europe

Audio Europe

3

"Minority interest" refers to the owners of shares which have no voting rights

False

4

The following segmental information is provided for Powerage Ltd.

Which segment is producing most sales in relation to capital employed?

A) Audio America

B) Audio Europe

C) Visual America

D) Visual Europe

Which segment is producing most sales in relation to capital employed?

A) Audio America

B) Audio Europe

C) Visual America

D) Visual Europe

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following statements is correct?

A) In a group or consolidated statement of financial position the share capital of the parent company and its subsidiaries are shown

B) In a group or consolidated statement of financial position the retained earnings of the parent company and its subsidiaries are shown

C) In a group or consolidated statement of financial position the figures for non-current assets and current assets of the parent company and its subsidiaries are added together

D) All of the above statements are correct

A) In a group or consolidated statement of financial position the share capital of the parent company and its subsidiaries are shown

B) In a group or consolidated statement of financial position the retained earnings of the parent company and its subsidiaries are shown

C) In a group or consolidated statement of financial position the figures for non-current assets and current assets of the parent company and its subsidiaries are added together

D) All of the above statements are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following would you associate with the Director's report?

A) Cash flow statement

B) Five year summary

C) Business review

D) Balance sheet

A) Cash flow statement

B) Five year summary

C) Business review

D) Balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following z-scores would suggest a company was likely to fail?

A) 1.86

B) 2.99

C) 1.72

D) 1.90

A) 1.86

B) 2.99

C) 1.72

D) 1.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

8

If one company buys another for less than the net book value of its assets,this is regarded as "negative goodwill" and does not require that the assets and liabilites be revalued at "fair value"

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following z-scores would suggest a company was not likely to fail?

A) 1.86

B) 2.99

C) 1.72

D) 1.90

A) 1.86

B) 2.99

C) 1.72

D) 1.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

10

A one-off loss is likely to be a major problem for company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

11

High levels of debt in a company is always a cause for concern

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

12

The following segmental information is provided for Powerage Ltd.

Which segment has the lowest profit sales ratio?

A) Audio America

B) Audio Europe

C) Visual America

D) Visual Europe

Which segment has the lowest profit sales ratio?

A) Audio America

B) Audio Europe

C) Visual America

D) Visual Europe

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

13

According to Altman (1983)the amount of working capital in relation to total assets is an important component in predicting the failure of a company,while measures of return on capital employed (ROCE)can not help predict failure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

14

The following segmental information is provided for Powerage Ltd.

Which segment is most profitable in relation to capital employed?

A) Audio America

B) Audio Europe

C) Visual America

D) Visual Europe

Which segment is most profitable in relation to capital employed?

A) Audio America

B) Audio Europe

C) Visual America

D) Visual Europe

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

15

In a group or consolidated balance sheet,the retained earnings figure for the group is the sum of the retained earnings for the parent company and all of the retained earnings for each subsidiary

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

16

When a company is in financial distress,creditors may suffer direct financial loss,but shareholders can not loose their investment because they have limited liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

17

Deferred taxation is a "liability" that may never have to be paid

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

18

A company with interest cover of 10 is less safe than a company with interest cover of 2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is not included in the calculation of a Z-Score?

A) Working capital

B) Cash Flow

C) Market value of equity

D) Sales

A) Working capital

B) Cash Flow

C) Market value of equity

D) Sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

20

The International Accounting Standards Board (IASB)require companies to publish information related to business or geographical segments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following are potential indicators of financial distress?

(i) A sudden drop in share price

(ii) Increased turnover

(iii) Increased gearing ratio

(iv)Fall in profits

A) All of them could indicate financial problems

B) None of these factors would cause much concern, especially in isolation

C) (i), (iii) and (iv) are bad news, but increased turnover would be good news

D) (i) and (iv) are indicators, but (ii) and (iii) are improvements to the financial position

(i) A sudden drop in share price

(ii) Increased turnover

(iii) Increased gearing ratio

(iv)Fall in profits

A) All of them could indicate financial problems

B) None of these factors would cause much concern, especially in isolation

C) (i), (iii) and (iv) are bad news, but increased turnover would be good news

D) (i) and (iv) are indicators, but (ii) and (iii) are improvements to the financial position

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

22

A company is about to buy another company,but this would result in "negative goodwill".For example,Company A pays £2m for Company S which has net assets of £3m.However,the fair value of the net assets of S is actually only £2.1m Which of the following is the correct treatment of this situation?

A) Revalue the assets of S to reflect the "fair value" of them prior to purchase

B) Show negative goodwill £1m on the consolidated Statement of Financial Position

C) Show the loss on purchase £1m on the Income Statement of A

D) Write off the loss of £1m in company A prior to purchase

A) Revalue the assets of S to reflect the "fair value" of them prior to purchase

B) Show negative goodwill £1m on the consolidated Statement of Financial Position

C) Show the loss on purchase £1m on the Income Statement of A

D) Write off the loss of £1m in company A prior to purchase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

23

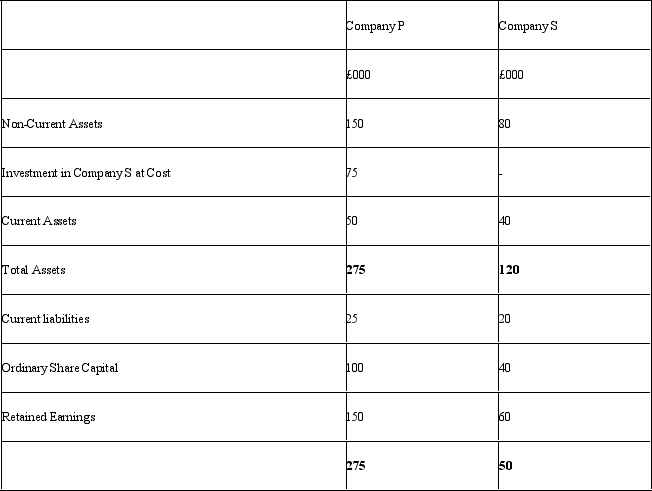

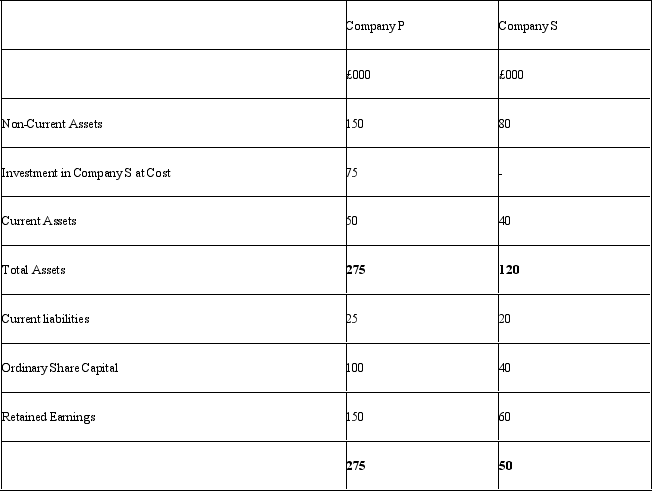

The Statements of Financial Position for company P and company S are shown below:

At the time of the acquisition,the net asset value of S was £50,000.This was £40,000 share capital plus £10,000 retained earnings.If company P owns 75% of Company S,then the consolidated Statement of Financial Position will include:

A) 100% of the assets and liabilities of P and 75% of the assets and liabilities of S

B) 100% of the assets and liabilities of P and 50% of the assets and liabilities of S

C) 100% of the assets and liabilities of P and 100% of the assets and liabilities of S

D) 75% of the assets and liabilities of P and 75% of the assets and liabilities of S

At the time of the acquisition,the net asset value of S was £50,000.This was £40,000 share capital plus £10,000 retained earnings.If company P owns 75% of Company S,then the consolidated Statement of Financial Position will include:

A) 100% of the assets and liabilities of P and 75% of the assets and liabilities of S

B) 100% of the assets and liabilities of P and 50% of the assets and liabilities of S

C) 100% of the assets and liabilities of P and 100% of the assets and liabilities of S

D) 75% of the assets and liabilities of P and 75% of the assets and liabilities of S

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

24

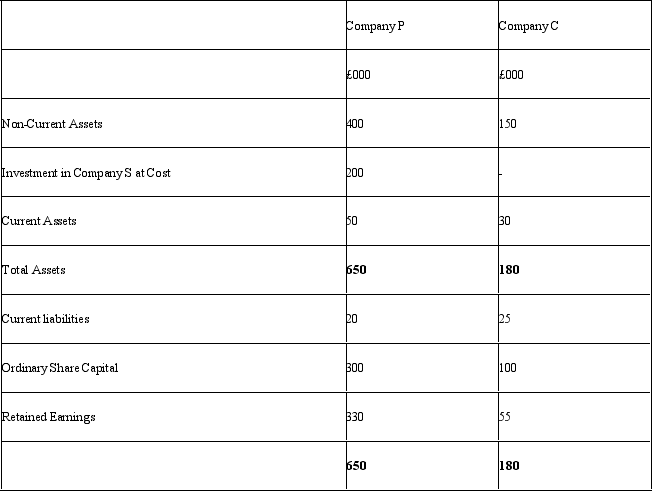

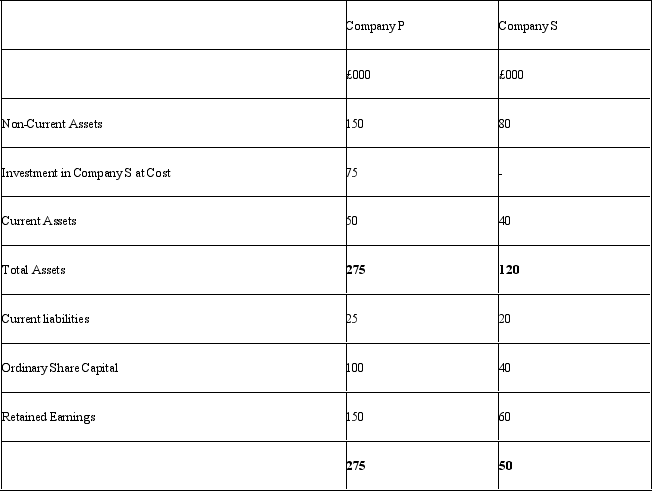

The Statements of Financial Position for company P and company C are shown below:

At the time of the acquisition,the net asset value of C was £100,000.This was made up entirely of £100,000 share capital.If company P owns 100% of Company C,then the consolidated Statement of Financial Position will show a Total Assets figure of:

A) £830. This is made up of 100% of the assets of P and C and the investment of P in C

B) £630. This is 100% of the assets of P and C excluding the investment of P in C

C) £730. This is made up of 100% of the assets of P and C and the goodwill on the investment of P in C

D) £585. This is made up of 100% of the assets and liabilities of P and C

At the time of the acquisition,the net asset value of C was £100,000.This was made up entirely of £100,000 share capital.If company P owns 100% of Company C,then the consolidated Statement of Financial Position will show a Total Assets figure of:

A) £830. This is made up of 100% of the assets of P and C and the investment of P in C

B) £630. This is 100% of the assets of P and C excluding the investment of P in C

C) £730. This is made up of 100% of the assets of P and C and the goodwill on the investment of P in C

D) £585. This is made up of 100% of the assets and liabilities of P and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck

25

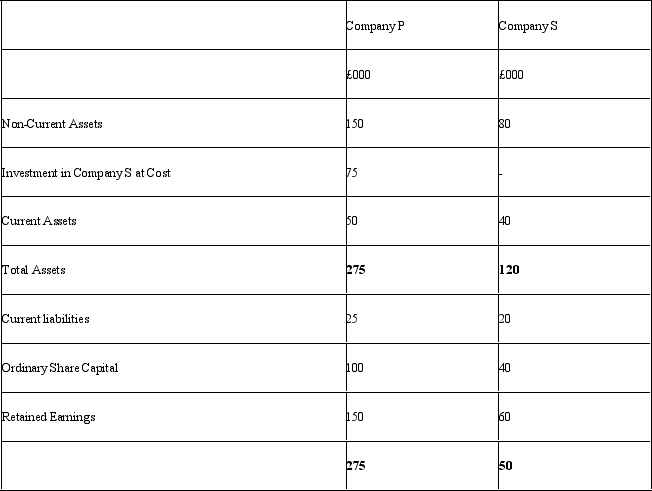

The Statements of Financial Position for company P and company S are shown below:

At the time of the acquisition,the net asset value of S was £50,000.This was £40,000 share capital plus £10,000 retained earnings.If company P owns 75% of Company S,then the consolidated Statement of Financial Position will include,as well as 100% of the assets and liabilities of both companies:

A) £50,000 which represents 100% of the goodwill on the purchase of S

B) £37,500 which represents 75% of the goodwill on the purchase of S

C) £25,000 which represents 50% of the goodwill on the purchase of S

D) Nothing

At the time of the acquisition,the net asset value of S was £50,000.This was £40,000 share capital plus £10,000 retained earnings.If company P owns 75% of Company S,then the consolidated Statement of Financial Position will include,as well as 100% of the assets and liabilities of both companies:

A) £50,000 which represents 100% of the goodwill on the purchase of S

B) £37,500 which represents 75% of the goodwill on the purchase of S

C) £25,000 which represents 50% of the goodwill on the purchase of S

D) Nothing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 25 في هذه المجموعة.

فتح الحزمة

k this deck