Deck 4: Cost-Volume-Profit Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/272

العب

ملء الشاشة (f)

Deck 4: Cost-Volume-Profit Analysis

1

Which of the following represents the excess of the selling price per unit of a product over the variable cost of obtaining and selling each unit?

A) Gross margin

B) Unit contribution margin

C) Net income

D) Operating income

A) Gross margin

B) Unit contribution margin

C) Net income

D) Operating income

B

2

Managers can quickly forecast the operating income by multiplying ________ and then subtracting fixed costs.

A) projected sales revenue by the contribution margin ratio

B) projected sales units by the contribution margin ratio

C) projected sales revenue by the unit contribution margin

D) projected sales units by the variable cost ratio

A) projected sales revenue by the contribution margin ratio

B) projected sales units by the contribution margin ratio

C) projected sales revenue by the unit contribution margin

D) projected sales units by the variable cost ratio

A

3

The contribution margin derived from different products can be used to motivate the sales force to increase sales of the most profitable products.

True

4

CVP stands for Cost-Volume-Profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

5

Managers can quickly forecast the total contribution margin by multiplying the projected

A) sales revenue by the contribution margin ratio.

B) sales units by the contribution margin ratio.

C) sales revenue by the unit contribution margin.

D) sales units by the variable cost ratio.

A) sales revenue by the contribution margin ratio.

B) sales units by the contribution margin ratio.

C) sales revenue by the unit contribution margin.

D) sales units by the variable cost ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

6

CVP analysis assumes that the only factor that affects costs is a change in volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

7

A product's contribution margin per unit is the excess value of the selling price per unit over the fixed cost of obtaining and selling each unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

8

The contribution margin ratio is the unit contribution margin divided by the sales price per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

9

To compute the unit contribution margin, ________ should be subtracted from the sales price per unit.

A) only variable period costs

B) only variable inventoriable product costs

C) all variable costs

D) all fixed costs

A) only variable period costs

B) only variable inventoriable product costs

C) all variable costs

D) all fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

10

When using the contribution margin ratio, managers project operating income based upon sales units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

11

Contribution margin and gross margin income statements have different operating incomes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

12

CVP assumes that inventory levels change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

13

In cost-volume-profit (CVP) analysis, relevant costs include variable, fixed, and mixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

14

Sales mix of products does not affect CVP analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

15

The unit contribution margin is computed by

A) dividing the variable cost per unit by the sales revenue.

B) subtracting the sales price per unit from the variable cost per unit.

C) subtracting the variable cost per unit from the sales price per unit.

D) dividing the sales revenue by variable cost per unit.

A) dividing the variable cost per unit by the sales revenue.

B) subtracting the sales price per unit from the variable cost per unit.

C) subtracting the variable cost per unit from the sales price per unit.

D) dividing the sales revenue by variable cost per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

16

Contribution margin ratio is computed by dividing

A) contribution margin by sales revenue.

B) contribution margin by operating income.

C) sales revenue by contribution margin.

D) operating income by contribution margin.

A) contribution margin by sales revenue.

B) contribution margin by operating income.

C) sales revenue by contribution margin.

D) operating income by contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

17

If a unit sells for $11.40 and has a variable cost of $3.80, its contribution margin per unit is $7.60.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

18

Contribution margin on an income statement is equal to sales revenue minus variable expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

19

CVP analysis assumes all of the following except that

A) a change in volume is the only factor that affect costs.

B) inventory levels will increase.

C) revenues are linear throughout the relevant range.

D) the mix of products will not change.

A) a change in volume is the only factor that affect costs.

B) inventory levels will increase.

C) revenues are linear throughout the relevant range.

D) the mix of products will not change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

20

The contribution margin ratio explains the percentage of each sales dollar that contributes towards

A) variable costs.

B) sales revenue.

C) fixed costs and generating a profit.

D) period expenses.

A) variable costs.

B) sales revenue.

C) fixed costs and generating a profit.

D) period expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

21

First Robotics Company sells basic kits to build robots for $112 each. The variable costs for each kit are $72. The total contribution margin for 20 kits is

A) $2,240.

B) $3,680.

C) $1,440.

D) $800.

A) $2,240.

B) $3,680.

C) $1,440.

D) $800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

22

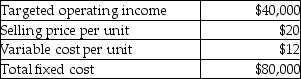

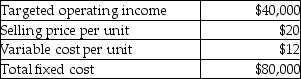

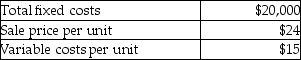

Izzy Creations provides the following information about its single product:

What is the contribution margin ratio?

A) 2.50

B) 0.08

C) 0.40

D) 0.60

What is the contribution margin ratio?

A) 2.50

B) 0.08

C) 0.40

D) 0.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

23

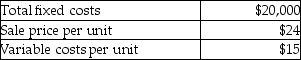

Use the information below to answer the following question(s).

The following selected data relates to Lazarus Corporation:

Assuming 8,000 units are sold, what is the contribution margin at the Lazarus Corporation?

A) $56,000

B) $78,000

C) $34,000

D) $344,000

The following selected data relates to Lazarus Corporation:

Assuming 8,000 units are sold, what is the contribution margin at the Lazarus Corporation?

A) $56,000

B) $78,000

C) $34,000

D) $344,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

24

Branson Movies sells movie tickets for $13 per movie patron. Variable costs are $8 per movie patron and fixed costs are $60,000 per month. The company's relevant range extends to 35,000 movie patrons per month. What is Branson's projected operating income if 28,000 movie patrons see movies during a month?

A) $364,000

B) $140,000

C) $304,000

D) $80,000

A) $364,000

B) $140,000

C) $304,000

D) $80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

25

Mario's Pizza sells pizzas for $10. The variable costs for each pizza are $4, while the total fixed costs are $1,500. The contribution margin for 1,000 pizzas is

A) $8,500.

B) $4,500.

C) $6,000.

D) $10,000.

A) $8,500.

B) $4,500.

C) $6,000.

D) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

26

Use the information below to answer the following question(s).

During the year, Cornell produced and sold 60,000 units of product at a sale price of $8.00 per unit. There was no beginning inventory of product at the start of the year.

-What is the operating income (loss) for the year at Cornell Corporation?

A) $92,000

B) $480,000

C) $282,000

D) $290,000

During the year, Cornell produced and sold 60,000 units of product at a sale price of $8.00 per unit. There was no beginning inventory of product at the start of the year.

-What is the operating income (loss) for the year at Cornell Corporation?

A) $92,000

B) $480,000

C) $282,000

D) $290,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

27

Use the information below to answer the following question(s).

The Burr Mystery Dinner Theatre sells tickets for dinner and a show for $50 each. The cost of providing dinner is $30 per ticket, and the fixed cost of operating the theater is $100,000 per month. The company can accommodate 15,000 patrons each month.

What is the projected monthly income if 12,000 patrons visit the theatre each month?

A) $200,000

B) $340,000

C) $140,000

D) $240,000

The Burr Mystery Dinner Theatre sells tickets for dinner and a show for $50 each. The cost of providing dinner is $30 per ticket, and the fixed cost of operating the theater is $100,000 per month. The company can accommodate 15,000 patrons each month.

What is the projected monthly income if 12,000 patrons visit the theatre each month?

A) $200,000

B) $340,000

C) $140,000

D) $240,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

28

Gibbs Company has a product which sells for $100 and has a unit contribution margin of $45. It has fixed costs of $30/unit at the current production volume. Gibbs Company's contribution margin ratio is

A) 45%.

B) 30%.

C) 85%.

D) 75%.

A) 45%.

B) 30%.

C) 85%.

D) 75%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

29

Use the information below to answer the following question(s).

The Burr Mystery Dinner Theatre sells tickets for dinner and a show for $50 each. The cost of providing dinner is $30 per ticket, and the fixed cost of operating the theater is $100,000 per month. The company can accommodate 15,000 patrons each month.

What is the contribution margin per passenger at the Burr Mystery Dinner Theatre?

A) $2.50

B) $30.00

C) $0.40

D) $20.00

The Burr Mystery Dinner Theatre sells tickets for dinner and a show for $50 each. The cost of providing dinner is $30 per ticket, and the fixed cost of operating the theater is $100,000 per month. The company can accommodate 15,000 patrons each month.

What is the contribution margin per passenger at the Burr Mystery Dinner Theatre?

A) $2.50

B) $30.00

C) $0.40

D) $20.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

30

Use the information below to answer the following question(s).

Akron Laser Wash sells deluxe car washes for $15 per customer. Variable costs are $9 per wash. Fixed costs are $40,000 per month.

What is Akron Laser Wash's contribution margin per car wash?

A) $0.40

B) $9.00

C) $6.00

D) $2.50

Akron Laser Wash sells deluxe car washes for $15 per customer. Variable costs are $9 per wash. Fixed costs are $40,000 per month.

What is Akron Laser Wash's contribution margin per car wash?

A) $0.40

B) $9.00

C) $6.00

D) $2.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

31

Use the information below to answer the following question(s).

Anthony Office Supplies sells refills on printer ink cartridges for $16 per refill. Variable costs are $4 per refill. Fixed costs are $2,000 per month.

What is the contribution margin per refill at Anthony Office Supplies?

A) $1.33

B) $0.75

C) $12.00

D) $4.00

Anthony Office Supplies sells refills on printer ink cartridges for $16 per refill. Variable costs are $4 per refill. Fixed costs are $2,000 per month.

What is the contribution margin per refill at Anthony Office Supplies?

A) $1.33

B) $0.75

C) $12.00

D) $4.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

32

Use the information below to answer the following question(s).

During the year, Cornell produced and sold 60,000 units of product at a sale price of $8.00 per unit. There was no beginning inventory of product at the start of the year.

-What is the contribution margin for the year at Cornell Corporation?

A) $92,000

B) $282,000

C) $480,000

D) $290,000

During the year, Cornell produced and sold 60,000 units of product at a sale price of $8.00 per unit. There was no beginning inventory of product at the start of the year.

-What is the contribution margin for the year at Cornell Corporation?

A) $92,000

B) $282,000

C) $480,000

D) $290,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

33

On a contribution margin income statement, to what is contribution margin equal?

A) Fixed expenses plus variable expenses

B) Sales revenues minus variable expenses

C) Fixed expenses minus variable expenses

D) Sales revenues minus fixed expenses

A) Fixed expenses plus variable expenses

B) Sales revenues minus variable expenses

C) Fixed expenses minus variable expenses

D) Sales revenues minus fixed expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

34

Use the information below to answer the following question(s).

During the year, Cornell produced and sold 60,000 units of product at a sale price of $8.00 per unit. There was no beginning inventory of product at the start of the year.

-The Sage Group produces a single product selling for $60 per unit. Variable costs are $12 per unit and total fixed costs are $6,000. What is the contribution margin ratio?

A) 0.48

B) 0.20

C) 0.80

D) 1.25

During the year, Cornell produced and sold 60,000 units of product at a sale price of $8.00 per unit. There was no beginning inventory of product at the start of the year.

-The Sage Group produces a single product selling for $60 per unit. Variable costs are $12 per unit and total fixed costs are $6,000. What is the contribution margin ratio?

A) 0.48

B) 0.20

C) 0.80

D) 1.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

35

Use the information below to answer the following question(s).

The Burr Mystery Dinner Theatre sells tickets for dinner and a show for $50 each. The cost of providing dinner is $30 per ticket, and the fixed cost of operating the theater is $100,000 per month. The company can accommodate 15,000 patrons each month.

What is the contribution margin ratio at the Burr Mystery Dinner Theatre?

A) 40%

B) 250%

C) 60%

D) 20%

The Burr Mystery Dinner Theatre sells tickets for dinner and a show for $50 each. The cost of providing dinner is $30 per ticket, and the fixed cost of operating the theater is $100,000 per month. The company can accommodate 15,000 patrons each month.

What is the contribution margin ratio at the Burr Mystery Dinner Theatre?

A) 40%

B) 250%

C) 60%

D) 20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

36

Use the information below to answer the following question(s).

Express Bus Company operates a bus route that takes passengers from Cleveland to Chicago every day. Assume the bus tickets sell for $50 per rider; the bus line's variable costs are $35 per rider; and its fixed costs are $75,000 each month.

What is the contribution margin per rider at Express Bus Company?

A) $15.00

B) $0.30

C) $35.00

D) $3.33

Express Bus Company operates a bus route that takes passengers from Cleveland to Chicago every day. Assume the bus tickets sell for $50 per rider; the bus line's variable costs are $35 per rider; and its fixed costs are $75,000 each month.

What is the contribution margin per rider at Express Bus Company?

A) $15.00

B) $0.30

C) $35.00

D) $3.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

37

Use the information below to answer the following question(s).

Anthony Office Supplies sells refills on printer ink cartridges for $16 per refill. Variable costs are $4 per refill. Fixed costs are $2,000 per month.

What is the contribution margin ratio for the printer ink cartridge refills at Anthony Office Supplies?

A) 133%

B) 12%

C) 25%

D) 75%

Anthony Office Supplies sells refills on printer ink cartridges for $16 per refill. Variable costs are $4 per refill. Fixed costs are $2,000 per month.

What is the contribution margin ratio for the printer ink cartridge refills at Anthony Office Supplies?

A) 133%

B) 12%

C) 25%

D) 75%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the information below to answer the following question(s).

The following selected data relates to Lazarus Corporation:

If sales revenue per unit increases to $27 and 8,000 units are sold, what is the contribution margin at the Lazarus Corporation?

A) $50,000

B) $72,000

C) $56,000

D) $360,000

The following selected data relates to Lazarus Corporation:

If sales revenue per unit increases to $27 and 8,000 units are sold, what is the contribution margin at the Lazarus Corporation?

A) $50,000

B) $72,000

C) $56,000

D) $360,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

39

Use the information below to answer the following question(s).

Akron Laser Wash sells deluxe car washes for $15 per customer. Variable costs are $9 per wash. Fixed costs are $40,000 per month.

What is Akron Laser Wash's contribution margin ratio?

A) 40%

B) 250%

C) 6%

D) 60%

Akron Laser Wash sells deluxe car washes for $15 per customer. Variable costs are $9 per wash. Fixed costs are $40,000 per month.

What is Akron Laser Wash's contribution margin ratio?

A) 40%

B) 250%

C) 6%

D) 60%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the information below to answer the following question(s).

Express Bus Company operates a bus route that takes passengers from Cleveland to Chicago every day. Assume the bus tickets sell for $50 per rider; the bus line's variable costs are $35 per rider; and its fixed costs are $75,000 each month.

What is the contribution margin ratio at Express Bus Company?

A) 70%

B) 30%

C) 333%

D) 15%

Express Bus Company operates a bus route that takes passengers from Cleveland to Chicago every day. Assume the bus tickets sell for $50 per rider; the bus line's variable costs are $35 per rider; and its fixed costs are $75,000 each month.

What is the contribution margin ratio at Express Bus Company?

A) 70%

B) 30%

C) 333%

D) 15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

41

Use the information below to answer the following question(s).

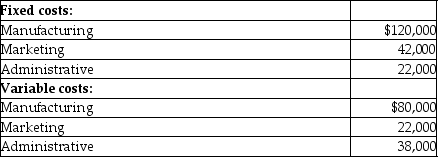

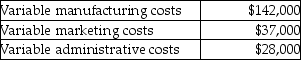

Bernard Corporation gathered the following information for the year just ended:

During the year, Bernard produced and sold 50,000 units of product at a selling price of $9.00 per unit. There was no beginning inventory of product at the start of the year.

-What is the operating income (loss) for the year at Bernard Corporation?

A) $266,000

B) $450,000

C) $126,000

D) $310,000

Bernard Corporation gathered the following information for the year just ended:

During the year, Bernard produced and sold 50,000 units of product at a selling price of $9.00 per unit. There was no beginning inventory of product at the start of the year.

-What is the operating income (loss) for the year at Bernard Corporation?

A) $266,000

B) $450,000

C) $126,000

D) $310,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

42

Hickory Point Amusement Park sells admission tickets for $50 per person for one visit. Variable costs are $15 per visitor and fixed costs are $60,000,000 per month. The company's relevant range extends to 2,000,000 visitors per month. What is Hickory Point's projected operating income if 1,750,000 visitors come to the park during the month?

A) $1,250,000

B) $61,250,000

C) $87,500,000

D) $27,500,000

A) $1,250,000

B) $61,250,000

C) $87,500,000

D) $27,500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

43

The break-even point can either be calculated in terms of number of units or in terms of sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

44

The Settler's Chuck Wagon sells tickets for dinner and a show for $50 each. The cost of providing dinner is $23 per ticket and the fixed cost of operating the theater is $115,000 per month. The company can accommodate 13,500 patrons each month. What is the projected monthly income if 5,500 patrons visit the theater each month?

A) $263,500

B) $148,500

C) $249,500

D) $33,500

A) $263,500

B) $148,500

C) $249,500

D) $33,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

45

Fixed costs of $10,000 divided by the contribution margin ratio of 40% would yield the dollar amount of break-even sales as $25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

46

Wiser Group sells a single product for $30 per unit. The variable costs for each unit are $7.50, while the total fixed costs are $4,500. If a 10% sales commission is introduced what is the new Contribution Margin Ratio?

A) 72.5%

B) 65%

C) 75%

D) No Change

A) 72.5%

B) 65%

C) 75%

D) No Change

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

47

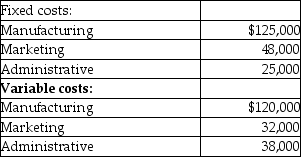

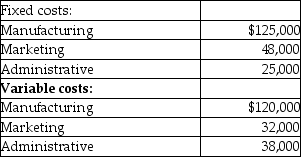

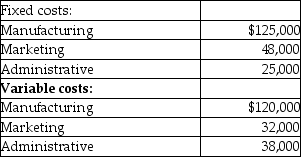

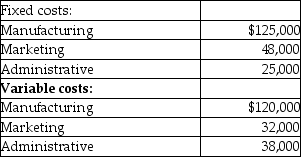

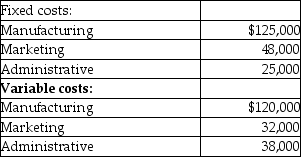

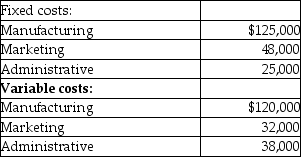

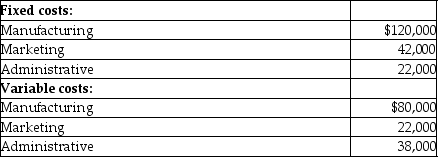

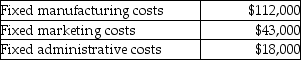

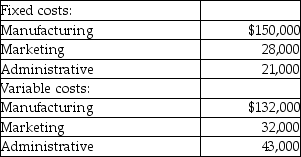

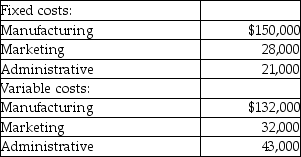

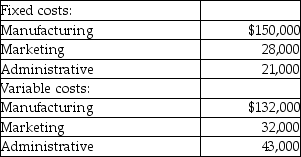

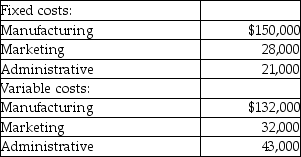

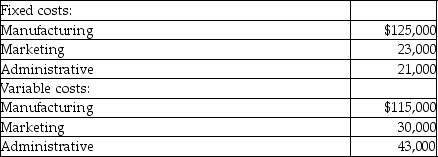

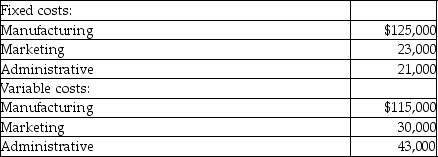

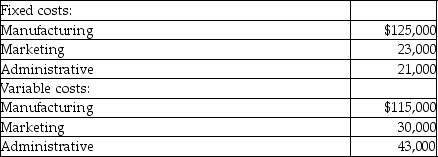

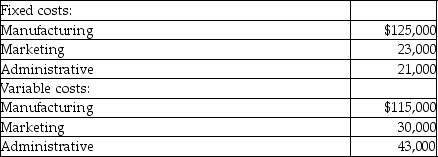

During the past year, Pettay Enterprises had the following fixed costs:

The company also had the following variable costs:

The company also had the following variable costs:

During the year, the company produced and sold 60,000 units of the product at a selling price of $7.00 per unit. The company had no inventory at the beginning of the year.

During the year, the company produced and sold 60,000 units of the product at a selling price of $7.00 per unit. The company had no inventory at the beginning of the year.

Required: Prepare a contribution margin income statement for the year.

The company also had the following variable costs:

The company also had the following variable costs: During the year, the company produced and sold 60,000 units of the product at a selling price of $7.00 per unit. The company had no inventory at the beginning of the year.

During the year, the company produced and sold 60,000 units of the product at a selling price of $7.00 per unit. The company had no inventory at the beginning of the year.Required: Prepare a contribution margin income statement for the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

48

Roller Corp sells wagon wheels for $150. The variable costs for each wheel are $85, while the total fixed costs are $60,000. The contribution margin for 500 wheels is

A) $75,000.

B) $32,500.

C) $42,500.

D) $10,000.

A) $75,000.

B) $32,500.

C) $42,500.

D) $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

49

The break-even point on a CVP graph is the point where the fixed expenses line intersects the total expense costs line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

50

The break-even point represents the minimum number of units a company must sell before it earns a profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the information below to answer the following question(s).

Bernard Corporation gathered the following information for the year just ended:

During the year, Bernard produced and sold 50,000 units of product at a selling price of $9.00 per unit. There was no beginning inventory of product at the start of the year.

-What is the contribution margin for the year at Bernard Corporation?

A) $126,000

B) $310,000

C) $450,000

D) $266,000

Bernard Corporation gathered the following information for the year just ended:

During the year, Bernard produced and sold 50,000 units of product at a selling price of $9.00 per unit. There was no beginning inventory of product at the start of the year.

-What is the contribution margin for the year at Bernard Corporation?

A) $126,000

B) $310,000

C) $450,000

D) $266,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

52

A company that sells thousands of different products would be more likely to calculate break-even in terms of sales units, rather than sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

53

Use the information below to answer the following question(s).

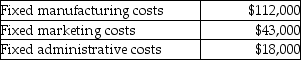

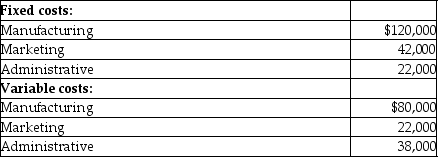

The following information for the past year for the Lambert Company has been provided:

During the year, the Lambert Company produced and sold 50,000 units of product at a sale price of $10.00 per unit. There was no beginning inventory of product at the beginning of the year.

-What is the operating income (loss) for the year at the Lambert Company?

A) $94,000

B) $301,000

C) $500,000

D) $293,000

The following information for the past year for the Lambert Company has been provided:

During the year, the Lambert Company produced and sold 50,000 units of product at a sale price of $10.00 per unit. There was no beginning inventory of product at the beginning of the year.

-What is the operating income (loss) for the year at the Lambert Company?

A) $94,000

B) $301,000

C) $500,000

D) $293,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

54

Use the information below to answer the following question(s).

The following information for the past year for the Lambert Company has been provided:

During the year, the Lambert Company produced and sold 50,000 units of product at a sale price of $10.00 per unit. There was no beginning inventory of product at the beginning of the year.

-What is the contribution margin for the year at the Lambert Company?

A) $94,000

B) $293,000

C) $301,000

D) $500,000

The following information for the past year for the Lambert Company has been provided:

During the year, the Lambert Company produced and sold 50,000 units of product at a sale price of $10.00 per unit. There was no beginning inventory of product at the beginning of the year.

-What is the contribution margin for the year at the Lambert Company?

A) $94,000

B) $293,000

C) $301,000

D) $500,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

55

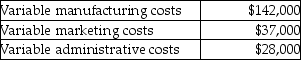

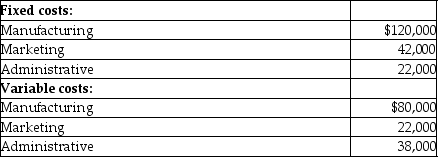

Use the information below to answer the following question(s).

During the year, the company produced and sold 30,000 units of product at a selling price of $15.00 per unit. There was no beginning inventory of product at the beginning of the year.

During the year, the company produced and sold 30,000 units of product at a selling price of $15.00 per unit. There was no beginning inventory of product at the beginning of the year.

What is the contribution margin for the year at Blaine Corporation?

A) $93,000

B) $450,000

C) $262,000

D) $281,000

During the year, the company produced and sold 30,000 units of product at a selling price of $15.00 per unit. There was no beginning inventory of product at the beginning of the year.

During the year, the company produced and sold 30,000 units of product at a selling price of $15.00 per unit. There was no beginning inventory of product at the beginning of the year.What is the contribution margin for the year at Blaine Corporation?

A) $93,000

B) $450,000

C) $262,000

D) $281,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

56

Use the information below to answer the following question(s).

During the year, the company produced and sold 30,000 units of product at a selling price of $15.00 per unit. There was no beginning inventory of product at the beginning of the year.

During the year, the company produced and sold 30,000 units of product at a selling price of $15.00 per unit. There was no beginning inventory of product at the beginning of the year.

What is the operating income (loss) for the year at Blaine Corporation?

A) $281,000

B) $450,000

C) $262,000

D) $93,000

During the year, the company produced and sold 30,000 units of product at a selling price of $15.00 per unit. There was no beginning inventory of product at the beginning of the year.

During the year, the company produced and sold 30,000 units of product at a selling price of $15.00 per unit. There was no beginning inventory of product at the beginning of the year.What is the operating income (loss) for the year at Blaine Corporation?

A) $281,000

B) $450,000

C) $262,000

D) $93,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

57

On a CVP graph, total fixed costs are shown as a vertical line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

58

Only the unit contribution margin approach may be used to calculate the break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

59

On a CVP graph, the vertical distance between the total expense line and the total fixed cost line equals the operating income or operating loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

60

LaComedia Dinner Theater sells tickets for dinner and a show for $40 each. The cost of providing dinner is $26 per ticket and the fixed cost of operating the theater is $100,000 per month. The company can accommodate 12,000 patrons each month. What is the projected monthly income if 10,000 patrons visit the theater each month?

A) $68,000

B) $140,000

C) $240,000

D) $40,000

A) $68,000

B) $140,000

C) $240,000

D) $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

61

Use the information below to answer the following question(s).

The Sweet Factory produces and sells specialty fudge. The selling price per pound is $20, variable costs are $12 per pound, and total fixed costs are $6,000.

What are break-even sales in dollars at The Sweet Factory?

A) $9,000

B) $3,750

C) $750

D) $15,000

The Sweet Factory produces and sells specialty fudge. The selling price per pound is $20, variable costs are $12 per pound, and total fixed costs are $6,000.

What are break-even sales in dollars at The Sweet Factory?

A) $9,000

B) $3,750

C) $750

D) $15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

62

The area to the right of the break-even point and between the total revenue line and total expense line represents

A) expected losses.

B) expected profits.

C) variable expenses.

D) fixed expenses.

A) expected losses.

B) expected profits.

C) variable expenses.

D) fixed expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

63

In CVP analysis it is best to use after-tax income when determining the volume of sales required to earn a target profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

64

If the sale price per unit is $30.00, the variable expense per unit is $21, and total fixed expenses are $300,000, what are the break-even sales in dollars?

A) $10,000

B) $1,000,000

C) $90,000

D) $176,471

A) $10,000

B) $1,000,000

C) $90,000

D) $176,471

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

65

Use the information below to answer the following question(s).

The Sweet Factory produces and sells specialty fudge. The selling price per pound is $20, variable costs are $12 per pound, and total fixed costs are $6,000.

How many pounds of fudge must The Sweet Factory sell to break even?

A) 15,000

B) 300

C) 750

D) 188

The Sweet Factory produces and sells specialty fudge. The selling price per pound is $20, variable costs are $12 per pound, and total fixed costs are $6,000.

How many pounds of fudge must The Sweet Factory sell to break even?

A) 15,000

B) 300

C) 750

D) 188

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

66

On a CVP graph, the total cost line intersects the total revenue line at which of the following points?

A) The level of the fixed costs

B) The level of the variable costs

C) The break-even point

D) None of the above

A) The level of the fixed costs

B) The level of the variable costs

C) The break-even point

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

67

The break-even point may be defined as the number of units a company must sell to do which of the following?

A) Generate a zero profit

B) Generate a net loss

C) Earn more net income than the previous accounting period

D) Generate a net income

A) Generate a zero profit

B) Generate a net loss

C) Earn more net income than the previous accounting period

D) Generate a net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

68

When calculating the break-even point in terms of units, fixed costs should be divided by the contribution margin ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following is TRUE when using the income statement approach to finding break-even?

A) Sales revenue - variable expenses - fixed expenses = operating income

B) (Variable expenses × number of units) - fixed expenses = operating income

C) Fixed expenses + variable expenses + sales revenue = operating income

D) Fixed expenses + variable expenses - sales revenue = operating income

A) Sales revenue - variable expenses - fixed expenses = operating income

B) (Variable expenses × number of units) - fixed expenses = operating income

C) Fixed expenses + variable expenses + sales revenue = operating income

D) Fixed expenses + variable expenses - sales revenue = operating income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

70

On a CVP graph, the line that begins at the origin represents

A) total fixed expenses.

B) total expenses.

C) total sales revenues.

D) both the total expenses and the total sales revenues.

A) total fixed expenses.

B) total expenses.

C) total sales revenues.

D) both the total expenses and the total sales revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following is an underlying assumption of the cost-volume-profit graph?

A) Total fixed expenses will change during the accounting period.

B) The sales mix of products is constantly changing.

C) Inventory levels are constantly changing.

D) Volume is the only cost driver.

A) Total fixed expenses will change during the accounting period.

B) The sales mix of products is constantly changing.

C) Inventory levels are constantly changing.

D) Volume is the only cost driver.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

72

The formula used to find the number of units that need to be sold in order to break even or generate a target profit is

A) (fixed expenses + operating income) ÷ contribution margin ratio.

B) (fixed expenses + operating income) ÷ contribution margin per unit.

C) (fixed expenses - operating income) ÷ contribution margin ratio.

D) (fixed expenses - operating income) ÷ contribution margin per unit.

A) (fixed expenses + operating income) ÷ contribution margin ratio.

B) (fixed expenses + operating income) ÷ contribution margin per unit.

C) (fixed expenses - operating income) ÷ contribution margin ratio.

D) (fixed expenses - operating income) ÷ contribution margin per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

73

Sales below the break-even point indicate a ________, whereas sales above the break-even point indicate a ________.

A) loss; loss

B) loss; profit

C) profit; profit

D) profit; loss

A) loss; loss

B) loss; profit

C) profit; profit

D) profit; loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

74

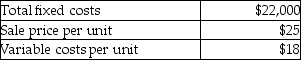

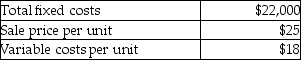

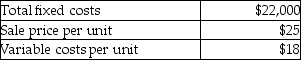

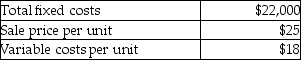

Assume the following amounts:

If sales revenue per unit decreases to $22 and 10,000 units are sold, what is the operating income?

A) $50,000

B) $90,000

C) $220,000

D) $70,000

If sales revenue per unit decreases to $22 and 10,000 units are sold, what is the operating income?

A) $50,000

B) $90,000

C) $220,000

D) $70,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

75

When calculating the break-even point in terms of sales revenue, fixed costs should be divided by the contribution margin ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

76

To find the break-even point using the shortcut formulas, you use zero for the

A) operating income.

B) fixed expenses.

C) contribution margin ratio.

D) contribution margin per unit.

A) operating income.

B) fixed expenses.

C) contribution margin ratio.

D) contribution margin per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

77

The formula used to find the sales revenue (sales in dollars) needed in order to break even or generate a target profit is

A) (fixed expenses + operating income) ÷ contribution margin ratio.

B) (fixed expenses + operating income) ÷ contribution margin per unit.

C) (fixed expenses - operating income) ÷ contribution margin ratio.

D) (fixed expenses - operating income) ÷ contribution margin per unit.

A) (fixed expenses + operating income) ÷ contribution margin ratio.

B) (fixed expenses + operating income) ÷ contribution margin per unit.

C) (fixed expenses - operating income) ÷ contribution margin ratio.

D) (fixed expenses - operating income) ÷ contribution margin per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

78

If the sale price per unit is $12, the unit contribution margin is $5, and total fixed expenses are $21,000, what are the break-even sales in units?

A) 105,000

B) 252,000

C) 4,200

D) 1,750

A) 105,000

B) 252,000

C) 4,200

D) 1,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

79

On a CVP graph, the horizontal line intersecting the vertical y-axis represents

A) total costs.

B) total fixed costs.

C) total variable costs.

D) break-even point.

A) total costs.

B) total fixed costs.

C) total variable costs.

D) break-even point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck

80

On a CVP graph, the intersection of the sales revenue line and the variable expense line is considered to be

A) the margin of safety point.

B) the break-even point.

C) the total cost point.

D) the intersection of the axis.

A) the margin of safety point.

B) the break-even point.

C) the total cost point.

D) the intersection of the axis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 272 في هذه المجموعة.

فتح الحزمة

k this deck