Deck 10: Choices Involving Time

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

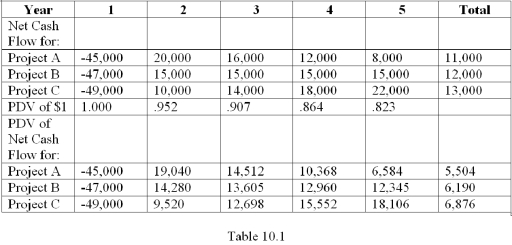

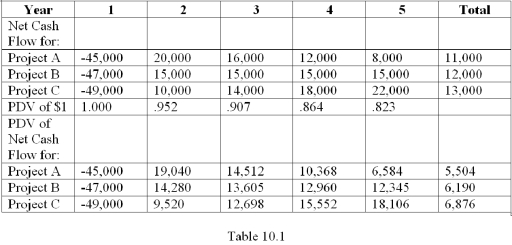

سؤال

سؤال

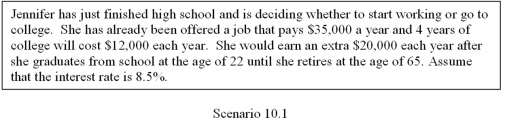

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

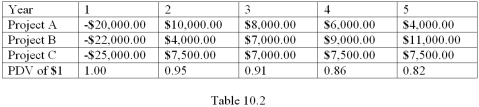

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/67

العب

ملء الشاشة (f)

Deck 10: Choices Involving Time

1

Which of the following is NOT a reason people save?

A) To reach consumption bundles in the future that would otherwise be unattainable

B) To protect against unforeseen expenses

C) To maximize their current consumption

D) To earn additional money on unused income

A) To reach consumption bundles in the future that would otherwise be unattainable

B) To protect against unforeseen expenses

C) To maximize their current consumption

D) To earn additional money on unused income

To maximize their current consumption

2

A ______ chance of default will cause the interest rate to be ______.

A) Lower, lower

B) Lower, higher

C) Higher, lower

D) Higher, higher

A) Lower, lower

B) Lower, higher

C) Higher, lower

D) Higher, higher

Higher, higher

3

Suppose you lend $2,500 at 11.5% for 3 years.If the interest is compounded annually,how much interest will you receive in those 3 years?

A) $862.50

B) $965.49

C) $3,362.50

D) $2,465.49

A) $862.50

B) $965.49

C) $3,362.50

D) $2,465.49

$965.49

4

Which scenario has a higher present discounted value (assume interest is compounded annually); $100 owed in 3 years at 8% interest or $90 owed in 2 years at 7.25 % interest?

A) $100 owed in 3 years

B) $90 owed in 2 years

C) Both scenarios have the same present discounted value

D) Cannot be determined with information provided

A) $100 owed in 3 years

B) $90 owed in 2 years

C) Both scenarios have the same present discounted value

D) Cannot be determined with information provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following statements about nominal interest and real interest is true?

A) Nominal interest is a yearly rate and real interest is a monthly rate

B) Nominal interest does not adjust for inflation, whereas real interest does

C) Nominal interest is what the lender receives and real interest is what the borrower pays

D) Nominal interest and real interest are two ways of saying the same thing

A) Nominal interest is a yearly rate and real interest is a monthly rate

B) Nominal interest does not adjust for inflation, whereas real interest does

C) Nominal interest is what the lender receives and real interest is what the borrower pays

D) Nominal interest and real interest are two ways of saying the same thing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

6

Given the formula PDV = $F/(1 + R)T,the PDV is smaller when the number of years is ______ and when the interest rate is ______.

A) Smaller, lower

B) Smaller, higher

C) Larger, lower

D) Larger, higher

A) Smaller, lower

B) Smaller, higher

C) Larger, lower

D) Larger, higher

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

7

Suppose the interest rate is 6% and compounded annually.What is the present discounted value of 6 monthly payments of $150?

A) $855.00

B) $877.50

C) $884.46

D) $900.00

A) $855.00

B) $877.50

C) $884.46

D) $900.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

8

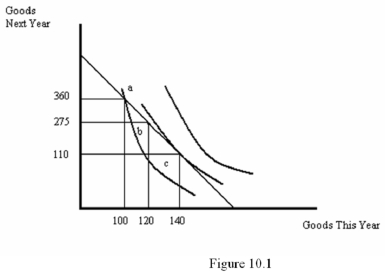

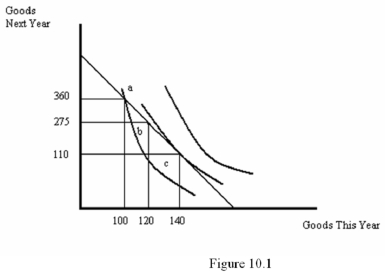

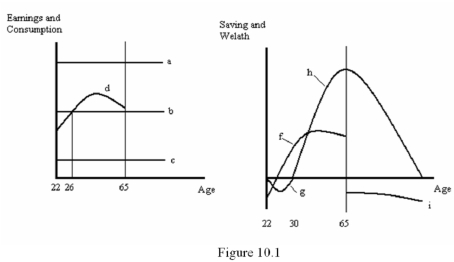

Refer to Figure 10.1.Suppose the individual is initially at point b.Based on the figure,the individual is relatively ______ and will ultimately move to point _____.

A) Impatient; c

B) Impatient; b

C) Patient; c

D) Patient; b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

9

A consumption bundle is affordable as long as

A) It is a point that is on an indifference curve that is to the right of the budget line

B) It is a point that falls on the 45 degree line

C) The present discount value of the consumption stream is less than the present discount value of the income stream

D) The amount of the good consumed from year to year does not increase

A) It is a point that is on an indifference curve that is to the right of the budget line

B) It is a point that falls on the 45 degree line

C) The present discount value of the consumption stream is less than the present discount value of the income stream

D) The amount of the good consumed from year to year does not increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

10

Assume the interest rate is 5%.What is the present discounted value of a $1,000 bond that pays a $50 coupon each year for 10 years?

A) $989.91

B) $999.91

C) $1,000.00

D) $1,009.99

A) $989.91

B) $999.91

C) $1,000.00

D) $1,009.99

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

11

If a bank is lending money at 6.25% while the government is lending money at 8.25% and the rate of inflation is 3.5%,what is the real interest being earned by the bank?

A) 2.00%

B) 2.66%

C) 2.75%

D) 6.25%

A) 2.00%

B) 2.66%

C) 2.75%

D) 6.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

12

A ______ is a legally binding promise to make specific future payments.

A) Stock

B) Coupon

C) Bond

D) Deposit

A) Stock

B) Coupon

C) Bond

D) Deposit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

13

The amount of money a lender requires for the use of funds is called

A) Interest

B) Principal

C) Internal rate of return

D) Present discounted value

A) Interest

B) Principal

C) Internal rate of return

D) Present discounted value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

14

Suppose you borrow $1,000 at 8% for 2 years.If the interest is compounded annually,how much money will you owe at the end of those 2 years?

A) $1,080.00

B) $1,160.00

C) $1,166.40

D) $1,345.60

A) $1,080.00

B) $1,160.00

C) $1,166.40

D) $1,345.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

15

At an interest rate of 8.25% compounded annually,what is the present discounted value of $2000 to be received 2 years from now?

A) $1670.00

B) $1706.78

C) $1716.74

D) $1835.00

A) $1670.00

B) $1706.78

C) $1716.74

D) $1835.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

16

The amount of money borrowed in a transaction is called

A) Interest

B) Principal

C) Internal rate of return

D) Present discounted value

A) Interest

B) Principal

C) Internal rate of return

D) Present discounted value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

17

If the real interest rate is 7.5% and the rate of inflation is 3%,what is the nominal interest rate?

A) 4.50%

B) 4.57%

C) 10.50%

D) 10.73%

A) 4.50%

B) 4.57%

C) 10.50%

D) 10.73%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of following statements about bonds is NOT true?

A) Bonds have a variable term

B) The face value of a bond is the amount to be paid at maturity

C) The maturity of a bond refers to the period over which payments are made

D) When interest rates rise, the present discounted value of a bond falls

A) Bonds have a variable term

B) The face value of a bond is the amount to be paid at maturity

C) The maturity of a bond refers to the period over which payments are made

D) When interest rates rise, the present discounted value of a bond falls

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

19

The current worth of a claim on future resources is called

A) Net present value

B) Future value

C) Present discounted value

D) Internal rate of return

A) Net present value

B) Future value

C) Present discounted value

D) Internal rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

20

Refer to Figure 10.1.Suppose the individual is initially at point b.Based on the figure,the individual is relatively ______ and will ultimately be a _____.

A) Impatient; saver

B) Impatient; borrower

C) Patient; saver

D) Patient; borrower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

21

What happens to borrowing when interest rates rise?

A) It increases

B) It decreases

C) It can increase or decrease

D) It is impossible to tell

A) It increases

B) It decreases

C) It can increase or decrease

D) It is impossible to tell

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

22

Suppose you are looking to add more capacity to your current manufacturing plant.The new project will cost $6 million up front and is projected to increase revenue $1.5 million a year for each of the next 5 years.If the interest rate is 8%,what is this project's NPV and is it a profitable investment?

A) -$10,934.94, Yes it is profitable

B) -$10,934.94, No it is not profitable

C) $944,444.44, Yes it is profitable

D) $944,444.44, No it is not profitable

A) -$10,934.94, Yes it is profitable

B) -$10,934.94, No it is not profitable

C) $944,444.44, Yes it is profitable

D) $944,444.44, No it is not profitable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

23

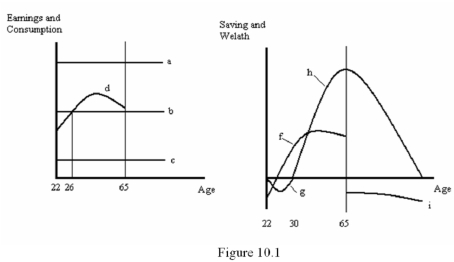

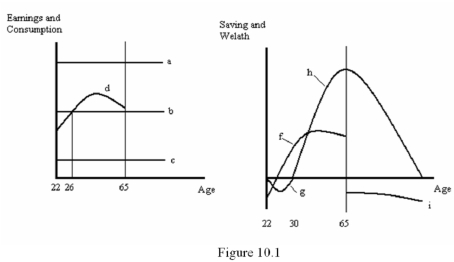

Refer to Figure 10.1.Which line represents saving?

A) b

B) h

C) f + i

D) d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

24

Suppose you make $1,000 investment today that you believe will have a one time return of $2,500 in 5 years.If the interest rate is 12%,will you have a profitable investment?

A) Yes, because the NPV is positive

B) Yes, because the NPV is negative

C) No, because the NPV is positive

D) No, because the NPV is negative

A) Yes, because the NPV is positive

B) Yes, because the NPV is negative

C) No, because the NPV is positive

D) No, because the NPV is negative

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

25

The NPV criterion states that an investment project is profitable when its NPV is ______ and unprofitable when its NPV is ______.

A) Positive, positive

B) Positive, negative

C) Negative, positive

D) Negative, negative

A) Positive, positive

B) Positive, negative

C) Negative, positive

D) Negative, negative

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

26

Refer to Figure 10.1.Which line represents wealth?

A) b

B) h

C) f + i

D) g

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

27

Suppose you make a $5,000 investment that will return $3,000 in year 2 and another $3,500 in year 4.With an interest rate of 4.5%,what is the NPV of this project?

A) $247.34

B) $682.15

C) $1,500.00

D) $2,162.50

A) $247.34

B) $682.15

C) $1,500.00

D) $2,162.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

28

Refer to Figure 10.1.For an individual that prefers a stable living standard,which line represents the best feasible consumption path?

A) a

B) b

C) c

D) h

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is NOT used to describe an investment?

A) It is a means of saving

B) It is a way of acquiring capital

C) It is an up-front cost

D) It holds the expectation of generating future profits

A) It is a means of saving

B) It is a way of acquiring capital

C) It is an up-front cost

D) It holds the expectation of generating future profits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

30

Suppose you have put $5,000 into a project that should generate cash inflows of $1,250 for each of the next 5 years.If the interest rate is 8% is this a good investment?

A) Yes, because you will earn a profit of $1,250 dollars in 5 years

B) Yes, because the internal rate of return is higher than the interest rate

C) No, because the internal rate of return is higher than the interest rate

D) No, because the net present value is negative

A) Yes, because you will earn a profit of $1,250 dollars in 5 years

B) Yes, because the internal rate of return is higher than the interest rate

C) No, because the internal rate of return is higher than the interest rate

D) No, because the net present value is negative

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which statement about the Life Cycle Hypothesis is NOT true?

A) It describes the choices of consumers who live for a long time

B) It separates consumers' earnings into two stages

C) It assumes that people prefer instability

D) It assumes that people prefer a higher standard of living to a lower standard of living

A) It describes the choices of consumers who live for a long time

B) It separates consumers' earnings into two stages

C) It assumes that people prefer instability

D) It assumes that people prefer a higher standard of living to a lower standard of living

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

32

The difference between revenue and cost during a single year of a project's life is called the

A) Interest rate

B) Net present value

C) Net cash flow

D) Profit

A) Interest rate

B) Net present value

C) Net cash flow

D) Profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

33

What is another term for time value of money?

A) Net present value

B) Internal rate of return

C) Opportunity cost of funds

D) Yield to maturity

A) Net present value

B) Internal rate of return

C) Opportunity cost of funds

D) Yield to maturity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is a way the government can stimulate saving?

A) Decrease interest rates

B) Increase taxes

C) Offering tax incentives for retirement accounts

D) There is nothing the government can do to stimulate saving

A) Decrease interest rates

B) Increase taxes

C) Offering tax incentives for retirement accounts

D) There is nothing the government can do to stimulate saving

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

35

The rate of interest at which a project's NPV is exactly zero is called its

A) Equilibrium rate

B) Internal rate of return

C) Break-even rate

D) Zero net rate

A) Equilibrium rate

B) Internal rate of return

C) Break-even rate

D) Zero net rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

36

Refer to Figure 10.1.Which line represents earnings?

A) b

B) h

C) f + i

D) d

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

37

The difference between the present discount value of a revenue stream and the present discount value of a cost stream is called the

A) Interest rate

B) Net present value

C) Net cash flow

D) Profit

A) Interest rate

B) Net present value

C) Net cash flow

D) Profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following are two main assumptions of The Life Cycle Hypothesis?

A) People can earn in both the first and second stages of their life. People also prefer stability in their consumption patterns

B) People earn in the first stage of their life, but they don't earn in the second stage of their life. Interest rates are higher in the second period of a person's life than they are in the first period of a person's life

C) People earn in the first stage of their life, but they don't earn in the second stage of their life. People also prefer stability in their consumption patterns

D) People earn in the first stage of their life, but they don't earn in the second stage of their life. People are indifferent about the stability of their consumption patterns

A) People can earn in both the first and second stages of their life. People also prefer stability in their consumption patterns

B) People earn in the first stage of their life, but they don't earn in the second stage of their life. Interest rates are higher in the second period of a person's life than they are in the first period of a person's life

C) People earn in the first stage of their life, but they don't earn in the second stage of their life. People also prefer stability in their consumption patterns

D) People earn in the first stage of their life, but they don't earn in the second stage of their life. People are indifferent about the stability of their consumption patterns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

39

When the interest rate rises,saving becomes ______ rewarding and borrowing becomes ______ costly.

A) Less, less

B) Less, more

C) More, less

D) More, more

A) Less, less

B) Less, more

C) More, less

D) More, more

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

40

What happens to saving when interest rates rise?

A) It increases

B) It decreases

C) It can increase or decrease

D) It is impossible to tell

A) It increases

B) It decreases

C) It can increase or decrease

D) It is impossible to tell

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

41

The amount of time required before a project's total inflows match its total outflows is the

A) Break-even period

B) Payback period

C) Duration

D) Yield to maturity

A) Break-even period

B) Payback period

C) Duration

D) Yield to maturity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

42

You have made an investment of $250 that will yield a profit of $30 in one year.If the interest rate is 11.5%,what is your internal rate of return?

A) 10.7%

B) 11.8%

C) 12.0%

D) 12.2%

A) 10.7%

B) 11.8%

C) 12.0%

D) 12.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

43

Durable,marketable skills that generate higher income are also known as

A) Physical capital

B) Investment capital

C) Human capital

D) Education capital

A) Physical capital

B) Investment capital

C) Human capital

D) Education capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

44

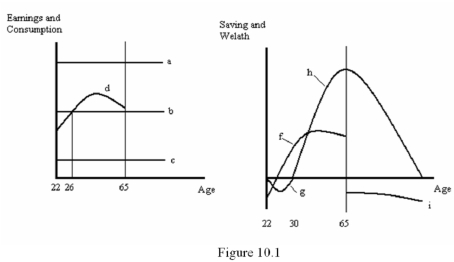

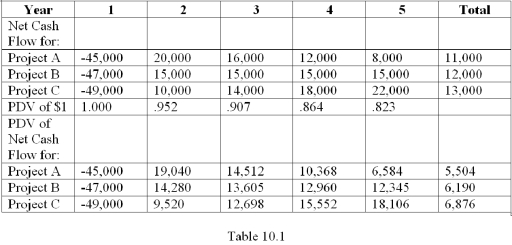

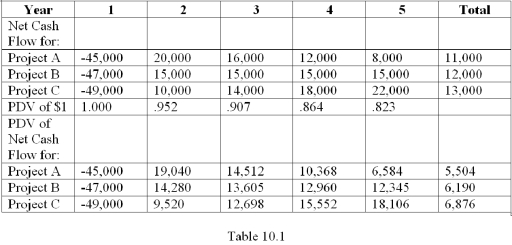

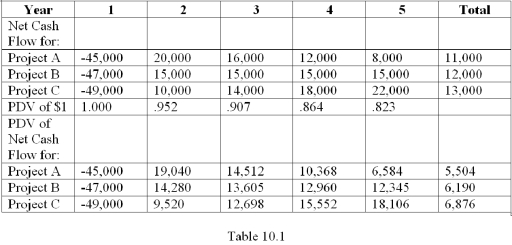

Table 10.1 shows the cash flows and discounted cash flows for three mutually exclusive projects available to a company.Assume an interest rate of 5%.Which project has the highest internal rate of return?

A) Project A

B) Project B

C) Project C

D) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

45

When someone buys a bond,they give up the bond's price in exchange for

A) Right of ownership

B) Future income

C) Current income

D) Stock

A) Right of ownership

B) Future income

C) Current income

D) Stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

46

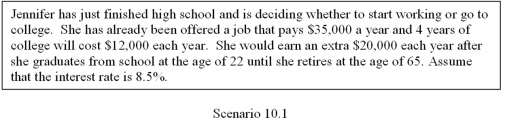

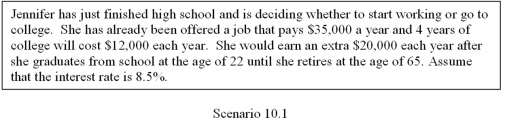

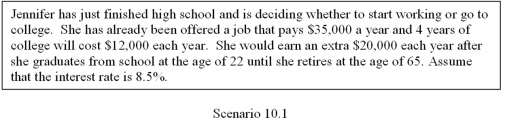

Refer to Scenario 10.1.Given this information,what should Jennifer do upon graduating from high school?

A) Take the job

B) Go to college

C) Take the job until the interest rate goes down and then go to college

D) Cannot determine from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

47

Suppose you have put $5,000 into a project that should generate cash inflows of $1,250 for each of the next 5 years.How long will it take to recover your initial investment?

A) 3 years

B) 3.5 years

C) 4 years

D) 4.2 years

A) 3 years

B) 3.5 years

C) 4 years

D) 4.2 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

48

Table 10.1 shows the cash flows and discounted cash flows for three mutually exclusive projects available to a company.Assume an interest rate of 5%.Which project has the highest NPV?

A) Project A

B) Project B

C) Project C

D) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

49

Suppose the interest rate is 8%.If a project requires an initial investment of $5,000 and returns $5,500 in a year,what is its internal rate of return?

A) 2%

B) 8%

C) 10%

D) 18%

A) 2%

B) 8%

C) 10%

D) 18%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

50

A bond's internal rate of return is also know as it's

A) Coupon

B) Payback period

C) Duration

D) Yield to maturity

A) Coupon

B) Payback period

C) Duration

D) Yield to maturity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

51

Table 10.1 shows the cash flows and discounted cash flows for three mutually exclusive projects available to a company.Assume an interest rate of 5%.Which project should the company choose if they want to recover their initial investment as soon as possible?

A) Project A

B) Project B

C) Project C

D) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

52

You have made an investment of $250 that will yield a profit of $30 in one year.If the interest rate is 11.5% is this a good investment.

A) Yes, because the internal rate of return is greater than the interest rate

B) Yes, because the internal rate of return is less than the interest rate

C) No, because the internal rate of return is greater than the interest rate

D) No, because the internal rate of return is less than the interest rate

A) Yes, because the internal rate of return is greater than the interest rate

B) Yes, because the internal rate of return is less than the interest rate

C) No, because the internal rate of return is greater than the interest rate

D) No, because the internal rate of return is less than the interest rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

53

Refer to Scenario 10.1.What is Jennifer's opportunity cost of one year of college?

A) $12,000

B) $17,000

C) $35,000

D) $47,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

54

Refer to Scenario 10.1.Jennifer should invest in college when the net present value of that investment is ______ and the internal rate of return is ______ the current interest rate.

A) Positive, greater than

B) Negative, greater than

C) Positive, less than

D) Negative, less than

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is NOT a reason why an increase in the interest rate usually makes investment projects less attractive?

A) At a higher rate, future dollars are worth less compared to current dollars

B) A typical investment project incurs the majority of its costs early in its life

C) A typical investment project receives a disproportionate fraction of its revenue early in its life

D) At a higher rate, putting money into the bank is more attractive

A) At a higher rate, future dollars are worth less compared to current dollars

B) A typical investment project incurs the majority of its costs early in its life

C) A typical investment project receives a disproportionate fraction of its revenue early in its life

D) At a higher rate, putting money into the bank is more attractive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

56

If a project has an initial investment of $20,000 and consecutive yearly cash inflows of $5,000,$8000,$10,000 and $7,000,respectively,what is its payback period?

A) 2 years

B) 2.5 years

C) 2.7 years

D) 3 years

A) 2 years

B) 2.5 years

C) 2.7 years

D) 3 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

57

Refer to Scenario 10.1.What is the net present value of the decision to go to invest in college?

A) $10,742.71

B) $11,141.18

C) $11,655.84

D) $12,088.18

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

58

Table 10.1 shows the cash flows and discounted cash flows for three mutually exclusive projects available to a company.Assume an interest rate of 5%.Which project should the company choose if they want to maximize their return?

A) Project A

B) Project B

C) Project C

D) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

59

A project is profitable when its internal rate of return is ______ the interest rate.

A) Greater than

B) Less than

C) Equal to

D) Greater than or equal to

A) Greater than

B) Less than

C) Equal to

D) Greater than or equal to

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

60

Table 10.1 shows the cash flows and discounted cash flows for three mutually exclusive projects available to a company.Assume an interest rate of 5%.Which project has the shortest payback period?

A) Project A

B) Project B

C) Project C

D) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

61

What would the interest rate need to be in order to earn $100 on an investment of $1,000 over two years? Assume interest compounds annually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

62

Using a carefully-labeled graph,explain the Life Cycle Hypothesis.What are some of the implications of the Life Cycle Hypothesis?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

63

Suppose you invest $5,000 for 5 years.The interest rate for the first 2 years is 4.7%,5.2% for year 3 and 5.4% for the final 2 years.Assuming interest compounds annually,what would your investment have returned in those 5 years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

64

If you were to invest $10,000 for two years and the interest rates for each of those years are 4.5% and 4.65% respectively,how much interest would you earn from the end of year one until the end of year two? Assume interest compounds annually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

65

Suppose you use the rate of inflation as the interest rate for determining the present value of $1.What would the present value of $3,000 received in three equal yearly payments be if the current rate of inflation is 3.5% and increases by 15 basis points each year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

66

Joe has just retired and would like to convert some of his savings into an annuity that will pay him an equal amount each year for the next 5 years.If the current interest rate is 5.75%,how much money will he have to invest in order to receive $30,000 a year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

67

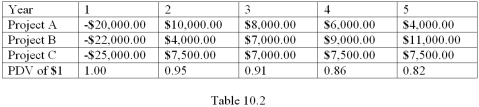

The Table 10.2 below shows net cash flows for 3 mutually exclusive projects from which a company can choose.Each project requires an investment in the first year,then produces a positive net cash flow for each of the following four years.Assuming an interest rate of 5%,which project would the company choose? Does the best project have the highest total net cash flow? The shortest payback period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck