Deck 3: The Reporting Entity and Consolidated Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/43

العب

ملء الشاشة (f)

Deck 3: The Reporting Entity and Consolidated Financial Statements

1

Small-Town Retail owns 70 percent of Supplier Corporation's common stock.For the current financial year,Small-Town and Supplier reported sales of $450,000 and $300,000 and expenses of $290,000 and $240,000,respectively.

Based on the preceding information,what is the amount of net income to be reported in the consolidated income statement for the year under the proprietary theory approach?

A)$210,000

B)$202,000

C)$160,000

D)$200,000

Based on the preceding information,what is the amount of net income to be reported in the consolidated income statement for the year under the proprietary theory approach?

A)$210,000

B)$202,000

C)$160,000

D)$200,000

B

2

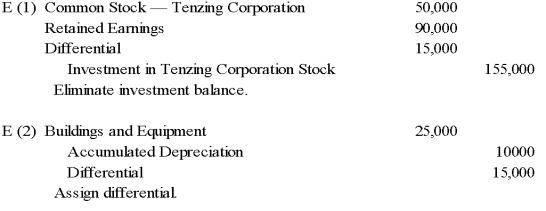

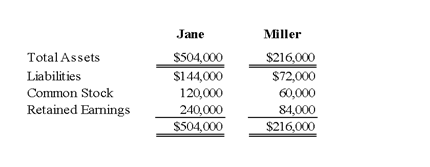

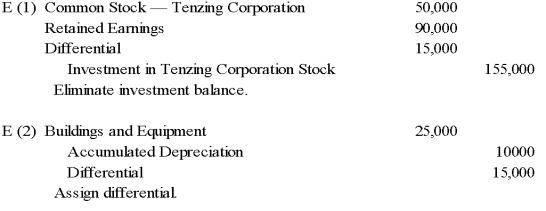

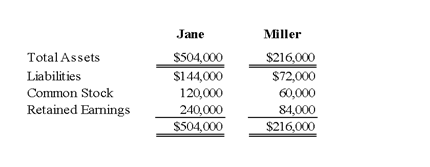

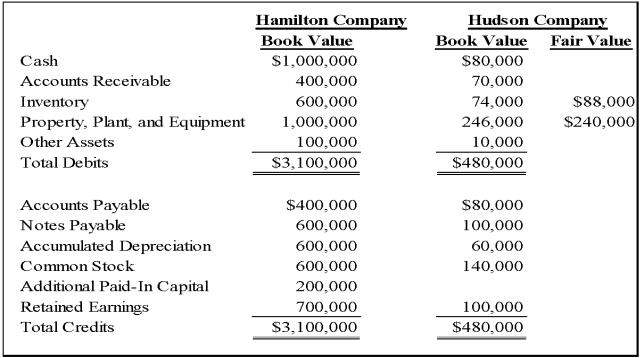

On January 3, 2009, Jane Company acquired 75 percent of Miller Company's outstanding common stock for cash. The fair value of the noncontrolling interest was equal to a proportionate share of the book value of Miller Company's net assets at the date of acquisition. Selected balance sheet data at December 31, 2009, are as follows:

Based on the preceding information,what amount will Jane Company report as common stock outstanding in its consolidated balance sheet at December 31,2009?

A)$120,000

B)$180,000

C)$156,000

D)$264,000

Based on the preceding information,what amount will Jane Company report as common stock outstanding in its consolidated balance sheet at December 31,2009?

A)$120,000

B)$180,000

C)$156,000

D)$264,000

A

3

Small-Town Retail owns 70 percent of Supplier Corporation's common stock.For the current financial year,Small-Town and Supplier reported sales of $450,000 and $300,000 and expenses of $290,000 and $240,000,respectively.

Based on the preceding information,what is the amount of net income to be reported in the consolidated income statement for the year under the parent company theory approach?

A)$220,000

B)$202,000

C)$160,000

D)$200,000

Based on the preceding information,what is the amount of net income to be reported in the consolidated income statement for the year under the parent company theory approach?

A)$220,000

B)$202,000

C)$160,000

D)$200,000

B

4

Beta Company acquired 100 percent of the voting common shares of Standard Video Corporation,its bitter rival,by issuing bonds with a par value and fair value of $150,000.Immediately prior to the acquisition,Beta reported total assets of $500,000,liabilities of $280,000,and stockholders' equity of $220,000.At that date,Standard Video reported total assets of $400,000,liabilities of $250,000,and stockholders' equity of $150,000.Included in Standard's liabilities was an account payable to Beta in the amount of $20,000,which Beta included in its accounts receivable.

Based on the preceding information,what amount of total liabilities was reported in the consolidated balance sheet immediately after acquisition?

A)$500,000

B)$530,000

C)$280,000

D)$660,000

Based on the preceding information,what amount of total liabilities was reported in the consolidated balance sheet immediately after acquisition?

A)$500,000

B)$530,000

C)$280,000

D)$660,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

5

Goodwill under the parent theory:

A)exceeds goodwill under the proprietary theory.

B)exceeds goodwill under the entity theory.

C)is less than goodwill under the entity theory.

D)is less than goodwill under the proprietary theory.

A)exceeds goodwill under the proprietary theory.

B)exceeds goodwill under the entity theory.

C)is less than goodwill under the entity theory.

D)is less than goodwill under the proprietary theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

6

Quid Corporation acquired 75 percent of Pro Company's common stock on December 31,2006.Goodwill (attributable to Quid's acquisition of Pro shares)of $300,000 was reported in the consolidated financial statements at December 31,2006.Parent company approach was used in determining this amount.What is the amount of goodwill to be reported under proprietary theory approach?

A)$300,000

B)$400,000

C)$150,000

D)$100,000

A)$300,000

B)$400,000

C)$150,000

D)$100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

7

Company Pea owns 90 percent of Company Essone which in turn owns 80 percent of Company Esstwo.Company Esstwo owns 100 percent of Company Essthree.Consolidated financial statements should be prepared to report the financial status and results of operations for:

A)Pea.

B)Pea plus Essone.

C)Pea plus Essone plus Esstwo.

D)Pea plus Essone plus Esstwo plus Essthree.

A)Pea.

B)Pea plus Essone.

C)Pea plus Essone plus Esstwo.

D)Pea plus Essone plus Esstwo plus Essthree.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

8

On December 31,2009,Rudd Company acquired 80 percent of the common stock of Wilton Company.At the time,Rudd held land with a book value of $100,000 and a fair value of $260,000;Wilton held land with a book value of $50,000 and fair value of $600,000.Using the parent company theory,at what amount would land be reported in a consolidated balance sheet prepared immediately after the combination?

A)$550,000

B)$590,000

C)$700,000

D)$860,000

A)$550,000

B)$590,000

C)$700,000

D)$860,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

9

Beta Company acquired 100 percent of the voting common shares of Standard Video Corporation,its bitter rival,by issuing bonds with a par value and fair value of $150,000.Immediately prior to the acquisition,Beta reported total assets of $500,000,liabilities of $280,000,and stockholders' equity of $220,000.At that date,Standard Video reported total assets of $400,000,liabilities of $250,000,and stockholders' equity of $150,000.Included in Standard's liabilities was an account payable to Beta in the amount of $20,000,which Beta included in its accounts receivable.

Based on the preceding information,what amount of total assets did Beta report in its balance sheet immediately after the acquisition?

A)$500,000

B)$650,000

C)$750,000

D)$900,000

Based on the preceding information,what amount of total assets did Beta report in its balance sheet immediately after the acquisition?

A)$500,000

B)$650,000

C)$750,000

D)$900,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

10

On January 3,2009,Redding Company acquired 80 percent of Frazer Corporation's common stock for $344,000 in cash.At the acquisition date,the book values and fair values of Frazer's assets and liabilities were equal,and the fair value of the noncontrolling interest was equal to 20 percent of the total book value of Frazer.The stockholders' equity accounts of the two companies at the acquisition date are:

Noncontrolling interest was assigned income of $11,000 in Redding's consolidated income statement for 2009.

Based on the preceding information,what will be the amount of net income reported by Frazer Corporation in 2009?

A)$44,000

B)$55,000

C)$66,000

D)$36,000

Noncontrolling interest was assigned income of $11,000 in Redding's consolidated income statement for 2009.

Based on the preceding information,what will be the amount of net income reported by Frazer Corporation in 2009?

A)$44,000

B)$55,000

C)$66,000

D)$36,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

11

On January 3,2009,Redding Company acquired 80 percent of Frazer Corporation's common stock for $344,000 in cash.At the acquisition date,the book values and fair values of Frazer's assets and liabilities were equal,and the fair value of the noncontrolling interest was equal to 20 percent of the total book value of Frazer.The stockholders' equity accounts of the two companies at the acquisition date are:

Noncontrolling interest was assigned income of $11,000 in Redding's consolidated income statement for 2009.

Based on the preceding information,what will be the total stockholders' equity in the consolidated balance sheet as of January 3,2009?

A)$1,580,000

B)$1,064,000

C)$1,150,000

D)$1,236,000

Noncontrolling interest was assigned income of $11,000 in Redding's consolidated income statement for 2009.

Based on the preceding information,what will be the total stockholders' equity in the consolidated balance sheet as of January 3,2009?

A)$1,580,000

B)$1,064,000

C)$1,150,000

D)$1,236,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

12

Beta Company acquired 100 percent of the voting common shares of Standard Video Corporation,its bitter rival,by issuing bonds with a par value and fair value of $150,000.Immediately prior to the acquisition,Beta reported total assets of $500,000,liabilities of $280,000,and stockholders' equity of $220,000.At that date,Standard Video reported total assets of $400,000,liabilities of $250,000,and stockholders' equity of $150,000.Included in Standard's liabilities was an account payable to Beta in the amount of $20,000,which Beta included in its accounts receivable.

Based on the preceding information,what amount of stockholders' equity was reported in the consolidated balance sheet immediately after acquisition?

A)$220,000

B)$150,000

C)$370,000

D)$350,000

Based on the preceding information,what amount of stockholders' equity was reported in the consolidated balance sheet immediately after acquisition?

A)$220,000

B)$150,000

C)$370,000

D)$350,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

13

Small-Town Retail owns 70 percent of Supplier Corporation's common stock.For the current financial year,Small-Town and Supplier reported sales of $450,000 and $300,000 and expenses of $290,000 and $240,000,respectively.

Based on the preceding information,what is the amount of net income to be reported in the consolidated income statement for the year under the entity theory approach?

A)$210,000

B)$202,000

C)$160,000

D)$220,000

Based on the preceding information,what is the amount of net income to be reported in the consolidated income statement for the year under the entity theory approach?

A)$210,000

B)$202,000

C)$160,000

D)$220,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

14

On January 3, 2009, Jane Company acquired 75 percent of Miller Company's outstanding common stock for cash. The fair value of the noncontrolling interest was equal to a proportionate share of the book value of Miller Company's net assets at the date of acquisition. Selected balance sheet data at December 31, 2009, are as follows:

Based on the preceding information,what amount should be reported as noncontrolling interest in net assets in Jane Company's December 31,2009,consolidated balance sheet?

A)$90,000

B)$54,000

C)$36,000

D)$0

Based on the preceding information,what amount should be reported as noncontrolling interest in net assets in Jane Company's December 31,2009,consolidated balance sheet?

A)$90,000

B)$54,000

C)$36,000

D)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

15

Beta Company acquired 100 percent of the voting common shares of Standard Video Corporation,its bitter rival,by issuing bonds with a par value and fair value of $150,000.Immediately prior to the acquisition,Beta reported total assets of $500,000,liabilities of $280,000,and stockholders' equity of $220,000.At that date,Standard Video reported total assets of $400,000,liabilities of $250,000,and stockholders' equity of $150,000.Included in Standard's liabilities was an account payable to Beta in the amount of $20,000,which Beta included in its accounts receivable.

Based on the preceding information,what amount of total assets was reported in the consolidated balance sheet immediately after acquisition?

A)$650,000

B)$880,000

C)$920,000

D)$750,000

Based on the preceding information,what amount of total assets was reported in the consolidated balance sheet immediately after acquisition?

A)$650,000

B)$880,000

C)$920,000

D)$750,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

16

On January 3,2009,Redding Company acquired 80 percent of Frazer Corporation's common stock for $344,000 in cash.At the acquisition date,the book values and fair values of Frazer's assets and liabilities were equal,and the fair value of the noncontrolling interest was equal to 20 percent of the total book value of Frazer.The stockholders' equity accounts of the two companies at the acquisition date are:

Noncontrolling interest was assigned income of $11,000 in Redding's consolidated income statement for 2009.

Based on the preceding information,what amount will be assigned to the noncontrolling interest on January 3,2009,in the consolidated balance sheet?

A)$86,000

B)$44,000

C)$68,800

D)$50,000

Noncontrolling interest was assigned income of $11,000 in Redding's consolidated income statement for 2009.

Based on the preceding information,what amount will be assigned to the noncontrolling interest on January 3,2009,in the consolidated balance sheet?

A)$86,000

B)$44,000

C)$68,800

D)$50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

17

Under FASB 141R,consolidation follows largely which theory approach?

A)Proprietary

B)Parent company

C)Entity

D)Variable

A)Proprietary

B)Parent company

C)Entity

D)Variable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

18

Princeton Company acquired 75 percent of the common stock of Sheffield Corporation on December 31,2009.On the date of acquisition,Princeton held land with a book value of $150,000 and a fair value of $300,000;Sheffield held land with a book value of $100,000 and fair value of $500,000.Using the entity theory,at what amount would land be reported in a consolidated balance sheet prepared immediately after the combination?

A)$650,000

B)$500,000

C)$550,000

D)$375,000

A)$650,000

B)$500,000

C)$550,000

D)$375,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

19

If Push Company owned 51 percent of the outstanding common stock of Shove Company,which reporting method would be appropriate?

A)Cost method

B)Consolidation

C)Equity method

D)Merger method

A)Cost method

B)Consolidation

C)Equity method

D)Merger method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

20

Xing Corporation owns 80 percent of the voting common shares of Adams Corporation.Noncontrolling interest was assigned $24,000 of income in the 2009 consolidated income statement.What amount of net income did Adams Corporation report for the year?

A)$150,000

B)$96,000

C)$120,000

D)$30,000

A)$150,000

B)$96,000

C)$120,000

D)$30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

21

Blue Company owns 80 percent of the common stock of White Corporation.During the year,Blue reported sales of $1,000,000,and White reported sales of $500,000,including sales to Blue of $80,000.The amount of sales that should be reported in the consolidated income statement for the year is:

A)$500,000.

B)$1,300,000.

C)$1,420,000.

D)$1,500,000.

A)$500,000.

B)$1,300,000.

C)$1,420,000.

D)$1,500,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

22

When a primary beneficiary's consolidation of a variable interest entity (VIE)is appropriate,the amounts of the VIE to be consolidated are: I.Book values for assets and liabilities transferred by the primary beneficiary.

II)Fair values when the primary beneficiary relationship became established.

A)I

B)II

C)Both I and II

D)Neither I nor II

II)Fair values when the primary beneficiary relationship became established.

A)I

B)II

C)Both I and II

D)Neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

23

Roland Company acquired 100 percent of Garros Company's voting shares in 2007.During 2008,Garros purchased tennis equipment for $30,000 and sold them to Roland for $55,000.Roland continues to hold the items in inventory on December 31,2008.Sales for the two companies during 2008 totaled $655,000,and total cost of goods sold was $420,000.Which of the following observations will be true if no adjustment is made to eliminate the intercorporate sale when a consolidated income statement is prepared for 2008?

A)Sales would be overstated by $30,000.

B)Cost of goods sold will be understated by $25,000.

C)Net income will be overstated by $25,000.

D)Consolidated net income will be unaffected.

A)Sales would be overstated by $30,000.

B)Cost of goods sold will be understated by $25,000.

C)Net income will be overstated by $25,000.

D)Consolidated net income will be unaffected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following usually does not represent a variable interest?

A)Common stock,with no special features or provisions

B)Senior debt

C)Subordinated debt

D)Loan or asset guarantees

A)Common stock,with no special features or provisions

B)Senior debt

C)Subordinated debt

D)Loan or asset guarantees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

25

Elbonia Corporation,a 100 percent subsidiary of Atomic Corporation,caters to its parent's entire inventory requirements.In 2007,Elbonia produced inventory at a cost of $36,000 and sold it to Atomic for $75,000.Atomic held all the items in inventory on January 1,2008.During 2008,Atomic sold all the units for $98,000.Assume that the companies had no other transactions during 2007 and 2008.

Based on the preceding information,what amount would be reported in the consolidated financial statements for inventory on January 1,2008?

A)$39,000

B)$36,000

C)$75,000

D)$0

Based on the preceding information,what amount would be reported in the consolidated financial statements for inventory on January 1,2008?

A)$39,000

B)$36,000

C)$75,000

D)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

26

Consolidated financial statements are required by GAAP in certain circumstances.This information can be very useful to stockholders and creditors.Yet,there are limitations to these financial statements for which the users must be aware.What are at least three (3)limitations of consolidated financial statements?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

27

On January 1,2009,Heathcliff Corporation acquired 80 percent of Garfield Corporation's voting common stock.Garfield's buildings and equipment had a book value of $300,000 and a fair value of $350,000 at the time of acquisition.

Based on the preceding information,what will be the amount at which Garfield's buildings and equipment will be reported in consolidated statements using the parent company approach?

A)$350,000

B)$340,000

C)$280,000

D)$300,000

Based on the preceding information,what will be the amount at which Garfield's buildings and equipment will be reported in consolidated statements using the parent company approach?

A)$350,000

B)$340,000

C)$280,000

D)$300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

28

Elbonia Corporation,a 100 percent subsidiary of Atomic Corporation,caters to its parent's entire inventory requirements.In 2007,Elbonia produced inventory at a cost of $36,000 and sold it to Atomic for $75,000.Atomic held all the items in inventory on January 1,2008.During 2008,Atomic sold all the units for $98,000.Assume that the companies had no other transactions during 2007 and 2008.

Based on the preceding information,what amount would be reported in the consolidated financial statements for cost of goods sold for 2007?

A)$39,000

B)$36,000

C)$75,000

D)$0

Based on the preceding information,what amount would be reported in the consolidated financial statements for cost of goods sold for 2007?

A)$39,000

B)$36,000

C)$75,000

D)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

29

Elbonia Corporation,a 100 percent subsidiary of Atomic Corporation,caters to its parent's entire inventory requirements.In 2007,Elbonia produced inventory at a cost of $36,000 and sold it to Atomic for $75,000.Atomic held all the items in inventory on January 1,2008.During 2008,Atomic sold all the units for $98,000.Assume that the companies had no other transactions during 2007 and 2008.

Based on the preceding information,what amount would be reported in the consolidated financial statements for sales for 2007?

A)$0

B)$39,000

C)$36,000

D)$75,000

Based on the preceding information,what amount would be reported in the consolidated financial statements for sales for 2007?

A)$0

B)$39,000

C)$36,000

D)$75,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

30

In reading a set of consolidated financial statements you are surprised to see the term noncontrolling interest not reported under the Stockholders' Equity section of the Balance Sheet.

a.What is a non-controlling interest?

b.Why must it be reported in the financial statements as an element of equity rather than a liability?

a.What is a non-controlling interest?

b.Why must it be reported in the financial statements as an element of equity rather than a liability?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

31

Rohan Corporation holds assets with a fair value of $150,000 and a book value of $125,000 and liabilities with a book value and fair value of $50,000.What balance will be assigned to the noncontrolling interest in the consolidated balance sheet if Helms Company pays $90,000 to acquire 75 percent ownership in Rohan and goodwill of $20,000 is reported?

A)$50,000

B)$30,000

C)$40,000

D)$20,000

A)$50,000

B)$30,000

C)$40,000

D)$20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

32

Elbonia Corporation,a 100 percent subsidiary of Atomic Corporation,caters to its parent's entire inventory requirements.In 2007,Elbonia produced inventory at a cost of $36,000 and sold it to Atomic for $75,000.Atomic held all the items in inventory on January 1,2008.During 2008,Atomic sold all the units for $98,000.Assume that the companies had no other transactions during 2007 and 2008.

Based on the preceding information,what amount would be reported in the consolidated financial statements for cost of goods sold for 2008?

A)$0

B)$39,000

C)$36,000

D)$98,000

Based on the preceding information,what amount would be reported in the consolidated financial statements for cost of goods sold for 2008?

A)$0

B)$39,000

C)$36,000

D)$98,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

33

In which of the following cases would consolidation be inappropriate?

A)The subsidiary is in bankruptcy.

B)Subsidiary's operations are dissimilar from those of the parent.

C)The parent owns 90 percent of the subsidiary's common stock,but all of the subsidiary's nonvoting preferred stock is held by a single investor.

D)Subsidiary is foreign.

A)The subsidiary is in bankruptcy.

B)Subsidiary's operations are dissimilar from those of the parent.

C)The parent owns 90 percent of the subsidiary's common stock,but all of the subsidiary's nonvoting preferred stock is held by a single investor.

D)Subsidiary is foreign.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

34

FASB issued Interpretation No.46 R related to the Consolidation of Variable Interest Entities.Why does FASB have difficulty in prescribing when these entities are consolidated?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

35

On January 1,2009,Gold Rush Company acquires 80 percent ownership in California Corporation for $200,000.The fair value of the noncontrolling interest at that time is determined to be $50,000.It reports net assets with a book value of $200,000 and fair value of $230,000.Gold Rush Company reports net assets with a book value of $600,000 and a fair value of $650,000 at that time,excluding its investment in California.What will be the amount of goodwill that would be reported immediately after the combination under current accounting practice?

A)$50,000

B)$30,000

C)$40,000

D)$20,000

A)$50,000

B)$30,000

C)$40,000

D)$20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

36

Consolidated financial statements tend to be most useful for:

A)Creditors of a consolidated subsidiary.

B)Investors and long-term creditors of the parent company.

C)Short-term creditors of the parent company.

D)Stockholders of a consolidated subsidiary.

A)Creditors of a consolidated subsidiary.

B)Investors and long-term creditors of the parent company.

C)Short-term creditors of the parent company.

D)Stockholders of a consolidated subsidiary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

37

On January 1,2009,Heathcliff Corporation acquired 80 percent of Garfield Corporation's voting common stock.Garfield's buildings and equipment had a book value of $300,000 and a fair value of $350,000 at the time of acquisition.

Based on the preceding information,what will be the amount at which Garfield's buildings and equipment will be reported in consolidated statements using the current accounting practice?

A)$350,000

B)$340,000

C)$280,000

D)$300,000

Based on the preceding information,what will be the amount at which Garfield's buildings and equipment will be reported in consolidated statements using the current accounting practice?

A)$350,000

B)$340,000

C)$280,000

D)$300,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

38

Quid Corporation acquired 60 percent of Pro Company's common stock on December 31,2004.Goodwill (attributable to Quid's acquisition of Pro shares)of $150,000 was reported in the consolidated financial statements at December 31,2004.Proprietary theory approach was used in determining this amount.What is the amount of goodwill to be reported under entity theory approach?

A)$150,000

B)$200,000

C)$250,000

D)$100,000

A)$150,000

B)$200,000

C)$250,000

D)$100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

39

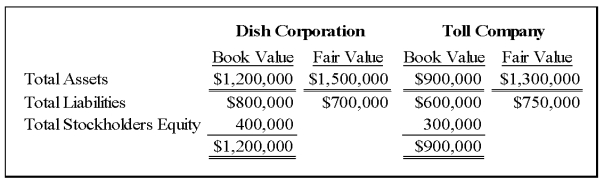

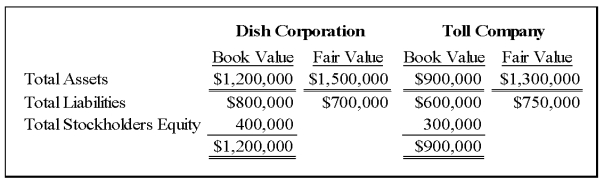

Dish Corporation acquired 100 percent of the common stock of Toll Company by issuing 10,000 shares of $10 par common stock with a market value of $60 per share.Summarized balance sheet data for the two companies immediately preceding the acquisition are as follows:

Required: Determine the dollar amounts to be presented in the consolidated balance sheet for (1)total assets, (2)total liabilities,and (3)total stockholders' equity.

Required: Determine the dollar amounts to be presented in the consolidated balance sheet for (1)total assets, (2)total liabilities,and (3)total stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

40

Zeta Corporation and its subsidiary reported consolidated net income of $320,000 for the year ended December 31,2008.Zeta owns 80 percent of the common shares of its subsidiary,acquired at book value.Noncontrolling interest was assigned income of $30,000 in the consolidated income statement for 2008.What is the amount of separate operating income reported by Zeta for the year?

A)$170,000

B)$150,000

C)$120,000

D)$200,000

A)$170,000

B)$150,000

C)$120,000

D)$200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

41

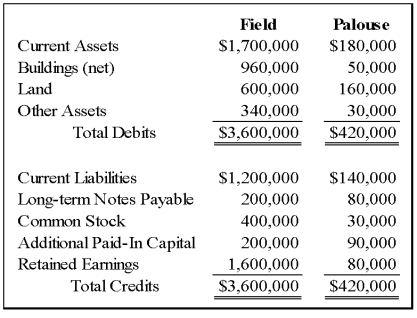

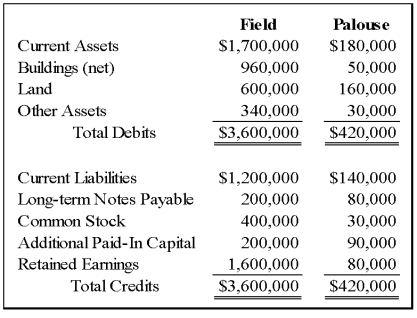

On January 1,2009,Field Corporation,a retail outlet chain,acquired 100 percent of the common stock of Palouse Company by issuing 14,000 shares of Field's $5 par value common stock.The market price of Field's common stock was $20 per share on the eve of December 31,2008.Summarized balance sheet data at December 31,2008,are as follows:

Additional Information:

The book values of Palouse's assets approximated their respective fair values,except for inventory (included in current assets),which had a fair value $20,000 more than book value,and land,which had a market value of $200,000 on the date of combination.At that date,Field owed Palouse $34,000 on account.

Required: Prepare a consolidated balance sheet immediately following the acquisition.

Additional Information:

The book values of Palouse's assets approximated their respective fair values,except for inventory (included in current assets),which had a fair value $20,000 more than book value,and land,which had a market value of $200,000 on the date of combination.At that date,Field owed Palouse $34,000 on account.

Required: Prepare a consolidated balance sheet immediately following the acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

42

Barnes Company acquired 80 percent of the outstanding voting stock of Dean Company on January 1,2008.During 2008 Dean Company sold inventory costing $50,000 to Barnes Company for $80,000.Barnes Company continued to hold the inventory at December 31,2008.Also during 2008,Barnes Company sold merchandise costing $400,000 to nonaffiliates for $600,000,and on its separate balance sheet reported total inventory at year end of $140,000.In its separate financial statements,Dean Company reported total sales and cost of goods sold of $350,000 and $220,000,respectively,for 2008 and ending inventory of $150,000.

Required: Based on the above information,compute the amounts that should appear in the consolidated financial statements prepared for Barnes Company and it subsidiary,Dean Company,at year end for the following items: 1)sales;2)cost of goods sold;3)gross profit on sales;4)inventory.

Required: Based on the above information,compute the amounts that should appear in the consolidated financial statements prepared for Barnes Company and it subsidiary,Dean Company,at year end for the following items: 1)sales;2)cost of goods sold;3)gross profit on sales;4)inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck

43

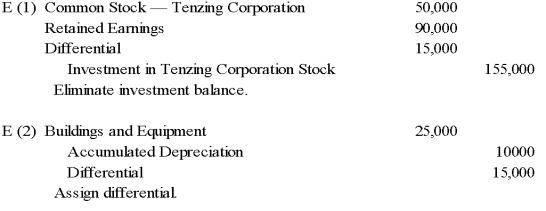

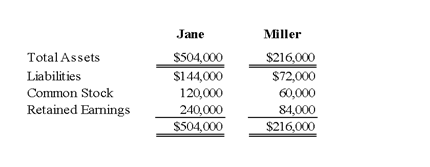

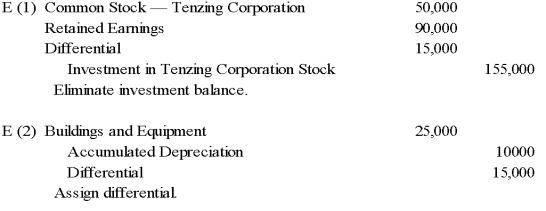

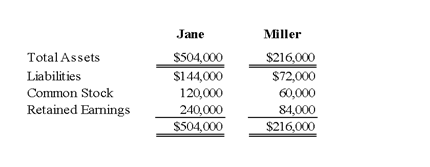

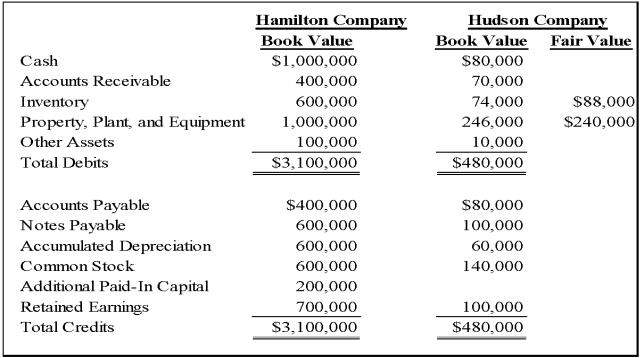

The Hamilton Company acquired 100 percent of the stock of Hudson Company on January 1,2010,for $308,000 cash.Summarized balance sheet data for the companies on December 31,2009,are as follows:

The book values of Hudson's assets and liabilities are equal to their fair values,except as indicated.On January 1,2010,Hudson owed Hamilton $14,000 on account.

Required: Prepare a consolidated balance sheet immediately following the acquisition.

The book values of Hudson's assets and liabilities are equal to their fair values,except as indicated.On January 1,2010,Hudson owed Hamilton $14,000 on account.

Required: Prepare a consolidated balance sheet immediately following the acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 43 في هذه المجموعة.

فتح الحزمة

k this deck