Deck 13: Partnerships

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/91

العب

ملء الشاشة (f)

Deck 13: Partnerships

1

Dana and Emile allocate 2/3 of the profits and losses to Dana and 1/3 to Emile.The net profit of the firm is $20,000.The journal entry to close the Income summary will include:

A) credit to Emile, capital for $13,333.

B) credit to Income summary for $13,333.

C) debit to Income summary for $20,000.

D) debit to Dana, capital for $6667.

A) credit to Emile, capital for $13,333.

B) credit to Income summary for $13,333.

C) debit to Income summary for $20,000.

D) debit to Dana, capital for $6667.

C

2

Andre,Beau and Caroline share profits and losses of their partnership as 2:3:6.If the net profit is $1,200,000,calculate the profit share of Caroline.

A) $327,273

B) $218,182

C) $109,091

D) $654,545

A) $327,273

B) $218,182

C) $109,091

D) $654,545

D

3

Felix and Ian allocate 2/5 of the profits and losses to Felix and 3/5 to Ian.The net profit of the firm is $40,000.The journal entry to close the Income summary will include:

A) credit to Income summary for $40,000.

B) debit to Felix, capital for $16,000.

C) credit to Ian, capital for $24,000.

D) debit to Felix, capital for $24,000.

A) credit to Income summary for $40,000.

B) debit to Felix, capital for $16,000.

C) credit to Ian, capital for $24,000.

D) debit to Felix, capital for $24,000.

C

4

Which of the following statements is TRUE about a limited partnership?

A) The partners all share equally in the profit or losses of the partnership.

B) The general partner takes on greater liability than the limited partners.

C) In a limited partnership, all partners are considered to be limited partners.

D) The general partner has first claim on the profit of the partnership.

A) The partners all share equally in the profit or losses of the partnership.

B) The general partner takes on greater liability than the limited partners.

C) In a limited partnership, all partners are considered to be limited partners.

D) The general partner has first claim on the profit of the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

5

In a partnership business,George has an ownership of 57% and Ben has an ownership of 43%.For developing the business,they purchased equipment for $9800.George contributes a sum of $6800 and Ben makes a contribution of $3000 on 1 July.Based on the information provided,which of the following is true of the partnership balance sheet?

A) George, capital will increase by $9800 and Ben, capital will remain unchanged.

B) Both George, capital and Ben, capital will increase by $9800.

C) George, capital will increase by $6800 and Ben, capital will increase by $3000.

D) George, capital will increase by $5586 and Ben, capital will increase by $4214.

A) George, capital will increase by $9800 and Ben, capital will remain unchanged.

B) Both George, capital and Ben, capital will increase by $9800.

C) George, capital will increase by $6800 and Ben, capital will increase by $3000.

D) George, capital will increase by $5586 and Ben, capital will increase by $4214.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

6

Steve and Roger allocate 2/3 of the profits and losses to Steve and 1/3 to Roger.If the net profit of the firm is $29,000,calculate the share of Roger's profit.

A) $24,167

B) $19,333

C) $29,000

D) $9667

A) $24,167

B) $19,333

C) $29,000

D) $9667

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

7

Arlene Dominic is a partner in a partnership,and at 1 July 2017,her capital balance was $42 000.On the same day,she made withdrawals of $4 000 from the partnership.What entry is made on the partnership books?

A) Debit A. Dominic, capital; credit Cash

B) Debit Cash; credit A. Dominic, drawings

C) Debit A. Dominic, drawings; credit Cash

D) Debit Cash; credit A. Dominic, capital

A) Debit A. Dominic, capital; credit Cash

B) Debit Cash; credit A. Dominic, drawings

C) Debit A. Dominic, drawings; credit Cash

D) Debit Cash; credit A. Dominic, capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

8

Rodriguez and Ying start a partnership business on 1 July 2017.Rodriguez brings in cash worth $3600,furniture with a current market value of $46,000 and computer equipment.The computer equipment cost $43,000 in 2014 and has an accumulated depreciation of $25,000.The current market value of the computer equipment is $15,000.At what value should the computer equipment be recorded in the books of the partnership firm?

A) $43,000

B) $25,000

C) $15,000

D) $18,000

A) $43,000

B) $25,000

C) $15,000

D) $18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

9

Bill and Bob share profits of their partnership firm in the ratio of 4:1.If the net profit of the firm is $25,000,calculate the share of Bill's profit.

A) $25,000

B) $15,000

C) $20,000

D) $5000

A) $25,000

B) $15,000

C) $20,000

D) $5000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

10

A partnership agreement includes all of the following EXCEPT the:

A) provisions for the issue of ordinary shares.

B) method of sharing profits and losses.

C) procedures for liquidating the partnership.

D) name and initial investment of each partner.

A) provisions for the issue of ordinary shares.

B) method of sharing profits and losses.

C) procedures for liquidating the partnership.

D) name and initial investment of each partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

11

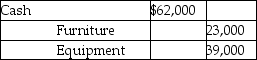

Rodriguez and Ying start a partnership business on 1 July 2017.Rodriguez brings in cash worth $3500,furniture with a current market value of $50,000,payables with a current market value of $16,000 and equipment with a current market value of $22,000.Which of the following is the correct journal entry to record the above transaction?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following BEST describes the term mutual agency?

A) When all partners of a partnership share profits equally

B) When each partner has the authority to act on behalf of the partnership

C) When each partner has the power to withdraw on the investment accounts of the others

D) When only one partner has the authority to contractually bind the partnership

A) When all partners of a partnership share profits equally

B) When each partner has the authority to act on behalf of the partnership

C) When each partner has the power to withdraw on the investment accounts of the others

D) When only one partner has the authority to contractually bind the partnership

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

13

Tim and Michelle have decided to form a partnership.Tim contributes $7800 cash and $2100 in inventory.While journalising this transaction:

A) Tim, capital will be debited for $9900.

B) Tim, capital will be credited for $9900.

C) Tim, capital will be debited for $5700 and Michelle, capital will be debited for $3600.

D) Tim, capital will be credited for $5700 and Michelle, capital will be credited for $3600.

A) Tim, capital will be debited for $9900.

B) Tim, capital will be credited for $9900.

C) Tim, capital will be debited for $5700 and Michelle, capital will be debited for $3600.

D) Tim, capital will be credited for $5700 and Michelle, capital will be credited for $3600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

14

When a partnership is formed and a partner contributes property,plant and equipment,it is recorded on the books of the partnership at its net book value-the original cost less accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is NOT a characteristic of a partnership?

A) The partners have limited liability for the debts of the partnership.

B) The partnership pays no separate business profit tax.

C) Each partner has a separate capital account.

D) Each partner has mutual agency.

A) The partners have limited liability for the debts of the partnership.

B) The partnership pays no separate business profit tax.

C) Each partner has a separate capital account.

D) Each partner has mutual agency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

16

Albert,Billy and Cathy share profits and losses of their partnership as 1:4:3.If the net profit is $70,000,calculate the profit share of Albert.

A) $17,500

B) $35,000

C) $8750

D) $26,250

A) $17,500

B) $35,000

C) $8750

D) $26,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

17

Each partner in a partnership:

A) shares in a jointly held capital account.

B) pays his or her share of the partnership business profit tax.

C) has co-ownership of the assets of the partnership.

D) has limited liability for the debts of the business.

A) shares in a jointly held capital account.

B) pays his or her share of the partnership business profit tax.

C) has co-ownership of the assets of the partnership.

D) has limited liability for the debts of the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

18

Steve owns 62% and Mark owns 38% of a partnership business.For developing the business,they purchased equipment for $10,300.The current market value of the equipment at the time of purchase was $9800.At the time of the balance sheet preparation,depreciation of $220 was incurred.Based on the information provided,which of the following is true of the partnership balance sheet?

A) The Equipment account will be debited at $9800 on the date of purchase.

B) The Equipment account will be debited at $9580 on the date of purchase.

C) The Equipment account will be debited at $10,080 on the date of purchase.

D) The Equipment account will be debited at $10,300 on the date of purchase.

A) The Equipment account will be debited at $9800 on the date of purchase.

B) The Equipment account will be debited at $9580 on the date of purchase.

C) The Equipment account will be debited at $10,080 on the date of purchase.

D) The Equipment account will be debited at $10,300 on the date of purchase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

19

Sasha and Michelle form a partnership.Sasha contributes $19,000 cash and inventory with a current market value of $4000.While journalising this transaction:

A) Inventory will be debited for $4000.

B) Inventory will be credited for $2400.

C) Inventory will be credited for $4000.

D) Inventory will be debited for $2400.

A) Inventory will be debited for $4000.

B) Inventory will be credited for $2400.

C) Inventory will be credited for $4000.

D) Inventory will be debited for $2400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

20

In a partnership business,Jack has an ownership of 55% and Teresa has an ownership of 45%.For developing the business,Jack contributed $7500 and Teresa contributed $2800 on 1 July.Which of the following is true of this scenario?

A) Individual contribution of $7500 by Jack and $2800 by Teresa will be recorded.

B) Either the total contribution of $10,300 or the contribution in the ownership ratio will be recorded.

C) Only the total contribution of $10,300 will be recorded.

D) 55% of Jack's contribution and 45% of Teresa's contribution will be recorded.

A) Individual contribution of $7500 by Jack and $2800 by Teresa will be recorded.

B) Either the total contribution of $10,300 or the contribution in the ownership ratio will be recorded.

C) Only the total contribution of $10,300 will be recorded.

D) 55% of Jack's contribution and 45% of Teresa's contribution will be recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

21

Partnerships always share profit equally among all partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

22

When a new person purchases the partnership interest of an existing partner,which of the following is TRUE?

A) The newly admitted partner will assume the same capital balance of the old partner regardless of the amount paid.

B) The partnership will record either a gain or a loss if the amount paid is higher or lower than the existing partner's capital account balance.

C) The amount paid for the partnership interest is recorded on the partnership books.

D) The purchase price is determined by the balance in the existing partner's capital account.

A) The newly admitted partner will assume the same capital balance of the old partner regardless of the amount paid.

B) The partnership will record either a gain or a loss if the amount paid is higher or lower than the existing partner's capital account balance.

C) The amount paid for the partnership interest is recorded on the partnership books.

D) The purchase price is determined by the balance in the existing partner's capital account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

23

If the partnership agreement does NOT specifically state how profits and losses are to be distributed,then the partners will share profits and losses equally.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following statements describes the situation in which a new person pays a bonus to buy into a partnership?

A) The new person pays a greater amount into the partnership than his or her proportionate share of the total capital.

B) The new partner pays in to the partnership an amount that is less than his or her proportionate share of the total capital.

C) The new person pays certain amounts directly to the existing partners in addition to his or her payment to the partnership.

D) The new partner pays in an amount equal to the average capital balances of the existing partners.

A) The new person pays a greater amount into the partnership than his or her proportionate share of the total capital.

B) The new partner pays in to the partnership an amount that is less than his or her proportionate share of the total capital.

C) The new person pays certain amounts directly to the existing partners in addition to his or her payment to the partnership.

D) The new partner pays in an amount equal to the average capital balances of the existing partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

25

Adam,Bill and Charlie are partners.The profit and rule sharing rule between them is 3:4:4,with Bill getting the most and Adam getting the least.The partnership incurs a net loss of $18,000.While closing the Income summary:

A) Charlie, capital will be debited for $6545.

B) Adam, capital will be debited for $6545.

C) Income summary will be credited for $6545.

D) Adam, capital will be credited for $6545.

A) Charlie, capital will be debited for $6545.

B) Adam, capital will be debited for $6545.

C) Income summary will be credited for $6545.

D) Adam, capital will be credited for $6545.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

26

On 1 July,Herb Block purchased the partnership interest of James Steinfort for $40 000.The balance in Steinfort's capital account prior to the purchase was $32 000.How will this transaction be reflected on the partnership's books?

A) Partnership will debit cash for $8 000 and credit Block's account for $40 000.

B) Partnership will close out Steinfort's capital account for $32 000 and will open up a new capital account for Block in the same amount.

C) No entries will be made by the partnership because the purchase is a personal transaction between the two persons and does not involve the partnership books.

D) Partnership will close out Steinfort's account for $32 000, open Block's account for $40 000 and record a gain of $8 000.

A) Partnership will debit cash for $8 000 and credit Block's account for $40 000.

B) Partnership will close out Steinfort's capital account for $32 000 and will open up a new capital account for Block in the same amount.

C) No entries will be made by the partnership because the purchase is a personal transaction between the two persons and does not involve the partnership books.

D) Partnership will close out Steinfort's account for $32 000, open Block's account for $40 000 and record a gain of $8 000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

27

Keith and Jim are partners.Keith has a capital balance of $54,000 and Jim has a capital balance of $32,000.Jim sells $11,000 of his ownership to Bill.Which of the following is true of the journal entry to admit Bill?

A) Bill, capital will be debited for $21,000.

B) Bill, capital will be credited for $11,000.

C) Jim, capital will be debited for $21,000.

D) Jim, capital will be credited for $11,000.

A) Bill, capital will be debited for $21,000.

B) Bill, capital will be credited for $11,000.

C) Jim, capital will be debited for $21,000.

D) Jim, capital will be credited for $11,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

28

Farrell and Jimmy enter into a partnership agreement on 1 May 2017.Farrell contributes $70,000 and Jimmy contributes $150,000 as their capital contributions.They decide to share profits and losses in the ratio of their respective capital account balances.The net profit for the year ended 31 December 2017 is $80,000.Which of the following is the correct journal entry to record the allocation of profit?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

29

David,Chris and John started off a partnership firm on 31 July 2017.They decided to share profits equally,but also inserted a clause in the partnership agreement whereby any loss suffered would be borne in the ratio 4:4:1.For the year ended 31 December 2017,the firm earned a net profit of $41,000.However,for the year ended 31 December 2018,the firm incurred a loss of $61,000.Assuming that John had an initial capital contribution of $43,000 and made no further withdrawals,what is the balance of John's Capital account as of 31 December 2018? (Assume that none of the partners made any further contributions to their capital accounts.)

A) $56,667

B) $43,000

C) $36,111

D) $49,889

A) $56,667

B) $43,000

C) $36,111

D) $49,889

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

30

Dominic and Morgan are partners.Dominic has a capital balance of $340,000 and Morgan has a capital balance of $225,000.Morgan sells $95,000 of his ownership to Lance.Which of the following is true of the items in balance sheet?

A) The total equity remains unchanged.

B) Assets will decrease by $95,000.

C) The total equity decreases by $95,000.

D) Assets will increase by $95,000.

A) The total equity remains unchanged.

B) Assets will decrease by $95,000.

C) The total equity decreases by $95,000.

D) Assets will increase by $95,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

31

Alex,Brad and Carl are partners.The profit and rule sharing rule between them is 5:2:2 in the alphabetical order.The partnership incurs a net loss of $100,000.Before preparing the closing journal entry the:

A) Alex, capital account will have a credit balance of $55,556.

B) Alex, capital account will have a debit balance of $55,556.

C) Income summary account will have a debit balance of $100,000.

D) Carl, capital account will have a debit balance of $22,222.

A) Alex, capital account will have a credit balance of $55,556.

B) Alex, capital account will have a debit balance of $55,556.

C) Income summary account will have a debit balance of $100,000.

D) Carl, capital account will have a debit balance of $22,222.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

32

When a new person is admitted into a partnership by investing assets in the partnership at book value,the new person:

A) pays cash directly to existing partners based on the market value of the partnership's assets.

B) transfers assets to the partnership which are equal in value to the existing partners' capital balances (no bonus).

C) pays cash directly to the existing partners in amounts equal to their respective capital balances.

D) transfers assets to the partnership which are equal in value to the market value of the partnership's assets.

A) pays cash directly to existing partners based on the market value of the partnership's assets.

B) transfers assets to the partnership which are equal in value to the existing partners' capital balances (no bonus).

C) pays cash directly to the existing partners in amounts equal to their respective capital balances.

D) transfers assets to the partnership which are equal in value to the market value of the partnership's assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

33

Farrell and Jimmy enter into a partnership agreement on 1 May 2017.Farrell contributes $50,000 and Jimmy contributes $160,000 as their capital contributions.They decide to share profits and losses in the ratio of their respective capital account balances.The net profit for the year ended 31 December 2017 is $60,000.Which of the following amounts should be credited to Jimmy's capital account?

A) $45,714

B) $60,000

C) $14,286

D) $50,000

A) $45,714

B) $60,000

C) $14,286

D) $50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

34

Keith and Jim formed a partnership business.The partnership incurs a net loss of $5000 and the partners agreed to share the losses equally.The entry to close the net loss will:

A) decrease Jim, capital by $5000.

B) decrease Keith, capital by $2500.

C) debit Income summary by $5000.

D) increase Jim, capital by $2500.

A) decrease Jim, capital by $5000.

B) decrease Keith, capital by $2500.

C) debit Income summary by $5000.

D) increase Jim, capital by $2500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

35

Nancy and Betty enter into a partnership agreement whereby they undertake to share profits according to the following rules:

(a)Nancy and Betty will receive a salary of $1400 and $11,500 respectively.

(b)The next allocation is based on 10% of the partner's capital balances.

(c)Any remaining profit or loss is to be borne completely by Betty.

The partnership's profit for the first year is $40,000.Nancy's capital balance is $88,000 and Betty's capital balance is $12,000 as at the end of the year.Calculate the share of profit/loss to be borne by Betty.

A) $1000

B) $10,200

C) $29,800

D) $9000

(a)Nancy and Betty will receive a salary of $1400 and $11,500 respectively.

(b)The next allocation is based on 10% of the partner's capital balances.

(c)Any remaining profit or loss is to be borne completely by Betty.

The partnership's profit for the first year is $40,000.Nancy's capital balance is $88,000 and Betty's capital balance is $12,000 as at the end of the year.Calculate the share of profit/loss to be borne by Betty.

A) $1000

B) $10,200

C) $29,800

D) $9000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

36

Adam,Bill and Charlie are partners.The profit and rule sharing rule between them is 2:6:2,with Bill getting the most and Adam getting the least.The partnership incurs a net loss of $76,000.While closing the Income summary:

A) Adam, capital will be credited for $45,600.

B) Income summary will be debited for $76,000.

C) Charlie, capital will be credited for $45,600.

D) Adam, capital will be debited for $15,200.

A) Adam, capital will be credited for $45,600.

B) Income summary will be debited for $76,000.

C) Charlie, capital will be credited for $45,600.

D) Adam, capital will be debited for $15,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

37

Nancy and Betty enter into a partnership agreement whereby they undertake to share profits according to the following rules:

(a)Nancy and Betty will receive a salary of $9500 and $23,500 respectively.

(b)The next allocation is based on 30% of the partner's capital balances.

(c)Any remaining profit or loss is to be borne completely by Betty.

The partnership's net loss for the first year is $30,000.Nancy's capital balance is $109,000 and Betty's capital balance is $10,000 as at the end of the year.Calculate the share of profit (loss)to be borne by Nancy.

A) $42,200

B) $9500

C) $(12,200)

D) $(32,700)

(a)Nancy and Betty will receive a salary of $9500 and $23,500 respectively.

(b)The next allocation is based on 30% of the partner's capital balances.

(c)Any remaining profit or loss is to be borne completely by Betty.

The partnership's net loss for the first year is $30,000.Nancy's capital balance is $109,000 and Betty's capital balance is $10,000 as at the end of the year.Calculate the share of profit (loss)to be borne by Nancy.

A) $42,200

B) $9500

C) $(12,200)

D) $(32,700)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

38

Kenny and Jeff formed a partnership business.During the year,Kenny and Jeff withdrew $25,000 and $18,000,respectively.Which of the following will be included in the journal entry to record the withdrawals?

A) credit to Kenny, drawings for $21,500

B) credit to Jeff, drawings for $18,000

C) debit to Kenny, drawings for $25,000

D) debit to Jeff, drawings for $21,500

A) credit to Kenny, drawings for $21,500

B) credit to Jeff, drawings for $18,000

C) debit to Kenny, drawings for $25,000

D) debit to Jeff, drawings for $21,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

39

Floyd and Merriam start a partnership business on 12 June 2019.Their capital account balances as of 31 December 2020 stood as follows:

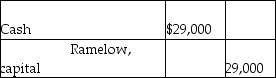

Floyd agrees to sell off half of his share to Ramelow in exchange for $26,000 cash.Which of the following is the correct journal entry in the books of the firm for the above transfer of interest?

A)

B)

C)

D)

Floyd agrees to sell off half of his share to Ramelow in exchange for $26,000 cash.Which of the following is the correct journal entry in the books of the firm for the above transfer of interest?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

40

When a partnership makes profit and the accounts are closed,the partner capital accounts will be credited with their designated shares of the profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

41

When one person purchases the partnership interest of a partner,a new partnership agreement will have to be created.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

42

Allan and Ralph are partners.Allan has a capital balance of $89,000 and Ralph has a capital balance of $73,000.Carol invested $61,000 to acquire an ownership interest of $50,000.Which of the following is true of the impact of the transaction on the balance sheet?

A) Assets will increase and equity will decrease.

B) Both assets and equity will increase.

C) Assets will increase and the equity will remain unchanged.

D) Asset increases and the equity will remain unchanged.

A) Assets will increase and equity will decrease.

B) Both assets and equity will increase.

C) Assets will increase and the equity will remain unchanged.

D) Asset increases and the equity will remain unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

43

When a new person wishes to be admitted to an existing partnership on an equal profit-sharing basis,the amount the new person must invest to be admitted is not necessarily tied to the total capital of the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

44

When a new partner pays a bonus to join an existing partnership,the bonus amount is recorded as a gain on the partnership books.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

45

When a new person wishes to join an existing partnership,the difference between what the new partner contributes and the value the new partner receives in capital is either a bonus to the existing partners or a bonus to the new partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

46

When a new person wishes to be admitted into an existing partnership that consists of two partners and wishes to obtain an equal share (1/3 share)of the new partnership,the amount that the new person must invest is required to be the average of the capital balances of the existing partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

47

When a new partner pays a bonus to join an existing partnership,the bonus amount is the amount in excess of his or her proportionate share of the total capital of the new partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

48

Ruby and Anita are partners.Ruby has a capital balance of $230,000 and Anita has a capital balance of $200,000.Denis invests in a building with a current market value of $150,000 to acquire an interest in the new partnership.Which of the following is true of the journal entry to record this transaction? (Assume no bonus to any partner.)

A) Building will be debited for $150,000 and Denis, capital will be credited for $150,000.

B) Ruby, capital and Anita, capital will be debited for $75,000 each and Denis, capital will be credited for $150,000.

C) Ruby, capital and Anita, capital will be credited for $75,000 each and Denis, capital will be debited for $150,000.

D) Building will be debited for $150,000, Ruby, capital and Anita, capital will be credited for $75,000 each.

A) Building will be debited for $150,000 and Denis, capital will be credited for $150,000.

B) Ruby, capital and Anita, capital will be debited for $75,000 each and Denis, capital will be credited for $150,000.

C) Ruby, capital and Anita, capital will be credited for $75,000 each and Denis, capital will be debited for $150,000.

D) Building will be debited for $150,000, Ruby, capital and Anita, capital will be credited for $75,000 each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

49

Floyd and Merriam start a partnership business on 12 June 2019.Their capital account balances as of 31 December 2020 stood as follows:

They agreed to admit Ramelow into the business for a one-fifth interest in the new partnership.He had to bring in a cash contribution of $29,000 for the same.Assuming that Floyd and Merriam shared profits and losses in the ratio 3:1 before the admission of Ramelow,which of the following is the correct journal entry to record the above admission?

A)

B)

C)

D)

They agreed to admit Ramelow into the business for a one-fifth interest in the new partnership.He had to bring in a cash contribution of $29,000 for the same.Assuming that Floyd and Merriam shared profits and losses in the ratio 3:1 before the admission of Ramelow,which of the following is the correct journal entry to record the above admission?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

50

Rex and Sandy are partners.Rex has a capital balance of $380,000 and Sandy has a capital balance of $250,000.Marcus invests a building worth $200,000 to acquire interest in the new partnership.How much will be the partnership share of Marcus after he makes the investment? (Assume no bonus to any partner.)

A) 30.1%

B) 24.1%

C) 45.8%

D) 21.7%

A) 30.1%

B) 24.1%

C) 45.8%

D) 21.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

51

Keith and Jim are partners.Keith has a capital balance of $50,000 and Jim has a capital balance of $38,000.Bill invested a building worth $30,000 to the partnership for an ownership interest of 20%.How much is the total bonus for the existing partners?

A) $30,000

B) $6400

C) $15,000

D) $8000

A) $30,000

B) $6400

C) $15,000

D) $8000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

52

Keith and Jim are partners.Keith has a capital balance of $51,000 and Jim has a capital balance of $37,000.Bill invested $27,000 to acquire an ownership interest of 30%.Which of the following statements is true of this transaction?

A) Keith and Jim received a bonus of $2550 each.

B) Keith and Jim received a bonus of $3750 each.

C) Bill received a bonus of $5100.

D) Bill received a bonus of $7500.

A) Keith and Jim received a bonus of $2550 each.

B) Keith and Jim received a bonus of $3750 each.

C) Bill received a bonus of $5100.

D) Bill received a bonus of $7500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

53

A new partner may be admitted to a partnership without dissolving the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

54

Sarah and Jane formed a partnership with capital of $200,000 and $126,000,respectively.Peter contributed $85,000 to acquire an ownership interest of 12% in the new partnership.How much is the total bonus for the existing partners?

A) $35,680

B) $49,320

C) $85,000

D) $17,840

A) $35,680

B) $49,320

C) $85,000

D) $17,840

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

55

Shaun and Rick are partners.Shaun has a capital balance of $9000 and Rick has a capital balance of $7000.Edwin invests a building with a current market value of $5000 to acquire an interest in the new partnership.Which of the following is true of the effect of the transaction on the balance sheet? (Assume no bonus to any partner.)

A) Both assets and equity will decrease by $5000.

B) Both assets and equity will increase by $5000.

C) Both assets and liabilities will increase by $5000.

D) Both assets and liabilities will decrease by $5000.

A) Both assets and equity will decrease by $5000.

B) Both assets and equity will increase by $5000.

C) Both assets and liabilities will increase by $5000.

D) Both assets and liabilities will decrease by $5000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

56

Floyd and Merriam start a partnership business on 12 June 2019.Their capital account balances as of 31 December 2020 stood as follows:

They agreed to admit Ramelow into the business for a one-third interest in the new partnership.He had to bring in a cash contribution of $24,000 for the same.Which of the following is the correct capital account balance of Ramelow after he enters the business?

A) $24,000

B) $26,666

C) $47,000

D) $29,333

They agreed to admit Ramelow into the business for a one-third interest in the new partnership.He had to bring in a cash contribution of $24,000 for the same.Which of the following is the correct capital account balance of Ramelow after he enters the business?

A) $24,000

B) $26,666

C) $47,000

D) $29,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

57

Anna and Naomi are partners.Anna has a capital balance of $49,000 and Naomi has a capital balance of $43,000.Gary invested $27,000 to acquire an ownership interest of $23,000.Which of the following is true of the partnership journal entry to record the receipt of Gary's contribution? (Assume the existing partners equally divide the bonus.)

A) Cash is credited for $23,000 and Gary, capital is debited for $23,000.

B) Cash is debited for $23,000 and Gary, capital is credited for $23,000.

C) Cash is credited for $27,000 and Gary, capital is debited for $23,000.

D) Cash is debited for $27,000 and Gary, capital is credited for $23,000.

A) Cash is credited for $23,000 and Gary, capital is debited for $23,000.

B) Cash is debited for $23,000 and Gary, capital is credited for $23,000.

C) Cash is credited for $27,000 and Gary, capital is debited for $23,000.

D) Cash is debited for $27,000 and Gary, capital is credited for $23,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

58

If a new person wishes to be admitted to a partnership with two existing partners,and the existing partners accept,then the new person is automatically entitled to share in one-third the profits of the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

59

When one person purchases the partnership interest of a partner,the cash is paid directly to the existing partner,not to the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

60

Whenever there is a change in the mix of partners,the old partnership is dissolved and a new one begins.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

61

In the process of liquidation,a partnership firm sells its non-cash assets of a book value of $46,000,for $76,000.Which of the following will be included in the entry to record the sale of assets at liquidation?

A) Gain on disposal will be debited by $30,000.

B) Gain on disposal will be credited by $76,000.

C) Gain on disposal will be debited by $76,000.

D) Gain on disposal will be credited by $30,000.

A) Gain on disposal will be debited by $30,000.

B) Gain on disposal will be credited by $76,000.

C) Gain on disposal will be debited by $76,000.

D) Gain on disposal will be credited by $30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

62

When a partner withdraws from the partnership for a settlement that is less than his or her capital balance,the difference between the exiting partner's capital and the settlement amount is added to the capital of the remaining partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

63

Mathew,Patrick and Robin and have capital balances of $78,000,$125,000 and $90,000,respectively.As per the partnership agreement,Mathew gets a profit share of 2/9; Patrick gets 4/9; and Robin gets 3/9.Partnership agrees to pay $62,000 as final settlement to Mathew.How much bonus will Robin receive as a result of this transaction?

A) $8889

B) $6857

C) $7111

D) $9143

A) $8889

B) $6857

C) $7111

D) $9143

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

64

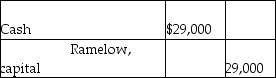

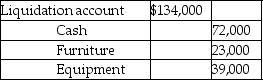

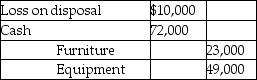

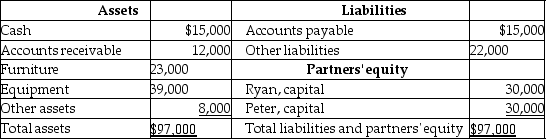

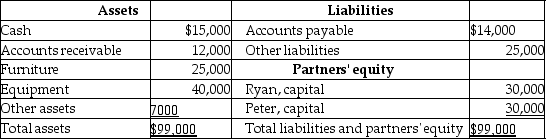

The balance sheet of Ryan and Peter firm as at 30 June 2017 is given below.

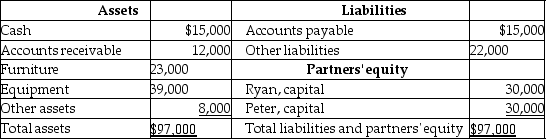

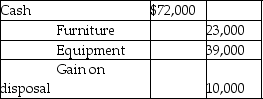

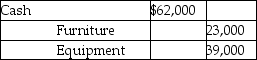

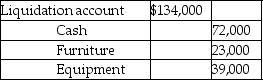

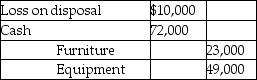

Ryan and Peter share profits in the ratio 3:2.They have decided to liquidate the partnership with immediate effect.They sold the furniture and equipment for $72,000.Which of the following is the correct journal entry for the sale transaction?

A)

B)

C)

D)

Ryan and Peter share profits in the ratio 3:2.They have decided to liquidate the partnership with immediate effect.They sold the furniture and equipment for $72,000.Which of the following is the correct journal entry for the sale transaction?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

65

Gary,Peter and Chris and have capital balances of $27,000,$43,000,and $31,000,respectively.As per the partnership agreement,Gary gets a profit share of 2/9; Peter gets 4/9; and Chris gets 3/9.The partnership agrees to pay $21,000 as the final settlement to Gary.How much bonus does Peter receive as a result of this transaction?

A) $2667

B) $3429

C) $2571

D) $3333

A) $2667

B) $3429

C) $2571

D) $3333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

66

The liquidation of a partnership means that:

A) a new partner or partner is admitted, requiring a new partnership agreement.

B) the partnership simply ceases doing business.

C) partnership assets are sold, liabilities paid and remaining cash distributed to the partners.

D) one or more partners withdraw from the partnership, requiring a new partnership agreement.

A) a new partner or partner is admitted, requiring a new partnership agreement.

B) the partnership simply ceases doing business.

C) partnership assets are sold, liabilities paid and remaining cash distributed to the partners.

D) one or more partners withdraw from the partnership, requiring a new partnership agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

67

Gary,Peter and Chris own a firm as partners.Gary has a capital balance of $21,000; Peter a capital balance of $38,000; and Chris has a capital balance of $33,000.As per the partnership agreement,Gary gets a profit share of 2/9; Peter has 4/9; and Chris has 3/9.Which of the following is true,if Gary withdraws from the partnership by receiving $21,000?

A) Peter, capital will be credited for $21,000.

B) Cash is debited for $21,000.

C) Peter, capital and Chris, capital will be credited for $10,500 each.

D) Gary, capital will be debited for $21,000.

A) Peter, capital will be credited for $21,000.

B) Cash is debited for $21,000.

C) Peter, capital and Chris, capital will be credited for $10,500 each.

D) Gary, capital will be debited for $21,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

68

When a partner withdraws from a partnership at book value,the partner will take a distribution of assets in the value of his or her capital account balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

69

If a partner withdraws from a partnership and elects to take some of the assets of the partnership away,the partnership will use the current book value of those assets to calculate the final settlement with the withdrawing partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

70

The balance sheet of Ryan and Peter firm as at 30 June 2017 is given below.

Ryan and Peter share profits in the ratio 3:2.They have decided to liquidate the partnership with immediate effect.The accounts payable were settled at $11,000 due to the poor financial condition of the partnership firm.As a result,Ryan's capital account will be credited by:

A) $1800.

B) $9000.

C) $6600.

D) $3000.

Ryan and Peter share profits in the ratio 3:2.They have decided to liquidate the partnership with immediate effect.The accounts payable were settled at $11,000 due to the poor financial condition of the partnership firm.As a result,Ryan's capital account will be credited by:

A) $1800.

B) $9000.

C) $6600.

D) $3000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

71

Ronald,Ross and Carol opened a partnership firm.Ronald has a capital of $73,000; Ross has a capital of $117,000; and Carol has a capital of $93,000.Ronald decided to withdraw from the partnership and received $84,000.Which of the following will be included in the journal entry to record this? (Assume an equal profit-loss sharing between the existing partners.)

A) Ross, capital is credited for $5500.

B) Carol, capital is debited for $5500.

C) Ross, capital is debited for $11,000.

D) Cash is credited for $11,000.

A) Ross, capital is credited for $5500.

B) Carol, capital is debited for $5500.

C) Ross, capital is debited for $11,000.

D) Cash is credited for $11,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

72

When a partner withdraws from the partnership for a settlement that is more than his or her capital balance,the difference between the exiting partner's capital and the settlement amount goes to increase the capital balances of the remaining partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

73

When one partner leaves the partnership for any reason,the old partnership ceases to exist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

74

Gary,Peter and Chris are partners.Their capital balances are,$25,000; $39,000; and $33,000,respectively.As per the partnership agreement,Gary gets a profit share of 2/9; Peter has 4/9; and Chris has 3/9.Gary withdraws from the partnership by receiving $25,000.What will be the impact of this transaction on the journal entries?

A) Peter, capital will be debited for $2286.

B) Cash will be debited for $25,000.

C) Gary, capital will be debited for $25,000.

D) Chris, capital will be credited for $2286.

A) Peter, capital will be debited for $2286.

B) Cash will be debited for $25,000.

C) Gary, capital will be debited for $25,000.

D) Chris, capital will be credited for $2286.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

75

Harry,Tony and Liza run a partnership firm.In the process of liquidation,the partnership sells non-cash assets,having a book value of $73,000,for $92,000.Which of the following is true of the journal entries?

A) Non-cash assets will be credited for $92,000.

B) Cash will be credited for $73,000.

C) Cash will be credited by $19,000.

D) Non-cash assets will be credited for $73,000.

A) Non-cash assets will be credited for $92,000.

B) Cash will be credited for $73,000.

C) Cash will be credited by $19,000.

D) Non-cash assets will be credited for $73,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

76

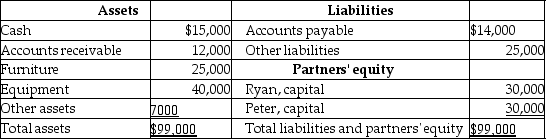

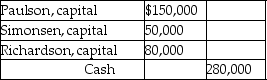

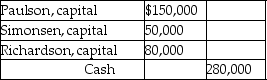

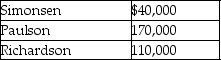

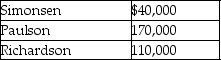

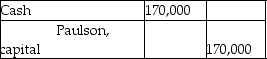

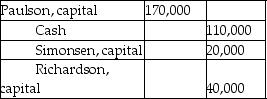

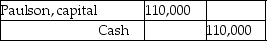

Simonsen,Paulson and Richardson are partners in a firm with the following capital account balances:

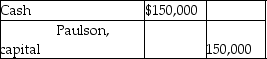

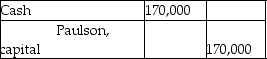

The profit-and-loss-sharing ratio among Simonsen,Paulson and Richardson is 1:3:2,in the order given.Paulson is retiring from the partnership on 31 December 2017.Paulson's capital account is settled at book value.Journalise the cash payment to Paulson upon retirement.

A)

B)

C)

D)

The profit-and-loss-sharing ratio among Simonsen,Paulson and Richardson is 1:3:2,in the order given.Paulson is retiring from the partnership on 31 December 2017.Paulson's capital account is settled at book value.Journalise the cash payment to Paulson upon retirement.

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

77

Marshall retires from the partnership of Marshall,Mark and Dennis.Marshall had a capital balance of $15,000.If Marshall received $15,000 as final settlement,how will this transaction affect the balance sheet items?

A) Equity will decrease.

B) Liabilities will decrease.

C) Cash will increase.

D) Liabilities will increase.

A) Equity will decrease.

B) Liabilities will decrease.

C) Cash will increase.

D) Liabilities will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following statements MOST accurately describes the withdrawal of a partner at book value?

A) Withdrawing partner takes a portion of the non-current assets valued at their net book value.

B) Withdrawing partner takes a payment equal to his or her capital balance.

C) Withdrawing partner takes his or her proportionate share of partnership assets.

D) Withdrawing partner takes a payment equal to his or her proportion of the partnership cash balance.

A) Withdrawing partner takes a portion of the non-current assets valued at their net book value.

B) Withdrawing partner takes a payment equal to his or her capital balance.

C) Withdrawing partner takes his or her proportionate share of partnership assets.

D) Withdrawing partner takes a payment equal to his or her proportion of the partnership cash balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

79

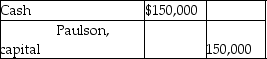

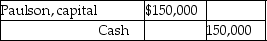

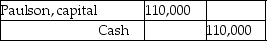

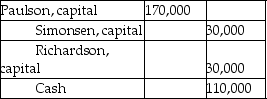

Simonsen,Paulson and Richardson are partners in a firm with the following capital account balances:

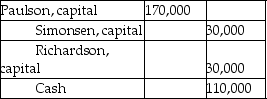

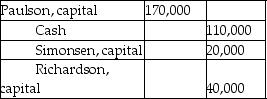

Paulson is retiring from the partnership on 31 December 2017.The profit-and-loss-sharing ratio among Simonsen,Paulson and Richardson is 1:3:2,in the order given.Paulson is paid $110,000 cash in full compensation for her capital account balance.Journalise the cash payment of $110,000 to Paulson upon retirement.

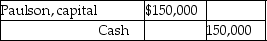

A)

B)

C)

D)

Paulson is retiring from the partnership on 31 December 2017.The profit-and-loss-sharing ratio among Simonsen,Paulson and Richardson is 1:3:2,in the order given.Paulson is paid $110,000 cash in full compensation for her capital account balance.Journalise the cash payment of $110,000 to Paulson upon retirement.

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following statements about the liquidation of a partnership is TRUE?

A) The final cash distribution is always based on equal shares.

B) The final cash distribution is based on the partners' capital account balances.

C) Gains and losses from the disposal of assets are always distributed to the partner's capital accounts based on their respective percentage of total capital.

D) The final cash distribution is always based on the profit sharing formula specified in the partnership agreement.

A) The final cash distribution is always based on equal shares.

B) The final cash distribution is based on the partners' capital account balances.

C) Gains and losses from the disposal of assets are always distributed to the partner's capital accounts based on their respective percentage of total capital.

D) The final cash distribution is always based on the profit sharing formula specified in the partnership agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck