Deck 3: Analyzing Bank Performance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

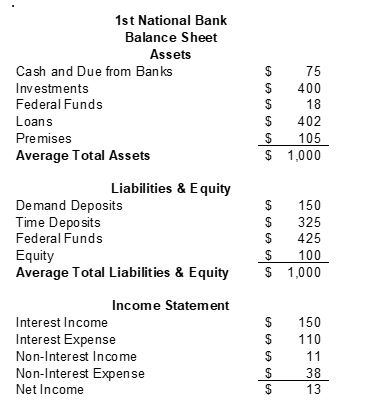

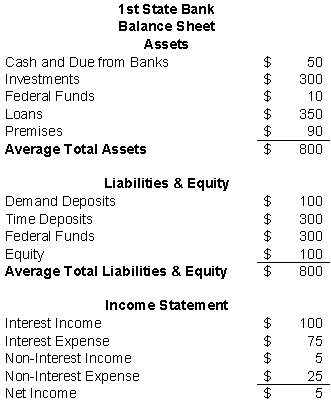

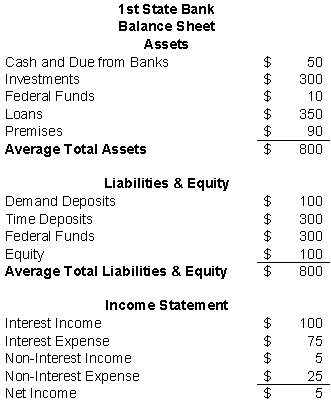

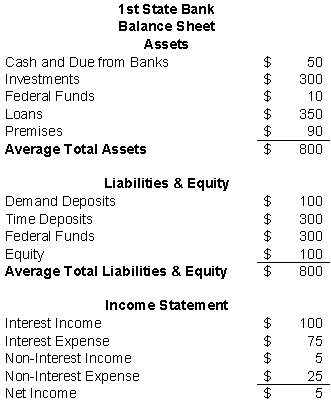

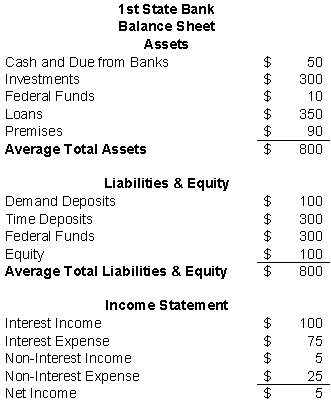

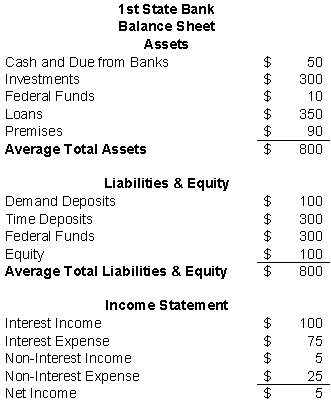

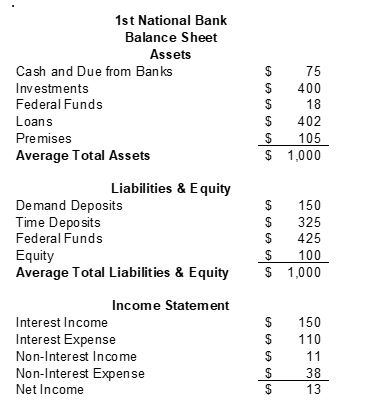

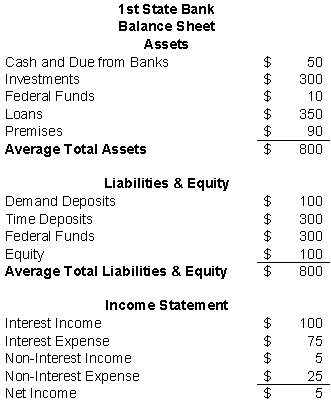

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

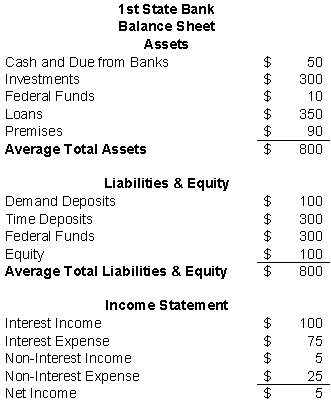

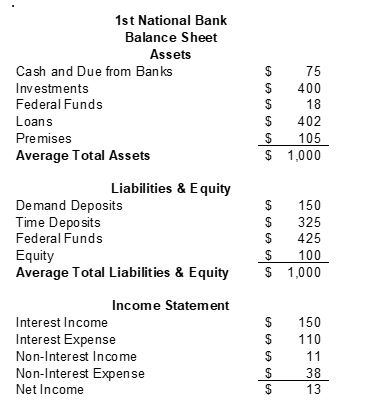

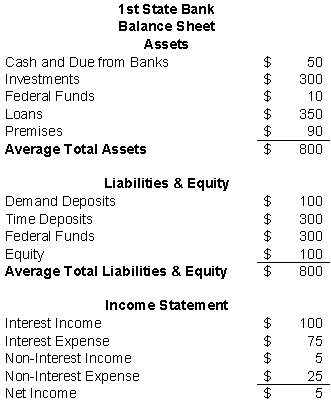

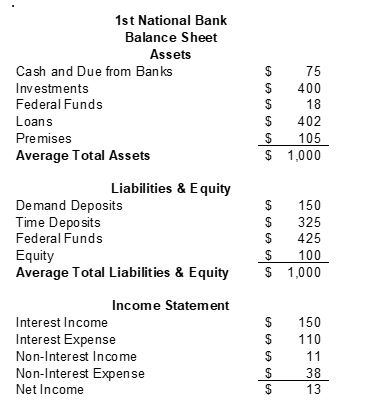

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/100

العب

ملء الشاشة (f)

Deck 3: Analyzing Bank Performance

1

Banks generate their largest portion of income from:

A)loans.

B)short-term investment.

C)demand deposits.

D)long-term investments.

E)certificates of deposit.

A)loans.

B)short-term investment.

C)demand deposits.

D)long-term investments.

E)certificates of deposit.

A

2

The volume of net deferred credit is commonly referred to as:

A)the burden.

B)NOW balances.

C)reserve requirements.

D)equity.

E)float.

A)the burden.

B)NOW balances.

C)reserve requirements.

D)equity.

E)float.

E

3

Securities that require unrealized gains or losses to be recorded on the income statement are called:

A)held-to-maturity securities.

B)trading account securities.

C)available-for-sale securities.

D)revenue securities.

E)repurchase agreements

A)held-to-maturity securities.

B)trading account securities.

C)available-for-sale securities.

D)revenue securities.

E)repurchase agreements

B

4

Which of the following bank assets is the most liquid?

A)Long-term investments

B)Short-term investments

C)Loans

D)Demand deposits

E)Unearned income

A)Long-term investments

B)Short-term investments

C)Loans

D)Demand deposits

E)Unearned income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is not a characteristic of a typical commercial bank?

A)Most banks own few fixed assets.

B)Most banks have a high degree of operating leverage.

C)Most banks have few fixed costs.

D)Many bank liabilities are payable on demand.

E)Banks generally operate with less equity capital than non-financial firms.

A)Most banks own few fixed assets.

B)Most banks have a high degree of operating leverage.

C)Most banks have few fixed costs.

D)Many bank liabilities are payable on demand.

E)Banks generally operate with less equity capital than non-financial firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following would not be considered a commercial loan?

A)An interim construction loan

B)A working capital loan

C)A loans to another financial institution

D)A loan to purchase a piece of industrial equipment

E)A loan to expand a factory

A)An interim construction loan

B)A working capital loan

C)A loans to another financial institution

D)A loan to purchase a piece of industrial equipment

E)A loan to expand a factory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

7

Bank assets fall into each of the following categories except:

A)loans.

B)investment securities.

C)demand deposits.

D)noninterest cash and due from banks.

E)other assets.

A)loans.

B)investment securities.

C)demand deposits.

D)noninterest cash and due from banks.

E)other assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

8

A negotiable instrument often used in trading goods that guarantees payment to the owner the instrument is known as (a):

A)bankers acceptance.

B)payment guarantee.

C)commercial paper.

D)bankers payment.

E)repurchase agreement.

A)bankers acceptance.

B)payment guarantee.

C)commercial paper.

D)bankers payment.

E)repurchase agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

9

Securities that are "held-to-maturity" are:

A)trading account securities.

B)recorded on the balance sheet at amortized cost.

C)marked-to-market.

D)a.and b.

E)a.and c.

A)trading account securities.

B)recorded on the balance sheet at amortized cost.

C)marked-to-market.

D)a.and b.

E)a.and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following led to the sharp decline in bank profits in 2008?

A)Record high loan loss provisions

B)Record gains in trading activities

C)Significant goodwill impairment expenses

D)All of the above.

E)a.& c.only.

A)Record high loan loss provisions

B)Record gains in trading activities

C)Significant goodwill impairment expenses

D)All of the above.

E)a.& c.only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

11

The largest component of "non- interest cash and due from banks" is:

A)cash items in process of collection.

B)deposits held at other financial institutions.

C)federal funds sold.

D)vault cash.

E)loans from the Federal Reserve.

A)cash items in process of collection.

B)deposits held at other financial institutions.

C)federal funds sold.

D)vault cash.

E)loans from the Federal Reserve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following would a bank generally classify as a long-term investment?

A)Treasury bill

B)Vault cash

C)Cash items in process of collection

D)Municipal bond

E)Repurchase agreements

A)Treasury bill

B)Vault cash

C)Cash items in process of collection

D)Municipal bond

E)Repurchase agreements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

13

Loans typically fall into each of the following categories except:

A)real estate.

B)individual.

C)commercial.

D)agricultural.

E)municipal.

A)real estate.

B)individual.

C)commercial.

D)agricultural.

E)municipal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

14

A loan to an individual to purchase a home would be considered a:

A)consumer loan.

B)commercial loan.

C)agricultural loan.

D)construction loan.

E)real estate loan.

A)consumer loan.

B)commercial loan.

C)agricultural loan.

D)construction loan.

E)real estate loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

15

All other things constant, securities that are extremely liquid:

A)earn higher rates of return than securities that are less liquid.

B)have a longer maturity than less liquid securities.

C)have lower risk than less liquid securities.

D)a.and b.

E)b.and c.

A)earn higher rates of return than securities that are less liquid.

B)have a longer maturity than less liquid securities.

C)have lower risk than less liquid securities.

D)a.and b.

E)b.and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following would a bank generally classify as a short-term investment?

A)Demand deposits

B)Deposits at the Federal Reserve

C)Repurchase agreements

D)Fed Funds purchased

E)Vault cash

A)Demand deposits

B)Deposits at the Federal Reserve

C)Repurchase agreements

D)Fed Funds purchased

E)Vault cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

17

Securities that require unrealized gains or losses to be recorded as a change in stockholder's equity are called:

A)held-to-maturity securities.

B)trading account securities.

C)available-for-sale securities.

D)revenue securities.

E)repurchase agreements

A)held-to-maturity securities.

B)trading account securities.

C)available-for-sale securities.

D)revenue securities.

E)repurchase agreements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

18

An example of a contra-asset account is:

A)the loan and lease loss allowance.

B)unearned income.

C)buildings and equipment.

D)revenue bonds.

E)the provision for loan loss.

A)the loan and lease loss allowance.

B)unearned income.

C)buildings and equipment.

D)revenue bonds.

E)the provision for loan loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following adjustments are made to gross loans and leases to obtain net loans and leases?

A)The loan and lease loss allowance is subtracted from gross loans

B)Unearned income is subtracted from gross interest received

C)Investment income is added to gross interest received

D)a.and b.

E)a.and c.

A)The loan and lease loss allowance is subtracted from gross loans

B)Unearned income is subtracted from gross interest received

C)Investment income is added to gross interest received

D)a.and b.

E)a.and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

20

Typically, "Call loans" are:

A)residential mortgages.

B)farm loans.

C)demand deposits.

D)payable on demand.

E)automobile loans.

A)residential mortgages.

B)farm loans.

C)demand deposits.

D)payable on demand.

E)automobile loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

21

Jumbo certificates of deposit (CDs) typically:

A)have maturities greater than 10 years..

B)are negotiable.

C)are $1 million in size.

D)All of the above

E)b.and c.

A)have maturities greater than 10 years..

B)are negotiable.

C)are $1 million in size.

D)All of the above

E)b.and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

22

Non-interest income includes all of the following except:

A)monthly fee income on checking accounts.

B)late fees on loans.

C)trust income.

D)insufficient funds service charges.

E)all of the above are considered non-interest income.

A)monthly fee income on checking accounts.

B)late fees on loans.

C)trust income.

D)insufficient funds service charges.

E)all of the above are considered non-interest income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

23

A bank currently owns a municipal bond paying a tax-exempt rate of 5%.If the banks marginal tax rate is 35%, what is the taxable equivalent yield?

A)7.69%

B)3.25%

C)6.75%

D)3.70%

E)9.32%

A)7.69%

B)3.25%

C)6.75%

D)3.70%

E)9.32%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

24

A bank's core deposits are:

A)vault cash.

B)stable deposits that are not typically withdrawn over short periods of time.

C)the bank's deposits at the Federal Reserve.

D)the most interest rate sensitive liabilities of a bank.

E)deposits held in foreign offices.

A)vault cash.

B)stable deposits that are not typically withdrawn over short periods of time.

C)the bank's deposits at the Federal Reserve.

D)the most interest rate sensitive liabilities of a bank.

E)deposits held in foreign offices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

25

A bank's "burden" is defined as:

A)net interest income minus non-interest income.

B)non-interest income minus non-interest expense.

C)non-interest expense minus non-interest income.

D)net interest income plus non-interest income.

E)interest expense plus non-interest expense.

A)net interest income minus non-interest income.

B)non-interest income minus non-interest expense.

C)non-interest expense minus non-interest income.

D)net interest income plus non-interest income.

E)interest expense plus non-interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

26

_________ own(s) the bulk of demand deposit accounts.

A)Consumers

B)Businesses

C)State governments

D)The federal government

E)Non-profits

A)Consumers

B)Businesses

C)State governments

D)The federal government

E)Non-profits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

27

Everything else the same, a bank's "burden" would most likely increase given:

A)a decrease in overhead expenses.

B)an increase in interest rates.

C)a decrease in interest rates.

D)an increase in executive salaries.

E)an increase in service charges collected by the bank.

A)a decrease in overhead expenses.

B)an increase in interest rates.

C)a decrease in interest rates.

D)an increase in executive salaries.

E)an increase in service charges collected by the bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following would be the least sensitive to changes in interest rates?

A)Demand deposits

B)Repurchase agreements

C)Federal funds purchased

D)Eurodollar liabilities

E)Jumbo CDs

A)Demand deposits

B)Repurchase agreements

C)Federal funds purchased

D)Eurodollar liabilities

E)Jumbo CDs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

29

A bank currently owns a municipal bond paying a tax-exempt rate of 8%.If the banks marginal tax rate is 39%, what is the taxable equivalent yield?

A)11.12%

B)4.88%

C)13.11%

D)5.76%

E)9.32%

A)11.12%

B)4.88%

C)13.11%

D)5.76%

E)9.32%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

30

The "provision for loan and lease losses":

A)are the realized losses from the previous accounting period.

B)represents management's estimate of potential lost revenue from bad loans.

C)determined by the Federal Reserve for all banks.

D)does not affect net income.

E)is another name for a bank's "burden."

A)are the realized losses from the previous accounting period.

B)represents management's estimate of potential lost revenue from bad loans.

C)determined by the Federal Reserve for all banks.

D)does not affect net income.

E)is another name for a bank's "burden."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

31

Net interest income is the difference between:

A)gross interest income and net interest expense.

B)gross interest income and non-interest income.

C)the burden and realized gains or losses.

D)non-interest income and net interest expense.

E)gross interest income and gross interest expense.

A)gross interest income and net interest expense.

B)gross interest income and non-interest income.

C)the burden and realized gains or losses.

D)non-interest income and net interest expense.

E)gross interest income and gross interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is not considered a volatile liability?

A)Jumbo CDs

B)Deposits in foreign offices

C)Repurchase agreements

D)Federal funds sold

E)All of the above are considered volatile liabilities

A)Jumbo CDs

B)Deposits in foreign offices

C)Repurchase agreements

D)Federal funds sold

E)All of the above are considered volatile liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

33

Non-interest income includes all of the following except:

A)checking account fees.

B)insufficient funds service charges.

C)trust income.

D)personnel expenses.

E)all of the above are considered non-interest income.

A)checking account fees.

B)insufficient funds service charges.

C)trust income.

D)personnel expenses.

E)all of the above are considered non-interest income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

34

Unsecured liabilities created from the exchange of immediately available funds are known as:

A)federal funds purchased.

B)repurchase agreements.

C)federal funds sold.

D)pledged securities.

E)brokered deposits.

A)federal funds purchased.

B)repurchase agreements.

C)federal funds sold.

D)pledged securities.

E)brokered deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

35

Core deposits consist of all of the following except:

A)demand deposits.

B)NOW accounts.

C)jumbo certificates of deposit.

D)savings accounts.

E)money market demand accounts.

A)demand deposits.

B)NOW accounts.

C)jumbo certificates of deposit.

D)savings accounts.

E)money market demand accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

36

Interest income includes:

A)interest earned on all of the bank's assets.

B)fees earned on all of the bank's assets.

C)fees earned on all of the bank's deposit accounts.

D)all of the above.

E)a.and b.only

A)interest earned on all of the bank's assets.

B)fees earned on all of the bank's assets.

C)fees earned on all of the bank's deposit accounts.

D)all of the above.

E)a.and b.only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

37

A bank currently owns a municipal bond paying a tax-exempt rate of 6.5%.If the banks marginal tax rate is 40%, what is the taxable equivalent yield?

A)3.90%

B)10.83%

C)9.10%

D)4.64%

E)9.32%

A)3.90%

B)10.83%

C)9.10%

D)4.64%

E)9.32%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

38

Jumbo CDs that a bank obtains from a third-party broker are called:

A)money market demand accounts.

B)time deposit accounts.

C)mortgage loans.

D)brokered deposits.

E)core deposits.

A)money market demand accounts.

B)time deposit accounts.

C)mortgage loans.

D)brokered deposits.

E)core deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

39

Checking accounts with unlimited check-writing and pay interest are known as:

A)demand deposit accounts.

B)money market deposit accounts.

C)NOW accounts.

D)certificates of deposit.

E)time deposits.

A)demand deposit accounts.

B)money market deposit accounts.

C)NOW accounts.

D)certificates of deposit.

E)time deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following is are only available to non-commercial customers?

A)Money Market Demand Accounts

B)Demand deposit accounts

C)Mortgage loans

D)Negotiable Orders of Withdrawal (NOW) accounts

E)Auto leases

A)Money Market Demand Accounts

B)Demand deposit accounts

C)Mortgage loans

D)Negotiable Orders of Withdrawal (NOW) accounts

E)Auto leases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

41

Return on equity can be decomposed into:

A)the sum of return on assets and the equity multiplier.

B)the product of return on assets and the equity multiplier.

C)the product of the profit margin and the equity multiplier.

D)the sum of the profit margin and the equity multiplier.

E)the sum of the profit margin, equity multiplier, and the interest ratio.

A)the sum of return on assets and the equity multiplier.

B)the product of return on assets and the equity multiplier.

C)the product of the profit margin and the equity multiplier.

D)the sum of the profit margin and the equity multiplier.

E)the sum of the profit margin, equity multiplier, and the interest ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following would be considered an extraordinary item on an income statement of a bank?

A)Revenue from the sale of the bank's office building.

B)Interest income when the spread is greater than 10%.

C)Realized security gains.

D)Collection on loans already charged off.

E)All of the above would be considered extraordinary items.

A)Revenue from the sale of the bank's office building.

B)Interest income when the spread is greater than 10%.

C)Realized security gains.

D)Collection on loans already charged off.

E)All of the above would be considered extraordinary items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

43

Net income is calculated as:

A)total revenue - total operating expenses.

B)total revenue - total operating expenses - taxes.

C)asset utilization - expense ratio.

D)asset utilization - expense ratio - tax ratio.

E)interest expense ratio - non-interest expense ratio - provision for loan loss ratio.

A)total revenue - total operating expenses.

B)total revenue - total operating expenses - taxes.

C)asset utilization - expense ratio.

D)asset utilization - expense ratio - tax ratio.

E)interest expense ratio - non-interest expense ratio - provision for loan loss ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

44

Net income is defined as:

A)Net interest income - burden + provision for loan loss + securities gains or losses - taxes.

B)Net interest income + burden + provision for loan loss + securities gains or losses - taxes.

C)Net interest income - burden - provision for loan loss + securities gains or losses - taxes.

D)Net interest income - burden - provision for loan loss + securities gains or losses + taxes.

E)Net interest income + burden - provision for loan loss + securities gains or losses - taxes.

A)Net interest income - burden + provision for loan loss + securities gains or losses - taxes.

B)Net interest income + burden + provision for loan loss + securities gains or losses - taxes.

C)Net interest income - burden - provision for loan loss + securities gains or losses - taxes.

D)Net interest income - burden - provision for loan loss + securities gains or losses + taxes.

E)Net interest income + burden - provision for loan loss + securities gains or losses - taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

45

Non-interest expenses includes all of the following except:

A)occupancy expenses.

B)goodwill impairment.

C)insufficient funds service charges.

D)personnel expenses.

E)all of the above are considered non-interest expense.

A)occupancy expenses.

B)goodwill impairment.

C)insufficient funds service charges.

D)personnel expenses.

E)all of the above are considered non-interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

46

Total operating expense is comparable to _________ for a non-financial firm.

A)sales

B)cost of goods sold + other operating expenses

C)interest expense

D)earnings before taxes

E)net income

A)sales

B)cost of goods sold + other operating expenses

C)interest expense

D)earnings before taxes

E)net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

47

Relative to retail banks, wholesale banks:

A)deal primarily with consumers.

B)operate with fewer commercial deposits.

C)purchase more non-core liabilities.

D)hold proportionally more consumer loans.

E)All of the above.

A)deal primarily with consumers.

B)operate with fewer commercial deposits.

C)purchase more non-core liabilities.

D)hold proportionally more consumer loans.

E)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

48

Everything else the same, financial leverage works to a bank's advantage when:

A)the return on assets is positive.

B)the return on assets is negative.

C)fixed assets are high.

D)fixed assets are low.

E)a.and d.

A)the return on assets is positive.

B)the return on assets is negative.

C)fixed assets are high.

D)fixed assets are low.

E)a.and d.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

49

Relative to wholesale banks, retail banks:

A)focus on individual consumer banking relationships.

B)operate with fewer consumer deposits.

C)purchase more non-core liabilities.

D)hold proportionally more business loans to large firms.

E)All of the above.

A)focus on individual consumer banking relationships.

B)operate with fewer consumer deposits.

C)purchase more non-core liabilities.

D)hold proportionally more business loans to large firms.

E)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

50

What is the equity multiplier for a bank where equity is equal to 8% of total assets?

A)1.08

B)8.00

C)0.92

D)12.5

E)1.25

A)1.08

B)8.00

C)0.92

D)12.5

E)1.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

51

What is the return on equity for a bank that has an equity multiplier of 14, an interest expense ratio of 4%, and a return on assets of .9%?

A)1.3%

B)4.0%

C)9.0%

D)12.6%

E)8.6%

A)1.3%

B)4.0%

C)9.0%

D)12.6%

E)8.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

52

A bank's equity multiplier measures the bank's:

A)financial leverage.

B)operating leverage.

C)credit leverage.

D)interest rate exposure.

E)duration gap.

A)financial leverage.

B)operating leverage.

C)credit leverage.

D)interest rate exposure.

E)duration gap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

53

What is the return on equity for a bank that has an equity multiplier of 12, an interest expense ratio of 5%, and a return on assets of 1.1%?

A)5.0%

B)13.2%

C)8.2%

D)26.4%

E)0.66%

A)5.0%

B)13.2%

C)8.2%

D)26.4%

E)0.66%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

54

Total operating income is comparable to _________ for a non-financial firm.

A)sales

B)cost of goods sold

C)gross profit

D)earnings before interest and taxes

E)net income

A)sales

B)cost of goods sold

C)gross profit

D)earnings before interest and taxes

E)net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

55

A change in net interest income would occur when:

A)the composition of the assets of the bank change.

B)the average asset yield changes.

C)the volume of the assets of the bank change.

D)the average interest expense changes.

E)All of the above

A)the composition of the assets of the bank change.

B)the average asset yield changes.

C)the volume of the assets of the bank change.

D)the average interest expense changes.

E)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

56

hat is the equity multiplier for a bank where equity is equal to 10% of total assets?

A)90.00

B)10.00

C)1.10

D)110.00

E)1.00

A)90.00

B)10.00

C)1.10

D)110.00

E)1.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

57

Return on assets can be calculated as:

A)return on equity plus the equity multiplier.

B)net interest income divided by earning assets.

C)asset utilization minus the expense ratio and the tax ratio.

D)interest income minus interest expense.

E)earning assets divided by average total assets.

A)return on equity plus the equity multiplier.

B)net interest income divided by earning assets.

C)asset utilization minus the expense ratio and the tax ratio.

D)interest income minus interest expense.

E)earning assets divided by average total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

58

A bank that deals primarily with commercial customers is called:

A)an Edge Act bank.

B)a retail bank.

C)a wholesale bank.

D)a uniform bank.

E)a liability bank.

A)an Edge Act bank.

B)a retail bank.

C)a wholesale bank.

D)a uniform bank.

E)a liability bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

59

What is the equity multiplier for a bank where equity is equal to 12% of total assets?

A)83.33

B)1.12

C)0.88

D)12.00

E)8.33

A)83.33

B)1.12

C)0.88

D)12.00

E)8.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

60

What is the return on equity for a bank that has an equity multiplier of 9, an interest expense ratio of 6%, and a return on assets of 1.2%?

A)10.8%

B)6.0%

C)8.0%

D)4.8%

E)0.65%

A)10.8%

B)6.0%

C)8.0%

D)4.8%

E)0.65%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

61

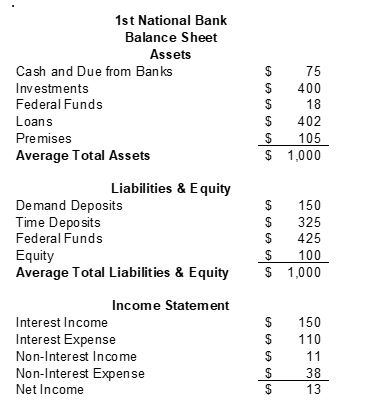

What is 1st State's return on equity?

A)0.6%

B)3.8%

C)5.0%

D)8.2%

E)13.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

62

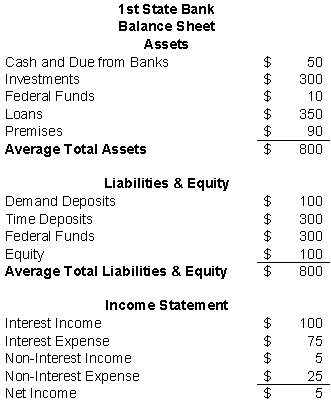

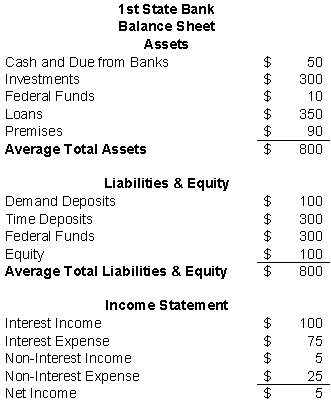

Use the following information for questions

What is 1st State's net interest margin?

A)0.6%

B)3.8%

C)5.0%

D)8.2%

E)9.8%

What is 1st State's net interest margin?

A)0.6%

B)3.8%

C)5.0%

D)8.2%

E)9.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is not one of the risks identified by the Federal Reserve Board?

A)Credit Risk

B)Market Risk

C)Ownership Risk

D)Reputation Risk

E)Legal Risk

A)Credit Risk

B)Market Risk

C)Ownership Risk

D)Reputation Risk

E)Legal Risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

64

What is the earnings base at 1st State?

A)12.5%

B)17.0%

C)58.5%

D)75.5%

E)82.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

65

Use the following information for questions

What is 1st State's burden?

A)2.5%

B)17.5%

C)25.0%

D)75.5%

E)82.5%

What is 1st State's burden?

A)2.5%

B)17.5%

C)25.0%

D)75.5%

E)82.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

66

Use the following information for questions

What is 1st State's efficiency ratio?

A)2.53%

B)17.51%

C)0.83%

D)0.45%

E)83.3%

What is 1st State's efficiency ratio?

A)2.53%

B)17.51%

C)0.83%

D)0.45%

E)83.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

67

The efficiency ratio measures:

A)a bank's ability to control interest expense.

B)a bank's ability to control non-interest expense.

C)a bank's spread.

D)a bank's burden.

E)a bank's operating leverage.

A)a bank's ability to control interest expense.

B)a bank's ability to control non-interest expense.

C)a bank's spread.

D)a bank's burden.

E)a bank's operating leverage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

68

Recoveries refer to:

A)the dollar value of loans actually written off as uncollectible.

B)the dollar amount of loans that were previously charged-off but now collected.

C)net charge-offs.

D)loans not currently accruing interest.

E)loans that regulators have required the bank to "recover".

A)the dollar value of loans actually written off as uncollectible.

B)the dollar amount of loans that were previously charged-off but now collected.

C)net charge-offs.

D)loans not currently accruing interest.

E)loans that regulators have required the bank to "recover".

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

69

Classified loans:

A)still accrue interest.

B)have not had a principle or interest payment made in 90 days.

C)exactly offset gross charge-offs.

D)are loans in which regulators have forced management to set aside reserves.

E)all of the above

A)still accrue interest.

B)have not had a principle or interest payment made in 90 days.

C)exactly offset gross charge-offs.

D)are loans in which regulators have forced management to set aside reserves.

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

70

The goal of a bank manager should be:

A)to maximize earnings.

B)to minimize taxes.

C)to minimize risk.

D)to maximize shareholder wealth.

E)to maximize net interest income.

A)to maximize earnings.

B)to minimize taxes.

C)to minimize risk.

D)to maximize shareholder wealth.

E)to maximize net interest income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

71

What is 1st State's burden?

A)2.7%

B)17.5%

C)25.0%

D)75.5%

E)82.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following would not be considered an earning asset?

A)Cash due from banks

B)Municipal securities

C)Treasury bills

D)Repurchase agreements

E)Mortgages

A)Cash due from banks

B)Municipal securities

C)Treasury bills

D)Repurchase agreements

E)Mortgages

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

73

Use the following information for questions

What is 1st State's return on equity?

A)0.6%

B)3.8%

C)5.0%

D)8.2%

E)9.8%

What is 1st State's return on equity?

A)0.6%

B)3.8%

C)5.0%

D)8.2%

E)9.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

74

A savings and loan that sold off their junk bond holdings and issued consumer auto loans with the proceed would most likely be:

A)decreasing their market risk.

B)increasing their capital risk.

C)decreasing their legal risk.

D)increasing their operating risk.

E)reducing their credit risk.

A)decreasing their market risk.

B)increasing their capital risk.

C)decreasing their legal risk.

D)increasing their operating risk.

E)reducing their credit risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

75

What is 1st State's net interest margin?

A)0.6%

B)3.8%

C)4.9%

D)8.2%

E)9.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

76

Use the following information for questions

What is the earnings base at 1st State?

A)12.5%

B)17.5%

C)58.5%

D)75.5%

E)82.5%

What is the earnings base at 1st State?

A)12.5%

B)17.5%

C)58.5%

D)75.5%

E)82.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

77

Interest expense varies between banks because of:

a.rate effects.

b.composition effects.

c.volume effects.

d.all of the above.

e.a.and c.

a.rate effects.

b.composition effects.

c.volume effects.

d.all of the above.

e.a.and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

78

What is 1st State's efficiency ratio?

A)2.5%

B)17.5%

C)25.0%

D)74.5%

E)82.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

79

The expense ratio is calculated as:

A)total revenue - total operating expenses.

B)total revenue - total operating expenses - taxes.

C)interest expense ratio - non-interest expense ratio - provision for loan loss ratio.

D)asset utilization - expense ratio - tax ratio.

E)interest expense ratio + non-interest expense ratio + provision for loan loss ratio.

A)total revenue - total operating expenses.

B)total revenue - total operating expenses - taxes.

C)interest expense ratio - non-interest expense ratio - provision for loan loss ratio.

D)asset utilization - expense ratio - tax ratio.

E)interest expense ratio + non-interest expense ratio + provision for loan loss ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which type of risk is the most difficult to quantify?

A)Credit risk

B)Liquidity risk

C)Legal risk

D)Operating risk

E)Market risk

A)Credit risk

B)Liquidity risk

C)Legal risk

D)Operating risk

E)Market risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck