Deck 19: Exchange Rates and International Finance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/109

العب

ملء الشاشة (f)

Deck 19: Exchange Rates and International Finance

1

The nominal exchange rate between the U.S.dollar and the Croatian kuna is the:

A)number of kuna you can get for one dollar.

B)number of kuna you can get for lending one dollar in Croatia for one year.

C)price of U.S.goods divided by the price of Croatian goods.

D)price of Croatian goods divided by the price of U.S.goods.

E)the ratio of per capita U.S.GDP to Croatian per capita GDP.

A)number of kuna you can get for one dollar.

B)number of kuna you can get for lending one dollar in Croatia for one year.

C)price of U.S.goods divided by the price of Croatian goods.

D)price of Croatian goods divided by the price of U.S.goods.

E)the ratio of per capita U.S.GDP to Croatian per capita GDP.

A

2

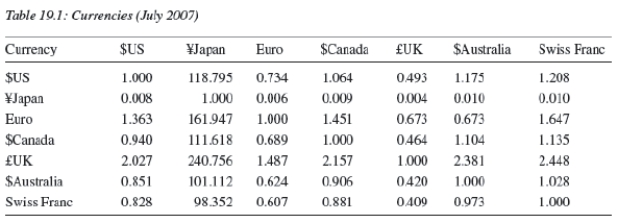

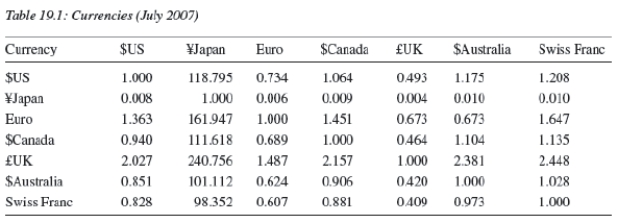

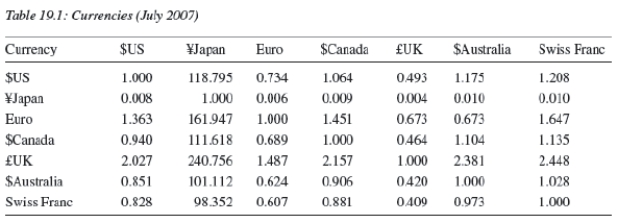

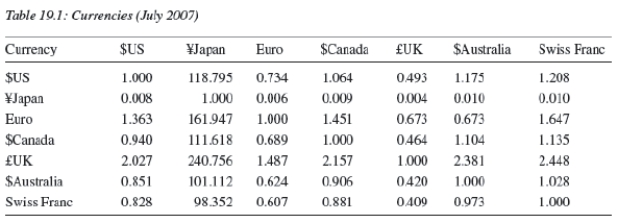

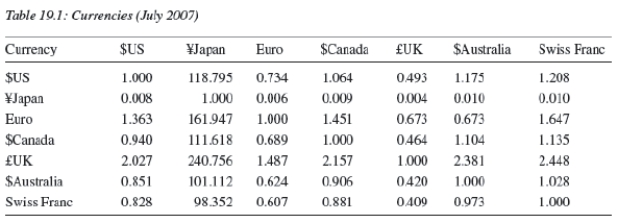

Consider Table 19.1.According to the table,$1US buys:

A)€0.734.

B)£0.493.

C)Swiss Franc 0.828.

D)€1.363.

E)a-c.

E

3

Buying at a low price in one country to sell at a higher price somewhere else to make a profit is called:

A)investing.

B)the law of one price.

C)purchasing power parity.

D)arbitrage.

E)profit maximizing.

A)investing.

B)the law of one price.

C)purchasing power parity.

D)arbitrage.

E)profit maximizing.

D

4

Which of the following countries use the euro?

A)Greece

B)Italy

C)Portugal

D)Sweden

E)all of the above

A)Greece

B)Italy

C)Portugal

D)Sweden

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following explains why the law of one price might not hold?

A)trade barriers

B)transportation costs

C)institutions

D)differences in preferences

E)all of the above

A)trade barriers

B)transportation costs

C)institutions

D)differences in preferences

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

6

France,Italy,Germany,the United Kingdom,and Spain all use the same currency,called the:

A)euro.

B)dollar.

C)pound.

D)franc.

E)They do not all use the same currency.

A)euro.

B)dollar.

C)pound.

D)franc.

E)They do not all use the same currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

7

When it takes fewer euro to buy one dollar,

A)the euro has appreciated.

B)the dollar has depreciated.

C)the euro has depreciated.

D)a and b

E)None of the above is correct.

A)the euro has appreciated.

B)the dollar has depreciated.

C)the euro has depreciated.

D)a and b

E)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

8

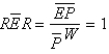

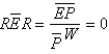

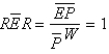

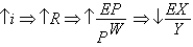

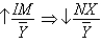

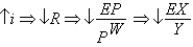

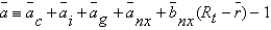

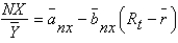

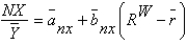

Consider the two exchange rates,in period 1 and period 2,

And

(CY is the Chinese yuan. )Over this time,the:

A)dollar has appreciated.

B)yuan has appreciated.

C)dollar has depreciated.

D)euro has appreciated.

E)a and b

And

(CY is the Chinese yuan. )Over this time,the:

A)dollar has appreciated.

B)yuan has appreciated.

C)dollar has depreciated.

D)euro has appreciated.

E)a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

9

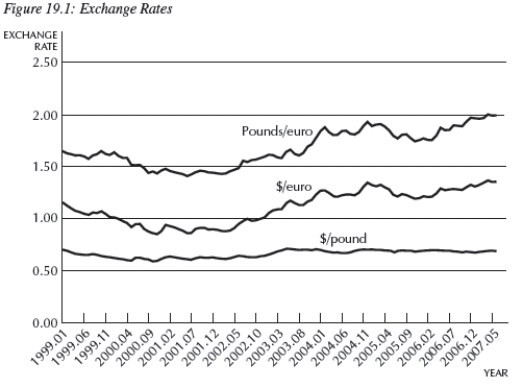

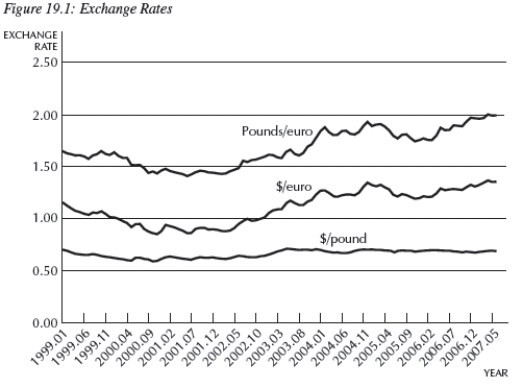

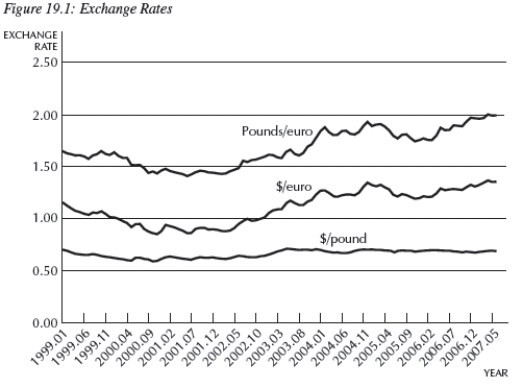

Consider Figure 19.1,which shows the £UK/$US,$US/€,and £UK/€ exchange rates.During the period 1999-2001,the U.S.dollar __________ relative to the euro and __________ relative to the U.K.pound.

A)appreciated;appreciated

B)appreciated;depreciated

C)depreciated;depreciated

D)depreciated;appreciated

E)Not enough information is given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

10

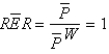

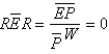

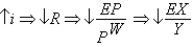

Let P denote the price of goods in the United States,

Denote the price of goods in the foreign country,and E the exchange rate,measured as the number of units of foreign currency that can be purchased with one dollar.According to the law of one price,

A) .

.

B) .

.

C) .

.

D) .

.

E) .

.

Denote the price of goods in the foreign country,and E the exchange rate,measured as the number of units of foreign currency that can be purchased with one dollar.According to the law of one price,

A)

.

.B)

.

.C)

.

.D)

.

.E)

.

.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

11

Consider Table 19.1.The numbers represent:

A)the interest rate.

B)the real exchange rate.

C)purchasing power parity.

D)the nominal exchange rate.

E)the forward exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

12

Consider Table 19.1.The euro has:

A)appreciated against the U.S.dollar.

B)depreciated against the Swiss franc.

C)appreciated against the Canadian dollar.

D)depreciated against the Japanese yen.

E)Not enough information is given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

13

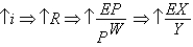

Consider the two exchange rates,in period 1 and period 2,over this time,the:

A)dollar has depreciated.

B)euro has appreciated.

C)dollar has appreciated.

D)euro has depreciated.

E)a and b

A)dollar has depreciated.

B)euro has appreciated.

C)dollar has appreciated.

D)euro has depreciated.

E)a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

14

Consider Table 19.1.The dollar has

A)appreciated against the euro.

B)depreciated against the euro.

C)appreciated against the Canadian dollar.

D)depreciated against the Japanese yen.

E)Not enough information is given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

15

The rate at which one currency is exchanged for another is called:

A)the interest rate.

B)the real exchange rate.

C)purchasing power parity.

D)the nominal exchange rate.

E)the forward exchange rate.

A)the interest rate.

B)the real exchange rate.

C)purchasing power parity.

D)the nominal exchange rate.

E)the forward exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

16

__________ simply states that,in the long run,individual goods must sell for the same price in all countries.

A)Arbitrage

B)Purchasing power parity

C)The law of one price

D)The real exchange rate

E)The quantity theory

A)Arbitrage

B)Purchasing power parity

C)The law of one price

D)The real exchange rate

E)The quantity theory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

17

Consider Table 19.1.According to the table,€1 buys:

A)$US1.363.

B)¥161.947.

C)¥0.006.

D)SFr0.607.

E)a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

18

If the price of Yoo-hoo is $US2.00 in New York and $US1.00 in St.Petersburg (after converting the rubles to dollars),you might expect __________.

A)people to buy Yoo-hoo in St.Petersburg and sell it in New York until the price was the same in each country.

B)people to buy Yoo-hoo in New York and sell it in St.Petersburg until the price was the same in each country.

C)people to buy Yoo-hoo in St.Petersburg and sell it in New York and the price difference would remain.

D)the price difference to exist forever.

E)None of the above is correct.

A)people to buy Yoo-hoo in St.Petersburg and sell it in New York until the price was the same in each country.

B)people to buy Yoo-hoo in New York and sell it in St.Petersburg until the price was the same in each country.

C)people to buy Yoo-hoo in St.Petersburg and sell it in New York and the price difference would remain.

D)the price difference to exist forever.

E)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

19

Consider Figure 19.1,which shows the £UK/$US,$US/€,and £UK/€ exchange rates.During the period 2001-2007,the U.S.dollar __________ relative to the euro and __________ relative to the U.K.pound.

A)appreciated;appreciated

B)depreciated;remained somewhat unchanged

C)appreciated;remained somewhat unchanged

D)depreciated;appreciated

E)Not enough information is given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

20

Consider Figure 19.1,which shows the £UK/$US,$US/€,and £UK/€ exchange rates.In the period 1999-2001,the euro __________ relative to the U.K.pound and __________ relative to the U.K.pound after 2001.

A)depreciated;appreciated

B)depreciated;remained somewhat unchanged

C)appreciated;depreciated

D)appreciated;remained somewhat unchanged

E)Not enough information is given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

21

The real exchange rate measures:

A)the number of foreign goods required to purchase a single unit of a domestic good.

B)the amount of foreign currency you can get for one unit of domestic currency.

C)the number of foreign goods one unit of domestic currency can buy.

D)the value of foreign currency denominated in domestic prices.

E)the relationship between foreign and domestic inflation.

A)the number of foreign goods required to purchase a single unit of a domestic good.

B)the amount of foreign currency you can get for one unit of domestic currency.

C)the number of foreign goods one unit of domestic currency can buy.

D)the value of foreign currency denominated in domestic prices.

E)the relationship between foreign and domestic inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

22

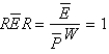

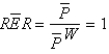

If the law of one price holds for all goods in the long run,

A) .

.

B) .

.

C) .

.

D) .

.

E) .

.

A)

.

.B)

.

.C)

.

.D)

.

.E)

.

.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

23

If inflation is higher in the United States than in the United Kingdom,

A)the dollar should appreciate to the pound.

B)the dollar should depreciate to the pound.

C)real interest rates should be higher in the United States than in the United Kingdom.

D)the U.S.net exports to the United Kingdom should fall.

E)pounds will flow to the United States from the United Kingdom.

A)the dollar should appreciate to the pound.

B)the dollar should depreciate to the pound.

C)real interest rates should be higher in the United States than in the United Kingdom.

D)the U.S.net exports to the United Kingdom should fall.

E)pounds will flow to the United States from the United Kingdom.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is (are)a reason (reasons)to trade currencies?

A)to buy and sell foreign goods

B)to buy and sell foreign financial instruments

C)to hold currencies as foreign assets in their own right

D)all of the above

E)none of the above

A)to buy and sell foreign goods

B)to buy and sell foreign financial instruments

C)to hold currencies as foreign assets in their own right

D)all of the above

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

25

The U.S.dollar would appreciate if:

A)

B) .

.

C) .

.

D) .

.

E)a and b

A)

B)

.

.C)

.

.D)

.

.E)a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

26

In the long run,the nominal exchange rate:

A)is indeterminant.

B)is equal to the ratio of the money supply in the two economies.

C)is equal to the ratio of the price levels in the two economies.

D)equals the real exchange rate.

E)equals,in the short run,the nominal exchange rate.

A)is indeterminant.

B)is equal to the ratio of the money supply in the two economies.

C)is equal to the ratio of the price levels in the two economies.

D)equals the real exchange rate.

E)equals,in the short run,the nominal exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

27

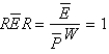

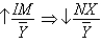

If the law of one price holds for all goods,

A)the real exchange rate equals 0.

B)the real exchange rate equals 1.

C)the nominal exchange rate equals the real exchange rate.

D)the ratio of domestic to foreign price levels equals 1.

E)the nominal exchange rate equals 1.

A)the real exchange rate equals 0.

B)the real exchange rate equals 1.

C)the nominal exchange rate equals the real exchange rate.

D)the ratio of domestic to foreign price levels equals 1.

E)the nominal exchange rate equals 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

28

You open up the Wall Street Journal and notice the federal funds rate in the United States is 5.25 percent,while in the United Kingdom,the current bank rate is 5.75 percent.From this,you conclude:

A)the dollar will depreciate against the pound.

B)the pound will appreciate against the dollar.

C)the dollar will appreciate against the pound.

D)there will be no movement in the exchange rate.

E)a and b

A)the dollar will depreciate against the pound.

B)the pound will appreciate against the dollar.

C)the dollar will appreciate against the pound.

D)there will be no movement in the exchange rate.

E)a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

29

If the real exchange rate is greater than 1,foreign goods:

A)and domestic goods are both relatively cheap.

B)are relatively expensive and domestic goods are relatively cheap.

C)are relatively cheap and domestic goods are relatively expensive.

D)and domestic goods are both relatively expensive.

E)None of the above is correct.

A)and domestic goods are both relatively cheap.

B)are relatively expensive and domestic goods are relatively cheap.

C)are relatively cheap and domestic goods are relatively expensive.

D)and domestic goods are both relatively expensive.

E)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

30

If the law of one price holds for all goods and the quantity theory of money determines the long-run price level,we can pin down:

A)the real exchange rate.

B)the short-run level of the exchange rate.

C)differences in inflation levels across countries.

D)the long-run level of the exchange rate.

E)the arbitrage conditions.

A)the real exchange rate.

B)the short-run level of the exchange rate.

C)differences in inflation levels across countries.

D)the long-run level of the exchange rate.

E)the arbitrage conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

31

An explanation for the depreciation of the dollar vis-àvis the euro is that:

A)incomes are higher in the euro area than in the United States.

B)interest rates are higher in the United States than in the euro area.

C)inflation in the United States is higher than in the euro area.

D)there is less risk in the United States than in the euro area.

E)None of the above is correct.

A)incomes are higher in the euro area than in the United States.

B)interest rates are higher in the United States than in the euro area.

C)inflation in the United States is higher than in the euro area.

D)there is less risk in the United States than in the euro area.

E)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

32

The Big Mac index is compiled by:

A)The Financial Times.

B)The Wall Street Journal.

C)The American Economic Review.

D)The Economist.

E)Forbes.

A)The Financial Times.

B)The Wall Street Journal.

C)The American Economic Review.

D)The Economist.

E)Forbes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

33

In 2004,the average amount of foreign exchange trades each day was about:

A)$2 billion per day.

B)$2 trillion per year.

C)$2 trillion per day.

D)$2 trillion per month.

E)$1 trillion per day.

A)$2 billion per day.

B)$2 trillion per year.

C)$2 trillion per day.

D)$2 trillion per month.

E)$1 trillion per day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

34

The U.S.dollar would appreciate if:

A) .

.

B) .

.

C) .

.

D) .

.

E)a-c

A)

.

.B)

.

.C)

.

.D)

.

.E)a-c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is true?

A)

B)

C)

D)

E)either a or b

A)

B)

C)

D)

E)either a or b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following can be used to explain the failure of the law of one price with respect to Big Macs?

A)transportation costs

B)the price of nontradable goods

C)differences in money supply

D)over- or undervalued currency

E)a and b

A)transportation costs

B)the price of nontradable goods

C)differences in money supply

D)over- or undervalued currency

E)a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

37

Using the notation in the text,the long-run level of the exchange rate is:

A) .

.

B) .

.

C) .

.

D) .

.

E)none of the above

A)

.

.B)

.

.C)

.

.D)

.

.E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

38

If goods are nontradable,like haircuts,

A)the law of one price does not hold because there are no arbitrage possibilities.

B)the law of one price does not hold because all goods are different.

C)the law of one price holds.

D)exchange rate changes have a bigger impact on the price than if goods are tradable.

E)haircuts are tradable.

A)the law of one price does not hold because there are no arbitrage possibilities.

B)the law of one price does not hold because all goods are different.

C)the law of one price holds.

D)exchange rate changes have a bigger impact on the price than if goods are tradable.

E)haircuts are tradable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

39

The real exchange rate can be decomposed into two parts,the __________ and the __________.

A)nominal exchange rate;ratio of the domestic price level to the world price level

B)nominal exchange rate;the difference between the domestic and foreign interest rate

C)interest rate differential;the difference between the domestic and foreign inflation rate

D)nominal exchange rate;ratio of the price of exported goods to imported goods

E)interest rate differential;ratio of the domestic price level to the world price level

A)nominal exchange rate;ratio of the domestic price level to the world price level

B)nominal exchange rate;the difference between the domestic and foreign interest rate

C)interest rate differential;the difference between the domestic and foreign inflation rate

D)nominal exchange rate;ratio of the price of exported goods to imported goods

E)interest rate differential;ratio of the domestic price level to the world price level

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following explains why the law of one price might not hold?

A)similar preferences

B)differences in currencies

C)transportation costs

D)similar taxes

E)all of the above

A)similar preferences

B)differences in currencies

C)transportation costs

D)similar taxes

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

41

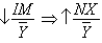

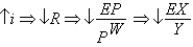

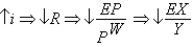

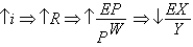

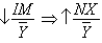

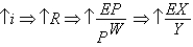

Which of the following best describes the relationship between monetary policy and net exports?

A) and

and

B) and

and

C) and

and

D) and

and  no change

no change

E) no change

no change  no change

no change

A)

and

and

B)

and

and

C)

and

and

D)

and

and  no change

no change

E)

no change

no change  no change

no change

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

42

The reason the real and nominal exchange rates may differ in the short run is:

A)a sticky nominal exchange rate.

B)sticky prices.

C)price and nominal exchange rate stickiness.

D)differences in the nominal interest rate across countries.

E)differences in the inflation rate across countries.

A)a sticky nominal exchange rate.

B)sticky prices.

C)price and nominal exchange rate stickiness.

D)differences in the nominal interest rate across countries.

E)differences in the inflation rate across countries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

43

If China wanted to maintain a fixed nominal exchange rate to the United States in the long run,

A)the price level in China would have to move in tandem with the U.S.price level.

B)Chinese interest rates would have to move in tandem with U.S.interest rates.

C)the law of one price would have to hold for at least one good.

D)the Chinese would have to want to buy American goods.

E)the Chinese would want to sell its financial assets.

A)the price level in China would have to move in tandem with the U.S.price level.

B)Chinese interest rates would have to move in tandem with U.S.interest rates.

C)the law of one price would have to hold for at least one good.

D)the Chinese would have to want to buy American goods.

E)the Chinese would want to sell its financial assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

44

With the foreign interest rate in the IS model,an increase in the foreign interest rate causes __________ because __________.

A)the IS curve to shift right;it leads to a depreciation of the domestic real exchange rate

B)rightward movement along the IS curve;it leads to a depreciation of the domestic real exchange rate

C)the IS curve to shift left;it leads to a depreciation of the domestic real exchange rate

D)the IS curve to shift right;it leads to an appreciation of the domestic real exchange rate

E)the IS curve to stay put;the change in investment and net exports offset each other

A)the IS curve to shift right;it leads to a depreciation of the domestic real exchange rate

B)rightward movement along the IS curve;it leads to a depreciation of the domestic real exchange rate

C)the IS curve to shift left;it leads to a depreciation of the domestic real exchange rate

D)the IS curve to shift right;it leads to an appreciation of the domestic real exchange rate

E)the IS curve to stay put;the change in investment and net exports offset each other

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

45

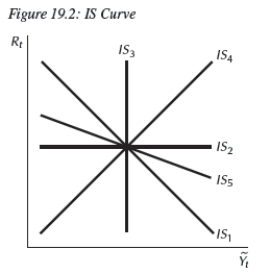

When we include the interest gap in the IS model,the IS curve:

A)becomes shallower,reflecting how the domestic interest rate affects investment and net exports.

B)becomes steeper,reflecting how the domestic interest rate affects investment and net exports.

C)becomes steeper,reflecting how the foreign interest rate affects investment and net exports.

D)keeps the same slope,reflecting how the foreign interest rate affects investment and net exports.

E)Not enough information is given.

A)becomes shallower,reflecting how the domestic interest rate affects investment and net exports.

B)becomes steeper,reflecting how the domestic interest rate affects investment and net exports.

C)becomes steeper,reflecting how the foreign interest rate affects investment and net exports.

D)keeps the same slope,reflecting how the foreign interest rate affects investment and net exports.

E)Not enough information is given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

46

Consider Figure 19.2.If __________ is the IS curve without the interest rate gap,__________ is the IS curve that includes the interest rate gap.

A)IS2;IS5

B)IS1;IS4

C)IS1;IS5

D)IS1;IS3

E)IS3;IS5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

47

Why might Mexico choose to maintain a fixed exchange rate to the U.S.dollar?

A)to help it maintain low and stable inflation

B)to "import" the reputation of the U.S.Federal Reserve

C)to maintain exchange rate stability

D)to reduce exchange risk

E)all of the above

A)to help it maintain low and stable inflation

B)to "import" the reputation of the U.S.Federal Reserve

C)to maintain exchange rate stability

D)to reduce exchange risk

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

48

If there is an appreciation of the real exchange rate,

A)imports will fall.

B)exports will rise.

C)net exports will fall.

D)net exports will remain constant.

E)the economy will move toward a trade surplus.

A)imports will fall.

B)exports will rise.

C)net exports will fall.

D)net exports will remain constant.

E)the economy will move toward a trade surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

49

In the short run,the real exchange rate moves with:

A)the law of one price.

B)unanticipated changes in the nominal exchange rate.

C)the quantity theory of money.

D)monetary policy.

E)the relative prices in the two economies.

A)the law of one price.

B)unanticipated changes in the nominal exchange rate.

C)the quantity theory of money.

D)monetary policy.

E)the relative prices in the two economies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

50

Why might a country choose to maintain a fixed exchange rate?

A)to allow it to print money

B)to reduce tariffs on its exports

C)to discourage direct foreign investment

D)to help it maintain low and stable inflation

E)None of the above is correct.

A)to allow it to print money

B)to reduce tariffs on its exports

C)to discourage direct foreign investment

D)to help it maintain low and stable inflation

E)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

51

In the long run,the nominal exchange rate is determined by:

A)the law of one price.

B)supply and demand in currency markets.

C)the relative prices in the two economies.

D)adjustments in factor prices.

E)monetary policy.

A)the law of one price.

B)supply and demand in currency markets.

C)the relative prices in the two economies.

D)adjustments in factor prices.

E)monetary policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

52

Prior to __________,most countries maintained a system of fixed exchange rates.

A)1945

B)1973

C)1999

D)1986

E)2001

A)1945

B)1973

C)1999

D)1986

E)2001

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

53

If the foreign price level rises,__________ and __________.

A)there is a depreciation of the real exchange rate;net exports rise

B)there is a depreciation of the real exchange rate;net exports fall

C)there is an appreciation of the real exchange rate;net exports rise

D)there is a depreciation of the nominal exchange rate;net exports rise

E)there is an appreciation of the nominal exchange rate;net exports rise

A)there is a depreciation of the real exchange rate;net exports rise

B)there is a depreciation of the real exchange rate;net exports fall

C)there is an appreciation of the real exchange rate;net exports rise

D)there is a depreciation of the nominal exchange rate;net exports rise

E)there is an appreciation of the nominal exchange rate;net exports rise

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

54

To extend the short run to include a more sophisticated version of the trade balance,we include:

A)foreign income.

B)the gap between domestic and foreign inflation rates.

C)the changes in the money supply.

D)the gap between the domestic and foreign real interest rates.

E)none of the above

A)foreign income.

B)the gap between domestic and foreign inflation rates.

C)the changes in the money supply.

D)the gap between the domestic and foreign real interest rates.

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

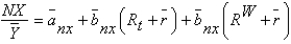

55

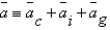

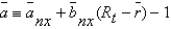

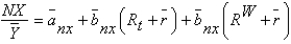

In the updated international IS curve a and b are given by:

A) and

and

B) and

and  .

.

C) and

and  .

.

D) and

and  .

.

E)none of the above

A)

and

and

B)

and

and  .

.C)

and

and  .

.D)

and

and  .

.E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

56

With the foreign interest rate in the IS model,an increase in the domestic interest rate causes __________ because __________.

A)leftward movement along the IS curve;it leads to appreciation of the domestic real exchange rate and causes domestic investment to fall

B)leftward movement along the IS curve;domestic investment falls

C)the IS curve to shift left;it leads to appreciation of the domestic real exchange rate and causes domestic investment to fall

D)the IS curve to shift left;it leads to depreciation in the domestic real exchange rate and causes a decline in domestic investment

E)the IS curve to shift right;it leads to appreciation in the domestic real exchange rate

A)leftward movement along the IS curve;it leads to appreciation of the domestic real exchange rate and causes domestic investment to fall

B)leftward movement along the IS curve;domestic investment falls

C)the IS curve to shift left;it leads to appreciation of the domestic real exchange rate and causes domestic investment to fall

D)the IS curve to shift left;it leads to depreciation in the domestic real exchange rate and causes a decline in domestic investment

E)the IS curve to shift right;it leads to appreciation in the domestic real exchange rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

57

The reason that the law of one price might fail in the short run is that:

A)prices are sticky and the nominal exchange rate is a financial price and adjusts rapidly to new information.

B)prices are flexible and the nominal exchange rate is a financial price that is sticky.

C)both prices and exchange rates are sticky.

D)both prices and the exchange rate react immediately to new information.

E)None of the above is correct.

A)prices are sticky and the nominal exchange rate is a financial price and adjusts rapidly to new information.

B)prices are flexible and the nominal exchange rate is a financial price that is sticky.

C)both prices and exchange rates are sticky.

D)both prices and the exchange rate react immediately to new information.

E)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

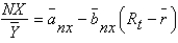

58

Including the interest rate gap,the net export functionbecomes:

A)

B)

C)

D) ,because

,because

E)none of the above

A)

B)

C)

D)

,because

,because

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

59

If Mexico wants to fix the peso to the U.S.dollar in the short run,

A)Mexico's monetary policy must echo the U.S.monetary policy.

B)Mexico must adjust its interest rates by the same amount as changes in the federal funds rate.

C)Mexico must ensure its inflation rate is the same as U.S.inflation.

D)It will never be able to maintain a fixed exchange rate.

E)a and b

A)Mexico's monetary policy must echo the U.S.monetary policy.

B)Mexico must adjust its interest rates by the same amount as changes in the federal funds rate.

C)Mexico must ensure its inflation rate is the same as U.S.inflation.

D)It will never be able to maintain a fixed exchange rate.

E)a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

60

In the short-run model that includes the interest rate gap,

A)money is constant.

B)the world interest can fluctuate.

C)the domestic interest rate is a parameter in the model.

D)the rate of inflation is constant and is given.

E)the world interest rate is a parameter in the model.

A)money is constant.

B)the world interest can fluctuate.

C)the domestic interest rate is a parameter in the model.

D)the rate of inflation is constant and is given.

E)the world interest rate is a parameter in the model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

61

Under the Bretton Woods system,

A)the dollar was pegged at $35 per ounce of gold and all other countries pegged their currency to the dollar.

B)all currencies were pegged to gold at a fixed rate.

C)the euro was pegged at 35 per ounce of gold and all other countries pegged their currency to the euro.

D)the dollar was allowed to float against all other currencies,but their exchange rates were fixed to each other.

E)all currencies were flexible.

A)the dollar was pegged at $35 per ounce of gold and all other countries pegged their currency to the dollar.

B)all currencies were pegged to gold at a fixed rate.

C)the euro was pegged at 35 per ounce of gold and all other countries pegged their currency to the euro.

D)the dollar was allowed to float against all other currencies,but their exchange rates were fixed to each other.

E)all currencies were flexible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

62

Free flow of international assets is desirable because it allows countries to:

A)borrow when times are bad to smooth consumption.

B)borrow when times are good in order to increase consumption.

C)buy in higher value asset markets.

D)hold gold.

E)maintain price stability.

A)borrow when times are bad to smooth consumption.

B)borrow when times are good in order to increase consumption.

C)buy in higher value asset markets.

D)hold gold.

E)maintain price stability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

63

The decline in the gold standard was due to:

A)the economic instability caused by World War I and the Great Depression.

B)the economic instability caused by the American Civil War.

C)the economic instability caused by the creation of the euro.

D)the economic instability caused by persistent large U.S.trade deficits.

E)the economic instability caused by the flexibility of gold prices.

A)the economic instability caused by World War I and the Great Depression.

B)the economic instability caused by the American Civil War.

C)the economic instability caused by the creation of the euro.

D)the economic instability caused by persistent large U.S.trade deficits.

E)the economic instability caused by the flexibility of gold prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

64

Over the last two centuries of exchange rate "regimes," the history can be divided into three phases.In chronological order they are:

A)the gold standard,the Bretton Woods system,and the era of floating exchange rates.

B)the Bretton Woods system,the gold standard,and the era of floating exchange rates.

C)the era of floating exchange rates,the gold standard,and the Bretton Woods system.

D)the gold standard,the Bretton Woods system,and the EMS.

E)the silver standard,the Bretton Woods system,and the era of floating exchange rates.

A)the gold standard,the Bretton Woods system,and the era of floating exchange rates.

B)the Bretton Woods system,the gold standard,and the era of floating exchange rates.

C)the era of floating exchange rates,the gold standard,and the Bretton Woods system.

D)the gold standard,the Bretton Woods system,and the EMS.

E)the silver standard,the Bretton Woods system,and the era of floating exchange rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

65

Under the gold standard,

A)countries specified a fixed price at which they were willing to trade their currency for an ounce of gold.

B)countries adopted a flexible price at which they were willing to trade their currency for an ounce of gold.

C)all countries traded gold at the market price and traded their currency at that price.

D)countries allowed their currency to float against the price of gold.

E)all countries fixed their currency at the same rate.

A)countries specified a fixed price at which they were willing to trade their currency for an ounce of gold.

B)countries adopted a flexible price at which they were willing to trade their currency for an ounce of gold.

C)all countries traded gold at the market price and traded their currency at that price.

D)countries allowed their currency to float against the price of gold.

E)all countries fixed their currency at the same rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

66

The Mexican peso,Asian financial,and Argentinean financial crises had which of the following in common?

A)All countries involved attempted to maintain a fixed exchange rate.

B)There was an increase in country and economic risk.

C)All countries experienced a steep decline in their foreign exchange reserves.

D)All countries had relatively open financial markets.

E)all of the above

A)All countries involved attempted to maintain a fixed exchange rate.

B)There was an increase in country and economic risk.

C)All countries experienced a steep decline in their foreign exchange reserves.

D)All countries had relatively open financial markets.

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

67

The end of the Bretton Woods system was in about __________,due to __________.

A)1981;rising U.S.inflation

B)1971;falling U.S.inflation

C)1929;the stock market crash

D)1971;rising U.S.inflation

E)1999;the creation of the euro

A)1981;rising U.S.inflation

B)1971;falling U.S.inflation

C)1929;the stock market crash

D)1971;rising U.S.inflation

E)1999;the creation of the euro

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

68

A stable exchange rate is desirable because:

A)it leads to economic stability.

B)it allows individuals and firms to make plans over time.

C)it leads to higher growth rates in the long run.

D)it leads to large transfers from one group to the other.

E)None of the above is correct.

A)it leads to economic stability.

B)it allows individuals and firms to make plans over time.

C)it leads to higher growth rates in the long run.

D)it leads to large transfers from one group to the other.

E)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

69

The U.S.dollar exchange rate fluctuates due to changes in:

A)U.S.trade policy.

B)U.S.monetary policy only.

C)both U.S.monetary policy and the policy of other countries.

D)the demand for foreign goods.

E)the price of oil.

A)U.S.trade policy.

B)U.S.monetary policy only.

C)both U.S.monetary policy and the policy of other countries.

D)the demand for foreign goods.

E)the price of oil.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

70

Exchange rate stability is desirable because a sudden sharp __________ of the exchange rate could __________.

A)depreciation;increase import prices

B)depreciation;exacerbate debt held in foreign currencies

C)appreciation;decrease export prices

D)All of the above are correct.

E)a and b

A)depreciation;increase import prices

B)depreciation;exacerbate debt held in foreign currencies

C)appreciation;decrease export prices

D)All of the above are correct.

E)a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

71

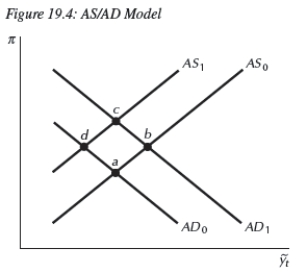

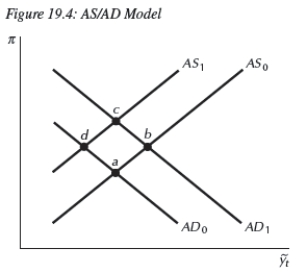

Use the aggregate supply/aggregate demand model in Figure 19.4 to answer the following scenario.The European central bank reduces its interest rates,while the Federal Reserve maintains its federal funds rate.The economy initially moves from point __________ to point __________;eventually,the economy returns to the steady state at point __________.

A)a;d;a

B)a;d;a

C)c;d;c

D)b;d;b

E)Not enough information is given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

72

When Argentina adopted a currency board,it set the exchange rate at __________,meaning that,for every peso in circulation,__________.

A)10 pesos to the dollar;it needed 10 cents in reserve

B)one peso to the dollar;it needed five dollars in reserve

C)one peso to the dollar;it needed one dollar in reserve

D)one peso to the dollar;it needed one gram of gold in reserve

E)None of the above is correct.

A)10 pesos to the dollar;it needed 10 cents in reserve

B)one peso to the dollar;it needed five dollars in reserve

C)one peso to the dollar;it needed one dollar in reserve

D)one peso to the dollar;it needed one gram of gold in reserve

E)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

73

The natural goal(s)of an international monetary system are:

A)a stable exchange rate.

B)monetary policy autonomy.

C)free flow of international finance.

D)all of the above

E)a and b

A)a stable exchange rate.

B)monetary policy autonomy.

C)free flow of international finance.

D)all of the above

E)a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

74

Use the aggregate supply/aggregate demand model in Figure 19.4 to answer the following scenario.The European central bank reduces its interest rates,while the Federal Reserve maintains its federal funds rate.The economy initially moves from point __________ to point __________.

A)a;d

B)c;d

C)b;c

D)a;b

E)a;c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

75

France,Italy,Germany,the United Kingdom,and Spain all use the same currency,called the euro.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

76

The euro zone is now the largest economy in the world.If the European central bank raises its interest rates,we expect __________ because __________.

A)the U.S.IS curve to shift right;the dollar would depreciate relative to the euro

B)the U.S.IS curve to shift left;the dollar would appreciate relative to the euro

C)the U.S.IS curve to not move;the dollar would depreciate relative to the euro

D)rightward movement along the U.S.IS curve;the dollar would depreciate relative to the euro

E)leftward movement along the U.S.IS curve;the dollar would appreciate relative to the euro

A)the U.S.IS curve to shift right;the dollar would depreciate relative to the euro

B)the U.S.IS curve to shift left;the dollar would appreciate relative to the euro

C)the U.S.IS curve to not move;the dollar would depreciate relative to the euro

D)rightward movement along the U.S.IS curve;the dollar would depreciate relative to the euro

E)leftward movement along the U.S.IS curve;the dollar would appreciate relative to the euro

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

77

China maintains a fixed and,many say,__________ exchange rate to __________.

A)overvalued;keep prices stable

B)undervalued;promote exports

C)overvalued;reduce inflation

D)undervalued;reduce the domestic Chinese price of imports

E)undervalued;keep the government in power

A)overvalued;keep prices stable

B)undervalued;promote exports

C)overvalued;reduce inflation

D)undervalued;reduce the domestic Chinese price of imports

E)undervalued;keep the government in power

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

78

Between 1834 and 1934,the United States fixed the dollar at $20.70 per ounce of gold and the United Kingdom pegged the pound at £4.25 per ounce.This yields

A)a dollar-pound exchange rate of about $2/£1.

B)a dollar-pound exchange rate of about $0.205/£1.

C)a dollar-pound exchange rate of about $88/£1.

D)a dollar-pound exchange rate of about $4.90/£1.

E)Not enough information is given.

A)a dollar-pound exchange rate of about $2/£1.

B)a dollar-pound exchange rate of about $0.205/£1.

C)a dollar-pound exchange rate of about $88/£1.

D)a dollar-pound exchange rate of about $4.90/£1.

E)Not enough information is given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

79

Under a currency board,the central bank holds __________,so that the domestic currency is __________ by the foreign exchange.

A)gold;fully backed

B)foreign exchange reserves;fully backed

C)domestic bonds;fully backed

D)foreign exchange reserves and domestic bonds;fully backed

E)None of the above is correct.

A)gold;fully backed

B)foreign exchange reserves;fully backed

C)domestic bonds;fully backed

D)foreign exchange reserves and domestic bonds;fully backed

E)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck

80

In the era of floating exchange rates,currency values relative to each other are determined by:

A)supply and demand for those currencies.

B)the interest rate gap between countries.

C)changes in inflation rates.

D)all of the above

E)none of the above

A)supply and demand for those currencies.

B)the interest rate gap between countries.

C)changes in inflation rates.

D)all of the above

E)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 109 في هذه المجموعة.

فتح الحزمة

k this deck