Deck 5: Trade Restrictions: Tariffs

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/57

العب

ملء الشاشة (f)

Deck 5: Trade Restrictions: Tariffs

1

Suppose,to produce $200,000 worth of finished cloth in the US,textile producers import $150,000 of raw materials.The raw materials are imported duty free.However,the US has imposed a 5% nominal tariff on imports of finished cloth.What is the effective rate of protection enjoyed by the domestic cloth producers in the US?

A)20%

B)10%

C)5%

D)6%

A)20%

B)10%

C)5%

D)6%

A

2

____________ have historically been the most important and most used type of trade restriction.

A)Quotas

B)Domestic content requirements

C)Import tariffs

D)Export tariffs

A)Quotas

B)Domestic content requirements

C)Import tariffs

D)Export tariffs

C

3

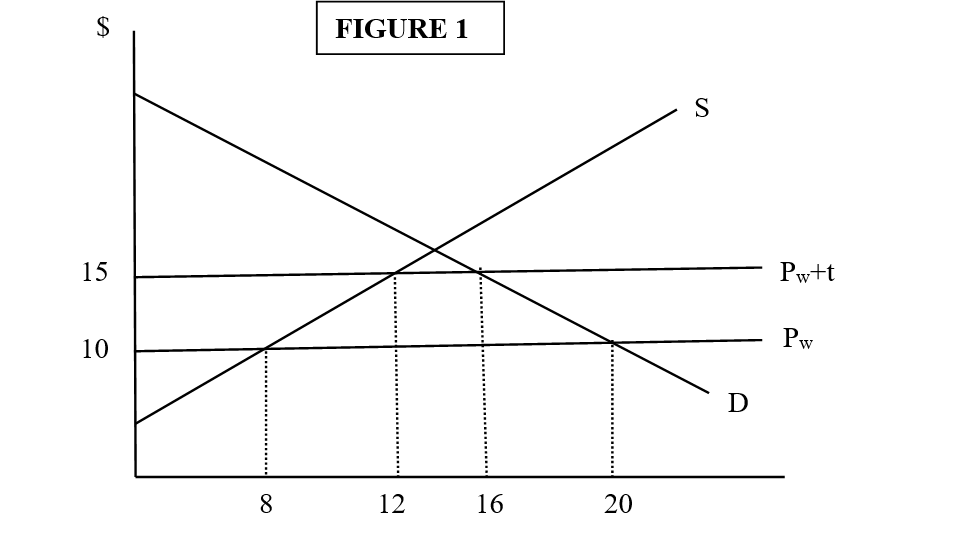

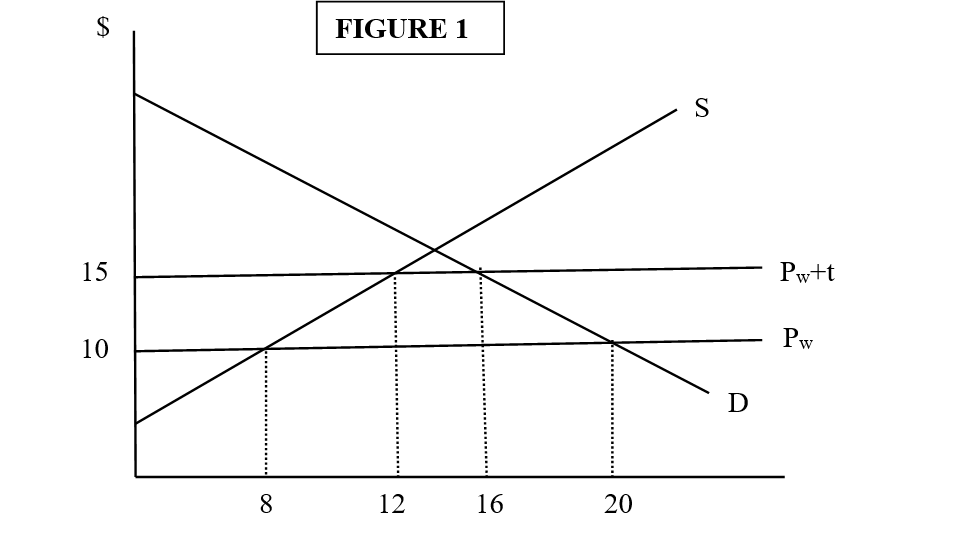

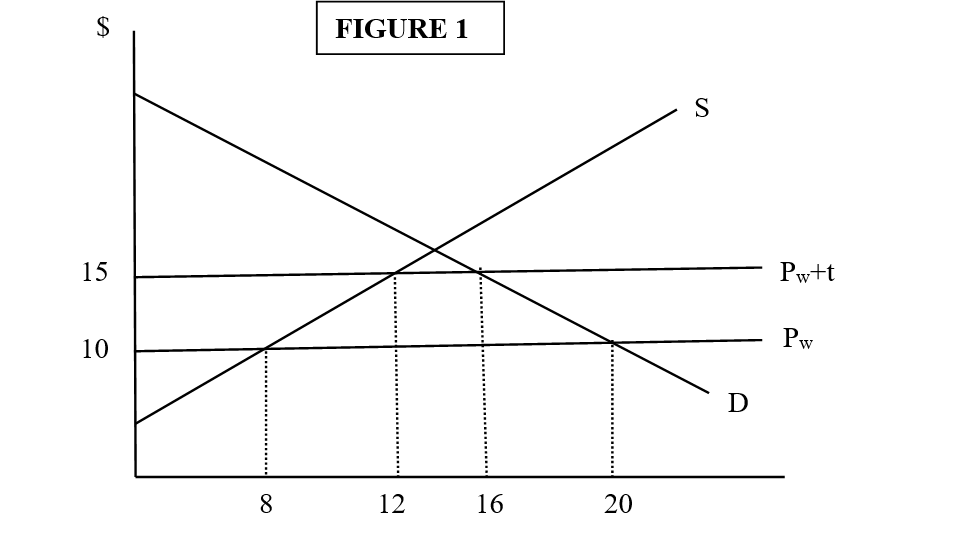

Use Figure 1 to answer questions

-In Figure 1,if the free trade price was $10 and a $5 tariff was imposed on the imports,then how much is the consumption effect of the tariff (how much will the consumers loose as a result of the tariff)?

A)10

B)20

C)50

D)90

-In Figure 1,if the free trade price was $10 and a $5 tariff was imposed on the imports,then how much is the consumption effect of the tariff (how much will the consumers loose as a result of the tariff)?

A)10

B)20

C)50

D)90

90

4

The decline in import volumes as a result of the imposition of a tariff is attributed to the :

A)production effect of a tariff

B)trade effect of a tariff

C)revenue effect of a tariff

D)consumption effect of a tariff

A)production effect of a tariff

B)trade effect of a tariff

C)revenue effect of a tariff

D)consumption effect of a tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

5

A(n)____________ is a duty levied on a commodity as it leaves a nation and is transported to another nation..

A)specific tariff

B)import tariff

C)export tariff

D)ad valorem tariff

A)specific tariff

B)import tariff

C)export tariff

D)ad valorem tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

6

The _______________ is expressed as a fixed sum per physical unit of the traded commodity.

A)ad valorem tariff

B)export tariff

C)specific tariff

D)compound tariff

A)ad valorem tariff

B)export tariff

C)specific tariff

D)compound tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

7

A tariff that is a combination of an ad valorem and a specific tariff is a(n):

A)import tariff

B)export tariff

C)compound tariff

D)optimum tariff

A)import tariff

B)export tariff

C)compound tariff

D)optimum tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

8

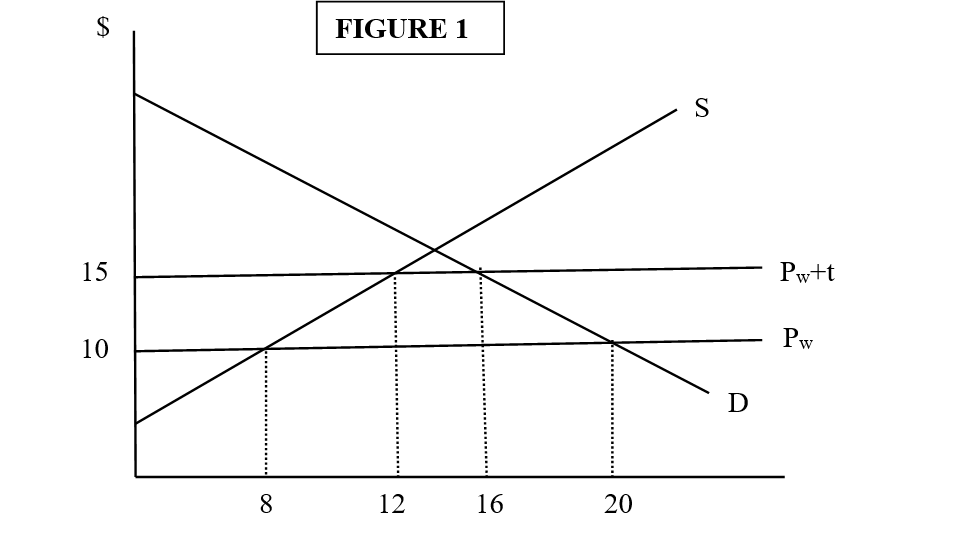

Use Figure 1 to answer questions

-In Figure 1,if the free trade price was $10 and a $5 tariff was imposed on the imports,then how much is the deadweight loss to the society?

A)10

B)20

C)50

D)90

-In Figure 1,if the free trade price was $10 and a $5 tariff was imposed on the imports,then how much is the deadweight loss to the society?

A)10

B)20

C)50

D)90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

9

The reduction in domestic quantity demanded,and therefore reduction in consumer surplus,of a commodity resulting from the increase in its price due to a tariff is attributed to the:

A)production effect of a tariff

B)trade effect of a tariff

C)revenue effect of a tariff

D)consumption effect of a tariff

A)production effect of a tariff

B)trade effect of a tariff

C)revenue effect of a tariff

D)consumption effect of a tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

10

When a specific tariff is used instead of an ad valorem tariff:

A)higher priced goods enjoy a greater degree of protection than cheaper goods

B)domestic consumers are encouraged to purchase cheaper goods

C)cheaper goods enjoy a greater degree of protection than higher priced goods

D)domestic producers enjoy a greater degree of protection in periods of rising prices

A)higher priced goods enjoy a greater degree of protection than cheaper goods

B)domestic consumers are encouraged to purchase cheaper goods

C)cheaper goods enjoy a greater degree of protection than higher priced goods

D)domestic producers enjoy a greater degree of protection in periods of rising prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

11

What type of tariff is prohibited by the U.S.Constitution?

A)export tariff

B)ad valorem tariff

C)compound tariff

D)import tariff

A)export tariff

B)ad valorem tariff

C)compound tariff

D)import tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

12

__________ constitute the regulations governing a nation's international trade.

A)Tariff policies

B)Commercial policies

C)Non-tariff barriers

D)Globalization policies

A)Tariff policies

B)Commercial policies

C)Non-tariff barriers

D)Globalization policies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

13

The loss of surplus associated with the expansion of domestic production resulting from the tariff is attributed to the:

A)production effect of a tariff

B)terms of trade effect of a tariff

C)revenue effect of a tariff

D)consumption effect of a tariff

A)production effect of a tariff

B)terms of trade effect of a tariff

C)revenue effect of a tariff

D)consumption effect of a tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

14

A tax of 5% per unit of imported wine would be an example of a(n):

A)compound tariff

B)specific tariff

C)export tariff

D)ad valorem tariff

A)compound tariff

B)specific tariff

C)export tariff

D)ad valorem tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

15

Since the restrictions and regulations that a nation imposes on international trade deal with the nation's trade or commerce,they are generally known as _________________.

A)tariff policies

B)commercial policies

C)non-tariff barriers

D)globalization policies

A)tariff policies

B)commercial policies

C)non-tariff barriers

D)globalization policies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

16

A(n)__________ is a tax or duty levied on the traded commodity as it enters a nation.

A)ad valorem tariff

B)compound tariff

C)optimum tariff

D)import tariff

A)ad valorem tariff

B)compound tariff

C)optimum tariff

D)import tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

17

A defining characteristic of a "small nation" relative to a "large nation" with respect to identifying the welfare effects of a tariff is that the:

A)small nation has less land mass than a large nation

B)small nation cannot influence world price of imported goods as much as a large nation can

C)small nation has a smaller trade deficit than the large nation

D)small nation has a smaller population compared to a large nation

A)small nation has less land mass than a large nation

B)small nation cannot influence world price of imported goods as much as a large nation can

C)small nation has a smaller trade deficit than the large nation

D)small nation has a smaller population compared to a large nation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

18

With free trade,the small nation will import all its commodities at what price level?

A)the world market price

B)the domestic price plus the compound tariff

C)the small nation's autarky price

D)the large nation's autarky price

A)the world market price

B)the domestic price plus the compound tariff

C)the small nation's autarky price

D)the large nation's autarky price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

19

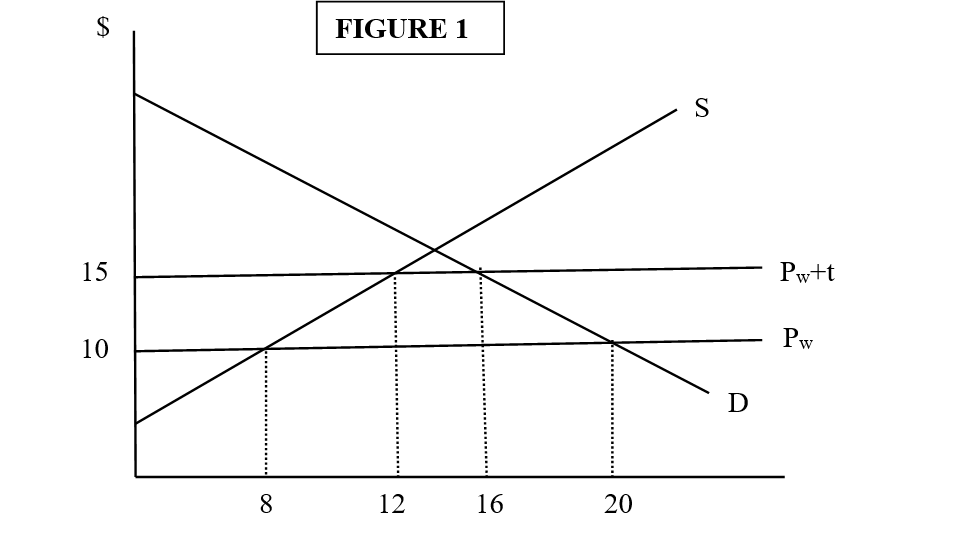

Use Figure 1 to answer questions

-In Figure 1,if the free trade price was $10 and a $5 tariff was imposed on the imports,then how much is the gain in producer surplus?

A)20

B)40

C)50

D)80

-In Figure 1,if the free trade price was $10 and a $5 tariff was imposed on the imports,then how much is the gain in producer surplus?

A)20

B)40

C)50

D)80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

20

A tariff expressed as a fixed percentage of the value of a traded commodity is a(n):

A)export tariff

B)ad valorem tariff

C)compound tariff

D)import tariff

A)export tariff

B)ad valorem tariff

C)compound tariff

D)import tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

21

The reduction in the price of the import commodity that results when a large nation imposes an import tariff is attributed to the ____________ and constitutes a __________ of welfare for the nation.

A)consumption effect of the tariff,loss

B)terms of trade effect of the tariff,loss

C)protective effect,gain

D)terms of trade effect,gain

A)consumption effect of the tariff,loss

B)terms of trade effect of the tariff,loss

C)protective effect,gain

D)terms of trade effect,gain

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

22

______________ represents payment that is made above the amount required for the producers to be willing to supply a specific amount of a commodity to the market.

A)Producer surplus

B)Consumer surplus

C)Revenue effect

D)Import tariff

A)Producer surplus

B)Consumer surplus

C)Revenue effect

D)Import tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

23

In a large nation,who bears the burden of the import tariff?

A)domestic import-competing producers

B)foreign producers of the imported good

C)domestic consumers only

D)domestic consumers and foreign producers of the imported good

A)domestic import-competing producers

B)foreign producers of the imported good

C)domestic consumers only

D)domestic consumers and foreign producers of the imported good

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

24

A tariff redistributes income in a small nation from the _____________ to the _____________ of the commodity.

A)domestic producers,domestic consumers

B)government,domestic producers

C)domestic consumers,domestic producers

D)domestic consumers,government

A)domestic producers,domestic consumers

B)government,domestic producers

C)domestic consumers,domestic producers

D)domestic consumers,government

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

25

The consumption component of the deadweight loss in a small nation arises with a tariff because

A)the tariff causes consumers to consume less of the good than they normally would have without the tariff.

B)the tariff causes consumers to consume more of the good than they normally would have without the tariff.

C)consumers continue to consume the same quantity of the good as before the tariff,but they receive less utility than before the tariff

D)the marginal utility of the consumption of each good is less after the imposition of the tariff than before,resulting in a loss of consumer surplus

A)the tariff causes consumers to consume less of the good than they normally would have without the tariff.

B)the tariff causes consumers to consume more of the good than they normally would have without the tariff.

C)consumers continue to consume the same quantity of the good as before the tariff,but they receive less utility than before the tariff

D)the marginal utility of the consumption of each good is less after the imposition of the tariff than before,resulting in a loss of consumer surplus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

26

The more _____________ the demand or supply curves of the imported commodity in the nation imposing the tariff,the more likely it is that a large nation will experience a net welfare gain from the tariff.

A)inelastic

B)elastic

C)linear

D)nonlinear

A)inelastic

B)elastic

C)linear

D)nonlinear

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

27

When a 10 percent tariff is imposed on commodity X,there is a(n)____________ in consumer surplus and a(n)_________ in producer surplus.

A)decrease,increase

B)increase,decrease

C)decrease,decrease

D)increase,increase

A)decrease,increase

B)increase,decrease

C)decrease,decrease

D)increase,increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

28

A defining characteristic of a "large nation" relative to a "small nation" with respect to identifying the welfare effects of a tariff is that the:

A)large nation is sufficiently powerful to influence the world market price of the imported commodity

B)large nation has a higher per capita income than the small nation

C)large nation is a monopsonist in the market for the imported commodity

D)large nation has a higher marginal rate of substitution for the imported commodity than the small nation

A)large nation is sufficiently powerful to influence the world market price of the imported commodity

B)large nation has a higher per capita income than the small nation

C)large nation is a monopsonist in the market for the imported commodity

D)large nation has a higher marginal rate of substitution for the imported commodity than the small nation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

29

The effects attributed to the decline in the volume of trade in a large nation,considered independently of changes in terms of trade,will

A)reduce the nation's welfare

B)increase the nation's welfare

C)not change the nation's welfare

D)have ambiguous outcomes with respect to gain or loss of welfare

A)reduce the nation's welfare

B)increase the nation's welfare

C)not change the nation's welfare

D)have ambiguous outcomes with respect to gain or loss of welfare

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

30

Graphically,how is the consumer surplus measured?

A)the area above the demand curve

B)the area under the demand curve and above the market price

C)the area above the supply curve and below the market price

D)the area under the supply curve

A)the area above the demand curve

B)the area under the demand curve and above the market price

C)the area above the supply curve and below the market price

D)the area under the supply curve

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

31

The imposition of tariffs on imports results in deadweight losses for the home country.These losses consist of the:

A)Revenue effect and production effect

B)Consumption effect and production effect

C)Redistributive effect and consumption effect

D)Terms of trade effect and consumption effect

A)Revenue effect and production effect

B)Consumption effect and production effect

C)Redistributive effect and consumption effect

D)Terms of trade effect and consumption effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

32

The production component of the deadweight loss in a small nation arises with a tariff because

A)some domestic resources are transferred from the production of an import-competing commodity to the more efficient use in the production of an exportable good.

B)some domestic resources are transferred from a more efficient use to less efficient production of an importable commodity

C)domestic producers are unhappy with the imposition of the tariff,and therefore refuse to produce a higher level of output.

D)domestic producers allocate fewer resources into the production of the import-competing good than they should based on their costs.

A)some domestic resources are transferred from the production of an import-competing commodity to the more efficient use in the production of an exportable good.

B)some domestic resources are transferred from a more efficient use to less efficient production of an importable commodity

C)domestic producers are unhappy with the imposition of the tariff,and therefore refuse to produce a higher level of output.

D)domestic producers allocate fewer resources into the production of the import-competing good than they should based on their costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

33

The difference between what consumers would be willing to pay for each unit of commodity and what they actually pay for that unit is called ____________.

A)producer surplus

B)consumer surplus

C)reservation price

D)import tariff

A)producer surplus

B)consumer surplus

C)reservation price

D)import tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

34

The resulting increase in producer surplus made possible by the imposition of a tariff is often referred to as the:

A)tax effect of a tariff

B)revenue effect of a tariff

C)subsidy effect of a tariff

D)consumption effect of a tariff

A)tax effect of a tariff

B)revenue effect of a tariff

C)subsidy effect of a tariff

D)consumption effect of a tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

35

The change in welfare attributed to the terms of trade effect,when considered independently of changes in welfare associated with the decline in trade volume,will:

A)reduce the nation's welfare

B)increase the nation's welfare

C)not change the nation's welfare

D)have ambiguous outcomes with respect to gain or loss of welfare

A)reduce the nation's welfare

B)increase the nation's welfare

C)not change the nation's welfare

D)have ambiguous outcomes with respect to gain or loss of welfare

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

36

________________ refers to the real loss in a small nation's welfare due to inefficiencies in production and distortions in consumption resulting from the imposition of a tariff.

A)Deadweight loss

B)Protection loss

C)Consumer loss

D)Economic loss

A)Deadweight loss

B)Protection loss

C)Consumer loss

D)Economic loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

37

When a large nation imposes an import tariff,the volume of trade will ___________,and the nation's terms of trade will ____________.

A)increase,improve

B)decline,deteriorate

C)decline,improve

D)increase,remain unchanged

A)increase,improve

B)decline,deteriorate

C)decline,improve

D)increase,remain unchanged

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

38

In a small nation,the portion of the loss in consumer surplus found by multiplying the tariff amount by the volume of imports is __________________.

A)Transferred to the foreign exporter of the good

B)earned by the producers

C)accrued by the government

D)not transferred to another party and therefore considered a loss to the nation.

A)Transferred to the foreign exporter of the good

B)earned by the producers

C)accrued by the government

D)not transferred to another party and therefore considered a loss to the nation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

39

The revenue collected by the government as a result of an imposed tariff is attributed to the:

A)production effect of a tariff

B)trade effect of a tariff

C)revenue effect of a tariff

D)consumption effect of a tariff

A)production effect of a tariff

B)trade effect of a tariff

C)revenue effect of a tariff

D)consumption effect of a tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

40

The ______________ is the tariff that maximizes the positive difference between gains associated with improvement in terms of trade and the losses resulting from reduction in the volume of trade.

A)optimum tariff

B)prohibitive tariff

C)nominal tariff

D)absolute tariff

A)optimum tariff

B)prohibitive tariff

C)nominal tariff

D)absolute tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

41

A(n)_____________ is a tariff sufficiently high to stop all international trade so that the nation returns to autarky.

A)optimum tariff

B)prohibitive tariff

C)nominal tariff

D)ad valorem

A)optimum tariff

B)prohibitive tariff

C)nominal tariff

D)ad valorem

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

42

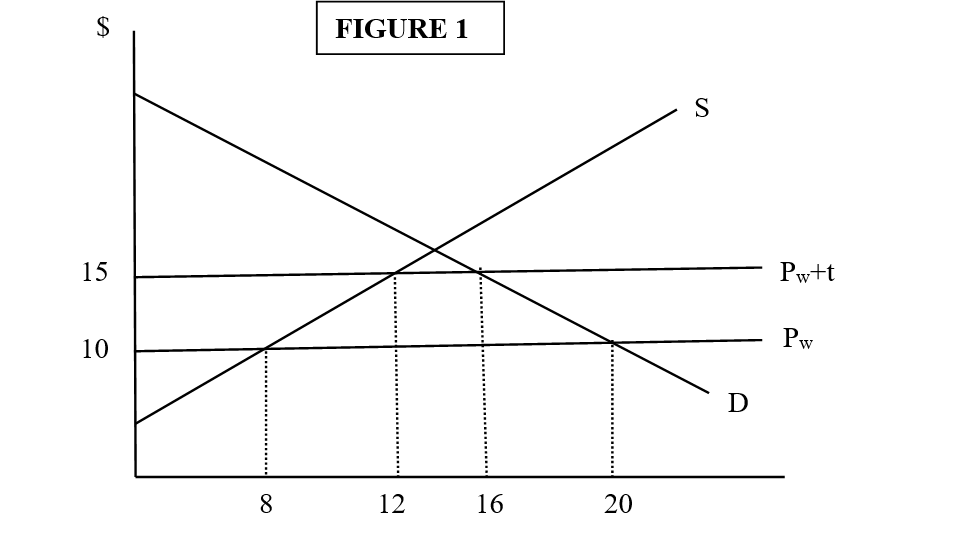

In question 54 can you find out the deadweight loss to the society,the loss to the consumers and the gain of the producers and also the amount of the tariff revenue generated from the tariff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

43

A small nation is not large enough to affect the world price of the commodity it is importing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

44

"Using international trade theory,we can unambiguously state that the imposition of a tariff imposes net losses to the imposing nation." Is this statement true or false? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

45

The domestic demand for good X is Dd =165-35P.The domestic supply of good X is Sd = 5+5P.If imports of good X are available in the world market at Px = 2,how much will be the domestic production,quantity consumed and import under free trade?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

46

The nominal tariff indicates how much the price of the final commodity decreases as a result of a tariff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

47

The rate of effective protection is equal to the nominal tariff imposed on the imported product only if the domestic producer utilizes imported components in the production of the good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

48

A quota is a tax imposed on a traded commodity when it crosses a national boundary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

49

A specific tariff of $10 would provide the same level of protection for a $100 good as for a $200 good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

50

A(n)______________ is a tariff calculated on the price of a final commodity.

A)optimum tariff

B)prohibitive tariff

C)nominal tariff

D)terms of trade effect on a tariff

A)optimum tariff

B)prohibitive tariff

C)nominal tariff

D)terms of trade effect on a tariff

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

51

Graphically,consumer surplus is measured by the area between the supply curve and the market price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

52

In a small nation,the revenue effect of a tariff accrues to the foreign producer of the imported good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

53

The domestic demand for good X is Dd =165-35P.The domestic supply of good X is Sd = 5+5P.Imports of good X are available in the world market at Px = 2.If the country imposes a specific tariff of t = 1 per unit imported X,what are the equilibrium price,quantity produced domestically,quantity consumed domestically,and quantity imported?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

54

The effective rate of protection of a tariff is important to producers because it indicates how much the domestic import-competing producer of the good can increase the value added portion of their final product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

55

Consumer surplus is the difference between what consumers are willing to pay for a commodity and the price they actually pay for the commodity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

56

In industrialized nations,a lower tariff is often imposed on raw materials than the final commodity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck

57

Country A is a large country in the market for Widgets.The following table summarizes two hypothetical situations in country A's domestic market for widgets.The first column depicts the situation with a $1000 tariff on imported widgets.The second column represents the situation with no tariff (that is,under free trade).Assume that transportation costs are zero and that demand and supply curves are linear.

Find out if there will be net welfare gain for the large country due to the imposition of the tariff.

Find out if there will be net welfare gain for the large country due to the imposition of the tariff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 57 في هذه المجموعة.

فتح الحزمة

k this deck