Deck 13: Segment and Interim Reporting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/52

العب

ملء الشاشة (f)

Deck 13: Segment and Interim Reporting

1

Zeus Corporation has determined that it has 15 reportable operating segments.In order to comply with the standard for segment disclosures,Zeus Corporation should do which of the following?

A)Report 10 reportable segments and disclose the remaining 5 segments as other operating segments.

B)Report 10 reportable segments by combining the most closely related segments.

C)Report 15 reportable segments as long as the 75 percent revenue test has been satisfied.

D)Report 12 reportable segments and show all other operating segments in a column labeled "Other Operating Segments."

A)Report 10 reportable segments and disclose the remaining 5 segments as other operating segments.

B)Report 10 reportable segments by combining the most closely related segments.

C)Report 15 reportable segments as long as the 75 percent revenue test has been satisfied.

D)Report 12 reportable segments and show all other operating segments in a column labeled "Other Operating Segments."

B

2

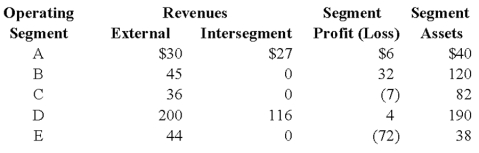

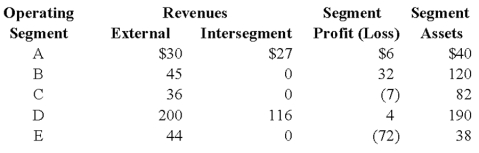

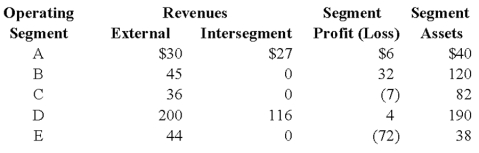

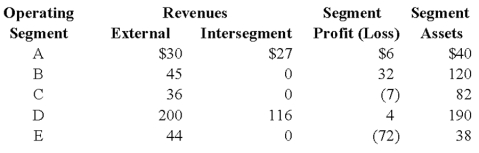

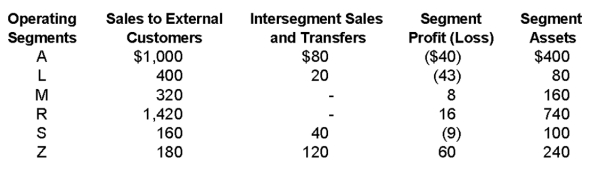

An analysis of Abbey Company's operating segments provides the following information:

Refer to the above information.Which of the operating segments above meet the revenue test?

A)B,D,and E

B)A and D

C)A,B,and D

D)B,C,D,and E

Refer to the above information.Which of the operating segments above meet the revenue test?

A)B,D,and E

B)A and D

C)A,B,and D

D)B,C,D,and E

B

3

Main Manufacturing Corporation reported consolidated revenues of $50,000,000 on its income statement for 20X8.The management of the corporation identified 3 industry segments,M,N,and O.These segments had the following intersegment sales and transfers during 20X8:

For Main Manufacturing Corporation,the revenue test would be satisfied if any of its industry segments had revenue equal to or greater than which of the following?

A)$7,400,000

B)$5,740,000

C)$5,000,000

D)$4,260,000

For Main Manufacturing Corporation,the revenue test would be satisfied if any of its industry segments had revenue equal to or greater than which of the following?

A)$7,400,000

B)$5,740,000

C)$5,000,000

D)$4,260,000

B

4

Trimester Corporation's revenue for the year ended December 31,20X8,was as follows:

Trimester has a reportable operating segment if that segment's revenue exceeds:

A)$65,500

B)$60,000

C)$64,500

D)$61,000

Trimester has a reportable operating segment if that segment's revenue exceeds:

A)$65,500

B)$60,000

C)$64,500

D)$61,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

5

FASB 131 (ASC 280)requires certain disclosures about major customers.All of the following statements about those disclosures are true with the exception of which statement?

A)The identity of the segment reporting the revenue from a significant customer must be disclosed a footnote.

B)The amount of revenue from a significant customer must be disclosed in a footnote.

C)For applying the disclosure test a threshold of 10 percent of total revenues is mandated.

D)A local,state,or foreign government can be considered a major customer.

A)The identity of the segment reporting the revenue from a significant customer must be disclosed a footnote.

B)The amount of revenue from a significant customer must be disclosed in a footnote.

C)For applying the disclosure test a threshold of 10 percent of total revenues is mandated.

D)A local,state,or foreign government can be considered a major customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

6

Five of eight internally reported operating segments of Rollins Company qualify under the standards set by FASB 131 (ASC 280)for segment reporting.However,the five identified segments do not meet the 75 percent revenue test.FASB 131 (ASC 280)prescribes that management:

A)subdivide segments until there are at least 10 reportable segments.

B)consolidate the remaining operating segments and include them under an "all other" category.

C)select additional operating segments until the 75% threshold is met.

D)include the heading "corporate headquarters" as an operating segment.

A)subdivide segments until there are at least 10 reportable segments.

B)consolidate the remaining operating segments and include them under an "all other" category.

C)select additional operating segments until the 75% threshold is met.

D)include the heading "corporate headquarters" as an operating segment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

7

Wakefield Company uses a perpetual inventory system.In August,it sold 2,000 units from its LIFO-base inventory,which had originally cost $35 per unit.The replacement cost is expected to be $45 per unit.The company is planning to reduce its inventory and expects to replace only 1,500 of these units by December 31,the end of its fiscal year.The company replaced 1,500 units in November at an actual cost of $50 per unit.

Based on the preceding information,in the entry to record the replacement of the 1,500 units in November,Cost of Goods Sold will be debited for:

A)$52,500.

B)$22,500.

C)$15,000.

D)$7,500.

Based on the preceding information,in the entry to record the replacement of the 1,500 units in November,Cost of Goods Sold will be debited for:

A)$52,500.

B)$22,500.

C)$15,000.

D)$7,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

8

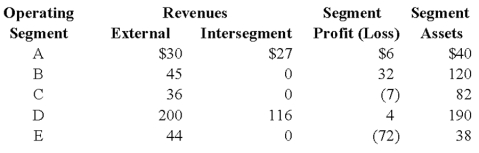

An analysis of Abbey Company's operating segments provides the following information:

Refer to the above information.Which of the operating segments above are reportable segments?

A)B,C,and D

B)A,B,D,and E

C)B,D,and E

D)A,B,C,D,and E

Refer to the above information.Which of the operating segments above are reportable segments?

A)B,C,and D

B)A,B,D,and E

C)B,D,and E

D)A,B,C,D,and E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

9

Crisfield Company has two reportable segments,C and D.Segment C made $4,000,000 of sales to external customers and $400,000 of sales to other operating segments.Segment D,on the other hand,made sales of $8,000,000 to external customers and $1,600,000 of sales to other operating segments.Crisfield Company reported $13,200,000 of revenues on its consolidated income statement.What calculation below correctly determines whether Crisfield Company's reportable segments satisfy the 75% revenue test?

A)$14,000,000/$15,200,000

B)$14,000,000/$13,200,000

C)$12,000,000/$13,200,000

D)$12,000,000/$15,200,000

A)$14,000,000/$15,200,000

B)$14,000,000/$13,200,000

C)$12,000,000/$13,200,000

D)$12,000,000/$15,200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

10

Trevor Company discloses supplementary operating segment information for its three reportable segments.Data for 20X8 are available as follows:

Additional 20X8 expenses include indirect operating expenses of $200,000.Appropriately selected common indirect operating expenses are allocated to segments based on the ratio of each segment's sales to total sales.The 20X8 operating profit for Segment B was:

A)$180,000

B)$120,000

C)$150,000

D)$250,000

Additional 20X8 expenses include indirect operating expenses of $200,000.Appropriately selected common indirect operating expenses are allocated to segments based on the ratio of each segment's sales to total sales.The 20X8 operating profit for Segment B was:

A)$180,000

B)$120,000

C)$150,000

D)$250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

11

In 20X6 and 20X7,each of Putney Company's four operating segments met one of the three quantitative tests for segment reporting.In 20X8,Segment B failed to qualify under the prescribed tests because of abnormal financial conditions.The other three segments qualified for reporting.For 20X8,Segment B:

A)should be excluded from segment disclosure but referred to in the management letter to shareholders.

B)should be distinctly separated from the other three segments and listed as a "nonqualifying" segment.

C)should be combined with one of the other three segments and reported.

D)should be included in the segment disclosures at the discretion of management.

A)should be excluded from segment disclosure but referred to in the management letter to shareholders.

B)should be distinctly separated from the other three segments and listed as a "nonqualifying" segment.

C)should be combined with one of the other three segments and reported.

D)should be included in the segment disclosures at the discretion of management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

12

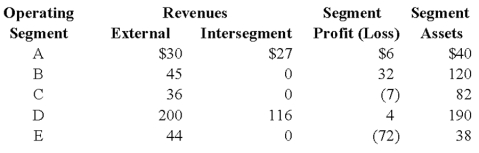

An analysis of Abbey Company's operating segments provides the following information:

Refer to the above information.Which of the operating segments above meet the operating profit (loss)test?

A)B and E

B)A and B

C)A,B,and E

D)A,B,C,and E

Refer to the above information.Which of the operating segments above meet the operating profit (loss)test?

A)B and E

B)A and B

C)A,B,and E

D)A,B,C,and E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

13

FASB 131 (ASC 280)uses a(n)______ approach to the definition of segments.

A)line of business

B)entity approach

C)portfolio

D)management

A)line of business

B)entity approach

C)portfolio

D)management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following are established by FASB 131(ASC 280)as "enterprisewide disclosure" standards to provide more information about the risks to a company?

I)Information about dominant industry segments.

II)Information about major customers.

III)Information about geographic areas.

A)Both II and III

B)Both I and III

C)Both I and II

D)I,II,and II

I)Information about dominant industry segments.

II)Information about major customers.

III)Information about geographic areas.

A)Both II and III

B)Both I and III

C)Both I and II

D)I,II,and II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

15

All of the following are differences between international standards and U.S.GAAP regarding operating segments,except:

A)IFRS requires disclosures about geographical segments,not business segments.

B)IFRS requires two different bases of segmentation,a primary basis and a secondary basis.

C)IFRS required more disclosure for primary segments.

D)The amounts disclosed under IFRS are based on the same accounting policies as the financial statements,not based on amounts reported to the chief operating decision maker.

A)IFRS requires disclosures about geographical segments,not business segments.

B)IFRS requires two different bases of segmentation,a primary basis and a secondary basis.

C)IFRS required more disclosure for primary segments.

D)The amounts disclosed under IFRS are based on the same accounting policies as the financial statements,not based on amounts reported to the chief operating decision maker.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

16

Trevor Company discloses supplementary operating segment information for its three reportable segments.Data for 20X8 are available as follows:

Allocable costs for the year was $180,000.Allocable costs are assigned based on the ratio of a segment's income before allocable costs to total income before allocable costs.The 20X8 operating profit for Segment B was:

A)$110,000

B)$180,000

C)$126,000

D)$120,000

Allocable costs for the year was $180,000.Allocable costs are assigned based on the ratio of a segment's income before allocable costs to total income before allocable costs.The 20X8 operating profit for Segment B was:

A)$110,000

B)$180,000

C)$126,000

D)$120,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

17

The management approach to the definition of segments for financial reporting expects a company to:

I)Report disaggregated information on the same organizational basis as used by the company's internal decision makers.

II)Report disaggregated information for at least ten segments.

A)I

B)II

C)Both I and II

D)Neither I nor II

I)Report disaggregated information on the same organizational basis as used by the company's internal decision makers.

II)Report disaggregated information for at least ten segments.

A)I

B)II

C)Both I and II

D)Neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

18

Stone Company reported $100,000,000 of revenues on its 20X8 income statement.During the year ended December 31,20X8,Stone made sales of $8,000,000 to external customers in Western Europe.In addition,Stone made sales of $10,000,000 to the U.S.government and $4,000,000 of sales to various state governments.In the footnotes to its financial statements for 20X8,in reporting enterprisewide disclosures,Stone is required to disclose:

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

19

Wakefield Company uses a perpetual inventory system.In August,it sold 2,000 units from its LIFO-base inventory,which had originally cost $35 per unit.The replacement cost is expected to be $45 per unit.The company is planning to reduce its inventory and expects to replace only 1,500 of these units by December 31,the end of its fiscal year.The company replaced 1,500 units in November at an actual cost of $50 per unit.

Based on the preceding information,in the entry in August to record the sale of the 2,000 units:

A)Cost of Goods Sold will be debited for $70,000.

B)Inventory will be credited for $85,000.

C)Excess of Replacement Cost over LIFO Cost of Inventory Liquidation will be credited for $15,000.

D)Excess of Replacement Cost over LIFO Cost of Inventory Liquidation will be credited for $67,000.

Based on the preceding information,in the entry in August to record the sale of the 2,000 units:

A)Cost of Goods Sold will be debited for $70,000.

B)Inventory will be credited for $85,000.

C)Excess of Replacement Cost over LIFO Cost of Inventory Liquidation will be credited for $15,000.

D)Excess of Replacement Cost over LIFO Cost of Inventory Liquidation will be credited for $67,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

20

Collins Company reported consolidated revenue of $120,000,000 in 20X8.Collins operates in two geographic areas,domestic and Asia.The following information pertains to these two areas:

What calculation below is correct to determine if the revenue test is satisfied for the Asian operations?

A)$58,000,000/$140,000,000

B)$50,000,000/$120,000,000

C)$58,000,000/$120,000,000

D)$50,000,000/$140,000,000

What calculation below is correct to determine if the revenue test is satisfied for the Asian operations?

A)$58,000,000/$140,000,000

B)$50,000,000/$120,000,000

C)$58,000,000/$120,000,000

D)$50,000,000/$140,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

21

Wakefield Company uses a perpetual inventory system.In August,it sold 2,000 units from its LIFO-base inventory,which had originally cost $35 per unit.The replacement cost is expected to be $45 per unit.The company is planning to reduce its inventory and expects to replace only 1,500 of these units by December 31,the end of its fiscal year.The company replaced 1,500 units in November at an actual cost of $50 per unit.

Based on the preceding information,in the entry to record the replacement of the 1,500 units in November,Inventory will be debited for:

A)$52,500.

B)$75,000.

C)$67,500.

D)$60,000.

Based on the preceding information,in the entry to record the replacement of the 1,500 units in November,Inventory will be debited for:

A)$52,500.

B)$75,000.

C)$67,500.

D)$60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

22

During the third quarter of 20X8,Pride Company sold a piece of equipment at an $8,000 gain.What portion of the gain should Pride report in its income statement for the third quarter of 20X8?

A)$0

B)$2,000

C)$4,000

D)$8,000

A)$0

B)$2,000

C)$4,000

D)$8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

23

Denver Company,a calendar-year corporation,had the following actual income before income tax expense and estimated effective annual income tax rates for the first three quarters in 20X8:

Denver's income tax expense in its interim income statement for the third quarter should be:

A)$126,000.

B)$68,400.

C)$62,400.

D)$54,000.

Denver's income tax expense in its interim income statement for the third quarter should be:

A)$126,000.

B)$68,400.

C)$62,400.

D)$54,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

24

On March 15,20X9,Clarion Company paid property taxes of $60,000 on its factory building for calendar year 20X9.On July 1,20X9,Clarion made $40,000 in unanticipated repairs to its machinery.The repairs will benefit operations for the remainder of the calendar year.What total amount of these expenses should be included in Clarion's quarterly income statement for the three months ended September 30,20X9?

A)$55,000

B)$15,000

C)$35,000

D)$40,000

A)$55,000

B)$15,000

C)$35,000

D)$40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following observations is true of the discrete view of interim reporting?

A)An interim period is viewed as an installment of an annual period.

B)Recognition and adjustment of certain income or expense items may be affected by judgments about the expected results of the entire year's operations.

C)Each interim period is considered as a basic accounting period to be evaluated as if it were an annual accounting period.

D)One interim period would not bear the entire expense that benefits more than one interim period.

A)An interim period is viewed as an installment of an annual period.

B)Recognition and adjustment of certain income or expense items may be affected by judgments about the expected results of the entire year's operations.

C)Each interim period is considered as a basic accounting period to be evaluated as if it were an annual accounting period.

D)One interim period would not bear the entire expense that benefits more than one interim period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

26

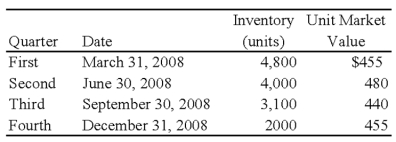

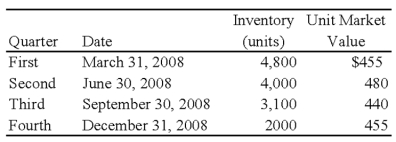

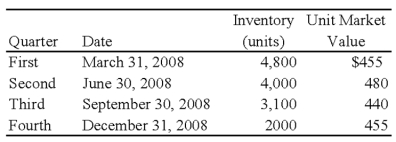

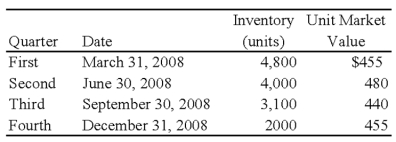

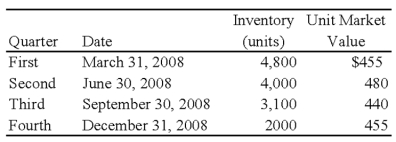

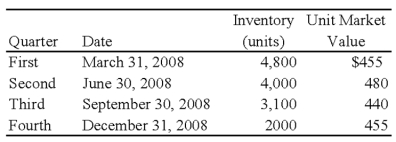

Forge Company,a calendar-year entity,had 6,000 units in its beginning inventory for 20X8.On December 31,20X7,the units had been adjusted down to $470 per unit from an actual cost of $510 per unit.It was the lower of cost or market.No additional units were purchased during 20X8.The following additional information is provided for 20X8:

Forge does not have sufficient experience with the seasonal market for its inventory units and assumes that any reductions in market value during the year will be permanent.

Based on the preceding information,the cost of goods sold for the year 20X8,is:

A)$2,080,000

B)$1,880,000

C)$1,835,000

D)$1,910,000

Forge does not have sufficient experience with the seasonal market for its inventory units and assumes that any reductions in market value during the year will be permanent.

Based on the preceding information,the cost of goods sold for the year 20X8,is:

A)$2,080,000

B)$1,880,000

C)$1,835,000

D)$1,910,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

27

Forge Company,a calendar-year entity,had 6,000 units in its beginning inventory for 20X8.On December 31,20X7,the units had been adjusted down to $470 per unit from an actual cost of $510 per unit.It was the lower of cost or market.No additional units were purchased during 20X8.The following additional information is provided for 20X8:

Forge does not have sufficient experience with the seasonal market for its inventory units and assumes that any reductions in market value during the year will be permanent.

Based on the preceding information,the cost of goods sold for the first quarter is:

A)$636,000

B)$564,000

C)$546,000

D)$624,000

Forge does not have sufficient experience with the seasonal market for its inventory units and assumes that any reductions in market value during the year will be permanent.

Based on the preceding information,the cost of goods sold for the first quarter is:

A)$636,000

B)$564,000

C)$546,000

D)$624,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

28

Samuel Corporation foresees a downturn in its business in the medium term.It expects to sustain an operating loss of $160,000 for the full year ending December 31,20X8.Samuel's tax rate is 35 percent.Anticipated tax credits for 20X8 total $8,000.No permanent differences are expected.Realization of the full tax benefit of the expected operating loss and realization of anticipated tax credits are assured beyond any reasonable doubt because they will be carried back.For the first quarter ended March 31,20X8,Samuel reported an operating loss of $30,000.How much of a tax benefit should Samuel report for the interim period ended March 31,20X8?

A)$8,000

B)$12,000

C)$13,500

D)$15,500

A)$8,000

B)$12,000

C)$13,500

D)$15,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

29

Davis Company uses LIFO for all of its inventories.During its second quarter of 20X9,Davis experienced a LIFO liquidation.Davis fully expects to replace the liquidated inventory in the early part of the third quarter.How should Davis report the inventory temporarily liquidated on its income statement for the second quarter?

A)Cost of goods sold for the second quarter should include the acquisition cost of the goods temporarily liquidated.

B)Cost of goods sold for the second quarter should include the expected replacement cost of the goods temporarily liquidated.

C)Cost of goods sold for the second quarter should not include the expected replacement cost of the goods temporarily liquidated.

D)Cost of goods sold for the second quarter is not affected by the temporary liquidation of LIFO inventory.

A)Cost of goods sold for the second quarter should include the acquisition cost of the goods temporarily liquidated.

B)Cost of goods sold for the second quarter should include the expected replacement cost of the goods temporarily liquidated.

C)Cost of goods sold for the second quarter should not include the expected replacement cost of the goods temporarily liquidated.

D)Cost of goods sold for the second quarter is not affected by the temporary liquidation of LIFO inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

30

Wakefield Company uses a perpetual inventory system.In August,it sold 2,000 units from its LIFO-base inventory,which had originally cost $35 per unit.The replacement cost is expected to be $45 per unit.The company is planning to reduce its inventory and expects to replace only 1,500 of these units by December 31,the end of its fiscal year.The company replaced 1,500 units in November at an actual cost of $50 per unit.

Based on the preceding information,in the entry to record the replacement of the 1,500 units in November,Accounts Payable will be credited for:

A)$67,500.

B)$75,000.

C)$62,500.

D)$60,000.

Based on the preceding information,in the entry to record the replacement of the 1,500 units in November,Accounts Payable will be credited for:

A)$67,500.

B)$75,000.

C)$62,500.

D)$60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

31

Estimated gross profit rates may be used to estimate a company's cost of goods sold and its ending inventory for:

A)quarterly but not for annual financial statements.

B)both quarterly and annual financial statements.

C)neither quarterly nor annual financial statements.

D)annual but not for quarterly financial statements.

A)quarterly but not for annual financial statements.

B)both quarterly and annual financial statements.

C)neither quarterly nor annual financial statements.

D)annual but not for quarterly financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

32

Mason Company paid its annual property taxes of $240,000 on February 15,20X9.Mason also anticipates that its annual repairs expense for 20X9 will be $1,200,000.This amount is usually incurred and paid in July and August when operations are shut down so that machinery and equipment can be repaired.What amount should Mason deduct for property taxes and repairs in each quarter for 20X9?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

33

Assume that the replacement did not happen in November.In December,the company decided not to replace any of the 1,500 units.The entry required on December 31 to eliminate valuation accounts related to the inventory that will not be replaced will include:

A)a debit to Excess of Replacement Cost over LIFO Cost of Inventory Liquidation for $22,500.

B)a credit to Cost of Goods Sold for $15,000.

C)a debit to Inventory for $70,000.

D)a debit to Inventory for $15,000.

A)a debit to Excess of Replacement Cost over LIFO Cost of Inventory Liquidation for $22,500.

B)a credit to Cost of Goods Sold for $15,000.

C)a debit to Inventory for $70,000.

D)a debit to Inventory for $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

34

Tyler Company incurred an inventory loss due to a decline in market prices during its first quarter of operations in 20X8.At the end of the first quarter,management of the company believed the decline in market prices to be permanent.In the second quarter,the market prices of Tyler's inventories increased above their acquisition cost.Market prices remained higher than acquisition cost during the remainder of 20X8.How should Tyler report the facts above on its first and second quarter income statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

35

William Corporation,which has a fiscal year ending January 31,had the following pretax accounting income and estimated effective annual income tax rates for the first three quarters of the year ended January 31,20X8:

William's income tax expenses in its interim income statement for the third quarter are:

A)$36,000.

B)$73,500.

C)$46,500.

D)$120,000.

William's income tax expenses in its interim income statement for the third quarter are:

A)$36,000.

B)$73,500.

C)$46,500.

D)$120,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

36

Toledo Imports,a calendar-year corporation,had the following income before tax expense and estimated effective annual income tax rates for the first three quarters in 20X8:

Toledo's income tax expense in its interim income statement for the nine months ended September 30 and for the third quarter,respectively,are:

A)$250,800 and $103,200.

B)$252,000 and $108,000.

C)$252,000 and $103,200.

D)$250,800 and $108,000.

Toledo's income tax expense in its interim income statement for the nine months ended September 30 and for the third quarter,respectively,are:

A)$250,800 and $103,200.

B)$252,000 and $108,000.

C)$252,000 and $103,200.

D)$250,800 and $108,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

37

On June 30,20X8,String Corporation incurred a $220,000 net loss from disposal of a business component.Also,on June 30,20X8,String paid $60,000 for property taxes assessed for the calendar year 20X8.What amount of the preceding items should be included in the determination of String's net income or loss for the six-month interim period ended June 30,20X8?

A)$250,000

B)$220,000

C)$140,000

D)$280,000

A)$250,000

B)$220,000

C)$140,000

D)$280,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

38

Forge Company,a calendar-year entity,had 6,000 units in its beginning inventory for 20X8.On December 31,20X7,the units had been adjusted down to $470 per unit from an actual cost of $510 per unit.It was the lower of cost or market.No additional units were purchased during 20X8.The following additional information is provided for 20X8:

Forge does not have sufficient experience with the seasonal market for its inventory units and assumes that any reductions in market value during the year will be permanent.

Based on the preceding information,the cost of goods sold for the second quarter is:

A)$416,000

B)$364,000

C)$304,000

D)$424,000

Forge does not have sufficient experience with the seasonal market for its inventory units and assumes that any reductions in market value during the year will be permanent.

Based on the preceding information,the cost of goods sold for the second quarter is:

A)$416,000

B)$364,000

C)$304,000

D)$424,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

39

Derby Company pays its executives a bonus of 6 percent of income before deducting the bonus and income taxes.For the quarter ended March 31,20X8,Derby had income before the bonus and income tax of $12,000,000.For the year ended December 31,20X8,Derby estimates that its income before bonus and income taxes will be $70,000,000.For the quarter ended March 31,20X8,what is the amount of the bonus that Derby should deduct on its income statement?

A)$4,200,000

B)$720,000

C)$1,050,000

D)$180,000

A)$4,200,000

B)$720,000

C)$1,050,000

D)$180,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

40

APB Opinion 28 (ASC 270)uses which view of interim reporting?

A)Integral

B)Discrete

C)Segmental

D)Comprehensive

A)Integral

B)Discrete

C)Segmental

D)Comprehensive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

41

All of the following situations require a retrospective application of a change in a reporting entity except for:

A)Presenting consolidated financials rather than individual statements for separate entities.

B)Changing the specific subsidiaries that make up a consolidated entity.

C)Presenting foreign subsidiaries in addition to domestic subsidiaries.

D)Changing entities that are included in combined financial statements.

A)Presenting consolidated financials rather than individual statements for separate entities.

B)Changing the specific subsidiaries that make up a consolidated entity.

C)Presenting foreign subsidiaries in addition to domestic subsidiaries.

D)Changing entities that are included in combined financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

42

Ridge Company is in the process of determining its reportable segments for the year ended December 31,20X8.As the person responsible for determining this information,you gather the following information:

Required:

a)Using the appropriate tests,determine which of the industry segments listed above are reportable for 20X8.Show your supporting computations in good form.

b)Indicate whether or not Ridge's reportable segments satisfy the 75 percent test.Show your supporting computations in good form.

Required:

a)Using the appropriate tests,determine which of the industry segments listed above are reportable for 20X8.Show your supporting computations in good form.

b)Indicate whether or not Ridge's reportable segments satisfy the 75 percent test.Show your supporting computations in good form.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

43

Frahm Company incurred a first quarter operating loss before income tax effect of $4,000,000.This is a normal occurrence for Frahm because of seasonal fluctuations.Experience has demonstrated the income earned during the remaining quarters far exceeds the first quarter losses each year.Frahm estimates its annual income tax rate will be 30 percent.What net loss should Frahm report for the first quarter?

A)$4,000,000

B)$2,800,000

C)$700,000

D)$0

A)$4,000,000

B)$2,800,000

C)$700,000

D)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

44

If a company changes the method it uses to compute the allowance for uncollectible accounts receivable because more recent information has become available,how is this change in method is accounted for?

A)The change is only reported in the current period in which the change is made

B)The change is reported in all future periods affected by the change

C)Previously issued financial statements are not adjusted by the change

D)All of the above are correct ways to account for the change

A)The change is only reported in the current period in which the change is made

B)The change is reported in all future periods affected by the change

C)Previously issued financial statements are not adjusted by the change

D)All of the above are correct ways to account for the change

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

45

How would a company report a change in an accounting principle made on the last day of the third quarter?

A)Retrospective application to all pre-change interim periods reported.

B)No change is required.

C)Apply to current and prospective interim periods only.

D)Apply to prospective interim periods only.

A)Retrospective application to all pre-change interim periods reported.

B)No change is required.

C)Apply to current and prospective interim periods only.

D)Apply to prospective interim periods only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

46

Iona Corporation is in the process of preparing its financial statements for the first quarter of 20X9 and has asked your advice as to how to report several items.These items include the following events which took place during the first quarter of 20X9 (assume all amounts are material):

1)Iona redeemed bonds with a carrying value of $4,000,000 at a cost of $3,760,000.This early extinguishment occurred because Iona wants to issue new debt at lower interest rates.

2)Iona uses the LIFO method for its inventories.On January 1,20X9,inventories amounted to $10,000,000,while,on March 31,20X9,inventories totaled $9,200,000.Iona expects to replace the liquidated inventory at the beginning of the second quarter at a cost of $1,000,000.

3)Iona changed its depreciation method on $4,000,000 of its delivery trucks from the declining balance method to the straight-line method.On January 1,20X9,accumulated depreciation under the declining balance method was $2,800,000.Had the straight-line method been used,accumulated depreciation on January 1,20X9,would have been $2,300,000.The remaining life of the trucks is two years.

4)Iona pays its top executives a bonus at year-end of 6 percent of operating income before bonus and income taxes.Operating income before bonus and income taxes for the three months ended March 31,20X9,was $10,000,000.Iona estimates that its yearly operating income before bonus and income taxes will be $60,000,000.

5)Iona closes its manufacturing operations in July of each year in order to make its major annual repairs.Iona estimates that the cost of these repairs in 20X9 will be $1,000,000.

Required:

For each of the events numbered 1 through 5,indicate how that event should be reported on Iona's income statement for the three months ended March 31,20X9,and the balance sheet accounts effects at March 31,20X9.Ignore income taxes.

1)Iona redeemed bonds with a carrying value of $4,000,000 at a cost of $3,760,000.This early extinguishment occurred because Iona wants to issue new debt at lower interest rates.

2)Iona uses the LIFO method for its inventories.On January 1,20X9,inventories amounted to $10,000,000,while,on March 31,20X9,inventories totaled $9,200,000.Iona expects to replace the liquidated inventory at the beginning of the second quarter at a cost of $1,000,000.

3)Iona changed its depreciation method on $4,000,000 of its delivery trucks from the declining balance method to the straight-line method.On January 1,20X9,accumulated depreciation under the declining balance method was $2,800,000.Had the straight-line method been used,accumulated depreciation on January 1,20X9,would have been $2,300,000.The remaining life of the trucks is two years.

4)Iona pays its top executives a bonus at year-end of 6 percent of operating income before bonus and income taxes.Operating income before bonus and income taxes for the three months ended March 31,20X9,was $10,000,000.Iona estimates that its yearly operating income before bonus and income taxes will be $60,000,000.

5)Iona closes its manufacturing operations in July of each year in order to make its major annual repairs.Iona estimates that the cost of these repairs in 20X9 will be $1,000,000.

Required:

For each of the events numbered 1 through 5,indicate how that event should be reported on Iona's income statement for the three months ended March 31,20X9,and the balance sheet accounts effects at March 31,20X9.Ignore income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

47

Interim income statements are required for Smith Orchards.Smith does most of its sales in the fall quarter of the year.These sales are both to individual and commercial customers.How do you recommend Smith report sales during the spring quarter of the year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

48

FASB has specified a "75% percent consolidated revenue test".

Required:

a)What is the 75% test?

b)How is the 75% test impacted by the "10% Significance Rule"?

Required:

a)What is the 75% test?

b)How is the 75% test impacted by the "10% Significance Rule"?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

49

The income tax expense applicable to the second quarter's income statement is determined by:

A)dividing the estimated annual income tax expense by four and allocating the amount to the second quarter.

B)multiplying the effective income tax rate times the income before tax for the second quarter.

C)subtracting the income tax expense applicable to the first quarter from the income tax expense applicable to the first two quarters.

D)subtracting the income tax liability applicable to the first quarter from the income tax liability applicable to the first two quarters.

A)dividing the estimated annual income tax expense by four and allocating the amount to the second quarter.

B)multiplying the effective income tax rate times the income before tax for the second quarter.

C)subtracting the income tax expense applicable to the first quarter from the income tax expense applicable to the first two quarters.

D)subtracting the income tax liability applicable to the first quarter from the income tax liability applicable to the first two quarters.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

50

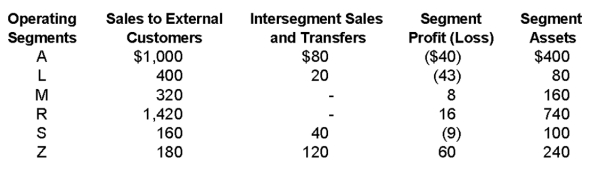

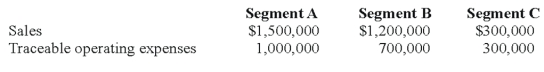

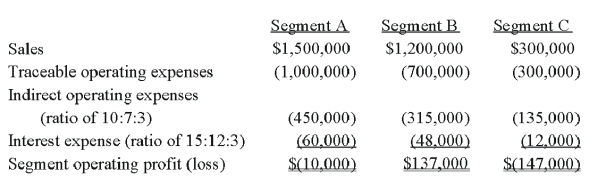

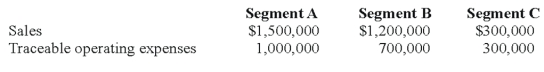

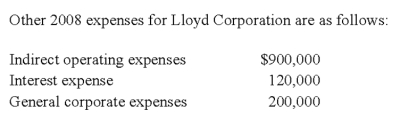

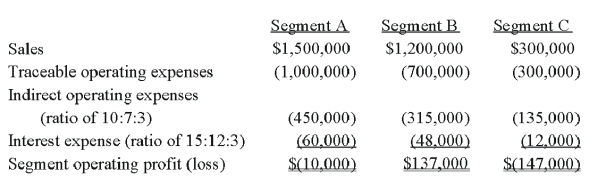

47.Lloyd Corporation reports the following information for 2008 for its three operating segments:

Indirect operating expenses are allocated to segments based upon the ratio of each segment's traceable operating expenses to total traceable operating expenses.Interest expense is allocated to segments based upon the ratio of each segment's sales to total sales.

Required:

a)Calculate the operating profit or loss for each of the segments for 2008.

b)Determine which segments are reportable,applying the operating profit or loss test.

Answer:

Answer:

a)Operating profit or loss for each segment.

Note: General corporate expenses are not allocated for the purpose of identifying reportable segments.

b)Reportable segments.

Segments B and C both meet the operating profit or loss test.The absolute dollar amount of their respective operating profit and loss amounts are 10% or more of the absolute dollar amount of the combined segment operating losses of $157,000 ($10,000 loss + $147,000 loss).

FASB 131 (ASC 280),Disclosure about Segments of an Enterprise and Related Information,has taken what has been referred to as a "management approach" to the definition of a segment and the allocation of costs to a segment.

Required:

a)What is meant by a management approach? How does this concept of a management approach impact the decision to disclose information?

b)How are decisions about cost allocation handled in segment disclosures?

Indirect operating expenses are allocated to segments based upon the ratio of each segment's traceable operating expenses to total traceable operating expenses.Interest expense is allocated to segments based upon the ratio of each segment's sales to total sales.

Required:

a)Calculate the operating profit or loss for each of the segments for 2008.

b)Determine which segments are reportable,applying the operating profit or loss test.

Answer:

Answer:a)Operating profit or loss for each segment.

Note: General corporate expenses are not allocated for the purpose of identifying reportable segments.

b)Reportable segments.

Segments B and C both meet the operating profit or loss test.The absolute dollar amount of their respective operating profit and loss amounts are 10% or more of the absolute dollar amount of the combined segment operating losses of $157,000 ($10,000 loss + $147,000 loss).

FASB 131 (ASC 280),Disclosure about Segments of an Enterprise and Related Information,has taken what has been referred to as a "management approach" to the definition of a segment and the allocation of costs to a segment.

Required:

a)What is meant by a management approach? How does this concept of a management approach impact the decision to disclose information?

b)How are decisions about cost allocation handled in segment disclosures?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

51

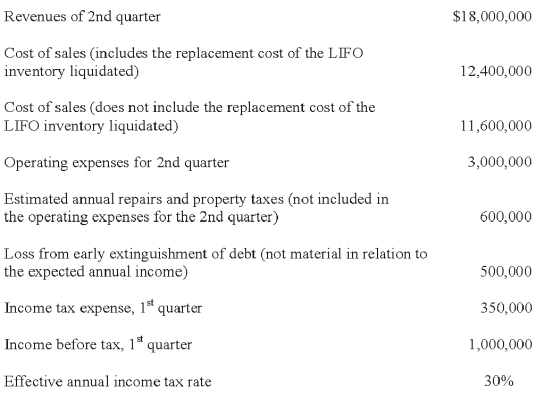

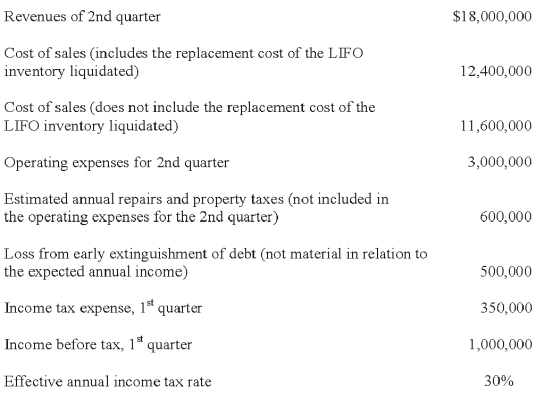

The information below is for the second quarter of Tampa Company for 20X8:

Required:

Prepare an interim income statement for the second quarter for Tampa Company.Assume the LIFO liquidation is expected to be restored by the end of 20X8.

Required:

Prepare an interim income statement for the second quarter for Tampa Company.Assume the LIFO liquidation is expected to be restored by the end of 20X8.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck

52

Missoula Corporation disposed of one of its segments in the second quarter and incurred a gain from disposal of discontinued segment of $600,000,net of taxes.What is the effect of this gain from disposal of discontinued segment?

A)Increase net income from operations for the year by $600,000.

B)Increase second quarter net income by $600,000.

C)Increase each quarter's net income by $150,000.

D)Increase each of the last three quarters' net income by $200,000.

A)Increase net income from operations for the year by $600,000.

B)Increase second quarter net income by $600,000.

C)Increase each quarter's net income by $150,000.

D)Increase each of the last three quarters' net income by $200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 52 في هذه المجموعة.

فتح الحزمة

k this deck