Deck 26: The Money Market and Monetary Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/146

العب

ملء الشاشة (f)

Deck 26: The Money Market and Monetary Policy

1

An individual would be most likely to increase the amount of money he wants to hold if

A) the price level declines

B) the price level declines and the interest rate increases

C) his real income increases

D) the interest rate increases

E) the interest rate and his real income decrease

A) the price level declines

B) the price level declines and the interest rate increases

C) his real income increases

D) the interest rate increases

E) the interest rate and his real income decrease

his real income increases

2

Which of the following would be most likely to increase the quantity of money demanded?

A) A decrease in real income

B) An increase in real income

C) A decrease in the interest rate

D) An increase in the cost of converting other assets into money

E) An increase in the price level

A) A decrease in real income

B) An increase in real income

C) A decrease in the interest rate

D) An increase in the cost of converting other assets into money

E) An increase in the price level

A decrease in the interest rate

3

The opportunity cost of holding money is

A) the dollar cost necessary to change other assets into money

B) the time cost of accessing funds

C) the value of the goods and services a person is able to obtain with the money

D) the interest a person could have earned by holding other forms of wealth instead

E) zero,because opportunity costs only apply to real assets,goods and services

A) the dollar cost necessary to change other assets into money

B) the time cost of accessing funds

C) the value of the goods and services a person is able to obtain with the money

D) the interest a person could have earned by holding other forms of wealth instead

E) zero,because opportunity costs only apply to real assets,goods and services

the interest a person could have earned by holding other forms of wealth instead

4

An individual's quantity of money demanded

A) refers to how much money the individual would like to have

B) refers to the amount of money an individual needs to maintain her desired standard of living

C) refers to her wealth constraint

D) refers to the amount of her wealth that an individual chooses to hold in the form of money

E) is virtually unlimited

A) refers to how much money the individual would like to have

B) refers to the amount of money an individual needs to maintain her desired standard of living

C) refers to her wealth constraint

D) refers to the amount of her wealth that an individual chooses to hold in the form of money

E) is virtually unlimited

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

5

The demand for curve for money

A) shows the amount of money people actually hold

B) shows the amount of money people would like to hold,given the constraints they face

C) shifts if the interest rate changes

D) is independent of the price level

E) changes whenever the Fed changes the money supply.

A) shows the amount of money people actually hold

B) shows the amount of money people would like to hold,given the constraints they face

C) shifts if the interest rate changes

D) is independent of the price level

E) changes whenever the Fed changes the money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following will lead to an increase in the quantity of money demanded?

A) A decrease in the overall level of wealth in the economy

B) A decrease in the price level

C) A decrease in nominal income

D) An increase in real income

E) A decrease in real income

A) A decrease in the overall level of wealth in the economy

B) A decrease in the price level

C) A decrease in nominal income

D) An increase in real income

E) A decrease in real income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

7

The demand for money

A) is the same as the demand for bonds

B) is the same as the supply of bonds

C) increases whenever the price level falls

D) reflects the constraints that people face

E) shows the people always demand as much money as possible

A) is the same as the demand for bonds

B) is the same as the supply of bonds

C) increases whenever the price level falls

D) reflects the constraints that people face

E) shows the people always demand as much money as possible

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

8

A household's quantity of money demanded is defined as

A) the amount of income that the household chooses to hold in the form of money,at each possible interest rate

B) the amount of wealth that the household chooses to hold as money,rather than as other assets

C) the household's desire to have greater financial wealth

D) the percentage of each dollar of income that the household wishes to spend

E) the total amount the household decides to hold in cash,bonds,and other assets,at each possible interest rate

A) the amount of income that the household chooses to hold in the form of money,at each possible interest rate

B) the amount of wealth that the household chooses to hold as money,rather than as other assets

C) the household's desire to have greater financial wealth

D) the percentage of each dollar of income that the household wishes to spend

E) the total amount the household decides to hold in cash,bonds,and other assets,at each possible interest rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

9

A decrease in the interest rate reduces the opportunity cost of holding money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

10

When economists speak of the demand for money,they refer to the amount of money people would like to hold

A) given that it can only be printed slowly

B) in the best of all possible worlds

C) in their bank accounts rather than their wallets

D) at each interest rate

E) rather than spend

A) given that it can only be printed slowly

B) in the best of all possible worlds

C) in their bank accounts rather than their wallets

D) at each interest rate

E) rather than spend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is the opportunity cost of money?

A) The use of money as a means of payment

B) The trouble of having to get money out of the bank

C) The interest forgone by holding money

D) The ability to purchase things at a moment's notice

E) Commissions paid to brokers

A) The use of money as a means of payment

B) The trouble of having to get money out of the bank

C) The interest forgone by holding money

D) The ability to purchase things at a moment's notice

E) Commissions paid to brokers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

12

An increase in the interest rate reduces the opportunity cost of holding money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following would be most likely to increase the demand for money?

A) An increase in the price level

B) A decrease in real income

C) An increase in the interest rate

D) A decrease in the cost of converting other assets into money

E) A decrease in the price level

A) An increase in the price level

B) A decrease in real income

C) An increase in the interest rate

D) A decrease in the cost of converting other assets into money

E) A decrease in the price level

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

14

An increase in the interest rate shifts the money demand curve to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

15

A decrease in the interest rate shifts the money demand curve to the right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

16

The amount of wealth that an individual wishes to hold as money is determined by

A) the price level

B) the price level and real income

C) real income

D) real income and the interest rate

E) the price level,real income,and the interest rate

A) the price level

B) the price level and real income

C) real income

D) real income and the interest rate

E) the price level,real income,and the interest rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

17

An individual's wealth constraint is determined by

A) the individual's level of education

B) the facts that wealth is given and so she must give up one kind of wealth in order to acquire another

C) overall conditions in the economy

D) the amount of wealth the individual chooses to hold in the form of money

E) the value of corporate stock

A) the individual's level of education

B) the facts that wealth is given and so she must give up one kind of wealth in order to acquire another

C) overall conditions in the economy

D) the amount of wealth the individual chooses to hold in the form of money

E) the value of corporate stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following determines how much money an individual will decide to hold?

A) Investment spending

B) Income taxes

C) The price level

D) The supply of money

E) Real GDP

A) Investment spending

B) Income taxes

C) The price level

D) The supply of money

E) Real GDP

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is a stock variable?

A) Saving

B) Consumption

C) Income

D) Investment

E) Money

A) Saving

B) Consumption

C) Income

D) Investment

E) Money

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

20

If income changes,that leads to a movement along the money demand curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

21

The money supply curve is vertical because

A) real income does not influence the quantity of money supplied

B) the price level does not influence the level of spending

C) only the interest rate influences the quantity of money supplied

D) the Federal Reserve sets the money supply

E) nominal income does not influence the quantity of money supplied

A) real income does not influence the quantity of money supplied

B) the price level does not influence the level of spending

C) only the interest rate influences the quantity of money supplied

D) the Federal Reserve sets the money supply

E) nominal income does not influence the quantity of money supplied

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

22

If the price level increases,the money demand curve will

A) shift leftward

B) become steeper

C) remain in the same position;however,there will be movement upward along the curve

D) shift rightward

E) remain in the same position;however,there will be movement downward along the curve

A) shift leftward

B) become steeper

C) remain in the same position;however,there will be movement upward along the curve

D) shift rightward

E) remain in the same position;however,there will be movement downward along the curve

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

23

If the interest rate decreases,there will be

A) a movement leftward from one point on the money demand curve to another point on the same curve

B) no change in the quantity of money demanded

C) a leftward shift of the entire money demand curve caused by a demand shock

D) a rightward shift of the entire money demand curve

E) a movement rightward from one point on the money demand curve to another point on the same curve

A) a movement leftward from one point on the money demand curve to another point on the same curve

B) no change in the quantity of money demanded

C) a leftward shift of the entire money demand curve caused by a demand shock

D) a rightward shift of the entire money demand curve

E) a movement rightward from one point on the money demand curve to another point on the same curve

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

24

The money market is in equilibrium when there is no excess supply of or excess demand for bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

25

If real income increases,

A) there will be a rightward movement along a stationary money demand curve

B) there will be a leftward movement along a stationary money demand curve

C) the demand for money curve will shift rightward

D) the demand for money curve will shift leftward

E) there will be no movement of the demand curve for money and no movement along it

A) there will be a rightward movement along a stationary money demand curve

B) there will be a leftward movement along a stationary money demand curve

C) the demand for money curve will shift rightward

D) the demand for money curve will shift leftward

E) there will be no movement of the demand curve for money and no movement along it

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

26

Open market sales of bonds by the Federal Reserve drain reserves from the banking system and shift

A) the allocation of wealth between bonds and stocks

B) the economy toward a trough in the business cycle

C) the money supply curve leftward

D) reserves to nonmember banks

E) the demand for money curve leftward

A) the allocation of wealth between bonds and stocks

B) the economy toward a trough in the business cycle

C) the money supply curve leftward

D) reserves to nonmember banks

E) the demand for money curve leftward

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

27

The economy's money supply curve is vertical.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following would lead to a rightward movement along a stationary money demand curve?

A) A decrease in the interest rate

B) A decrease in the price level

C) An increase in the interest rate

D) An increase in the price level

E) An increase in real income

A) A decrease in the interest rate

B) A decrease in the price level

C) An increase in the interest rate

D) An increase in the price level

E) An increase in real income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

29

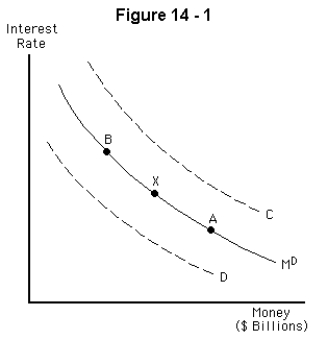

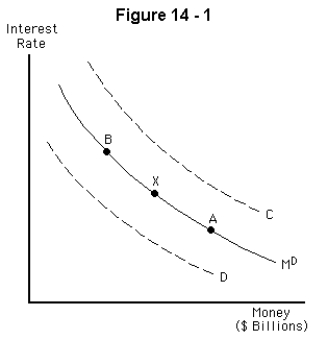

Refer to Figure 14-1.If the economy is currently at point X,a decrease in the interest rate will

A) increase the quantity of money demanded (moving the economy toward point A)

B) decrease the quantity of money demanded (moving the economy toward point B)

C) increase money demand (shifting the curve toward curve C)

D) decrease money demand (shifting the curve toward curve D)

E) leave the economy at point X

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

30

The classical model's theory of the interest rate does not apply in the short run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

31

If there is a decrease in the price level,

A) there will be a rightward movement along a stationary money demand curve

B) there will be a leftward movement along a stationary money demand curve

C) the demand curve for money will shift rightward

D) the demand curve for money will shift leftward

E) there will be no movement of the demand curve for money and no movement along it

A) there will be a rightward movement along a stationary money demand curve

B) there will be a leftward movement along a stationary money demand curve

C) the demand curve for money will shift rightward

D) the demand curve for money will shift leftward

E) there will be no movement of the demand curve for money and no movement along it

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

32

The money supply curve is

A) upward sloping

B) downward sloping

C) vertical

D) horizontal

E) parallel to the money demand curve

A) upward sloping

B) downward sloping

C) vertical

D) horizontal

E) parallel to the money demand curve

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

33

Refer to Figure 14-2.If the interest rate is 8 percent,

A) there is an excess supply of money equal to $100 billion

B) there is an excess demand for money

C) there is an excess supply of money equal to $400 billion

D) the Fed will decrease the money supply

E) the interest rate will tend to rise

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

34

The money demand curve is

A) downward sloping

B) upward sloping

C) horizontal

D) vertical

E) has an inverted V-shape.

A) downward sloping

B) upward sloping

C) horizontal

D) vertical

E) has an inverted V-shape.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

35

Where is the interest rate determined in the classical model?

A) In the goods market

B) In the loanable funds market

C) By the federal government

D) By the Fed

E) Where aggregate expenditure equals GDP.

A) In the goods market

B) In the loanable funds market

C) By the federal government

D) By the Fed

E) Where aggregate expenditure equals GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

36

The money demand curve indicates the total quantity of money demanded in the economy at each

A) price level

B) level of GDP

C) quantity of money supplied

D) level of income

E) interest rate

A) price level

B) level of GDP

C) quantity of money supplied

D) level of income

E) interest rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

37

An open market purchase of bonds by the Fed

A) drains reserves from the banking system and decreases the money supply

B) injects reserves into the banking system and increases money demand

C) injects reserves into the banking system and increases the money supply

D) drains reserves from the banking system and increases the money supply

E) injects reserves into the banking system and decreases the money supply

A) drains reserves from the banking system and decreases the money supply

B) injects reserves into the banking system and increases money demand

C) injects reserves into the banking system and increases the money supply

D) drains reserves from the banking system and increases the money supply

E) injects reserves into the banking system and decreases the money supply

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

38

The money supply is

A) positively related to the interest rate

B) negatively related to the interest rate

C) positively related to income

D) negatively related to income

E) set by the Fed and therefore independent of the interest rate and income

A) positively related to the interest rate

B) negatively related to the interest rate

C) positively related to income

D) negatively related to income

E) set by the Fed and therefore independent of the interest rate and income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

39

If there is an increase in the interest rate,

A) there will be a rightward movement along a stationary money demand curve

B) there will be a leftward movement along a stationary money demand curve

C) the demand curve for money will shift rightward

D) the demand curve for money will shift leftward

E) there will be no movement of the demand curve for money and no movement along it

A) there will be a rightward movement along a stationary money demand curve

B) there will be a leftward movement along a stationary money demand curve

C) the demand curve for money will shift rightward

D) the demand curve for money will shift leftward

E) there will be no movement of the demand curve for money and no movement along it

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

40

Refer to Figure 14-1.If the economy is currently at point X,an increase in the interest rate will

A) increase the quantity of money demanded (moving the economy toward point A)

B) decrease the quantity of money demanded (moving the economy toward point B)

C) increase money demand (shifting the curve toward curve C)

D) decrease money demand (shifting the curve toward curve D)

E) leave the economy at point X

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

41

An excess supply of money in the economy implies an excess demand for

A) stocks

B) mortgages

C) consumer nondurables

D) consumer durables

E) bonds

A) stocks

B) mortgages

C) consumer nondurables

D) consumer durables

E) bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

42

The equilibrium short-run interest rate is determined at the intersection of the demand and supply curves in the market for

A) labor

B) money

C) capital goods

D) mortgage funds

E) corporate bonds

A) labor

B) money

C) capital goods

D) mortgage funds

E) corporate bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

43

If the interest rate is above its equilibrium value,the price of

A) bonds will fall

B) real estate will rise

C) bonds will rise

D) stocks will fall because of fluctuations in the bond market

E) money will rise

A) bonds will fall

B) real estate will rise

C) bonds will rise

D) stocks will fall because of fluctuations in the bond market

E) money will rise

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

44

An increase in the demand for bonds will increase both the price of bonds and the quantity of bonds held.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

45

People's decision about whether to hold money or bonds can be influenced by the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

46

If the price of a bond increases,the interest rate (or rate of return on the bond)decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

47

Refer to Figure 14-2.If the interest rate is 4 percent,

A) there is an excess demand for money equal to $100 billion

B) there is an excess demand for money

C) there is an excess demand for money equal to $400 billion

D) the Fed will decrease the money supply

E) the interest rate will tend to rise

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

48

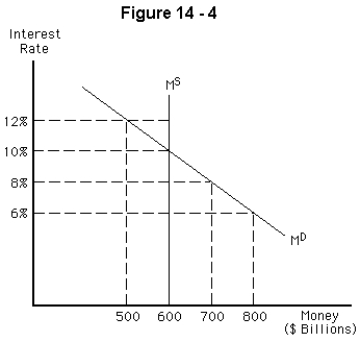

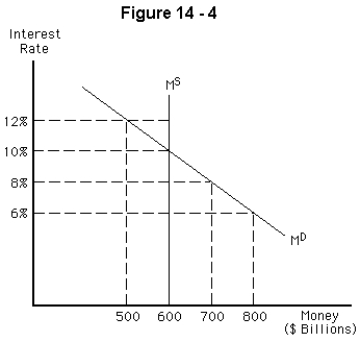

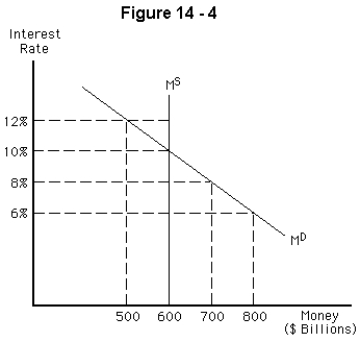

Refer to Figure 14-4.If the interest rate is currently 8 percent,we would expect the

A) interest rate to rise to 10 percent

B) interest rate to rise to 12 percent

C) interest rate to fall to 6 percent

D) quantity of money held to decrease to $500 billion

E) money supply to increase to $700 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

49

An excess demand for money exists if the interest rate is below the equilibrium rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

50

If there is an excess supply of money in the money market,there must be an excess supply of bonds in the bond market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

51

If the actual interest rate is below the equilibrium interest rate,the

A) Fed must intervene in financial markets to restore the interest rate to its equilibrium value

B) price of bonds will increase

C) price of bonds will decrease

D) money supply will increase until the interest rate rises

E) money supply will decrease until the interest rate rises

A) Fed must intervene in financial markets to restore the interest rate to its equilibrium value

B) price of bonds will increase

C) price of bonds will decrease

D) money supply will increase until the interest rate rises

E) money supply will decrease until the interest rate rises

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

52

If Pat pays $500 for a one-year bond that carries an interest rate of 10 percent per year,how much will she be repaid at the end of the year?

A) $600

B) $510

C) $620

D) $550

E) $500

A) $600

B) $510

C) $620

D) $550

E) $500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

53

Equilibrium in the money market means that the quantity of money people are holding equals

A) their entire wealth

B) their entire income

C) the quantity of money that they want to hold

D) the money supply

E) the value of bonds in their financial portfolios

A) their entire wealth

B) their entire income

C) the quantity of money that they want to hold

D) the money supply

E) the value of bonds in their financial portfolios

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

54

If there is an excess supply of money,there is an excess

A) demand for bonds and the price of bonds will decrease

B) supply of bonds and the price of bonds will decrease

C) supply of bonds but the price of bonds will not change

D) supply of bonds and the price of bonds will increase

E) demand for bonds and the price of bonds will increase

A) demand for bonds and the price of bonds will decrease

B) supply of bonds and the price of bonds will decrease

C) supply of bonds but the price of bonds will not change

D) supply of bonds and the price of bonds will increase

E) demand for bonds and the price of bonds will increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

55

If Chris pays $500 for a bond that will return $750 in one year,what is the interest rate?

A) 50 percent

B) 10 percent

C) 25 percent

D) 250 percent

E) 33 percent

A) 50 percent

B) 10 percent

C) 25 percent

D) 250 percent

E) 33 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

56

If there is an excess supply of money in the economy,

A) there is also an excess demand for money

B) there is also an excess demand for bonds

C) there is also an excess supply of bonds

D) the interest rate will rise

E) the Fed must intervene to restore equilibrium

A) there is also an excess demand for money

B) there is also an excess demand for bonds

C) there is also an excess supply of bonds

D) the interest rate will rise

E) the Fed must intervene to restore equilibrium

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

57

An excess supply of money implies an excess

A) supply of corporate stock

B) demand for bonds

C) supply of bonds

D) demand for corporate stock

E) demand for goods and services

A) supply of corporate stock

B) demand for bonds

C) supply of bonds

D) demand for corporate stock

E) demand for goods and services

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

58

Refer to Figure 14-4.If the interest rate is currently 12 percent,we would expect the

A) interest rate to fall to 10 percent

B) interest rate to remain at 12 percent

C) interest rate to fall to 6 percent

D) quantity of money held to decrease to $500 billion

E) money supply to increase to $700 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

59

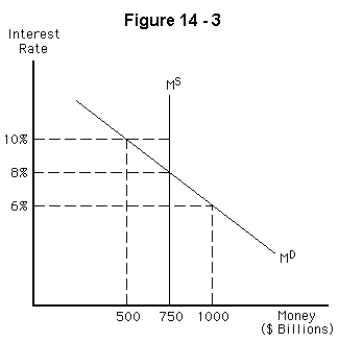

Refer to Figure 14-3.What are the equilibrium interest rate and quantity of money?

A) 10 percent and $500 billion

B) 8 percent and $500 billion

C) 6 percent and $500 billion

D) 8 percent and $750 billion

E) 6 percent and $750 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

60

If the price of bonds rises,

A) the Fed will decrease the money supply

B) the Fed will increase the money supply

C) the interest rate will rise

D) the interest rate will fall

E) inflation must be accelerating

A) the Fed will decrease the money supply

B) the Fed will increase the money supply

C) the interest rate will rise

D) the interest rate will fall

E) inflation must be accelerating

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

61

References in the newspaper to the bond market are usually references to

A) the primary bond market

B) the commodities market

C) the secondary bond market

D) the stock market

E) the futures market

A) the primary bond market

B) the commodities market

C) the secondary bond market

D) the stock market

E) the futures market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

62

Suppose that the equilibrium interest rate is 8 percent,but the actual interest rate is 5 percent.Very quickly,

A) bond prices fall

B) bond prices will rise

C) the interest rate will begin to fluctuate until bondholders reduce their demand for money

D) the primary bond market will start its adjustment process

E) the supply and demand for money will both increase

A) bond prices fall

B) bond prices will rise

C) the interest rate will begin to fluctuate until bondholders reduce their demand for money

D) the primary bond market will start its adjustment process

E) the supply and demand for money will both increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

63

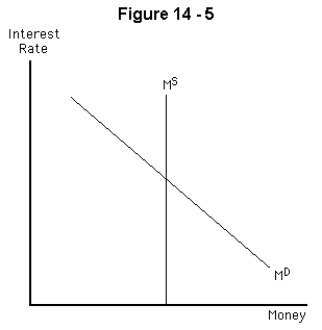

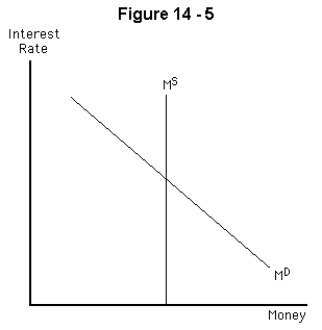

Refer to Figure 14-5.If the Fed wishes to reduce the interest rate,it will

A) increase money demand

B) decrease money demand

C) increase the money supply

D) decrease the money supply

E) simply set a lower market interest rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

64

If the Fed wishes to increase the interest rate,it can do so by

A) selling bonds

B) buying bonds

C) increasing the money supply

D) setting a higher prime lending rate

E) encouraging the public to buy bonds

A) selling bonds

B) buying bonds

C) increasing the money supply

D) setting a higher prime lending rate

E) encouraging the public to buy bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

65

Refer to Figure 14-5.If the Fed wishes to reduce the interest rate,it will

A) shift the demand curve to the right

B) shift the demand curve to the left

C) shift the supply curve of money to the right

D) shift the supply curve of money to the left

E) simply set a lower market interest rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

66

If the Fed wishes to raise the interest rate,it will

A) increase the money supply

B) decrease the money supply

C) increase money demand

D) decrease money demand

E) simply set a higher market interest rate

A) increase the money supply

B) decrease the money supply

C) increase money demand

D) decrease money demand

E) simply set a higher market interest rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

67

If the price of bonds falls,the

A) demand for bonds will rise

B) supply of bonds will fall

C) supply of bonds will rise

D) interest rate will rise

E) interest rate will fall

A) demand for bonds will rise

B) supply of bonds will fall

C) supply of bonds will rise

D) interest rate will rise

E) interest rate will fall

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

68

If the Fed conducted an open market sale of bonds,what would most likely happen in the bond market?

A) The excess demand for bonds would cause the price of bonds to fall.

B) The excess supply of bonds could cause the price of bonds to rise.

C) There would be no effect in the bond market.

D) The excess supply of bonds would cause the price of bonds to fall.

E) The excess demand for bonds would cause the price of bonds to rise.

A) The excess demand for bonds would cause the price of bonds to fall.

B) The excess supply of bonds could cause the price of bonds to rise.

C) There would be no effect in the bond market.

D) The excess supply of bonds would cause the price of bonds to fall.

E) The excess demand for bonds would cause the price of bonds to rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

69

The secondary market for bonds is

A) where new issues of bonds are purchased

B) of less importance to our economy than is the primary market

C) of less importance to our economy than the stock market

D) where bonds that were issued in previous periods are purchased

E) a key determinant of the money supply

A) where new issues of bonds are purchased

B) of less importance to our economy than is the primary market

C) of less importance to our economy than the stock market

D) where bonds that were issued in previous periods are purchased

E) a key determinant of the money supply

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

70

The money market achieves equilibrium when

A) individuals no longer want to spend their money

B) the price of bonds rises by an appropriate amount

C) buyers and sellers agree on a price for commodities

D) speculative balances are reduced to a minimum

E) individuals who hold bonds are satisfied with what they are holding

A) individuals no longer want to spend their money

B) the price of bonds rises by an appropriate amount

C) buyers and sellers agree on a price for commodities

D) speculative balances are reduced to a minimum

E) individuals who hold bonds are satisfied with what they are holding

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

71

The secondary market for bonds is a market for

A) bonds that is smaller than the primary market

B) bonds that are not first-class

C) previously issued bonds

D) bonds that are not substitutes for bonds found in the primary market

E) newly issued bonds

A) bonds that is smaller than the primary market

B) bonds that are not first-class

C) previously issued bonds

D) bonds that are not substitutes for bonds found in the primary market

E) newly issued bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

72

If the demand for bonds increases,the

A) price and quantity of bonds in existence both increase

B) price of bonds increases,but the quantity of bonds in existence decreases

C) price of bonds increases,but the quantity of bonds in existence remains unchanged

D) interest rate and quantity of bonds in existence both increase

E) interest rate increases,but the quantity of bonds in existence remains unchanged

A) price and quantity of bonds in existence both increase

B) price of bonds increases,but the quantity of bonds in existence decreases

C) price of bonds increases,but the quantity of bonds in existence remains unchanged

D) interest rate and quantity of bonds in existence both increase

E) interest rate increases,but the quantity of bonds in existence remains unchanged

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

73

If the Fed wants to lower the interest rate,it will

A) increase the money supply

B) decrease the money supply

C) increase money demand

D) decrease money demand

E) simply set a lower market interest rate

A) increase the money supply

B) decrease the money supply

C) increase money demand

D) decrease money demand

E) simply set a lower market interest rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

74

If the quantity of money demanded is less than the quantity supplied at a given interest rate,what will happen to restore the market to equilibrium?

A) The public will try to buy bonds,the price of bonds will increase,and the interest rate will fall until the equilibrium is attained where the money demand and supply curves intersect.

B) The public will try to sell bonds,the price of bonds will decrease,and the interest rate will rise until equilibrium is attained where the money demand and supply curves intersect.

C) The public will try to sell bonds,the price of bonds will increase,and the interest rate will fall until equilibrium is attained where the money demand and supply curves intersect.

D) The public will try to buy bonds,the price of bonds will increase,and the interest rate will rise until equilibrium is attained where the money demand and supply curves intersect.

E) The public will try to buy bonds,the price of bonds will decrease,and the interest rate will fall until equilibrium is attained where the money demand and supply curves intersect.

A) The public will try to buy bonds,the price of bonds will increase,and the interest rate will fall until the equilibrium is attained where the money demand and supply curves intersect.

B) The public will try to sell bonds,the price of bonds will decrease,and the interest rate will rise until equilibrium is attained where the money demand and supply curves intersect.

C) The public will try to sell bonds,the price of bonds will increase,and the interest rate will fall until equilibrium is attained where the money demand and supply curves intersect.

D) The public will try to buy bonds,the price of bonds will increase,and the interest rate will rise until equilibrium is attained where the money demand and supply curves intersect.

E) The public will try to buy bonds,the price of bonds will decrease,and the interest rate will fall until equilibrium is attained where the money demand and supply curves intersect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

75

If bond prices rise in the secondary market,

A) the interest rate rises in the secondary market

B) the interest rate rises in the primary market

C) this has no impact on the primary market

D) they fall in the primary market

E) they also rise in the primary market

A) the interest rate rises in the secondary market

B) the interest rate rises in the primary market

C) this has no impact on the primary market

D) they fall in the primary market

E) they also rise in the primary market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

76

If Johanna purchases a bond for $4,500 that promises to pay her $5,000 one year later,what is the interest rate on the bond?

A) 5.3 percent

B) 5.6 percent

C) 10.0 percent

D) 11.1 percent

E) 10.5 percent

A) 5.3 percent

B) 5.6 percent

C) 10.0 percent

D) 11.1 percent

E) 10.5 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

77

If Cathy has a bond that will pay $1,000 one year from now and its current price is $800,what is the current interest rate?

A) 10 percent

B) 25 percent

C) 20 percent

D) 200 percent

E) 2 percent

A) 10 percent

B) 25 percent

C) 20 percent

D) 200 percent

E) 2 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

78

The supply of bonds to the bond market

A) is positively related to the demand for stocks

B) is inversely related to the interest rate

C) is positively related to income

D) is positively related to the demand for bonds

E) only changes if new bonds are issued

A) is positively related to the demand for stocks

B) is inversely related to the interest rate

C) is positively related to income

D) is positively related to the demand for bonds

E) only changes if new bonds are issued

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

79

To cause the interest rate to fall,the Fed can

A) decrease the money supply

B) stabilize the money supply to increase investor confidence

C) decrease the price of bonds

D) increase the money supply

E) increase the demand for money

A) decrease the money supply

B) stabilize the money supply to increase investor confidence

C) decrease the price of bonds

D) increase the money supply

E) increase the demand for money

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

80

If the quantity of money demanded exceeds the quantity of money supplied at a given interest rate,what will happen to restore the market to equilibrium?

A) The public will try to buy bonds,the price of bonds will increase,and the interest rate will fall until equilibrium is attained where the money demand and supply curves intersect at the market interest rate.

B) The public will try to sell bonds,the price of bonds will decrease,and the interest rate will rise until equilibrium is attained where the money demand and supply curves intersect at the market interest rate.

C) The public will try to sell bonds,the price of bonds will increase,and the interest rate will fall until equilibrium is attained where the money demand and supply curves intersect.

D) The public will try to buy bonds,the price of bonds will increase,and the interest rate will rise until equilibrium is attained where the money demand and supply curves intersect.

E) The public will try to buy bonds,the price of bonds will decrease,and the interest rate will fall until equilibrium is attained where the money demand and supply curves intersect.

A) The public will try to buy bonds,the price of bonds will increase,and the interest rate will fall until equilibrium is attained where the money demand and supply curves intersect at the market interest rate.

B) The public will try to sell bonds,the price of bonds will decrease,and the interest rate will rise until equilibrium is attained where the money demand and supply curves intersect at the market interest rate.

C) The public will try to sell bonds,the price of bonds will increase,and the interest rate will fall until equilibrium is attained where the money demand and supply curves intersect.

D) The public will try to buy bonds,the price of bonds will increase,and the interest rate will rise until equilibrium is attained where the money demand and supply curves intersect.

E) The public will try to buy bonds,the price of bonds will decrease,and the interest rate will fall until equilibrium is attained where the money demand and supply curves intersect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck