Deck 2: International Monetary Arrangements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/52

العب

ملء الشاشة (f)

Deck 2: International Monetary Arrangements

1

Special Drawing Rights are issued by

A) The International Monetary Fund

B) The United Nations

C) The World Bank

D) The Central banks of England, Japan, and the United States

A) The International Monetary Fund

B) The United Nations

C) The World Bank

D) The Central banks of England, Japan, and the United States

The International Monetary Fund

2

Which of the following exchange rate systems is the least flexible?

A) Free floating

B) Managed floating.

C) Currency board

D) Fixed peg arrangement

A) Free floating

B) Managed floating.

C) Currency board

D) Fixed peg arrangement

Currency board

3

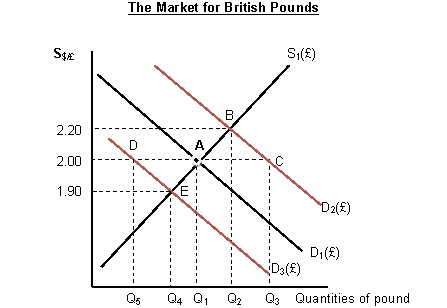

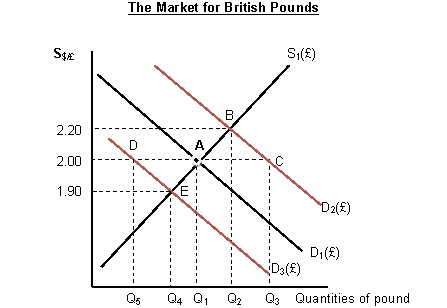

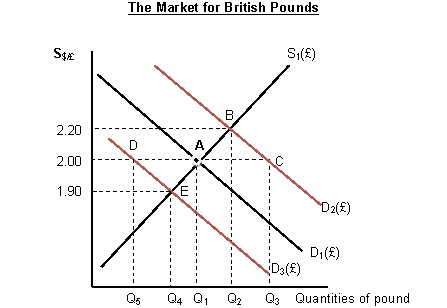

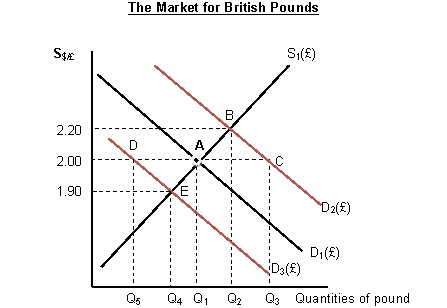

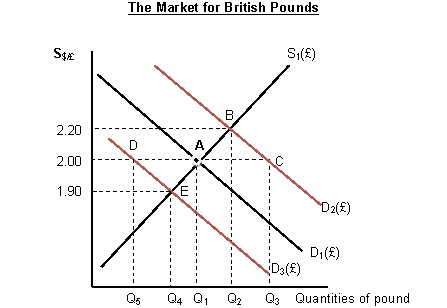

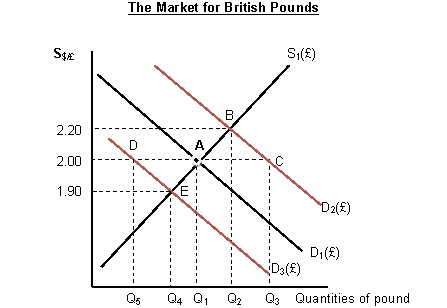

Use the graph below to answer questions 9-11.

Figure 2.3:

Refer to Figure 2.3.Suppose that the spot exchange rate of British pound is $2.00 per pound.Suppose that the U.S.decreases its imports from the U.K.Under flexible exchange rate system,the Bank of England will:

A) let the British pound appreciates

B) let the British pound depreciates

C) sell pounds and buy dollars in foreign exchange market.

D) sell dollars and buy pounds in foreign exchange market.

Figure 2.3:

Refer to Figure 2.3.Suppose that the spot exchange rate of British pound is $2.00 per pound.Suppose that the U.S.decreases its imports from the U.K.Under flexible exchange rate system,the Bank of England will:

A) let the British pound appreciates

B) let the British pound depreciates

C) sell pounds and buy dollars in foreign exchange market.

D) sell dollars and buy pounds in foreign exchange market.

let the British pound depreciates

4

The gold standard was an example of:

A) An optimum currency area

B) A commodity money standard

C) A standard currency board

D) All of the above

A) An optimum currency area

B) A commodity money standard

C) A standard currency board

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

5

When the United States suspended the convertibility of dollars into gold in 1971,this lead to:

A) The collapse of the Bretton Woods system

B) Creation of the regional currency boards

C) Creation of the International Monetary Fund

D) All of the above

A) The collapse of the Bretton Woods system

B) Creation of the regional currency boards

C) Creation of the International Monetary Fund

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

6

Small nations whose trade and financial relationships are mainly with a single partner tend to utilize:

A) pegged exchange rates

B) free floating exchange rates

C) managed floating exchange rates

D) target bands - pegged exchange rates

A) pegged exchange rates

B) free floating exchange rates

C) managed floating exchange rates

D) target bands - pegged exchange rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following statements is correct about the SDR?

A) The SDR is a fixed exchange rate system created by the IMF.

B) The SDR was designed to replace the U.S. dollar.

C) The SDR is the most popular trading currency among traders.

D) The SDR is used as international reserve assets between central banks.

A) The SDR is a fixed exchange rate system created by the IMF.

B) The SDR was designed to replace the U.S. dollar.

C) The SDR is the most popular trading currency among traders.

D) The SDR is used as international reserve assets between central banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

8

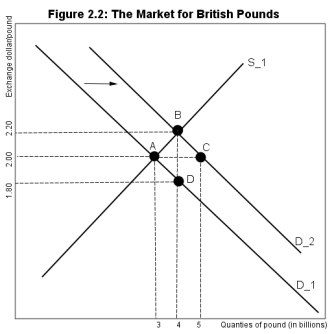

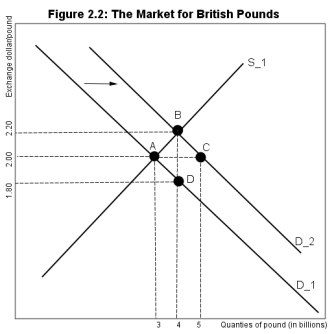

Referring to Figure 2.2,an increase in the demand for British goods by the U.S.importers has led to pressure on the pound to appreciate against the dollar.If the Bank of England wants to maintain a peg of $2.0/pound,what currency should it sell and how much?

A) Pounds, 1 billion

B) Pounds, 2 billion

C) Dollars, 1 billion

D) Dollars, 2 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following could be considered a cause of the collapse of the Bretton Woods system?

A) The existence of Japanese budget deficits offset currency reserves as the yen become increasingly overvalued.

B) The United States gold stock became increasingly too small to meet foreign dollar liabilities.

C) Countries in Europe devalued currencies to increase export competitiveness.

D) In order to meet reserve requirements imposed by the IMF, France and Germany mandated private holders of gold to purchase U.S. dollars destabilizing the U.S. dollar to gold peg.

A) The existence of Japanese budget deficits offset currency reserves as the yen become increasingly overvalued.

B) The United States gold stock became increasingly too small to meet foreign dollar liabilities.

C) Countries in Europe devalued currencies to increase export competitiveness.

D) In order to meet reserve requirements imposed by the IMF, France and Germany mandated private holders of gold to purchase U.S. dollars destabilizing the U.S. dollar to gold peg.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

10

__________ occurs when a country abolishes its own currency and adopts the currency of some other country.

A) Demonetization

B) Dollarization

C) A currency swap

D) A currency board

A) Demonetization

B) Dollarization

C) A currency swap

D) A currency board

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

11

Suppose that under a gold standard,that the price of gold in the United States is $450 per ounce and the price of gold in the United Kingdom is 200£ per ounce.The exchange rate is thus:

A) 2.25£ per dollar

B) $0.45 per pound.

C) $2.25 per pound.

D) 1£ per dollar.

A) 2.25£ per dollar

B) $0.45 per pound.

C) $2.25 per pound.

D) 1£ per dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

12

Consider the market for Chinese currency yuan.Suppose that the initial equilibrium exchange rate was $0.125 per one yuan.Then assume that American consumers like Chinese products more than before.If China's central bank wants to peg the exchange rate at its initial level $0.125 per yuan,the central bank will have to

A) buy yuan and sell dollar.

B) sell yuan and buy dollar.

C) buy yuan and buy dollar.

D) sell yuan and sell dollar.

A) buy yuan and sell dollar.

B) sell yuan and buy dollar.

C) buy yuan and buy dollar.

D) sell yuan and sell dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

13

Use the graph below to answer questions 9-11.

Figure 2.3:

Refer to Figure 2.3.Suppose that the U.K agreed to peg its currency against the U.S.dollar at $2.00 per pound during the Bretton Woods system.Assume that the U.S.decreases its imports from the U.K.As a result,the Bank of England would have to:

A) let the British pound appreciates

B) let the British pound depreciates

C) sell pounds and buy dollars in foreign exchange market.

D) sell dollars and buy pounds in foreign exchange market.

Figure 2.3:

Refer to Figure 2.3.Suppose that the U.K agreed to peg its currency against the U.S.dollar at $2.00 per pound during the Bretton Woods system.Assume that the U.S.decreases its imports from the U.K.As a result,the Bank of England would have to:

A) let the British pound appreciates

B) let the British pound depreciates

C) sell pounds and buy dollars in foreign exchange market.

D) sell dollars and buy pounds in foreign exchange market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following economies has adopted a "currency board" exchange rate system?

A) Malaysia

B) South Korea

C) China

D) Hong Kong

A) Malaysia

B) South Korea

C) China

D) Hong Kong

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

15

Referring to Figure 2.2,an increase in the demand for British goods by the U.S.importers has led to pressure on the pound to appreciate against the dollar.If the Bank of England wishes to intervene to maintain a peg of $2.0/pound,what distance represents that intervention?

A) A to B

B) B to A

C) A to C

D) B to C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

16

Use the graph below to answer questions 9-11.

Figure 2.3:

Refer to Figure 2.3.Suppose that the U.K agreed to peg its currency against the U.S.dollar at $2.00 per pound during the Bretton Woods system.Assume that the U.S.increases its imports from the U.K.As a result,the Bank of England would have to:

A) let the British pound appreciates

B) let the British pound depreciates

C) sell pounds and buy dollars in foreign exchange market.

D) sell dollars and buy pounds in foreign exchange market.

Figure 2.3:

Refer to Figure 2.3.Suppose that the U.K agreed to peg its currency against the U.S.dollar at $2.00 per pound during the Bretton Woods system.Assume that the U.S.increases its imports from the U.K.As a result,the Bank of England would have to:

A) let the British pound appreciates

B) let the British pound depreciates

C) sell pounds and buy dollars in foreign exchange market.

D) sell dollars and buy pounds in foreign exchange market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following statement is correct?

A) Since 1974, the major industrial countries have operated under a system of fixed exchange rates based on the gold standard.

B) Many developing nations with low inflation rates have pegged their currencies to the U.S. dollar as a way of allowing modest increases in domestic inflation rates.

C) Large industrial nations with diversified economies and small trade sectors have generally pegged their currencies to one of the world's key currencies.

D) Today, fixed exchange rates are used primarily by small, developing countries that tie their currencies to a key currency such as the U.S. dollar.

A) Since 1974, the major industrial countries have operated under a system of fixed exchange rates based on the gold standard.

B) Many developing nations with low inflation rates have pegged their currencies to the U.S. dollar as a way of allowing modest increases in domestic inflation rates.

C) Large industrial nations with diversified economies and small trade sectors have generally pegged their currencies to one of the world's key currencies.

D) Today, fixed exchange rates are used primarily by small, developing countries that tie their currencies to a key currency such as the U.S. dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

18

The Bretton Woods agreement required that each country,other than the U.S.,fix the value of its currency in terms of an:

A) Ounce of gold

B) Common currency

C) Commodity basket

D) Anchor currency

A) Ounce of gold

B) Common currency

C) Commodity basket

D) Anchor currency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

19

If Mexico fully dollarizes its economy,it agrees to:

A) print pesos only to finance deficits of its national government.

B) use the U.S. dollar alongside its peso to finance transactions.

C) have the U.S. Treasury be in charge of its tax collections.

D) replace pesos with U.S. dollars in its economy.

A) print pesos only to finance deficits of its national government.

B) use the U.S. dollar alongside its peso to finance transactions.

C) have the U.S. Treasury be in charge of its tax collections.

D) replace pesos with U.S. dollars in its economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

20

The Bretton Woods Agreement of 1944 established a monetary system based on:

A) Special Drawing Rights and managed floating exchange rates

B) Special Drawing Rights and adjustable pegged exchange rates

C) gold and managed floating exchange rates

D) gold and adjustable pegged exchange rates

A) Special Drawing Rights and managed floating exchange rates

B) Special Drawing Rights and adjustable pegged exchange rates

C) gold and managed floating exchange rates

D) gold and adjustable pegged exchange rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

21

The U.S.dollar is called a ________ because it is often used as a medium of exchange in international markets.

A) Transit currency

B) Main currency

C) Reserve currency

D) Target currency

A) Transit currency

B) Main currency

C) Reserve currency

D) Target currency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

22

Countries use reserve currencies as an international unit of account,a medium of exchange,and a store of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

23

The gold standard eliminates the possibility of a balance of payments disequilibrium by:

A) Changing the peg value of the currency to an ounce of gold.

B) Inflating prices in countries with net inflows of gold and deflating prices in countries with net outflows.

C) Shifting trade to the British pound.

D) Encouraging the discovery of gold deposits.

A) Changing the peg value of the currency to an ounce of gold.

B) Inflating prices in countries with net inflows of gold and deflating prices in countries with net outflows.

C) Shifting trade to the British pound.

D) Encouraging the discovery of gold deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

24

The geographic area that would maximize economic benefits by keeping the exchange rate fixed within the area is a an:

A) Trade union

B) Currency board

C) Trade bloc

D) Optimal currency area

A) Trade union

B) Currency board

C) Trade bloc

D) Optimal currency area

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following exchange rate systems is best suited for a country with trade concentrated with one major country?

A) Fixed peg

B) Currency standard

C) Free floating

D) Managed floating

A) Fixed peg

B) Currency standard

C) Free floating

D) Managed floating

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

26

Countries with floating exchange rates tend to have large,closed economies and trade largely with a single foreign country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

27

Countries with a floating exchange rate tend have what features?

I.Trade concentrated with a single country

II.Similar inflation rates with trading partners

III.Large,closed economies

IV.Trade diversified across many countries

A) I only

B) I and II

C) III and IV

D) II, III, and IV

I.Trade concentrated with a single country

II.Similar inflation rates with trading partners

III.Large,closed economies

IV.Trade diversified across many countries

A) I only

B) I and II

C) III and IV

D) II, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

28

Perfect mobility of factors of production is a requirement for

A) Spatially concentrated trade zones

B) Optimal currency areas

C) Commodity money standards

D) Free floating exchange rates

A) Spatially concentrated trade zones

B) Optimal currency areas

C) Commodity money standards

D) Free floating exchange rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

29

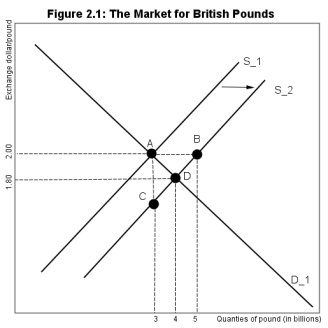

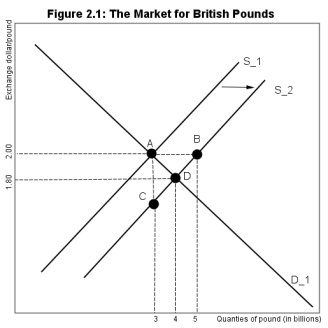

Referring to Figure 2.1,the pound per dollar exchange rate starts at 2.00.Assume that an increase in the taste for U.S.imports by U.K.residents leads to a shift in the supply of pounds.If the Bank of England wishes to intervene by buying pounds to restore the peg of $2.0/pound,what distance represents that intervention?

A) A to B

B) B to A

C) A to D

D) D to B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

30

Following the breakdown of the Bretton Woods system,the major currency countries:

A) Moved to the gold standard

B) Temporarily pegged currencies to the Swiss Franc

C) Moved to a free market floating arrangement

D) Introduced silver as an alternative backing to the dollar

A) Moved to the gold standard

B) Temporarily pegged currencies to the Swiss Franc

C) Moved to a free market floating arrangement

D) Introduced silver as an alternative backing to the dollar

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

31

What exchange rate is maintained with a central rate that is frequently adjusted?

A) Fixed Peg

B) Currency board

C) Managed floating

D) Crawling bands

A) Fixed Peg

B) Currency board

C) Managed floating

D) Crawling bands

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

32

The European Monetary System was established in 1979 to form a common currency for all member countries to be managed by a European Central Bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

33

Arrange the following currency exchange systems from the one with least independent monetary policy to the most independent monetary policy.

I.Horizontal bands

II.Currency board

III.Fixed peg

IV.Free floating

A) Free floating, horizontal bands, fixed peg, currency board

B) Currency board, horizontal bands, free floating, fixed peg

C) Currency board, fixed peg, horizontal bands, free floating

D) Horizontal bands, currency board, free floating, fixed peg

I.Horizontal bands

II.Currency board

III.Fixed peg

IV.Free floating

A) Free floating, horizontal bands, fixed peg, currency board

B) Currency board, horizontal bands, free floating, fixed peg

C) Currency board, fixed peg, horizontal bands, free floating

D) Horizontal bands, currency board, free floating, fixed peg

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

34

The International Monetary Fund was created at the beginning of the:

A) Bretton Woods system

B) Gold standard

C) Interwar period

D) Smithsonian agreement

A) Bretton Woods system

B) Gold standard

C) Interwar period

D) Smithsonian agreement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

35

During the gold standard,national money supplies were constrained by:

A) International treaties

B) The growth of trade

C) Commodity indexes

D) The growth of the stock of gold

A) International treaties

B) The growth of trade

C) Commodity indexes

D) The growth of the stock of gold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

36

Referring to Figure 2.1,the pound per dollar exchange rate starts at 2.00.Assume that an increase in the taste for U.S.imports by U.K.residents leads to a shift in the supply of pounds.How many pounds will the Bank of England need to purchase to restore the exchange of 2.00?

A) 0.2 billion

B) 1 billion

C) 2 billion

D) 4 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

37

Seigniorage is the system where the dominant money producer limits the supply of money to leverage foreign currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following currencies do not exist in physical form?

A) U.S. Dollar

B) Swiss Franc

C) Euro

D) Special Drawing Rights

A) U.S. Dollar

B) Swiss Franc

C) Euro

D) Special Drawing Rights

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

39

Destabilizing speculation is the process where

A) In a free floating exchange system, speculators cause wide fluctuations to the exchange rate.

B) In a fixed peg exchange system, speculators hold foreign reserves too long and destabilize the peg.

C) In a free floating exchange system, the International Monetary Fund is forced to issue Special Drawing Rights.

D) In a fixed peg exchange system, speculators sell all holdings of Special Drawing Rights.

A) In a free floating exchange system, speculators cause wide fluctuations to the exchange rate.

B) In a fixed peg exchange system, speculators hold foreign reserves too long and destabilize the peg.

C) In a free floating exchange system, the International Monetary Fund is forced to issue Special Drawing Rights.

D) In a fixed peg exchange system, speculators sell all holdings of Special Drawing Rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

40

The International Monetary Fund was created to assist countries with balance of payment difficulties and monitor an adjustable peg system with the U.S.dollar as the anchor currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

41

What is seignorage?

A) The reward for holding foreign currency reserves.

B) The difference between printing money and the return to the assets it acquires.

C) The special interest rates associated with Special Drawing Rights.

D) The process of adopting a currency peg.

A) The reward for holding foreign currency reserves.

B) The difference between printing money and the return to the assets it acquires.

C) The special interest rates associated with Special Drawing Rights.

D) The process of adopting a currency peg.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

42

An example of a fixed exchange rate was the gold standard.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

43

Consider the following scenario.The Swiss franc is operating under a managed float exchange system.Under this system,what actions can the Swiss central bank take to influence the current exchange?

A) Purchase or sell foreign currencies to bring the currency in line with its desired value

B) Announce a new target exchange rates

C) Commit to a new fixed rate against the current basket of foreign currencies

D) Set guidelines for when inflationary pressures will force action on money supply changes

A) Purchase or sell foreign currencies to bring the currency in line with its desired value

B) Announce a new target exchange rates

C) Commit to a new fixed rate against the current basket of foreign currencies

D) Set guidelines for when inflationary pressures will force action on money supply changes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

44

The introduction of the Bretton Woods system meant that the Federal Reserve had to take an active role in managing currency exchange rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

45

Why was the European Monetary System established?

A) To establish a common currency the euro.

B) To peg all member currencies to the Swiss Franc.

C) To maintain small exchange rate fluctuation among member countries.

D) To unite the coal and steel workers in France and Germany

A) To establish a common currency the euro.

B) To peg all member currencies to the Swiss Franc.

C) To maintain small exchange rate fluctuation among member countries.

D) To unite the coal and steel workers in France and Germany

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

46

A managed floating exchange rate is a market determined exchange system as long as rates stay between target zones as mandated by legislative commitments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

47

A pegged exchange rate is:

I.Fixed to a currency or basket of currencies

II.Responds to indicators such as inflation differentials

III.May require intervention to maintain the target pegged rate

A) I only

B) III only

C) I and III

D) I, II, and III

I.Fixed to a currency or basket of currencies

II.Responds to indicators such as inflation differentials

III.May require intervention to maintain the target pegged rate

A) I only

B) III only

C) I and III

D) I, II, and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

48

An example of an optimal currency area would be

A) United States

B) Southeast Asia

C) Latin America

D) Both A and C

A) United States

B) Southeast Asia

C) Latin America

D) Both A and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

49

In general,the smaller the country is,the more likely it is to peg its exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

50

Consider the following scenario.The Swiss franc is fixed to the U.S.dollar.Market pressures lead to a move away from the peg.Which of the following can be used to restore the previous peg?

A) The Swiss central bank can use a commodity such as gold to back the previous peg.

B) The Swiss government can lower domestic prices to offset import pressures.

C) Allow the exchange by the market and in the long run the peg will be restored.

D) The Swiss central bank can purchase or sell U.S. dollars.

A) The Swiss central bank can use a commodity such as gold to back the previous peg.

B) The Swiss government can lower domestic prices to offset import pressures.

C) Allow the exchange by the market and in the long run the peg will be restored.

D) The Swiss central bank can purchase or sell U.S. dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

51

What exchange rate system allows for periodic intervention without fixing to any other foreign currency?

A) Free floating

B) Horizontal band

C) Crawling peg

D) Dollarization

A) Free floating

B) Horizontal band

C) Crawling peg

D) Dollarization

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

52

"Dollarization" and currency boards are examples of exchange rate systems that provide relatively large independent monetary policy as compared to floating exchange rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck