Deck 9: Receivables

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/97

العب

ملء الشاشة (f)

Deck 9: Receivables

1

A company may collect its own receivables or alternatively hire a third-party collection agency to do this for a fee.

True

2

The following information is from the records of Armadillo Camera Shop:

Bad debts expense is estimated by the ageing of accounts receivable method.Management estimates that $3150 of accounts receivable will be uncollectable.Calculate the amount of net accounts receivable after the adjustment for bad debts.

A) $19,750

B) $17,550

C) $18,850

D) $17,950

Bad debts expense is estimated by the ageing of accounts receivable method.Management estimates that $3150 of accounts receivable will be uncollectable.Calculate the amount of net accounts receivable after the adjustment for bad debts.

A) $19,750

B) $17,550

C) $18,850

D) $17,950

$18,850

3

Which of the following is included in the category other receivables?

A) Investments

B) Bills receivable

C) Loans to employees

D) Accounts receivable

A) Investments

B) Bills receivable

C) Loans to employees

D) Accounts receivable

C

4

Accounts receivable are also known as trade receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is NOT a cost of selling on credit?

A) Opportunity cost of not having the cash immediately

B) Bad debt expense

C) Increased advertising

D) Collection costs

A) Opportunity cost of not having the cash immediately

B) Bad debt expense

C) Increased advertising

D) Collection costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

6

The Allowance for doubtful debts account has a credit balance of $4000.The company's management estimates that 3% of net credit sales will be uncollectable for the year 2016.Net credit sales for the year amounted to $260,000.What will be the amount of Bad debts expense reported on the income statement for 2016?

A) $3900

B) $11,800

C) $7800

D) $3800

A) $3900

B) $11,800

C) $7800

D) $3800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

7

AASB requires companies to use the:

A) direct write-off method to evaluate bad debts.

B) allowance method to evaluate bad debts.

C) 360-day method to evaluate bad debts.

D) amortisation method to evaluate bad debts.

A) direct write-off method to evaluate bad debts.

B) allowance method to evaluate bad debts.

C) 360-day method to evaluate bad debts.

D) amortisation method to evaluate bad debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following are the two methods of accounting for uncollectable receivables?

A) The allowance method and the liability method

B) The allowance method and the direct write-off method

C) The direct write-off method and the liability method

D) The asset method and the sales method

A) The allowance method and the liability method

B) The allowance method and the direct write-off method

C) The direct write-off method and the liability method

D) The asset method and the sales method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

9

A debtor is a party to the transaction who will receive the cash for the transaction at a later date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following are the two methods of estimating bad debts?

A) The direct write-off method and the percentage of completion method

B) The gross method and the direct write-off method

C) The ageing of accounts receivable method and the percentage of sales method

D) The allowance method and the amortisation method

A) The direct write-off method and the percentage of completion method

B) The gross method and the direct write-off method

C) The ageing of accounts receivable method and the percentage of sales method

D) The allowance method and the amortisation method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

11

A creditor is a person or business who:

A) purchases goods on credit.

B) has a payable to another party.

C) invests money in the shares of a company.

D) has a receivable from another party.

A) purchases goods on credit.

B) has a payable to another party.

C) invests money in the shares of a company.

D) has a receivable from another party.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

12

Bills receivable are usually longer in term than accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is a benefit of selling on credit?

A) Some customers do not pay, creating an expense.

B) Expenses are reduced by making sales to a wide range of customers.

C) Revenues are increased by making sales to a wider range of customers.

D) Cash is received sooner.

A) Some customers do not pay, creating an expense.

B) Expenses are reduced by making sales to a wide range of customers.

C) Revenues are increased by making sales to a wider range of customers.

D) Cash is received sooner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following is a disadvantage of selling on credit?

A) Some customers do not pay, creating an expense.

B) Profits are decreased by making sales to a more specific range of customers.

C) Sales can be made to fewer customers.

D) Prices must be reduced when selling on credit.

A) Some customers do not pay, creating an expense.

B) Profits are decreased by making sales to a more specific range of customers.

C) Sales can be made to fewer customers.

D) Prices must be reduced when selling on credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following entries would be used to account for bad debts using the allowance method?

A) Accounts receivable is debited and Bad debts expense is credited.

B) Bad debts expense is debited and Accounts receivable is credited.

C) Bad debts expense is debited and Allowance for doubtful debts is credited.

D) Allowance for doubtful debts is debited and Bad debts expense is credited.

A) Accounts receivable is debited and Bad debts expense is credited.

B) Bad debts expense is debited and Accounts receivable is credited.

C) Bad debts expense is debited and Allowance for doubtful debts is credited.

D) Allowance for doubtful debts is debited and Bad debts expense is credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following duties should NOT be performed by a credit department?

A) Monitoring customer payment records.

B) Reviewing applicant's income and credit history.

C) Evaluating customers who apply for credit.

D) Handling cash receipts.

A) Monitoring customer payment records.

B) Reviewing applicant's income and credit history.

C) Evaluating customers who apply for credit.

D) Handling cash receipts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is NOT a key issue in controlling and managing receivables?

A) Extend credit only to customers who are most likely to pay.

B) Separate the responsibility for custody and protection of inventory assets from the accounting for inventory assets.

C) Separate cash-handling, credit and accounting duties to keep employees from stealing cash collected from customers.

D) Pursue collection from customers to maximise cash flow.

A) Extend credit only to customers who are most likely to pay.

B) Separate the responsibility for custody and protection of inventory assets from the accounting for inventory assets.

C) Separate cash-handling, credit and accounting duties to keep employees from stealing cash collected from customers.

D) Pursue collection from customers to maximise cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

18

A record that contains the details by customer or vendor of the individual account balances would be called a:

A) journal.

B) subsidiary ledger.

C) control account.

D) liability account.

A) journal.

B) subsidiary ledger.

C) control account.

D) liability account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

19

The creditor is the entity that signs a bill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

20

The two major types of receivables are accounts receivable and bills receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

21

The ageing of accounts method is a balance sheet approach of estimating bad debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

22

A newly created design business called Smart Art is just finishing up its first year of operations.During the year,there were credit sales of $40,000 and collections of credit sales of $33,000.One account for $675 was written off.Smart Art uses the ageing method to account for bad debts expense.It has estimated $275 as uncollectable at year-end.At the end of the year,what is the ending balance in the Bad debts expense account?

A) $6050

B) $275

C) $675

D) $950

A) $6050

B) $275

C) $675

D) $950

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

23

A company reports net accounts receivable of $152,000 on its 31 December 2016 balance sheet.The Allowance for doubtful debts has a credit balance of $20,000.What is the balance in Accounts receivable?

A) $157,000

B) $172,000

C) $152,000

D) $132,000

A) $157,000

B) $172,000

C) $152,000

D) $132,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

24

The Allowance for doubtful debts account has a debit balance of $9000 before the adjusting entry for bad debt expense.After analysing the accounts in the accounts receivable subsidiary ledger,the company's management estimates that uncollectable accounts will be $13,000.What will be the amount of the adjustment in the Allowance for doubtful debts account?

A) $22,000

B) $13,000

C) $21,250

D) $20,900

A) $22,000

B) $13,000

C) $21,250

D) $20,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Allowance for doubtful debts has a credit balance of $8000 before the adjusting entry for bad debt expense.After analysing the accounts in the accounts receivable subsidiary ledger using the ageing method,the company's management estimates that uncollectable accounts will be $15,000.What will be the amount of bad debts expense reported on the income statement?

A) $23,000

B) $8000

C) $15,000

D) $7000

A) $23,000

B) $8000

C) $15,000

D) $7000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

26

The ageing of accounts receivable method calculates bad debts expense as a percentage of net credit sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

27

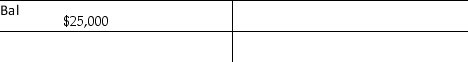

At the beginning of 2016,Peter Dots has the following ledger balances:

Accounts receivable

Allowance for doubtful debts

Bad debts expense

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $780,000 and $18,000 was written off.At the end of the year,the company adjusted for bad debts expense using the percentage of sales method and applied a rate,based on past history,of 3.5%.The ending balance of Accounts receivable would be:

A) $18,000

B) $40,000

C) $42,000

D) $56,700

Accounts receivable

Allowance for doubtful debts

Bad debts expense

During the year,credit sales amounted to $800,000.Cash collected on credit sales amounted to $780,000 and $18,000 was written off.At the end of the year,the company adjusted for bad debts expense using the percentage of sales method and applied a rate,based on past history,of 3.5%.The ending balance of Accounts receivable would be:

A) $18,000

B) $40,000

C) $42,000

D) $56,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

28

The following information is from the 2016 records of Armand Camera Shop:

Bad debts expense is estimated by the ageing of accounts receivable method.Management estimates that $8000 of accounts receivable will be uncollectable.Calculate the Allowance for doubtful debts after the adjustment for bad debt expense at 31 December 2016.

A) $5340

B) $8000

C) $6000

D) $11,800

Bad debts expense is estimated by the ageing of accounts receivable method.Management estimates that $8000 of accounts receivable will be uncollectable.Calculate the Allowance for doubtful debts after the adjustment for bad debt expense at 31 December 2016.

A) $5340

B) $8000

C) $6000

D) $11,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

29

Accounts receivable has a balance of $8000 and the Allowance for doubtful debts has a credit balance of $450.The allowance method is used.What is the net realisable value after a $170 account receivable is written off?

A) $7550

B) $7720

C) $7380

D) $8000

A) $7550

B) $7720

C) $7380

D) $8000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

30

At the beginning of 2016,Peter Dots has the following ledger balances:

Accounts receivable

Allowance for doubtful debts

Bad debts expense

During the year,credit sales amounted to $810,000.Cash collected on credit sales amounted to $790,000 and $16,000 was written off.At the end of the year,the company adjusted for bad debts expense using the percentage of sales method and applied a rate,based on past history,of 3.5%.The ending balance in Bad debts expense would be:

A) $57,540

B) $28,350

C) $16,000

D) $20,350

Accounts receivable

Allowance for doubtful debts

Bad debts expense

During the year,credit sales amounted to $810,000.Cash collected on credit sales amounted to $790,000 and $16,000 was written off.At the end of the year,the company adjusted for bad debts expense using the percentage of sales method and applied a rate,based on past history,of 3.5%.The ending balance in Bad debts expense would be:

A) $57,540

B) $28,350

C) $16,000

D) $20,350

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

31

Smart Art is a new establishment.During the first year,there were credit sales of $45,000 and collections of credit sales of $32,000.One account for $550 was written off.The company decided to use the percentage of sales method to account for bad debts expense and decided to use a factor of 2% for their year-end adjustment of bad debts expense.The ending balance in Allowance for doubtful debts account would be:

A) $350.

B) $900.

C) $1529.

D) $249.

A) $350.

B) $900.

C) $1529.

D) $249.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

32

The Allowance for doubtful debts account has a credit balance of $8500 before the adjusting entry for bad debt expense.After analysing the accounts in the accounts receivable subsidiary ledger using the ageing method,the company's management estimates that uncollectable accounts will be $14,500.What will be the balance of the Allowance for doubtful debts reported on the balance sheet?

A) $6000

B) $13,050

C) $23,000

D) $14,500

A) $6000

B) $13,050

C) $23,000

D) $14,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

33

The percentage of sales method calculates bad debts expense as a percentage of net credit sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

34

Accounts receivable has a balance of $31,000 and the Allowance for doubtful debts has a credit balance of $3100.The allowance method is used.What is the net realisable value before and after a $2400 Account receivable is written off?

A) $27,900; $25,500

B) $25,500; $25,500

C) $25,500; $30,300

D) $27,900; $27,900

A) $27,900; $25,500

B) $25,500; $25,500

C) $25,500; $30,300

D) $27,900; $27,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

35

The percentage of sales method calculates bad debts expense by analysing accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

36

The allowance method is a method of recording collection losses by estimating uncollectable amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

37

At the beginning of 2016,Peter Dots has the following ledger balances:

Accounts receivable

Allowance for doubtful debts

During the year,credit sales amounted to $840,000.Cash collected on credit sales amounted to $750,000 and $18,000 was written off.At the end of the year,the company adjusted for bad debts expense using the ageing method.The amount estimated as uncollectable was $29,000.The ending balance in the Allowance for doubtful debts would be:

A) $18,000

B) $29,000

C) $24,000

D) $42,000

Accounts receivable

Allowance for doubtful debts

During the year,credit sales amounted to $840,000.Cash collected on credit sales amounted to $750,000 and $18,000 was written off.At the end of the year,the company adjusted for bad debts expense using the ageing method.The amount estimated as uncollectable was $29,000.The ending balance in the Allowance for doubtful debts would be:

A) $18,000

B) $29,000

C) $24,000

D) $42,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

38

The following information is from the 2016 records of Armand Camera Shop:

Bad debts expense is estimated by the percentage of sales method.The management estimates that 4% of net credit sales will be uncollectable.Calculate the amount of bad debts expense for 2016.

A) $5320

B) $7120

C) $5620

D) $8320

Bad debts expense is estimated by the percentage of sales method.The management estimates that 4% of net credit sales will be uncollectable.Calculate the amount of bad debts expense for 2016.

A) $5320

B) $7120

C) $5620

D) $8320

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

39

The following information is from the 2016 records of Armand Camera Shop:

Bad debts expense is estimated by the percentage of sales method.Management estimates that 5% of net credit sales will be uncollectable.The balance of the Allowance for doubtful debts after adjustment will be:

A) $8750

B) $10,250

C) $11,550

D) $7450

Bad debts expense is estimated by the percentage of sales method.Management estimates that 5% of net credit sales will be uncollectable.The balance of the Allowance for doubtful debts after adjustment will be:

A) $8750

B) $10,250

C) $11,550

D) $7450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

40

Smart Art is a new establishment.During the first year,there were credit sales of $40,000 and collections of credit sales of $35,000.One account for $650 was written off.The company decided to use the percentage of sales method to account for bad debts expense and decided to use a factor of 3% for their year-end adjustment of bad debts expense.At the end of the year,the balance of bad debts expense would be:

A) $550

B) $650

C) $2250

D) $1200

A) $550

B) $650

C) $2250

D) $1200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

41

When a company is using the direct write-off method and an account is written off,the journal entry consists of a:

A) credit to Accounts receivable and a debit to Interest expense.

B) debit to Accounts receivable and a credit to Cash.

C) credit to Accounts receivable and a debit to Bad debts expense.

D) debit to the Allowance for doubtful debts and a credit to Accounts receivable.

A) credit to Accounts receivable and a debit to Interest expense.

B) debit to Accounts receivable and a credit to Cash.

C) credit to Accounts receivable and a debit to Bad debts expense.

D) debit to the Allowance for doubtful debts and a credit to Accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

42

The direct write-off method is in accordance with the accrual method of accounting,whereas the allowance method is not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is NOT one of the benefits of a business accepting credit cards from its customers?

A) The business does not have to check the credit ratings of customers.

B) The business can attract more customers and more sales.

C) The business doesn't take the risk of the customer failing to pay.

D) The business earns a higher profit on credit card sales than cash sales.

A) The business does not have to check the credit ratings of customers.

B) The business can attract more customers and more sales.

C) The business doesn't take the risk of the customer failing to pay.

D) The business earns a higher profit on credit card sales than cash sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

44

On 1 January,Davidson Services has the following balances:

Accounts receivable

Bad debts expense

Davidson has the following transactions during January: Credit sales of $120,000,collections of credit sales of $87,000 and write-offs of $16,000.Davidson uses the direct write-off method.At the end of January,the balance in Accounts receivable is :

A) $42,000.

B) $22,069.

C) $58,000.

D) $11,600.

Accounts receivable

Bad debts expense

Davidson has the following transactions during January: Credit sales of $120,000,collections of credit sales of $87,000 and write-offs of $16,000.Davidson uses the direct write-off method.At the end of January,the balance in Accounts receivable is :

A) $42,000.

B) $22,069.

C) $58,000.

D) $11,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

45

When a business accepts credit cards from customers in payment of sales,the business has to pay a fee to the credit card processor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

46

Zorro Company has significant amounts of accounts receivable and experiences bad debts from time to time.Zorro uses the direct write-off method.When Zorro Company writes off a bad debt,what is the effect of that single transaction?

A) It will increase total assets of the company.

B) It will reduce profit.

C) It will have no effect on profit.

D) It will generate positive cash flow.

A) It will increase total assets of the company.

B) It will reduce profit.

C) It will have no effect on profit.

D) It will generate positive cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

47

The direct write-off method would be considered acceptable if bad debts were very low.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

48

On 1 January,Davidson Services has the following balances:

Accounts receivable

Bad debts expense

Davidson has the following transactions during January: Credit sales of $100,000,collections of credit sales of $85,000,and write-offs of $20,000.Davidson uses the direct write-off method.At the end of January,the balance in Bad debts expense is:

A) $23,529

B) $23,000

C) $20,000

D) $17,000

Accounts receivable

Bad debts expense

Davidson has the following transactions during January: Credit sales of $100,000,collections of credit sales of $85,000,and write-offs of $20,000.Davidson uses the direct write-off method.At the end of January,the balance in Bad debts expense is:

A) $23,529

B) $23,000

C) $20,000

D) $17,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

49

The following information is from the 2016 records of Armadillo Camera Shop:

Bad debts expense is determined by the direct write-off method.Which of the following will be the amount of Bad debts expense?

A) $2 250

B) $2 850

C) $3 450

D) $7 000

Bad debts expense is determined by the direct write-off method.Which of the following will be the amount of Bad debts expense?

A) $2 250

B) $2 850

C) $3 450

D) $7 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

50

The direct write-off method requires an entry with a credit to Accounts receivable to record the Bad debts expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

51

A credit card processing company generally uses one of two methods of payment-the net and the gross method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following entries would be used to account for bad debts using the direct write-off method?

A) Accounts receivable is debited and Bad debts expense is credited.

B) Bad debts expense is debited and Allowance for doubtful debts is credited.

C) Bad debts expense is debited and Accounts receivable is credited.

D) Allowance for doubtful debts is debited and Bad debts expense is credited.

A) Accounts receivable is debited and Bad debts expense is credited.

B) Bad debts expense is debited and Allowance for doubtful debts is credited.

C) Bad debts expense is debited and Accounts receivable is credited.

D) Allowance for doubtful debts is debited and Bad debts expense is credited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

53

A company has significant bad debts.Why is the direct write-off method unacceptable?

A) Direct write-offs would be immaterial.

B) It is not allowed for tax reasons.

C) It is not in accordance with the accrual method of accounting.

D) Assets will be understated on the balance sheet.

A) Direct write-offs would be immaterial.

B) It is not allowed for tax reasons.

C) It is not in accordance with the accrual method of accounting.

D) Assets will be understated on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

54

Archer Company and Zorro Company both have significant amounts of accounts receivable at any time and both experience bad debts from time to time.Archer uses the percentage of sales method to account for bad debts and Zorro uses the direct write-off method.Archer Company's method complies with IFRS and produces a better matching of revenues and expenses than Zorro Company's method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

55

A company uses the direct write-off method to account for bad debts.Bad debts expense will be estimated as a percentage of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

56

The direct write-off method is used primarily by large,publicly owned companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

57

The following information is from the records of Armadillo Camera Shop:

The company uses the direct write-off method for bad debts.What is the amount of bad debts expense?

A) $15,000

B) $85,000

C) $60,000

D) $41,000

The company uses the direct write-off method for bad debts.What is the amount of bad debts expense?

A) $15,000

B) $85,000

C) $60,000

D) $41,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

58

Target allows customers to use MasterCard.It reports Sales revenue of $24 000 for the week.MasterCard charges Target a 3% fee.The journal entry for this transaction would be:

A)

B)

C)

D) None of the above.

A)

B)

C)

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

59

Charlton Sales has a receivable for $92 that they now deem to be uncollectable.Charlton uses the direct write-off method.Which of the following entries correctly records the write-off?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

60

Anchor Sales accepts credit cards from its customers.Assume Anchor makes a sale of $100 and the processor charges a 3% fee.Assume that the credit card processing company uses the net method of depositing funds.Which of the following is the journal entry made by Anchor to record the sales revenue?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

61

A six-month bill receivable for $6000 at 11%,dated 1 September 2017,has accrued interest revenue of ________ on 31 December 2017.

A) $220

B) $660

C) $110

D) $330

A) $220

B) $660

C) $110

D) $330

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

62

What is the maturity value of a 3-month,12% bill for $50,000?

A) $51,500

B) $56,000

C) $50,000

D) $52,000

A) $51,500

B) $56,000

C) $50,000

D) $52,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

63

On 1 October 2016,Android Ltd made a loan to one of its customers.The customer signed a 4-month note for $100,000 at 13%.How much interest revenue did the company record in the year 2016?

A) $4333

B) $1083

C) $3250

D) $1300

A) $4333

B) $1083

C) $3250

D) $1300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following exists if the maker of a promissory bill fails to pay the bill on the due date?

A) A depreciated bill

B) A dishonoured bill

C) An amortised bill

D) A discounted bill

A) A depreciated bill

B) A dishonoured bill

C) An amortised bill

D) A discounted bill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

65

Assets are listed on the balance sheet in order of liquidity.Which of the following items reflects the normal order of liquidity?

A) Cash, Accounts receivable, Inventory, Bills receivable

B) Non-current assets, Inventory, Bills receivable, Cash

C) Cash, Inventory, Bills receivable, Accounts receivable

D) Bills Receivable, Inventory, Accounts receivable, Cash

A) Cash, Accounts receivable, Inventory, Bills receivable

B) Non-current assets, Inventory, Bills receivable, Cash

C) Cash, Inventory, Bills receivable, Accounts receivable

D) Bills Receivable, Inventory, Accounts receivable, Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

66

On 1 October 2017,Android Ltd made a loan to one of its customers.The customer signed a 9-month bill for $100,000 at 14%.Calculate the total interest earned on the bill.

A) $3501

B) $1167

C) $10,500

D) $14,000

A) $3501

B) $1167

C) $10,500

D) $14,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

67

On 1 December 2016,Parsons Ltd sold machinery to a customer for $25,000.The customer could not pay at the time of sale but agreed to pay 11 months later and signed a 11-month bill at 8% interest.What was the total amount of cash collected by Parsons on the maturity of the bill?

A) $1833.33333

B) $27,000

C) $23,166.6667

D) $26,833.3333

A) $1833.33333

B) $27,000

C) $23,166.6667

D) $26,833.3333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following is the party lending funds on a bill?

A) The debtor of the bill

B) The principal of the bill

C) The acceptor of the bill

D) The drawer of the bill

A) The debtor of the bill

B) The principal of the bill

C) The acceptor of the bill

D) The drawer of the bill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

69

On 1 October 2016,Android Ltd made a loan to one of its customers.The customer signed a 4-month bill for $140,000 at 15%.Calculate the maturity value of the bill.

A) $161,000

B) $133,000

C) $147,000

D) $119,000

A) $161,000

B) $133,000

C) $147,000

D) $119,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

70

On 1 January,Ajax Company accepted a one-year bill for $50,000 at 5% from one of its customers.When the bill matured on 31 December,the customer was unable to pay and the company recorded the dishonour.The amount of the debit in the dishonour entry would be:

A) $50,000

B) $47,500

C) $2500

D) $52,500

A) $50,000

B) $47,500

C) $2500

D) $52,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

71

The maturity value of a bill is the sum of the principal plus interest due at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

72

On 1 December 2016,Parsons Ltd sold machinery to a customer for $20,000.The customer could not pay at the time of sale but agreed to pay 9 months later and signed a 9-month bill at 9% interest.How much interest revenue was earned for the entire term of the bill?

A) $1350

B) $1200

C) $1800

D) $150

A) $1350

B) $1200

C) $1800

D) $150

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following is the party borrowing funds on a bill?

A) The acceptor of the bill

B) The drawer of the bill

C) The payee of the bill

D) The principal of the bill

A) The acceptor of the bill

B) The drawer of the bill

C) The payee of the bill

D) The principal of the bill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

74

On 1 October 2016,Ealys Jewellers accepted a 4-month,10% bill for $8000 in settlement of an overdue account receivable.The company closes its accounts at the year-end.Calculate and record the accrued interest on the bill at 31 December 2016.

A) $400

B) $200

C) $267

D) $800

A) $400

B) $200

C) $267

D) $800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

75

On which of the following dates does a three-month bill dated 12 November mature?

A) 11 February

B) 10 February

C) 12 February

D) 13 February

A) 11 February

B) 10 February

C) 12 February

D) 13 February

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

76

What is the maturity value of a bill?

A) The principal amount minus interest due

B) The principal amount times the interest rate

C) The principal amount plus interest due

D) The face amount of the bill

A) The principal amount minus interest due

B) The principal amount times the interest rate

C) The principal amount plus interest due

D) The face amount of the bill

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

77

Interest revenue must be reported for a bill receivable that is outstanding at the end of the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

78

A company issues a 100-day,14% bill for $17,000.What is the principal amount of the bill?

A) $16,339

B) $17,000

C) $17,661

D) $19,380

A) $16,339

B) $17,000

C) $17,661

D) $19,380

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

79

A bill is dishonoured when the debtor of the bill fails to pay the bill at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

80

On 1 October 2016,Android Ltd made a loan to one of its customers.The customer signed a 4-month bill for $130,000 at 13%.How much interest revenue did the company record in the year 2017 for this bill?

A) $2817

B) $5633

C) $1408

D) $4225

A) $2817

B) $5633

C) $1408

D) $4225

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck