Deck 13: Overview of Credit Policy and Loan Characteristics

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

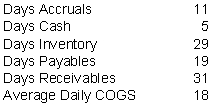

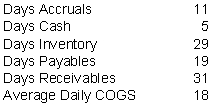

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/55

العب

ملء الشاشة (f)

Deck 13: Overview of Credit Policy and Loan Characteristics

1

Businesses can obtain funds from which of the following?

A)Loans from life insurance companies

B)Issuing commercial paper

C)Issuing junk bonds

D)Loans from commercial banks

E)All of the above

A)Loans from life insurance companies

B)Issuing commercial paper

C)Issuing junk bonds

D)Loans from commercial banks

E)All of the above

E

2

The lender's secondary source of repayment in case of default is:

A)capacity.

B)collateral.

C)character.

D)capital.

E)credit.

A)capacity.

B)collateral.

C)character.

D)capital.

E)credit.

B

3

A loan that is specifically designed to meet the needs of one or a few companies but has been packaged for resale is known as a:

A)structured note.

B)staggered note.

C)struggling note.

D)marked-for-sale note.

E)specific note.

A)structured note.

B)staggered note.

C)struggling note.

D)marked-for-sale note.

E)specific note.

A

4

The ability to repay a loan is measured by a firm's:

A)capacity.

B)collateral.

C)character.

D)capital.

E)credit.

A)capacity.

B)collateral.

C)character.

D)capital.

E)credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

5

Banks that emphasize lending to individuals are labeled:

A)wholesale banks.

B)retail banks.

C)personal banks.

D)non-bank banks.

E)regional banks.

A)wholesale banks.

B)retail banks.

C)personal banks.

D)non-bank banks.

E)regional banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

6

A security interest in a loan is said to be perfected if the:

A)bank holds the collateral.

B)loan has no protective covenants.

C)borrower is a low credit risk.

D)government guarantees the loan.

E)bank has never lent to the customer before.

A)bank holds the collateral.

B)loan has no protective covenants.

C)borrower is a low credit risk.

D)government guarantees the loan.

E)bank has never lent to the customer before.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following refers to a lender's tendency to ignore circumstances in which a loan might default?

A)Complacency

B)Contention

C)Contingencies

D)Competition

E)Carelessness

A)Complacency

B)Contention

C)Contingencies

D)Competition

E)Carelessness

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

8

In the credit process, which of the following activities falls under Business Development and Credit Analysis?

A)Loan committee reviews

B)Loan documentation review

C)Officer call programs

D)Perfect security interest

E)Process loan payments

A)Loan committee reviews

B)Loan documentation review

C)Officer call programs

D)Perfect security interest

E)Process loan payments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is not one of the five Cs of bad credit?

A)Complacency

B)Contention

C)Contingencies

D)Competition

E)Carelessness

A)Complacency

B)Contention

C)Contingencies

D)Competition

E)Carelessness

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

10

The largest single loan category for all banks is:

A)real estate loans.

B)commercial loans.

C)credit card loans.

D)industrial loans.

E)agricultural loans.

A)real estate loans.

B)commercial loans.

C)credit card loans.

D)industrial loans.

E)agricultural loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is the primary emphasis of a values-driven credit culture?

A)Annual bank profit

B)Bank soundness and stability

C)Loan volume

D)Loan growth

E)Short-term earnings

A)Annual bank profit

B)Bank soundness and stability

C)Loan volume

D)Loan growth

E)Short-term earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

12

The risk of potential loss of interest and principal on international loans due to borrowers in a country refusing to make timely payments, as per the loan agreement is known as what type of risk?

A)International risk

B)Foreign risk

C)Continent risk

D)Country risk

E)Government risk

A)International risk

B)Foreign risk

C)Continent risk

D)Country risk

E)Government risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

13

Banks that emphasize lending to commercial customers are labeled:

A)wholesale banks.

B)retail banks.

C)personal banks.

D)non-bank banks.

E)regional banks.

A)wholesale banks.

B)retail banks.

C)personal banks.

D)non-bank banks.

E)regional banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

14

To be classified as a non-current loan, payments must be past due a minimum of how many days?

A)30 days

B)60 days

C)90 days

D)120 days

E)158 days

A)30 days

B)60 days

C)90 days

D)120 days

E)158 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

15

In the credit process, which of the following activities falls under Credit Execution and Administration?

A)Financial statement analysis

B)Evaluate collateral

C)Officer call programs

D)Review loan documentation

E)Monitor compliance with loan agreement

A)Financial statement analysis

B)Evaluate collateral

C)Officer call programs

D)Review loan documentation

E)Monitor compliance with loan agreement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

16

In the credit process, which of the following activities falls under Credit Review?

A)Loan committee reviews

B)Perfecting the security interest

C)Market research

D)Review loan documentation

E)Market research

A)Loan committee reviews

B)Perfecting the security interest

C)Market research

D)Review loan documentation

E)Market research

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is not one of the five Cs of (good) credit?

A)Character

B)Collateral

C)Capital

D)Capacity

E)Credit

A)Character

B)Collateral

C)Capital

D)Capacity

E)Credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following formalizes a bank's lending guidelines?

A)Loan policy

B)Credit culture

C)Credit analysis

D)Credit review

E)Loan documentation

A)Loan policy

B)Credit culture

C)Credit analysis

D)Credit review

E)Loan documentation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

19

The vast majority of FDIC-insured institutions are classified as:

A)credit card banks.

B)agricultural banks.

C)consumer lenders.

D)commercial lenders.

E)mortgage lenders.

A)credit card banks.

B)agricultural banks.

C)consumer lenders.

D)commercial lenders.

E)mortgage lenders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following refers to the principles that drive a bank's lending activity?

A)Loan policy

B)Credit culture

C)Credit analysis

D)Credit review

E)Loan documentation

A)Loan policy

B)Credit culture

C)Credit analysis

D)Credit review

E)Loan documentation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

21

Positive working capital for a firm implies:

a.the firm has no short-term debt.

b.the firm has no seasonal cash flow needs.

c.that current assets are completely financed by current liabilities.

d.the firm has no long-term debt.

e.that current assets are partially financed by long-term debt and equity.

a.the firm has no short-term debt.

b.the firm has no seasonal cash flow needs.

c.that current assets are completely financed by current liabilities.

d.the firm has no long-term debt.

e.that current assets are partially financed by long-term debt and equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

22

Banks rarely provide:

A)start-up capital loans.

B)mortgage loans.

C)automobile loans.

D)agricultural loans..

E)commercial loans.

A)start-up capital loans.

B)mortgage loans.

C)automobile loans.

D)agricultural loans..

E)commercial loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

23

What is the firm's liability cycle?

A)21 days

B)31 days

C)65 days

D)75 days

E)121 days

A)21 days

B)31 days

C)65 days

D)75 days

E)121 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

24

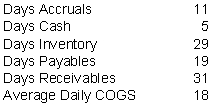

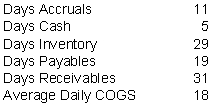

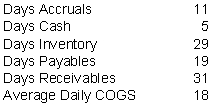

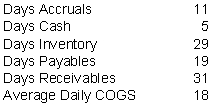

Use the following firm working capital cycle information for questions

What is the firm's cash-to-cash asset cycle?

A)30 days

B)59 days

C)65 days

D)95 days

E)113 days

What is the firm's cash-to-cash asset cycle?

A)30 days

B)59 days

C)65 days

D)95 days

E)113 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

25

What is the firm's cash-to-cash asset cycle?

A)31 days

B)44 days

C)65 days

D)75 days

E)121 days

A)31 days

B)44 days

C)65 days

D)75 days

E)121 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

26

_______________________ represents the amount of long-term financing required for current assets.

A)Permanent working capital

B)Seasonal working capital

C)Secondary working capital

D)Perpetual working capital

E)Passive working capital

A)Permanent working capital

B)Seasonal working capital

C)Secondary working capital

D)Perpetual working capital

E)Passive working capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

27

What are the firm's estimated working capital needs?

A)$90

B)$315

C)$660

D)$1,125

E)$2,250

A)$90

B)$315

C)$660

D)$1,125

E)$2,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

28

A _______________________ is a post office box number controlled by the bank.

A)syndication

B)local

C)lockbox

D)maintenance box

E)microhedge

A)syndication

B)local

C)lockbox

D)maintenance box

E)microhedge

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following would be considered a "positive" loan covenant?

A)Days receivables outstanding cannot exceed 30 days

B)No change in senior management

C)Capital outlays cannot exceed $1,000,000 per year

D)No additional liens may be placed on the collateral

E)The bank must approve any firm mergers or acquisitions

A)Days receivables outstanding cannot exceed 30 days

B)No change in senior management

C)Capital outlays cannot exceed $1,000,000 per year

D)No additional liens may be placed on the collateral

E)The bank must approve any firm mergers or acquisitions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

30

Venture capital financing that comes in the "later rounds" of financing may take the form of:

A)start-up capital loans.

B)mezzanine financing.

C)automobile financing.

D)seed money.

E)staff financing.

A)start-up capital loans.

B)mezzanine financing.

C)automobile financing.

D)seed money.

E)staff financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

31

When a bank's claim to collateral is superior to all other creditors, the claim is said to be:

A)developed.

B)guaranteed.

C)certified.

D)perfected.

E)endorsed.

A)developed.

B)guaranteed.

C)certified.

D)perfected.

E)endorsed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

32

Use the following firm working capital cycle information for questions

What are the firm's estimated working capital needs?

A)$90

B)$540

C)$630

D)$1,170

E)$2,034

What are the firm's estimated working capital needs?

A)$90

B)$540

C)$630

D)$1,170

E)$2,034

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

33

Use the following firm working capital cycle information for questions

What is the firm's liability cycle?

A)30 days

B)59 days

C)65 days

D)95 days

E)113 days

What is the firm's liability cycle?

A)30 days

B)59 days

C)65 days

D)95 days

E)113 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following would be considered an interim loan?

A)Automobile loan

B)Residential mortgage loan

C)Construction loan

D)Home equity loans

E)Student loans

A)Automobile loan

B)Residential mortgage loan

C)Construction loan

D)Home equity loans

E)Student loans

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

35

Agricultural loans became problem loans in mid-1980s for all of the following reasons except:

A)land values dropped dramatically.

B)there was a worldwide recession.

C)the U.S.dollar got stronger.

D)grain embargoes reduced demand for U.S.agricultural crops.

E)banks stressed cash flow too much when originating these loans.

A)land values dropped dramatically.

B)there was a worldwide recession.

C)the U.S.dollar got stronger.

D)grain embargoes reduced demand for U.S.agricultural crops.

E)banks stressed cash flow too much when originating these loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

36

A loan where the entire principal is due at maturity is called a:

A)balloon payment loan.

B)sinking fund loan.

C)mezzanine loan.

D)bullet loan.

E)highly leverage transaction loan.

A)balloon payment loan.

B)sinking fund loan.

C)mezzanine loan.

D)bullet loan.

E)highly leverage transaction loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following would be considered a "negative" loan covenant?

A)The firm's current ratio cannot fall below 2.0

B)All property must be maintained in good condition

C)The firm's net worth must exceed $10,000,000

D)The firm must carry property insurance on all collateral.

E)Cash dividends cannot exceed 50% of earnings

A)The firm's current ratio cannot fall below 2.0

B)All property must be maintained in good condition

C)The firm's net worth must exceed $10,000,000

D)The firm must carry property insurance on all collateral.

E)Cash dividends cannot exceed 50% of earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

38

Loans that finance the construction of roads and public utilities in new subdivisions are labeled:

A)public work loans.

B)take-out loans.

C)domestic loans.

D)land development loans.

E)working capital loans.

A)public work loans.

B)take-out loans.

C)domestic loans.

D)land development loans.

E)working capital loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

39

Loan covenants:

A)protect the borrower from lender interference in management.

B)are limited to "negative" provisions.

C)may limit discretionary cash outlays by borrowers.

D)are seldom enforced.

E)often result in the lender's bankruptcy.

A)protect the borrower from lender interference in management.

B)are limited to "negative" provisions.

C)may limit discretionary cash outlays by borrowers.

D)are seldom enforced.

E)often result in the lender's bankruptcy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

40

All of the following are loan classifications under the Uniform Bank Performance Report except:

A)real estate loans.

B)automobile loans.

C)individual loans.

D)commercial loans.

E)agricultural loans.

A)real estate loans.

B)automobile loans.

C)individual loans.

D)commercial loans.

E)agricultural loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

41

What are the major differences between a values-driven credit culture and a market-share driven credit culture?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

42

Discuss the five Cs of good credit and the five Cs of bad credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

43

The Internet has led to larger spreads for more standardized loan products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

44

As more lenders securitize loans, the supply of credit falls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

45

Discuss how seasonal working capital needs differ from permanent working capital needs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

46

The quality of bank loans varies with the business cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

47

All leveraged buyouts (LBOs) are labeled highly leveraged transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

48

How does a firm's seasonal working capital needs differ from its permanent working capital needs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

49

The largest banks have, on average, reduced their dependence on loans relative to smaller banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

50

Real estate lending is popular with bank, in part, due to the growth of the secondary mortgage market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

51

The primary focus of a values driven bank is on the bank's annual profit plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

52

Loans that are seasonal in nature should be self-liquidating.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

53

Discuss how banks benefit from the creation of the secondary mortgage market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

54

The most prominent risk banks assume in making loans is interest rate risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck

55

National banks can directly take equity positions in real estate projects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 55 في هذه المجموعة.

فتح الحزمة

k this deck