Deck 7: Goal Programming and Multiple Objective Optimization

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

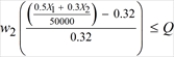

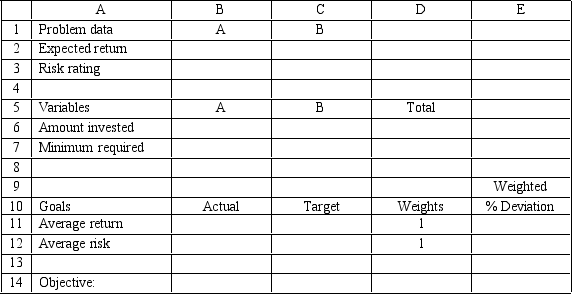

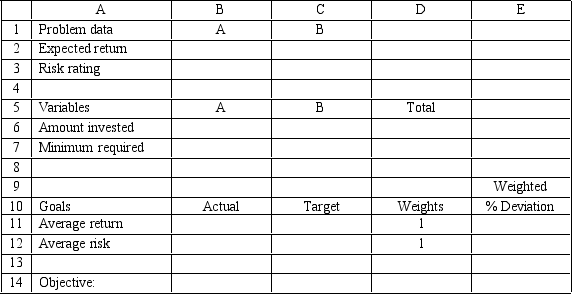

سؤال

سؤال

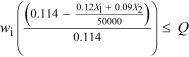

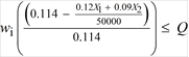

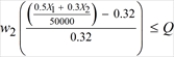

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/65

العب

ملء الشاشة (f)

Deck 7: Goal Programming and Multiple Objective Optimization

1

Which of the following is false regarding a goal constraint?

A)A goal constraint allows us to determine how close a given solution comes to achieving a goal.

B)A goal constraint will always contain two deviational variables.

C)Deviation variables are non-negative.

D)If two deviation variables are used in a constraint at least one will have a value of zero.

A)A goal constraint allows us to determine how close a given solution comes to achieving a goal.

B)A goal constraint will always contain two deviational variables.

C)Deviation variables are non-negative.

D)If two deviation variables are used in a constraint at least one will have a value of zero.

B

2

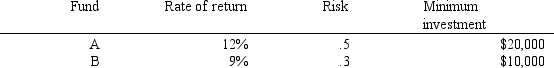

Exhibit 7.1

The following questions are based on the problem below.

A company wants to advertise on TV and radio.The company wants to produce about 6 TV ads and 12 radio ads.Each TV ad costs $20,000 and is viewed by 10 million people.Radio ads cost $10,000 and are heard by 7 million people.The company wants to reach about 140 million people,and spend about $200,000 for all the ads.The problem has been set up in the following Excel spreadsheet.

-Refer to Exhibit 7.1.What formula goes in cell B9?

A)=SUMB6:B8)

B)=B6+B7-B8

C)=B6-B7+B8

D)=B10-B8

The following questions are based on the problem below.

A company wants to advertise on TV and radio.The company wants to produce about 6 TV ads and 12 radio ads.Each TV ad costs $20,000 and is viewed by 10 million people.Radio ads cost $10,000 and are heard by 7 million people.The company wants to reach about 140 million people,and spend about $200,000 for all the ads.The problem has been set up in the following Excel spreadsheet.

-Refer to Exhibit 7.1.What formula goes in cell B9?

A)=SUMB6:B8)

B)=B6+B7-B8

C)=B6-B7+B8

D)=B10-B8

=B6+B7-B8

3

What is the soft constraint form of the following hard constraint?

3X1 + 2 X2 ? 10

A)

B)

C)

D)

3X1 + 2 X2 ? 10

A)

B)

C)

D)

4

What is the meaning of the ti term in this objective function for a goal programming problem?

A)The time required for each decision variable.

B)The percent of goal i met.

C)The coefficient for the ith decision variable

D)The target value for goal i.

A)The time required for each decision variable.

B)The percent of goal i met.

C)The coefficient for the ith decision variable

D)The target value for goal i.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

5

Decision-making problems which can be stated as a collection of desired objectives are known as what type of problem?

A)A non-linear programming problem.

B)An unconstrained programming problem.

C)A goal programming problem.

D)An integer programming problem.

A)A non-linear programming problem.

B)An unconstrained programming problem.

C)A goal programming problem.

D)An integer programming problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

6

Suppose that the first goal in a GP problem is to make 3 X1 + 4 X2 approximately equal to 36.Using the deviational variables d1? and d1+,the following constraint can be used to express this goal.

3 X1 + 4 X2 + d1? ? d1+ = 36

If we obtain a solution where X1 = 6 and X2 = 2,what values do the deviational variables assume?

A)

B)

C)

D)

3 X1 + 4 X2 + d1? ? d1+ = 36

If we obtain a solution where X1 = 6 and X2 = 2,what values do the deviational variables assume?

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

7

Exhibit 7.1

The following questions are based on the problem below.

A company wants to advertise on TV and radio.The company wants to produce about 6 TV ads and 12 radio ads.Each TV ad costs $20,000 and is viewed by 10 million people.Radio ads cost $10,000 and are heard by 7 million people.The company wants to reach about 140 million people,and spend about $200,000 for all the ads.The problem has been set up in the following Excel spreadsheet.

-Refer to Exhibit 7.1.Which of the following is a constraint specified to Analytic Solver Platform for this model?

A)$B$9:$E$9=$B$6:$E$6

B)$B$9:$E$9<$B$10:$E$10

C)$B$9:$E$9=$B$10:$E$10

D)$B$9:$E$9>$B$10:$E$10

The following questions are based on the problem below.

A company wants to advertise on TV and radio.The company wants to produce about 6 TV ads and 12 radio ads.Each TV ad costs $20,000 and is viewed by 10 million people.Radio ads cost $10,000 and are heard by 7 million people.The company wants to reach about 140 million people,and spend about $200,000 for all the ads.The problem has been set up in the following Excel spreadsheet.

-Refer to Exhibit 7.1.Which of the following is a constraint specified to Analytic Solver Platform for this model?

A)$B$9:$E$9=$B$6:$E$6

B)$B$9:$E$9<$B$10:$E$10

C)$B$9:$E$9=$B$10:$E$10

D)$B$9:$E$9>$B$10:$E$10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

8

The d+

Variable indicates the amount by which each goal's target value is

A)missed.

B)underachieved.

C)overachieved.

D)overstated.

Variable indicates the amount by which each goal's target value is

A)missed.

B)underachieved.

C)overachieved.

D)overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

9

The RHS value of a goal constraint is referred to as the

A)target value.

B)constraint value.

C)objective value.

D)desired value.

A)target value.

B)constraint value.

C)objective value.

D)desired value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

10

Exhibit 7.1

The following questions are based on the problem below.

A company wants to advertise on TV and radio.The company wants to produce about 6 TV ads and 12 radio ads.Each TV ad costs $20,000 and is viewed by 10 million people.Radio ads cost $10,000 and are heard by 7 million people.The company wants to reach about 140 million people,and spend about $200,000 for all the ads.The problem has been set up in the following Excel spreadsheet.

-Refer to Exhibit 7.1.Which cells are the variable cells in this model?

A)$B$6:$C$6,$B$7:$E$8

B)$B$6:$C$6

C)$B$9:$E$9

D)$B$6:$E$8

The following questions are based on the problem below.

A company wants to advertise on TV and radio.The company wants to produce about 6 TV ads and 12 radio ads.Each TV ad costs $20,000 and is viewed by 10 million people.Radio ads cost $10,000 and are heard by 7 million people.The company wants to reach about 140 million people,and spend about $200,000 for all the ads.The problem has been set up in the following Excel spreadsheet.

-Refer to Exhibit 7.1.Which cells are the variable cells in this model?

A)$B$6:$C$6,$B$7:$E$8

B)$B$6:$C$6

C)$B$9:$E$9

D)$B$6:$E$8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

11

A constraint which represents a target value for a problem is called a

A)fuzzy constraint.

B)vague constraint.

C)preference constraint

D)soft constraint

A)fuzzy constraint.

B)vague constraint.

C)preference constraint

D)soft constraint

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

12

Suppose that X1 equals 4.What are the values for d1+ and d1? in the following constraint?

X1 + d1?? d1+ = 8

A)

B)

C)

D)

X1 + d1?? d1+ = 8

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

13

The di+,di− variables are referred to as

A)objective variables.

B)goal variables.

C)target variables.

D)deviational variables.

A)objective variables.

B)goal variables.

C)target variables.

D)deviational variables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

14

Suppose that the first goal in a GP problem is to make 3 X1 + 4 X2 approximately equal to 36.Using the deviational variables d1? and d1+,what constraint can be used to express this goal?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following are true regarding weights assigned to deviational variables?

A)The weights assigned can be negative.

B)The weights assigned must sum to one.

C)The weight assigned to the deviation under a particular goal must be the same as the weight assigned to the deviation above that particular goal.

D)All of these are false.

A)The weights assigned can be negative.

B)The weights assigned must sum to one.

C)The weight assigned to the deviation under a particular goal must be the same as the weight assigned to the deviation above that particular goal.

D)All of these are false.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

16

Exhibit 7.1

The following questions are based on the problem below.

A company wants to advertise on TV and radio.The company wants to produce about 6 TV ads and 12 radio ads.Each TV ad costs $20,000 and is viewed by 10 million people.Radio ads cost $10,000 and are heard by 7 million people.The company wants to reach about 140 million people,and spend about $200,000 for all the ads.The problem has been set up in the following Excel spreadsheet.

-Refer to Exhibit 7.1.What formula goes in cell D6?

A)=SUMPRODUCTB2:B3,B6:B7)

B)=B2*C2+B6*C6

C)=SUMPRODUCTB2:C2,B10:C10)

D)=SUMPRODUCTB2:C2,B6:C6)

The following questions are based on the problem below.

A company wants to advertise on TV and radio.The company wants to produce about 6 TV ads and 12 radio ads.Each TV ad costs $20,000 and is viewed by 10 million people.Radio ads cost $10,000 and are heard by 7 million people.The company wants to reach about 140 million people,and spend about $200,000 for all the ads.The problem has been set up in the following Excel spreadsheet.

-Refer to Exhibit 7.1.What formula goes in cell D6?

A)=SUMPRODUCTB2:B3,B6:B7)

B)=B2*C2+B6*C6

C)=SUMPRODUCTB2:C2,B10:C10)

D)=SUMPRODUCTB2:C2,B6:C6)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

17

Goal programming differs from linear programming or integer linear programming is that

A)goal programming provides for multiple objectives.

B)goal programming excludes hard constraints.

C)with goal programming we iterate until an acceptable solution is obtained.

D)goal programming requires fewer variables.

A)goal programming provides for multiple objectives.

B)goal programming excludes hard constraints.

C)with goal programming we iterate until an acceptable solution is obtained.

D)goal programming requires fewer variables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

18

What weight would be assigned to a neutral deviational variable?

A)0

B)1

C)10

D)100

A)0

B)1

C)10

D)100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is true regarding goal programming?

A)The objective function is not useful when comparing goal programming solutions.

B)We can place upper bounds on any of the deviation variables.

C)A preemptive goal program involves deviations with arbitrarily large weights.

D)All of these are true.

A)The objective function is not useful when comparing goal programming solutions.

B)We can place upper bounds on any of the deviation variables.

C)A preemptive goal program involves deviations with arbitrarily large weights.

D)All of these are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

20

A constraint which cannot be violated is called a

A)binding constraint.

B)hard constraint.

C)definite constraint.

D)required constraint.

A)binding constraint.

B)hard constraint.

C)definite constraint.

D)required constraint.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

21

Exhibit 7.1

The following questions are based on the problem below.

A company wants to advertise on TV and radio.The company wants to produce about 6 TV ads and 12 radio ads.Each TV ad costs $20,000 and is viewed by 10 million people.Radio ads cost $10,000 and are heard by 7 million people.The company wants to reach about 140 million people,and spend about $200,000 for all the ads.The problem has been set up in the following Excel spreadsheet.

-Refer to Exhibit 7.1.Which cells)isare)the objective cells)in this model?

A)$B$20

B)$D$6

C)$E$6

D)$B$13:$E$14,$B$9:$E$9

The following questions are based on the problem below.

A company wants to advertise on TV and radio.The company wants to produce about 6 TV ads and 12 radio ads.Each TV ad costs $20,000 and is viewed by 10 million people.Radio ads cost $10,000 and are heard by 7 million people.The company wants to reach about 140 million people,and spend about $200,000 for all the ads.The problem has been set up in the following Excel spreadsheet.

-Refer to Exhibit 7.1.Which cells)isare)the objective cells)in this model?

A)$B$20

B)$D$6

C)$E$6

D)$B$13:$E$14,$B$9:$E$9

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

22

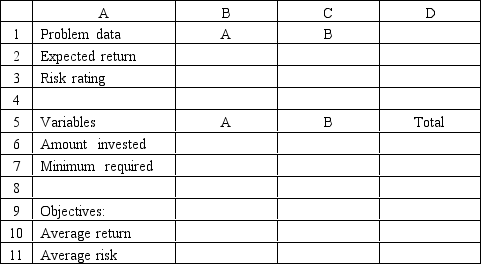

Exhibit 7.2

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B.Investment A requires a $10,000 minimum investment,pays a return of 12% and has a risk factor of .50.Investment B requires a $15,000 minimum investment,pays a return of 10% and has a risk factor of .20.The investor wants to maximize the return while minimizing the risk of the portfolio.The following multi-objective linear programming MOLP)has been solved in Excel.

-Refer to Exhibit 7.2.What formula goes in cell B11?

A)=SUMPRODUCTB2:C2,$B$6:$C$6)/$D$7

B)=B2*C2+B3*C3

C)=SUMPRODUCTB3:C3,$B$6:$C$6)/$D$7

D)=SUMPRODUCTB3:C3,$B$6:$C$6)

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B.Investment A requires a $10,000 minimum investment,pays a return of 12% and has a risk factor of .50.Investment B requires a $15,000 minimum investment,pays a return of 10% and has a risk factor of .20.The investor wants to maximize the return while minimizing the risk of the portfolio.The following multi-objective linear programming MOLP)has been solved in Excel.

-Refer to Exhibit 7.2.What formula goes in cell B11?

A)=SUMPRODUCTB2:C2,$B$6:$C$6)/$D$7

B)=B2*C2+B3*C3

C)=SUMPRODUCTB3:C3,$B$6:$C$6)/$D$7

D)=SUMPRODUCTB3:C3,$B$6:$C$6)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

23

Given the following goal constraints

5 X1 + 6 X2 + 7 X3 + d1− − d1+ = 87

3 X1 + X2 + 4 X3 + d2− − d2+ = 37

7 X1 + 3 X2 + 2 X3 + d3− − d3+ = 72

and solution X1,X2,X3)= 7,2,5),what values do the deviational variables assume?

5 X1 + 6 X2 + 7 X3 + d1− − d1+ = 87

3 X1 + X2 + 4 X3 + d2− − d2+ = 37

7 X1 + 3 X2 + 2 X3 + d3− − d3+ = 72

and solution X1,X2,X3)= 7,2,5),what values do the deviational variables assume?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

24

Exhibit 7.1

The following questions are based on the problem below.

A company wants to advertise on TV and radio.The company wants to produce about 6 TV ads and 12 radio ads.Each TV ad costs $20,000 and is viewed by 10 million people.Radio ads cost $10,000 and are heard by 7 million people.The company wants to reach about 140 million people,and spend about $200,000 for all the ads.The problem has been set up in the following Excel spreadsheet.

-Refer to Exhibit 7.1.If the company is very concerned about going over the $200,000 budget,which cell value should change and how should it change?

A)D13,increase

B)D13,decrease

C)D14,increase

D)D14,decrease

The following questions are based on the problem below.

A company wants to advertise on TV and radio.The company wants to produce about 6 TV ads and 12 radio ads.Each TV ad costs $20,000 and is viewed by 10 million people.Radio ads cost $10,000 and are heard by 7 million people.The company wants to reach about 140 million people,and spend about $200,000 for all the ads.The problem has been set up in the following Excel spreadsheet.

-Refer to Exhibit 7.1.If the company is very concerned about going over the $200,000 budget,which cell value should change and how should it change?

A)D13,increase

B)D13,decrease

C)D14,increase

D)D14,decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

25

The primary benefit of a MINIMAX objective function is

A)it yields any feasible solution by changing the weights.

B)it is limited to all corner points.

C)it yields a larger variety of solutions than generally available using an LP method.

D)it makes many of the deviational variables equal to zero.

A)it yields any feasible solution by changing the weights.

B)it is limited to all corner points.

C)it yields a larger variety of solutions than generally available using an LP method.

D)it makes many of the deviational variables equal to zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

26

Exhibit 7.2

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B.Investment A requires a $10,000 minimum investment,pays a return of 12% and has a risk factor of .50.Investment B requires a $15,000 minimum investment,pays a return of 10% and has a risk factor of .20.The investor wants to maximize the return while minimizing the risk of the portfolio.The following multi-objective linear programming MOLP)has been solved in Excel.

-Refer to Exhibit 7.2.Which cells)isare)the target cells in this model?

A)$B$6:$C$6,$B$10:$B$11

B)$B$6:$C$6

C)$B$6:$D$6

D)$B$10:$B$11

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B.Investment A requires a $10,000 minimum investment,pays a return of 12% and has a risk factor of .50.Investment B requires a $15,000 minimum investment,pays a return of 10% and has a risk factor of .20.The investor wants to maximize the return while minimizing the risk of the portfolio.The following multi-objective linear programming MOLP)has been solved in Excel.

-Refer to Exhibit 7.2.Which cells)isare)the target cells in this model?

A)$B$6:$C$6,$B$10:$B$11

B)$B$6:$C$6

C)$B$6:$D$6

D)$B$10:$B$11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

27

Exhibit 7.2

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B.Investment A requires a $10,000 minimum investment,pays a return of 12% and has a risk factor of .50.Investment B requires a $15,000 minimum investment,pays a return of 10% and has a risk factor of .20.The investor wants to maximize the return while minimizing the risk of the portfolio.The following multi-objective linear programming MOLP)has been solved in Excel.

-Refer to Exhibit 7.2.What Analytic Solver Platform constraint involves cells $B$6:$C$6?

A)$B$6:$C$6=$B$7:$C$7

B)$B$6:$C$6?$B$7:$C$7

C)$B$6:$C$6?$B$7:$C$7

D)$B$6:$C$6=$D$7

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B.Investment A requires a $10,000 minimum investment,pays a return of 12% and has a risk factor of .50.Investment B requires a $15,000 minimum investment,pays a return of 10% and has a risk factor of .20.The investor wants to maximize the return while minimizing the risk of the portfolio.The following multi-objective linear programming MOLP)has been solved in Excel.

-Refer to Exhibit 7.2.What Analytic Solver Platform constraint involves cells $B$6:$C$6?

A)$B$6:$C$6=$B$7:$C$7

B)$B$6:$C$6?$B$7:$C$7

C)$B$6:$C$6?$B$7:$C$7

D)$B$6:$C$6=$D$7

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

28

A manager wants to ensure that he does not exceed his budget by more than $1000 in a goal programming problem.If the budget constraint is the third constraint in the goal programming problem which of the following formulas will best ensure that the manager's objective is met?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

29

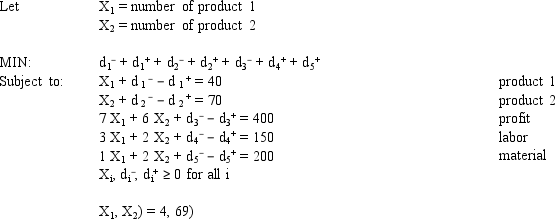

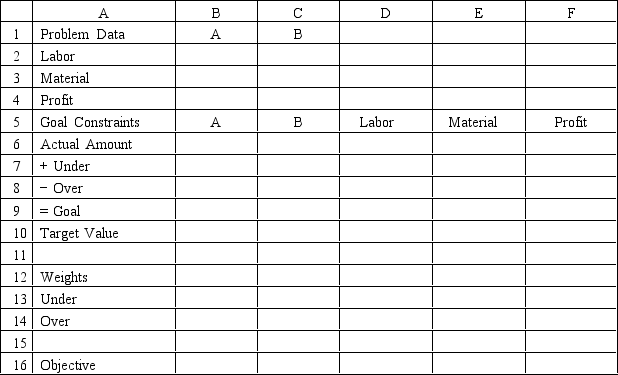

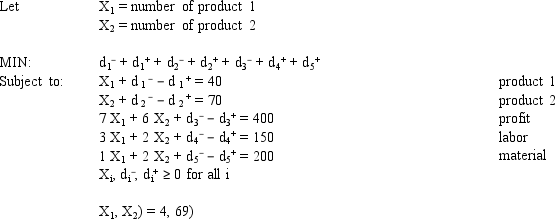

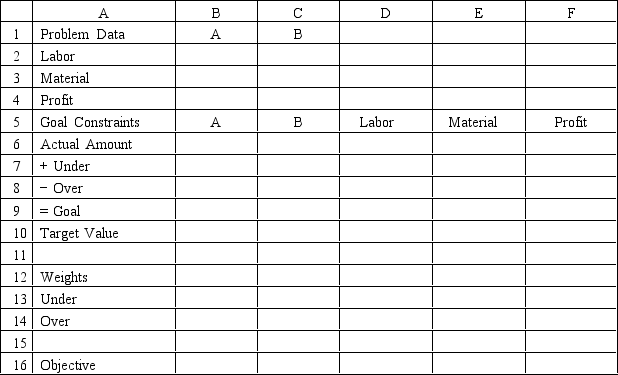

A company makes 2 products A and B from 2 resources.The products have the following resource requirements and produce the accompanying profits.The available quantity of resources is also shown in the table.

Management has developed the following set of goals

Goal 1: Produce approximately 40 units of product 1.

Goal 2: Produce approximately 70 units of product 2.Goal 3: Achieve a profit over $400.

Goal 4: Consume less than 150 hours of labor Goal 5: Consume less than 200 ounces of material

Based on this GP formulation of the problem and the associated optimal integer solution what values should go in cells B2:F16 of the following Excel spreadsheet?

Management has developed the following set of goals

Goal 1: Produce approximately 40 units of product 1.

Goal 2: Produce approximately 70 units of product 2.Goal 3: Achieve a profit over $400.

Goal 4: Consume less than 150 hours of labor Goal 5: Consume less than 200 ounces of material

Based on this GP formulation of the problem and the associated optimal integer solution what values should go in cells B2:F16 of the following Excel spreadsheet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

30

If no other feasible solution to a multi-objective linear programming MOLP)problem allows an increase in any objective without decreasing at least one other objective,the solution is said to be

A)dually optimal.

B)Pareto optimal.

C)suboptimal.

D)maximally optimal.

A)dually optimal.

B)Pareto optimal.

C)suboptimal.

D)maximally optimal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

31

An optimization technique useful for solving problems with more than one objective function is

A)dual programming.

B)sensitivity analysis.

C)multi-objective linear programming.

D)goal programming.

A)dual programming.

B)sensitivity analysis.

C)multi-objective linear programming.

D)goal programming.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

32

MINIMAX solutions to multi-objective linear programming MOLP)problems are

A)dually optimal.

B)Pareto optimal.

C)suboptimal.

D)maximally optimal.

A)dually optimal.

B)Pareto optimal.

C)suboptimal.

D)maximally optimal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

33

Exhibit 7.3

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B.Investment A requires a $10,000 minimum investment,pays a return of 12% and has a risk factor of .50.Investment B requires a $15,000 minimum investment,pays a return of 10% and has a risk factor of .20.The investor wants to maximize the return while minimizing the risk of the portfolio.The following minimax formulation of the problem has been solved in Excel.

-Refer to Exhibit 7.3.What formula goes in cell E11?

A)=D11*C11?B11)/C11

B)=C11?B11)/C11

C)=D11*C11

D)=D11*C11?B11)

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B.Investment A requires a $10,000 minimum investment,pays a return of 12% and has a risk factor of .50.Investment B requires a $15,000 minimum investment,pays a return of 10% and has a risk factor of .20.The investor wants to maximize the return while minimizing the risk of the portfolio.The following minimax formulation of the problem has been solved in Excel.

-Refer to Exhibit 7.3.What formula goes in cell E11?

A)=D11*C11?B11)/C11

B)=C11?B11)/C11

C)=D11*C11

D)=D11*C11?B11)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

34

Consider the following multi-objective linear programming problem MOLP):

MAX: 3 X1 + 4 X2

MAX: 2 X1 + X2

Subject to: 6 X1 + 13 X2 ? 78

12 X1 + 9 X2 ? 108

8 X1 + 10 X2 ? 80 X1,X2 ? 0

Graph the feasible region for this problem and compute the value of each objective at each extreme point.What are the solutions to each of the component LPs?

MAX: 3 X1 + 4 X2

MAX: 2 X1 + X2

Subject to: 6 X1 + 13 X2 ? 78

12 X1 + 9 X2 ? 108

8 X1 + 10 X2 ? 80 X1,X2 ? 0

Graph the feasible region for this problem and compute the value of each objective at each extreme point.What are the solutions to each of the component LPs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

35

A company makes 2 products A and B from 2 resources,labor and material.The products have the following resource requirements and produce the accompanying profits.The available quantity of resources is also shown in the table.

Management has developed the following set of goals

Goal 1: Produce approximately 40 units of product 1.

Goal 2: Produce approximately 70 units of product 2.Goal 3: Achieve a profit over $400.

Goal 4: Consume less than 150 hours of labor Goal 5: Consume less than 200 ounces of material

Formulate a goal programming model of this problem.

Management has developed the following set of goals

Goal 1: Produce approximately 40 units of product 1.

Goal 2: Produce approximately 70 units of product 2.Goal 3: Achieve a profit over $400.

Goal 4: Consume less than 150 hours of labor Goal 5: Consume less than 200 ounces of material

Formulate a goal programming model of this problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

36

Exhibit 7.3

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B.Investment A requires a $10,000 minimum investment,pays a return of 12% and has a risk factor of .50.Investment B requires a $15,000 minimum investment,pays a return of 10% and has a risk factor of .20.The investor wants to maximize the return while minimizing the risk of the portfolio.The following minimax formulation of the problem has been solved in Excel.

-Refer to Exhibit 7.3.Which value should the investor change,and in what direction,if he wants to reduce the risk of the portfolio?

A)D11,increase

B)D12,increase

C)C12,increase

D)D12,decrease

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B.Investment A requires a $10,000 minimum investment,pays a return of 12% and has a risk factor of .50.Investment B requires a $15,000 minimum investment,pays a return of 10% and has a risk factor of .20.The investor wants to maximize the return while minimizing the risk of the portfolio.The following minimax formulation of the problem has been solved in Excel.

-Refer to Exhibit 7.3.Which value should the investor change,and in what direction,if he wants to reduce the risk of the portfolio?

A)D11,increase

B)D12,increase

C)C12,increase

D)D12,decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

37

Exhibit 7.2

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B.Investment A requires a $10,000 minimum investment,pays a return of 12% and has a risk factor of .50.Investment B requires a $15,000 minimum investment,pays a return of 10% and has a risk factor of .20.The investor wants to maximize the return while minimizing the risk of the portfolio.The following multi-objective linear programming MOLP)has been solved in Excel.

-Refer to Exhibit 7.2.What formula goes in cell B10?

A)=SUMPRODUCTB2:C2,$B$6:$C$6)/$D$7

B)=B2*C2+B3*C3

C)=SUMPRODUCTB3:C3,$B$6:$C$6)/$D$7

D)=SUMPRODUCTB2:C2,$B$6:$C$6)

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B.Investment A requires a $10,000 minimum investment,pays a return of 12% and has a risk factor of .50.Investment B requires a $15,000 minimum investment,pays a return of 10% and has a risk factor of .20.The investor wants to maximize the return while minimizing the risk of the portfolio.The following multi-objective linear programming MOLP)has been solved in Excel.

-Refer to Exhibit 7.2.What formula goes in cell B10?

A)=SUMPRODUCTB2:C2,$B$6:$C$6)/$D$7

B)=B2*C2+B3*C3

C)=SUMPRODUCTB3:C3,$B$6:$C$6)/$D$7

D)=SUMPRODUCTB2:C2,$B$6:$C$6)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

38

Goal programming solution feedback indicates that the d4+ level of 50 should not be exceeded in future solution iterations.How should you modify your goal constraint to accommodate this requirement?

40 X1 + 20 X2 + d4? + d4+ = 300

A)

B)

C)

D)

40 X1 + 20 X2 + d4? + d4+ = 300

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

39

Exhibit 7.2

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B.Investment A requires a $10,000 minimum investment,pays a return of 12% and has a risk factor of .50.Investment B requires a $15,000 minimum investment,pays a return of 10% and has a risk factor of .20.The investor wants to maximize the return while minimizing the risk of the portfolio.The following multi-objective linear programming MOLP)has been solved in Excel.

-Refer to Exhibit 7.2.Which cells are the changing cells in this model?

A)$B$6:$C$6,$B$10:$B$11

B)$B$6:$C$6

C)$B$6:$D$6

D)$B$10:$B$11

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B.Investment A requires a $10,000 minimum investment,pays a return of 12% and has a risk factor of .50.Investment B requires a $15,000 minimum investment,pays a return of 10% and has a risk factor of .20.The investor wants to maximize the return while minimizing the risk of the portfolio.The following multi-objective linear programming MOLP)has been solved in Excel.

-Refer to Exhibit 7.2.Which cells are the changing cells in this model?

A)$B$6:$C$6,$B$10:$B$11

B)$B$6:$C$6

C)$B$6:$D$6

D)$B$10:$B$11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

40

The MINIMAX objective

A)yields the smallest possible deviations.

B)minimizes the maximum deviation from any goal.

C)chooses the deviation which has the largest value.

D)maximizes the minimum value of goal attainment.

A)yields the smallest possible deviations.

B)minimizes the maximum deviation from any goal.

C)chooses the deviation which has the largest value.

D)maximizes the minimum value of goal attainment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

41

A MINIMAX objective function in goal programming GP):

A)is used to minimize the maximum deviation from a goal

B)is captured in a decision table

C)is estimated by trial-and-error

D)often produces an infeasible solution

A)is used to minimize the maximum deviation from a goal

B)is captured in a decision table

C)is estimated by trial-and-error

D)often produces an infeasible solution

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

42

Exhibit 7.4

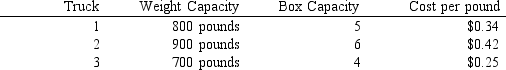

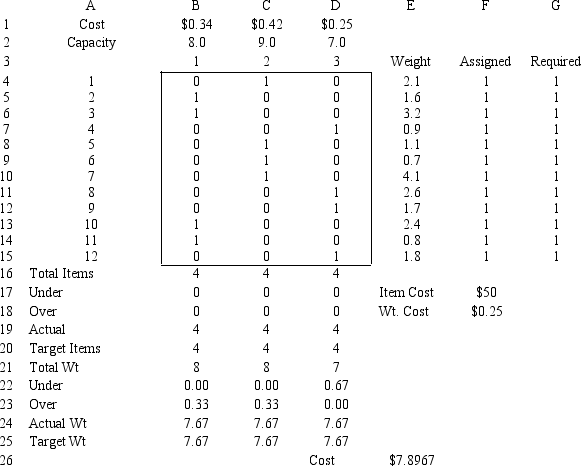

The following questions are based on the problem below.

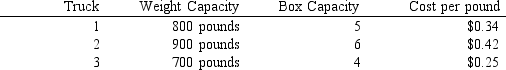

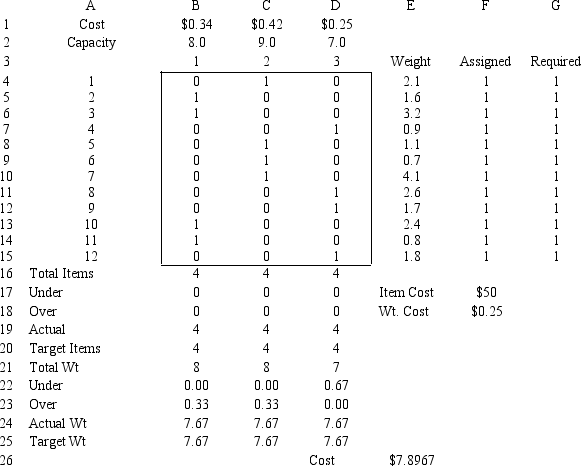

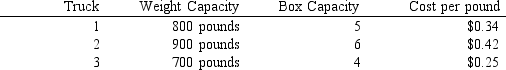

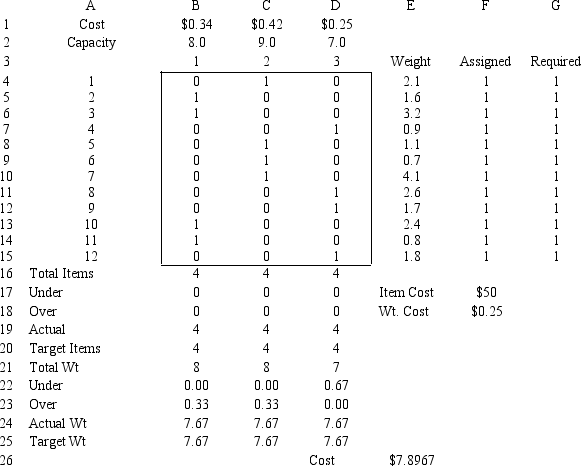

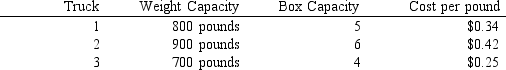

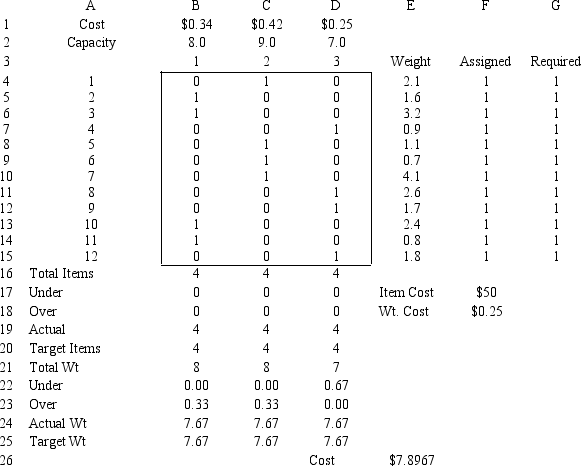

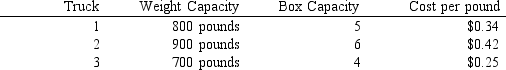

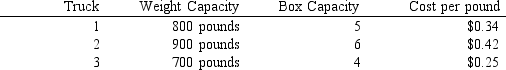

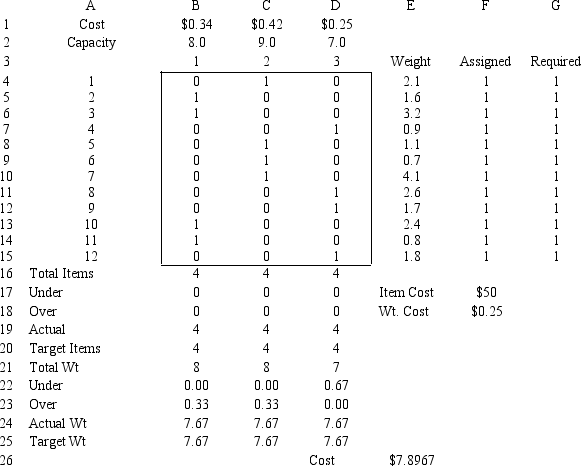

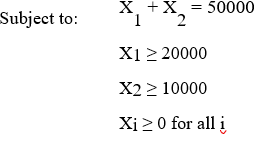

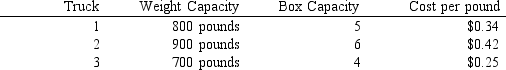

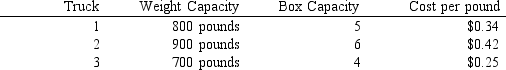

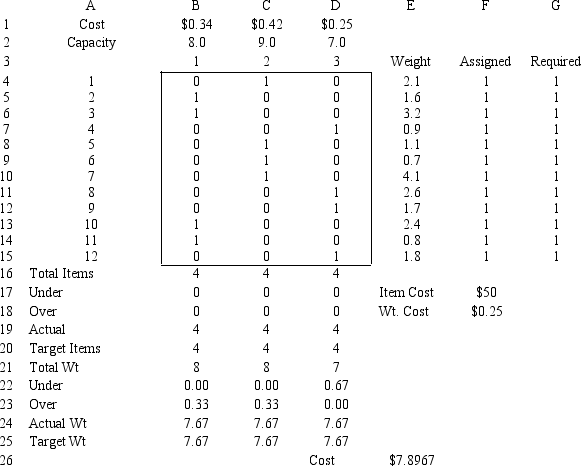

Robert Gardner runs a small,local-only delivery service.His fleet consists of three smaller panel trucks.He recently accepted a contract to deliver 12 shipping boxes of goods for delivery to 12 different customers.The box weights are: 210,160,320,90,110,70,410,260,170,240,80 and 180 for boxes 1 through 12,respectively.Since each truck differs each truck has different load capacities as given below:

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.

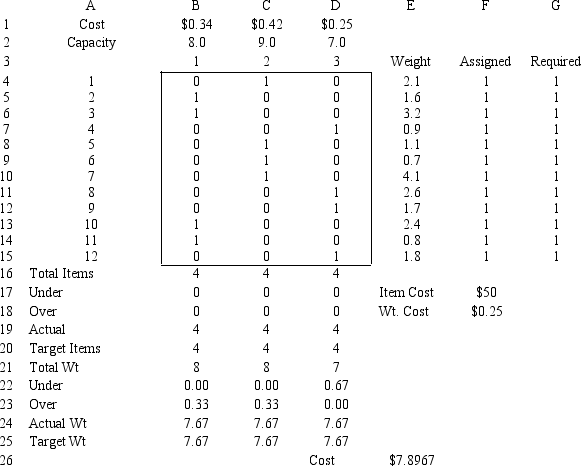

The following integer goal programming formulation applies to his problem.

Y1 = weight loaded in truck 1;Y2 = weight loaded in truck 2;Y3 = weight loaded intruck3;Xi,j = 0 if truck i not loaded with box j;1 if truck i loaded with box j.

Given the following spreadsheet solution of this integer goal programming formulation,answer the following questions.

Refer to Exhibit 7.4.What formulas should go in cell E26 of the spreadsheet?

The following questions are based on the problem below.

Robert Gardner runs a small,local-only delivery service.His fleet consists of three smaller panel trucks.He recently accepted a contract to deliver 12 shipping boxes of goods for delivery to 12 different customers.The box weights are: 210,160,320,90,110,70,410,260,170,240,80 and 180 for boxes 1 through 12,respectively.Since each truck differs each truck has different load capacities as given below:

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.The following integer goal programming formulation applies to his problem.

Y1 = weight loaded in truck 1;Y2 = weight loaded in truck 2;Y3 = weight loaded intruck3;Xi,j = 0 if truck i not loaded with box j;1 if truck i loaded with box j.

Given the following spreadsheet solution of this integer goal programming formulation,answer the following questions.

Refer to Exhibit 7.4.What formulas should go in cell E26 of the spreadsheet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

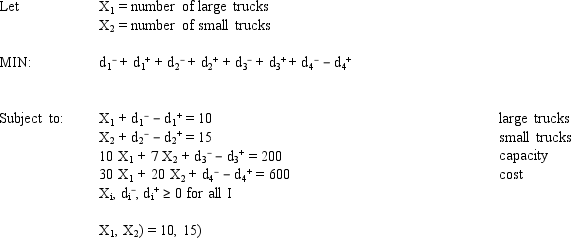

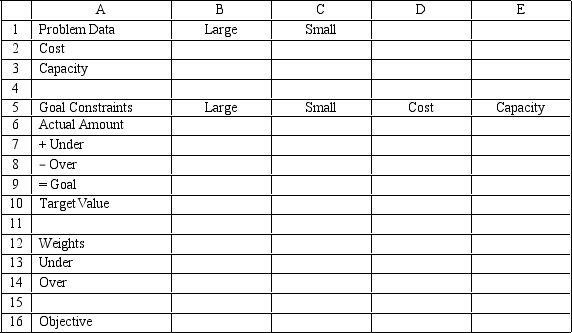

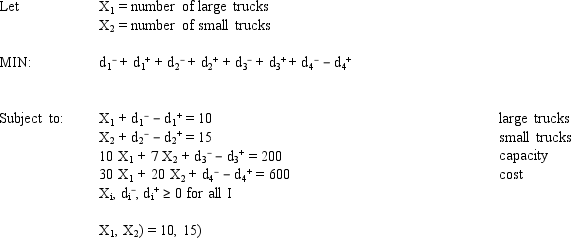

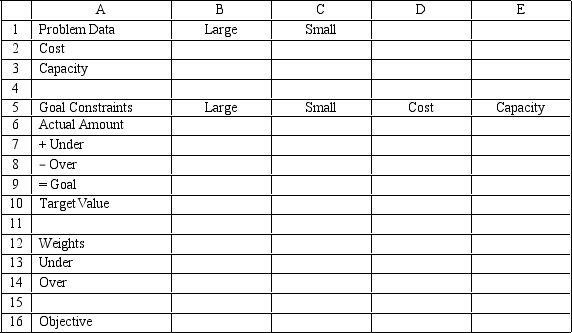

43

A company wants to purchase large and small delivery trucks.The company wants to purchase about 10 large and 15 small trucks.Each large truck costs $30,000 and has a 10 ton capacity.Each small truck costs $20,000 and has a 7 ton capacity.The company wants to have about 200 tons of capacity and spend about $600,000.

Based on the following formulation and associated integer solution,what values should go in cells B2:E16 of the spreadsheet?

Based on the following formulation and associated integer solution,what values should go in cells B2:E16 of the spreadsheet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

44

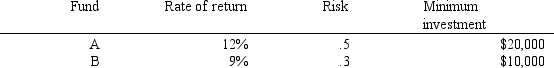

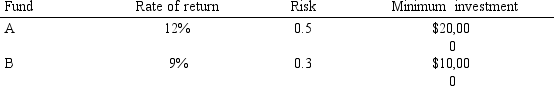

An investor wants to invest $50,000 in two mutual funds,A and B.The rates of return,risks and minimum investment requirements for each fund are:

Note that a low Risk rating means a less risky investment.The investor can invest to maximize the expected rate of return or minimize risk.Any money beyond the minimum investment requirements can be invested in either fund.

Formulate the MOLP for this investor.

Note that a low Risk rating means a less risky investment.The investor can invest to maximize the expected rate of return or minimize risk.Any money beyond the minimum investment requirements can be invested in either fund.

Formulate the MOLP for this investor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

45

Exhibit 7.4

The following questions are based on the problem below.

Robert Gardner runs a small,local-only delivery service.His fleet consists of three smaller panel trucks.He recently accepted a contract to deliver 12 shipping boxes of goods for delivery to 12 different customers.The box weights are: 210,160,320,90,110,70,410,260,170,240,80 and 180 for boxes 1 through 12,respectively.Since each truck differs each truck has different load capacities as given below:

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.

The following integer goal programming formulation applies to his problem.

Y1 = weight loaded in truck 1;Y2 = weight loaded in truck 2;Y3 = weight loaded intruck3;Xi,j = 0 if truck i not loaded with box j;1 if truck i loaded with box j.

Given the following spreadsheet solution of this integer goal programming formulation,answer the following questions.

Refer to Exhibit 7.4.The solution indicates Truck 3 is under the target weight by 67 pounds.What if anything can be done to this model to provide a solution in which Truck 3 is closer to the target weight?

The following questions are based on the problem below.

Robert Gardner runs a small,local-only delivery service.His fleet consists of three smaller panel trucks.He recently accepted a contract to deliver 12 shipping boxes of goods for delivery to 12 different customers.The box weights are: 210,160,320,90,110,70,410,260,170,240,80 and 180 for boxes 1 through 12,respectively.Since each truck differs each truck has different load capacities as given below:

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.The following integer goal programming formulation applies to his problem.

Y1 = weight loaded in truck 1;Y2 = weight loaded in truck 2;Y3 = weight loaded intruck3;Xi,j = 0 if truck i not loaded with box j;1 if truck i loaded with box j.

Given the following spreadsheet solution of this integer goal programming formulation,answer the following questions.

Refer to Exhibit 7.4.The solution indicates Truck 3 is under the target weight by 67 pounds.What if anything can be done to this model to provide a solution in which Truck 3 is closer to the target weight?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

46

A company wants to purchase large and small delivery trucks.The company wants to purchase about 10 large and 15 small trucks.Each large truck costs $30,000 and has a 10 ton capacity.Each small truck costs $20,000 and has a 7 ton capacity.The company wants to have about 200 tons of capacity and spend about $600,000.

Formulate a goal programming model of this problem.

Formulate a goal programming model of this problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

47

One major advantage of goal programming GP)is that the technique:

A)allows a decision-maker to jointly examine several objectives

B)multiple objectives can be assigned different weights depending on their relative importance

C)can focus on a single objective,if necessary

D)all of the above

A)allows a decision-maker to jointly examine several objectives

B)multiple objectives can be assigned different weights depending on their relative importance

C)can focus on a single objective,if necessary

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

48

A soft constraint

A)represents a target a decision-maker would like to achieve

B)is always tight

C)cannot be violated

D)typically represents a single goal

A)represents a target a decision-maker would like to achieve

B)is always tight

C)cannot be violated

D)typically represents a single goal

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

49

Goal programming problems

A)typically include a set of multiple goals

B)cannot include hard constraints

C)consist of soft constraints only

D)must have a single objective function

A)typically include a set of multiple goals

B)cannot include hard constraints

C)consist of soft constraints only

D)must have a single objective function

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

50

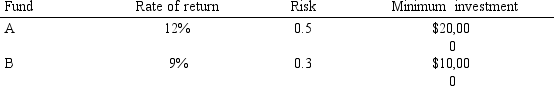

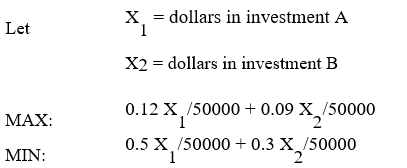

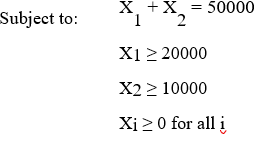

An investor wants to invest $50,000 in two mutual funds,A and B.The rates of return,risks and minimum investment requirements for each fund are:

Note that a low Risk rating means a less risky investment.The investor can invest to maximize the expected rate of return or minimize risk.Any money beyond the minimum investment requirements can be invested in either fund.

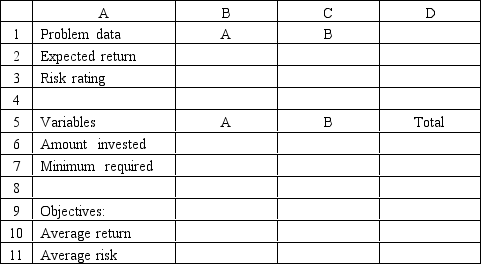

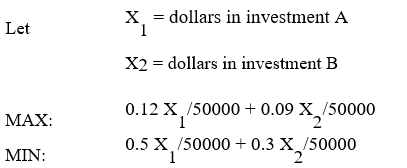

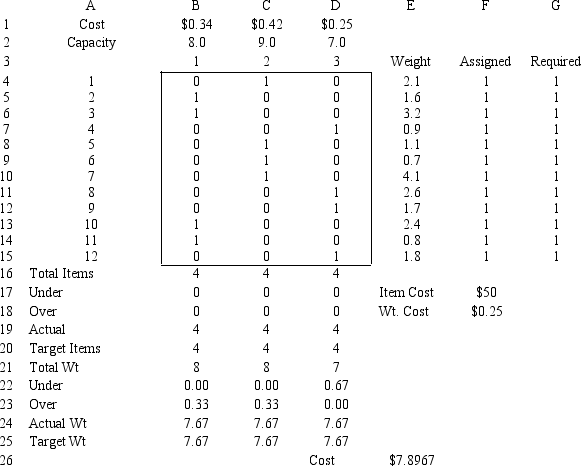

The following is the multi-objective linear programming MOLP)formulation for this problem:

Let X1 = dollars in investment A X2 = dollars in investment B

MAX: 0.12 X1/50000 + 0.09 X2/50000

MIN: 0.5 X1/50000 + 0.3 X2/50000

Subject to: X1 + X2 = 50000

X1 ≥ 20000

X2 ≥ 10000

Xi ≥ 0 for all i

The solution for the second LP is X1,X2)= 20,000,30,000).

Based on this solution,what values should go in cells B2:D11 of the spreadsheet?

Note that a low Risk rating means a less risky investment.The investor can invest to maximize the expected rate of return or minimize risk.Any money beyond the minimum investment requirements can be invested in either fund.

The following is the multi-objective linear programming MOLP)formulation for this problem:

Let X1 = dollars in investment A X2 = dollars in investment B

MAX: 0.12 X1/50000 + 0.09 X2/50000

MIN: 0.5 X1/50000 + 0.3 X2/50000

Subject to: X1 + X2 = 50000

X1 ≥ 20000

X2 ≥ 10000

Xi ≥ 0 for all i

The solution for the second LP is X1,X2)= 20,000,30,000).

Based on this solution,what values should go in cells B2:D11 of the spreadsheet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

51

Deviational variables

A)are added to constraints to indicate acceptable departures from the target vaoues of their corresponding goals

B)are negative

C)are positive for underachievement only

D)are positive for overachievement only

A)are added to constraints to indicate acceptable departures from the target vaoues of their corresponding goals

B)are negative

C)are positive for underachievement only

D)are positive for overachievement only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

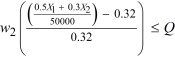

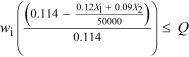

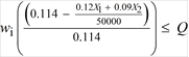

52

An investor wants to invest $50,000 in two mutual funds,A and B.The rates of return,risks and minimum investment requirements for each fund are:

Note that a low Risk rating means a less risky investment.The investor wants to maximize the expected rate of return while minimizing his risk.Any money beyond the minimum investment requirements can be invested in either fund.The investor has found that the maximum possible expected rate of return is 11.4% and the minimum possible risk is 0.32.

Formulate a goal programming model with a MINIMAX objective function.

Note that a low Risk rating means a less risky investment.The investor wants to maximize the expected rate of return while minimizing his risk.Any money beyond the minimum investment requirements can be invested in either fund.The investor has found that the maximum possible expected rate of return is 11.4% and the minimum possible risk is 0.32.

Formulate a goal programming model with a MINIMAX objective function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

53

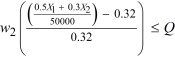

An investor wants to invest $50,000 in two mutual funds,A and B.The rates of return,risks and minimum investment requirements for each fund are:

Note that a low Risk rating means a less risky investment.The investor wants to maximize the expected rate of return while minimizing his risk.Any money beyond the minimum investment requirements can be invested in either fund.The investor has found that the maximum possible expected rate of return is 11.4% and the minimum possible risk is 0.32.

The following Excel spreadsheet has been created to solve a goal programming problem with a MINIMAX objective based on the following goal programming formulation with MINIMAX objective and corresponding solution.

MINIMIZE Q

Subject to: X1 + X2 = 50000

X1 ≥ 20000

X2 ≥ 10000

Xi ≥ 0 for all i,Q ≥ 0

with solution X1,X2)= 15,370,34,630).

What values should go in cells B2:D14 of the spreadsheet?

Note that a low Risk rating means a less risky investment.The investor wants to maximize the expected rate of return while minimizing his risk.Any money beyond the minimum investment requirements can be invested in either fund.The investor has found that the maximum possible expected rate of return is 11.4% and the minimum possible risk is 0.32.

The following Excel spreadsheet has been created to solve a goal programming problem with a MINIMAX objective based on the following goal programming formulation with MINIMAX objective and corresponding solution.

MINIMIZE Q

Subject to: X1 + X2 = 50000

X1 ≥ 20000

X2 ≥ 10000

Xi ≥ 0 for all i,Q ≥ 0

with solution X1,X2)= 15,370,34,630).

What values should go in cells B2:D14 of the spreadsheet?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

54

Exhibit 7.4

The following questions are based on the problem below.

Robert Gardner runs a small,local-only delivery service.His fleet consists of three smaller panel trucks.He recently accepted a contract to deliver 12 shipping boxes of goods for delivery to 12 different customers.The box weights are: 210,160,320,90,110,70,410,260,170,240,80 and 180 for boxes 1 through 12,respectively.Since each truck differs each truck has different load capacities as given below:

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.

The following integer goal programming formulation applies to his problem.

Y1 = weight loaded in truck 1;Y2 = weight loaded in truck 2;Y3 = weight loaded intruck3;Xi,j = 0 if truck i not loaded with box j;1 if truck i loaded with box j.

Given the following spreadsheet solution of this integer goal programming formulation,answer the following questions.

Refer to Exhibit 7.4.The spreadsheet model has scaled all the weights from pounds into 100s pounds.How does this scaling effect the solution obtained using the Risk Solver Platform RSP)?

The following questions are based on the problem below.

Robert Gardner runs a small,local-only delivery service.His fleet consists of three smaller panel trucks.He recently accepted a contract to deliver 12 shipping boxes of goods for delivery to 12 different customers.The box weights are: 210,160,320,90,110,70,410,260,170,240,80 and 180 for boxes 1 through 12,respectively.Since each truck differs each truck has different load capacities as given below:

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.The following integer goal programming formulation applies to his problem.

Y1 = weight loaded in truck 1;Y2 = weight loaded in truck 2;Y3 = weight loaded intruck3;Xi,j = 0 if truck i not loaded with box j;1 if truck i loaded with box j.

Given the following spreadsheet solution of this integer goal programming formulation,answer the following questions.

Refer to Exhibit 7.4.The spreadsheet model has scaled all the weights from pounds into 100s pounds.How does this scaling effect the solution obtained using the Risk Solver Platform RSP)?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

55

Goal programming GP)is:

A)iterative

B)inaccurate

C)static

D)all of the above

A)iterative

B)inaccurate

C)static

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

56

An investor wants to invest $50,000 in two mutual funds,A and B.The rates of return,risks and minimum investment requirements for each fund are:

Note that a low Risk rating means a less risky investment.The investor can invest to maximize the expected rate of return or minimize risk.Any money beyond the minimum investment requirements can be invested in either fund.

The following is the MOLP formulation for this problem:

The solution for the second LP is X1,X2)= 20,000,30,000).

What formulas should go in cells B2:D11 of the spreadsheet? NOTE: Formulas are not required in all of these cells.

Note that a low Risk rating means a less risky investment.The investor can invest to maximize the expected rate of return or minimize risk.Any money beyond the minimum investment requirements can be invested in either fund.

The following is the MOLP formulation for this problem:

The solution for the second LP is X1,X2)= 20,000,30,000).

What formulas should go in cells B2:D11 of the spreadsheet? NOTE: Formulas are not required in all of these cells.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

57

Goal programming GP)is typically

A)a minimization problem of the sum of weighted percentage deviations

B)a maximization problem of positive deviations only

C)a minimization problem of negative deviations only

D)a maximization problem of continuous goals

A)a minimization problem of the sum of weighted percentage deviations

B)a maximization problem of positive deviations only

C)a minimization problem of negative deviations only

D)a maximization problem of continuous goals

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

58

Exhibit 7.4

The following questions are based on the problem below.

Robert Gardner runs a small,local-only delivery service.His fleet consists of three smaller panel trucks.He recently accepted a contract to deliver 12 shipping boxes of goods for delivery to 12 different customers.The box weights are: 210,160,320,90,110,70,410,260,170,240,80 and 180 for boxes 1 through 12,respectively.Since each truck differs each truck has different load capacities as given below:

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.

The following integer goal programming formulation applies to his problem.

Y1 = weight loaded in truck 1;Y2 = weight loaded in truck 2;Y3 = weight loaded intruck3;Xi,j = 0 if truck i not loaded with box j;1 if truck i loaded with box j.

Given the following spreadsheet solution of this integer goal programming formulation,answer the following questions.

Refer to Exhibit 7.4.Given the solution indicated in the spreadsheet,which trucks,if any,are under an equal weight

amount,and which trucks are over an equal weight amount?

The following questions are based on the problem below.

Robert Gardner runs a small,local-only delivery service.His fleet consists of three smaller panel trucks.He recently accepted a contract to deliver 12 shipping boxes of goods for delivery to 12 different customers.The box weights are: 210,160,320,90,110,70,410,260,170,240,80 and 180 for boxes 1 through 12,respectively.Since each truck differs each truck has different load capacities as given below:

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.

Robert would like each truck equally loaded,both in terms of number of boxes and in terms of total weight,while minimizing his shipping costs.Assume a cost of $50 per item for trucks carrying extra boxes and $0.10 per pound cost for trucks carrying less weight.The following integer goal programming formulation applies to his problem.

Y1 = weight loaded in truck 1;Y2 = weight loaded in truck 2;Y3 = weight loaded intruck3;Xi,j = 0 if truck i not loaded with box j;1 if truck i loaded with box j.

Given the following spreadsheet solution of this integer goal programming formulation,answer the following questions.

Refer to Exhibit 7.4.Given the solution indicated in the spreadsheet,which trucks,if any,are under an equal weight

amount,and which trucks are over an equal weight amount?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

59

A dietician wants to formulate a low cost,high calorie food product for a customer.The following information is available about the 2 ingredients which can be combined to make the food.The customer wants 1000 pounds of the food product and it should contain 250 pounds of Food 1 and 300 pounds of Food 2.The final cost of the blend should be about $1.15 and contain about 2500 calories per pound.The percent of fat,protein,carbohydrate in each food is summarized below with the target values for the goals.The dietician would prefer the food product be low in fat while also high in protein and carbohydrates.

Formulate the GP for this problem

Formulate the GP for this problem

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

60

A hard constraint

A)cannot be violated

B)may be violated

C)is always binding

D)is always part of the feasible solution

A)cannot be violated

B)may be violated

C)is always binding

D)is always part of the feasible solution

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

61

In the "triple bottom line" the term "people" refers to:

A)social responsibility issues

B)environmental issues

C)financial objectives

D)all of the above

A)social responsibility issues

B)environmental issues

C)financial objectives

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

62

Suppose that environmental and human variables are assigned the weight of zero.Then the "triple bottom line" approach reduces to:

A)profit maximization

B)environmental issues

C)HR objectives

D)achieving social equilibrium

A)profit maximization

B)environmental issues

C)HR objectives

D)achieving social equilibrium

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

63

Multi-objective linear programming MOLP)provide

A)a way to analyze LP problems with multiple conflicting objectives

B)a way to incorporate soft constraints

C)a way to incorporate hard constraints

D)a simple way to solve the problem as a relaxed LP

A)a way to analyze LP problems with multiple conflicting objectives

B)a way to incorporate soft constraints

C)a way to incorporate hard constraints

D)a simple way to solve the problem as a relaxed LP

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

64

Suppose that profit and human variables are assigned the weight of zero.Then the "triple bottom line" approach reduces to:

A)profit maximization only

B)environmental considerations only

C)HR objectives only

D)achieving social happiness

A)profit maximization only

B)environmental considerations only

C)HR objectives only

D)achieving social happiness

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck

65

The "triple bottom line" incorporates multiple objective decision-making by:

A)simultaneously considering profit,people and planet

B)environmental issues only

C)financial objectives only

D)wealth redistribution in the society

A)simultaneously considering profit,people and planet

B)environmental issues only

C)financial objectives only

D)wealth redistribution in the society

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 65 في هذه المجموعة.

فتح الحزمة

k this deck